|

Authorised Push Payment Fraud

Push payment fraud (also known as "authorised push payment fraud" or APP fraud) is a form of fraud in which victims are manipulated into making real-time payments to fraudsters, typically by social engineering attacks involving impersonation. These authorised frauds can also be related to investment scams, where the victim is tricked into sending money for investments that do not exist, and to romance scams, where the fraudster tricks the victim into thinking they are in a relationship. The opposing type of fraud is known as "pull payment fraud", which occurs when an account holder provides a payee with the relevant bank account details enabling a fraudulent payee to take (or "pull") funds from the payer’s account.Power, L. and Elgar, R.Push payment fraud: Update Autumn 2018 ''Walker Morris'' published on 17 October 2018, accessed on 1 April 2025 United Kingdom Until 2019 in the United Kingdom, because the victims of these frauds authorised the payments, albeit mistakenly, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fraud

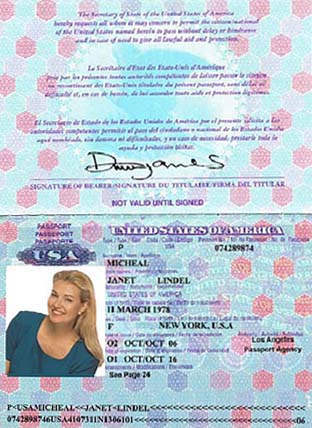

In law, fraud is intent (law), intentional deception to deprive a victim of a legal right or to gain from a victim unlawfully or unfairly. Fraud can violate Civil law (common law), civil law (e.g., a fraud victim may sue the fraud perpetrator to avoid the fraud or recover monetary compensation) or criminal law (e.g., a fraud perpetrator may be prosecuted and imprisoned by governmental authorities), or it may cause no loss of money, property, or legal right but still be an element of another civil or criminal wrong. The purpose of fraud may be monetary gain or other benefits, such as obtaining a passport, travel document, or driver's licence. In cases of mortgage fraud, the perpetrator may attempt to qualify for a mortgage by way of false statements. Terminology Fraud can be defined as either a civil wrong or a criminal act. For civil fraud, a government agency or person or entity harmed by fraud may bring litigation to stop the fraud, seek monetary damages, or both. For cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real-time Payment

Instant payment (sometimes referred to as real-time payment or faster payment) is a method of electronic funds transfer, allowing for almost immediate transfer of money between bank accounts. This was in contrast to the previous transfer times of one to three business days that had been in place until the mid-2010s. Since the mid-2010s many countries have implemented instant payment systems that speed up the transfer between bank accounts in response to customer demand for faster transactions. The ''Euro Retail Payments Board'' (ERPB) in 2018 defined instant payments as: History Originally clearing of payments was based on the cheque clearing cycle that required physical cheques to be exchanged by banks at clearing houses for payments to be made between bank accounts. When electronic payments entered the banking systems from the 1970s onwards, the same timeframes and processes were used to settle these electronic payments. The growth of e-commerce since the 2000s has caused ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Engineering (security)

In the context of information security, social engineering is the use of psychological influence of people into performing actions or divulging Confidentiality, confidential information. This differs from psychological manipulation in that it doesn't need to be controlling, negative or a one-way transaction. Manipulation involves a zero-sum game where one party wins and the other loses while social engineering can be win-win for both parties. A type of confidence trick for the purpose of information gathering, fraud, or system access, it differs from a traditional "con" in the sense that it is often one of many steps in a more complex fraud scheme. It has also been defined as "any act that influences a person to take an action that may or may not be in their best interests." Research done in 2020 has indicated that social engineering will be one of the most prominent challenges of the upcoming decade. Having proficiency in social engineering will be increasingly important for orga ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Impersonation

An impersonator is someone who imitates or copies the behavior or actions of another. There are many reasons for impersonating someone: *Living history: After close study of some historical figure, a performer may dress and speak "as" that person for an audience. Such historical interpretation may be a scripted dramatic performance like ''Mark Twain Tonight!'' or an unscripted interaction while staying in character. *Entertainment: An "Impressionist (entertainment), impressionist" impersonates well-known figures in order to entertain an audience. Especially popular objects of impersonation are Elvis Presley (''see Elvis impersonator''), Michael Jackson (''see Michael Jackson impersonator'') and Madonna (see ''Madonna impersonator''). Other uses of impersonation for entertainment include male drag queens (previously called "female impersonators", although this terminology is now considered outdated.) *Crime: As part of a Crime, criminal act such as identity theft. This is us ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities Fraud

Securities fraud, also known as stock fraud and investment fraud, is a deceptive practice in the stock or commodities markets that induces investors to make purchase or sale decisions on the basis of false information."Securities Fraud Awareness & Prevention Tips faq by FBI, accessed February 11, 2013 The setups are generally made to result in monetary gain for the deceivers, and generally result in unfair monetary losses for the investors. They are generally violating securities laws. Securities fraud can also include outright theft from investors ( embezzlement by [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Romance Scam

A romance scam is a confidence trick involving feigning romantic intentions towards a victim, gaining the victim's affection, and then using that goodwill to get the victim to send money to the scammer under false pretenses or to commit fraud against the victim. Fraudulent acts may involve access to the victim's money, bank accounts, credit cards, passports, Cash App, e-mail accounts, or national identification numbers; or forcing the victims to commit financial fraud on their behalf. These scams are often perpetrated by the fraud factory operated by the organized criminal gangs, who work together to take money from multiple victims at a time. Pig butchering scam (PBS or PB Scam) is increasingly rampant and widespread type of romance scam which usually also entail the high-yield investment program (HYIP) scam. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Account

A bank account is a financial account maintained by a bank or other financial institution in which the financial transaction A financial transaction is an Contract, agreement, or communication, between a buyer and seller to exchange goods, Service (economics), services, or assets for payment. Any transaction involves a change in the status of the finances of two or mo ...s between the bank and a customer are recorded. Each financial institution sets the terms and conditions for each type of account it offers, which are classified in commonly understood types, such as deposit accounts, credit card accounts, current accounts, loan accounts or many other types of account. A customer may have more than one account. Once an account is opened, funds entrusted by the customer to the financial institution on deposit are recorded in the account designated by the customer. Funds can be withdrawn from the accounts in accordance with their terms and conditions. The financial transac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Which?

''Which?'' is a United Kingdom brand name that promotes informed consumer choice in the purchase of goods and services by testing products, highlighting inferior products or services, raising awareness of consumer rights, and offering independent advice. The brand name is used by the Consumers' Association, a registered charity and company limited by guarantee that owns several businesses, including Which? Limited, which publishes the ''Which?'' magazines, and the currently dormant Which? Financial Services Limited (''Which?'' Mortgage and Insurance Advisers operated until 2019) and Which? Legal Limited. The vast majority of the association's income comes from the profit it makes on its trading businesses, for instance subscriptions to ''Which?'' magazine, which are donated to the campaigning part of the organisation to fund advocacy activity and inform the public about consumer issues. ''Which?'' magazine maintains its independence by not accepting advertising, and the organ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Super-complaint

A super-complaint is a complaint made in the UK by a state-approved "super-complainant" or watchdog organisation on behalf of consumers, which was fast-tracked to a higher authority such as the Office of Fair Trading (prior to its dissolution on 1 April 2014). The official body now responsible for dealing with general consumer protection super-complaints is the Competition and Markets Authority (CMA). A super-complaint, as defined in section 11(1) of the UK's Enterprise Act 2002, is a complaint submitted by a designated consumer body stating that "any feature, or combination of features, of a market in the UK for goods or services is or appears to be significantly harming the interests of consumers". Super-complaints have also specifically been introduced for the financial markets in the UK under the aegis of the Financial Conduct Authority (FCA). The Financial Services and Markets Act 2000 (FSMA) provides that certain consumer bodies may complain to the FCA about features of a mar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Systems Regulator

The Financial Conduct Authority (FCA) is a financial regulatory body in the United Kingdom. It operates independently of the UK Government and is financed by charging fees to members of the financial services industry. The FCA regulates financial firms providing services to consumers, and maintains the integrity of the financial markets in the United Kingdom. It focuses on the regulation of conduct by both retail and wholesale financial services firms. Like its predecessor the FSA, the FCA is structured as a company limited by guarantee.Goldsworth, J., ''Lexicon of Trust & Foundation Practice'' ( Wendens Ambo: Mulberry House Press, 2016)p. 140 The FCA works alongside the Prudential Regulation Authority and the Financial Policy Committee to set regulatory requirements for the financial sector. The FCA is responsible for the conduct of around 58,000 businesses which employ 2.2 million people and contribute around £65.6 billion in annual tax revenue to the economy in the United ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lending Standards Board

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Acting as a provider of loans is one of the main activities of financial institutions such as banks and credit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

KPMG

KPMG is a multinational professional services network, based in London, United Kingdom. As one of the Big Four accounting firms, along with Ernst & Young (EY), Deloitte, and PwC. KPMG is a network of firms in 145 countries with 275,288 employees, affiliated with KPMG International Limited, a private English company limited by guarantee. The name "KPMG" stands for "Klynveld Peat Marwick Goerdeler". The initialism was chosen when KMG (Klynveld Main Goerdeler) merged with Peat Marwick in 1987. KPMG has three lines of services: financial audit, tax, and advisory. Its tax and advisory services are further divided into various service groups. In the 21st century, various parts of the firm's global network of affiliates have been involved in regulatory actions as well as lawsuits. History Early years and mergers In 1816, Robert Fletcher started working as an accountant and in 1839 the firm he worked for changed its name to Robert Fletcher & Co. William Barclay Peat join ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |