Zero-sum game on:

[Wikipedia]

[Google]

[Amazon]

Zero-sum game is a mathematical representation in

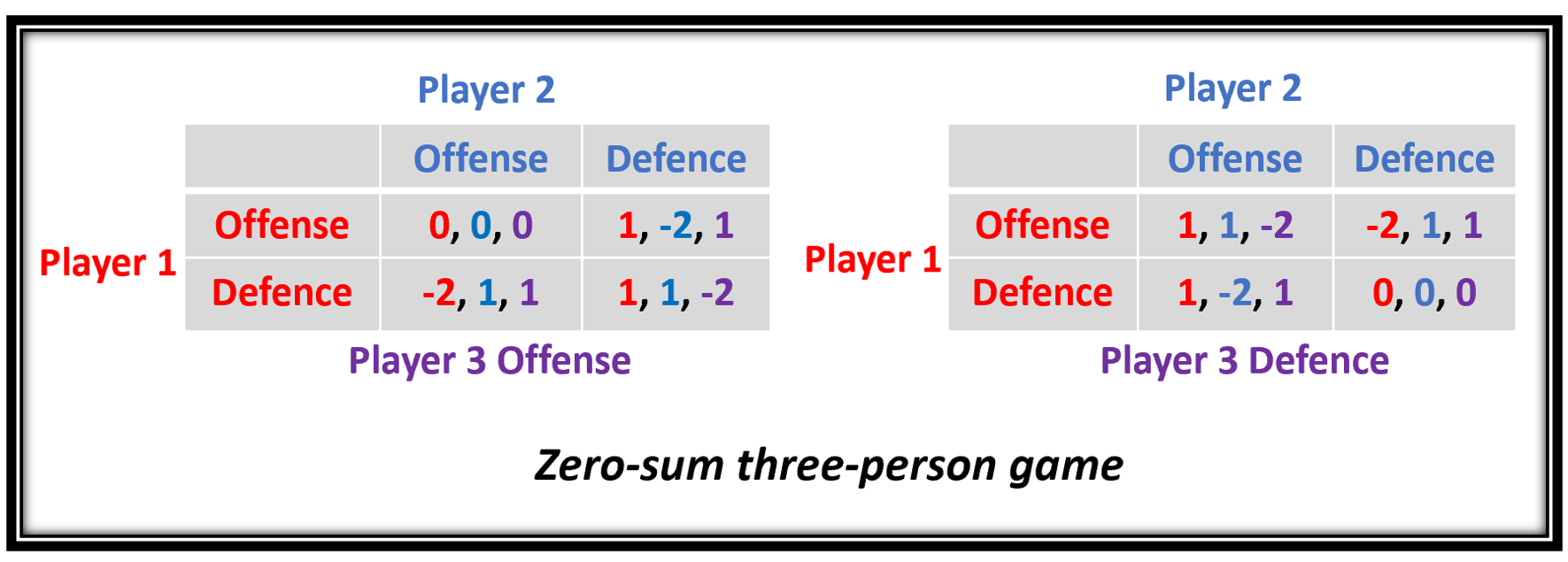

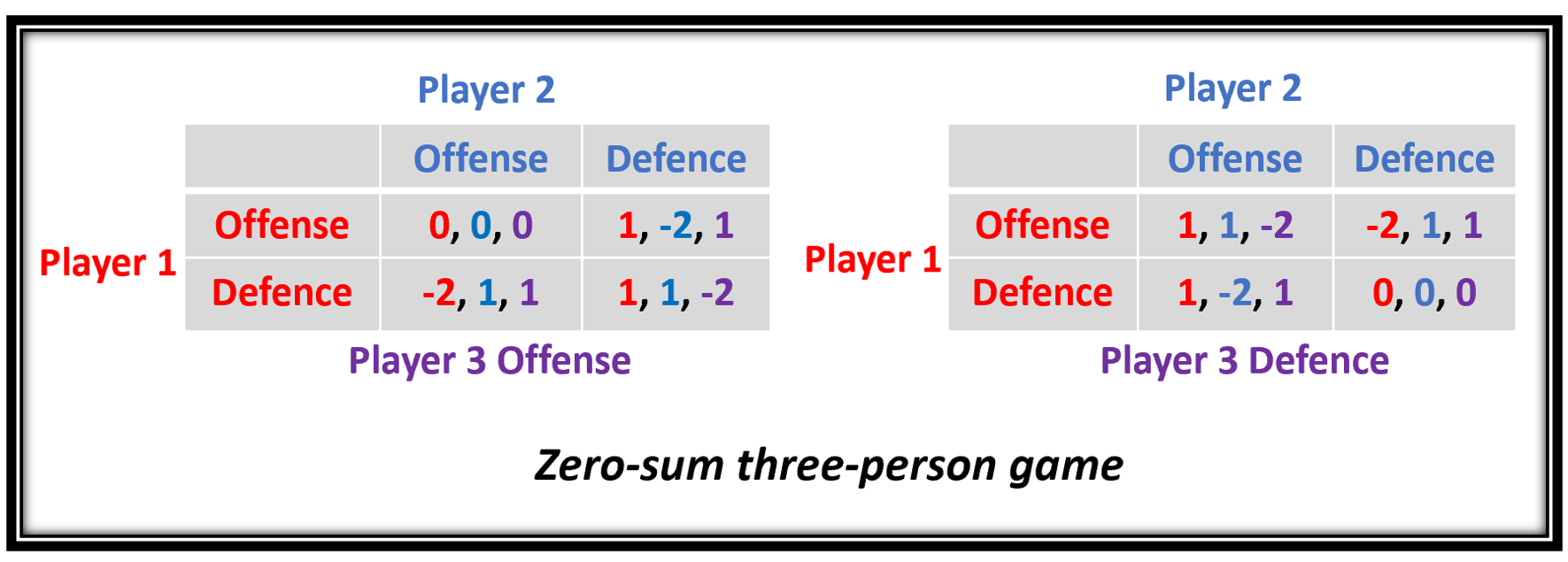

It is clear that there are manifold relationships between players in a zero-sum three-person game, in a zero-sum two-person game, anything one player wins is necessarily lost by the other and vice versa; therefore, there is always an absolute antagonism of interests, and that is similar in the three-person game. A particular move of a player in a zero-sum three-person game would be assumed to be clearly beneficial to him and may disbenefits to both other players, or benefits to one and disbenefits to the other opponent. Particularly, parallelism of interests between two players makes a cooperation desirable; it may happen that a player has a choice among various policies: Get into a parallelism interest with another player by adjusting his conduct, or the opposite; that he can choose with which of other two players he prefers to build such parallelism, and to what extent. The picture on the left shows that a typical example of a zero-sum three-person game. If Player 1 chooses to defence, but Player 2 & 3 chooses to offence, both of them will gain one point. At the same time, Player 1 will lose two-point because points are taken away by other players, and it is evident that Player 2 & 3 has parallelism of interests.

It is clear that there are manifold relationships between players in a zero-sum three-person game, in a zero-sum two-person game, anything one player wins is necessarily lost by the other and vice versa; therefore, there is always an absolute antagonism of interests, and that is similar in the three-person game. A particular move of a player in a zero-sum three-person game would be assumed to be clearly beneficial to him and may disbenefits to both other players, or benefits to one and disbenefits to the other opponent. Particularly, parallelism of interests between two players makes a cooperation desirable; it may happen that a player has a choice among various policies: Get into a parallelism interest with another player by adjusting his conduct, or the opposite; that he can choose with which of other two players he prefers to build such parallelism, and to what extent. The picture on the left shows that a typical example of a zero-sum three-person game. If Player 1 chooses to defence, but Player 2 & 3 chooses to offence, both of them will gain one point. At the same time, Player 1 will lose two-point because points are taken away by other players, and it is evident that Player 2 & 3 has parallelism of interests.

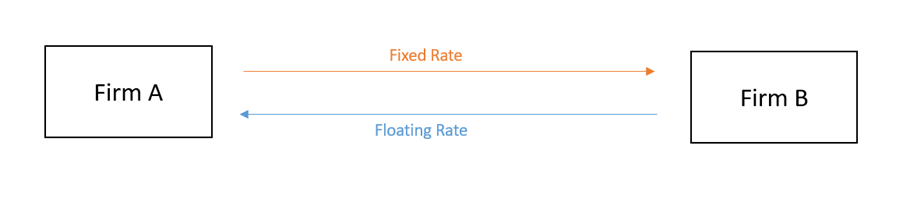

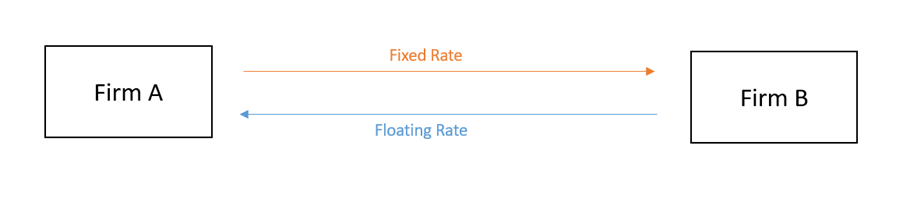

Swaps, which involve the exchange of cash flows from two different financial instruments, are also considered a zero-sum game. Consider a standard interest rate swap whereby Firm A pays a fixed rate and receives a floating rate; correspondingly Firm B pays a floating rate and receives a fixed rate. If rates increase, then Firm A will gain, and Firm B will lose by the rate differential (floating rate – fixed rate). If rates decrease, then Firm A will lose, and Firm B will gain by the rate differential (fixed rate – floating rate).

Whilst derivatives trading may be considered a zero-sum game, it is important to remember that this is not an absolute truth. The

Swaps, which involve the exchange of cash flows from two different financial instruments, are also considered a zero-sum game. Consider a standard interest rate swap whereby Firm A pays a fixed rate and receives a floating rate; correspondingly Firm B pays a floating rate and receives a fixed rate. If rates increase, then Firm A will gain, and Firm B will lose by the rate differential (floating rate – fixed rate). If rates decrease, then Firm A will lose, and Firm B will gain by the rate differential (fixed rate – floating rate).

Whilst derivatives trading may be considered a zero-sum game, it is important to remember that this is not an absolute truth. The

Play zero-sum games online

by Elmer G. Wiens.

– comprehensive text on psychology and game theory. (Contents and Preface to Second Edition.)

A playable zero-sum game

and its mixed strategy Nash equilibrium.

Positive Sum Games

{{DEFAULTSORT:Zero-Sum Non-cooperative games International relations theory Game theory game classes

game theory

Game theory is the study of mathematical models of strategic interactions. It has applications in many fields of social science, and is used extensively in economics, logic, systems science and computer science. Initially, game theory addressed ...

and economic theory

Economics () is a behavioral science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics anal ...

of a situation that involves two competing entities, where the result is an advantage for one side and an equivalent loss for the other. In other words, player one's gain is equivalent to player two's loss, with the result that the net improvement in benefit of the game is zero.

If the total gains of the participants are added up, and the total losses are subtracted, they will sum to zero. Thus, cutting a cake, where taking a more significant piece reduces the amount of cake available for others as much as it increases the amount available for that taker, is a zero-sum game if all participants value each unit of cake equally. Other examples of zero-sum games in daily life include games like poker

Poker is a family of Card game#Comparing games, comparing card games in which Card player, players betting (poker), wager over which poker hand, hand is best according to that specific game's rules. It is played worldwide, with varying rules i ...

, chess

Chess is a board game for two players. It is an abstract strategy game that involves Perfect information, no hidden information and no elements of game of chance, chance. It is played on a square chessboard, board consisting of 64 squares arran ...

, sport

Sport is a physical activity or game, often Competition, competitive and organization, organized, that maintains or improves physical ability and skills. Sport may provide enjoyment to participants and entertainment to spectators. The numbe ...

and bridge

A bridge is a structure built to Span (engineering), span a physical obstacle (such as a body of water, valley, road, or railway) without blocking the path underneath. It is constructed for the purpose of providing passage over the obstacle, whi ...

where one person gains and another person loses, which results in a zero-net benefit for every player. In the markets and financial instruments, futures contracts and options are zero-sum games as well.

In contrast, non-zero-sum describes a situation in which the interacting parties' aggregate gains and losses can be less than or more than zero. A zero-sum game is also called a ''strictly competitive'' game, while non-zero-sum games can be either competitive or non-competitive. Zero-sum games are most often solved with the minimax theorem which is closely related to linear programming duality, or with Nash equilibrium

In game theory, the Nash equilibrium is the most commonly used solution concept for non-cooperative games. A Nash equilibrium is a situation where no player could gain by changing their own strategy (holding all other players' strategies fixed) ...

. Prisoner's Dilemma is a classic non-zero-sum game.

Definition

The zero-sum property (if one gains, another loses) means that any result of a zero-sum situation is Pareto optimal. Generally, any game where all strategies are Pareto optimal is called a conflict game. Zero-sum games are a specific example of constant sum games where the sum of each outcome is always zero. Such games are distributive, not integrative; the pie cannot be enlarged by good negotiation. In situation where one decision maker's gain (or loss) does not necessarily result in the other decision makers' loss (or gain), they are referred to as non-zero-sum. Thus, a country with an excess of bananas trading with another country for their excess of apples, where both benefit from the transaction, is in a non-zero-sum situation. Other non-zero-sum games are games in which the sum of gains and losses by the players is sometimes more or less than what they began with. The idea of Pareto optimal payoff in a zero-sum game gives rise to a generalized relative selfish rationality standard, the punishing-the-opponent standard, where both players always seek to minimize the opponent's payoff at a favourable cost to themselves rather than prefer more over less. The punishing-the-opponent standard can be used in both zero-sum games (e.g. warfare game, chess) and non-zero-sum games (e.g. pooling selection games). The player in the game has a simple enough desire to maximise the profit for them, and the opponent wishes to minimise it.Solution

For two-player finite zero-sum games, if the players are allowed to play a mixed strategy, the game always has at least one equilibrium solution. The different game theoretic solution concepts ofNash equilibrium

In game theory, the Nash equilibrium is the most commonly used solution concept for non-cooperative games. A Nash equilibrium is a situation where no player could gain by changing their own strategy (holding all other players' strategies fixed) ...

, minimax, and maximin all give the same solution. Notice that this is not true for pure strategy.

Example

A game's payoff matrix is a convenient representation. Consider these situations as an example, the two-player zero-sum game pictured at right or above. The order of play proceeds as follows: The first player (red) chooses in secret one of the two actions 1 or 2; the second player (blue), unaware of the first player's choice, chooses in secret one of the three actions A, B or C. Then, the choices are revealed and each player's points total is affected according to the payoff for those choices. ''Example: Red chooses action 2 and Blue chooses action B. When the payoff is allocated, Red gains 20 points and Blue loses 20 points.'' In this example game, both players know the payoff matrix and attempt to maximize the number of their points. Red could reason as follows: "With action 2, I could lose up to 20 points and can win only 20, and with action 1 I can lose only 10 but can win up to 30, so action 1 looks a lot better." With similar reasoning, Blue would choose action C. If both players take these actions, Red will win 20 points. If Blue anticipates Red's reasoning and choice of action 1, Blue may choose action B, so as to win 10 points. If Red, in turn, anticipates this trick and goes for action 2, this wins Red 20 points.Émile Borel

Félix Édouard Justin Émile Borel (; 7 January 1871 – 3 February 1956) was a French people, French mathematician and politician. As a mathematician, he was known for his founding work in the areas of measure theory and probability.

Biograp ...

and John von Neumann

John von Neumann ( ; ; December 28, 1903 – February 8, 1957) was a Hungarian and American mathematician, physicist, computer scientist and engineer. Von Neumann had perhaps the widest coverage of any mathematician of his time, in ...

had the fundamental insight that probability

Probability is a branch of mathematics and statistics concerning events and numerical descriptions of how likely they are to occur. The probability of an event is a number between 0 and 1; the larger the probability, the more likely an e ...

provides a way out of this conundrum. Instead of deciding on a definite action to take, the two players assign probabilities to their respective actions, and then use a random device which, according to these probabilities, chooses an action for them. Each player computes the probabilities so as to minimize the maximum expected point-loss independent of the opponent's strategy. This leads to a linear programming

Linear programming (LP), also called linear optimization, is a method to achieve the best outcome (such as maximum profit or lowest cost) in a mathematical model whose requirements and objective are represented by linear function#As a polynomia ...

problem with the optimal strategies for each player. This minimax method can compute probably optimal strategies for all two-player zero-sum games.

For the example given above, it turns out that Red should choose action 1 with probability and action 2 with probability , and Blue should assign the probabilities 0, , and to the three actions A, B, and C. Red will then win points on average per game.

Solving

TheNash equilibrium

In game theory, the Nash equilibrium is the most commonly used solution concept for non-cooperative games. A Nash equilibrium is a situation where no player could gain by changing their own strategy (holding all other players' strategies fixed) ...

for a two-player, zero-sum game can be found by solving a linear programming

Linear programming (LP), also called linear optimization, is a method to achieve the best outcome (such as maximum profit or lowest cost) in a mathematical model whose requirements and objective are represented by linear function#As a polynomia ...

problem. Suppose a zero-sum game has a payoff matrix where element is the payoff obtained when the minimizing player chooses pure strategy and the maximizing player chooses pure strategy (i.e. the player trying to minimize the payoff chooses the row and the player trying to maximize the payoff chooses the column). Assume every element of is positive. The game will have at least one Nash equilibrium. The Nash equilibrium can be found (Raghavan 1994, p. 740) by solving the following linear program to find a vector :

The first constraint says each element of the vector must be nonnegative, and the second constraint says each element of the vector must be at least 1. For the resulting vector, the inverse of the sum of its elements is the value of the game. Multiplying by that value gives a probability vector, giving the probability that the maximizing player will choose each possible pure strategy.

If the game matrix does not have all positive elements, add a constant to every element that is large enough to make them all positive. That will increase the value of the game by that constant, and will not affect the equilibrium mixed strategies for the equilibrium.

The equilibrium mixed strategy for the minimizing player can be found by solving the dual of the given linear program. Alternatively, it can be found by using the above procedure to solve a modified payoff matrix which is the transpose and negation of (adding a constant so it is positive), then solving the resulting game.

If all the solutions to the linear program are found, they will constitute all the Nash equilibria for the game. Conversely, any linear program can be converted into a two-player, zero-sum game by using a change of variables that puts it in the form of the above equations and thus such games are equivalent to linear programs, in general.

Universal solution

If avoiding a zero-sum game is an action choice with some probability for players, avoiding is always an equilibrium strategy for at least one player at a zero-sum game. For any two players zero-sum game where a zero-zero draw is impossible or non-credible after the play is started, such as poker, there is no Nash equilibrium strategy other than avoiding the play. Even if there is a credible zero-zero draw after a zero-sum game is started, it is not better than the avoiding strategy. In this sense, it's interesting to find reward-as-you-go in optimal choice computation shall prevail over all two players zero-sum games concerning starting the game or not. The most common or simple example from the subfield ofsocial psychology

Social psychology is the methodical study of how thoughts, feelings, and behaviors are influenced by the actual, imagined, or implied presence of others. Although studying many of the same substantive topics as its counterpart in the field ...

is the concept of " social traps". In some cases pursuing individual personal interest can enhance the collective well-being of the group, but in other situations, all parties pursuing personal interest results in mutually destructive behaviour.

Copeland's review notes that an n-player non-zero-sum game can be converted into an (n+1)-player zero-sum game, where the n+1st player, denoted the ''fictitious player'', receives the negative of the sum of the gains of the other n-players (the global gain / loss).

Zero-sum three-person games

It is clear that there are manifold relationships between players in a zero-sum three-person game, in a zero-sum two-person game, anything one player wins is necessarily lost by the other and vice versa; therefore, there is always an absolute antagonism of interests, and that is similar in the three-person game. A particular move of a player in a zero-sum three-person game would be assumed to be clearly beneficial to him and may disbenefits to both other players, or benefits to one and disbenefits to the other opponent. Particularly, parallelism of interests between two players makes a cooperation desirable; it may happen that a player has a choice among various policies: Get into a parallelism interest with another player by adjusting his conduct, or the opposite; that he can choose with which of other two players he prefers to build such parallelism, and to what extent. The picture on the left shows that a typical example of a zero-sum three-person game. If Player 1 chooses to defence, but Player 2 & 3 chooses to offence, both of them will gain one point. At the same time, Player 1 will lose two-point because points are taken away by other players, and it is evident that Player 2 & 3 has parallelism of interests.

It is clear that there are manifold relationships between players in a zero-sum three-person game, in a zero-sum two-person game, anything one player wins is necessarily lost by the other and vice versa; therefore, there is always an absolute antagonism of interests, and that is similar in the three-person game. A particular move of a player in a zero-sum three-person game would be assumed to be clearly beneficial to him and may disbenefits to both other players, or benefits to one and disbenefits to the other opponent. Particularly, parallelism of interests between two players makes a cooperation desirable; it may happen that a player has a choice among various policies: Get into a parallelism interest with another player by adjusting his conduct, or the opposite; that he can choose with which of other two players he prefers to build such parallelism, and to what extent. The picture on the left shows that a typical example of a zero-sum three-person game. If Player 1 chooses to defence, but Player 2 & 3 chooses to offence, both of them will gain one point. At the same time, Player 1 will lose two-point because points are taken away by other players, and it is evident that Player 2 & 3 has parallelism of interests.

Real life example

Economic benefits of low-cost airlines in saturated markets - net benefits or a zero-sum game

Studies show that the entry of low-cost airlines into the Hong Kong market brought in $671 million in revenue and resulted in an outflow of $294 million. Therefore, the replacement effect should be considered when introducing a new model, which will lead to economic leakage and injection. Thus introducing new models requires caution. For example, if the number of new airlines departing from and arriving at the airport is the same, the economic contribution to the host city may be a zero-sum game. Because for Hong Kong, the consumption of overseas tourists in Hong Kong is income, while the consumption of Hong Kong residents in opposite cities is outflow. In addition, the introduction of new airlines can also have a negative impact on existing airlines. Consequently, when a new aviation model is introduced, feasibility tests need to be carried out in all aspects, taking into account the economic inflow and outflow and displacement effects caused by the model.Zero-sum games in financial markets

Derivatives trading may be considered a zero-sum game, as each dollar gained by one party in a transaction must be lost by the other, hence yielding a net transfer of wealth of zero. An options contract - whereby a buyer purchases a derivative contract which provides them with the right to buy an underlying asset from a seller at a specified strike price before a specified expiration date – is an example of a zero-sum game. Afutures contract

In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item tr ...

– whereby a buyer purchases a derivative contract to buy an underlying asset from the seller for a specified price on a specified date – is also an example of a zero-sum game. This is because the fundamental principle of these contracts is that they are agreements between two parties, and any gain made by one party must be matched by a loss sustained by the other.

If the price of the underlying asset increases before the expiration date the buyer may exercise/ close the options/ futures contract. The buyers gain and corresponding sellers loss will be the difference between the strike price and value of the underlying asset at that time. Hence, the net transfer of wealth is zero.

Swaps, which involve the exchange of cash flows from two different financial instruments, are also considered a zero-sum game. Consider a standard interest rate swap whereby Firm A pays a fixed rate and receives a floating rate; correspondingly Firm B pays a floating rate and receives a fixed rate. If rates increase, then Firm A will gain, and Firm B will lose by the rate differential (floating rate – fixed rate). If rates decrease, then Firm A will lose, and Firm B will gain by the rate differential (fixed rate – floating rate).

Whilst derivatives trading may be considered a zero-sum game, it is important to remember that this is not an absolute truth. The

Swaps, which involve the exchange of cash flows from two different financial instruments, are also considered a zero-sum game. Consider a standard interest rate swap whereby Firm A pays a fixed rate and receives a floating rate; correspondingly Firm B pays a floating rate and receives a fixed rate. If rates increase, then Firm A will gain, and Firm B will lose by the rate differential (floating rate – fixed rate). If rates decrease, then Firm A will lose, and Firm B will gain by the rate differential (fixed rate – floating rate).

Whilst derivatives trading may be considered a zero-sum game, it is important to remember that this is not an absolute truth. The financial market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial marke ...

s are complex and multifaceted, with a range of participants engaging in a variety of activities. While some trades may result in a simple transfer of wealth from one party to another, the market as a whole is not purely competitive, and many transactions serve important economic functions.

The stock market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange a ...

is an excellent example of a positive-sum game, often erroneously labelled as a zero-sum game. This is a zero-sum fallacy: the perception that one trader in the stock market may only increase the value of their holdings if another trader decreases their holdings.

The primary goal of the stock market is to match buyers and sellers, but the prevailing price is the one which equilibrates supply and demand. Stock prices generally move according to changes in future expectations, such as acquisition announcements, upside earnings surprises, or improved guidance.

For instance, if Company C announces a deal to acquire Company D, and investors believe that the acquisition will result in synergies and hence increased profitability for Company C, there will be an increased demand for Company C stock. In this scenario, all existing holders of Company C stock will enjoy gains without incurring any corresponding measurable losses to other players.

Furthermore, in the long run, the stock market is a positive-sum game. As economic growth occurs, demand increases, output increases, companies grow, and company valuations increase, leading to value creation and wealth addition in the market.

Complexity

It has been theorized by Robert Wright in his book '' Nonzero: The Logic of Human Destiny'', that society becomes increasingly non-zero-sum as it becomes more complex, specialized, and interdependent.Extensions

In 1944,John von Neumann

John von Neumann ( ; ; December 28, 1903 – February 8, 1957) was a Hungarian and American mathematician, physicist, computer scientist and engineer. Von Neumann had perhaps the widest coverage of any mathematician of his time, in ...

and Oskar Morgenstern

Oskar Morgenstern (; January 24, 1902 – July 26, 1977) was a German-born economist. In collaboration with mathematician John von Neumann, he is credited with founding the field of game theory and its application to social sciences and strategic ...

proved that any non-zero-sum game for ''n'' players is equivalent to a zero-sum game with ''n'' + 1 players; the (''n'' + 1)th player representing the negative of the total profit among the first ''n'' players.

Misunderstandings

Zero-sum games and particularly their solutions are commonly misunderstood by critics ofgame theory

Game theory is the study of mathematical models of strategic interactions. It has applications in many fields of social science, and is used extensively in economics, logic, systems science and computer science. Initially, game theory addressed ...

, usually with respect to the independence and rationality

Rationality is the quality of being guided by or based on reason. In this regard, a person acts rationally if they have a good reason for what they do, or a belief is rational if it is based on strong evidence. This quality can apply to an ab ...

of the players, as well as to the interpretation of utility functions. Furthermore, the word "game" does not imply the model is valid only for recreational game

A game is a structured type of play usually undertaken for entertainment or fun, and sometimes used as an educational tool. Many games are also considered to be work (such as professional players of spectator sports or video games) or art ...

s., chapters 1 & 7

Politics is sometimes called zero sum because in common usage the idea of a stalemate is perceived to be "zero sum"; politics and macroeconomics

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output (econ ...

are not zero-sum games, however, because they do not constitute conserved systems.. Applying zero-sum game logic to scenarios that are not zero-sum in nature may lead to incorrect conclusions. Zero-sum games are based on the notion that one person's win will result in the other person's loss, so naturally there is competition between the two. There are scenarios, however, where that is not the case. For instance, in some cases both sides cooperating and working together could result in both sides benefitting more than they otherwise would have. By applying zero-sum logic, we in turn create an unnecessary, and potentially harmful, sense of scarcity and hostility. Therefore, it is critical to make sure that zero-sum applications fit the given context.

Zero-sum thinking

In psychology, zero-sum thinking refers to the perception that a given situation is like a zero-sum game, where one person's gain is equal to another person's loss.See also

* Bimatrix game *Comparative advantage

Comparative advantage in an economic model is the advantage over others in producing a particular Goods (economics), good. A good can be produced at a lower relative opportunity cost or autarky price, i.e. at a lower relative marginal cost prior t ...

* Dutch disease

* Gains from trade

In economics, gains from trade are the net benefits to economic agents from being allowed an increase in voluntary trading with each other. In technical terms, they are the increase of consumer surplus plus producer surplus from lower tariffs ...

* Lump of labour fallacy

* Win–win game

* No-win situation

References

Further reading

* ''Misstating the Concept of Zero-Sum Games within the Context of Professional Sports Trading Strategies'', series ''Pardon the Interruption'' (2010-09-23)ESPN

ESPN (an initialism of their original name, which was the Entertainment and Sports Programming Network) is an American international basic cable sports channel owned by the Walt Disney Company (80% and operational control) and Hearst Commu ...

, created by Tony Kornheiser and Michael Wilbon, performance by Bill Simmons

* ''Handbook of Game Theory – volume 2'', chapter ''Zero-sum two-person games'', (1994) Elsevier

Elsevier ( ) is a Dutch academic publishing company specializing in scientific, technical, and medical content. Its products include journals such as ''The Lancet'', ''Cell (journal), Cell'', the ScienceDirect collection of electronic journals, ...

Amsterdam, by Raghavan, T. E. S., Edited by Aumann and Hart, pp. 735–759,

* ''Power: Its Forms, Bases and Uses'' (1997) Transaction Publishers, by Dennis Wrong,

External links

Play zero-sum games online

by Elmer G. Wiens.

– comprehensive text on psychology and game theory. (Contents and Preface to Second Edition.)

A playable zero-sum game

and its mixed strategy Nash equilibrium.

Positive Sum Games

{{DEFAULTSORT:Zero-Sum Non-cooperative games International relations theory Game theory game classes