Wells Fargo & Company is an American multinational financial services company with corporate

Wells Fargo & Company is an American multinational financial services company with corporate History

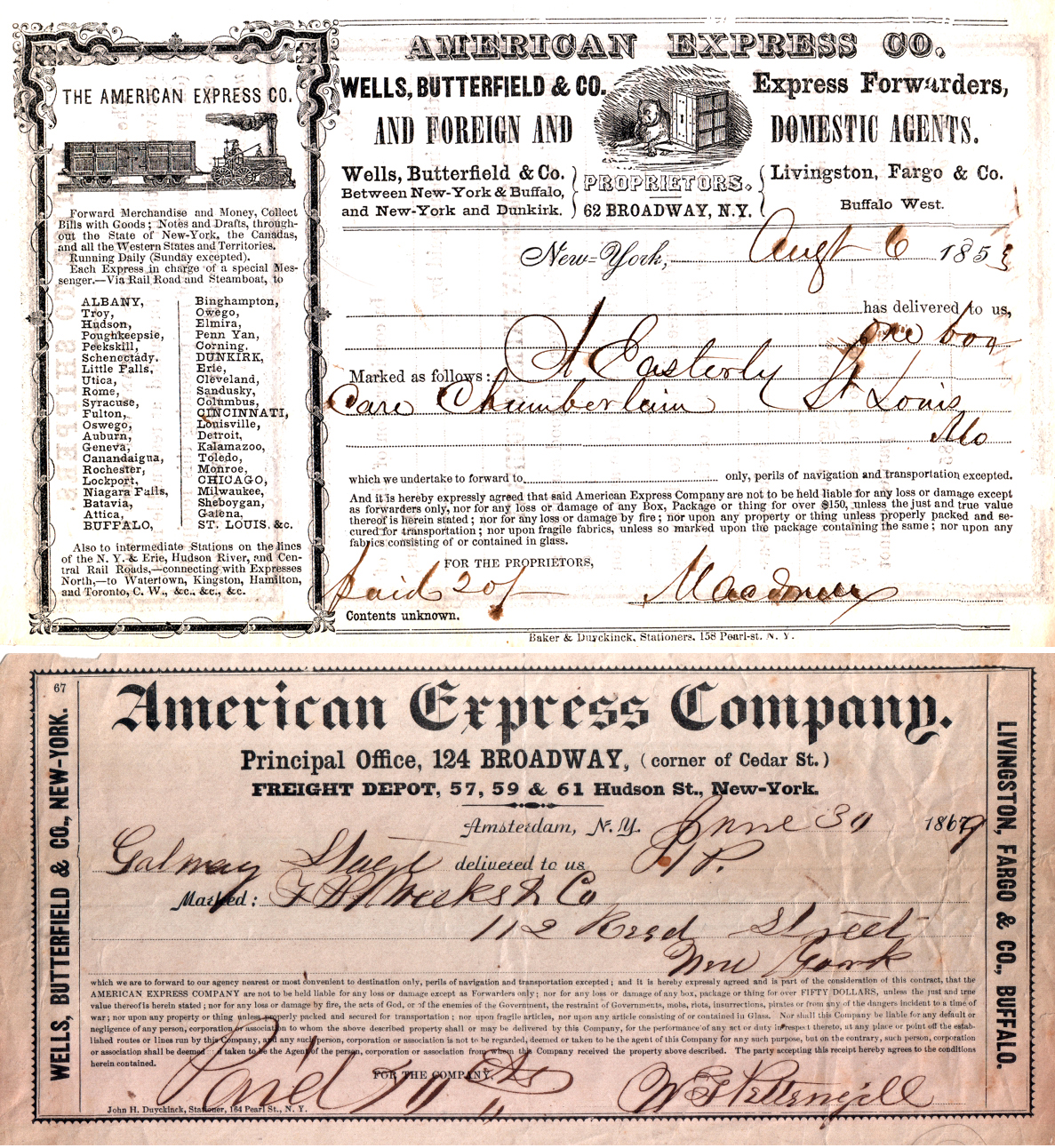

Six years later, the "Grand Consolidation" united Wells Fargo, Holladay, and Overland Mail stage lines under the Wells Fargo name.

Six years later, the "Grand Consolidation" united Wells Fargo, Holladay, and Overland Mail stage lines under the Wells Fargo name.

In 1872, Lloyd Tevis, a friend of the Central Pacific "Big Four" and holder of rights to operate an express service over the Transcontinental Railroad, became president of the company after acquiring a large stake, a position he held until 1892.

In 1905, Wells Fargo separated its banking and express operations, and Wells Fargo's bank merged with the Nevada National Bank to form the Wells Fargo Nevada National Bank.

During the

In 1872, Lloyd Tevis, a friend of the Central Pacific "Big Four" and holder of rights to operate an express service over the Transcontinental Railroad, became president of the company after acquiring a large stake, a position he held until 1892.

In 1905, Wells Fargo separated its banking and express operations, and Wells Fargo's bank merged with the Nevada National Bank to form the Wells Fargo Nevada National Bank.

During the Environmental record

In 2009, Wells Fargo ranked 1st among banks and insurance companies, and 13th overall, in Newsweek Magazine's inaugural "Green Rankings" of the country's 500 largest companies. In 2013, the company was recognized by the EPA Center for Corporate Climate Leadership as a Climate Leadership Award winner, in the category "Excellence in Greenhouse Gas Management (Goal Setting Certificate)"; this recognition was for the company's aim to reduce its absoluteWells Fargo History Museum

Operations and services

Consumer Banking and Lending

The Consumer Banking and Lending segment includes Regional Banking, Diversified Products, and Consumer Deposits groups, as well as Wells Fargo Customer Connection (formerly Wells Fargo Phone Bank, Wachovia Direct Access, the National Business Banking Center, and Credit Card Customer Service). Wells Fargo also has around 2,000 stand-alone mortgage branches throughout the country. There are also mini-branches located inside of other buildings, which are almost exclusively grocery stores, that usually contain ATMs, basicConsumer lending

Wells Fargo Home Mortgage is the second largest retail mortgage originator in the United States, originating one out of every four home loans. Wells Fargo services $1.8 trillion in home mortgages, the one of the largest servicing portfolios in the US.Equipment lending

Wells Fargo has various divisions, including Wells Fargo Rail, that finance and lease equipment to different types of companies.Wealth and Investment Management

Wells Fargo offers investment products through its subsidiaries, Wells Fargo Investments, LLC, and Wells Fargo Advisors, LLC, as well as through national broker/dealer firms. The company also serves high-net-worth individuals through its private bank and family wealth group.

Wells Fargo Advisors is the brokerage subsidiary of Wells Fargo, located in St. Louis, Missouri. It is the third-largest brokerage firm in the United States as of the third quarter of 2010 with $1.1 trillion retail client assets under management.

Wells Fargo Advisors was known as Wachovia Securities until May 1, 2009, when it was renamed following Wells Fargo's acquisition of Wachovia Corporation.

Wells Fargo offers investment products through its subsidiaries, Wells Fargo Investments, LLC, and Wells Fargo Advisors, LLC, as well as through national broker/dealer firms. The company also serves high-net-worth individuals through its private bank and family wealth group.

Wells Fargo Advisors is the brokerage subsidiary of Wells Fargo, located in St. Louis, Missouri. It is the third-largest brokerage firm in the United States as of the third quarter of 2010 with $1.1 trillion retail client assets under management.

Wells Fargo Advisors was known as Wachovia Securities until May 1, 2009, when it was renamed following Wells Fargo's acquisition of Wachovia Corporation.

Securities

Wells Fargo Securities (WFS) is the investment banking division of Wells Fargo & Co. headquartered in Charlotte, with other U.S. offices in New York, Minneapolis, Boston, Houston, San Francisco, and Los Angeles and with international offices in London, Hong Kong, Singapore, and Tokyo. Wells Fargo Securities was established in 2009 after the acquisition of Wachovia Securities. It provides sales and trading, fixed income, FX and rates,Cross-selling

A key part of Wells Fargo's business strategy isInternational operations

Wells Fargo has banking services throughout the world, with overseas offices inCharter

Wells Fargo operates under Charter #1, the first national bankLawsuits, fines and controversies

1981 MAPS Wells Fargo embezzlement scandal

In 1981, it was discovered that a Wells Fargo assistant operations officer, Lloyd Benjamin "Ben" Lewis, had perpetrated one of the largest embezzlements in history, through its Beverly Drive branch. During 1978 - 1981, Lewis had successfully written phony debit and credit receipts to benefitHigher costs charged to African-American and Hispanic borrowers

Illinois Attorney General Lisa Madigan filed suit against Wells Fargo on July 31, 2009, alleging that the bank steersFailure to monitor suspected money laundering

In a March 2010 agreement with US federal prosecutors, Wells Fargo acknowledged that between 2004 and 2007 Wachovia had failed to monitor and report suspected money laundering by narcotics traffickers, including the cash used to buy four planes that shipped a total of 22 tons of cocaine into Mexico.Overdraft fees

In August 2010, Wells Fargo was fined bySettlement and fines regarding mortgage servicing practices

On February 9, 2012, it was announced that the five largest mortgage servicers ( Ally Financial,SEC fine due to inadequate risk disclosures

On August 14, 2012, Wells Fargo agreed to pay around $6.5 million to settle U.S. Securities and Exchange Commission (SEC) charges that in 2007 it sold risky mortgage-backed securities without fully realizing their dangers.Lawsuit by FHA over loan underwriting

In 2016, Wells Fargo agreed to pay $1.2 billion to settle allegations that the company violated the False Claims Act by underwriting over 100,000 Federal Housing Administration (FHA) backed loans when over half of the applicants did not qualify for the program. In October 2012, Wells Fargo was sued by United States Attorney Preet Bharara over questionable mortgage deals.Lawsuit due to premium inflation on forced place insurance

In April 2013, Wells Fargo settled a suit with 24,000 Florida homeowners alongside insurer QBE Insurance, in which Wells Fargo was accused of inflating premiums on forced-place insurance.Lawsuit regarding excessive overdraft fees

In May 2013, Wells Fargo paid $203 million to settle class-action litigation accusing the bank of imposing excessive overdraft fees on checking-account customers.Violation of New York credit card laws

In February 2015, Wells Fargo agreed to pay $4 million, including a $2 million penalty and $2 million in restitution for illegally taking an interest in the homes of borrowers in exchange for opening credit card accounts for the homeowners.Tax liability and lobbying

In December 2011, Public Campaign criticized Wells Fargo for spending $11 million onPrison industry investment

The company has invested its clients' funds in GEO Group, a multi-national provider of for-profit private prisons. By March 2012, its stake had grown to more than 4.4 million shares worth $86.7 million. As of November 2012, Wells Fargo divested 33% of its holdings of GEO's stock, reducing its stake to 4.98% of Geo Group's common stock, below the threshold of which it must disclose further transactions.Discrimination against African Americans in hiring

In August 2020, the company agreed to pay $7.8 million in back wages for allegedly discriminating against 34,193 African Americans in hiring for tellers, personal bankers, customer sales and service representatives, and administrative support positions. The company agreed to provide jobs to 580 of the affected applicants.SEC settlement for insider trading case

In May 2015, Gregory T. Bolan Jr., a stock analyst at Wells Fargo agreed to pay $75,000 to the U.S. Securities and Exchange Commission to settle allegations that he gave Joseph C. Ruggieri, a stock trader, insider information on probable ratings charges. Ruggieri was not convicted of any crime.Wells Fargo fake accounts scandal

In September 2016, Wells Fargo was issued a combined total of $185 million in fines for opening over 1.5 million checking and savings accounts and 500,000 credit cards on behalf of customers without their consent. TheRacketeering lawsuit for mortgage appraisal overcharges

In November 2016, Wells Fargo agreed to pay $50 million to settle allegations of overcharging hundreds of thousands of homeowners for appraisals ordered after they defaulted on their mortgage loans. While banks are allowed to charge homeowners for such appraisals, Wells Fargo frequently charged homeowners $95 to $125 on appraisals for which the bank had been charged $50 or less. The plaintiffs had sought triple damages under the U.S. Racketeer Influenced and Corrupt Organizations Act on grounds that sending invoices and statements with fraudulently concealed fees constituted mail and wire fraud sufficient to allege racketeering.Financing of Dakota Access Pipeline

Wells Fargo is a lender on the Dakota Access Pipeline, a 1,172-mile-long (1,886 km) underground oilFailure to comply with document security requirements

In December 2016, the Financial Industry Regulatory Authority fined Wells Fargo $5.5 million for failing to store electronic documents in a "write once, read many" format, which makes it impossible to alter or destroy records after they are written.Doing business with the gun industry and NRA

From December 2012 through February 2018, Wells Fargo reportedly helped two of the biggest firearms and ammunition companies obtain $431.1 million in loans. It also handled banking for the National Rifle Association and provided bank accounts and a $28-million line of credit. In 2020, the company said that it is winding down its business with the National Rifle Association.Discrimination against female workers

In June 2018, about a dozen female Wells Fargo executives from the wealth management division met inOverselling auto insurance

On June 10, 2019, Wells Fargo agreed to pay $385 million to settle a lawsuit accusing it of allegedly scamming millions of auto-loan customers into buying insurance they did not need from National General Insurance.Failure to Supervise Registered Representatives

On August 28, 2020, Wells Fargo agreed to pay a fine of $350,000 as well as $10 million in restitution payments to certain customers after the Financial Industry Regulatory Authority accused the company of failing to reasonably supervise two of its registered representatives that recommended that customers invest a high percentage of their assets in high-risk energy securities in 2014 and 2015.Steering customers to more expensive retirement accounts

In April 2018, the United States Department of Labor launched a probe into whether Wells Fargo was pushing its customers into more expensive retirement plans as well as into retirement funds managed by Wells Fargo itself.Alteration of documents

In May 2018, the company discovered that its business banking group had improperly altered documents about business clients in 2017 and early 2018.Executive compensation

With CEO John Stumpf paid 473 times more than the median employee, Wells Fargo ranked number 33 among the S&P 500 companies for CEO—employee pay inequality. In October 2014, a Wells Fargo employee earning $15 per hour emailed the CEO—copying 200,000 other employees—asking that all employees be given a $10,000 per year raise taken from a portion of annual corporate profits to address wage stagnation and income inequality. After being contacted by the media, Wells Fargo responded that all employees receive "market competitive" pay and benefits significantly above US federal minimums. Pursuant to Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, publicly traded companies are required to disclose (1) the median total annual compensation of all employees other than the CEO and (2) the ratio of the CEO's annual total compensation to that of the median employee.Fine due to consumer banking violation

Well's fargo was heavily fined due to evident wrong records of customer payments on home and auto loans. The bank had to pay $3.7 billion to resolve claims which harmed millions of customers.Carbon footprint

Wells Fargo & Company reported Total CO2e emissions (Direct + Indirect) for the twelve months ending 31 December 2020 at 776 Kt (-87 /-10.1% y-o-y).Alt URL/ref> There has been a consistent declining trend in reported emissions since 2015.

In popular culture

Wells Fargo stagecoaches are mentioned in the song " The Deadwood Stage (Whip-Crack-Away!)" in the 1953 film '' Calamity Jane'' performed by Doris Day: "With a fancy cargo, care of Wells and Fargo, Illinois - Boy!". Wells Fargo is also shown as the delivery service bringing the instruments for the town band in the 1962 film ''Charity

On March 2, 2022, Wells Fargo announced $1 mil donation to the American Red Cross that will be used for Ukrainian refugees fleeing from the Russian invasion. In April 2022, The Wells Fargo foundation announced its pledge of $210 million toward racial equity in homeownership. With $60 million of the donation awarded in Wealth Opportunities Restored through Homeownership (WORTH) grants which will run until 2025. Additionally, $150 million will be committed to lower mortgage rates and reducing the refinancing costs to aid minority homeowners.See also

* List of Wells Fargo directors * List of Wells Fargo presidents * Wells Fargo Arena *References

External links

* {{Authority control 1852 establishments in New York (state) American companies established in 1852 Banks based in California Banks established in 1852 Companies based in San Francisco Companies listed on the New York Stock Exchange Financial District, San Francisco Mortgage lenders of the United States Online brokerages Systemically important financial institutions