Welfare cost of business cycles on:

[Wikipedia]

[Google]

[Amazon]

In

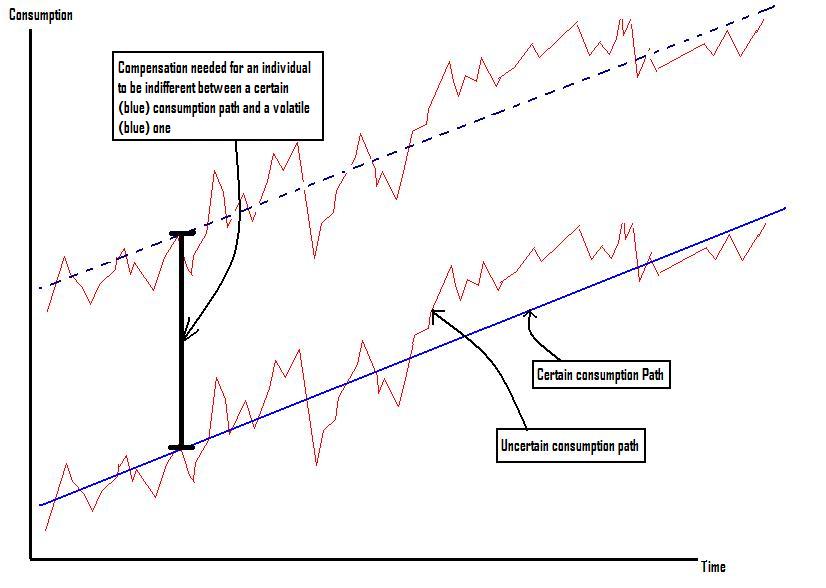

If we consider two consumption paths, each with the same

If we consider two consumption paths, each with the same

macroeconomics

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole.

For example, using interest rates, taxes, and ...

, the cost of business cycles is the decrease in social welfare

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet Basic needs, basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refe ...

, if any, caused by business cycle

Business cycles are intervals of Economic expansion, expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are ...

fluctuations.

Nobel economist

An economist is a professional and practitioner in the social sciences, social science discipline of economics.

The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this ...

Robert Lucas proposed measuring the cost of business cycles as the percentage increase in consumption

Consumption may refer to:

*Resource consumption

*Tuberculosis, an infectious disease, historically

* Consumption (ecology), receipt of energy by consuming other organisms

* Consumption (economics), the purchasing of newly produced goods for curren ...

that would be necessary to make a representative consumer indifferent between a smooth, non-fluctuating, consumption trend and one that is subject to business cycles.

Under the assumptions that business cycles represent random shocks around a trend growth path, Robert Lucas argued that the cost of business cycles is extremely small, and as a result the focus of both academic economists and policy makers on economic stabilization policy

{{unreferenced, date=July 2013

In macroeconomics, a stabilization policy is a package or set of measures introduced to stabilize a financial system or economy.

The term can refer to policies in two distinct sets of circumstances: business cycle st ...

rather than on long term growth

Growth may refer to:

Biology

* Auxology, the study of all aspects of human physical growth

* Bacterial growth

* Cell growth

* Growth hormone, a peptide hormone that stimulates growth

* Human development (biology)

* Plant growth

* Secondary growth ...

has been misplaced. Lucas himself, after calculating this cost back in 1987, reoriented his own macroeconomic

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole.

For example, using interest rates, taxes, and ...

research program away from the study of short run fluctuations.

However, Lucas' conclusion is controversial. In particular, Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and ...

economists typically argue that business cycles should not be understood as fluctuations above and below a trend. Instead, they argue that booms are times when the economy is near its potential output trend, and that recessions are times when the economy is substantially below trend, so that there is a large output gap

The GDP gap or the output gap is the difference between actual GDP or actual output and potential GDP, in an attempt to identify the current economic position over the business cycle. The measure of output gap is largely used in macroeconomic po ...

. Under this viewpoint, the welfare cost of business cycles is larger, because an economy with cycles not only suffers more variable consumption, but also lower consumption on average.

Basic intuition

trend

A fad or trend is any form of collective behavior that develops within a culture, a generation or social group in which a group of people enthusiastically follow an impulse (psychology), impulse for a short period.

Fads are objects or behavior ...

and the same initial level of consumption – and as a result same level of consumption per period on average – but with different levels of volatility, then, according to economic theory, the less volatile consumption path will be preferred to the more volatile one. This is due to risk aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more ce ...

on part of individual agents. One way to calculate how costly this greater volatility is in terms of individual

An individual is that which exists as a distinct entity. Individuality (or self-hood) is the state or quality of being an individual; particularly (in the case of humans) of being a person unique from other people and possessing one's own Maslow ...

(or, under some restrictive conditions, social) welfare

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specificall ...

is to ask what percentage of her annual average consumption would an individual be willing to sacrifice in order to eliminate this volatility entirely. Another way to express this is by asking how much an individual with a smooth consumption path would have to be compensated in terms of average consumption in order to accept the volatile path instead of the one without the volatility. The resulting amount of compensation, expressed as a percentage of average annual consumption, is the cost of the fluctuations calculated by Lucas. It is a function of people's degree of risk aversion and of the magnitude of the fluctuations which are to be eliminated, as measured by the standard deviation

In statistics, the standard deviation is a measure of the amount of variation or dispersion of a set of values. A low standard deviation indicates that the values tend to be close to the mean (also called the expected value) of the set, while ...

of the natural log

The natural logarithm of a number is its logarithm to the base of the mathematical constant , which is an irrational and transcendental number approximately equal to . The natural logarithm of is generally written as , , or sometimes, if ...

of consumption.

Lucas' formula

Robert Lucas' baseline formula for the welfare cost of business cycles is given by (see mathematical derivation below): : where is the cost of fluctuations (the % of average annual consumption that a person would be willing to pay to eliminate all fluctuations in her consumption), is the standard deviation of the natural log of consumption and measures the degree ofrelative risk aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more ce ...

.

It is straightforward to measure from available data. Using US data from between 1947 and 2001 Lucas obtained . It is a little harder to obtain an empirical estimate of ; although it should be theoretically possible, many controversies in economics revolve around the precise and appropriate measurement of this parameter. However it is doubtful that is particularly high (most estimates are no higher than 4).

As an illustrative example consider the case of log utility (see below) in which case . In this case the welfare cost of fluctuations is

:

In other words, eliminating ''all'' the fluctuations from a person's consumption path (i.e., eliminating the business cycle entirely) is worth only 1/20 of 1 percent of average annual consumption. For example, an individual who consumes $50,000 worth of goods a year on average would be willing to pay only $25 to eliminate consumption fluctuations.

The implication is that, if the calculation is correct and appropriate, the ups and downs of the business cycles, the recessions and the booms, hardly matter for individual and possibly social welfare. It is the long run trend of economic growth that is crucial.

If is at the upper range of estimates found in literature, around 4, then

:

or 1/5 of 1 percent. An individual with average consumption of $50,000 would be willing to pay $100 to eliminate fluctuations. This is still a very small amount compared to the implications of long run growth on income.

One way to get an upper bound on the degree of risk aversion is to use the Ramsey model of intertemporal savings and consumption. In that case, the equilibrium real interest rate is given by

:

where is the real (after tax) rate of return on capital (the real interest rate), is the subjective rate of time preference

In economics, time preference (or time discounting, delay discounting, temporal discounting, long-term orientation) is the current relative valuation placed on receiving a good or some cash at an earlier date compared with receiving it at a later ...

(which measures impatience) and is the annual growth rate of consumption. is generally estimated to be around 5% (.05) and the annual growth rate of consumption is about 2% (.02). Then the upper bound on the cost of fluctuations occurs when is at its highest, which in this case occurs if . This implies that the highest possible degree of risk aversion is

:

which in turn, combined with estimates given above, yields a cost of fluctuations as

:

which is still extremely small (13% of 1%).

Mathematical representation and formula

Lucas sets up an infinitely livedrepresentative agent

Economists use the term representative agent to refer to the typical decision-maker of a certain type (for example, the typical consumer, or the typical firm).

More technically, an economic model is said to have a representative agent if all agen ...

model where total lifetime utility () is given by the present discounted value

In economics and finance, present value (PV), also known as present discounted value, is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money has inte ...

(with representing the discount factor

Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee.See "Time Value", "Discount", "Discount Yield", "Compound Interest", "Efficient ...

) of per period utilities () which in turn depend on consumption in each period ()

:

In the case of a certain consumption path, consumption in each period is given by

:

where is initial consumption and is the growth rate of consumption (neither of these parameters turns out to matter for costs of fluctuations in the baseline model, so they can be normalized to 1 and 0 respectively).

In the case of a volatile, uncertain consumption path, consumption in each period is given by

:

where is the standard deviation of the natural log of consumption and is a random shock which is assumed to be log-normally distributed so that the mean of is zero, which in turn implies that the expected value

In probability theory, the expected value (also called expectation, expectancy, mathematical expectation, mean, average, or first moment) is a generalization of the weighted average. Informally, the expected value is the arithmetic mean of a l ...

of is 1 (i.e., on average, volatile consumption is same as certain consumption). In this case is the "compensation parameter" which measures the percentage by which average consumption has to be increased for the consumer to be indifferent between the certain path of consumption and the volatile one. is the cost of fluctuations.

We find this cost of fluctuations by setting

:

and solving for

For the case of isoelastic utility

In economics, the isoelastic function for utility, also known as the isoelastic utility function, or power utility function, is used to express utility in terms of consumption or some other economic variable that a decision-maker is concerned with ...

, given by

:

we can obtain an (approximate

An approximation is anything that is intentionally similar but not exactly equal to something else.

Etymology and usage

The word ''approximation'' is derived from Latin ''approximatus'', from ''proximus'' meaning ''very near'' and the prefix ' ...

) closed form solution which has already been given above

:

A special case of the above formula occurs if utility is logarithmic, which corresponds to the case of , which means that the above simplifies to . In other words, with log utility the cost of fluctuations is equal to one half the variance of the natural logarithm of consumption.

An alternative, more accurate solution gives losses that are somewhat larger, especially when volatility is large.

Risk aversion and the equity premium puzzle

However, a major problem related to the above way of estimating (hence ) and in fact, possibly to Lucas' entire approach is the so-calledequity premium puzzle

The equity premium puzzle refers to the inability of an important class of economic models to explain the average equity risk premium (ERP) provided by a diversified portfolio of U.S. equities over that of U.S. Treasury Bills, which has been obser ...

, first observed by Mehra

Mehra is a surname found in India and Iran. Also Mehra is a Parsi Girls name, the meaning of the name is "Affectionate, Kind" from Persian origin. This name is mainly used in Parsi. As per Indian Hindu and Sikhism, this name is suggested for Who b ...

and Prescott in 1985. The analysis above implies that since macroeconomic risk is unimportant, the premium associated with systematic risk

In finance and economics, systematic risk (in economics often called aggregate risk or undiversifiable risk) is vulnerability to events which affect aggregate outcomes such as broad market returns, total economy-wide resource holdings, or aggrega ...

, that is, risk in returns to an asset that is correlated with aggregate consumption should be small (less than 0.5 percentage points for the values of risk aversion considered above). In fact the premium has averaged around six percentage points.

In a survey of the implications of the equity premium, Simon Grant and John Quiggin

John Quiggin (born 29 March 1956) is an Australian economist, a professor at the University of Queensland. He was formerly an Australian Research Council Laureate Fellow and Federation Fellow and a member of the board of the Climate Change Aut ...

note that 'A high cost of risk means that

recessions are extremely destructive'.

Evidence from effects on subjective wellbeing

Justin Wolfers has shown that macroeconomic volatility reduces subjective wellbeing; the effects are somewhat larger than expected under the Lucas approach. According to Wolfers, 'eliminating unemployment volatility would raise well-being by an amount roughly equal to that from lowering the average level of unemployment by a quarter of a percentage point'. Justin Wolfers, “Is Business Cycle Volatility Costly? Evidence from Surveys of Subjective Wellbeing,” Working Paper (National Bureau of Economic Research, April 2003), https://doi.org/10.3386/w9619See also

*Welfare cost of inflation In macroeconomics, the welfare cost of inflation comprises the changes in social welfare caused by inflation.

The traditional approach, developed by Bailey (1956) and Friedman (1969), treats real money balances as a consumption good and inflat ...

* Unemployment#Costs

* Economic stability

Economic stability is the absence of excessive fluctuations in the macroeconomy. An economy with fairly constant output growth and low and stable inflation would be considered economically stable. An economy with frequent large recessions, a pronou ...

References

Further reading

*{{cite book , last=Lucas , first=Robert E., Jr. , authorlink= Robert Lucas Jr., year=1987 , title=Models of Business Cycles , publisher=Blackwell , location=Oxford , isbn=978-0631147893 , url-access=registration , url=https://archive.org/details/modelsofbusiness0000luca Business cycle theories Welfare economics