United States corporate law on:

[Wikipedia]

[Google]

[Amazon]

United States corporate law regulates the

United States corporate law regulates the

Over the late 19th century, more and more states allowed free incorporation of businesses with a simple registration procedure;

Over the late 19th century, more and more states allowed free incorporation of businesses with a simple registration procedure;

Corporations are invariably classified as "

Corporations are invariably classified as "

One of the most important things that the articles of incorporation determine is the state of incorporation. Different states can have different levels of

One of the most important things that the articles of incorporation determine is the state of incorporation. Different states can have different levels of

In the late 20th century, however, the issue of whether a corporation counted as a "person" for all or some purposes acquired political significance. Initially, in ''

In the late 20th century, however, the issue of whether a corporation counted as a "person" for all or some purposes acquired political significance. Initially, in ''

Toward the outside world, the acts of directors, officers and other employees will be binding on the corporation depending on the

Toward the outside world, the acts of directors, officers and other employees will be binding on the corporation depending on the

Although it is possible to structure corporations differently, the two basic organs in a corporate constitution will invariably be the

Although it is possible to structure corporations differently, the two basic organs in a corporate constitution will invariably be the

Apart from elections of directors, shareholders' entitlements to vote have been significantly protected by federal regulation, either through stock exchanges or the

Apart from elections of directors, shareholders' entitlements to vote have been significantly protected by federal regulation, either through stock exchanges or the  On a number of issues that are seen as very significant, or where directors have incurable conflicts of interest, many states and federal legislation give shareholders specific rights to veto or approve business decisions. Generally state laws give the right for shareholders to vote on decision by the corporation to sell off "all or substantially all assets" of the corporation. However fewer states give rights to shareholder to veto political contributions made by the board, unless this is in the articles of incorporation. One of the most contentious issues is the right for shareholders to have a "

On a number of issues that are seen as very significant, or where directors have incurable conflicts of interest, many states and federal legislation give shareholders specific rights to veto or approve business decisions. Generally state laws give the right for shareholders to vote on decision by the corporation to sell off "all or substantially all assets" of the corporation. However fewer states give rights to shareholder to veto political contributions made by the board, unless this is in the articles of incorporation. One of the most contentious issues is the right for shareholders to have a "

Most corporate laws empower directors, as part of their management functions, to determine which strategies will promote a corporation's success in the interests of all stakeholders. Directors will periodically decide whether and how much of a corporation's

Most corporate laws empower directors, as part of their management functions, to determine which strategies will promote a corporation's success in the interests of all stakeholders. Directors will periodically decide whether and how much of a corporation's  Delaware's law has also followed the same general logic, even though it has no specific constituency or stakeholder statute. The standard is, however, contested largely among business circles which favor a view that directors should act in the sole interests of

Delaware's law has also followed the same general logic, even though it has no specific constituency or stakeholder statute. The standard is, however, contested largely among business circles which favor a view that directors should act in the sole interests of

The

The  In 1985, the Delaware Supreme Court passed one of its most debated judgments, ''

In 1985, the Delaware Supreme Court passed one of its most debated judgments, ''

The risk of allowing individual shareholders to bring derivative suits is usually thought to be that it could encourage costly, distracting litigation, or "

The risk of allowing individual shareholders to bring derivative suits is usually thought to be that it could encourage costly, distracting litigation, or " In some cases corporate boards attempted to establish "independent litigation committees" to evaluate whether a shareholder's demand to bring a suit was justified. This strategy was used to pre-empt criticism that the board was conflicted. The directors would appoint the members of the "independent committee", which would then typically deliberate and come to the conclusion that there was no good cause for bringing litigation. In '' Zapata Corp v Maldonado'' the Delaware Supreme Court held that if the committee acted in good faith and showed reasonable grounds for its conclusion, and the court could be "satisfied

In some cases corporate boards attempted to establish "independent litigation committees" to evaluate whether a shareholder's demand to bring a suit was justified. This strategy was used to pre-empt criticism that the board was conflicted. The directors would appoint the members of the "independent committee", which would then typically deliberate and come to the conclusion that there was no good cause for bringing litigation. In '' Zapata Corp v Maldonado'' the Delaware Supreme Court held that if the committee acted in good faith and showed reasonable grounds for its conclusion, and the court could be "satisfied

vol I

*WW Cook, ''A treatise on the law of corporations having a capital stock'' (7th edn Little, Brown and Co 1913

vol I

* WO Douglas and CM Shanks, ''Cases and Materials on the Law of Management of Business Units''

Callaghan 1931

*

90 California LR 1775

(2002) *

39 Harvard Law Review 673

*

47(3) Columbia Law Review 343

*

19(4) University of Chicago Law Review 639

*

58 Columbia Law Review 1212

*

62 Columbia Law Review 433

*

65 Columbia Law Review 1

*

24 Business Lawyer 149

*V Brudney, ''Contract and Fiduciary Duty in Corporate Law'' 38 BCL Review 595 (1977) *RM Buxbaum, ''Conflict-of-Interest Statutes and the Need for a Demand on Directors in Derivative Actions'' (1980) 68 Californian Law Review 1122 *WL Cary, ''Federalism and Corporate Law: Reflections on Delaware'' (1974) 83(4) Yale Law Journal 663 *

List of States' corporate laws and websites from law.cornell.eduUS Corporate Law on Wikibooks

;Based on the MBCA

Arizona Revised Statutes, Title 10

(FBCA) * ttps://web.archive.org/web/20040720094345/http://www.legis.state.ga.us/legis/GaCode/Title14.pdf Georgia Business Corporation Code(GBCC)

Illinois Business Corporation Act

(IBCA)

North Carolina Business Corporation Act

(NCBCA)

(SCBCA)

Washington Business Corporation Act

(WBCA)

Wisconsin Business Corporation Law

(WBCL) ;Other states with own laws

California Corporations Code

(CCC)

(DGCL)

(NRS) * New Jersey Business Corporation Act (NJBCA)

(NYBCL)

(OGCL)

(PBCL)

(TBCA) {{Law of the United States

United States corporate law regulates the

United States corporate law regulates the governance

Governance is the process of interactions through the laws, norms, power or language of an organized society over a social system ( family, tribe, formal or informal organization, a territory or across territories). It is done by the g ...

, finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of f ...

and power

Power most often refers to:

* Power (physics), meaning "rate of doing work"

** Engine power, the power put out by an engine

** Electric power

* Power (social and political), the ability to influence people or events

** Abusive power

Power may a ...

of corporation

A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and ...

s in US law. Every state and territory has its own basic corporate code, while federal law

Federal law is the body of law created by the federal government of a country. A federal government is formed when a group of political units, such as states or provinces join in a federation, delegating their individual sovereignty and many ...

creates minimum standards for trade in company shares and governance rights, found mostly in the Securities Act of 1933

The Securities Act of 1933, also known as the 1933 Act, the Securities Act, the Truth in Securities Act, the Federal Securities Act, and the '33 Act, was enacted by the United States Congress on May 27, 1933, during the Great Depression and after ...

and the Securities and Exchange Act of 1934

The Securities Exchange Act of 1934 (also called the Exchange Act, '34 Act, or 1934 Act) (, codified at et seq.) is a law governing the secondary trading of securities (stocks, bonds, and debentures) in the United States of America. A landma ...

, as amended by laws like the Sarbanes–Oxley Act of 2002 and the Dodd–Frank Wall Street Reform and Consumer Protection Act

The Dodd–Frank Wall Street Reform and Consumer Protection Act, commonly referred to as Dodd–Frank, is a United States federal law that was enacted on July 21, 2010. The law overhauled financial regulation in the aftermath of the Great Rece ...

. The US Constitution

The Constitution of the United States is the supreme law of the United States of America. It superseded the Articles of Confederation, the nation's first constitution, in 1789. Originally comprising seven articles, it delineates the nation ...

was interpreted by the US Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that involve a point of ...

to allow corporations to incorporate in the state of their choice, regardless of where their headquarters are. Over the 20th century, most major corporations incorporated under the Delaware General Corporation Law

The Delaware General Corporation Law (Title 8, Chapter 1 of the Delaware Code) is the statute of the Delaware Code that governs corporate law in the U.S. state of Delaware. Adopted in 1899, the statute has since seen Delaware become the most im ...

, which offered lower corporate taxes, fewer shareholder rights against directors, and developed a specialized court and legal profession. Nevada has done the same. Twenty-four states follow the Model Business Corporation Act

The Model Business Corporation Act (MBCA) is a Model Act promulgated and periodically amended by the Corporate Laws Committee of the Business Law Section of the American Bar Association (Committee). The MBCA had been adopted by 36 states and other ...

, while New York and California are important due to their size.

History

At theDeclaration of Independence

A declaration of independence or declaration of statehood or proclamation of independence is an assertion by a polity in a defined territory that it is independent and constitutes a state. Such places are usually declared from part or all of th ...

, corporations had been unlawful without explicit authorization in a Royal Charter

A royal charter is a formal grant issued by a monarch under royal prerogative as letters patent. Historically, they have been used to promulgate public laws, the most famous example being the English Magna Carta (great charter) of 1215, b ...

or an Act of Parliament

Acts of Parliament, sometimes referred to as primary legislation, are texts of law passed by the legislative body of a jurisdiction (often a parliament or council). In most countries with a parliamentary system of government, acts of parliame ...

of the United Kingdom. Since the world's first stock market crash

A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often foll ...

(the South Sea Bubble

South is one of the cardinal directions or compass points. The direction is the opposite of north and is perpendicular to both east and west.

Etymology

The word ''south'' comes from Old English ''sūþ'', from earlier Proto-Germanic ''*sunþa ...

of 1720) corporations were perceived as dangerous. This was because, as the economist Adam Smith

Adam Smith (baptized 1723 – 17 July 1790) was a Scottish economist and philosopher who was a pioneer in the thinking of political economy and key figure during the Scottish Enlightenment. Seen by some as "The Father of Economics"——� ...

wrote in ''The Wealth of Nations

''An Inquiry into the Nature and Causes of the Wealth of Nations'', generally referred to by its shortened title ''The Wealth of Nations'', is the '' magnum opus'' of the Scottish economist and moral philosopher Adam Smith. First published in ...

'' (1776), directors managed "other people's money" and this conflict of interest

A conflict of interest (COI) is a situation in which a person or organization is involved in multiple interests, financial or otherwise, and serving one interest could involve working against another. Typically, this relates to situations i ...

meant directors were prone to "negligence

Negligence (Lat. ''negligentia'') is a failure to exercise appropriate and/or ethical ruled care expected to be exercised amongst specified circumstances. The area of tort law known as ''negligence'' involves harm caused by failing to act as ...

and profusion

In laws of equity, unjust enrichment occurs when one person is enriched at the expense of another in circumstances that the law sees as unjust. Where an individual is unjustly enriched, the law imposes an obligation upon the recipient to make re ...

". Corporations were only thought to be legitimate in specific industries (such as insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge ...

or banking

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

Because ...

) that could not be managed efficiently through partnerships. After the US Constitution

The Constitution of the United States is the supreme law of the United States of America. It superseded the Articles of Confederation, the nation's first constitution, in 1789. Originally comprising seven articles, it delineates the nation ...

was ratified in 1788, corporations were still distrusted, and were tied into debate about interstate exercise of sovereign power. The First Bank of the United States

First or 1st is the ordinal form of the number one (#1).

First or 1st may also refer to:

*World record, specifically the first instance of a particular achievement

Arts and media Music

* 1$T, American rapper, singer-songwriter, DJ, and rec ...

was chartered in 1791 by the US Congress

The United States Congress is the legislature of the federal government of the United States. It is bicameral, composed of a lower body, the House of Representatives, and an upper body, the Senate. It meets in the U.S. Capitol in Washin ...

to raise money for the government and create a common currency (alongside a federal excise tax and the US Mint). It had private investors (not government owned), but faced opposition from southern politicians who feared federal power overtaking state power. So, the First Bank's charter was written to expire in 20 years. State governments could and did also incorporate corporations through special legislation. In 1811, New York became the first state to have a simple public registration procedure to start corporations (not specific permission from the legislature) for manufacturing business. It also allowed investors to have limited liability

Limited liability is a legal status in which a person's financial liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company or partnership. If a company that provides limited liability to it ...

, so that if the enterprise went bankrupt investors would lose their investment, but not any extra debts that had been run up to creditors. An early Supreme Court

A supreme court is the highest court within the hierarchy of courts in most legal jurisdictions. Other descriptions for such courts include court of last resort, apex court, and high (or final) court of appeal. Broadly speaking, the decisions of ...

case, ''Dartmouth College v. Woodward

''Trustees of Dartmouth College v. Woodward'', 17 U.S. (4 Wheat.) 518 (1819), was a landmark decision in United States corporate law from the United States Supreme Court dealing with the application of the Contracts Clause of the United State ...

'' (1819), went so far as to say that once a corporation was established a state legislature (in this case, New Hampshire) could not amend it. States quickly reacted by reserving the right to regulate future dealings by corporations. Generally speaking, corporations were treated as "legal person

In law, a legal person is any person or 'thing' (less ambiguously, any legal entity) that can do the things a human person is usually able to do in law – such as enter into contracts, sue and be sued, own property, and so on. The reason f ...

s" with separate legal personality

In law, a legal person is any person or 'thing' (less ambiguously, any legal entity) that can do the things a human person is usually able to do in law – such as enter into contracts, sue and be sued, own property, and so on. The reason for ...

from its shareholders, directors or employees. Corporations were the subject of legal rights and duties: they could make contracts, hold property

Property is a system of rights that gives people legal control of valuable things, and also refers to the valuable things themselves. Depending on the nature of the property, an owner of property may have the right to consume, alter, share, r ...

or commission torts

A tort is a civil wrong that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits the tortious act. Tort law can be contrasted with criminal law, which deals with criminal wrongs that are punishab ...

, but there was no necessary requirement to treat a corporation as favorably as a real person.

Over the late 19th century, more and more states allowed free incorporation of businesses with a simple registration procedure;

Over the late 19th century, more and more states allowed free incorporation of businesses with a simple registration procedure; Delaware

Delaware ( ) is a state in the Mid-Atlantic region of the United States, bordering Maryland to its south and west; Pennsylvania to its north; and New Jersey and the Atlantic Ocean to its east. The state takes its name from the adjacent ...

enacted its General Corporation Law in 1899. Many corporations would be small and democratically organized, with one-person, one-vote, no matter what amount the investor had, and directors would be frequently up for election. However, the dominant trend led towards immense corporate groups where the standard rule was one-share, one-vote

One share, one vote is a standard found in corporate law and corporate governance, which suggests that each person who invests money in a company has one vote per share of the company they own, equally with other shareholders. Often, shares with ...

. At the end of the 19th century, " trust" systems (where formal ownership had to be used for another person's benefit) were used to concentrate control into the hands of a few people, or a single person. In response, the Sherman Antitrust Act

The Sherman Antitrust Act of 1890 (, ) is a United States antitrust law which prescribes the rule of free competition among those engaged in commerce. It was passed by Congress and is named for Senator John Sherman, its principal author.

...

of 1890 was created to break up big business conglomerates, and the Clayton Act

The Clayton Antitrust Act of 1914 (, codified at , ), is a part of United States antitrust law with the goal of adding further substance to the U.S. antitrust law regime; the Clayton Act seeks to prevent anticompetitive practices in their incipie ...

of 1914 gave the government power to halt mergers and acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspec ...

that could damage the public interest. By the end of the First World War

World War I (28 July 1914 11 November 1918), often abbreviated as WWI, was List of wars and anthropogenic disasters by death toll, one of the deadliest global conflicts in history. Belligerents included much of Europe, the Russian Empire, ...

, it was increasingly perceived that ordinary people had little voice compared to the "financial oligarchy" of bankers and industrial magnates. In particular, employees lacked voice compared to shareholders, but plans for a post-war "industrial democracy

Industrial democracy is an arrangement which involves workers making decisions, sharing responsibility and authority in the workplace. While in participative management organizational designs workers are listened to and take part in the decisi ...

" (giving employees votes for investing their labor) did not become widespread. Through the 1920s, power concentrated in fewer hands as corporations issued shares with multiple voting rights, while other shares were sold with no votes at all. This practice was halted in 1926 by public pressure and the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its liste ...

refusing to list non-voting shares. It was possible to sell voteless shares in the economic boom of the 1920s, because more and more ordinary people were looking to the stock market to save the new money they were earning, but the law did not guarantee good information or fair terms. New shareholders had no power to bargain against large corporate issuers, but still needed a place to save. Before the Wall Street Crash of 1929, people were being sold shares in corporations with fake businesses, as accounts and business reports were not made available to the investing public.

The Wall Street Crash saw the total collapse of stock market values, as shareholders realized that corporations had become overpriced. They sold shares ''en masse'', meaning many companies found it hard to get finance. The result was that thousands of businesses were forced to close, and they laid off workers. Because workers had less money to spend, businesses received less income, leading to more closures and lay-offs. This downward spiral began the Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

. Berle and Means argued that under-regulation was the primary cause in their foundational book in 1932, '' The Modern Corporation and Private Property''. They said directors had become too unaccountable, and the markets lacked basic transparency rules. Ultimately, shareholder interests had to be equal to or "subordinated to a number of claims by labor, by customers and patrons, by the community". This led directly to the New Deal

The New Deal was a series of programs, public work projects, financial reforms, and regulations enacted by President Franklin D. Roosevelt in the United States between 1933 and 1939. Major federal programs agencies included the Civilian Con ...

reforms of the Securities Act of 1933

The Securities Act of 1933, also known as the 1933 Act, the Securities Act, the Truth in Securities Act, the Federal Securities Act, and the '33 Act, was enacted by the United States Congress on May 27, 1933, during the Great Depression and after ...

and Securities and Exchange Act of 1934

The Securities Exchange Act of 1934 (also called the Exchange Act, '34 Act, or 1934 Act) (, codified at et seq.) is a law governing the secondary trading of securities (stocks, bonds, and debentures) in the United States of America. A landma ...

. A new Securities and Exchange Commission

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market ...

was empowered to require corporations disclose all material information about their business to the investing public. Because many shareholders were physically distant from corporate headquarters where meetings would take place, new rights were made to allow people to cast votes via proxies, on the view that this and other measures would make directors more accountable. Given these reforms, a major controversy still remained about the duties that corporations also owed to employees, other stakeholders, and the rest of society. After World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the World War II by country, vast majority of the world's countries—including all of the great power ...

, a general consensus emerged that directors were not bound purely to pursue "shareholder value

Shareholder value is a business term, sometimes phrased as shareholder value maximization. It became prominent during the 1980s and 1990s along with the management principle value-based management or "managing for value".

Definition

The term "shar ...

" but could exercise their discretion for the good of all stakeholders, for instance by increasing wages instead of dividends, or providing services for the good of the community instead of only pursuing profits, if it was in the interests of the enterprise as a whole. However, different states had different corporate laws. To increase revenue from corporate tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed a ...

, individual states had an incentive to lower their standards in a "race to the bottom

Race to the bottom is a socio-economic phrase to describe either government deregulation of the business environment or reduction in corporate tax rates, in order to attract or retain usually foreign economic activity in their jurisdictions. While ...

" to attract corporations to set up their headquarters in the state, particularly where directors controlled the decision to incorporate. " Charter competition", by the 1960s, had led Delaware to become home to the majority of the largest US corporations. This meant that the case law of the Delaware Chancery and Supreme Court

A supreme court is the highest court within the hierarchy of courts in most legal jurisdictions. Other descriptions for such courts include court of last resort, apex court, and high (or final) court of appeal. Broadly speaking, the decisions of ...

became increasingly influential. During the 1980s, a huge takeover and merger boom decreased directors' accountability. To fend off a takeover, courts allowed boards to institute " poison pills" or "shareholder rights plan

A shareholder rights plan, colloquially known as a "poison pill", is a type of defensive tactic used by a corporation's board of directors against a takeover.

In the field of mergers and acquisitions, shareholder rights plans were devised in the ...

s", which allowed directors to veto any bid – and probably get a payout for letting a takeover happen. More and more people's retirement savings were being invested into the stock market, through pension fund

A pension fund, also known as a superannuation fund in some countries, is any plan, fund, or scheme which provides retirement income.

Pension funds typically have large amounts of money to invest and are the major investors in listed and priva ...

s, life insurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the dea ...

and mutual funds

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV ...

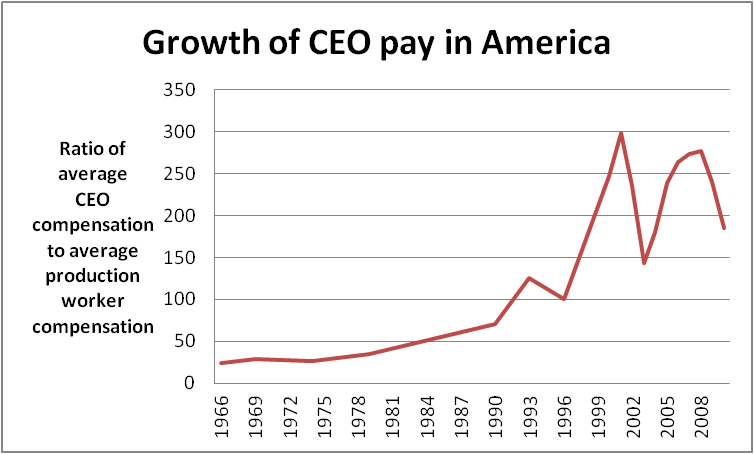

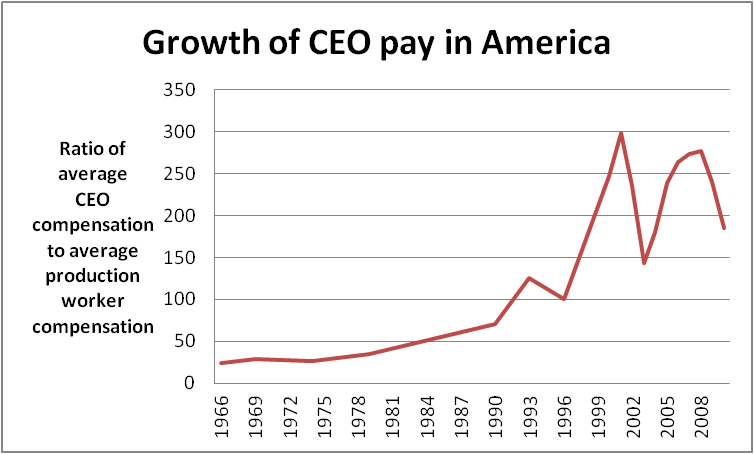

. This resulted in a vast growth in the asset management

Asset management is a systematic approach to the governance and realization of value from the things that a group or entity is responsible for, over their whole life cycles. It may apply both to tangible assets (physical objects such as buildings ...

industry, which tended to take control of voting rights. Both the financial sector's share of income, and executive pay for chief executive officers began to rise far beyond real wages for the rest of the workforce. The Enron scandal

The Enron scandal was an accounting scandal involving Enron Corporation, an American energy company based in Houston, Texas. Upon being publicized in October 2001, the company declared bankruptcy and its accounting firm, Arthur Andersen then ...

of 2001 led to some reforms in the Sarbanes-Oxley Act (on separating auditors from consultancy work). The financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of ...

of 2007 led to minor changes in the Dodd-Frank Act (on soft regulation of pay, alongside derivative

In mathematics, the derivative of a function of a real variable measures the sensitivity to change of the function value (output value) with respect to a change in its argument (input value). Derivatives are a fundamental tool of calculus. ...

markets). However, the basic shape of corporate law in the United States has remained the same since the 1980s.

Corporations and civil law

Corporations are invariably classified as "

Corporations are invariably classified as "legal persons

In law, a legal person is any person or 'thing' (less ambiguously, any legal entity) that can do the things a human person is usually able to do in law – such as enter into contracts, sue and be sued, own property, and so on. The reason for ...

" by all modern systems of law, meaning that like natural person

In jurisprudence, a natural person (also physical person in some Commonwealth countries, or natural entity) is a person (in legal meaning, i.e., one who has its own legal personality) that is an individual human being, distinguished from the b ...

s, they may acquire rights and duties. A corporation may be chartered in any of the 50 states (or the District of Columbia) and may become authorized to do business in each jurisdiction it does business within, except that when a corporation sues or is sued over a contract, the court, regardless of where the corporation's headquarters office is located, or where the transaction occurred, will use the law of the jurisdiction where the corporation was chartered (unless the contract says otherwise). So, for example, consider a corporation which sets up a concert in Hawaii, where its headquarters are in Minnesota, and it is chartered in Colorado, if it is sued over its actions involving the concert, whether it was sued in Hawaii (where the concert is located), or Minnesota (where its headquarters are located), the court in that state will still use Colorado law to determine how its corporate dealings are to be performed.

All major public corporations are also characterized by holding limited liability

Limited liability is a legal status in which a person's financial liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company or partnership. If a company that provides limited liability to it ...

and having a centralized management. When a group of people go through the procedures to incorporate, they will acquire rights to make contracts

A contract is a legally enforceable agreement between two or more parties that creates, defines, and governs mutual rights and obligations between them. A contract typically involves the transfer of goods, services, money, or a promise to tr ...

, to possess property

Property is a system of rights that gives people legal control of valuable things, and also refers to the valuable things themselves. Depending on the nature of the property, an owner of property may have the right to consume, alter, share, r ...

, to sue, and they will also be responsible for tort

A tort is a civil wrong that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits the tortious act. Tort law can be contrasted with criminal law, which deals with criminal wrongs that are punishable ...

s, or other wrongs, and be sued. The federal government does not charter corporations (except National Banks, Federal Savings Banks, and Federal Credit Unions) although it does regulate them. Each of the 50 states plus DC has its own corporation law. Most large corporations have historically chosen to incorporate in Delaware, even though they operate nationally, and may have little or no business in Delaware itself. The extent to which corporations should have the same rights as real people is controversial, particularly when it comes to the fundamental rights

Fundamental rights are a group of rights that have been recognized by a high degree of protection from encroachment. These rights are specifically identified in a constitution, or have been found under due process of law. The United Nations' Susta ...

found in the United States Bill of Rights

The United States Bill of Rights comprises the first ten amendments to the United States Constitution. Proposed following the often bitter 1787–88 debate over the ratification of the Constitution and written to address the objections ra ...

. As a matter of law, a corporation acts through real people that form its board of directors, and then through the officers and employees who are appointed on its behalf. Shareholders can in some cases make decisions on the corporation's behalf, though in larger companies they tend to be passive. Otherwise, most corporations adopt limited liability

Limited liability is a legal status in which a person's financial liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company or partnership. If a company that provides limited liability to it ...

so that generally shareholders cannot be sued for a corporation's commercial debts. If a corporation goes bankrupt, and is unable to pay debts to commercial creditors as they fall due, then in some circumstances state courts allow the so-called "veil of incorporation" to be pierced, and so to hold the people behind the corporation liable. This is usually rare and in almost all cases involves non-payment of trust fund tax {{Unreferenced, date=June 2019, bot=noref (GreenC bot)

A trust-fund tax is a special type of tax in which the person or entity who is liable for the tax obtains it by collecting it from another party and holding the tax until paid to the particular ...

es or willful misconduct, essentially amounting to fraud.

Incorporation and charter competition

The process of starting up a new corporation is quick, though each state differs. A corporation is not the only kind of business organization that can be chosen. People may wish to register a partnership or aLimited Liability Company

A limited liability company (LLC for short) is the US-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability ...

, depending on the precise tax status and organizational form that is sought. Most frequently, however, people running major enterprises will choose corporations which have limited liability

Limited liability is a legal status in which a person's financial liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company or partnership. If a company that provides limited liability to it ...

for those who become the shareholders: if the corporation goes bankrupt

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor ...

the default rule is that shareholders will only lose the money they paid for their shares, even if debts to commercial creditors are still unpaid. A state office, perhaps called the "Division of Corporations" or simply the "Secretary of State", will require the people who wish to incorporate to file "articles of incorporation

Article often refers to:

* Article (grammar), a grammatical element used to indicate definiteness or indefiniteness

* Article (publishing), a piece of nonfictional prose that is an independent part of a publication

Article may also refer to:

...

" (sometimes called a "charter") and pay a fee. The articles of incorporation typically record the corporation's name, if there are any limits to its powers, purposes or duration, identify whether all shares will have the same rights. With this information filed with the state, a new corporation will come into existence, and be subject to the legal rights and duties that the people involved create on its behalf. The incorporators will also have to adopt "bylaws

A by-law (bye-law, by(e)law, by(e) law), or as it is most commonly known in the United States bylaws, is a set of rules or law established by an organization or community so as to regulate itself, as allowed or provided for by some higher authorit ...

" which identify many more details such as the number of directors, the arrangement of the board, requirements for corporate meetings, duties of officer holders and so on. The certificate of incorporation will have identified whether the directors or the shareholders, or both have the competence to adopt and change these rules. All of this is typically achieved through the corporation's first meeting.

One of the most important things that the articles of incorporation determine is the state of incorporation. Different states can have different levels of

One of the most important things that the articles of incorporation determine is the state of incorporation. Different states can have different levels of corporate tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed a ...

or franchise tax

A franchise tax is a government levy (tax) charged by some US states to certain business organizations such as corporations and partnerships with a nexus in the state. A franchise tax is not based on income. Rather, the typical franchise tax ca ...

, different qualities of shareholder and stakeholder rights, more or less stringent directors' duties, and so on. However, it was held by the Supreme Court in '' Paul v Virginia'' that in principle states ought to allow corporations incorporated in a different state to do business freely. This appeared to remain true even if another state (e.g. Delaware) required significantly worse internal protections for shareholders, employees, or creditors than the state in which the corporation operated (e.g. New York). So far, federal regulation has affected more issues relating to the securities markets than the balance of power and duties among directors, shareholders, employees and other stakeholders. The Supreme Court has also acknowledged that one state's laws will govern the " internal affairs" of a corporation, to prevent conflicts among state laws. So on the present law, regardless of where a corporation operates in the 50 states, the rules of the state of incorporation (subject to federal law) will govern its operation. Early in the 20th century, it was recognized by some states, initially New Jersey, that the state could cut its tax rate in order to attract more incorporations, and thus bolster tax receipts. Quickly, Delaware emerged as a preferred state of incorporation. In the 1933 case of ''Louis K. Liggett Co v Lee

''Louis K. Liggett Co. v. Lee'', 288 U.S. 517 (1933), is a corporate law decision from the United States Supreme Court..

In his opinion, Justice Brandeis endorsed the theories that state corporate law, and lack of federal standards, enabled a rac ...

'', Brandeis J.

Louis Dembitz Brandeis (; November 13, 1856 – October 5, 1941) was an American lawyer and associate justice on the Supreme Court of the United States from 1916 to 1939.

Starting in 1890, he helped develop the " right to privacy" concep ...

represented the view that the resulting "race was one not of diligence, but of laxity", particularly in terms of corporate tax rates, and rules that might protect less powerful corporate stakeholders. Over the 20th century, the problem of a "race to the bottom

Race to the bottom is a socio-economic phrase to describe either government deregulation of the business environment or reduction in corporate tax rates, in order to attract or retain usually foreign economic activity in their jurisdictions. While ...

" was increasingly thought to justify Federal regulation of corporations. The contrasting view was that regulatory competition Regulatory competition, also called competitive governance or policy competition, is a phenomenon in law, economics and politics concerning the desire of lawmakers to compete with one another in the kinds of law offered in order to attract business ...

among states could be beneficial, on the assumption that shareholders would choose to invest their money with corporations that were well governed. Thus the state's corporation regulations would be "priced" by efficient markets. In this way it was argued to be a "race to the top". An intermediate viewpoint in the academic literature, suggested that regulatory competition could in fact be either positive or negative, and could be used to the advantage of different groups, depending on which stakeholders would exercise most influence in the decision about which state to incorporate in. Under most state laws, directors hold the exclusive power to allow a vote on amending the articles of incorporation, and shareholders must approve directors' proposals by a majority, unless a higher threshold is in the articles.

Corporate personality

In principle a duly incorporated business acquires "legal personality

Legal capacity is a quality denoting either the legal aptitude of a person to have rights and liabilities (in this sense also called transaction capacity), or altogether the personhood itself in regard to an entity other than a natural pers ...

" that is separate from the people who invest their capital, and their labor, into the corporation. Just as the common law

In law, common law (also known as judicial precedent, judge-made law, or case law) is the body of law created by judges and similar quasi-judicial tribunals by virtue of being stated in written opinions."The common law is not a brooding omniprese ...

had for municipal and church corporations for centuries, it was held by the Supreme Court in ''Bank of the United States v Deveaux

''Bank of the United States v. Deveaux'', is an early US corporate law case decided by the US Supreme Court. It held that corporations have the capacity to sue in federal court on grounds of diversity under article three, section two of the ...

'' that in principle corporations had legal capacity

Legal capacity is a quality denoting either the legal aptitude of a person to have rights and liabilities (in this sense also called transaction capacity), or altogether the personhood itself in regard to an entity other than a natural person ( ...

. At its center, corporations being "legal persons" mean they can make contracts and other obligations, hold property, sue to enforce their rights and be sued for breach of duty. Beyond the core of private law rights and duties the question has, however, continually arisen about the extent to which corporations and real people should be treated alike. The meaning of "person", when used in a statute or the US Bill of Rights is typically thought to turn on the construction of the statute, so that in different contexts the legislature or founding fathers could have intended different things by "person". For example, in an 1869 case named '' Paul v Virginia'', the US Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that involve a point of ...

held that the word "citizen" in the privileges and immunities clause

The Privileges and Immunities Clause ( U.S. Constitution, Article IV, Section 2, Clause 1, also known as the Comity Clause) prevents a state from treating citizens of other states in a discriminatory manner. Additionally, a right of interstate ...

of the US Constitution

The Constitution of the United States is the supreme law of the United States of America. It superseded the Articles of Confederation, the nation's first constitution, in 1789. Originally comprising seven articles, it delineates the nation ...

(article IV, section 2) did not include corporations. This meant that the Commonwealth of Virginia

Virginia, officially the Commonwealth of Virginia, is a state in the Mid-Atlantic and Southeastern regions of the United States, between the Atlantic Coast and the Appalachian Mountains. The geography and climate of the Commonwealth are ...

was entitled to require that a New York fire insurance

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or ...

corporation, run by Mr Samuel Paul, acquired a license to sell policies within Virginia, even though there were different rules for corporations incorporated within the state. By contrast, in ''Santa Clara County v Southern Pacific Railroad Co

''Santa Clara County v. Southern Pacific Railroad Company'', 118 U.S. 394 (1886), is a corporate law case of the United States Supreme Court concerning taxation of railroad properties. The case is most notable for a headnote stating that the Equ ...

'', a majority of the Supreme Court hinted that a corporation might be regarded as a "person" under the equal protection clause

The Equal Protection Clause is part of the first section of the Fourteenth Amendment to the United States Constitution. The clause, which took effect in 1868, provides "''nor shall any State ... deny to any person within its jurisdiction the equal ...

of the Fourteenth Amendment. The Southern Pacific Railroad Company had claimed it should not be subject to differential tax treatment, compared to natural persons, set by the State Board of Equalization

The California State Board of Equalization (BOE) is a public agency charged with tax administration and fee collection in the state of California in the United States. The authorities of the Board fall into four broad areas: sales and use t ...

acting under the Constitution of California

The Constitution of California ( es, Constitución de California) is the primary organizing law for the U.S. state of California, describing the duties, powers, structures and functions of the government of California. California's original ...

. However, in the event Harlan J

John Marshall Harlan (June 1, 1833 – October 14, 1911) was an American lawyer and politician who served as an associate justice of the U.S. Supreme Court from 1877 until his death in 1911. He is often called "The Great Dissenter" due to his ...

held that the company could not be assessed for tax on a technical point: the state county had included too much property in its calculations. Differential treatment between natural persons and corporations was therefore not squarely addressed.

In the late 20th century, however, the issue of whether a corporation counted as a "person" for all or some purposes acquired political significance. Initially, in ''

In the late 20th century, however, the issue of whether a corporation counted as a "person" for all or some purposes acquired political significance. Initially, in ''Buckley v Valeo

''Buckley v. Valeo'', 424 U.S. 1 (1976), was a landmark decision of the US Supreme Court on campaign finance. A majority of justices held that, as provided by section 608 of the Federal Election Campaign Act of 1971, limits on election expenditu ...

'' a slight majority of the US Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that involve a point of ...

had held that natural persons were entitled to spend unlimited amounts of their own money on their political campaigns. Over a strong dissent, the majority therefore held that parts of the Federal Election Campaign Act

The Federal Election Campaign Act of 1971 (FECA, , ''et seq.'') is the primary United States federal law regulating political campaign fundraising and spending. The law originally focused on creating limits for campaign spending on communicati ...

of 1974 were unconstitutional since spending money was, in the majority's view, a manifestation of the right to freedom of speech

Freedom of speech is a principle that supports the freedom of an individual or a community to articulate their opinions and ideas without fear of retaliation, censorship, or legal sanction. The right to freedom of expression has been recogni ...

under the First Amendment

First or 1st is the ordinal form of the number one (#1).

First or 1st may also refer to:

*World record, specifically the first instance of a particular achievement

Arts and media Music

* 1$T, American rapper, singer-songwriter, DJ, and reco ...

. This did not affect corporations, though the issue arose in ''Austin v Michigan Chamber of Commerce

''Austin v. Michigan Chamber of Commerce'', 494 U.S. 652 (1990), is a United States corporate law case of the Supreme Court of the United States holding that the Michigan Campaign Finance Act, which prohibited corporations from using treasury mo ...

''. A differently constituted US Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that involve a point of ...

held, with three dissents, that the Michigan Campaign Finance Act could, compatibly with the First Amendment, prohibit political spending by corporations. However, by 2010, the Supreme Court had a different majority. In a five to four decision, '' Citizens United v Federal Election Commission'' held that corporations were persons that should be protected in the same was as natural people under the First Amendment, and so they were entitled to spend unlimited amounts of money in donations to political campaigns. This struck down the Bipartisan Campaign Reform Act

The Bipartisan Campaign Reform Act of 2002 (, ), commonly known as the McCain–Feingold Act or BCRA (pronounced "bik-ruh"), is a United States federal law that amended the Federal Election Campaign Act of 1971, which regulates the financing o ...

of 2002, so that an anti-Hillary Clinton

Hillary Diane Rodham Clinton ( Rodham; born October 26, 1947) is an American politician, diplomat, and former lawyer who served as the 67th United States Secretary of State for President Barack Obama from 2009 to 2013, as a United States sen ...

advertisement (" Hillary: The Movie") could be run by a pro-business lobby group. Subsequently, the same Supreme Court majority decided in 2014, in ''Burwell v Hobby Lobby Stores Inc

''Burwell v. Hobby Lobby Stores, Inc.'', 573 U.S. 682 (2014), is a landmark decision in United States corporate law by the United States Supreme Court allowing privately held for-profit corporations to be exempt from a regulation its owners re ...

'' that corporations were also persons for the protection of religion under the Religious Freedom Restoration Act

The Religious Freedom Restoration Act of 1993, Pub. L. No. 103-141, 107 Stat. 1488 (November 16, 1993), codified at through (also known as RFRA, pronounced "rifra"), is a 1993 United States federal law that "ensures that interests in religiou ...

. Specifically, this meant that a corporation had to have a right to opt out of provisions of the Patient Protection and Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by Pres ...

of 2010, which could require giving health care

Health care or healthcare is the improvement of health via the prevention, diagnosis, treatment, amelioration or cure of disease, illness, injury, and other physical and mental impairments in people. Health care is delivered by health pr ...

to employees that the board of directors of the corporation might have religious objections to. It did not specifically address an alternative claim under the First Amendment

First or 1st is the ordinal form of the number one (#1).

First or 1st may also refer to:

*World record, specifically the first instance of a particular achievement

Arts and media Music

* 1$T, American rapper, singer-songwriter, DJ, and reco ...

. The dissenting four judges emphasized their view that previous cases provided "no support for the notion that free exercise f religious

F, or f, is the sixth letter in the Latin alphabet, used in the modern English alphabet, the alphabets of other western European languages and others worldwide. Its name in English is ''ef'' (pronounced ), and the plural is ''efs''.

His ...

rights pertain to for-profit corporations." Accordingly, the issue of corporate personality has taken on an increasingly political character. Because corporations are typically capable of commanding greater economic power than individual people, and the actions of a corporation may be unduly influenced by directors and the largest shareholders

A shareholder (in the United States often referred to as stockholder) of a corporation is an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the legal ...

, it raises the issue of the corruption of democratic politics.

Delegated management and agents

Although a corporation may be considered a separate legal person, it physically cannot act by itself. There are, therefore, necessarily rules from the corporation statutes and thelaw of agency

The law of agency is an area of commercial law dealing with a set of contractual, quasi-contractual and non-contractual fiduciary relationships that involve a person, called the agent, that is authorized to act on behalf of another (called the ...

that attribute the acts of real people to the corporation, to make contracts, deal with property, commission torts, and so on. First, the board of directors will be typically appointed at the first corporate meeting by whoever the articles of incorporation

Article often refers to:

* Article (grammar), a grammatical element used to indicate definiteness or indefiniteness

* Article (publishing), a piece of nonfictional prose that is an independent part of a publication

Article may also refer to:

...

identify as entitled to elect them. The board is usually given the collective power to direct, manage and represent the corporation. This power (and its limits) is usually delegated to directors by the state's law, or the articles of incorporation. Second, corporation laws frequently set out roles for particular "officers" of the corporation, usually in senior management, on or outside of the board. US labor law

United States labor law sets the rights and duties for employees, labor unions, and employers in the United States. Labor law's basic aim is to remedy the "inequality of bargaining power" between employees and employers, especially employers "orga ...

views directors and officers as holding contracts of employment, although not for all purposes. If the state law, or the corporation's bylaws are silent, the terms of these contracts will define in further detail the role of the directors and officers. Third, directors and officers of the corporation will usually have the authority to delegate tasks, and hire employees for the jobs that need performing. Again, the terms of the employment contracts will shape the express terms on which employees act on behalf of the corporation.

Toward the outside world, the acts of directors, officers and other employees will be binding on the corporation depending on the

Toward the outside world, the acts of directors, officers and other employees will be binding on the corporation depending on the law of agency

The law of agency is an area of commercial law dealing with a set of contractual, quasi-contractual and non-contractual fiduciary relationships that involve a person, called the agent, that is authorized to act on behalf of another (called the ...

and principles of vicarious liability

Vicarious liability is a form of a strict, secondary liability that arises under the common law doctrine of agency, '' respondeat superior'', the responsibility of the superior for the acts of their subordinate or, in a broader sense, the re ...

(or ''respondeat superior

''Respondeat superior'' ( Latin: "let the master answer"; plural: ''respondeant superiores'') is a doctrine that a party is responsible for (has vicarious liability for) acts of their agents.''Criminal Law - Cases and Materials'', 7th ed. 2012, ...

''). It used to be that the common law recognized constraints on the total capacity of the corporation. If a director or employee acted beyond the purposes or powers of the corporation (''ultra vires

('beyond the powers') is a Latin phrase used in law to describe an act which requires legal authority but is done without it. Its opposite, an act done under proper authority, is ('within the powers'). Acts that are may equivalently be termed ...

''), any contract would be ''ex ante'' void and unenforceable. This rule was abandoned in the earlier 20th century, and today corporations generally have unlimited capacity and purposes. However, not all actions by corporate agents are binding. For instance, in ''South Sacramento Drayage Co v Campbell Soup Co

South is one of the cardinal directions or compass points. The direction is the opposite of north and is perpendicular to both east and west.

Etymology

The word ''south'' comes from Old English ''sūþ'', from earlier Proto-Germanic ''*sun� ...

'' it was held that a traffic manager who worked for the Campbell Soup Company

Campbell Soup Company, trade name, doing business as Campbell's, is an American processed food and snack company. The company is most closely associated with its flagship canned soup products; however, through mergers and acquisitions, it has gro ...

did not (unsurprisingly) have authority to enter a 15-year exclusive dealing contract for intrastate hauling of tomatoes. Standard principles of commercial agency apply ("apparent authority In the United States, the United Kingdom, Australia, Canada and South Africa, apparent authority (also called "ostensible authority") relates to the doctrines of the law of agency. It is relevant particularly in corporate law and constitutional la ...

"). If a reasonable person would not think that an employee (given his or her position and role) has authority to enter a contract, then the corporation cannot be bound. However, corporations can always expressly confer greater authority on officers and employees, and so will be bound if the contracts give express or implied actual authority

The law of agency is an area of commercial law dealing with a set of contractual, quasi-contractual and non-contractual fiduciary relationships that involve a person, called the agent, that is authorized to act on behalf of another (called the p ...

. The treatment of liability for contracts and other consent based obligations, however, differs to torts

A tort is a civil wrong that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits the tortious act. Tort law can be contrasted with criminal law, which deals with criminal wrongs that are punishab ...

and other wrongs. Here the objective of the law to ensure the internalization of "externalities

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced goods involved in either c ...

" or "enterprise risks Enterprise liability is a legal doctrine under which individual entities (for example, otherwise legally unrelated corporations or people) can be held jointly liable for some action on the basis of being part of a shared enterprise. Enterprise lia ...

" is generally seen to cast a wider scope of liability.

Shareholder liability for debts

One of the basic principles of modern corporate law is that people who invest in a corporation havelimited liability

Limited liability is a legal status in which a person's financial liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company or partnership. If a company that provides limited liability to it ...

. For example, as a general rule shareholders can only lose the money they invested in their shares. Practically, limited liability operates only as a default rule {{inline, date=June 2021

In legal theory, a default rule is a rule of law that can be overridden by a contract, trust, will, or other legally effective agreement. Contract law, for example, can be divided into two kinds of rules: ''default rules'' ...

for creditors that can adjust their risk. Banks which lend money to corporations frequently contract with a corporation's directors or shareholders to get personal guarantee

Guarantee is a legal term more comprehensive and of higher import than either warranty or "security". It most commonly designates a private transaction by means of which one person, to obtain some trust, confidence or credit for another, engages ...

s, or to take security interest

In finance, a security interest is a legal right granted by a debtor to a creditor over the debtor's property (usually referred to as the ''collateral'') which enables the creditor to have recourse to the property if the debtor defaults in makin ...

s their personal assets, or over a corporation's assets, to ensure their debts are paid in full. This means much of the time, shareholders are in fact liable beyond their initial investments. Similarly trade creditors, such as suppliers of raw materials, can use title retention clause A retention of title clause (also called a reservation of title clause or a ''Romalpa'' clause in some jurisdictions) is a provision in a contract for the sale of goods that the title to the goods remains vested in the seller until the buyer fulfils ...

or other device with the equivalent effect to security interests, to be paid before other creditors in bankruptcy. However, if creditors are unsecured, or for some reason guarantees and security are not enough, creditors cannot (unless there are exceptions) sue shareholders for outstanding debts. Metaphorically speaking, their liability is limited behind the "corporate veil". The same analysis, however has been rejected by the US Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that involve a point of ...

in '' Davis v Alexander'', where a railroad subsidiary company caused injury to cattle that were being transported. As Brandeis J put it, when one "company actually controls another and operates both as a single system, the dominant company will be liable for injuries due to the negligence

Negligence (Lat. ''negligentia'') is a failure to exercise appropriate and/or ethical ruled care expected to be exercised amongst specified circumstances. The area of tort law known as ''negligence'' involves harm caused by failing to act as ...

of the subsidiary company."

There are a number of exceptions, which differ according to the law of each state, to the principle of limited liability. First, at the very least, as is recognized in public international law

International law (also known as public international law and the law of nations) is the set of rules, norms, and standards generally recognized as binding between states. It establishes normative guidelines and a common conceptual framework for ...

, courts will "pierce the corporate veil" if a corporation is being used evade obligations in a dishonest manner. Defective organization, such as a failure to duly file the articles of incorporation with a state official, is another universally acknowledged ground. However, there is considerable diversity in state law, and controversy, over how much further the law ought to go. In ''Kinney Shoe Corp v Polan

''Kinney Shoe Corp v. Polan'', 939 F.2d 209 (4th Cir. 1991), is a US corporate law case, concerning piercing the corporate veil.

Facts

Kinney Shoe Corp sued Mr Lincoln M Polan to pay money outstanding on a sub-lease by the "Industrial Realty Co ...

'' the Fourth Circuit Federal Court of Appeals

The United States Court of Appeals for the Fourth Circuit (in case citations, 4th Cir.) is a federal court located in Richmond, Virginia, with appellate jurisdiction over the district courts in the following districts:

* District of Maryland ...

held that it would also pierce the veil if (1) the corporation had been inadequately capitalized to meet its future obligations (2) if no corporate formalities (e.g. meetings and minutes) had been observed, or (3) the corporation was deliberately used to benefit an associated corporation. However, a subsequent opinion of the same court emphasized that piercing could not take place merely to prevent an abstract notion of "unfairness" or "injustice". A further, though technically different, equitable remedy is that according to the US Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that involve a point of ...

in ''Taylor v Standard Gas Co

''Taylor v. Standard Gas and Electric Company'', 306 U.S. 307 (1939), was an important United States Supreme Court case in United States corporate law that laid down the "Deep Rock doctrine" as a rule of bankruptcy and corporate law. This holds ...

'' corporate insiders (e.g. directors or major shareholders) who are also creditors of a company are subordinated to other creditors when the company goes bankrupt if the company is inadequately capitalized for the operations it was undertaking.

Tort

A tort is a civil wrong that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits the tortious act. Tort law can be contrasted with criminal law, which deals with criminal wrongs that are punishable ...

victims differ from commercial creditors because they have no ability to contract around limited liability, and are therefore regarded differently under most state laws. The theory developed in the mid-20th century that beyond the corporation itself, it was more appropriate for the law to recognize the economic "enterprise", which usually composes groups of corporations, where the parent takes the benefit of a subsidiary's activities and is capable of exercising decisive influence. A concept of "enterprise liability Enterprise liability is a legal doctrine under which individual entities (for example, otherwise legally unrelated corporations or people) can be held jointly liable for some action on the basis of being part of a shared enterprise. Enterprise liab ...

" was developed in fields such tax law, accounting practices, and antitrust law

Competition law is the field of law that promotes or seeks to maintain market competition by regulating anti-competitive conduct by companies. Competition law is implemented through public and private enforcement. It is also known as antitrust ...

that were gradually received into the courts' jurisprudence. Older cases had suggested that there was no special right to pierce the veil in favor of tort victims, even where pedestrians had been hit by a tram owned by a bankrupt-subsidiary corporation, or by taxi-cabs that were owned by undercapitalized subsidiary corporations. More modern authority suggested a different approach. In a case concerning one of the worst oil spill

An oil spill is the release of a liquid petroleum hydrocarbon into the environment, especially the marine ecosystem, due to human activity, and is a form of pollution. The term is usually given to marine oil spills, where oil is released into t ...

s in history, caused by the ''Amoco Cadiz

''Amoco Cadiz'' was a VLCC (very large crude carrier) owned by Amoco Transport Corp and transporting crude oil for Shell Oil. Operating under the Liberian flag of convenience, she ran aground on 16 March 1978 on Portsall Rocks, from the coa ...

'' which was owned through subsidiaries of the Amoco Corporation

Amoco () is a brand of fuel stations operating in the United States, and owned by BP since 1998. The Amoco Corporation was an American chemical and oil company, founded by Standard Oil Company in 1889 around a refinery in Whiting, Indiana ...

, the Illinois court that heard the case stated that the parent corporation was liable by the fact of its group structure. The courts therefore "usually apply more stringent standards to piercing the corporate veil in a contract case than they do in tort cases" because tort claimants do not voluntarily accept limited liability. Under the Comprehensive Environmental Response, Compensation, and Liability Act of 1980

Superfund is a United States federal environmental remediation program established by the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (CERCLA). The program is administered by the Environmental Protection Agen ...

, the US Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that involve a point of ...

in ''United States v Bestfoods

''United States v. Bestfoods'', 524 U.S. 51 (1998), is a United States corporate law and environmental law case in which the Supreme Court of the United States held that the indirect liability of a parent corporation under CERCLA is to be deter ...

'' held if a parent corporation "actively participated in, and exercised control over, the operations of" a subsidiary's facilities it "may be held directly liable". This leaves the question of the nature of the common law, in absence of a specific statute, or where a state law forbids piercing the veil except on very limited grounds. One possibility is that tort victims go uncompensated, even while a parent corporation is solvent and has insurance. A second possibility is that a compromise liability regime, such as pro rata

''Pro rata'' is an adverb or adjective meaning in equal portions or in proportion. The term is used in many legal and economic contexts. The hyphenated spelling ''pro-rata'' for the adjective form is common, as recommended for adjectives by some E ...

rather than joint and several liability

Where two or more persons are liable in respect of the same liability, in most common law legal systems they may either be:

* jointly liable, or

* severally liable, or

* jointly and severally liable.

Joint liability

If parties have joint liabili ...

is imposed across all shareholders regardless of size. A third possibility, and one that does not interfere with the basics of corporate law, is that a direct duty of care could be owed in tort

A tort is a civil wrong that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits the tortious act. Tort law can be contrasted with criminal law, which deals with criminal wrongs that are punishable ...

to the injured person by parent corporations and major shareholders to the extent they could exercise control. This route means corporate enterprise would not gain a subsidy at the expense of other people's health and environment, and that there is no need to pierce the veil.

Corporate governance

Corporate governance

Corporate governance is defined, described or delineated in diverse ways, depending on the writer's purpose. Writers focused on a disciplinary interest or context (such as accounting, finance, law, or management) often adopt narrow definitions ...

, though used in many senses, is primarily concerned with the balance of power among the main actors in a corporation: directors, shareholders, employees, and other stakeholders. A combination of a state's corporation law, case law developed by the courts, and a corporation's own articles of incorporation

Article often refers to:

* Article (grammar), a grammatical element used to indicate definiteness or indefiniteness

* Article (publishing), a piece of nonfictional prose that is an independent part of a publication

Article may also refer to:

...

and bylaws

A by-law (bye-law, by(e)law, by(e) law), or as it is most commonly known in the United States bylaws, is a set of rules or law established by an organization or community so as to regulate itself, as allowed or provided for by some higher authorit ...

determine how power is shared. In general, the rules of a corporation's constitution can be written in whatever way its incorporators choose, or however it is subsequently amended, so long as they comply with the minimum compulsory standards of the law. Different laws seek to protect the corporate stakeholders to different degrees. Among the most important are the voting rights they exercise against the board of directors, either to elect or remove them from office. There is also the right to sue for breaches of duty, and rights of information, typically used to buy, sell and associate, or disassociate on the market. The federal Securities and Exchange Act

The Securities Exchange Act of 1934 (also called the Exchange Act, '34 Act, or 1934 Act) (, codified at et seq.) is a law governing the secondary trading of securities (stocks, bonds, and debentures) in the United States of America. A landma ...

of 1934, requires minimum standards on the process of voting, particularly in a "proxy contest

A proxy fight, proxy contest or proxy battle (sometimes even called a proxy war) is an unfriendly contest for the control over an organization. The event usually occurs when a corporation's stockholders develop opposition to some aspect of the corp ...

" where competing groups attempt to persuade shareholders to delegate them their "proxy

Proxy may refer to: