U-shaped recession on:

[Wikipedia]

[Google]

[Amazon]

Recession shapes or recovery shapes are used by economists to describe different types of

In a V-shaped recession, the economy suffers a sharp but brief period of economic decline with a clearly defined trough, followed by a strong recovery. V-shapes are the normal shape for a recession, as the strength of the economic recovery is typically closely related to the severity of the preceding recession.

An example of a V-shaped recession is the

In a V-shaped recession, the economy suffers a sharp but brief period of economic decline with a clearly defined trough, followed by a strong recovery. V-shapes are the normal shape for a recession, as the strength of the economic recovery is typically closely related to the severity of the preceding recession.

An example of a V-shaped recession is the

A U-shaped recession is longer than a V-shaped recession and has a less-clearly defined trough. GDP may shrink for several quarters, and only slowly return to trend growth. Simon Johnson, former chief economist for the

A U-shaped recession is longer than a V-shaped recession and has a less-clearly defined trough. GDP may shrink for several quarters, and only slowly return to trend growth. Simon Johnson, former chief economist for the

In a W-shaped recession (also known as a double-dip recession), the economy falls into recession, recovers with a short period of growth, then falls back into recession before finally recovering, giving a "down up down up" pattern resembling the letter W.

The

In a W-shaped recession (also known as a double-dip recession), the economy falls into recession, recovers with a short period of growth, then falls back into recession before finally recovering, giving a "down up down up" pattern resembling the letter W.

The

An L-shaped recession or depression occurs when an economy has a severe recession and does not return to trend line growth for many years, if ever. The steep decline, is followed by a flat line makes the shape of an L. This is the most severe of the different shapes of recession. Alternative terms for long periods of underperformance include " depression" and " lost decade"; compare also " malaise".

A classic example of an L-shaped recession occurred in Japan following the bursting of the Japanese asset price bubble in 1990. From the end of World War II throughout the 1980s, Japan's economy was growing robustly. In the late 1980s, a massive asset-price bubble developed in Japan. After the bubble burst the economy suffered from

An L-shaped recession or depression occurs when an economy has a severe recession and does not return to trend line growth for many years, if ever. The steep decline, is followed by a flat line makes the shape of an L. This is the most severe of the different shapes of recession. Alternative terms for long periods of underperformance include " depression" and " lost decade"; compare also " malaise".

A classic example of an L-shaped recession occurred in Japan following the bursting of the Japanese asset price bubble in 1990. From the end of World War II throughout the 1980s, Japan's economy was growing robustly. In the late 1980s, a massive asset-price bubble developed in Japan. After the bubble burst the economy suffered from

V-Shaped Recovery

Investopedia (September 2020)

U-Shaped Recovery

Investopedia (September 2020)

W-Shaped Recovery

Investopedia (September 2020)

L-Shaped Recovery

Investopedia (September 2020)

K-Shaped Recovery

Investopedia (November 2020) {{United States – Commonwealth of Nations recessions Economics lists Gross domestic product Recessions

recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

s and their subsequent recoveries. There is no specific academic theory or classification system for recession shapes; rather the terminology is used as an informal shorthand to characterize recessions and their recoveries. The most commonly used terms are V-shaped (with variations of square-root shaped, and Nike-swoosh shaped), U-shaped, W-shaped (also known as a double-dip recession), and L-shaped recessions, with the COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identi ...

leading to the K-shaped recession (also known as a two-stage recession). The names derive from the shape the economic data – particularly GDP

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is ofte ...

– takes during the recession and recovery.

V-shaped

In a V-shaped recession, the economy suffers a sharp but brief period of economic decline with a clearly defined trough, followed by a strong recovery. V-shapes are the normal shape for a recession, as the strength of the economic recovery is typically closely related to the severity of the preceding recession.

An example of a V-shaped recession is the

In a V-shaped recession, the economy suffers a sharp but brief period of economic decline with a clearly defined trough, followed by a strong recovery. V-shapes are the normal shape for a recession, as the strength of the economic recovery is typically closely related to the severity of the preceding recession.

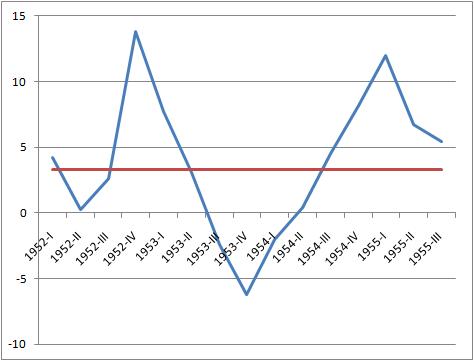

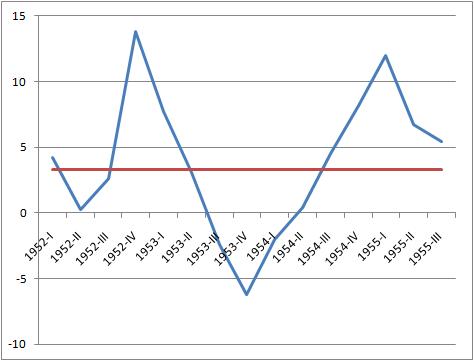

An example of a V-shaped recession is the Recession of 1953

The Recession of 1953 was a recession in the United States that began in the second quarter of 1953 and lasted until the first quarter of 1954. The total recession cost roughly $56 billion. It has been described by James L. Sundquist, a staff m ...

in the United States. In the early 1950s, the economy in the United States was growing, but because the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

expected inflation it raised interest rates, tipping the economy into recession. In 1953, growth began to slow in the third quarter and the economy shrank by 2.4 percent. In the fourth quarter, the economy shrank by 6.2 percent, and in the first quarter of 1954, it shrank by 2 percent before returning to growth. By the fourth quarter of 1954, the economy was growing at an 8 percent pace, well above the trend. Thus GDP growth for this recession formed a V-shape.

During the 2020 recession caused by the COVID-19 pandemic, where the left side of the V was particularly severe, some commentators expected that the recovery might not follow a full V-shape (i.e. right side equal to the drop from the left side), but would look more like a square-root shape, or a Nike-swoosh shape (square-root but with an upward trending right arm). By August 2020, the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

was expecting a "bumpy" Nike-swoosh recovery.

U-shaped

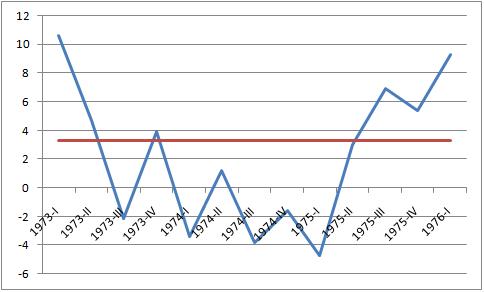

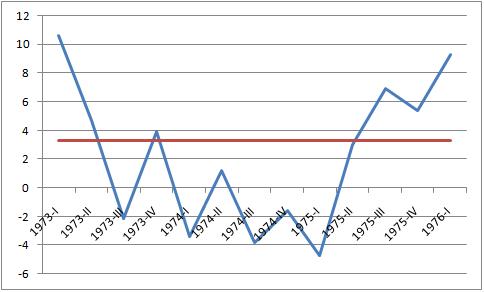

A U-shaped recession is longer than a V-shaped recession and has a less-clearly defined trough. GDP may shrink for several quarters, and only slowly return to trend growth. Simon Johnson, former chief economist for the

A U-shaped recession is longer than a V-shaped recession and has a less-clearly defined trough. GDP may shrink for several quarters, and only slowly return to trend growth. Simon Johnson, former chief economist for the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

, says a U-shaped recession is like a bathtub: "You go in. You stay in. The sides are slippery. You know, maybe there's some bumpy stuff in the bottom, but you don't come out of the bathtub for a long time."

The 1973–75 recession in the United States can be considered a U-shaped recession. In early 1973 the economy began to shrink and continued to decline or have very low growth for nearly two years. After bumping along the bottom, the economy climbed back to recovery in 1975.

W-shaped

In a W-shaped recession (also known as a double-dip recession), the economy falls into recession, recovers with a short period of growth, then falls back into recession before finally recovering, giving a "down up down up" pattern resembling the letter W.

The

In a W-shaped recession (also known as a double-dip recession), the economy falls into recession, recovers with a short period of growth, then falls back into recession before finally recovering, giving a "down up down up" pattern resembling the letter W.

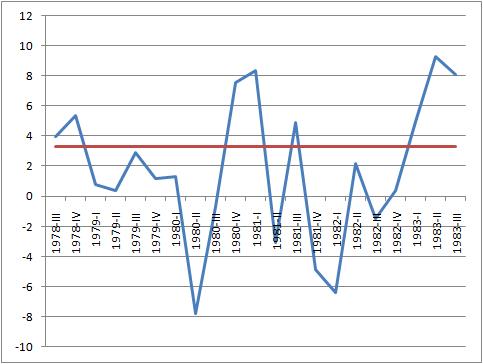

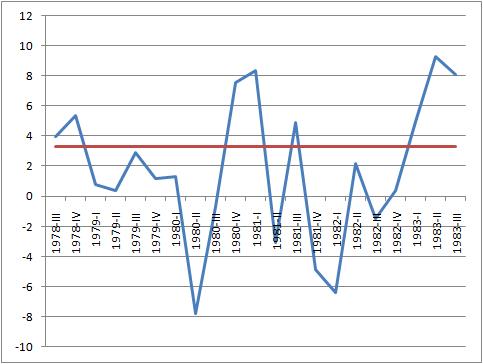

The early 1980s recession

The early 1980s recession was a severe economic recession that affected much of the world between approximately the start of 1980 and 1983. It is widely considered to have been the most severe recession since World War II. A key event leading to ...

in the United States is cited as an example of a W-shaped recession. The National Bureau of Economic Research

The National Bureau of Economic Research (NBER) is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic c ...

considers two recessions to have occurred in the early 1980s. The economy fell into recession from January 1980 to July 1980, shrinking at an 8 percent annual rate from April to June 1980. The economy then entered a quick period of growth, and in the first three months of 1981 grew at an 8.4 percent annual rate. As the Federal Reserve under Paul Volcker

Paul Adolph Volcker Jr. (September 5, 1927 – December 8, 2019) was an American economist who served as the 12th chairman of the Federal Reserve from 1979 to 1987. During his tenure as chairman, Volcker was widely credited with having ended th ...

raised interest rates to fight inflation, the economy dipped back into recession (hence, the "double-dip") from July 1981 to November 1982. The economy then entered a period of mostly robust growth for the rest of the decade.

The European debt crisis in the early-2010s is a more recent example of a W-shaped recession. A combination of government austerity, falling business investment, rising interest rates, global economic weakness, high energy prices, and weak consumer spending after the Great Recession of 2008–2009 tipped many Eurozone

The euro area, commonly called eurozone (EZ), is a currency union of 19 member states of the European Union (EU) that have adopted the euro ( €) as their primary currency and sole legal tender, and have thus fully implemented EMU polici ...

countries into a second recession from 2011 to 2013. Countries affected included Italy, Spain, Portugal, France, Ireland, Germany and Cyprus. Greece, while part of the Eurozone, saw continuous economic contraction from 2007 to 2015, and thus does not fit the definition of a W-shaped recession, but rather an L-shaped recession. The United Kingdom is not a member of the Eurozone, but was a member of the European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been de ...

until 2020

2020 was heavily defined by the COVID-19 pandemic, which led to global social and economic disruption, mass cancellations and postponements of events, worldwide lockdowns and the largest economic recession since the Great Depression in t ...

, and suffered a minor W-shaped recession when GDP contracted in Q4 2011 and Q1 2012.

L-shaped

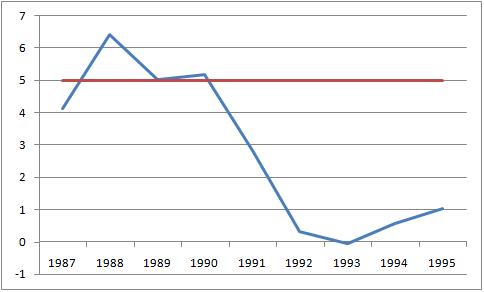

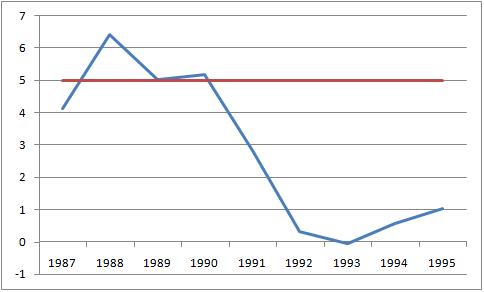

An L-shaped recession or depression occurs when an economy has a severe recession and does not return to trend line growth for many years, if ever. The steep decline, is followed by a flat line makes the shape of an L. This is the most severe of the different shapes of recession. Alternative terms for long periods of underperformance include " depression" and " lost decade"; compare also " malaise".

A classic example of an L-shaped recession occurred in Japan following the bursting of the Japanese asset price bubble in 1990. From the end of World War II throughout the 1980s, Japan's economy was growing robustly. In the late 1980s, a massive asset-price bubble developed in Japan. After the bubble burst the economy suffered from

An L-shaped recession or depression occurs when an economy has a severe recession and does not return to trend line growth for many years, if ever. The steep decline, is followed by a flat line makes the shape of an L. This is the most severe of the different shapes of recession. Alternative terms for long periods of underperformance include " depression" and " lost decade"; compare also " malaise".

A classic example of an L-shaped recession occurred in Japan following the bursting of the Japanese asset price bubble in 1990. From the end of World War II throughout the 1980s, Japan's economy was growing robustly. In the late 1980s, a massive asset-price bubble developed in Japan. After the bubble burst the economy suffered from deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflatio ...

, and experienced years of sluggish growth; never returning to the higher growth Japan experienced from 1950 to 1990. After the late-2000s recession in the United States followed a similar economic bubble (the United States housing bubble

The 2000s United States housing bubble was a real-estate bubble affecting over half of the U.S. states. It was the impetus for the subprime mortgage crisis. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reac ...

) some economists feared the U.S. economy could enter a prolonged period of low growth even after recovering from the recession. By 2013, however, U.S. GDP growth rebounded, allaying fears of stagnation.

The Greek recession of 2007–2016 could be considered an example of an L-shaped recession, as Greek GDP growth in 2017 was merely 1.6%. Greece technically suffered through four separate, but compounding, periods of contractions over the nine-year period.

K-shaped

A K-shaped recession (or two-stage recession), is where parts of society experiences more of a V-shaped recession, while other parts of society experience a slower more protracted L-shaped recession (the shape of the K denoting the divergence in the recovery paths). The term arose from the economic recovery post theCOVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identi ...

, where central banks had used exceptional monetary tools to generate asset bubbles that protected the wealthier segments of society (i.e. asset-owning), from the financial effects of the pandemic. K-shaped recoveries are controversial, and the 2020 K-shaped recovery in the United States led to levels of wealth inequality

The distribution of wealth is a comparison of the wealth of various members or groups in a society. It shows one aspect of economic inequality or heterogeneity in economics, economic heterogeneity.

The distribution of wealth differs from the i ...

not seen since the 1920s. In December 2020, Bloomberg News

Bloomberg News (originally Bloomberg Business News) is an international news agency headquartered in New York City and a division of Bloomberg L.P. Content produced by Bloomberg News is disseminated through Bloomberg Terminals, Bloomberg Tele ...

called 2020, "... a great year for Wall Street, but a bear market

A market trend is a perceived tendency of financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time-fram ...

for humans". In January 2021, Edward Luce

Edward Geoffrey Luce (born 1 June 1968) is an English journalist and the ''Financial Times'' chief US commentator and columnist based in Washington, D.C.

Early life and education

Luce is the son of Rose Helen (née Nicholson) and Richard Luc ...

of the ''Financial Times'' warned that Jerome Powell

Jerome Hayden "Jay" Powell (born February 4, 1953) is an American attorney and investment banker who has served as the 16th chair of the Federal Reserve since 2018.

After earning a degree in politics from Princeton University in 1975 and a ...

's explicit use of asset bubbles in creating a K-shaped recovery, and the resultant widening of wealth inequality, could lead to political and social instability in the United States, saying: "The majority of people are suffering amid a Great Gatsby–style boom at the top".

Others

* Inverted square root: FinancierGeorge Soros

George Soros ( name written in eastern order), (born György Schwartz, August 12, 1930) is a Hungarian-American businessman and philanthropist. , he had a net worth of US$8.6 billion, Note that this site is updated daily. having donated mo ...

said the 2009 recession could follow an "inverted square root

In mathematics, a square root of a number is a number such that ; in other words, a number whose ''square'' (the result of multiplying the number by itself, or ⋅ ) is . For example, 4 and −4 are square roots of 16, because .

...

sign"–shaped recession. Soros explained to Reuters

Reuters ( ) is a news agency owned by Thomson Reuters Corporation. It employs around 2,500 journalists and 600 photojournalists in about 200 locations worldwide. Reuters is one of the largest news agencies in the world.

The agency was esta ...

that this meant: "You hit bottom and you automatically rebound some (i.e. a spike), but then you don't come out of it in a V-shape recovery or anything like that. You settle down—step down". Soros actually meant reverse instead of "inverted" square root shape of economic recovery. A similar shape of recovery was observed during the COVID-19 pandemic induced economic crisis.

* Normal square root: During the COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identi ...

, several commentators used the shape of a normal square root to describe a situation where the recovery would not be complete (as per a V-shaped recovery), but after an initial rise, would flatline for a period.

See also

*Glossary of shapes with metaphorical names

Many shapes have metaphorical names, i.e., their names are metaphors: these shapes are named after a most common object that has it. For example, "U-shape" is a shape that resembles the letter U, a bell-shaped curve has the shape of the vertical ...

* List of recessions in the United States

There have been as many as 48 recessions in the United States dating back to the Articles of Confederation, and although economists and historians dispute certain 19th-century recessions, the consensus view among economists and historians is that ...

References

Further reading

*External links

V-Shaped Recovery

Investopedia (September 2020)

U-Shaped Recovery

Investopedia (September 2020)

W-Shaped Recovery

Investopedia (September 2020)

L-Shaped Recovery

Investopedia (September 2020)

K-Shaped Recovery

Investopedia (November 2020) {{United States – Commonwealth of Nations recessions Economics lists Gross domestic product Recessions