The Bank of New York Mellon on:

[Wikipedia]

[Google]

[Amazon]

The Bank of New York Mellon Corporation, commonly known as BNY Mellon, is an American investment banking services holding company headquartered in

The bank had a monopoly on banking services in the city until the

The bank had a monopoly on banking services in the city until the

/ref> From 1993 to 1998, the bank made 33 acquisitions, including acquiring JP Morgan's Global Custody Business in 1995. Ivy Asset Management was acquired in 2000, and the bank acquired Pershing LLC, the United States' second-largest trade clearinghouse, in 2003. In the 1990s, or "Mickey" Galitzine (russian: Владимир Кириллович Голицын; 1942-2018, born Belgrade) with the pseudonym ''Vladimirov'', whose father was a director of the

Mellon Financial was founded as T. Mellon & Sons' Bank in

Mellon Financial was founded as T. Mellon & Sons' Bank in

File:AssetsandLiabilities2000to2016.png, Assets and Liabilities 2000–2016

File:AssetsandLiabilitiesRatio2000to2016.png, Assets/Liabilities Ratio (%) 2000–2016

File:NetIncome2000to2016.png, Net Income 2000–2016 (in millions)

Pershing LLC., a subsidiary of The Bank of New York Mellon Corporation

* /www.youtube.com/bnym225years 225th Anniversary Commemorative Video

iNautix Technologies, a subsidiary of The Bank of New York Mellon

New York Life Insurance and Trust Company Records

at Baker Library Historical Collections, Harvard Business School. {{DEFAULTSORT:Bank Of New York Mellon Companies listed on the New York Stock Exchange 2007 establishments in New York City Banks based in New York City Systemically important financial institutions Companies based in Manhattan American companies established in 2007 Banks established in 2007 Multinational companies based in New York City Publicly traded companies based in New York City

New York City

New York, often called New York City or NYC, is the List of United States cities by population, most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the L ...

. BNY Mellon was formed from the merger of The Bank of New York and the Mellon Financial Corporation

Mellon Financial Corporation was an investment firm which was once one of the world's largest money management firms. Based in Pittsburgh, Pennsylvania, it was in the business of institutional and high-net-worth individual asset management, incl ...

in 2007. It is the world's largest custodian bank and securities services company, with $2.4 trillion in assets under management and $46.7 trillion in assets under custody as of the second quarter of 2021. It is considered a systemically important bank by the Financial Stability Board

The Financial Stability Board (FSB) is an international body that monitors and makes recommendations about the global financial system. It was established after the G20 London summit in April 2009 as a successor to the Financial Stability For ...

. BNY Mellon is incorporated in Delaware.

Through its Bank of New York predecessor, it is one of the three oldest banking corporations in the United States and among the oldest banks in the world, having been established in June 1784 by a group that included American Founding Fathers

The Founding Fathers of the United States, known simply as the Founding Fathers or Founders, were a group of late-18th-century American revolutionary leaders who united the Thirteen Colonies, oversaw the war for independence from Great Brita ...

Alexander Hamilton and Aaron Burr. T. Mellon and Sons Bank, was founded in Pittsburgh

Pittsburgh ( ) is a city in the Commonwealth (U.S. state), Commonwealth of Pennsylvania, United States, and the county seat of Allegheny County, Pennsylvania, Allegheny County. It is the most populous city in both Allegheny County and Wester ...

in 1869 by Thomas Mellon and his sons Richard and Andrew

Andrew is the English form of a given name common in many countries. In the 1990s, it was among the top ten most popular names given to boys in English-speaking countries. "Andrew" is frequently shortened to "Andy" or "Drew". The word is derive ...

, the latter of whom later became Secretary of the US Treasury.

History

Bank of New York

The first bank in the U.S. was the Bank of North America in Philadelphia, which was chartered by the Continental Congress in 1781; Alexander Hamilton, Thomas Jefferson and Benjamin Franklin were among its founding shareholders. In February 1784, The Massachusetts Bank in Boston was chartered. The shipping industry inNew York City

New York, often called New York City or NYC, is the List of United States cities by population, most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the L ...

chafed under the lack of a bank, and investors envied the 14% dividends that Bank of North America paid, and months of local discussion culminated in a June 1784 meeting at a coffee house on St. George's Square which led to the formation of the Bank of New York company; it operated without a charter for seven years. The initial plan was to capitalize the company with $750,000, a third in cash and the rest in mortgages, but after this was disputed the first offering was to capitalize it with $500,000 in gold or silver. When the bank opened on June 9, 1784, the full $500,000 had not been raised; 723 shares had been sold, held by 192 people. Aaron Burr had three of them, and Hamilton had one and a half shares. The first president was Alexander McDougall and the Cashier was William Seton.

Its first offices were in the old Walton Mansion in New York City. In 1787, it moved to a site on Hanover Square that the New York Cotton Exchange

The New York Cotton Exchange (NYCE) is a commodities exchange founded in 1870 by a group of one hundred cotton brokers and merchants in New York City. In 1998, the New York Board of Trade (NYBOT) became the parent company of the New York Cotton ...

later moved into.

The bank provided the United States government its first loan in 1789. The loan was orchestrated by Hamilton, then Secretary of the Treasury, and it paid the salaries of United States Congress

The United States Congress is the legislature of the federal government of the United States. It is Bicameralism, bicameral, composed of a lower body, the United States House of Representatives, House of Representatives, and an upper body, ...

members and President

President most commonly refers to:

*President (corporate title)

* President (education), a leader of a college or university

* President (government title)

President may also refer to:

Automobiles

* Nissan President, a 1966–2010 Japanese ...

George Washington

George Washington (February 22, 1732, 1799) was an American military officer, statesman, and Founding Father who served as the first president of the United States from 1789 to 1797. Appointed by the Continental Congress as commander of ...

.

The Bank of New York was the first company to be traded on the New York Stock Exchange when it first opened in 1792. In 1796, the bank moved to a location at the corner of Wall Street and William Street, which would later become 48 Wall Street.

The bank had a monopoly on banking services in the city until the

The bank had a monopoly on banking services in the city until the Bank of the Manhattan Company

The Manhattan Company was a New York bank and holding company established on September 1, 1799. The company merged with Chase National Bank in 1955 to form the Chase Manhattan Bank. It is the oldest of the predecessor institutions that eventually ...

was founded by Aaron Burr in 1799; the Bank of New York and Hamilton vigorously opposed its founding.

During the 19th century, the bank was known for its conservative lending practices that allowed it to weather financial crises. It was involved in the funding of the Morris and Erie canals, and steamboat companies. The bank helped finance both the War of 1812

The War of 1812 (18 June 1812 – 17 February 1815) was fought by the United States of America and its indigenous allies against the United Kingdom and its allies in British North America, with limited participation by Spain in Florida. It be ...

and the Union Army

During the American Civil War, the Union Army, also known as the Federal Army and the Northern Army, referring to the United States Army, was the land force that fought to preserve the Union (American Civil War), Union of the collective U.S. st ...

during the American Civil War

The American Civil War (April 12, 1861 – May 26, 1865; also known by Names of the American Civil War, other names) was a civil war in the United States. It was fought between the Union (American Civil War), Union ("the North") and t ...

. Following the Civil War, the bank loaned money to many major infrastructure projects, including utilities, railroads, and the New York City Subway

The New York City Subway is a rapid transit system owned by the government of New York City and leased to the New York City Transit Authority, an affiliate agency of the state-run Metropolitan Transportation Authority (MTA). Opened on October ...

.

Through the early 20th century, the Bank of New York continued to expand and prosper. In July 1922, the bank merged with the New York Life Insurance and Trust Company. The bank continued to profit and pay dividends throughout the Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

, and its total deposits increased during the decade. In 1948, the Bank again merged, this time with the Fifth Avenue Bank, which was followed by a merger in 1966 with the Empire Trust Company. The bank's holding company

A holding company is a company whose primary business is holding a controlling interest in the securities of other companies. A holding company usually does not produce goods or services itself. Its purpose is to own shares of other companies ...

was created in 1969.

In 1988, the Bank of New York merged with Irving Bank Corporation after a year-long hostile take over

In business, a takeover is the purchase of one company (the ''target'') by another (the ''acquirer'' or ''bidder''). In the UK, the term refers to the acquisition of a public company whose shares are listed on a stock exchange, in contrast to t ...

bid by Bank of New York. Irving had been headquartered at 1 Wall Street and after the merger, this became the headquarters of the Bank of New York on July 20, 1998. In 1922, Irving Trust

Irving Trust was an American Commercial bank headquartered in New York City that operated between 1851 and 1988 when it was acquired by Bank of New York. From 1965 the bank was the principal subsidiary of the Irving Bank Corporation.

Between 191 ...

opened an account with Vnesheconombank, now known as VEB, and beginning on October 7, 1988, when the merger was approved, the Bank of New York was able to conduct transactions with the Soviet Union

The Soviet Union,. officially the Union of Soviet Socialist Republics. (USSR),. was a transcontinental country that spanned much of Eurasia from 1922 to 1991. A flagship communist state, it was nominally a federal union of fifteen nationa ...

and later in 1991 Russia

Russia (, , ), or the Russian Federation, is a transcontinental country spanning Eastern Europe and Northern Asia. It is the largest country in the world, with its internationally recognised territory covering , and encompassing one-ei ...

. Natasha Kagalovsky (née

A birth name is the name of a person given upon birth. The term may be applied to the surname, the given name, or the entire name. Where births are required to be officially registered, the entire name entered onto a birth certificate or birth re ...

Gurfinkel) with the pseudonym ''Gurova'', who had been an employee at Irving Trust since 1986 and was in charge of the banking with the Soviet Union, became a senior vice president at the Bank of New York heading the Eastern European operations from 1992 until October 13, 1999, when she resigned.Alt website/ref> From 1993 to 1998, the bank made 33 acquisitions, including acquiring JP Morgan's Global Custody Business in 1995. Ivy Asset Management was acquired in 2000, and the bank acquired Pershing LLC, the United States' second-largest trade clearinghouse, in 2003. In the 1990s, or "Mickey" Galitzine (russian: Владимир Кириллович Голицын; 1942-2018, born Belgrade) with the pseudonym ''Vladimirov'', whose father was a director of the

Tolstoy Foundation The Tolstoy Foundation is a non-profit charitable and philanthropic organization. It was established on April 26, 1939, by Alexandra Tolstaya, the youngest daughter of the Russian writer Leo Tolstoy, and her friend Tatiana Schaufuss. Its headquarte ...

, established and headed the Eastern European Department at the Bank of New York until 1992 and hired many Russians. He mentored many new bankers in Hungary

Hungary ( hu, Magyarország ) is a landlocked country in Central Europe. Spanning of the Carpathian Basin, it is bordered by Slovakia to the north, Ukraine to the northeast, Romania to the east and southeast, Serbia to the south, Cr ...

, the former East Germany

East Germany, officially the German Democratic Republic (GDR; german: Deutsche Demokratische Republik, , DDR, ), was a country that existed from its creation on 7 October 1949 until German reunification, its dissolution on 3 October 1990. In t ...

, Poland

Poland, officially the Republic of Poland, is a country in Central Europe. It is divided into 16 administrative provinces called voivodeships, covering an area of . Poland has a population of over 38 million and is the fifth-most populou ...

, Romania

Romania ( ; ro, România ) is a country located at the crossroads of Central Europe, Central, Eastern Europe, Eastern, and Southeast Europe, Southeastern Europe. It borders Bulgaria to the south, Ukraine to the north, Hungary to the west, S ...

, and Bulgaria

Bulgaria (; bg, България, Bǎlgariya), officially the Republic of Bulgaria,, ) is a country in Southeast Europe. It is situated on the eastern flank of the Balkans, and is bordered by Romania to the north, Serbia and North Macedo ...

and travelled extensively to capital cities in the former Soviet Union or the CIS to assist new bankers especially in Russia

Russia (, , ), or the Russian Federation, is a transcontinental country spanning Eastern Europe and Northern Asia. It is the largest country in the world, with its internationally recognised territory covering , and encompassing one-ei ...

to where he travelled for his first time in 1990, Ukraine

Ukraine ( uk, Україна, Ukraïna, ) is a country in Eastern Europe. It is the second-largest European country after Russia, which it borders to the east and northeast. Ukraine covers approximately . Prior to the ongoing Russian inva ...

, Latvia

Latvia ( or ; lv, Latvija ; ltg, Latveja; liv, Leţmō), officially the Republic of Latvia ( lv, Latvijas Republika, links=no, ltg, Latvejas Republika, links=no, liv, Leţmō Vabāmō, links=no), is a country in the Baltic region of ...

, Georgia, Armenia

Armenia (), , group=pron officially the Republic of Armenia,, is a landlocked country in the Armenian Highlands of Western Asia.The UNbr>classification of world regions places Armenia in Western Asia; the CIA World Factbook , , and ''O ...

, Turkmenistan

Turkmenistan ( or ; tk, Türkmenistan / Түркменистан, ) is a country located in Central Asia, bordered by Kazakhstan to the northwest, Uzbekistan to the north, east and northeast, Afghanistan to the southeast, Iran to the s ...

, and Kazakhstan

Kazakhstan, officially the Republic of Kazakhstan, is a transcontinental country located mainly in Central Asia and partly in Eastern Europe. It borders Russia to the north and west, China to the east, Kyrgyzstan to the southeast, Uzbeki ...

. In 1960, he joined the Bank of New York and worked as an accountant in its International Department but later headed the Russia team as a vice president of the bank. His wife Tatiana Vladimirovna Kazimirova (russian: Татьяна Владимировна Казимирова; b. 1943, Berlin), an employee at the Bank of New York whom he married in 1963, worked very closely with him. He traveled for his first time to Russia in 1990. He worked closely with banks in Greece

Greece,, or , romanized: ', officially the Hellenic Republic, is a country in Southeast Europe. It is situated on the southern tip of the Balkans, and is located at the crossroads of Europe, Asia, and Africa. Greece shares land borders wi ...

, Malta

Malta ( , , ), officially the Republic of Malta ( mt, Repubblika ta' Malta ), is an island country in the Mediterranean Sea. It consists of an archipelago, between Italy and Libya, and is often considered a part of Southern Europe. It lies ...

, and Italy

Italy ( it, Italia ), officially the Italian Republic, ) or the Republic of Italy, is a country in Southern Europe. It is located in the middle of the Mediterranean Sea, and its territory largely coincides with the homonymous geographical ...

and was an expert in cotton

Cotton is a soft, fluffy staple fiber that grows in a boll, or protective case, around the seeds of the cotton plants of the genus '' Gossypium'' in the mallow family Malvaceae. The fiber is almost pure cellulose, and can contain minor pe ...

, gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile ...

, silver

Silver is a chemical element with the symbol Ag (from the Latin ', derived from the Proto-Indo-European ''h₂erǵ'': "shiny" or "white") and atomic number 47. A soft, white, lustrous transition metal, it exhibits the highest electrical ...

, and other raw materials financing.

Bank of New York had correspondent accounts for several Russian banks including Inkombank

Vladimir Viktorovich Vinogradov ( Russian Владимир Викторович Виноградов) (19 September 1955 in Ufa — 29 June 2008 in Moscow) was the owner and president of Inkombank, one of the largest banks in 90s' Russia. Consid ...

(russian: Инкомбанк), Menatep

Bank "MENATEP", Bank "MENATEP SPb" (Russian: Банк "МЕНАТЕП Санкт-Петербург" / Банк «МЕНАТЕП СПб») and "Group Menatep Limited" were financial companies, created by Russian businessman Mikhail Khodorkovsky. " ...

(russian: «Менатеп»), Tokobank (russian: Токобанк), Tveruniversalbank (russian: Тверьуниверсалбанк), Alfa-Bank (russian: Альфа-банк), (russian: Собинбанк), Moscow International Bank (russian: Московский международный банк) and others.

In 2005, the bank settled a US federal investigation that began in 1996 concerning money laundering

Money laundering is the process of concealing the origin of money, obtained from illicit activities such as drug trafficking, corruption, embezzlement or gambling, by converting it into a legitimate source. It is a crime in many jurisdicti ...

related to post-Soviet privatization in Russia. The illegal operation involved two Russian emigres, Peter Berlin and his wife Lyudmila "Lucy" (née

A birth name is the name of a person given upon birth. The term may be applied to the surname, the given name, or the entire name. Where births are required to be officially registered, the entire name entered onto a birth certificate or birth re ...

Pritzker) Edwards who was a Vice President of the bank and worked at its London office, moving over US$7 billion via hundreds of wires. Through accounts created by Peter Berlin for Alexei Volkov's Torfinex Corportion, Bees Lowland, which was an offshore shell company created by Peter Berlin, and Benex International Company Inc, numerous irregular wire transfers occurred at the Bank of New York. In October 1997 at Bologna

Bologna (, , ; egl, label= Emilian, Bulåggna ; lat, Bononia) is the capital and largest city of the Emilia-Romagna region in Northern Italy. It is the seventh most populous city in Italy with about 400,000 inhabitants and 150 different na ...

, Joseph Roisis, also spelled Yosif Aronovizh Roizis and nicknamed ''Cannibal'' as a member of Russian mafia's Solntsevskaya Bratva

The Solntsevskaya Organized Crime Group (russian: Солнцевская организованная преступная группировка), also known as the Solntsevskaya Bratva (russian: link=no, Солнцевская братва), is a ...

with businesses in Czechoslovakia

, rue, Чеськословеньско, , yi, טשעכאסלאוואקיי,

, common_name = Czechoslovakia

, life_span = 1918–19391945–1992

, p1 = Austria-Hungary

, image_p1 ...

, explained to Italian prosecutors that 90% of the money flowing through Benex accounts at the Bank of New York is Russian mafia money.; b. late 1940s, Soviet Union

The Soviet Union,. officially the Union of Soviet Socialist Republics. (USSR),. was a transcontinental country that spanned much of Eurasia from 1922 to 1991. A flagship communist state, it was nominally a federal union of fifteen nationa ...

), who was also known as Aron, Gregory, Grisha, or "Ogre", immigrated to the United States with his wife and two children two years after fighting for Israel in the Yom Kippur War

The Yom Kippur War, also known as the Ramadan War, the October War, the 1973 Arab–Israeli War, or the Fourth Arab–Israeli War, was an armed conflict fought from October 6 to 25, 1973 between Israel and a coalition of Arab states led by E ...

and operated a furniture store in Brighton Beach as a front for trafficking heroin

Heroin, also known as diacetylmorphine and diamorphine among other names, is a potent opioid mainly used as a recreational drug for its euphoric effects. Medical grade diamorphine is used as a pure hydrochloride salt. Various white and bro ...

from Romania

Romania ( ; ro, România ) is a country located at the crossroads of Central Europe, Central, Eastern Europe, Eastern, and Southeast Europe, Southeastern Europe. It borders Bulgaria to the south, Ukraine to the north, Hungary to the west, S ...

where he purchased furniture for his store. Marat Balagula (russian: Марат Балагул) assisted him with obtaining heroin from Thailand

Thailand ( ), historically known as Siam () and officially the Kingdom of Thailand, is a country in Southeast Asia, located at the centre of the Indochinese Peninsula, spanning , with a population of almost 70 million. The country is b ...

via Poland

Poland, officially the Republic of Poland, is a country in Central Europe. It is divided into 16 administrative provinces called voivodeships, covering an area of . Poland has a population of over 38 million and is the fifth-most populou ...

. Roitsis gave Leonid "Tarzan" Fainberg or Feinberg (russian: Леонид «Тарзан» Файнберг; b. Ukraine), who was also known as Ludwid "Tarzan" Fainberg and was trained as a dentist but left the Soviet Union for Israel where he obtained an Israeli passport and immigrated to the United States in the 1980s via Germany, a job at his furniture store in Brighton Beach, Brooklyn, New York City. Alexei Volkov was charged in the United States but fled to Russia which has no extradition treaty with the United States and later the charges were dropped. Svetlana Kudryavtsev, a Bank of New York employee that was responsible for the proper operation of the Benex accounts in New York which had ties to Semion Mogilevich

Semion Yudkovich Mogilevich ( uk, Семен Юдкович Могилевич, Semén Yúdkovych Mohylévych ; born June 30, 1946) is a Ukrainian-born Russian organized crime boss. He quickly built a highly structured criminal organization, in ...

and through which passed $4.2 billion from October 1998 to March 1999, refused to cooperate and resigned during an internal audit of the matter but was later indicted by the FBI for her role in which she received $500 a month from Edwards for her services. Alexander Mamut's Sobinbank, which since August 2010 is a subsidiary of Rossiya Bank, was raided on October 10, 1999, in support of United States investigations into money laundering at the Bank of New York. The Vanuatu

Vanuatu ( or ; ), officially the Republic of Vanuatu (french: link=no, République de Vanuatu; bi, Ripablik blong Vanuatu), is an island country located in the South Pacific Ocean. The archipelago, which is of volcanic origin, is east of ...

registered Sobinbank Limited facilitated transfers between December 1997 and February 1999 for Benex accounts. Edmond Safra

Edmond J. Safra ( ar, ادموند يعقوب صفرا; 6 August 1932 – 3 December 1999) was a Lebanese-Brazilian banker who continued the family tradition of banking in Brazil and Switzerland. He was married to Lily Watkins from 1976 until ...

of the bank Republic New York, which is a longtime rival of the Bank of New York, alerted the FBI to the money laundering scheme which also involved Russian banks including Sobinbank and the Depozitarno-Kliringovy Bank (DKB) or the Russian Deposit Clearinghouse Bank (russian: российский «Депозитарно-клиринговый банк» («ДКБ»)) which was created by Peter Berlin and had the same address as the Bees Lowland offshore shell company. $3 billion went from both Russian DKB and Sobinbank accounts through the Igor and Oleg Berezovsky owned Italian firm ''Prima'' based in Rimini and, through Andrei Marisov at the Grigory Luchansky associated French firm ''Kama Trade'' which had accounts with the Société bancaire arabe (SBA) to accounts at the Peter Berlin created Sinex Bank in Nauru.

In 2006, the Bank of New York traded its retail banking and regional middle-market businesses for J.P. Morgan Chase's corporate trust assets. The deal signaled the bank's exit from retail banking.

Mellon Financial

Mellon Financial was founded as T. Mellon & Sons' Bank in

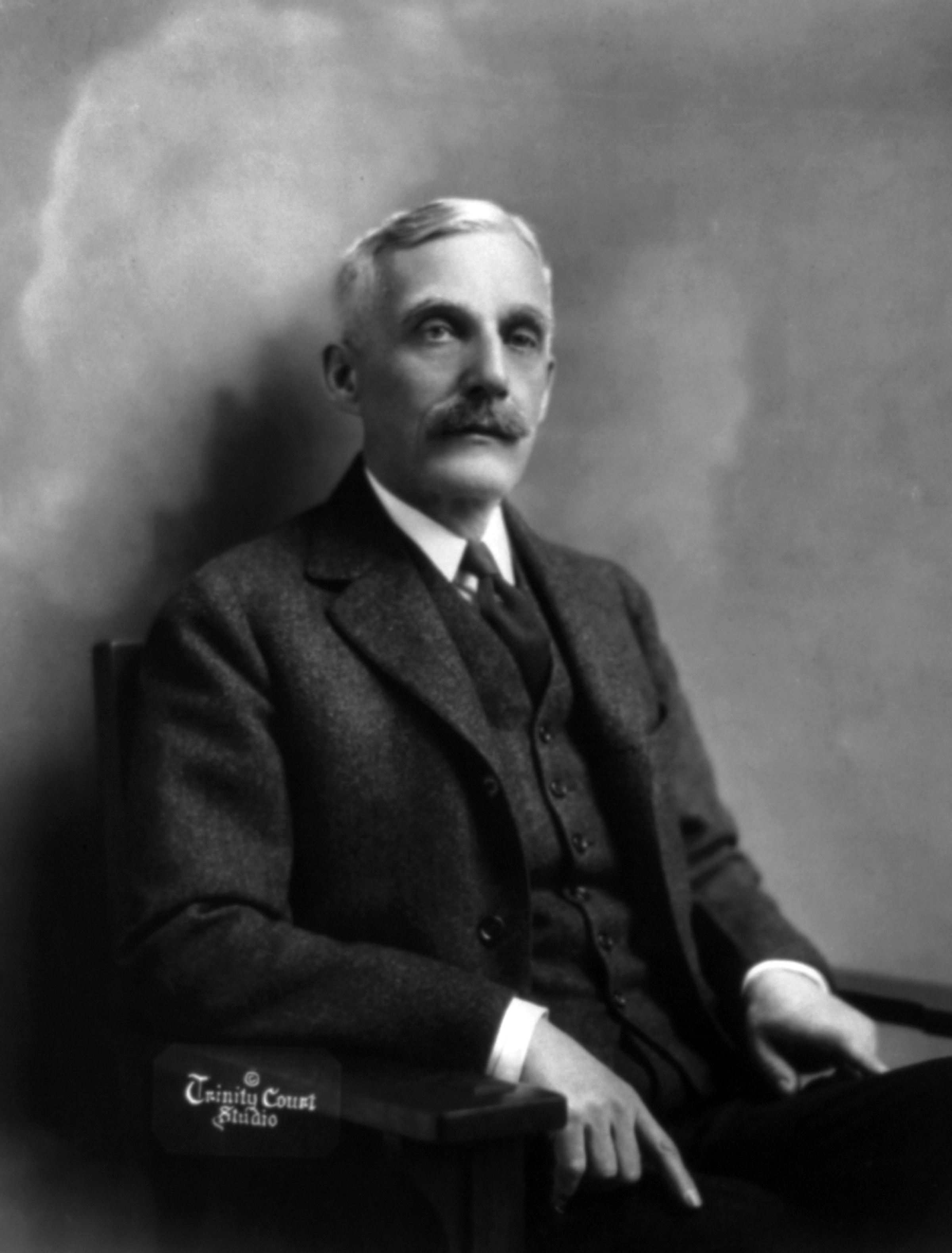

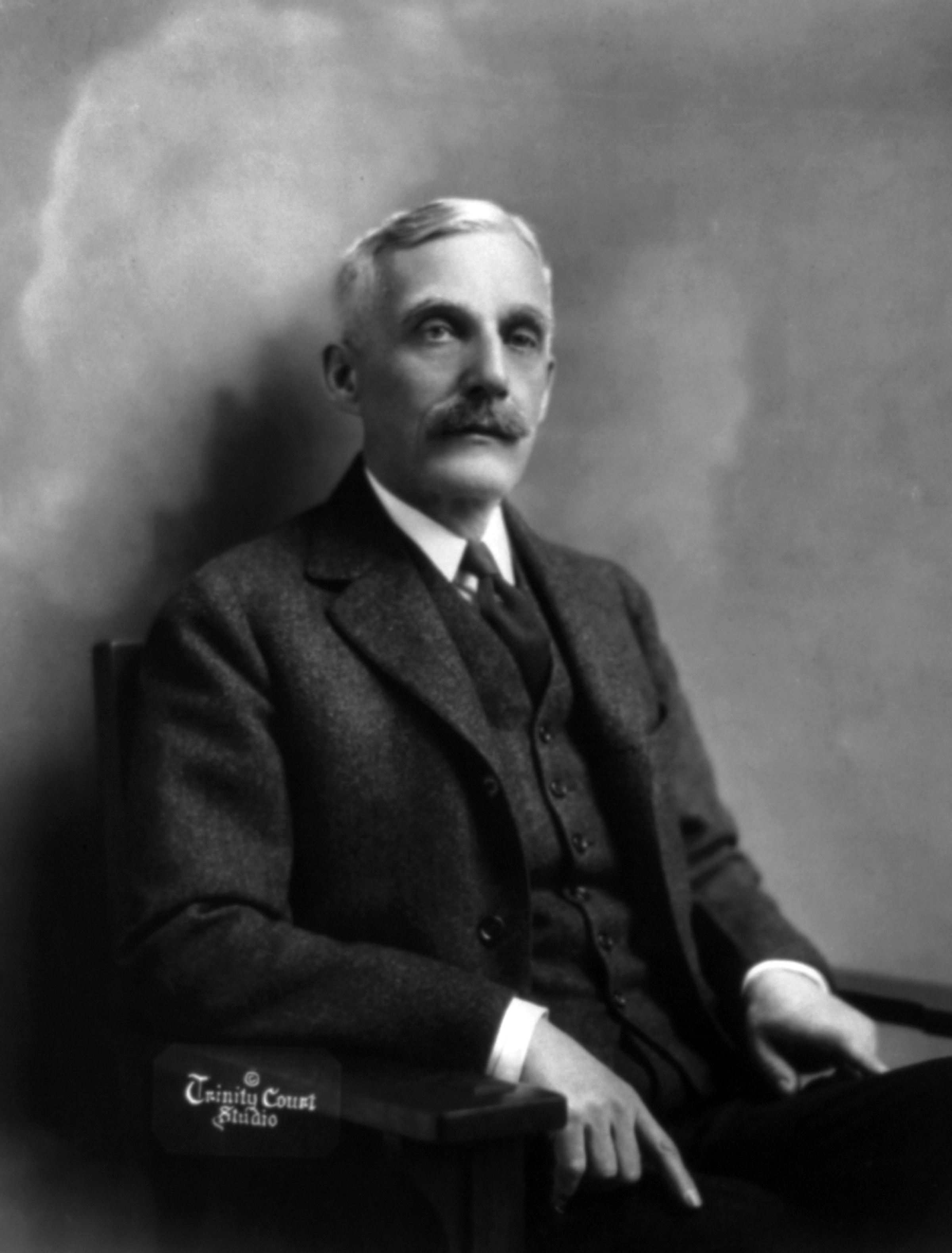

Mellon Financial was founded as T. Mellon & Sons' Bank in Pittsburgh

Pittsburgh ( ) is a city in the Commonwealth (U.S. state), Commonwealth of Pennsylvania, United States, and the county seat of Allegheny County, Pennsylvania, Allegheny County. It is the most populous city in both Allegheny County and Wester ...

, Pennsylvania, in 1869 by retired judge Thomas Mellon and his sons Andrew W. Mellon and Richard B. Mellon

Richard Beatty Mellon (March 19, 1858 – December 1, 1933), sometimes R.B., part of the Mellon family, was a banker, industrialist, and philanthropist from Pittsburgh, Pennsylvania.

Biography

He and his brother Andrew Mellon, sons of Judge Tho ...

. The bank invested in and helped found numerous industrial firms in the late 1800s and early 1900s including Alcoa, Westinghouse, Gulf Oil

Gulf Oil was a major global oil company in operation from 1901 to 1985. The eighth-largest American manufacturing company in 1941 and the ninth-largest in 1979, Gulf Oil was one of the so-called Seven Sisters oil companies. Prior to its merger ...

, General Motors

The General Motors Company (GM) is an American Multinational corporation, multinational Automotive industry, automotive manufacturing company headquartered in Detroit, Michigan, United States. It is the largest automaker in the United States and ...

and Bethlehem Steel

The Bethlehem Steel Corporation was an American steelmaking company headquartered in Bethlehem, Pennsylvania. For most of the 20th century, it was one of the world's largest steel producing and shipbuilding companies. At the height of its succ ...

. Both Gulf Oil and Alcoa are, according to the financial media, considered to be T. Mellon & Sons' most successful financial investments.

In 1902, T. Mellon & Sons' name was changed to the Mellon National Bank. The firm merged with the Union Trust Company, a business founded by Andrew Mellon, in 1946. The newly formed organization resulting from the merger was named the Mellon National Bank and Trust Company, and was Pittsburgh's first US$1 billion bank.

The bank formed the first dedicated family office

A family office is a privately held company that handles investment management and wealth management for a wealthy family, generally one with at least $50-$100 million in investable assets, with the goal being to effectively grow and transfe ...

in the United States in 1971. A reorganization in 1972 led to the bank's name changing to Mellon Bank, N.A. and the formation of a holding company, Mellon National Corporation.

Mellon Bank acquired multiple banks and financial institutions in Pennsylvania during the 1980s and 1990s. In 1992, Mellon acquired 54 branch offices of Philadelphia Savings Fund Society, the first savings bank in the United States, founded in 1819.

In 1993, Mellon acquired The Boston Company from American Express

American Express Company (Amex) is an American multinational corporation, multinational corporation specialized in payment card industry, payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Man ...

and AFCO Credit Corporation from The Continental Corporation. The following year, Mellon merged with the Dreyfus Corporation, bringing its mutual funds under its umbrella. In 1999, Mellon Bank Corporation became Mellon Financial Corporation. Two years later, it exited the retail banking business by selling its assets and retail bank branches to Citizens Financial Group.

Merger

On December 4, 2006, the Bank of New York and Mellon Financial Corporation announced they would merge. The merger created the world's largest securities servicing company and one of the largest asset management firms by combining Mellon's wealth-management business and the Bank of New York's asset-servicing and short-term-lending specialties. The companies anticipated saving about $700 million in costs and cutting around 3,900 jobs, mostly by attrition. The deal was valued at $16.5 billion and under its terms, the Bank of New York's shareholders received 0.9434 shares in the new company for each share of the Bank of New York that they owned, while Mellon Financial shareholders received 1 share in the new company for each Mellon share they owned. The Bank of New York and Mellon Financial entered into mutual stock option agreements for 19.9 percent of the issuer's outstanding common stock. The merger was finalized on July 1, 2007. The company's principal office of business at the One Wall Street office previously held by the Bank of New York. The full name of the company became The Bank of New York Mellon Corp., with the BNY Mellon brand name being used for most lines of business.Post-merger history

In October 2008, the U.S. Treasury named BNY Mellon the master custodian of theTroubled Asset Relief Program

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President ...

(TARP) bailout fund during the financial crisis of 2007 to 2010. BNY Mellon won the assignment, which included handling accounting and record-keeping for the program, through a bidding process. In November 2008, the company announced that it would lay-off 1,800 employees, or 4 percent of its global workforce, due to the financial crisis. According to the results of a February 2009 stress test conducted by federal regulators, BNY Mellon was one of only three banks that could withstand a worsening economic situation. The company received $3 billion from TARP, which it paid back in full in June 2009, along with US$136 million to buy back warrants

Warrant may refer to:

* Warrant (law), a form of specific authorization

** Arrest warrant, authorizing the arrest and detention of an individual

** Search warrant, a court order issued that authorizes law enforcement to conduct a search for eviden ...

from the Treasury in August 2009.

In August 2009, BNY Mellon purchased Insight Investment, a management business for external funds, from Lloyds Banking Group. The company acquired PNC Financial Services' Global Investment Servicing Inc. in July 2010 and Talon Asset Management's wealth management business in 2011.

By 2013, the company's capital had steadily risen from the financial crisis. In the results of the Federal Reserve's Dodd-Frank stress test in 2013, the bank was least affected by hypothetical extreme economic scenarios among banks tested. It was also a top performer on the same test in 2014.

BNY Mellon began a marketing campaign in 2013 to increase awareness of the company that included a new slogan and logo.

In 2013, the bank started building a new IT system called NEXEN

CNOOC Petroleum North America ULC, formerly known as Nexen, is a Canadian oil and gas company based in Calgary, Alberta.

Originally the Canadian subsidiary of US-based Occidental Petroleum (known as Canadian Occidental Petroleum or CanOxy), it ...

. NEXEN uses open source technology and includes components such as an API store, data analytics, and a cloud computing

Cloud computing is the on-demand availability of computer system resources, especially data storage ( cloud storage) and computing power, without direct active management by the user. Large clouds often have functions distributed over mu ...

environment.

In May 2014, BNY Mellon sold its 1 Wall Street headquarters, and in 2015, moved into leased space at Brookfield Place. In June 2014, the company combined its global markets, global collateral services and prime services to create the new Markets Group, also known as BNY Markets Mellon. The company expanded its Hong Kong

Hong Kong ( (US) or (UK); , ), officially the Hong Kong Special Administrative Region of the People's Republic of China (abbr. Hong Kong SAR or HKSAR), is a List of cities in China, city and Special administrative regions of China, special ...

office in October 2014 as part of the company's plans to grow its wealth management business.

Between 2014 and 2016, BNY Mellon opened innovation centers focused on emerging technologies, big data, digital and cloud-based projects, with the first opening in Silicon Valley

Silicon Valley is a region in Northern California that serves as a global center for high technology and innovation. Located in the southern part of the San Francisco Bay Area, it corresponds roughly to the geographical areas San Mateo Cou ...

.

In September 2017, BNY Mellon announced that it agreed to sell CenterSquare Investment Management to its management team and the private equity firm Lovell Minnick Partners. The transaction is subject to standard regulatory approvals and is expected to be completed by the end of 2017.

In January 2018, BNY Mellon announced that it was again moving its headquarters location, less than four years after its prior move. The headquarters location was announced as 240 Greenwich Street, a renaming of the already BNY Mellon-owned 101 Barclay Street office building in Tribeca, New York City

New York, often called New York City or NYC, is the List of United States cities by population, most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the L ...

. BNY Mellon had owned the office building for over 30 years, with control of the location obtained via 99-year ground lease. The same year, the company purchased the location from the city for $352 million.

Historical data

The following graphs represent the net income and assets and liabilities for the years 2000 to 2016 for the Bank of New York Mellon, the Bank of New York Mellon Corporation's New York state-chartered bank and an FDIC-insured depository institution.Operations

BNY Mellon operates in 35 countries in theAmericas

The Americas, which are sometimes collectively called America, are a landmass comprising the totality of North America, North and South America. The Americas make up most of the land in Earth's Western Hemisphere and comprise the New World. ...

, Europe, the Middle East and Africa (EMEA), and Asia-Pacific

Asia-Pacific (APAC) is the part of the world near the western Pacific Ocean. The Asia-Pacific region varies in area depending on context, but it generally includes East Asia, Russian Far East, South Asia, Southeast Asia, Australia and Paci ...

. The company employed 51,300 people as of December 2018. In October 2015, the group's American and global headquarters relocated to 225 Liberty Street

225 Liberty Street, formerly Two World Financial Center, is one of four towers that comprise the Brookfield Place complex in the Financial District of Lower Manhattan in New York City. Rising 44 floors and , it is situated between the Hudson Ri ...

, as the former 1 Wall Street building was sold in 2014. In July 2018, the company changed its headquarters again, this time to its existing 240 Greenwich Street location in New York (previously addressed 101 Barclay St). The group's EMEA headquarters are located in London and its Asia-Pacific headquarters are located in Hong Kong

Hong Kong ( (US) or (UK); , ), officially the Hong Kong Special Administrative Region of the People's Republic of China (abbr. Hong Kong SAR or HKSAR), is a List of cities in China, city and Special administrative regions of China, special ...

.

Business

The bank's primary functions are managing and servicing the investments of institutions andhigh-net-worth individual

High-net-worth individual (HNWI) is a term used by some segments of the financial services industry to designate persons whose investible wealth (assets such as stocks and bonds) exceeds a given amount. Typically, these individuals are defi ...

s. Its two primary businesses are Investment Services and Investment Management. The bank's clients include 80 percent of Fortune 500 companies. The company also serves 77 percent of the top 100 endowments, 87 percent of the top 1,000 pension and employee benefit funds, 51 percent of the top 200 life and health insurance companies and 50 percent of the top 50 universities.

Investment Services

The bank'sInvestment Services

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing is ...

business represents approximately 72 percent of the company's revenue and it has $31.1 trillion under its custody or administration as of September 2016. The financial services offered by the business include asset servicing, alternative investment

An alternative investment, also known as an alternative asset or alternative investment fund (AIF), is an investment in any asset class excluding stocks, bonds, and cash. The term is a relatively loose one and includes tangible assets such as ...

services, broker-dealer services, corporate trust

In the most basic sense of the term, A corporate trust is a trust created by a corporation.

The term in the United States is most often used to describe the business activities of many financial services companies and banks that act in a fiducia ...

services and treasury services. Other offerings include global collateral services, foreign exchange, securities lending, middle and back office outsourcing, and depository receipt

A depositary receipt (DR) is a negotiable financial instrument issued by a bank to represent a foreign company's publicly traded securities. The depositary receipt trades on a local stock exchange. Depositary receipts facilitates buying shares in f ...

s.

The company's subsidiary Pershing LLC

Pershing LLC is an American clearing house. Formed in 1939, Pershing became a subsidiary of The Bank of New York Mellon in 2003. Pershing has nearly $1.9 trillion in assets under administration. The Bank of New York Mellon has more than $35.5 tr ...

handles securities services, including execution, settlement, and clearing. It also provides back office support to financial advisors.

In 2014, the company formed a new Markets Group, which offers collateral management, securities finance, foreign exchange and capital markets. The group is now known as BNY Mellon Markets.

Investment Management

Wealth Management

BNY Mellon'sWealth Management

Wealth management (WM) or wealth management advisory (WMA) is an investment advisory service that provides financial management and wealth advisory services to a wide array of clients ranging from affluent to high-net-worth (HNW) and ultra-high ...

unit handles the private banking, estate planning, family office

A family office is a privately held company that handles investment management and wealth management for a wealthy family, generally one with at least $50-$100 million in investable assets, with the goal being to effectively grow and transfe ...

services, and investment servicing and management of high-net-worth individuals and families. As of 2014, it ranks 7th among wealth management businesses in the United States. Starting in 2013, the unit began expansion efforts, including opening eight new banking offices, increasing salespeople, bankers, and portfolio managers on staff, and launching an awareness campaign for wealth management services through television ads.

Leadership

Charles W. Scharf

Charles "Charlie" W. Scharf (born April 24, 1965) is an American investment banker and business executive who serves as the chief executive officer and president of Wells Fargo. He was previously the CEO of Visa Inc. and BNY Mellon, and has been ...

was appointed CEO in July 2017 and became Chairman after former CEO and Chairman Gerald Hassell

Gerald L. Hassell (born 1952) is an American bank executive and is the former Chairman and CEO of The Bank of New York Mellon.

Career

Gerald Hassell joined the Bank of New York in 1973 when he was only 21 years old as a management trainee, and h ...

retired at the end of 2017. Hassell had been Chairman and CEO since 2011, after serving as BNY Mellon's president from 2007 to 2012 and as the president of the Bank of New York from 1998 until its merger. Scharf stepped down in 2019 to become the new CEO of Wells Fargo. Thomas "Todd" Gibbons served as BNY Mellon's CEO from 2020 to 2022. Robin Vince took over as the new CEO in 2022.

Karen Peetz

Karen Peetz was the president of The Bank of New York Mellon from 2013 to 2016. She had joined the company and 1998, and prior to her appointment as the bank's first female president, had led the bank's financial markets and treasury services tea ...

served as president (the bank's first female president) from 2013 to 2016, when she retired; the company did not appoint a new president when she retired. Thomas Gibbons served as CFO between 2008 and 2017, when he also served as vice chairman. In 2017, Gibbons was replaced as CFO by Michael P. Santomassimo. BNY Mellon's Investment Management business is run by CEO Mitchell Harris, and the company's Investment Services business was led by Brian Shea until his retirement in December 2017.

As of July 2017, the company's board members were Linda Z. Cook, Nicholas M. Donofrio

Nicholas Michael Donofrio (born September 7, 1945) is an American scientist and engineer and was the Executive Vice President of Innovation and Technology at the IBM Corporation until 2008. Upon retirement, he was selected as an honorary IBM Fell ...

, Joseph J. Echevarria, Edward P. Garden, Jeffrey A. Goldstein, Gerald L. Hassell, John M. Hinshaw, Edmund F. (Ted) Kelly, John A. Luke Jr., Jennifer Morgan

Jennifer Morgan (born March 13, 1971) is an American technology executive. She is the former Co-Chief Executive Officer at SAP SE. Morgan became the first American woman ever appointed to the SAP Executive Board in 2017. Morgan is the first fema ...

, Mark A. Nordenberg

Mark A. Nordenberg (born July 12, 1948) is the chancellor emeritus of the University of Pittsburgh and chair of the university's Institute of Politics. A professor of law and university administrator, Nordenberg served as the seventeenth Chancel ...

, Elizabeth E. Robinson, Charles W. Scharf and Samuel C. Scott III.

Company culture

In 2008, BNY Mellon formed a Board of Directors corporate social responsibility committee to set sustainability goals. The company'scorporate social responsibility

Corporate social responsibility (CSR) is a form of international private business self-regulation which aims to contribute to societal goals of a philanthropic, activist, or charitable nature by engaging in or supporting volunteering or ethicall ...

activities include philanthropy, social finance in the communities the bank is located in, and protecting financial markets globally.

The bank's philanthropic activities include financial donations and volunteerism. The company matches employee volunteer hours and donations with financial contributions through its Community Partnership program. Between 2010 and 2012, the company and its employees donated approximately $100 million to charity. In 2014, the company worked with the Forbes

''Forbes'' () is an American business magazine owned by Integrated Whale Media Investments and the Forbes family. Published eight times a year, it features articles on finance, industry, investing, and marketing topics. ''Forbes'' also r ...

Fund to create a platform that connects nonprofit organization

A nonprofit organization (NPO) or non-profit organisation, also known as a non-business entity, not-for-profit organization, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in co ...

s with private businesses to solve social challenges.

The company received a 100 A rating in 2013, 2014 and 2015 by the CDP, which measures corporate greenhouse gas emissions and disclosures. BNY Mellon was named on the Dow Jones Sustainability North America Index in 2013, 2014 and 2015, and the World Index in 2014, 2015 and 2016. Another one of the company's focuses has been building efficiency. As of 2014, the company has saved $48 million due to building efficiency. Five of its buildings have achieved Leadership in Energy and Environmental Design (LEED-EB) certification and 23 have interiors that are LEED certified.

The company has business resource groups for employees that are focused on diversity and inclusion. In 2009, Karen Peetz co-founded the BNY Mellon Women's Initiative Network (WIN), a resource group for female employees' professional development. As of 2013, WIN had 50 chapters. Other groups include PRISM for LGBT

' is an initialism that stands for lesbian, gay, bisexual, and transgender. In use since the 1990s, the initialism, as well as some of its common variants, functions as an umbrella term for sexuality and gender identity.

The LGBT term ...

employees, IMPACT, which serves multicultural employees and HEART for employees with disabilities. The bank has services for returning military, including a tool to help veterans align military skills and training with jobs at the company. In 2014, it was recognized for its diversity practices by the National Business Inclusion Consortium, which named it Financial Services Diversity Corporation of the Year.

In 2009, the company began an innovation program for employees to suggest ideas for large-scale projects and company improvement. Ideas from the initial pilot program generated approximately $165 million in pretax profit. The program results in an annual contest called "ACE" in which teams pitch their ideas.

Controversies and legal issues

Foreign currency exchange issues

In October 2011, the U.S. Justice Department and New York's attorney general filed civil lawsuits against the Bank of New York, alleging foreign currency fraud. The suits held that the bank deceived pension-fund clients by manipulating the prices assigned to them for foreign currency transactions. Allegedly, the bank selected the day's lowest rates for currency sales and highest rates for purchases, appropriating the difference as corporate profit. The scheme was said to have generated $2 billion for the bank, at the expense of millions of Americans' retirement funds, and to have transpired over more than a decade. Purportedly, the bank would offer secret pricing deals to clients who raised concerns, in order to avoid discovery. Bank of New York defended itself vigorously, maintaining the fraud accusations were "flat out wrong" and warning that as the bank employed 8,700 employees in New York, any damage to the bank would have negative repercussions for the state of New York. Finally, in March 2015, the company admitted to facts concerning the misrepresentation of foreign exchange pricing and execution. BNY Mellon's alleged misconduct in this area includes representing pricing as best rates to its clients, when in fact they were providing clients with bad prices while retaining larger margins. In addition to dismissing key executives, the company agreed to pay a total of US$714 million to settle related lawsuits. In May 2015, BNY Mellon agreed to pay $180 million to settle a foreign exchange-related lawsuit. In May 2016, multiple plaintiffs filed suit against the bank, alleging that the company had breached its fiduciary duty to ERISA plans that held American Depositary Receipts by overcharging retirement plans that invested in foreign securities. In March 2017, the presiding judge declined to dismiss the suit. In December 2017, another lawsuit alleged that BNY Mellon manipulated foreign exchange rates was filed by Sheet Metal Workers' National Pension Fund. BNY Mellon agreed to pay $12.5 million to settle the 2016 lawsuit in December 2018.Personal data breach

In February 2008, BNY Mellon suffered a security breach resulting in the loss of personal information when backup tapes containing the personal records of 4.5 million individuals went missing. Social security numbers and bank account information were included in the records. The breach was not reported to the authorities until May 2008, and letters were sent to those affects on May 22, 2008. In August 2008, the number of affected individuals was raised to 12.5 million, 8 million more than originally thought.IT system outages

On Saturday, August 22, 2015, BNY Mellon's SunGard accounting system broke down during a software change. This led to the bank being unable to calculate net asset value (NAV) for 1,200 mutual funds via automated computer system. Between the breakdown and the eventual fix, the bank calculated the values using alternative means, such as manual operation staff. By Wednesday, August 26, the system was still not fully operational. The system was finally operational to regular capacity the following week. As a result of a Massachusetts Securities Division investigation into the company's failure and lack of a backup plan, the company paid $3 million. In December 2016, another major technology issue caused BNY Mellon to be unable to process payments related to the SWIFT network. As of the time of the issue, the bank processed about 160,000 global payments daily totally an average of $1.6 trillion. The company was unable to process payments for a 19 hours, which led to a backlog of payments and an extension of Fedwire payment services.Privately owned public space agreement violation

According to aNew York City Comptroller

The Office of Comptroller of New York City, a position established in 1801, is the chief financial officer and chief auditor of the city agencies and their performance and spending. The comptroller also reviews all city contracts, handles the ...

audit in April 2017, BNY Mellon was in violation of a privately owned public space (POPS) agreement for at least 15 years. In constructing the 101 Barclay Street building in Lower Manhattan, BNY Mellon had received a permit allowing modification of height and setback regulations in exchange for providing a lobby accessible to the general public 24 hours a day. Auditors and members of the public had been unable to access or assess the lobby for many years, and were actively prevented from doing so by BNY Mellon security.

In September 2018, the company began to permit public access to a portion of the lobby. However, BNY Mellon remains in violation of its agreement, as the lobby must be accessible to the public 24 hours a day. As of early 2021 the city Comptroller reported that company security personnel prevented auditors from entering or photographing the lobby and was seeking to have the "public lobby" designation removed.

Employment legal issues

BNY Mellon settled foreign bribery charges with the U.S. Securities and Exchange Commission (SEC) in August 2015 regarding its practice of providing internships to relatives of officials at a Middle Eastern investment fund. The U.S. SEC found the firm in violation of the Foreign Corrupt Practices Act. The case was settled for $14.8 million. In March 2019, BNY Mellon staff considered legal options after the company banned employees from working from home. In particular, staff cited concerns regarding the impact on childcare, mental health, and diversity. The company reverted the ban as a result of employee outcry.Other legal issues

In September 2009, BNY Mellon settled a lawsuit that had been filed against the Bank of New York by the Russian government in May 2007 formoney laundering

Money laundering is the process of concealing the origin of money, obtained from illicit activities such as drug trafficking, corruption, embezzlement or gambling, by converting it into a legitimate source. It is a crime in many jurisdicti ...

; the original suit claimed $22.5 billion in damages and was settled for $14 million.

In 2011, South Carolina

)''Animis opibusque parati'' ( for, , Latin, Prepared in mind and resources, links=no)

, anthem = " Carolina";" South Carolina On My Mind"

, Former = Province of South Carolina

, seat = Columbia

, LargestCity = Charleston

, LargestMetro = ...

sued BNY Mellon for allegedly failing to adhere to the investment guidelines relating to the state's pension fund. The company settled with the state in June 2013 for $34 million.

In July 2012, BNY Mellon settled a class action lawsuit relating to the collapse of Sigma Finance Corp. The suit alleged that the bank invested and lost cash collateral in medium-term notes. The company settled the lawsuit for $280 million.

In December 2018, BNY Mellon agreed to pay nearly $54 million to settle charges of improper handling of "pre-released" American depositary receipts (ADRs) under investigation of the U.S. Securities and Exchange Commission (SEC). BNY Mellon did not admit or deny the investigation findings but agreed to pay disgorgement of more than $29.3 million, $4.2 million in prejudgment interest and a penalty of $20.5 million.

Recognition and rankings

As of 2015, BNY Mellon was the world's largest custody bank, the sixth-largest investment management firm in the world, and the seventh-largest wealth management firm in the United States. In 2018, BNY Mellon ranked 175 on theFortune 500

The ''Fortune'' 500 is an annual list compiled and published by ''Fortune (magazine), Fortune'' magazine that ranks 500 of the largest United States Joint-stock company#Closely held corporations and publicly traded corporations, corporations by ...

and 250 on the Financial Times Global 500 The FT Global 500 is an annual snapshot of the world's largest companies to show how corporate fortunes have changed in the past year, highlighting relative performance of countries and sectors. The companies are ranked by market capitalization. The ...

. It was named one of world's 50 Safest Banks by ''Global Finance

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financ ...

'' in 2013 and 2014, and one of the 20 Most Valuable Banking Brands in 2014 by ''The Banker

''The Banker'' is an English-language monthly international financial affairs publication owned by ''The Financial Times'' Ltd. and edited in London, United Kingdom. The magazine was first published in January 1926 through founding Editor, Bren ...

''.

The bank says it is the longest running bank in the United States, a distinction sometimes disputed by its rivals and some historians. The Bank of North America was chartered in 1781, and was absorbed by a series of other entities until it was acquired by Wells Fargo. Similarly, The Massachusetts Bank went through a series of acquisitions and ended up as part of Bank of America

The Bank of America Corporation (often abbreviated BofA or BoA) is an American multinational investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North Carolina. The bank ...

. The Bank of New York remained independent, absorbing other companies, until its merger with Mellon. BNY Mellon is at least the third-oldest bank in the US.

Sponsorships

Since 2012, BNY Mellon has expanded its number of sponsorships. BNY Mellon was the title sponsor of theOxford

Oxford () is a city in England. It is the county town and only city of Oxfordshire. In 2020, its population was estimated at 151,584. It is north-west of London, south-east of Birmingham and north-east of Bristol. The city is home to the ...

and Cambridge

Cambridge ( ) is a university city and the county town in Cambridgeshire, England. It is located on the River Cam approximately north of London. As of the 2021 United Kingdom census, the population of Cambridge was 145,700. Cambridge bec ...

Boat Race

Boat racing is a sport in which boats, or other types of watercraft, race on water. Boat racing powered by oars is recorded as having occurred in ancient Egypt, and it is likely that people have engaged in races involving boats and other w ...

from 2012 to 2015. The company also sponsors the Head of the Charles Regatta

The Head of the Charles Regatta, also known as HOCR, is a rowing head race held on the penultimate complete weekend of October (i.e., on the Friday that falls between the 16th and the 22nd of the month, and on the Saturday and Sunday immedi ...

in Boston

Boston (), officially the City of Boston, is the state capital and most populous city of the Commonwealth of Massachusetts, as well as the cultural and financial center of the New England region of the United States. It is the 24th- mo ...

. In 2013, the company became a 10-year sponsor of the San Francisco 49ers

The San Francisco 49ers (also written as the San Francisco Forty-Niners) are a professional American football team based in the San Francisco Bay Area. The 49ers compete in the National Football League (NFL) as a member of the league's Nationa ...

and a founding partner of Levi's Stadium

Levi's Stadium is an American football stadium located in Santa Clara, California, just outside San Jose in the San Francisco Bay Area. It has served as the home venue for the National Football League (NFL)'s San Francisco 49ers since 201 ...

. The company is a regular sponsor of the Royal Academy of Arts

The Royal Academy of Arts (RA) is an art institution based in Burlington House on Piccadilly in London. Founded in 1768, it has a unique position as an independent, privately funded institution led by eminent artists and architects. Its pur ...

in London.

See also

* 1 Wall Street *BNY Mellon Center (disambiguation) BNY Mellon Center may refer to:

*BNY Mellon Center at One Boston Place, Boston, Massachusetts

*BNY Mellon Center (Philadelphia), Pennsylvania

*BNY Mellon Center (Pittsburgh), Pennsylvania

*Mellon National Bank Building, Pittsburgh, Pennsylvania

Se ...

* CIBC Mellon

CIBC Mellon was founded in 1996 as a joint venture between the Canadian Imperial Bank of Commerce (hereafter CIBC) and the Mellon Financial Corporation (now The Bank of New York Mellon) (hereafter Mellon) to offer asset servicing to instituti ...

* Eagle Investment Systems

Eagle Investment Systems is an American global provider of financial services technology and a subsidiary of BNY Mellon. Founded in 1989 and based in Wellesley, Massachusetts, Eagle has 15 offices internationally, including offices in Beijing, ...

* Mellon Financial Corporation

Mellon Financial Corporation was an investment firm which was once one of the world's largest money management firms. Based in Pittsburgh, Pennsylvania, it was in the business of institutional and high-net-worth individual asset management, incl ...

* Pershing LLC

Pershing LLC is an American clearing house. Formed in 1939, Pershing became a subsidiary of The Bank of New York Mellon in 2003. Pershing has nearly $1.9 trillion in assets under administration. The Bank of New York Mellon has more than $35.5 tr ...

Notes

References

Books

* *External links

*Pershing LLC., a subsidiary of The Bank of New York Mellon Corporation

* /www.youtube.com/bnym225years 225th Anniversary Commemorative Video

iNautix Technologies, a subsidiary of The Bank of New York Mellon

New York Life Insurance and Trust Company Records

at Baker Library Historical Collections, Harvard Business School. {{DEFAULTSORT:Bank Of New York Mellon Companies listed on the New York Stock Exchange 2007 establishments in New York City Banks based in New York City Systemically important financial institutions Companies based in Manhattan American companies established in 2007 Banks established in 2007 Multinational companies based in New York City Publicly traded companies based in New York City