Tax revolt on:

[Wikipedia]

[Google]

[Amazon]

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of

The earliest and most widespread forms of taxation were the corvée and

The earliest and most widespread forms of taxation were the corvée and  Because taxation is often oppressive, governments have always struggled with

Because taxation is often oppressive, governments have always struggled with

Tax resisters come from a wide range of backgrounds with diverse ideologies and aims. For example,

Tax resisters come from a wide range of backgrounds with diverse ideologies and aims. For example,

Other tax resisters change their lifestyles so that they owe less tax. For instance; to avoid consumption taxes on alcohol, a resister might home-brew beer; to avoid excise taxes on gasoline, a resister might take up

Other tax resisters change their lifestyles so that they owe less tax. For instance; to avoid consumption taxes on alcohol, a resister might home-brew beer; to avoid excise taxes on gasoline, a resister might take up

Not paying phone tax becomes war protest

''San Francisco Chronicle'' 4 December 2005

Climate change and my tax returnConscience Canada

*

Death and Taxes

' - NWTRCC film about war tax resisters and their motivations

History of War Tax Resistance

by Peace Tax Seven (U.S./UK focus)

Resistance to Civil Government

by

Silence and Courage: Income Taxes, War and Mennonites 1940-1993

— tax resistance in the women's suffrage movement

by Lawrence Rosenwald {{Lady Godiva Civil disobedience Community organizing Protest tactics Anarchist theory Libertarian theory Tax noncompliance

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of direct action

Direct action originated as a political activist term for economic and political acts in which the actors use their power (e.g. economic or physical) to directly reach certain goals of interest, in contrast to those actions that appeal to oth ...

and, if in violation of the tax regulations, also a form of civil disobedience

Civil disobedience is the active, professed refusal of a citizen to obey certain laws, demands, orders or commands of a government (or any other authority). By some definitions, civil disobedience has to be nonviolent to be called "civil". H ...

.

Examples of tax resistance campaigns include those advocating home rule

Home rule is government of a colony, dependent country, or region by its own citizens. It is thus the power of a part (administrative division) of a state or an external dependent country to exercise such of the state's powers of governance wi ...

, such as the Salt March led by Mahatma Gandhi

Mohandas Karamchand Gandhi (; ; 2 October 1869 – 30 January 1948), popularly known as Mahatma Gandhi, was an Indian lawyer, anti-colonial nationalist Quote: "... marks Gandhi as a hybrid cosmopolitan figure who transformed ... anti- ...

, and those promoting women's suffrage

Women's suffrage is the right of women to vote in elections. Beginning in the start of the 18th century, some people sought to change voting laws to allow women to vote. Liberal political parties would go on to grant women the right to vot ...

, such as the Women's Tax Resistance League

The Women's Tax Resistance League (WTRL) was from 1909 to 1918 a direct action group associated with the Women's Freedom League that used tax resistance to protest against the disenfranchisement of women during the British women's suffrage move ...

. War tax resistance is the refusal to pay some or all taxes that pay for war, and may be practiced by conscientious objector

A conscientious objector (often shortened to conchie) is an "individual who has claimed the right to refuse to perform military service" on the grounds of freedom of thought, conscience, or religion. The term has also been extended to objec ...

s, pacifists

Pacifism is the opposition or resistance to war, militarism (including conscription and mandatory military service) or violence. Pacifists generally reject theories of Just War. The word ''pacifism'' was coined by the French peace campaigne ...

, or those protesting against a particular war.

Tax resisters are distinct from "tax protesters

A tax protester is someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. Tax protesters are different from tax resisters, who refuse to pay taxes as a protest against a government or its policies ...

", who deny that the legal obligation to pay taxes exists or applies to them. Tax resisters may accept that some law commands them to pay taxes but they still choose to resist taxation.

History

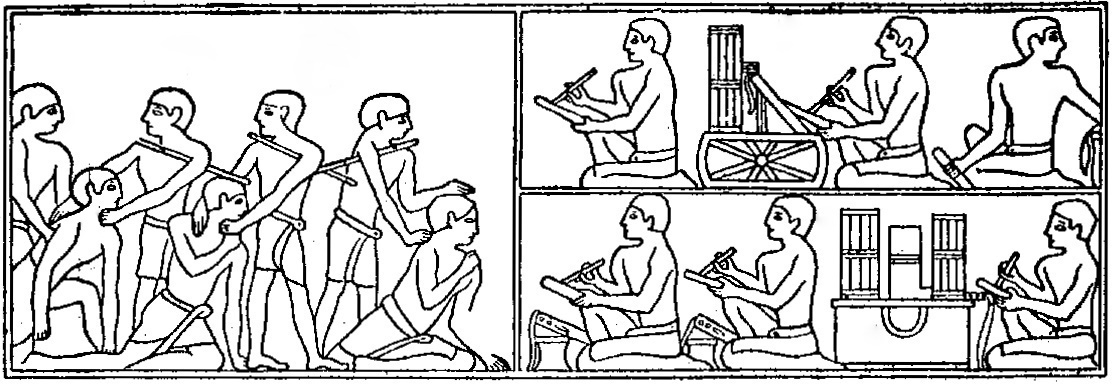

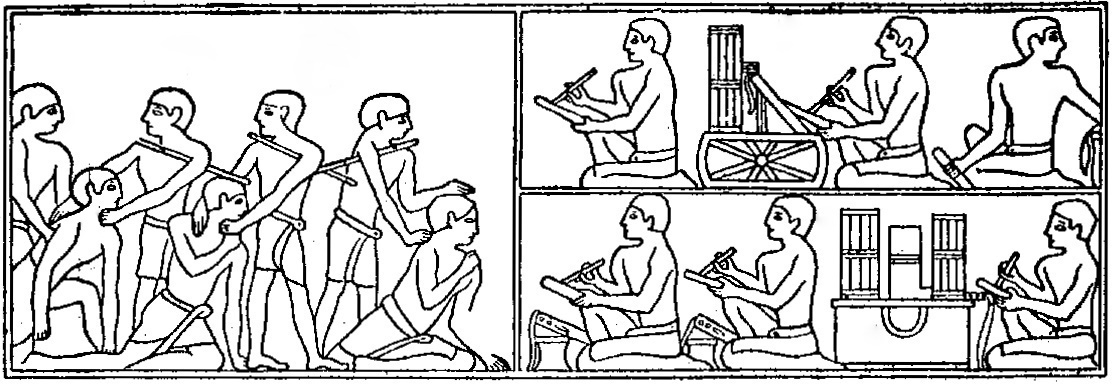

The earliest and most widespread forms of taxation were the corvée and

The earliest and most widespread forms of taxation were the corvée and tithe

A tithe (; from Old English: ''teogoþa'' "tenth") is a one-tenth part of something, paid as a contribution to a religious organization or compulsory tax to government. Today, tithes are normally voluntary and paid in cash or cheques or more ...

, both of which can be traced back to the beginning of civilization

A civilization (or civilisation) is any complex society characterized by the development of a state, social stratification, urbanization, and symbolic systems of communication beyond natural spoken language (namely, a writing system).

...

. The corvée was state-imposed forced labour

Forced labour, or unfree labour, is any work relation, especially in modern or early modern history, in which people are employed against their will with the threat of destitution, detention, violence including death, or other forms of ex ...

on peasant

A peasant is a pre-industrial agricultural laborer or a farmer with limited land-ownership, especially one living in the Middle Ages under feudalism and paying rent, tax, fees, or services to a landlord. In Europe, three classes of peasa ...

s too poor to pay other forms of taxation (''labour'' in ancient Egyptian is a synonym for taxes). Low taxes helped the Roman aristocracy increase their wealth, which equalled or exceeded the revenues of the central government. An emperor sometimes replenished his treasury by confiscating the estates of the "super-rich", but in the later period, the resistance of the wealthy to paying taxes was one of the factors contributing to the collapse of the Empire. Morris, p. 184.

Because taxation is often oppressive, governments have always struggled with

Because taxation is often oppressive, governments have always struggled with tax noncompliance

Tax noncompliance (informally tax avoision) is a range of activities that are unfavorable to a government's tax system. This may include tax avoidance, which is tax reduction by legal means, and tax evasion which is the criminal non-payment of ...

and resistance. It has been suggested that tax resistance played a significant role in the collapse of several empire

An empire is a "political unit" made up of several territories and peoples, "usually created by conquest, and divided between a dominant center and subordinate peripheries". The center of the empire (sometimes referred to as the metropole) ex ...

s, including the Egyptian, Roman

Roman or Romans most often refers to:

* Rome, the capital city of Italy

* Ancient Rome, Roman civilization from 8th century BC to 5th century AD

*Roman people, the people of ancient Rome

*''Epistle to the Romans'', shortened to ''Romans'', a lett ...

, Spanish, and Aztec

The Aztecs () were a Mesoamerican culture that flourished in central Mexico in the post-classic period from 1300 to 1521. The Aztec people included different ethnic groups of central Mexico, particularly those groups who spoke the Nahuatl ...

.

Reports of collective tax refusal include Zealots resisting the Roman poll tax

A poll tax, also known as head tax or capitation, is a tax levied as a fixed sum on every liable individual (typically every adult), without reference to income or resources.

Head taxes were important sources of revenue for many governments f ...

during the 1st century AD, culminating in the First Jewish–Roman War

The First Jewish–Roman War (66–73 CE), sometimes called the Great Jewish Revolt ( he, המרד הגדול '), or The Jewish War, was the first of three major rebellions by the Jews against the Roman Empire, fought in Roman-controlled ...

. Other historic events that originated as tax revolts include Magna Carta

(Medieval Latin for "Great Charter of Freedoms"), commonly called (also ''Magna Charta''; "Great Charter"), is a royal charter of rights agreed to by King John of England at Runnymede, near Windsor, on 15 June 1215. First drafted by t ...

, the American Revolution

The American Revolution was an ideological and political revolution that occurred in British America between 1765 and 1791. The Americans in the Thirteen Colonies formed independent states that defeated the British in the American Revoluti ...

and the French Revolution

The French Revolution ( ) was a period of radical political and societal change in France that began with the Estates General of 1789 and ended with the formation of the French Consulate in November 1799. Many of its ideas are conside ...

.

War tax resisters often highlight the relationship between income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Ta ...

and war. In Britain income tax was introduced in 1799, to pay for weapons and equipment in preparation for the Napoleonic wars

The Napoleonic Wars (1803–1815) were a series of major global conflicts pitting the French Empire and its allies, led by Napoleon I, against a fluctuating array of European states formed into various coalitions. It produced a period of Fre ...

, whilst the US federal government

The federal government of the United States (U.S. federal government or U.S. government) is the national government of the United States, a federal republic located primarily in North America, composed of 50 states, a city within a f ...

imposed their first income tax in the Revenue Act of 1861 to help pay for the American Civil War

The American Civil War (April 12, 1861 – May 26, 1865; also known by Names of the American Civil War, other names) was a civil war in the United States. It was fought between the Union (American Civil War), Union ("the North") and t ...

.

Views and aims

Tax resisters come from a wide range of backgrounds with diverse ideologies and aims. For example,

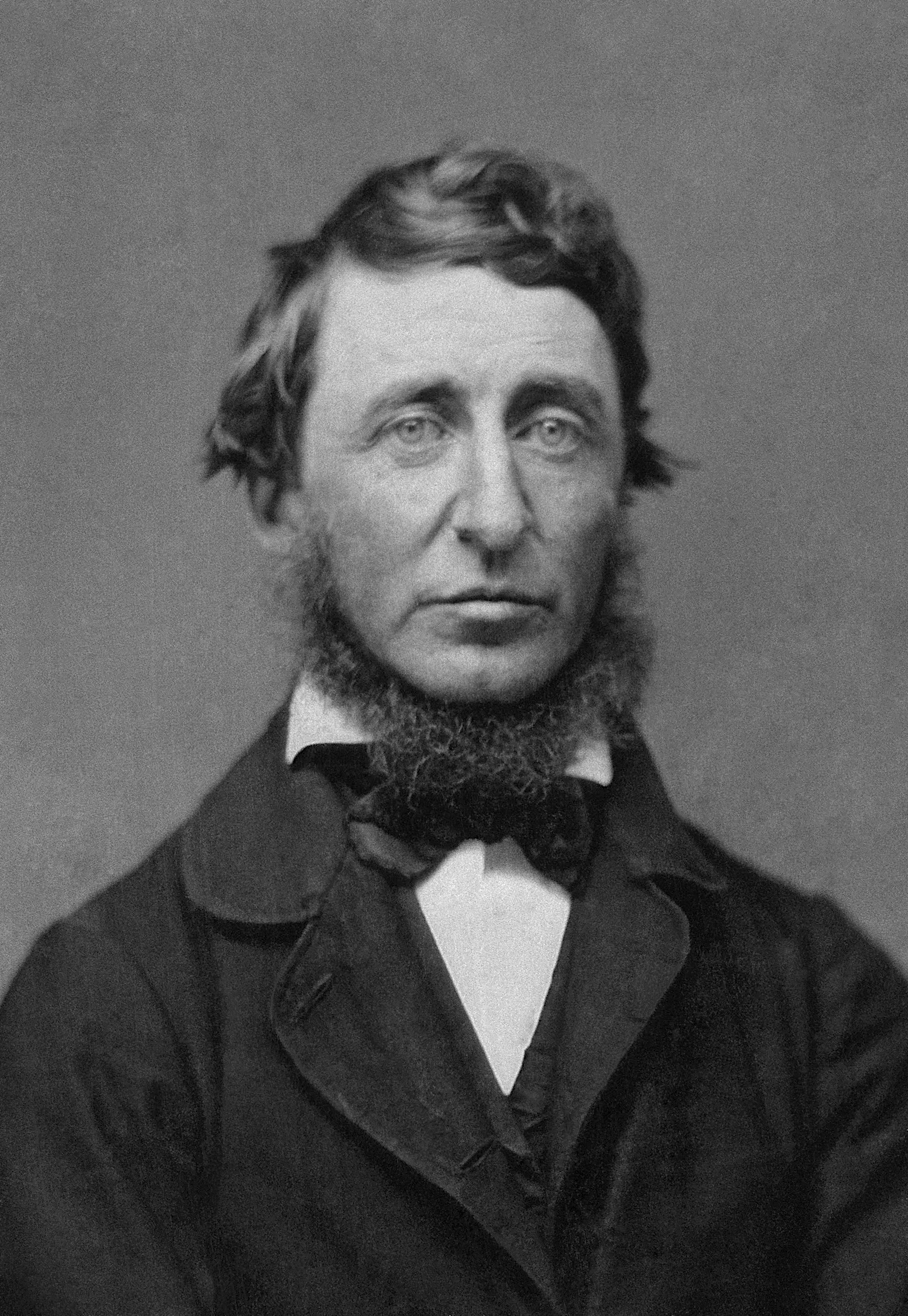

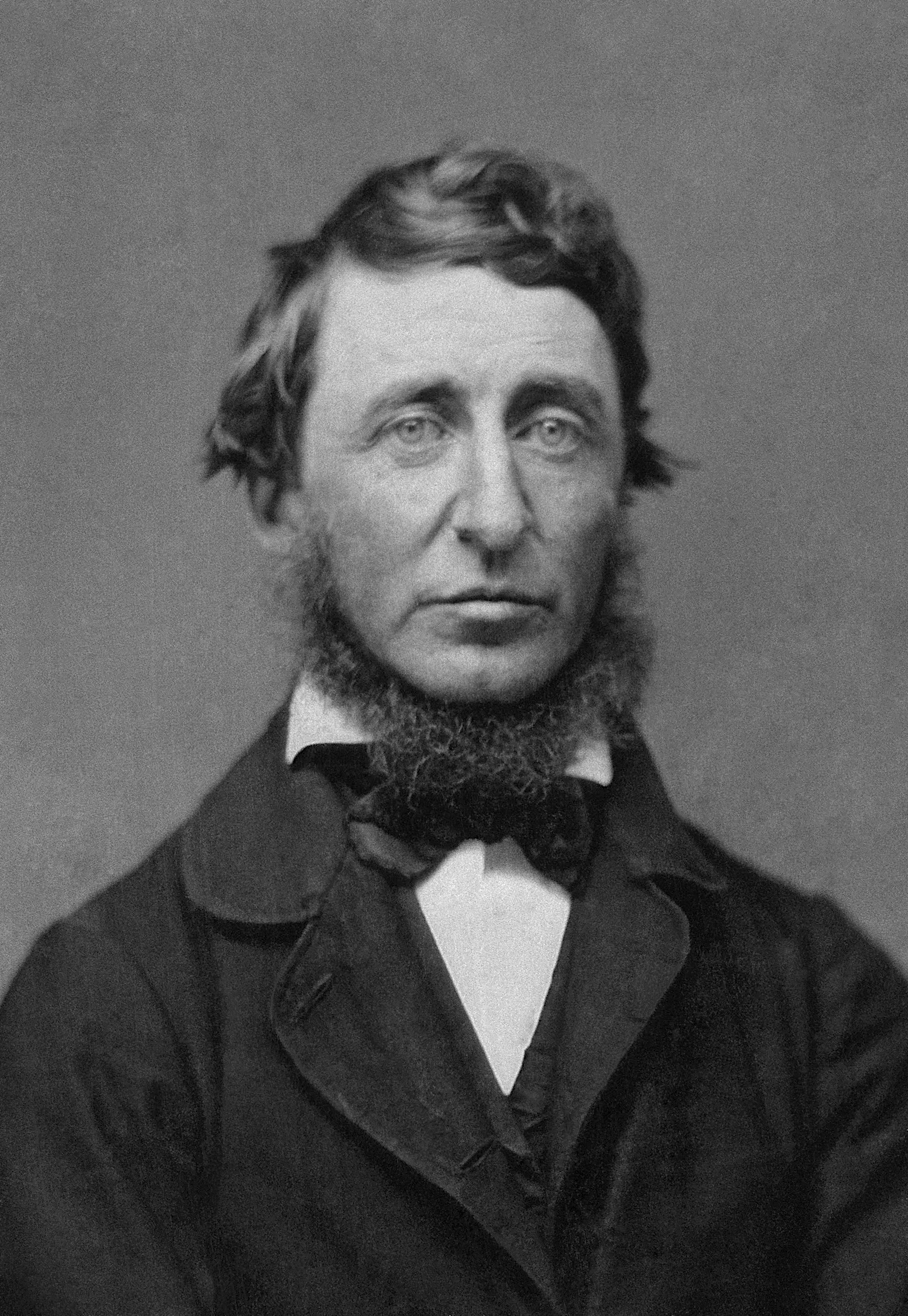

Tax resisters come from a wide range of backgrounds with diverse ideologies and aims. For example, Henry David Thoreau

Henry David Thoreau (July 12, 1817May 6, 1862) was an American naturalist, essayist, poet, and philosopher. A leading transcendentalist, he is best known for his book ''Walden'', a reflection upon simple living in natural surroundings, and h ...

and William Lloyd Garrison

William Lloyd Garrison (December , 1805 – May 24, 1879) was a prominent American Christian, abolitionist, journalist, suffragist, and social reformer. He is best known for his widely read antislavery newspaper '' The Liberator'', which he fo ...

drew inspiration from the American Revolution and the stubborn pacifism of the Quakers

Quakers are people who belong to a historically Protestant Christian set of denominations known formally as the Religious Society of Friends. Members of these movements ("theFriends") are generally united by a belief in each human's abili ...

. Some tax resisters refuse to pay tax because their conscience will not allow them to fund war, whilst others resist tax as part of a campaign to overthrow the government.

Tax resisters have been violent revolutionaries like John Adams

John Adams (October 30, 1735 – July 4, 1826) was an American statesman, attorney, diplomat, writer, and Founding Fathers of the United States, Founding Father who served as the second president of the United States from 1797 to 1801. Befor ...

and pacifist nonresistants like John Woolman; communists like Karl Marx

Karl Heinrich Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, economist, historian, sociologist, political theorist, journalist, critic of political economy, and socialist revolutionary. His best-known titles are the 1848 ...

and capitalists like Vivien Kellems

Vivien Kellems (June 7, 1896 – January 25, 1975) was an American industrialist, inventor, public speaker, and political candidate who became known for her battle with the Federal government of the United States over withholding unde26 U.S.C ...

; solitary anti-war

An anti-war movement (also ''antiwar'') is a social movement, usually in opposition to a particular nation's decision to start or carry on an armed conflict, unconditional of a maybe-existing just cause. The term anti-war can also refer to p ...

activists like Ammon Hennacy and leaders of independence movements like Mahatma Gandhi.

Leo Tolstoy

Count Lev Nikolayevich TolstoyTolstoy pronounced his first name as , which corresponds to the romanization ''Lyov''. () (; russian: link=no, Лев Николаевич Толстой,In Tolstoy's day, his name was written as in pre-refor ...

, a Christian anarchist

Christian anarchism is a Christian movement in political theology that claims anarchism is inherent in Christianity and the Gospels. It is grounded in the belief that there is only one source of authority to which Christians are ultimately ans ...

, urged government leaders to change their attitude to war and citizens to taxes:

Methods

As an example of the numerous tax resistance methods, below are some of the legal and illegal techniques used by war tax resisters:Legal

Avoidance

A resister may lower their tax payments by using legaltax avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdi ...

techniques.

Paying under protest

Some taxpayers pay their taxes, but include protest letters along with their tax forms. Others pay in a protesting form—for instance, by writing their cheque on a toilet seat or a mock-up of a missile. Others pay in a way that creates inconvenience for the collector—for instance, by paying the entire amount in low-denomination coins. This last method is less effective in countries where small coins arelegal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in ...

only in limited amounts, allowing the tax authority legally to reject such payments; for example in England and Wales, 1p coins are legal tender only in amounts up to 20p.

Reducing taxable income and consumption

Other tax resisters change their lifestyles so that they owe less tax. For instance; to avoid consumption taxes on alcohol, a resister might home-brew beer; to avoid excise taxes on gasoline, a resister might take up

Other tax resisters change their lifestyles so that they owe less tax. For instance; to avoid consumption taxes on alcohol, a resister might home-brew beer; to avoid excise taxes on gasoline, a resister might take up cycling

Cycling, also, when on a two-wheeled bicycle, called bicycling or biking, is the use of cycles for transport, recreation, exercise or sport. People engaged in cycling are referred to as "cyclists", "bicyclists", or "bikers". Apart from ...

; to avoid income tax, a resister may reduce their income below the tax threshold by embracing simple living or a freegan

Freeganism is an ideology of limited participation in the conventional economy and minimal consumption of resources, particularly through recovering wasted goods like food. The word "freegan" is a portmanteau of "free" and "vegan". While vegans ...

lifestyle. For example, British citizens pay no income tax if their income is below the personal allowance

In the UK tax system, personal allowance is the threshold above which income tax is levied on an individual's income. A person who receives less than their own personal allowance in taxable income (such as earnings and some benefits) in a give ...

. In the US the equivalent tax-free annual income is the standard deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deduc ...

, though many deductions and credits allow people to earn much more than this and still avoid income tax.

Opposition to war has led some, such as Ammon Hennacy and Ellen Thomas, to a form of tax resistance in which they reduce their income below the tax threshold by taking up a simple living

Simple living refers to practices that promote simplicity in one's lifestyle. Common practices of simple living include reducing the number of possessions one owns, depending less on technology and services, and spending less money. Not only is ...

lifestyle. These individuals believe that their government is engaged in immoral, unethical or destructive activities such as war, and that paying taxes inevitably funds these activities.

These methods differ from tax evasion

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the tax ...

in that they stay within the tax laws, and they differ from tax avoidance in that the goal is to pay as little tax as possible rather than to keep as much post-tax income as possible.

Illegal

Evasion

A resister may decide to reduce their tax paid through illegal tax evasion. For instance, one way to evade income tax is to only work for cash-in-hand, therefore circumventingwithholding tax

Tax withholding, also known as tax retention, Pay-as-You-Go, Pay-as-You-Earn, Tax deduction at source or a ''Prélèvement à la source'', is income tax paid to the government by the payer of the income rather than by the recipient of the incom ...

.

Redirection

Some tax resisters refuse to pay all or a portion of the taxes due, but then make an equivalent donation to charity. In this way, they demonstrate that the intent of their resistance is not selfish and that they want to use a portion of their earnings to contribute to the common good. For instance, Julia Butterfly Hill resisted about $150,000 in federal taxes, and donated that money to after school programs, arts and cultural programs, community gardens, programs for Native Americans, alternatives to incarceration, and environmental protection programs. She said:I actually take the money that theIRS The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax ...says goes to them and I give it to the places where our taxes ''should'' be going. And in my letter to the IRS I said: "I'm not refusing to pay my taxes. I'm actually paying them but I'm paying them where they belong because you refuse to do so."

Refusing specific taxes

Some resisters refuse to willingly pay only certain taxes, either because those taxes are especially noxious to them, or because they present a useful symbolic target, or because they are more easily resisted. For instance, in theUnited States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country Continental United States, primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., ...

, many tax resisters resist the telephone federal excise tax. The tax was initiated to pay for the Spanish–American War

, partof = the Philippine Revolution, the decolonization of the Americas, and the Cuban War of Independence

, image = Collage infobox for Spanish-American War.jpg

, image_size = 300px

, caption = (clock ...

and has frequently been raised or extended by the government during times of war. This made it an attractive symbolic target as a "war tax

A war tax stamp is a type of postage stamp added to an envelope in addition to regular postage. It is similar to a postal tax stamp, but the revenue is used to defray the costs of a war; as with other postal taxes, its use is obligatory for ...

". Such refusal is relatively safe: because this tax is typically small, resistance very rarely triggers significant government retaliation. Phone companies will cooperate with such resisters by removing the excise tax from their phone bills and reporting their resistance to the government.''San Francisco Chronicle'' 4 December 2005

Refusing to pay

The most dramatic and characteristic method of tax resistance is to refuse to pay a tax – either by quietly ignoring the tax bill or by openly declaring the refusal to pay. Some tax resisters resist only a portion of the taxes due. For instance, some war tax resisters refuse to pay a percentage of their taxes equivalent to the military percentage of the government's budget.See also

*Draft resistance

Draft evasion is any successful attempt to elude a government-imposed obligation to serve in the military forces of one's nation. Sometimes draft evasion involves refusing to comply with the military draft laws of one's nation. Illegal draft ev ...

* Tax choice

In public choice theory, tax choice (sometimes called taxpayer sovereignty, earmarking, or fiscal subsidiarity) is the belief that individual taxpayers should have direct control over how their taxes are spent. Its proponents apply the theory of ...

* Taxation as theft

References

Further reading

* War Resisters League (2003) ''War Tax Resistance: A Guide To Withholding Your Support from the Military''. * Donald D. Kaufman (2006) ''What Belongs to Caesar?: A Discussion on the Christian's Response to Payment of War Taxes''. * Donald D. Kaufman (2006) ''The Tax Dilemma: Praying for Peace, Paying for War''. * David M. Gross (2008) ''We Won't Pay: A Tax Resistance Reader''. * David M. Gross (2009) ''Against War and War Taxes: Quaker Arguments for War Tax Refusal''. * Marian Franz (2009) ''Persistent Voice: Marian Franz and Conscientious Objection to Military Taxation''. * David M. Gross (2011) ''American Quaker War Tax Resistance''. *External links

Climate change and my tax return

*

Death and Taxes

' - NWTRCC film about war tax resisters and their motivations

History of War Tax Resistance

by Peace Tax Seven (U.S./UK focus)

Resistance to Civil Government

by

Henry David Thoreau

Henry David Thoreau (July 12, 1817May 6, 1862) was an American naturalist, essayist, poet, and philosopher. A leading transcendentalist, he is best known for his book ''Walden'', a reflection upon simple living in natural surroundings, and h ...

Silence and Courage: Income Taxes, War and Mennonites 1940-1993

— tax resistance in the women's suffrage movement

by Lawrence Rosenwald {{Lady Godiva Civil disobedience Community organizing Protest tactics Anarchist theory Libertarian theory Tax noncompliance