Target date fund on:

[Wikipedia]

[Google]

[Amazon]

A target date fund (TDF), also known as a lifecycle fund, dynamic-risk fund, or age-based fund, is a

The main Target Date Benchmarks in the US are:

S&P Target Date Indices

Dow Jones Target Date Indices

Morningstar Lifetime Allocation Indexes

Major TDF managers in the United States include Fidelity, Vanguard, T. Rowe Price, BlackRock (which manages the "Lifecycle Funds" – the target-date funds within the US Government

The main Target Date Benchmarks in the US are:

S&P Target Date Indices

Dow Jones Target Date Indices

Morningstar Lifetime Allocation Indexes

Major TDF managers in the United States include Fidelity, Vanguard, T. Rowe Price, BlackRock (which manages the "Lifecycle Funds" – the target-date funds within the US Government

SEC Proposes New Measures to Help Investors in Target Date Funds

/ref>

collective investment scheme

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such as reducing the risks of the investment by a significant percentage. These advantages inc ...

, often a mutual fund

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICA ...

or a collective trust fund, designed to provide a simple investment solution through a portfolio whose asset allocation

Asset allocation is the implementation of an investment strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according to the investor's risk tolerance, goals and investment t ...

mix becomes more conservative as the target date (usually retirement) approaches.

History

Target-date funds were invented by Donald Luskin and Larry Tint of Wells Fargo Investment Advisors (later Barclays Global Investors), and first introduced in the early 1990s by BGI. Their popularity in the US increased significantly in recent years due in part to the auto-enrollment legislationPension Protection Act of 2006

The Pension Protection Act of 2006 (), 120 Stat. 780, was signed into law by U.S. President George W. Bush on August 17, 2006.

Pension reform

This legislation requires companies who have underfunded their pension plans to pay higher premiums to ...

that created the need for safe-harbor type Qualifying Default Investment Alternatives, such as target-date funds, for 401(k)

In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodical employee contributions come directly out of the ...

savings plans. With the UK enacting auto-enrollment legislation in 2012, target-date funds are used by the National Employment Savings Trust

The National Employment Savings Trust (Nest) is a defined contribution workplace pension scheme in the United Kingdom. It was set up to facilitate automatic enrolment as part of the government's workplace pension reforms under the Pensions Act 2 ...

(NEST), and are expected to become increasingly popular as their design should satisfy the DWP's eligible default fund criteria.

A similar approach, called age-based asset allocation, was proposed by Mark Kantrowitz in the mid-1990s and was rapidly adopted by all 529 college savings plans.

Design

Target-date funds are aimed at people planning for retirement and have appeal because they offer a lifelong managed investment strategy that should remain appropriate to an investor's risk profile even if left unreviewed. Research suggests that age is by far the most important determinant in setting an investment strategy, thus Target Date, or age-based funds are particularly attractive as default investment funds. They do not offer a guaranteed return but offer a convenient multi-asset retirement savings strategy through a single outcome-oriented fund. Target-date funds' asset allocation mix typically provides exposure to return-seeking assets, such asequities

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company ...

, in early years when risk capacity is higher, and becomes increasingly conservative as time progresses with exposure switched progressively towards capital-preservation assets, such as government- and index-linked bonds.

The speed with which a target date fund de-risks its asset allocation is known in the industry as the "glide-path", using the analogy of an airplane (the fund, presumably) coming in for a landing (the landing being, presumably, arriving at the Target Date with the appropriately low-risk mix of underlying assets).

By taking a managed, or stochastic, approach to de-risking the fund, target-date funds offer a higher level of both technical and fiduciary care than earlier lifestyling techniques that rely on an automated, or deterministic, approach.

The theoretical underpinnings to glidepath design are based on combining modern portfolio theory, with the theory of "Human Capital", the present value

In economics and finance, present value (PV), also known as present discounted value, is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money has inte ...

of expected future earnings.

The Glidepath

The strategic asset allocation model over time is known as the '' glidepath '' illustrating how an investment strategy becomes increasingly conservative over time towards the target date. An example of a glidepath for a selection of savings strategies for the UK market is shown in the above graphic. Generally, each fund's managements provide different glidepaths depending upon the end requirement of each client (a lump sum for withdrawal or an income producing portfolio for income drawdown), in terms of different target dates.Nudge and behavioral economics

Target Date Funds are commonly used as default funds as they make it easier for savers to select a savings strategy. This reduces the risk of inferior outcomes that behavioral tendencies might create. According to 2016 research study of retirement plan participants, 74% of respondents would like to see more socially responsible investments in their retirement plan offerings and most (78%) believe it is important to make the world a better place while growing their personal assets. A 2016 Survey of Defined Contribution Plan Participants found that 71% of millennial-age investors would be "more willing to contribute to their retirement plan if they knew their investments were doing social good". The survey also finds 84% of millennials want their "investments to reflect their personal values" and 77% want more socially responsible investments in their retirement planning.TDFs in the United States

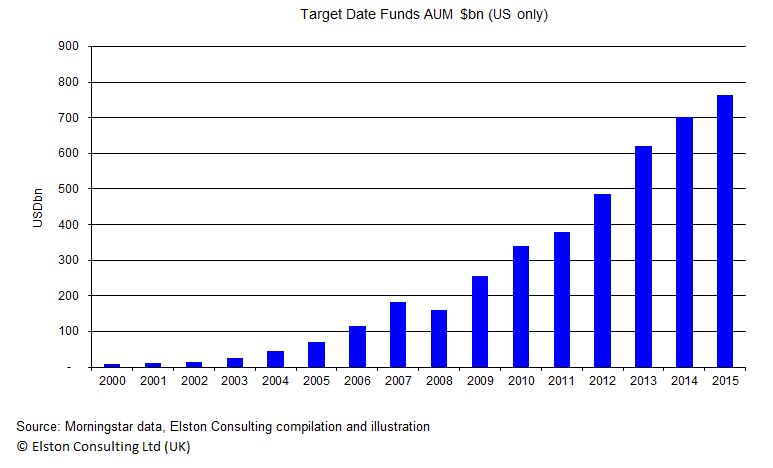

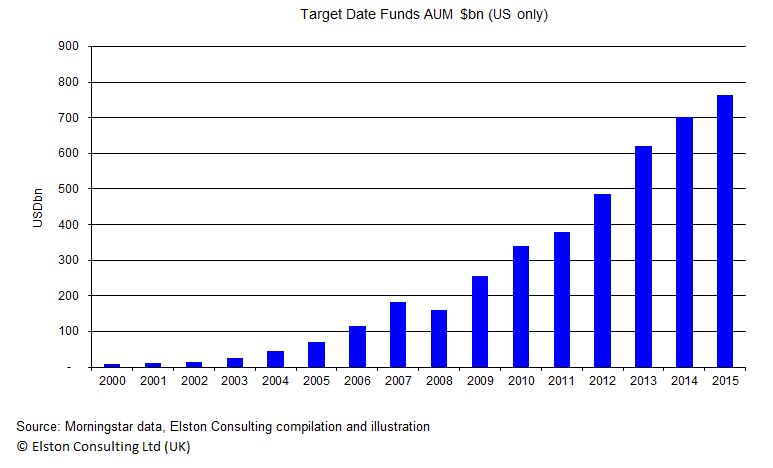

In the US, the use of Target Date Funds accelerated from 2006 onwards with the introduction of automatic-enrollment pensions legislation, where the convenience of a single 'fund for life' made them the most popular type of default strategy. Since that, time TDF assets under management have grown more than 10x reaching $763 billion at end 2015. As of March 2020, assets in target-date mutual funds and collective investment trusts (CITs) totaled approximately $1.9 trillion. At the end of 2020, target-date assets in CITs reached $1.18 trillion according to data from Morningstar. Target-date mutual funds held $1.57 trillion. The main Target Date Benchmarks in the US are:

S&P Target Date Indices

Dow Jones Target Date Indices

Morningstar Lifetime Allocation Indexes

Major TDF managers in the United States include Fidelity, Vanguard, T. Rowe Price, BlackRock (which manages the "Lifecycle Funds" – the target-date funds within the US Government

The main Target Date Benchmarks in the US are:

S&P Target Date Indices

Dow Jones Target Date Indices

Morningstar Lifetime Allocation Indexes

Major TDF managers in the United States include Fidelity, Vanguard, T. Rowe Price, BlackRock (which manages the "Lifecycle Funds" – the target-date funds within the US Government Thrift Savings Plan

The Thrift Savings Plan (TSP) is a defined contribution plan for United States civil service employees and retirees as well as for members of the uniformed services. As of December 31, 2020, TSP has approximately 6.2million participants (of wh ...

), Principal Funds, Wells Fargo Advantage, American Century, and Northern Trust.

Note that the actual sizes of the books of different managers are difficult to estimate, as many hold assets in vehicles other than mutual funds. Northern Trust, for example, uses Collective Trust Funds (CTFs), which typically do not figure in Morningstar or Bloomberg estimates of AUM.

TDFs in the United Kingdom

In the UK, the use of Target Date Funds is gaining traction, with the first launch in 2003, and current AUM estimated to be approximately £4.0bn. This is expected to increase with the advent of automatic enrolment pensions legislation. Major TDF managers in the UK include: Retail: Architas BirthStar (managed by AllianceBernstein), Fidelity Institutional: AllianceBernstein, BirthStar, BlackRock, Fidelity, JPMorgan, NEST, State Street Global Advisers According to independent research, TDFs are expected to grow from a low base to 17% of all UK Defined Contribution (DC) default assets by 2023. Multi-employer pensions schemes (also known as 'master trusts') are amongst the early adopters of Target Date Funds in the UK market. BlackRock Master Trust: BlackRock Lifepath Target Date Funds Carey Workplace Pension Trust: BirthStar Target Date Funds Intelligent Money: IM Optimum Portfolios Intelligent Money provides Target Date Portfolios (rather than Funds). Lighthouse Pensions Trust: BirthStar Target Date Funds Target Date Benchmarks in the UK are: FTSE UK DC BenchmarksControversy

The funds are not without their critics, who point to the unexpected volatility of some near-dated target-date funds in thefinancial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of ...

, suggesting they were not as conservatively positioned as their name would imply. While this is expected in the earlier phases of capital accumulation, it was unexpected at the money-market and bond stage of near-dated funds. In response to this, the SEC and DoL hosted a joint hearing on Examining Target Date Funds in June 2009, which found that while target-date funds were generally a welcome innovation, disclosure had to be improved to ensure investors were fully aware of a target-date fund glidepath, which may differ from manager to manager. The rules on disclosures for target-date funds were published by the SEC in 2010./ref>

See also

*Defined contribution plan

A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. Individual accounts are set up for participants and benefits are based on the amounts credited to these a ...

*401(k)

In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodical employee contributions come directly out of the ...

*529 plan

5 (five) is a number, numeral and digit. It is the natural number, and cardinal number, following 4 and preceding 6, and is a prime number. It has attained significance throughout history in part because typical humans have five digits on eac ...

* Nudge theory

*Behavioral economics

Behavioral economics studies the effects of psychological, cognitive, emotional, cultural and social factors on the decisions of individuals or institutions, such as how those decisions vary from those implied by classical economic theory. ...

*Exchange-traded fund

An exchange-traded fund (ETF) is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold from other owners throughout th ...

* Stock fund

*Bond fund

A bond fund or debt fund is a fund that invests in bonds, or other debt securities. Bond funds can be contrasted with stock funds and money funds. Bond funds typically pay periodic dividends that include interest payments on the fund's underlyi ...

* Money fund

*Income fund

An income fund is a fund whose goal is to provide an income from investments. It is usually organized through a trust or partnership, rather than a corporation, to obtain more efficient flow through tax consequences in relation to the income it e ...

* Lifestyling

References

{{DEFAULTSORT:Target Date Fund Investment funds