Predicting the timing of peak oil on:

[Wikipedia]

[Google]

[Amazon]

Peak oil is the point at which oil production, sometimes including unconventional oil sources, hits its maximum. Predicting the timing of peak oil involves estimation of future production from existing oil fields as well as future discoveries. The most influential production model is Hubbert peak theory, first proposed in the 1950s. The effect of peak oil on the world economy remains controversial.

Peak oil is the point at which oil production, sometimes including unconventional oil sources, hits its maximum. Predicting the timing of peak oil involves estimation of future production from existing oil fields as well as future discoveries. The most influential production model is Hubbert peak theory, first proposed in the 1950s. The effect of peak oil on the world economy remains controversial.

The idea that human use of petroleum faces sustainability limits attracted practical concern at least as early as the 1880s, as did the related idea that the timing of those limits depends on the extraction technology. The concept of exhausting a natural resource to a point of diminishing returns had some antecedent examples. During the same decades when the modern petroleum industry was launching, the New England whale oil industry whaling in the United States, had just experienced a peak and was grappling with decline.

Economist and oil analyst Daniel Yergin notes that the first predictions of imminent oil peaks go back to the 1880s, when some American experts believed that exhaustion of the Pennsylvania oil fields would kill the US oil industry. Another wave of peak predictions occurred after World War I.Daniel Yergin

The idea that human use of petroleum faces sustainability limits attracted practical concern at least as early as the 1880s, as did the related idea that the timing of those limits depends on the extraction technology. The concept of exhausting a natural resource to a point of diminishing returns had some antecedent examples. During the same decades when the modern petroleum industry was launching, the New England whale oil industry whaling in the United States, had just experienced a peak and was grappling with decline.

Economist and oil analyst Daniel Yergin notes that the first predictions of imminent oil peaks go back to the 1880s, when some American experts believed that exhaustion of the Pennsylvania oil fields would kill the US oil industry. Another wave of peak predictions occurred after World War I.Daniel Yergin

“There will be oil,”

Wall Street Journal, 17 Sept. 2011. :"... the peak of production will soon be passed, possibly within 3 years. ... There are many well-informed geologists and engineers who believe that the peak in the production of natural petroleum in this country will be reached by 1921 and who present impressive evidence that it may come even before 1920." ::- David White, chief geologist, United States Geological Survey (1919) :“The average middle-aged man of today will live to see the virtual exhaustion of the world’s supply of oil from wells,” ::- Victor C. Anderson, president of the Colorado School of Mines (1921) A correspondent named W.D. Hornaday, quoting oil industry executive Joseph S. Cullinan, J.S. Cullinan, described the concerns in a 1918 article for ''Tractor and Gas Engine Review'' titled "Petroleum consumption enormous." The article said, "There has been considerable discussion of late as to the possible length of time that the petroleum supply of the United States and the world will hold out." The article quoted Cullinan as saying, "It is just possible, so far as the United States is concerned, that the development and the exhaustion of the supplies may occur within the course of one human life. It is certain that unless radical changes from present methods are applied promptly, all sources of supply within the range of known drilling methods will be exhausted during the life of your children and mine." It turned out that radical changes from 1910s drilling methods were, in fact, applied promptly, and thus, the predicted timeframe was premature; but the underlying concerns (that the vastness of consumption would lead to shortages soon enough to worry about, regardless of the exact decade) did not disappear.

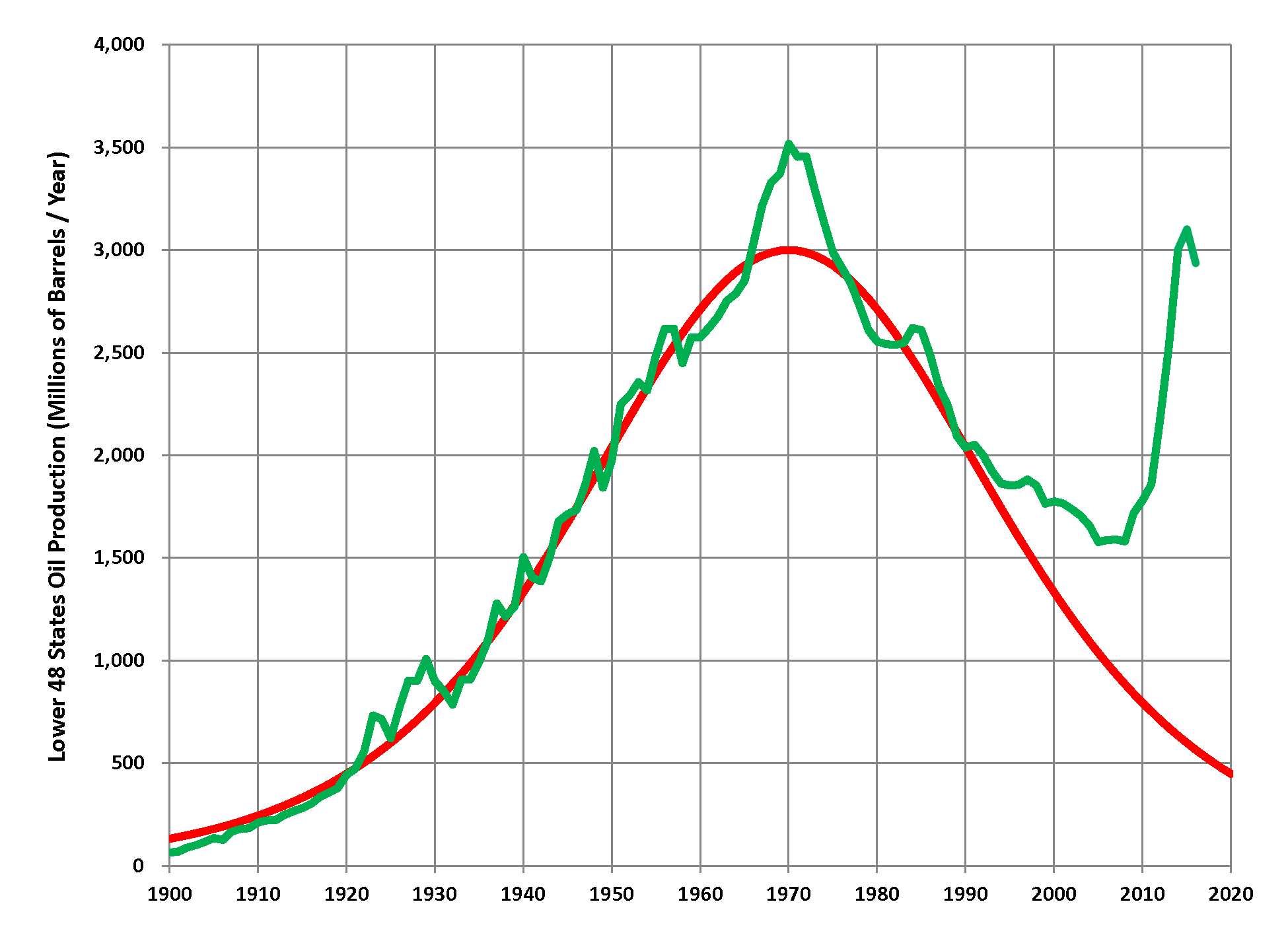

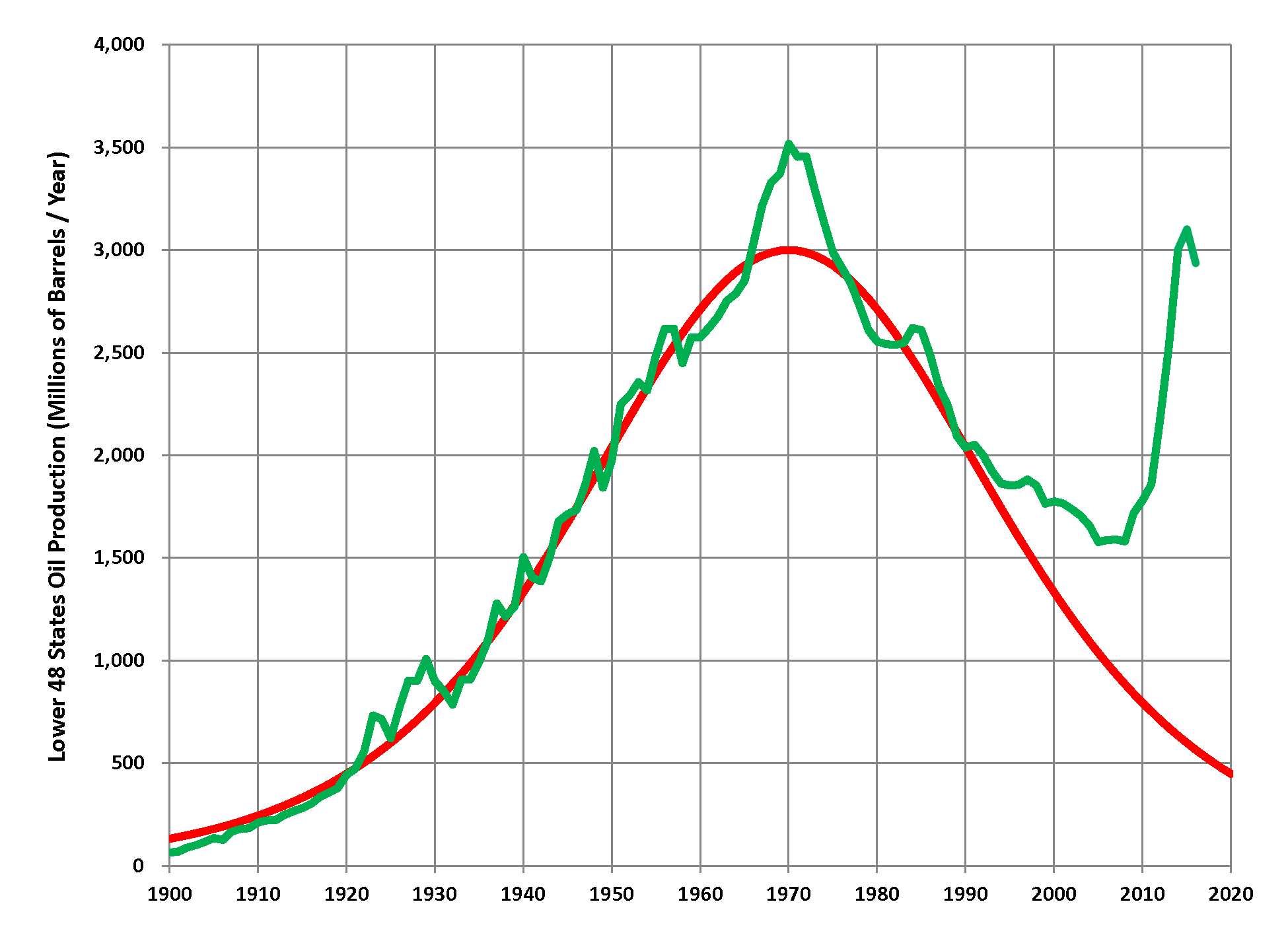

In 1956, M. King Hubbert created and first used the models behind peak oil to predict that United States oil production would peak between 1965 and 1971.

In 1956, Hubbert calculated that the world held an ultimate cumulative of 1.25 trillion barrels, of which 124 billion had already been produced. He projected that world oil production would peak at about 12.5 billion barrels per year, sometime around the year 2000. He repeated the prediction in 1962. World oil production surpassed his predicted peak in 1967 and kept rising; world oil production did not peak on or near the year 2000, and for the year 2012 was 26.67 billion barrels, more that twice the peak rate Hubbert had projected back in 1956.

In 1974, Hubbert again predicted that world peak oil would occur near 2000, this time in 1995 "if current trends continue."

However, in the late 1970s and early 1980s, global oil consumption (economics), consumption actually dropped (due to the shift to efficient energy use, energy-efficient cars,

the shift to electricity and natural gas for heating,

and other factors), then rebounded with a lower rate of growth in the mid 1980s. Thus oil production did not peak in 1995, and has climbed to more than double the rate initially projected.

In 1956, M. King Hubbert created and first used the models behind peak oil to predict that United States oil production would peak between 1965 and 1971.

In 1956, Hubbert calculated that the world held an ultimate cumulative of 1.25 trillion barrels, of which 124 billion had already been produced. He projected that world oil production would peak at about 12.5 billion barrels per year, sometime around the year 2000. He repeated the prediction in 1962. World oil production surpassed his predicted peak in 1967 and kept rising; world oil production did not peak on or near the year 2000, and for the year 2012 was 26.67 billion barrels, more that twice the peak rate Hubbert had projected back in 1956.

In 1974, Hubbert again predicted that world peak oil would occur near 2000, this time in 1995 "if current trends continue."

However, in the late 1970s and early 1980s, global oil consumption (economics), consumption actually dropped (due to the shift to efficient energy use, energy-efficient cars,

the shift to electricity and natural gas for heating,

and other factors), then rebounded with a lower rate of growth in the mid 1980s. Thus oil production did not peak in 1995, and has climbed to more than double the rate initially projected.

The July 2007 International Energy Agency, IEA Medium-Term Oil Market Report projected a 2% non-OPEC liquids supply growth in 2007-2009, reaching in 2008, receding thereafter as the slate of verifiable investment projects diminishes. They refer to this decline as a plateau. The report expects only a small amount of supply growth from OPEC producers, with 70% of the increase coming from Saudi Arabia, the UAE, and Angola as security and investment issues continue to impinge on oil exports from Iraq, Nigeria and Venezuela.

The July 2007 International Energy Agency, IEA Medium-Term Oil Market Report projected a 2% non-OPEC liquids supply growth in 2007-2009, reaching in 2008, receding thereafter as the slate of verifiable investment projects diminishes. They refer to this decline as a plateau. The report expects only a small amount of supply growth from OPEC producers, with 70% of the increase coming from Saudi Arabia, the UAE, and Angola as security and investment issues continue to impinge on oil exports from Iraq, Nigeria and Venezuela.

In October 2007, the Energy Watch Group, a German research group founded by MP Hans-Josef Fell, released a report claiming that oil production peaked in 2006 and would decline by several percent annually. The authors predicted negative economic effects and social unrest as a result. They stated that the IEA production plateau prediction uses purely economic models, which rely on an ability to raise production and discovery rates at will.

Sadad Ibrahim Al Husseini, former head of Saudi Aramco's production and exploration, stated in an October 29, 2007 interview that oil production had likely already reached its peak in 2006, and that assumptions by the IEA and EIA of production increases by OPEC to over are "quite unrealistic." Data from the United States Energy Information Administration show that world production leveled out in 2004, and an October 2007 retrospective report by the Energy Watch Group concluded that this data showed the peak of conventional oil production in the third quarter of 2006.

ASPO predicted in their January 2008 newsletter that the peak in all oil (including non-conventional sources), would occur in 2010. This is earlier than the July 2007 newsletter prediction of 2011. ASPO Ireland in its May 2008 newsletter, number 89, revised its depletion model and advanced the date of the peak of overall liquids from 2010 to 2007.

Texas alternative energy activist and oilman T. Boone Pickens stated in 2005 that worldwide conventional oil production was very close to peaking. On June 17, 2008, in testimony before the U.S. Senate Energy and Natural Resources Committee, Pickens stated that "I do believe you have peaked out at 85 million barrels a day globally."

The UK Industry Taskforce on Peak Oil and Energy Security (ITPOES) reported in late October 2008 that peak oil is likely to occur by 2013. ITPOES consists of eight companies: Arup, FirstGroup, Foster + Partners, Scottish and Southern Energy, Solarcentury, Stagecoach Group, Virgin Group, and Yahoo. Their report includes a chapter written by Royal Dutch Shell, Shell corporation.

In October 2009, a report published by the Government-supported UK Energy Research Centre, following 'a review of over 500 studies, analysis of industry databases and comparison of global supply forecasts', concluded that 'a peak in conventional oil production before 2030 appears likely and there is a significant risk of a peak before 2020'. The authors believe this forecast to be valid 'despite the large uncertainties in the available data'. The study was claimed to be the first to undertake an 'independent, thorough and systematic review of the evidence and arguments in the 'peak oil’ debate'. The authors noted that 'forecasts that delay a peak in conventional oil production until after 2030 are at best optimistic and at worst implausible' and warn of the risk that 'rising price of petroleum, oil prices will encourage the rapid development of carbon intensity, carbon-intensive alternatives that will make it difficult or impossible to Avoiding dangerous climate change, prevent dangerous climate changeUKERC Report Finds ‘Significant Risk’ of Oil Production Peaking in Ten Years

In October 2007, the Energy Watch Group, a German research group founded by MP Hans-Josef Fell, released a report claiming that oil production peaked in 2006 and would decline by several percent annually. The authors predicted negative economic effects and social unrest as a result. They stated that the IEA production plateau prediction uses purely economic models, which rely on an ability to raise production and discovery rates at will.

Sadad Ibrahim Al Husseini, former head of Saudi Aramco's production and exploration, stated in an October 29, 2007 interview that oil production had likely already reached its peak in 2006, and that assumptions by the IEA and EIA of production increases by OPEC to over are "quite unrealistic." Data from the United States Energy Information Administration show that world production leveled out in 2004, and an October 2007 retrospective report by the Energy Watch Group concluded that this data showed the peak of conventional oil production in the third quarter of 2006.

ASPO predicted in their January 2008 newsletter that the peak in all oil (including non-conventional sources), would occur in 2010. This is earlier than the July 2007 newsletter prediction of 2011. ASPO Ireland in its May 2008 newsletter, number 89, revised its depletion model and advanced the date of the peak of overall liquids from 2010 to 2007.

Texas alternative energy activist and oilman T. Boone Pickens stated in 2005 that worldwide conventional oil production was very close to peaking. On June 17, 2008, in testimony before the U.S. Senate Energy and Natural Resources Committee, Pickens stated that "I do believe you have peaked out at 85 million barrels a day globally."

The UK Industry Taskforce on Peak Oil and Energy Security (ITPOES) reported in late October 2008 that peak oil is likely to occur by 2013. ITPOES consists of eight companies: Arup, FirstGroup, Foster + Partners, Scottish and Southern Energy, Solarcentury, Stagecoach Group, Virgin Group, and Yahoo. Their report includes a chapter written by Royal Dutch Shell, Shell corporation.

In October 2009, a report published by the Government-supported UK Energy Research Centre, following 'a review of over 500 studies, analysis of industry databases and comparison of global supply forecasts', concluded that 'a peak in conventional oil production before 2030 appears likely and there is a significant risk of a peak before 2020'. The authors believe this forecast to be valid 'despite the large uncertainties in the available data'. The study was claimed to be the first to undertake an 'independent, thorough and systematic review of the evidence and arguments in the 'peak oil’ debate'. The authors noted that 'forecasts that delay a peak in conventional oil production until after 2030 are at best optimistic and at worst implausible' and warn of the risk that 'rising price of petroleum, oil prices will encourage the rapid development of carbon intensity, carbon-intensive alternatives that will make it difficult or impossible to Avoiding dangerous climate change, prevent dangerous climate changeUKERC Report Finds ‘Significant Risk’ of Oil Production Peaking in Ten Years

, October 08, 2009, UK Energy Research Centre and that 'early investment in alternative energy, low-carbon alternatives to conventional oil is of considerable importance' in avoiding this scenario.

The United States Energy Information Administration projects (as of 2006) world consumption of oil to increase to in 2015 and in 2030.

This would require a more than 35 percent increase in world oil production by 2030. A 2004 paper by the Energy Information Administration based on data collected in 2000 disagrees with Hubbert peak theory on several points. It:

* explicitly incorporates demand into model as well as supply

* does not assume pre/post-peak symmetry of production levels

* models pre- and post-peak production with different functions (exponential growth and constant reserves-to-production ratio, respectively)

* assumes reserve growth, including via technological advancement and exploitation of small reservoirs

The EIA estimates of future oil supply are disagreed with by Sadad Ibrahim Al Husseini, a retired Vice President of Exploration of Aramco, who called it a 'dangerous over-estimate'.

Husseini also pointed out that population growth and the emergence of China and India means oil prices are now going to be structurally higher than they have been.

Colin Campbell (geologist), Colin Campbell argued that the 2000 United States Geological Survey (USGS) estimates was a methodologically flawed study that has done incalculable damage by misleading international agencies and governments. Campbell dismisses the notion that the world can seamlessly move to more difficult and expensive sources of oil and gas when the need arises. He argued that oil is in profitable abundance or not there at all, due ultimately to the fact that it is a liquid concentrated by nature in a few places that possess the right geology, geological conditions. Campbell believes OPEC countries raised their reserves to get higher oil quotas and to avoid internal critique. He has also pointed out that the USGS failed to extrapolate past discovery trends in the world’s mature basins. He concluded (2002) that peak production was "imminent."

Campbell's own record is that he successively predicted that the peak in world production would occur in 1989, 2004, and 2010.

The United States Energy Information Administration projects (as of 2006) world consumption of oil to increase to in 2015 and in 2030.

This would require a more than 35 percent increase in world oil production by 2030. A 2004 paper by the Energy Information Administration based on data collected in 2000 disagrees with Hubbert peak theory on several points. It:

* explicitly incorporates demand into model as well as supply

* does not assume pre/post-peak symmetry of production levels

* models pre- and post-peak production with different functions (exponential growth and constant reserves-to-production ratio, respectively)

* assumes reserve growth, including via technological advancement and exploitation of small reservoirs

The EIA estimates of future oil supply are disagreed with by Sadad Ibrahim Al Husseini, a retired Vice President of Exploration of Aramco, who called it a 'dangerous over-estimate'.

Husseini also pointed out that population growth and the emergence of China and India means oil prices are now going to be structurally higher than they have been.

Colin Campbell (geologist), Colin Campbell argued that the 2000 United States Geological Survey (USGS) estimates was a methodologically flawed study that has done incalculable damage by misleading international agencies and governments. Campbell dismisses the notion that the world can seamlessly move to more difficult and expensive sources of oil and gas when the need arises. He argued that oil is in profitable abundance or not there at all, due ultimately to the fact that it is a liquid concentrated by nature in a few places that possess the right geology, geological conditions. Campbell believes OPEC countries raised their reserves to get higher oil quotas and to avoid internal critique. He has also pointed out that the USGS failed to extrapolate past discovery trends in the world’s mature basins. He concluded (2002) that peak production was "imminent."

Campbell's own record is that he successively predicted that the peak in world production would occur in 1989, 2004, and 2010.

''World Energy Outlook 2010''

, pages 48 and 125 (). In September 2020 BP stated their belief (as reported by Bloomberg) that 2019 would be the all-time global liquid fossil fuel production peak. If true, the collapse in demand due to the Covid pandemic from early 2020, the accelaration of previous trends (e.g. electric vehicle adoption), and the deteriorating economics of oil production from large existing fields would all have contributed to making 2019 the peak year.

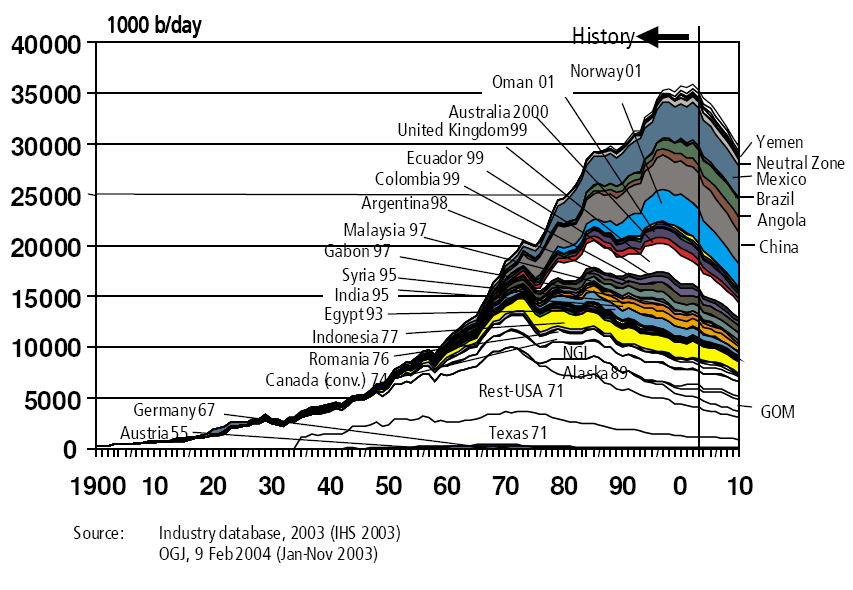

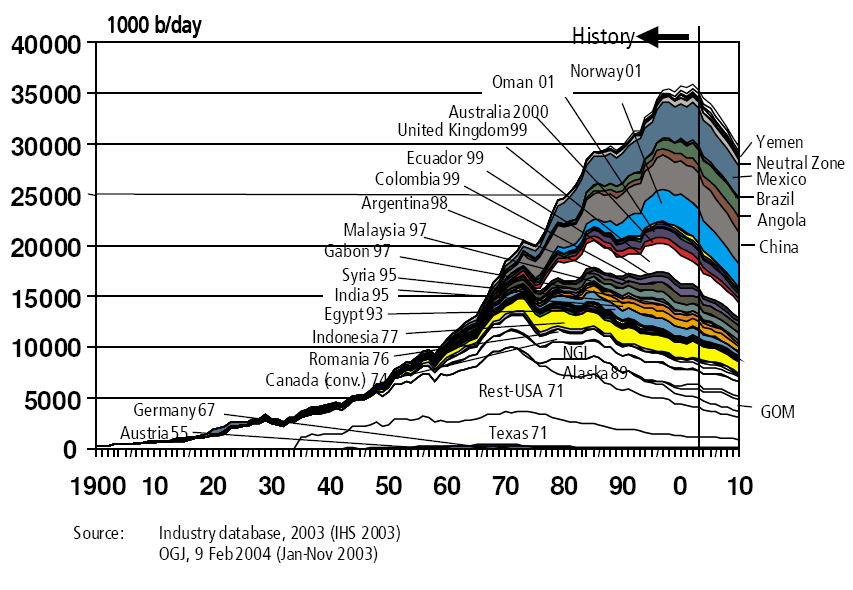

Peak Oil as a concept applies globally, but it is based on the summation of individual nations experiencing peak oil.

In ''State of the World 2005'', Worldwatch Institute observed that oil production was in decline in 33 of the 48 largest oil-producing countries. Oil reserves#Countries that have already passed their production peak, Other countries have also passed their individual oil production peaks.

The following list shows some oil-producing nations and their peak oil production years.

* Algeria: 2006US Energy Information Administration

Peak Oil as a concept applies globally, but it is based on the summation of individual nations experiencing peak oil.

In ''State of the World 2005'', Worldwatch Institute observed that oil production was in decline in 33 of the 48 largest oil-producing countries. Oil reserves#Countries that have already passed their production peak, Other countries have also passed their individual oil production peaks.

The following list shows some oil-producing nations and their peak oil production years.

* Algeria: 2006US Energy Information Administration

International energy statistics

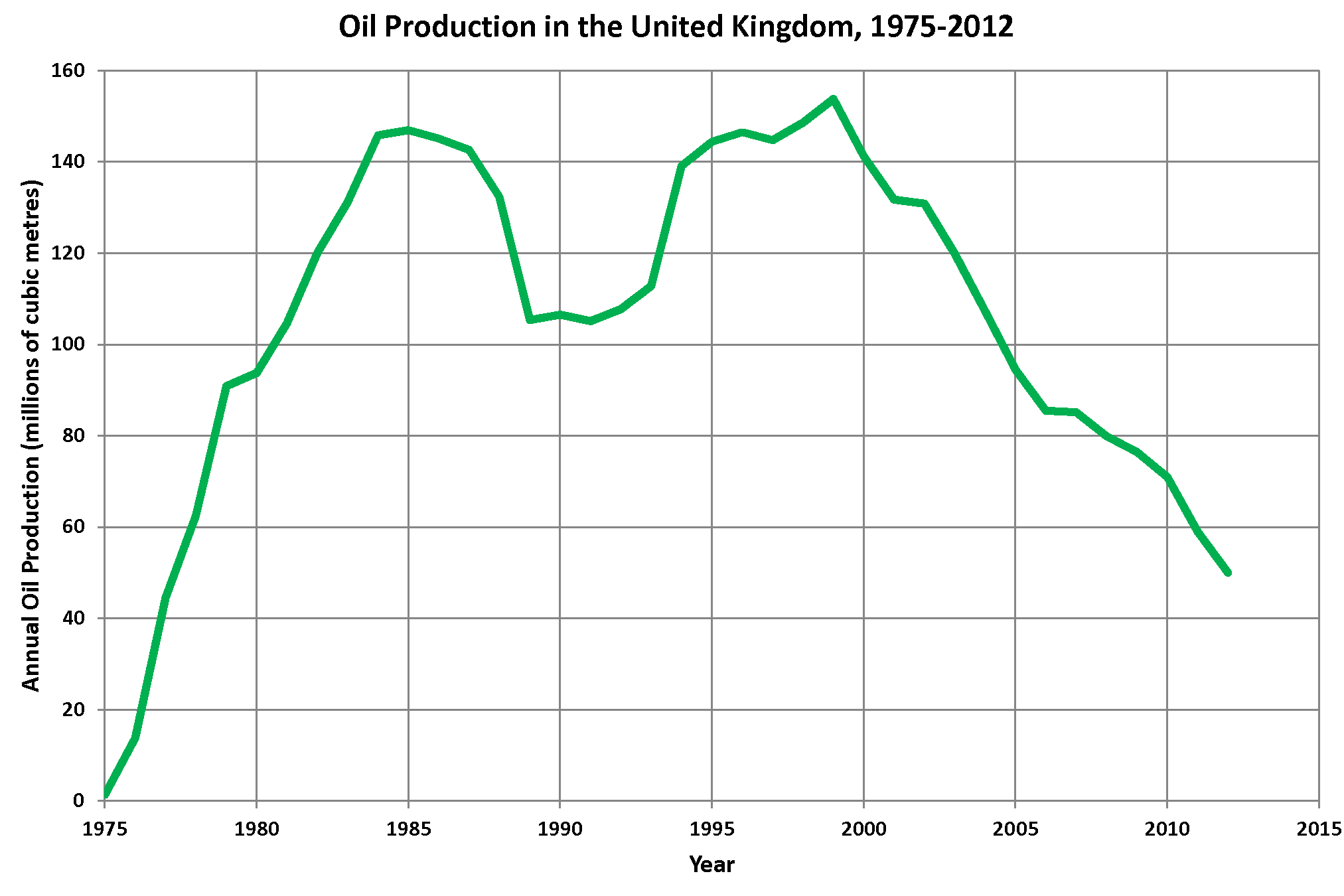

/ref> * Angola: 2008 * Argentina: 2001 *Azerbaijan: 2010 * Australia: 2000 * China: 2015.OPEC

Data Download

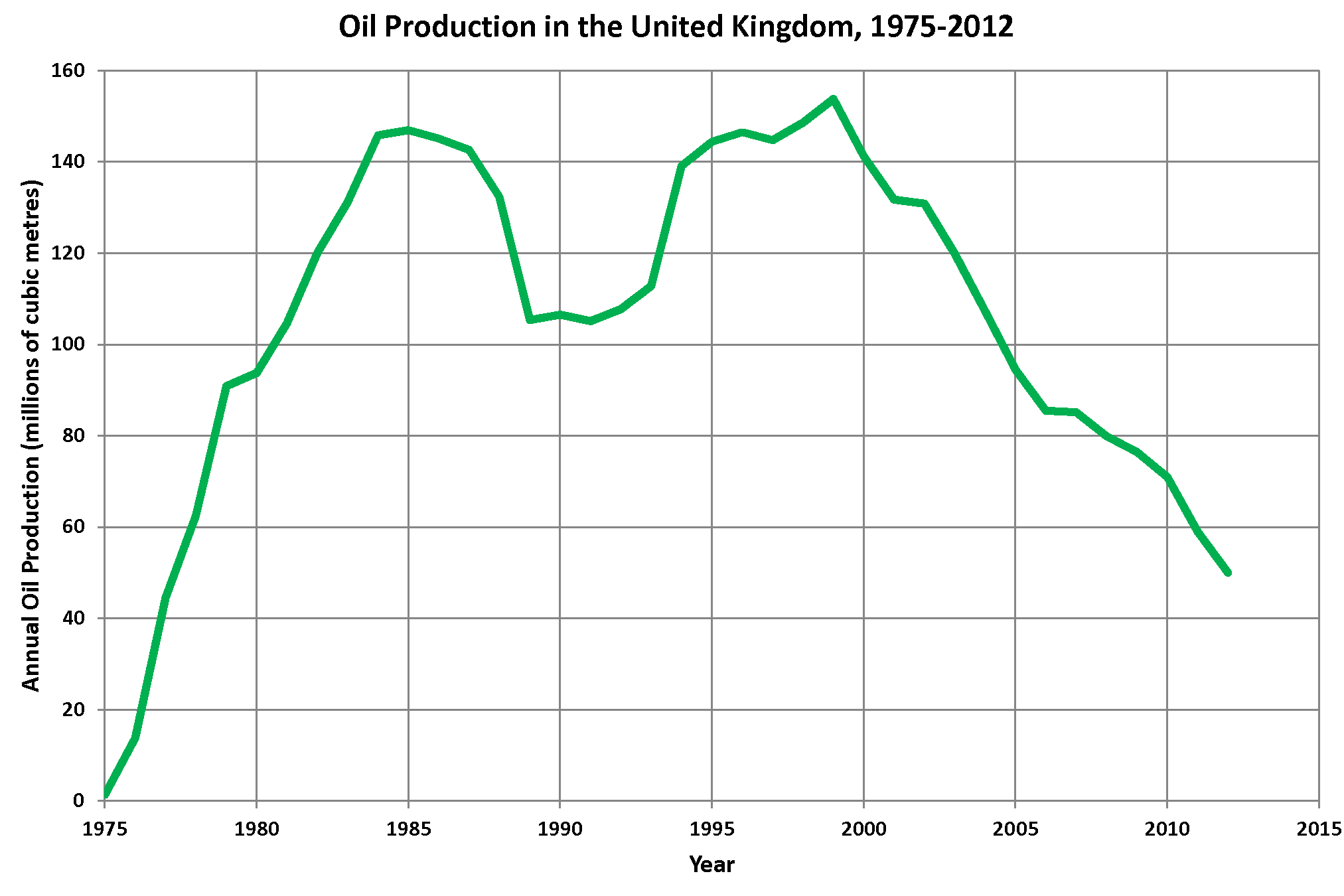

accessed 20 July 2017. * Egypt: 1987 * Denmark: 2004 * France: 1988 * Germany: 1966 * India: 2011 * Iran: 1974 * Indonesia: 1991 * Libya: 1970 (disputed) * Malaysia: 2004 *Mexico: 2003 * New Zealand: 2008 * Nigeria: 1979 * Norway: 2000 * Oman: 2000 * Peru: 1982, with an additional peak possible if the Amazon is drilled * Qatar: 2007 * Syria: 1996 * Tobago: 1981 * UK: 1999 * USA: 1970, ? - Production peaked in 1970 and declined 48 percent by 2008, then rose rapidly following investments in shale extracting technologies (fracking), and as of March 2018, crude oil was being extracted in the US at new record-high rates. However, Oil shale, shale may approach its own limits, with many analysts believing shale will peak before 2030. * Venezuela: 1970 Peak oil production has not been reached in the following nations (and is estimated in a 2010 Kuwait University study to occur in the following years): * Iraq: 2036 * Kazakhstan: 2020 * Kuwait: 2033 * Saudi Arabia: 2027 In addition, the most recent International Energy Agency and Energy Information Administration, US Energy Information Administration production data show record and rising production in Canada and China. While conventional oil production from Canada is listed as peaking in 1973, oil sands production are expected to permit increasing production until at least 2020 - see also the graph ''Canadian Oil Production''. An ABC television program in 2006 predicted that Russia would hit peak in 2010, it has continued to rise through 2016.ABC TV's Four Corners

10 July 2006.

Peak oil is the point at which oil production, sometimes including unconventional oil sources, hits its maximum. Predicting the timing of peak oil involves estimation of future production from existing oil fields as well as future discoveries. The most influential production model is Hubbert peak theory, first proposed in the 1950s. The effect of peak oil on the world economy remains controversial.

Peak oil is the point at which oil production, sometimes including unconventional oil sources, hits its maximum. Predicting the timing of peak oil involves estimation of future production from existing oil fields as well as future discoveries. The most influential production model is Hubbert peak theory, first proposed in the 1950s. The effect of peak oil on the world economy remains controversial.

Present range of predictions

There was a consensus between industry leaders and analysts that world oil production would peak between 2010 and 2030, with a significant chance that the peak will occur before 2020. Dates after 2030 were considered implausible by some. Determining a more specific range is difficult due to the lack of certainty over the actual size of world oil reserves. Unconventional oil is not currently predicted to meet the expected shortfall even in a best-case scenario. For unconventional oil to fill the gap without "potentially serious impacts on the global economy", oil production would have to remain stable after its peak, until 2035 at the earliest. On the other hand, the US Energy Information Administration projected in 2014 that world production of “total liquids,” which, in addition to liquid petroleum, includes biofuels, natural gas liquids, and oil sands, would increase at an average rate of about one percent per year through 2040 without peaking. OPEC countries are expected to increase oil production at a faster rate than non-OPEC countries. Given the large range offered by meta-studies, papers published since 2010 have been relatively pessimistic. A 2010 Kuwait University study predicted production would peak in 2014. A 2010 Oxford University study predicted that production will peak before 2015. A 2014 validation of a significant 2004 study in the journal ''Energy'' proposed that it is likely that conventional oil production peaked, according to various definitions, between 2005 and 2011. Models which show a continued increase in oil production may be including both conventional and non-conventional oil. A set of models published in a 2014 Ph.D. thesis predicted that a 2012 peak would be followed by a drop in oil prices, which in some scenarios could turn into a rapid rise in prices thereafter. Phibro statistics show that major oil companies hit peak production in 2005. Fatih Birol, chief economist at the International Energy Agency, stated in 2011 that "crude oil production for the world has already peaked in 2006." An October 2021 article by Fortune (magazine), Fortune journalist Sophie Mellor predicts that 2025 will mark peak oil demand, though mentioned that the International Energy Agency stressed trillions of dollars in renewable energy investment.Past predictions

1880s-1940s

The idea that human use of petroleum faces sustainability limits attracted practical concern at least as early as the 1880s, as did the related idea that the timing of those limits depends on the extraction technology. The concept of exhausting a natural resource to a point of diminishing returns had some antecedent examples. During the same decades when the modern petroleum industry was launching, the New England whale oil industry whaling in the United States, had just experienced a peak and was grappling with decline.

Economist and oil analyst Daniel Yergin notes that the first predictions of imminent oil peaks go back to the 1880s, when some American experts believed that exhaustion of the Pennsylvania oil fields would kill the US oil industry. Another wave of peak predictions occurred after World War I.Daniel Yergin

The idea that human use of petroleum faces sustainability limits attracted practical concern at least as early as the 1880s, as did the related idea that the timing of those limits depends on the extraction technology. The concept of exhausting a natural resource to a point of diminishing returns had some antecedent examples. During the same decades when the modern petroleum industry was launching, the New England whale oil industry whaling in the United States, had just experienced a peak and was grappling with decline.

Economist and oil analyst Daniel Yergin notes that the first predictions of imminent oil peaks go back to the 1880s, when some American experts believed that exhaustion of the Pennsylvania oil fields would kill the US oil industry. Another wave of peak predictions occurred after World War I.Daniel Yergin“There will be oil,”

Wall Street Journal, 17 Sept. 2011. :"... the peak of production will soon be passed, possibly within 3 years. ... There are many well-informed geologists and engineers who believe that the peak in the production of natural petroleum in this country will be reached by 1921 and who present impressive evidence that it may come even before 1920." ::- David White, chief geologist, United States Geological Survey (1919) :“The average middle-aged man of today will live to see the virtual exhaustion of the world’s supply of oil from wells,” ::- Victor C. Anderson, president of the Colorado School of Mines (1921) A correspondent named W.D. Hornaday, quoting oil industry executive Joseph S. Cullinan, J.S. Cullinan, described the concerns in a 1918 article for ''Tractor and Gas Engine Review'' titled "Petroleum consumption enormous." The article said, "There has been considerable discussion of late as to the possible length of time that the petroleum supply of the United States and the world will hold out." The article quoted Cullinan as saying, "It is just possible, so far as the United States is concerned, that the development and the exhaustion of the supplies may occur within the course of one human life. It is certain that unless radical changes from present methods are applied promptly, all sources of supply within the range of known drilling methods will be exhausted during the life of your children and mine." It turned out that radical changes from 1910s drilling methods were, in fact, applied promptly, and thus, the predicted timeframe was premature; but the underlying concerns (that the vastness of consumption would lead to shortages soon enough to worry about, regardless of the exact decade) did not disappear.

Hubbert's model

Early predictions in 2000s

In 2001, Kenneth S. Deffeyes, professor emeritus of geology at Princeton University, used Hubbert’s theory to predict that world oil production would peak about 2005, with a possible range of 2003 to 2006. He used the observed growth of production plus reserves to calculate ultimate world oil production of 2.12 trillion barrels, noting: "No educated guesses go in." He considered the application of new technology, but wrote: "This much is certain: no initiative put in place starting today can have a substantial effect on the peak production year." His final conclusion was: "There is nothing plausible that could postpone the peak until 2009. Get used to it." As of late 2009, Deffeyes was still convinced that 2005 had been the peak, and wrote: “I think it unlikely that oil production will ever climb back to the 2005 levels.” Matthew Simmons said on October 26, 2006 that global oil production may have peaked in December 2005, though he cautioned that further monitoring of production is required to determine if a peak has actually occurred. The July 2007 International Energy Agency, IEA Medium-Term Oil Market Report projected a 2% non-OPEC liquids supply growth in 2007-2009, reaching in 2008, receding thereafter as the slate of verifiable investment projects diminishes. They refer to this decline as a plateau. The report expects only a small amount of supply growth from OPEC producers, with 70% of the increase coming from Saudi Arabia, the UAE, and Angola as security and investment issues continue to impinge on oil exports from Iraq, Nigeria and Venezuela.

The July 2007 International Energy Agency, IEA Medium-Term Oil Market Report projected a 2% non-OPEC liquids supply growth in 2007-2009, reaching in 2008, receding thereafter as the slate of verifiable investment projects diminishes. They refer to this decline as a plateau. The report expects only a small amount of supply growth from OPEC producers, with 70% of the increase coming from Saudi Arabia, the UAE, and Angola as security and investment issues continue to impinge on oil exports from Iraq, Nigeria and Venezuela.

In October 2007, the Energy Watch Group, a German research group founded by MP Hans-Josef Fell, released a report claiming that oil production peaked in 2006 and would decline by several percent annually. The authors predicted negative economic effects and social unrest as a result. They stated that the IEA production plateau prediction uses purely economic models, which rely on an ability to raise production and discovery rates at will.

Sadad Ibrahim Al Husseini, former head of Saudi Aramco's production and exploration, stated in an October 29, 2007 interview that oil production had likely already reached its peak in 2006, and that assumptions by the IEA and EIA of production increases by OPEC to over are "quite unrealistic." Data from the United States Energy Information Administration show that world production leveled out in 2004, and an October 2007 retrospective report by the Energy Watch Group concluded that this data showed the peak of conventional oil production in the third quarter of 2006.

ASPO predicted in their January 2008 newsletter that the peak in all oil (including non-conventional sources), would occur in 2010. This is earlier than the July 2007 newsletter prediction of 2011. ASPO Ireland in its May 2008 newsletter, number 89, revised its depletion model and advanced the date of the peak of overall liquids from 2010 to 2007.

Texas alternative energy activist and oilman T. Boone Pickens stated in 2005 that worldwide conventional oil production was very close to peaking. On June 17, 2008, in testimony before the U.S. Senate Energy and Natural Resources Committee, Pickens stated that "I do believe you have peaked out at 85 million barrels a day globally."

The UK Industry Taskforce on Peak Oil and Energy Security (ITPOES) reported in late October 2008 that peak oil is likely to occur by 2013. ITPOES consists of eight companies: Arup, FirstGroup, Foster + Partners, Scottish and Southern Energy, Solarcentury, Stagecoach Group, Virgin Group, and Yahoo. Their report includes a chapter written by Royal Dutch Shell, Shell corporation.

In October 2009, a report published by the Government-supported UK Energy Research Centre, following 'a review of over 500 studies, analysis of industry databases and comparison of global supply forecasts', concluded that 'a peak in conventional oil production before 2030 appears likely and there is a significant risk of a peak before 2020'. The authors believe this forecast to be valid 'despite the large uncertainties in the available data'. The study was claimed to be the first to undertake an 'independent, thorough and systematic review of the evidence and arguments in the 'peak oil’ debate'. The authors noted that 'forecasts that delay a peak in conventional oil production until after 2030 are at best optimistic and at worst implausible' and warn of the risk that 'rising price of petroleum, oil prices will encourage the rapid development of carbon intensity, carbon-intensive alternatives that will make it difficult or impossible to Avoiding dangerous climate change, prevent dangerous climate changeUKERC Report Finds ‘Significant Risk’ of Oil Production Peaking in Ten Years

In October 2007, the Energy Watch Group, a German research group founded by MP Hans-Josef Fell, released a report claiming that oil production peaked in 2006 and would decline by several percent annually. The authors predicted negative economic effects and social unrest as a result. They stated that the IEA production plateau prediction uses purely economic models, which rely on an ability to raise production and discovery rates at will.

Sadad Ibrahim Al Husseini, former head of Saudi Aramco's production and exploration, stated in an October 29, 2007 interview that oil production had likely already reached its peak in 2006, and that assumptions by the IEA and EIA of production increases by OPEC to over are "quite unrealistic." Data from the United States Energy Information Administration show that world production leveled out in 2004, and an October 2007 retrospective report by the Energy Watch Group concluded that this data showed the peak of conventional oil production in the third quarter of 2006.

ASPO predicted in their January 2008 newsletter that the peak in all oil (including non-conventional sources), would occur in 2010. This is earlier than the July 2007 newsletter prediction of 2011. ASPO Ireland in its May 2008 newsletter, number 89, revised its depletion model and advanced the date of the peak of overall liquids from 2010 to 2007.

Texas alternative energy activist and oilman T. Boone Pickens stated in 2005 that worldwide conventional oil production was very close to peaking. On June 17, 2008, in testimony before the U.S. Senate Energy and Natural Resources Committee, Pickens stated that "I do believe you have peaked out at 85 million barrels a day globally."

The UK Industry Taskforce on Peak Oil and Energy Security (ITPOES) reported in late October 2008 that peak oil is likely to occur by 2013. ITPOES consists of eight companies: Arup, FirstGroup, Foster + Partners, Scottish and Southern Energy, Solarcentury, Stagecoach Group, Virgin Group, and Yahoo. Their report includes a chapter written by Royal Dutch Shell, Shell corporation.

In October 2009, a report published by the Government-supported UK Energy Research Centre, following 'a review of over 500 studies, analysis of industry databases and comparison of global supply forecasts', concluded that 'a peak in conventional oil production before 2030 appears likely and there is a significant risk of a peak before 2020'. The authors believe this forecast to be valid 'despite the large uncertainties in the available data'. The study was claimed to be the first to undertake an 'independent, thorough and systematic review of the evidence and arguments in the 'peak oil’ debate'. The authors noted that 'forecasts that delay a peak in conventional oil production until after 2030 are at best optimistic and at worst implausible' and warn of the risk that 'rising price of petroleum, oil prices will encourage the rapid development of carbon intensity, carbon-intensive alternatives that will make it difficult or impossible to Avoiding dangerous climate change, prevent dangerous climate changeUKERC Report Finds ‘Significant Risk’ of Oil Production Peaking in Ten Years, October 08, 2009, UK Energy Research Centre and that 'early investment in alternative energy, low-carbon alternatives to conventional oil is of considerable importance' in avoiding this scenario.

Late predictions in 2000s

Non-'peakists' can be divided into several different categories based on their specific criticism of peak oil. Some claim that any peak will not come soon or have a dramatic effect on the world economies. Others claim we will not reach a peak for technological reasons, while still others claim our oil reserves are quickly regenerated abiotically. Cambridge Energy Research Associates, CERA, which counts Peak oil#Unconventional sources, unconventional sources in reserves while discounting EROEI, believes that global production will eventually follow an “undulating plateau” for one or more decades before declining slowly. In 2005 the group predicted that "petroleum supplies will be expanding faster than demand over the next five years." In 2007, ''The Wall Street Journal'' reported that "a growing number of oil-industry chieftains" believed that oil production would soon reach a ceiling for a variety of reasons, and plateau at that level for some time. Several chief executives stated that projections of over of production per day are unrealistic, contradicting the projections of the International Energy Agency and United States Energy Information Administration. It has been argued that even a "plateau oil" scenario may cause political and economic disruption due to increasing petroleum demand and price volatility.Energy Information Administration and USGS 2000 reports

The United States Energy Information Administration projects (as of 2006) world consumption of oil to increase to in 2015 and in 2030.

This would require a more than 35 percent increase in world oil production by 2030. A 2004 paper by the Energy Information Administration based on data collected in 2000 disagrees with Hubbert peak theory on several points. It:

* explicitly incorporates demand into model as well as supply

* does not assume pre/post-peak symmetry of production levels

* models pre- and post-peak production with different functions (exponential growth and constant reserves-to-production ratio, respectively)

* assumes reserve growth, including via technological advancement and exploitation of small reservoirs

The EIA estimates of future oil supply are disagreed with by Sadad Ibrahim Al Husseini, a retired Vice President of Exploration of Aramco, who called it a 'dangerous over-estimate'.

Husseini also pointed out that population growth and the emergence of China and India means oil prices are now going to be structurally higher than they have been.

Colin Campbell (geologist), Colin Campbell argued that the 2000 United States Geological Survey (USGS) estimates was a methodologically flawed study that has done incalculable damage by misleading international agencies and governments. Campbell dismisses the notion that the world can seamlessly move to more difficult and expensive sources of oil and gas when the need arises. He argued that oil is in profitable abundance or not there at all, due ultimately to the fact that it is a liquid concentrated by nature in a few places that possess the right geology, geological conditions. Campbell believes OPEC countries raised their reserves to get higher oil quotas and to avoid internal critique. He has also pointed out that the USGS failed to extrapolate past discovery trends in the world’s mature basins. He concluded (2002) that peak production was "imminent."

Campbell's own record is that he successively predicted that the peak in world production would occur in 1989, 2004, and 2010.

The United States Energy Information Administration projects (as of 2006) world consumption of oil to increase to in 2015 and in 2030.

This would require a more than 35 percent increase in world oil production by 2030. A 2004 paper by the Energy Information Administration based on data collected in 2000 disagrees with Hubbert peak theory on several points. It:

* explicitly incorporates demand into model as well as supply

* does not assume pre/post-peak symmetry of production levels

* models pre- and post-peak production with different functions (exponential growth and constant reserves-to-production ratio, respectively)

* assumes reserve growth, including via technological advancement and exploitation of small reservoirs

The EIA estimates of future oil supply are disagreed with by Sadad Ibrahim Al Husseini, a retired Vice President of Exploration of Aramco, who called it a 'dangerous over-estimate'.

Husseini also pointed out that population growth and the emergence of China and India means oil prices are now going to be structurally higher than they have been.

Colin Campbell (geologist), Colin Campbell argued that the 2000 United States Geological Survey (USGS) estimates was a methodologically flawed study that has done incalculable damage by misleading international agencies and governments. Campbell dismisses the notion that the world can seamlessly move to more difficult and expensive sources of oil and gas when the need arises. He argued that oil is in profitable abundance or not there at all, due ultimately to the fact that it is a liquid concentrated by nature in a few places that possess the right geology, geological conditions. Campbell believes OPEC countries raised their reserves to get higher oil quotas and to avoid internal critique. He has also pointed out that the USGS failed to extrapolate past discovery trends in the world’s mature basins. He concluded (2002) that peak production was "imminent."

Campbell's own record is that he successively predicted that the peak in world production would occur in 1989, 2004, and 2010.

IEA ''World Energy Outlook'' and British Petroleum

The 2008 ''World Energy Outlook'' of the International Energy Agency suggested that there was sufficient oil supply to meet demand at reasonable prices for the foreseeable future. This was critiqued by K. Aleklett and M. Höök, but their critique has itself been accused of bias towards non-representative depletion rates, with the result that their figures are ill-founded. Subsequent research clarified more on depletion rates and different ways to define them, but still showed that it rests on solid scientific ground. Ultimately, much of the criticism raised by Uppsala has been addressed and corrected for by the IEA as the same group has thoroughly reviewed oil projections in the IEA World Energy Outlook while remaining uncertainties are chiefly attributable to OPEC and unconventional oil . According to the ''World Energy Outlook 2010'', conventional crude oil production Peak oil, peaked in 2006, with an all-time maximum of 70 million oil barrels, barrels per day.International Energy Agency''World Energy Outlook 2010''

, pages 48 and 125 (). In September 2020 BP stated their belief (as reported by Bloomberg) that 2019 would be the all-time global liquid fossil fuel production peak. If true, the collapse in demand due to the Covid pandemic from early 2020, the accelaration of previous trends (e.g. electric vehicle adoption), and the deteriorating economics of oil production from large existing fields would all have contributed to making 2019 the peak year.

No peak oil

The view that oil extraction will never enter a depletion phase is often referred to as "cornucopian" in ecology and sustainability literature. Abdullah S. Jum'ah, President, Director and CEO of Saudi Aramco states that the world has adequate reserves of conventional and nonconventional oil sources that will last for more than a century. As recently as 2008 he pronounced "We have grossly underestimated mankind’s ability to find new reserves of petroleum, as well as our capacity to raise recovery rates and tap fields once thought inaccessible or impossible to produce.” Jum’ah believes that in-place conventional and non-conventional liquid resources may ultimately total between 13 trillion and and that only a small fraction (1.1 trillion) has been extracted to date. Economist Michael Lynch (economist), Michael Lynch says that the Hubbert Peak theory is flawed and that there is no imminent peak in oil production. He argued in 2004 that production is determined by demand as well as geology, and that fluctuations in oil supply are due to political and economic effects as well as the physical processes of exploration, discovery and production. This idea is echoed by Jad Mouawad, who explains that as oil prices rise, new extraction technologies become viable, thus expanding the total recoverable oil reserves. This, according to Mouwad, is one explanation of the changes in peak production estimates. Leonardo Maugeri, the former group senior vice president, Corporate Strategies of Eni, Eni S.p.A., dismissed the peak oil thesis in a 2004 policy position piece in ''Science (journal), Science'' as "the current model of oil doomsters," and based on several flawed assumptions. He characterized the peak oil theory as part of Peak oil#Historical understanding of world oil supply limits, a series of "recurring oil panics" that have "driven Western political circles toward oil imperialism and attempts to assert direct or indirect control over oil-producing regions". Maugeri claimed the geological structure of the earth has not been explored thoroughly enough to conclude that the declining trend in discoveries, which began in the 1960s, will continue. He also stated that complete global oil production, discovery trends, and geological data are Peak oil#Concerns over stated reserves, not available globally. Economist and oil analyst Daniel Yergin criticizes Hubbert peak oil theory for ignoring the effects of both economics and improved technology. Yergin believes that world oil production will continue to rise until “perhaps sometime around mid-century” and then “plateau” or enter a gradual decline. He considers it possible that declining oil production, when it comes, will be caused less by resource scarcity than by lower demand brought about by improved efficiency.Abiogenesis

The theory that petroleum derives from Fossil fuel#Origin, biogenic processes is held by the overwhelming majority of petroleum geologists. However, Abiogenic petroleum origin, abiogenic theorists, such as the late professor of astronomy Thomas Gold, assert that oil may be a continually renewing abiotic product, rather than a “fossil fuel” in Non-renewable resources, limited supply. They hypothesize that if abiogenic petroleum sources are found and are quick to replenish, petroleum production will not decline. Gold was not able to prove his theories in experiments One of the main counter arguments to the abiotic theory is the existence of Biomarker (petroleum), biomarkers in petroleum. These chemical compounds can be best explained as residues of biogenic organic matter. They have been found in all oil and gas accumulations tested so far and suggest that oil has a biological origin and is generated from kerogen by pyrolysis.Peak oil for individual nations

International energy statistics

/ref> * Angola: 2008 * Argentina: 2001 *Azerbaijan: 2010 * Australia: 2000 * China: 2015.OPEC

Data Download

accessed 20 July 2017. * Egypt: 1987 * Denmark: 2004 * France: 1988 * Germany: 1966 * India: 2011 * Iran: 1974 * Indonesia: 1991 * Libya: 1970 (disputed) * Malaysia: 2004 *Mexico: 2003 * New Zealand: 2008 * Nigeria: 1979 * Norway: 2000 * Oman: 2000 * Peru: 1982, with an additional peak possible if the Amazon is drilled * Qatar: 2007 * Syria: 1996 * Tobago: 1981 * UK: 1999 * USA: 1970, ? - Production peaked in 1970 and declined 48 percent by 2008, then rose rapidly following investments in shale extracting technologies (fracking), and as of March 2018, crude oil was being extracted in the US at new record-high rates. However, Oil shale, shale may approach its own limits, with many analysts believing shale will peak before 2030. * Venezuela: 1970 Peak oil production has not been reached in the following nations (and is estimated in a 2010 Kuwait University study to occur in the following years): * Iraq: 2036 * Kazakhstan: 2020 * Kuwait: 2033 * Saudi Arabia: 2027 In addition, the most recent International Energy Agency and Energy Information Administration, US Energy Information Administration production data show record and rising production in Canada and China. While conventional oil production from Canada is listed as peaking in 1973, oil sands production are expected to permit increasing production until at least 2020 - see also the graph ''Canadian Oil Production''. An ABC television program in 2006 predicted that Russia would hit peak in 2010, it has continued to rise through 2016.

10 July 2006.

See also

*Hubbert peak theory *Petroleum *Hubbert linearizationReferences

External links

* * {{DEFAULTSORT:Predicting The Timing Of Peak Oil Peak oil Petroleum politics