Petrobras on:

[Wikipedia]

[Google]

[Amazon]

Petróleo Brasileiro S.A., better known by the portmanteau Petrobras (), is a

Petrobras was created in 1953 under the government of Brazilian president

Petrobras was created in 1953 under the government of Brazilian president

Reserves held outside of Brazil accounted for 8.4% of production in 2014. The majority of these reserves are in

Reserves held outside of Brazil accounted for 8.4% of production in 2014. The majority of these reserves are in

The P-51 Platform, the first semisubmersible platform built entirely in Brazil, capable of producing up to 180,000 barrels of oil per day, started production in the Campos Basin in January 2009, and in February 2009, China agreed to loan Petrobras US$10 billion in exchange for a supply of 60,000-100,000 barrels of oil per day to a subsidiary of

The P-51 Platform, the first semisubmersible platform built entirely in Brazil, capable of producing up to 180,000 barrels of oil per day, started production in the Campos Basin in January 2009, and in February 2009, China agreed to loan Petrobras US$10 billion in exchange for a supply of 60,000-100,000 barrels of oil per day to a subsidiary of

Petrobras' News Agency

{{authority control Oil and gas companies of Brazil

state-owned

State ownership, also called government ownership and public ownership, is the ownership of an industry, asset, or enterprise by the state or a public body representing a community, as opposed to an individual or private party. Public ownersh ...

Brazilian multinational corporation

A multinational company (MNC), also referred to as a multinational enterprise (MNE), a transnational enterprise (TNE), a transnational corporation (TNC), an international corporation or a stateless corporation with subtle but contrasting senses, i ...

in the petroleum industry

The petroleum industry, also known as the oil industry or the oil patch, includes the global processes of exploration, extraction, refining, transportation (often by oil tankers and pipelines), and marketing of petroleum products. The larges ...

headquartered in Rio de Janeiro

Rio de Janeiro ( , , ; literally 'River of January'), or simply Rio, is the capital of the state of the same name, Brazil's third-most populous state, and the second-most populous city in Brazil, after São Paulo. Listed by the GaWC as a b ...

, Brazil

Brazil ( pt, Brasil; ), officially the Federative Republic of Brazil (Portuguese: ), is the largest country in both South America and Latin America. At and with over 217 million people, Brazil is the world's fifth-largest country by area ...

. The company's name translates to Brazilian Petroleum Corporation — Petrobras.

The company was ranked #181 in the most recent Fortune Global 500

The ''Fortune'' Global 500, also known as Global 500, is an annual ranking of the top 500 corporations worldwide as measured by revenue. The list is compiled and published annually by ''Fortune'' magazine.

Methodology

Until 1989, it listed onl ...

list. In the 2020 Forbes Global 2000

The ''Forbes'' Global 2000 is an annual ranking of the top 2000 public companies in the world, published by ''Forbes'' magazine. "The Global 2000" annual ranking is assembled by ''Forbes'' using a weighted assessment of four metrics: sales, profi ...

, Petrobras was ranked as the 65th-largest public company in the world.'

History

Petrobras was created in 1953 under the government of Brazilian president

Petrobras was created in 1953 under the government of Brazilian president Getúlio Vargas

Getúlio Dornelles Vargas (; 19 April 1882 – 24 August 1954) was a Brazilian lawyer and politician who served as the 14th and 17th president of Brazil, from 1930 to 1945 and from 1951 to 1954. Due to his long and controversial tenure as Brazi ...

with the slogan "The Oil is Ours" (Portuguese: "O petróleo é nosso"). It was given a legal monopoly in Brazil. In 1953, Brazil produced only 2,700 barrels of oil per day. In 1961, the company's REDUC refinery began operations near Rio de Janeiro, and in 1963, its Cenpes The Centro de Pesquisas Leopoldo Américo Miguez de Mello known as Cenpes is the unit of Research Center of Petrobras responsible for research and development (R & D) and basic engineering of the company. It was formed on 4 December 1963 and aims to ...

research center opened in Rio de Janeiro

Rio de Janeiro ( , , ; literally 'River of January'), or simply Rio, is the capital of the state of the same name, Brazil's third-most populous state, and the second-most populous city in Brazil, after São Paulo. Listed by the GaWC as a b ...

; it remains one of the world's largest centers dedicated to energy research. In 1968, the company established Petrobras Quimica S.A ("Petroquisa"), a subsidiary focused on petrochemical

Petrochemicals (sometimes abbreviated as petchems) are the chemical products obtained from petroleum by refining. Some chemical compounds made from petroleum are also obtained from other fossil fuels, such as coal or natural gas, or renewable sou ...

s and the conversion of naphtha

Naphtha ( or ) is a flammable liquid hydrocarbon mixture.

Mixtures labelled ''naphtha'' have been produced from natural gas condensates, petroleum distillates, and the distillation of coal tar and peat. In different industries and regions ''n ...

into ethene

Ethylene (IUPAC name: ethene) is a hydrocarbon which has the formula or . It is a colourless, flammable gas with a faint "sweet and musky" odour when pure. It is the simplest alkene (a hydrocarbon with carbon-carbon double bonds).

Ethylene is ...

.

Petrobras had begun processing oil shale

Oil shale is an organic-rich fine-grained sedimentary rock containing kerogen (a solid mixture of organic chemical compounds) from which liquid hydrocarbons can be produced. In addition to kerogen, general composition of oil shales constitute ...

in 1953, developing the Petrosix

Petrosix is the world's largest surface oil shale pyrolysis retort with an diameter vertical shaft kiln, operational since 1992. It is located in São Mateus do Sul, Brazil, and it is owned and operated by the Brazil energy company Petrobras. Pet ...

technology for extracting oil from oil shale. It began using an industrial-size retort

In a chemistry laboratory, a retort is a device used for distillation or dry distillation of substances. It consists of a spherical vessel with a long downward-pointing neck. The liquid to be distilled is placed in the vessel and heated. The n ...

to process shale in the 1990s. In 2006, Petrobras said that their industrial retort could process 260 tonnes/hour of oil shale.

In 1994, Petrobras put the Petrobras 36

''Petrobras 36'' (''P-36'') was at the time the largest floating semi-submersible oil platform in the world prior to its sinking on 20 March 2001. It was owned by Petrobras, a semi-public Brazilian oil company headquartered in Rio de Janeiro. The c ...

, the world's largest oil platform

An oil platform (or oil rig, offshore platform, oil production platform, and similar terms) is a large structure with facilities to extract and process petroleum and natural gas that lie in rock formations beneath the seabed. Many oil platfor ...

, into service. It sank after an explosion in 2001 and was a complete loss. In 1997, the government approved Law N.9.478, which broke Petrobras's monopoly and allowed competition in Brazil's oilfields, and also created the national petroleum agency Agência Nacional do Petróleo, (ANP) responsible for the regulation and supervision of the petroleum industry, and the National Council of Energy Policies, a public agency responsible for developing public energy policy. In 1999, the National Petroleum Agency signed agreements with other companies, ending the company's monopoly.

In 2000, Petrobras set a world record for oil exploration in deep waters, reaching a depth of below sea level. In 2002, Petrobras acquired the Argentine company Perez Companc Energía (PECOM Energía S.A.) from the and its family foundation for $1.18 billion. This acquisition included assets in Argentina, Brazil, Venezuela, Bolivia, Peru, and Ecuador, 1.1 billion barrels of crude oil reserves, and production of per day.

In 2005, Petrobras announced a joint venture

A joint venture (JV) is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance. Companies typically pursue joint ventures for one of four reasons: to acces ...

with Nippon Alcohol Hanbai KK to sell Brazilian ethanol

Ethanol (abbr. EtOH; also called ethyl alcohol, grain alcohol, drinking alcohol, or simply alcohol) is an organic compound. It is an Alcohol (chemistry), alcohol with the chemical formula . Its formula can be also written as or (an ethyl ...

to Japan, called Brazil-Japan Ethanol. On 21 April 2006, the company started production on the P-50 oil platform in the Albacora East field at Campos Basin, which made Brazil self-sufficient in oil production. By November 2015, the company had accumulated $128 billion in debt, 84% of it denominated in foreign currencies.

Operations

Business areas

The company operates in six business areas, listed in order of revenue: * Refining, transportation and marketing – refining,logistics

Logistics is generally the detailed organization and implementation of a complex operation. In a general business sense, logistics manages the flow of goods between the point of origin and the point of consumption to meet the requirements of ...

, transportation, trading operations, oil products and crude oil exports and imports and petrochemical investments in Brazil

* Exploration and production – crude oil, natural gas liquids

Natural-gas condensate, also called natural gas liquids, is a low-density mixture of hydrocarbon liquids that are present as gaseous components in the raw natural gas produced from many natural gas fields. Some gas species within the raw natur ...

(NGL) and natural gas exploration, development and production in Brazil

* Distribution – distribution of oil products, ethanol

Ethanol (abbr. EtOH; also called ethyl alcohol, grain alcohol, drinking alcohol, or simply alcohol) is an organic compound. It is an Alcohol (chemistry), alcohol with the chemical formula . Its formula can be also written as or (an ethyl ...

, biodiesel

Biodiesel is a form of diesel fuel derived from plants or animals and consisting of long-chain fatty acid esters. It is typically made by chemically reacting lipids such as animal fat (tallow), soybean oil, or some other vegetable oil with ...

and natural gas

Natural gas (also called fossil gas or simply gas) is a naturally occurring mixture of gaseous hydrocarbons consisting primarily of methane in addition to various smaller amounts of other higher alkanes. Low levels of trace gases like carbo ...

to wholesalers

Wholesaling or distributing is the sale of goods or merchandise to retailers; to industrial, commercial, institutional or other professional business users; or to other wholesalers (wholesale businesses) and related subordinated services. In ...

and through the Petrobras Distribuidora S.A. retail network in Brazil

* Gas and power – transportation and trading of natural gas and LNG, and generation and trading of electric power, and the fertilizer

A fertilizer (American English) or fertiliser (British English; see spelling differences) is any material of natural or synthetic origin that is applied to soil or to plant tissues to supply plant nutrients. Fertilizers may be distinct from ...

business

* International – exploration and production of oil and gas, refining, transportation and marketing, distribution and gas and power operations outside of Brazil

* Biofuels – production of biodiesel

Biodiesel is a form of diesel fuel derived from plants or animals and consisting of long-chain fatty acid esters. It is typically made by chemically reacting lipids such as animal fat (tallow), soybean oil, or some other vegetable oil with ...

and its co-products and ethanol-related activities such as equity

Equity may refer to:

Finance, accounting and ownership

* Equity (finance), ownership of assets that have liabilities attached to them

** Stock, equity based on original contributions of cash or other value to a business

** Home equity, the dif ...

investments, production and trading of ethanol

Ethanol (abbr. EtOH; also called ethyl alcohol, grain alcohol, drinking alcohol, or simply alcohol) is an organic compound. It is an Alcohol (chemistry), alcohol with the chemical formula . Its formula can be also written as or (an ethyl ...

, sugar and the excess electricity generated from sugarcane bagasse

Bagasse ( ) is the dry pulpy fibrous material that remains after crushing sugarcane or sorghum stalks to extract their juice. It is used as a biofuel for the production of heat, energy, and electricity, and in the manufacture of pulp and building ...

Production and reserves

Petrobras controls significant oil and energy assets in 16 countries in Africa, North America, South America, Europe, and Asia. However, Brazil represented 92% of Petrobras' worldwide production in 2014 and accounted for 97% of Petrobras' worldwide reserves on 31 December 2014, when the company had of proved developed reserves and of proved undeveloped reserves inBrazil

Brazil ( pt, Brasil; ), officially the Federative Republic of Brazil (Portuguese: ), is the largest country in both South America and Latin America. At and with over 217 million people, Brazil is the world's fifth-largest country by area ...

. Of these, 62.7% were located in the offshore Campos Basin. The largest growth prospect for the company is the Tupi oil field

The Tupi oil field (reverted from Lula oil field) is a large oil field located in the Santos Basin, off the coast of Rio de Janeiro, Brazil.

The field was originally nicknamed in honor of the Tupi people and later named after the mollusc, how ...

in the Santos Basin

The Santos Basin ( pt, Bacia de Santos) is an approximately large mostly offshore sedimentary basin. It is located in the south Atlantic Ocean, some southeast of Santos, Brazil. The basin is one of the Brazilian basins to have resulted from th ...

.

In 2015, the company produced per day, of which 89% was petroleum

Petroleum, also known as crude oil, or simply oil, is a naturally occurring yellowish-black liquid mixture of mainly hydrocarbons, and is found in geological formations. The name ''petroleum'' covers both naturally occurring unprocessed crud ...

and 11% was natural gas

Natural gas (also called fossil gas or simply gas) is a naturally occurring mixture of gaseous hydrocarbons consisting primarily of methane in addition to various smaller amounts of other higher alkanes. Low levels of trace gases like carbo ...

.

International investments

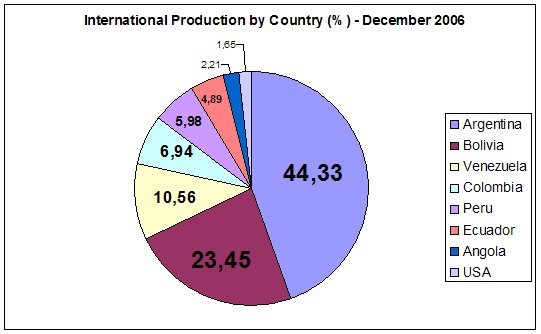

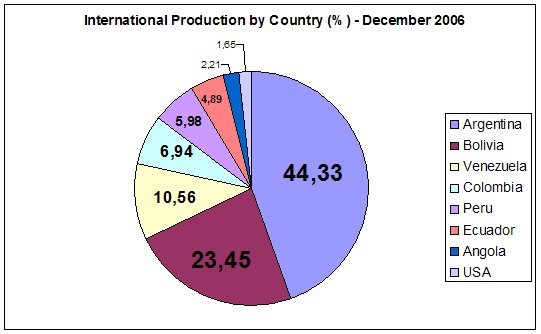

Reserves held outside of Brazil accounted for 8.4% of production in 2014. The majority of these reserves are in

Reserves held outside of Brazil accounted for 8.4% of production in 2014. The majority of these reserves are in South America

South America is a continent entirely in the Western Hemisphere and mostly in the Southern Hemisphere, with a relatively small portion in the Northern Hemisphere at the northern tip of the continent. It can also be described as the southe ...

; the company has assets in Bolivia

, image_flag = Bandera de Bolivia (Estado).svg

, flag_alt = Horizontal tricolor (red, yellow, and green from top to bottom) with the coat of arms of Bolivia in the center

, flag_alt2 = 7 × 7 square p ...

and Colombia

Colombia (, ; ), officially the Republic of Colombia, is a country in South America with insular regions in North America—near Nicaragua's Caribbean coast—as well as in the Pacific Ocean. The Colombian mainland is bordered by the Car ...

.

Petrobras owns refineries in Texas (100,000 barrels per day of throughput). The company also owns exploration blocks in the Gulf of Mexico

The Gulf of Mexico ( es, Golfo de México) is an oceanic basin, ocean basin and a marginal sea of the Atlantic Ocean, largely surrounded by the North American continent. It is bounded on the northeast, north and northwest by the Gulf Coast of ...

.

Refineries

; North Region * REMAN - Refinaria Isaac Sabbá -Manaus

Manaus () is the capital and largest city of the Brazilian state of Amazonas. It is the seventh-largest city in Brazil, with an estimated 2020 population of 2,219,580 distributed over a land area of about . Located at the east center of the s ...

( Amazonas) - 46 000 bpd

; Northeast Region

* RNEST - Abreu e Lima Refinery - Suape (Pernambuco) - 230.000 bpd

* RPCC - Potiguar Clara Refinery - Guamaré (Rio Grande do Norte

Rio Grande do Norte (, , ) is one of the states of Brazil. It is located in the northeastern region of the country, forming the northeasternmost tip of the South American continent. The name literally translates as "Great Northern River", ref ...

) - 37 700 bpd

* LUBNOR - Lubrificantes e Derivados de Petróleo do Nordeste - Fortaleza

Fortaleza (, locally , Portuguese for ''Fortress'') is the state capital of Ceará, located in Northeastern Brazil. It belongs to the Metropolitan mesoregion of Fortaleza and microregion of Fortaleza. It is Brazil's 5th largest city and the t ...

(Ceará

Ceará (, pronounced locally as or ) is one of the 26 states of Brazil, located in the northeastern part of the country, on the Atlantic coast. It is the eighth-largest Brazilian State by population and the 17th by area. It is also one of the ...

) - 8 000 bpd

; Southeast Region

* REGAP - Gabriel Passos Refinery - Betim

Betim is a town in Minas Gerais, Brazil. It is located at around . The city belongs to the mesoregion Metropolitan of Belo Horizonte (BH) and to the microregion of Belo Horizonte. It is the fifth largest city in Minas Gerais and one of the 50 larg ...

(Minas Gerais

Minas Gerais () is a state in Southeastern Brazil. It ranks as the second most populous, the third by gross domestic product (GDP), and the fourth largest by area in the country. The state's capital and largest city, Belo Horizonte (literally ...

) - 150.000 bpd

* REPLAN - Refinery of Paulínia - Paulínia

Paulínia is a municipality in the state of São Paulo in Brazil. It is part of the São Paulo Macrometropolis. The population is 112,003 (2020 est.) in an area of 138.78 km². The elevation is 590 m. It is known for hosting the Replan, t ...

(São Paulo

São Paulo (, ; Portuguese for 'Saint Paul') is the most populous city in Brazil, and is the capital of the state of São Paulo, the most populous and wealthiest Brazilian state, located in the country's Southeast Region. Listed by the GaWC a ...

) - 415 000 bpd

* REVAP - Henrique Lages Refinery - São José dos Campos

São José dos Campos (, meaning Saint Joseph of the Fields) is a major city and the seat of the Municipalities of Brazil, municipality of the same name in the state of São Paulo (state), São Paulo, Brazil. One of the leading industrial and res ...

(São Paulo) - 252 000 bpd

* RPBC - Presidente Bernardes Refinery - Cubatão

Cubatão is a city in the state of São Paulo, Brazil, 12 kilometers away from Santos seaport, the largest in Latin America. It is part of the Metropolitan Region of Baixada Santista. The population is 131,626 (2020 est.) in an area of 142.88 ...

(São Paulo) - 178 000 bpd

* RECAP - Refinery of Capuava - Mauá

Mauá () is a municipality in the state of São Paulo, in Brazil. Is part of the metropolitan region of São Paulo. The population as of 2020 is 477,552 inhabitants (11th largest city in population number of the state), the density is and the ar ...

(São Paulo)- 53 000 bpd

* REDUC - Refinery of Duque de Caxias - Duque de Caxias

Duque is a Spanish surname meaning "duke".

People

Notable people with the name include:

* Jaime Enrique Duque Correa (1943–2013), Colombian Roman Catholic bishop

* Andrés Duque (21st century), American activist

* Carlos Duque (1930–2014), Pa ...

(Rio de Janeiro

Rio de Janeiro ( , , ; literally 'River of January'), or simply Rio, is the capital of the state of the same name, Brazil's third-most populous state, and the second-most populous city in Brazil, after São Paulo. Listed by the GaWC as a b ...

) - 239 000 bpd

* COMPERJ (Renamed GASLUB) - Itaboraí (Rio de Janeiro) - UNDER CONSTRUCTION

; South Region

* REPAR - Presidente Getúlio Vargas Refinery - Araucária

Araucária is a municipality in the Brazilian state of Paraná (state), Paraná. The population in 2020 was 146,214 inhabitants.

History

The first movement of the white man in today Araucaria Brazil, dating back to the year 1668,period in which ...

( Paraná) - 207 563 bpd

* REFAP - Alberto Pasqualini Refinery - Canoas

Canoas (), which earned city status in 1939, is a municipality in the Brazilian state of Rio Grande do Sul. With more than 340,000 inhabitants, it is part of the Porto Alegre conurbation and has the second highest GDP in the state. It is also th ...

(Rio Grande do Sul

Rio Grande do Sul (, , ; "Great River of the South") is a Federative units of Brazil, state in the South Region, Brazil, southern region of Brazil. It is the Federative_units_of_Brazil#List, fifth-most-populous state and the List of Brazilian st ...

) - 201 280 bpd

Production

In 1961, Petrobras geologist Walter K. Link published Link's memorandum, which implied that the company was better off exploring offshore instead of onshore. In 1963, Petrobras discovered the and Carmópolis oil fields. The company's growth was halted by the1973 oil crisis

The 1973 oil crisis or first oil crisis began in October 1973 when the members of the Organization of Arab Petroleum Exporting Countries (OAPEC), led by Saudi Arabia, proclaimed an oil embargo. The embargo was targeted at nations that had supp ...

. The entire country was affected, and the "Brazilian miracle", a period when annual GDP

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is ofte ...

growth exceeded 10%, ended. Petrobras nearly went bankrupt.

In 1974, the company discovered an oil field in the Campos Basin. This discovery boosted its finances and helped it restructure nationwide. In 1975, the Brazilian Government

The politics of Brazil take place in a framework of a federal presidential representative democratic republic, whereby the President is both head of state and head of government, and of a multi-party system. The political and administrative or ...

temporarily allowed foreign operators into Brazil, and Petrobras signed exploration contracts with foreign companies for oilfields in Brazil.

The company was affected by the 1979 energy crisis, although not nearly as badly as in 1973.

In 1997, Petrobras reached the production milestone of per day. The company also executed agreements with other Latin American governments and began operations outside Brazil.

In 2003, on its 50th anniversary, Petrobras surpassed of daily production. On 1 May 2006, after the Bolivian gas conflict

The Bolivian gas conflict was a social confrontation in Bolivia reaching its peak in 2003, centering on the exploitation of the country's vast natural gas reserves. The expression can be extended to refer to the general conflict in Bolivia ov ...

, Bolivia's president Evo Morales

Juan Evo Morales Ayma (; born 26 October 1959) is a Bolivian politician, trade union organizer, and former cocalero activist who served as the 65th president of Bolivia from 2006 to 2019. Widely regarded as the country's first president to co ...

announced the nationalization of all gas and oil fields in the country and ordered the occupation of all fields by the Bolivian Army

The Bolivian Army ( es, Ejército Boliviano) is the land force branch of the Armed Forces of Bolivia.

Figures on the size and composition of the Bolivian army vary considerably, with little official data available. It is estimated that the arm ...

. On 4 May 2006, Petrobras cancelled a major future investment plan in Bolivia as a result. The Bolivian government demanded an increase in royalty payments from foreign petroleum companies to 82%, but eventually settled for a 50% royalty interest.

In 2007, Petrobras inaugurated the Petrobras 52 Oil Platform. The 52 is the biggest Brazilian oil platform and the third-biggest in the world.

In 2007 and 2008, Petrobras made several major oil discoveries including the Tupi oil field

The Tupi oil field (reverted from Lula oil field) is a large oil field located in the Santos Basin, off the coast of Rio de Janeiro, Brazil.

The field was originally nicknamed in honor of the Tupi people and later named after the mollusc, how ...

(formerly known as the Lula oil field), the Jupiter field

Jupiter is the fifth planet from the Sun and the largest in the Solar System. It is a gas giant with a mass more than two and a half times that of all the other planets in the Solar System combined, but slightly less than one-thousandth th ...

, and the Sugar Loaf field, all in the Santos Basin

The Santos Basin ( pt, Bacia de Santos) is an approximately large mostly offshore sedimentary basin. It is located in the south Atlantic Ocean, some southeast of Santos, Brazil. The basin is one of the Brazilian basins to have resulted from th ...

, 300 km off the coast of Rio de Janeiro

Rio de Janeiro ( , , ; literally 'River of January'), or simply Rio, is the capital of the state of the same name, Brazil's third-most populous state, and the second-most populous city in Brazil, after São Paulo. Listed by the GaWC as a b ...

. The oil fields were discovered by partnerships that include Petrobras, Royal Dutch Shell

Shell plc is a British multinational oil and gas company headquartered in London, England. Shell is a public limited company with a primary listing on the London Stock Exchange (LSE) and secondary listings on Euronext Amsterdam and the New Yo ...

, and Galp Energia

Galp Energia, SGPS, S.A. is a Portuguese multinational energy corporation, headquartered in Lisbon, Portugal. Galp consists of more than 100 companies engaged in every aspect of the oil and natural gas supply, hydrocarbon exploration and product ...

. However, estimates for the reserves of these new fields varied widely.

The P-51 Platform, the first semisubmersible platform built entirely in Brazil, capable of producing up to 180,000 barrels of oil per day, started production in the Campos Basin in January 2009, and in February 2009, China agreed to loan Petrobras US$10 billion in exchange for a supply of 60,000-100,000 barrels of oil per day to a subsidiary of

The P-51 Platform, the first semisubmersible platform built entirely in Brazil, capable of producing up to 180,000 barrels of oil per day, started production in the Campos Basin in January 2009, and in February 2009, China agreed to loan Petrobras US$10 billion in exchange for a supply of 60,000-100,000 barrels of oil per day to a subsidiary of Sinopec

China Petroleum & Chemical Corporation (中国石油化工股份有限公司) or Sinopec (), is a Chinese oil and gas enterprise based in Beijing. It is listed in Hong Kong and also trades in Shanghai.

Sinopec Limited's parent, Sinopec Gr ...

and 40,000-60,000 barrels of oil per day to PetroChina

PetroChina Company Limited () is a Chinese oil and gas company and is the listed arm of state-owned China National Petroleum Corporation (CNPC), headquartered in Dongcheng District, Beijing. The company is currently Asia's largest oil and gas pr ...

. In August 2009, Petrobras acquired ExxonMobil

ExxonMobil Corporation (commonly shortened to Exxon) is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller's Standard Oil, and was formed on November 30, ...

's Esso

Esso () is a trading name for ExxonMobil. Originally, the name was primarily used by its predecessor Standard Oil of New Jersey after the breakup of the original Standard Oil company in 1911. The company adopted the name "Esso" (the phonetic p ...

assets in Chile

Chile, officially the Republic of Chile, is a country in the western part of South America. It is the southernmost country in the world, and the closest to Antarctica, occupying a long and narrow strip of land between the Andes to the east a ...

for US$400 million.

In September 2010, Petrobras completed a US$70 billion share offering, the largest share offering in history, to be used to develop newly discovered oil fields. Giovanni Biscardi and Machado Meyer represented Petrobras. Biscardi brought his Brazilian corporate practice to Greenberg Traurig

Greenberg Traurig is a multinational law firm founded in Miami in 1967. As of 2022, the Greenberg Traurig is the 9th largest law firm in the United States.

The firm has 43 offices in the United States, Latin America, Europe, the Middle East and ...

in January 2020.

In 2012, Petrobras surrendered permits to explore offshore in New Zealand

New Zealand ( mi, Aotearoa ) is an island country in the southwestern Pacific Ocean. It consists of two main landmasses—the North Island () and the South Island ()—and over 700 smaller islands. It is the sixth-largest island count ...

. Petrobras did not provide a reason but the New Zealand Prime Minister John Key

Sir John Phillip Key (born 9 August 1961) is a New Zealand retired politician who served as the 38th prime minister of New Zealand, Prime Minister of New Zealand from 2008 to 2016 and as Leader of the New Zealand National Party from 2006 to ...

said the decision was "not a reflection on the capacity to undertake deep-sea drilling or the prospect of activity of that area". He attributed the decision to a regrouping by the company after some setbacks.

In July 2013, a worker strike action

Strike action, also called labor strike, labour strike, or simply strike, is a work stoppage caused by the mass refusal of employees to Labor (economics), work. A strike usually takes place in response to grievance (labour), employee grievance ...

shut down production at several of the company's oil platforms. In September 2013, Petrobras sold eleven onshore exploration and production blocks in Colombia

Colombia (, ; ), officially the Republic of Colombia, is a country in South America with insular regions in North America—near Nicaragua's Caribbean coast—as well as in the Pacific Ocean. The Colombian mainland is bordered by the Car ...

to Perenco for US$380 million.

In September 2013 Organizações Globo

Grupo Globo ( en, Globo Group), formerly known as Organizações Globo ( en, Globo Organization), is a Brazilian private mass media conglomerate based in Rio de Janeiro, Brazil. Founded in 1925 by Irineu Marinho, it is the largest media group i ...

reported on national television that the US National Security Agency

The National Security Agency (NSA) is a national-level intelligence agency of the United States Department of Defense, under the authority of the Director of National Intelligence (DNI). The NSA is responsible for global monitoring, collecti ...

(NSA) had been spying on Petrobras. The information was based on a top secret NSA file provided to ''Guardian

Guardian usually refers to:

* Legal guardian, a person with the authority and duty to care for the interests of another

* ''The Guardian'', a British daily newspaper

(The) Guardian(s) may also refer to:

Places

* Guardian, West Virginia, Unite ...

'' journalist Glenn Greenwald

Glenn Edward Greenwald (born March 6, 1967) is an American journalist, author and lawyer. In 2014, he cofounded ''The Intercept'', of which he was an editor until he resigned in October 2020. Greenwald subsequently started publishing on Substac ...

by Edward Snowden

Edward Joseph Snowden (born June 21, 1983) is an American and naturalized Russian former computer intelligence consultant who leaked highly classified information from the National Security Agency (NSA) in 2013, when he was an employee and su ...

as part of the Global surveillance disclosures. The file showed that Petrobras was one of several targets for the NSA's Blackpearl program, which extricates data from private networks. Petrobras announced that it was investing R$21 billion over five years to improve its data security.

In 2014, the company sold its assets in Peru

, image_flag = Flag of Peru.svg

, image_coat = Escudo nacional del Perú.svg

, other_symbol = Great Seal of the State

, other_symbol_type = Seal (emblem), National seal

, national_motto = "Fi ...

to PetroChina

PetroChina Company Limited () is a Chinese oil and gas company and is the listed arm of state-owned China National Petroleum Corporation (CNPC), headquartered in Dongcheng District, Beijing. The company is currently Asia's largest oil and gas pr ...

for US$2.6 billion. Also in 2014, Petrobras set a new company record for average daily production of .

In January 2017, the company concluded the sale of 100 percent of Petrobras Chile Distribuición Ltda (PCD) to the Southern Cross Group. The transaction included the licensing of the Petrobras and Lubrax brands for 8 years. To operate the assets acquired from Petrobras in Chile, Southern Cross created Esmax, a company that acts as a Petrobras licensee in the fuel and lubricant distribution segments. In March 2019, the company concluded the sale of 100 percent of Petrobras Paraguay Distribución Limited (PPDL UK), Petrobras Paraguay Operaciones y Logística SRL (PPOL) and Petrobras Paraguay Gas SRL (PPG) to the Grupo Copetrol, through its subsidiary Paraguay Energy. The agreement provides for the licensing for the exclusive use of the Petrobras brand by Nextar (the successor of Petrobras Paraguay Operaciones y Logística SRL) at that country’s service stations, for the initial term of five years. In February 2021, the company concluded the sale of entire stake in Petrobras Uruguay Distribución S.A. (PUDSA), by indirect subsidiary (Petrobras Uruguay Sociedad Anónima de Inversión -PUSAI), in Uruguay, to Mauruguay S.A., an indirect wholly-owned subsidiary of Disa Corporación Petrolífera S.A. (DISA).

In January 2020, Petroleo Brasileiro stated that it ended all of its business in Africa after completing the sale of a 50% stake in Petrobras Oil & Gas BV.

Corporate affairs

Ownership

The Brazilian government directly owns 54% of Petrobras'common shares

Common stock is a form of corporate equity ownership, a type of security. The terms voting share and ordinary share are also used frequently outside of the United States. They are known as equity shares or ordinary shares in the UK and other Co ...

with voting rights, while the Brazilian Development Bank

The National Bank for Economic and Social Development ( pt, Banco Nacional de Desenvolvimento Econômico e Social, abbreviated: BNDES) is a development bank structured as a federal public company associated with the Ministry of the Economy of Bra ...

and Brazil's Sovereign Wealth Fund (Fundo Soberano) each control 5%, bringing the State's direct and indirect ownership to 64%. The privately held shares are traded on B3, where they are part of the Ibovespa index. It is also listed in the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed c ...

in the form of American depositary receipt

An American depositary receipt (ADR, and sometimes spelled ''depository'') is a negotiable security that represents securities of a foreign company and allows that company's shares to trade in the U.S. financial markets.

Shares of many non-U.S ...

s and in the Madrid Stock Exchange

Bolsa de Madrid (; Madrid Stock Exchange) is the largest and most international of Spain's four regional stock exchanges (the others are located in Barcelona, Valencia, and Bilbao) that trade shares and convertible bonds and fixed income securiti ...

.

Social responsibility

Petrobras is a major supporter of the arts in Brazil.Operation Car Wash and related protests in Brazil

Operation Car Wash ( pt, Operação Lava Jato) was a criminal investigation by theFederal Police of Brazil

The Federal Police of Brazil (Portuguese: ''Polícia Federal'') is a federal law enforcement agency of Brazil and one of the three national police forces. The other two are the Federal Highway Police, and the National Force. From 1944 to 1967 it ...

's Curitiba

Curitiba () is the capital and largest city in the state of Paraná (state), Paraná in Brazil. The city's population was 1,948,626 , making it the List of cities in Brazil by population, eighth most populous city in Brazil and the largest in ...

branch. Originally a money laundering

Money laundering is the process of concealing the origin of money, obtained from illicit activities such as drug trafficking, corruption, embezzlement or gambling, by converting it into a legitimate source. It is a crime in many jurisdictions ...

investigation, it expanded to cover allegations of corruption at Petrobras, where executives allegedly accepted bribe

Bribery is the offering, giving, receiving, or soliciting of any item of value to influence the actions of an official, or other person, in charge of a public or legal duty. With regard to governmental operations, essentially, bribery is "Corr ...

s in return for awarding contracts to construction firms at inflated prices. The aim of the investigation was to ascertain the extent of a money laundering scheme, estimated by the Regional Superintendent of the Federal Police of Paraná State in 2015 at (US$– billion), largely through the embezzlement

Embezzlement is a crime that consists of withholding assets for the purpose of conversion of such assets, by one or more persons to whom the assets were entrusted, either to be held or to be used for specific purposes. Embezzlement is a type ...

of Petrobras funds.

The authorities issued over a thousand warrants against business figures and politicians. It also led to a wave of arrests. Fernando Soares, also known as "Fernando Baiano," a businessman and lobbyist, was allegedly the connection between major Brazilian construction firms and the government formed by the Workers’ Party(PT) and Brazilian Democratic Movement

The Brazilian Democratic Movement ( pt, Movimento Democrático Brasileiro, MDB) is a Brazilian political party. It is considered a " big tent party" and it is one of the parties with the greatest representation throughout the national territory, ...

(PMDB). Between 2014 and February 2016, the Federal Public Prosecutor's Office () filed 37 criminal charges against 179 people, mostly politicians and businessmen.Fausto, S. (2017). The Lengthy Brazilian Crisis Is Not Yet Over. Issue Brief, 2. Former President Luiz Inácio Lula da Silva

Luiz Inácio Lula da Silva (; born Luiz Inácio da Silva; 27 October 1945), known mononymously as Lula, is a Brazilian politician, trade unionist, and former metalworker who is the president-elect of Brazil. A member of the Workers' Party, ...

and then President Dilma Rousseff

Dilma Vana Rousseff (; born 14 December 1947) is a Brazilian economist and politician who served as the 36th president of Brazil, holding the position from 2011 until her impeachment and removal from office on 31 August 2016. She is the first w ...

were also implicated.

On 8 March 2016, Marcelo Odebrecht

Marcelo Bahia Odebrecht (; born 18 October 1968) is a Brazilian businessman and the former CEO of Odebrecht, a diversified Brazilian conglomerate. In March 2016, he was sentenced to 19 years in prison for paying more than $30 million in bribes. ...

, CEO of Odebrecht

Odebrecht S.A. (), officially known as Novonor, is a Brazilian conglomerate, headquartered in Salvador, Bahia, Brazil, consisting of diversified businesses in the fields of engineering, construction, chemicals and petrochemicals. The company w ...

and grandson of the company's founder, was sentenced to 19 years in prison after being convicted of paying more than $30 million in bribes to Petrobras executives. Eduardo Cunha

Eduardo Cosentino da Cunha (born 29 September 1958), is a Brazilian politician and radio host, born in Rio de Janeiro. He was President of the Chamber of Deputies of Brazil from February 2015 until May 5, 2016, when he was removed from the pos ...

, president of the Chamber of Deputies

The chamber of deputies is the lower house in many bicameral legislatures and the sole house in some unicameral legislatures.

Description

Historically, French Chamber of Deputies was the lower house of the French Parliament during the Bourbon R ...

from 2015 to 2016, was convicted of taking approximately $40 million in bribes and hiding funds in secret bank accounts and sentenced to 15 years in prison.

Protests broke out calling for the resignation or impeachment of President Rousseff. The most widespread of these occurred on 13 March 2016 in over 300 municipalities. Police estimates gave about 3.5 million protestors throughout the country. Some of the protests were in areas previously thought of as strongholds of the Workers Party, of which Rousseff was the leader.

The Bill and Melinda Gates Foundation

The Bill & Melinda Gates Foundation (BMGF), a merging of the William H. Gates Foundation and the Gates Learning Foundation, is an American private foundation founded by Bill Gates and Melinda French Gates. Based in Seattle, Washington, it was ...

sued Petrobras and its auditors, PriceWaterhouseCoopers

PricewaterhouseCoopers is an international professional services brand of firms, operating as partnerships under the PwC brand. It is the second-largest professional services network in the world and is considered one of the Big Four accounting ...

as a result of the corruption scandal. In January 2018, Petrobras agreed to pay $2.95 billion to settle a U.S.

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territori ...

class action corruption lawsuit. Later in September 2018, Petrobras agreed to pay $853.2 million to settle with Brazil

Brazil ( pt, Brasil; ), officially the Federative Republic of Brazil (Portuguese: ), is the largest country in both South America and Latin America. At and with over 217 million people, Brazil is the world's fifth-largest country by area ...

ian and U.S.

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territori ...

authorities. Petrobras settled with shareholder Vanguard Group

The Vanguard Group, Inc. is an American registered investment advisor based in Malvern, Pennsylvania, with about $7 trillion in global assets under management, as of January 13, 2021. It is the largest provider of mutual funds and the second-lar ...

in June 2017.

Environmental record

Petrobras's website notes several initiatives to preserve the environment. These include efforts to support both ocean and forest ecosystems. Most notably, Petrobras has sponsoredpopulation studies Population study is an interdisciplinary field of scientific study that uses various statistical methods and models to analyse, determine, address, and predict population challenges and trends from data collected through various data collection met ...

and conservation efforts for humpback whale

The humpback whale (''Megaptera novaeangliae'') is a species of baleen whale. It is a rorqual (a member of the family Balaenopteridae) and is the only species in the genus ''Megaptera''. Adults range in length from and weigh up to . The hump ...

s in northeast Brazil. The company's efforts helped to rebuild Brazil's humpback whale populations from 2,000 in the mid-nineties to over 9,000 in 2008.

Petrobras subscribes to the United Nations Global Compact

The United Nations Global Compact is a non-binding United Nations pact to encourage businesses and firms worldwide to adopt sustainable and socially responsible policies, and to report on their implementation. The UN Global Compact is a princ ...

, a voluntary agreement regarding human rights, working condition {{Short description, 1=Overview of and topical guide to working time and conditions

This is a list of topics on working time and conditions.

Legislation

* See :Employment law

Working time

* See :Working time

* Flextime

Working conditions

* Bio ...

s, corruption

Corruption is a form of dishonesty or a criminal offense which is undertaken by a person or an organization which is entrusted in a position of authority, in order to acquire illicit benefits or abuse power for one's personal gain. Corruption m ...

, and the environment

Environment most often refers to:

__NOTOC__

* Natural environment, all living and non-living things occurring naturally

* Biophysical environment, the physical and biological factors along with their chemical interactions that affect an organism or ...

.

In 2008, the Spanish consultancy firm Management and Excellence named Petrobras the world's most sustainable

Specific definitions of sustainability are difficult to agree on and have varied in the literature and over time. The concept of sustainability can be used to guide decisions at the global, national, and individual levels (e.g. sustainable livin ...

oil company.

Oil spills

Sponsorships and namesakes

* In the ''Speed Racer

''Speed Racer'', also known as , is a Japanese media franchise about Auto racing, automobile racing. ''Mach GoGoGo'' was originally serialized in print in Shueisha's 1966 ''Shōnen Book''. It was released in tankōbon book form by Sun W ...

'' live-action movie, one of the cars featured is the "Green Energy", a biodiesel

Biodiesel is a form of diesel fuel derived from plants or animals and consisting of long-chain fatty acid esters. It is typically made by chemically reacting lipids such as animal fat (tallow), soybean oil, or some other vegetable oil with ...

-fueled racing car sponsored by Petrobras.

* Petrobras sponsored the Brazilian Série A

Brazilian commonly refers to:

* Something of, from or relating to Brazil

* Brazilian Portuguese, the dialect of the Portuguese language used mostly in Brazil

* Brazilians, the people (citizens) of Brazil, or of Brazilian descent

Brazilian may also ...

from 2009 to 2012.

* Petrobras was a secondary sponsor for the AT&T Williams F1 Team from 1998 to 2008 and signed again with Williams F1 from 2014 onwards. From 2018, Petrobras left Williams and sponsored McLaren

McLaren Racing Limited is a British motor racing team based at the McLaren Technology Centre in Woking, Surrey, England. McLaren is best known as a Formula One constructor, the second oldest active team, and the second most successful Formul ...

, but cancelled their sponsorship at the end of 2019.

* Petrobras sponsored the Clube de Regatas do Flamengo

Clube de Regatas do Flamengo (; English: ''Flamengo Rowing Club''), more commonly referred to as simply Flamengo, is a Brazilian sports club based in Rio de Janeiro, in the neighborhood of Gávea, best known for their professional football ...

in Brazil from 1984 to 2009, Racing Club de Avellaneda

Racing Club de Avellaneda, officially known as Racing Club or shortened to just Racing, is an Argentine professional sports club based in Avellaneda, a city of the Buenos Aires Province. Founded in 1903, Racing has been historically considered o ...

from 2002 to 2006, Club Atlético River Plate

Club Atlético River Plate, commonly known as River Plate, is an Argentine professional

sports club based in the Núñez, Buenos Aires, Núñez neighborhood of Buenos Aires. Founded in 1901, the club is named after the English name for the city ...

in Argentina from 2006 to 2012 and Universidad de Chile

The University of Chile ( es, Universidad de Chile) is a public research university in Santiago, Chile. It was founded on November 19, 1842, and inaugurated on September 17, 1843.

in Chile from 2019 to 2021.

* The sauropod

Sauropoda (), whose members are known as sauropods (; from '' sauro-'' + '' -pod'', 'lizard-footed'), is a clade of saurischian ('lizard-hipped') dinosaurs. Sauropods had very long necks, long tails, small heads (relative to the rest of their bo ...

dinosaur

Dinosaurs are a diverse group of reptiles of the clade Dinosauria. They first appeared during the Triassic period, between 243 and 233.23 million years ago (mya), although the exact origin and timing of the evolution of dinosaurs is t ...

'' Petrobrasaurus'' is named after the company.

*Petrobras sponsored the game ''Copa Petrobras de Marcas'', an unfinished version of ''Stock Car Extreme'' by Reiza Studios, the creators of the ''Automobilista'' series.

See also

*History of Brazil (1945–1964)

)

, national_anthem =" Hino Nacional Brasileiro"( en, "Brazilian National Anthem")

, common_languages = Portuguese

, government_type = Federal presidential republic(1946–1961; 1963–1964) Federal parliamentary republic(1961–19 ...

*Eletrobras

Eletrobras (, full name: Centrais Elétricas Brasileiras S.A.) is a major Brazilian electric utilities company. The company's headquarters are located in Rio de Janeiro.

It is Latin America's biggest power utility company, tenth largest in the wo ...

*H-Bio H-Bio is an oil-refining processes which involves converting vegetable oil into high-quality diesel via hydrogenation. Hydrogenation is a chemical reaction, in which a substance is treated with Hydrogen, thus resulting in a new product. In H-Bio, H ...

*Ethanol fuel in Brazil

Brazil is the world's second largest producer of ethanol fuel. Brazil and the United States have led the industrial production of ethanol fuel for several years, together accounting for 85 percent of the world's production in 2017. Brazil produc ...

* Petrobras 36 Oil Platform

*Petrosix

Petrosix is the world's largest surface oil shale pyrolysis retort with an diameter vertical shaft kiln, operational since 1992. It is located in São Mateus do Sul, Brazil, and it is owned and operated by the Brazil energy company Petrobras. Pet ...

*Transpetro

Petrobras Transporte S.A. (Transpetro) is the largest oil and gas transportation company of Brazil. Transpetro works with transportation and storage activities of oil and byproducts, ethanol, biofuels and natural gas. It is responsible for a net ...

*Tupi oil field

The Tupi oil field (reverted from Lula oil field) is a large oil field located in the Santos Basin, off the coast of Rio de Janeiro, Brazil.

The field was originally nicknamed in honor of the Tupi people and later named after the mollusc, how ...

* Walter K. Link

* Brazil- China Relations

References

External links

*Petrobras' News Agency

{{authority control Oil and gas companies of Brazil

Bra

A bra, short for brassiere or brassière (, or ; ), is a form-fitting undergarment that is primarily used to support and cover breasts. It can serve a range of other practical and aesthetic purposes, including enhancing or reducing the appea ...

Government-owned companies of Brazil

Natural gas pipeline companies

Oil shale companies

Automotive fuel retailers

Biodiesel producers

Energy companies established in 1953

Non-renewable resource companies established in 1953

1953 establishments in Brazil

Multinational companies headquartered in Brazil

Companies listed on the New York Stock Exchange

Companies listed on B3 (stock exchange)

Companies listed on the Madrid Stock Exchange

Brazilian brands

Vaza Jato