Loss aversion on:

[Wikipedia]

[Google]

[Amazon]

Loss aversion is the tendency to prefer avoiding losses to acquiring equivalent gains. The principle is prominent in the domain of

Loss aversion is the tendency to prefer avoiding losses to acquiring equivalent gains. The principle is prominent in the domain of

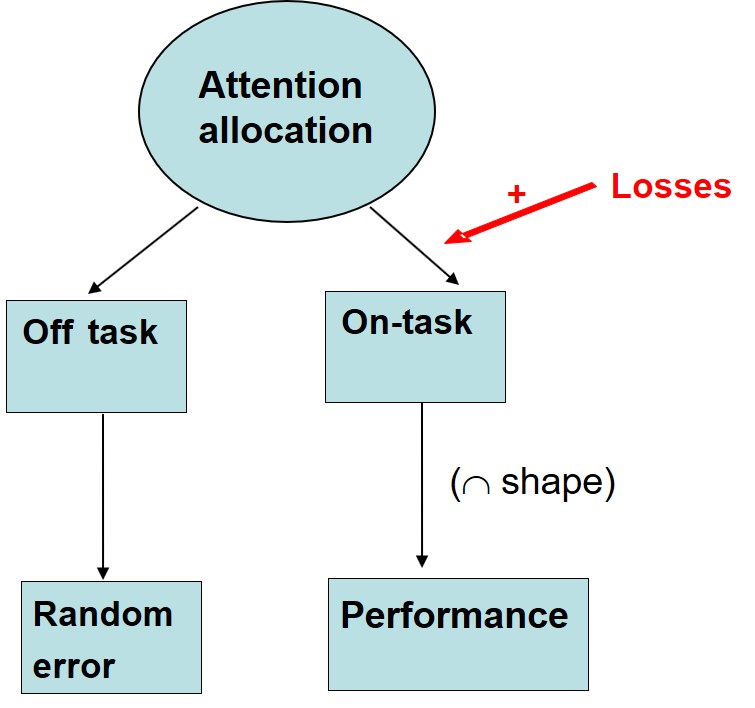

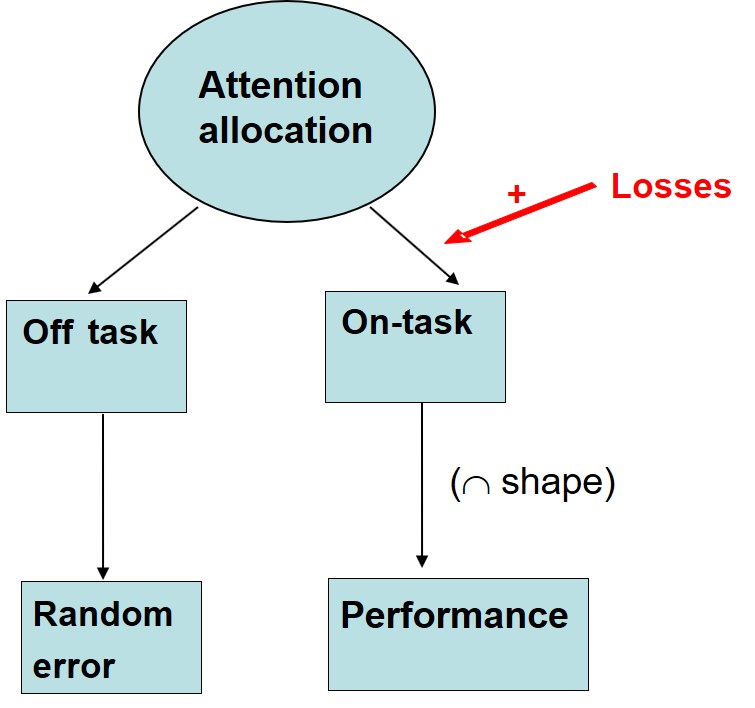

Specifically, the effect of losses is assumed to be on general attention rather than plain visual or auditory attention. The loss attention account assumes that losses in a given task mainly increase the general attentional resource pool available for that task. The increase in attention is assumed to have an inverse-U shape effect on performance (following the so called Yerkes-Dodson law).

The inverse U-shaped effect implies that the effect of losses on performance is most apparent in settings where task attention is low to begin with, for example in a monotonous vigilance task or when a concurrent task is more appealing. Indeed, it was found that the positive effect of losses on performance in a given task was more pronounced in a task performed concurrently with another task which was primary in its importance.

Loss attention is consistent with several empirical findings in economics , finance, marketing, and decision making. Some of these effects have been previously attributed to loss aversion, but can be explained by a mere attention asymmetry between gains and losses. An example is the performance advantage attributed to

Specifically, the effect of losses is assumed to be on general attention rather than plain visual or auditory attention. The loss attention account assumes that losses in a given task mainly increase the general attentional resource pool available for that task. The increase in attention is assumed to have an inverse-U shape effect on performance (following the so called Yerkes-Dodson law).

The inverse U-shaped effect implies that the effect of losses on performance is most apparent in settings where task attention is low to begin with, for example in a monotonous vigilance task or when a concurrent task is more appealing. Indeed, it was found that the positive effect of losses on performance in a given task was more pronounced in a task performed concurrently with another task which was primary in its importance.

Loss attention is consistent with several empirical findings in economics , finance, marketing, and decision making. Some of these effects have been previously attributed to loss aversion, but can be explained by a mere attention asymmetry between gains and losses. An example is the performance advantage attributed to

File:Tufted capuchin on a branch in Singapore.jpg, Tufted capuchin monkey display human-like behavioral biases, including loss aversion.

Loss aversion is the tendency to prefer avoiding losses to acquiring equivalent gains. The principle is prominent in the domain of

Loss aversion is the tendency to prefer avoiding losses to acquiring equivalent gains. The principle is prominent in the domain of economics

Economics () is the social science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics anal ...

. What distinguishes loss aversion from risk aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more ...

is that the utility

As a topic of economics, utility is used to model worth or value. Its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or happiness as part of the theory of utilitarianism by moral philosophe ...

of a monetary payoff depends on what was previously experienced or was expected to happen. Some studies have suggested that losses are twice as powerful, psychologically, as gains. Loss aversion was first identified by Amos Tversky

Amos Nathan Tversky ( he, עמוס טברסקי; March 16, 1937 – June 2, 1996) was an Israeli cognitive and mathematical psychologist and a key figure in the discovery of systematic human cognitive bias and handling of risk.

Much of his ...

and Daniel Kahneman

Daniel Kahneman (; he, דניאל כהנמן; born March 5, 1934) is an Israeli-American psychologist and economist notable for his work on the psychology of judgment and decision-making, as well as behavioral economics, for which he was award ...

.

Loss aversion implies that one who loses $100 will lose more satisfaction than the same person will gain satisfaction from a $100 windfall. In marketing

Marketing is the process of exploring, creating, and delivering value to meet the needs of a target market in terms of goods and services; potentially including selection of a target audience; selection of certain attributes or themes to emph ...

, the use of trial periods and rebates tries to take advantage of the buyer's tendency to value the good

In most contexts, the concept of good denotes the conduct that should be preferred when posed with a choice between possible actions. Good is generally considered to be the opposite of evil and is of interest in the study of ethics, morality, ph ...

more after the buyer incorporates it in the status quo. In past behavioral economics

Behavioral economics studies the effects of psychological, cognitive, emotional, cultural and social factors on the decisions of individuals or institutions, such as how those decisions vary from those implied by classical economic theory. ...

studies, users participate up until the threat of loss equals any incurred gains. Recent methods established by Botond Kőszegi and Matthew Rabin in experimental economics

Experimental economics is the application of experimental methods to study economic questions. Data collected in experiments are used to estimate effect size, test the validity of economic theories, and illuminate market mechanisms. Economic expe ...

illustrates the role of expectation, wherein an individual's belief about an outcome can create an instance of loss aversion, whether or not a tangible change of state has occurred.

Whether a transaction is framed as a loss or as a gain is important to this calculation. The same change in price framed differently, for example as a $5 discount or as a $5 surcharge avoided, has a significant effect on consumer behavior. Although traditional economists consider this "endowment effect

In psychology and behavioral economics, the endowment effect (also known as divestiture aversion and related to the mere ownership effect in social psychology) is the finding that people are more likely to retain an object they own than acquire th ...

", and all other effects of loss aversion, to be completely irrational

Irrationality is cognition, thinking, talking, or acting without inclusion of rationality. It is more specifically described as an action or opinion given through inadequate use of reason, or through emotional distress or cognitive deficiency. T ...

, it is important to the fields of marketing

Marketing is the process of exploring, creating, and delivering value to meet the needs of a target market in terms of goods and services; potentially including selection of a target audience; selection of certain attributes or themes to emph ...

and behavioral finance

Behavioral economics studies the effects of psychological, cognitive, emotional, cultural and social factors on the decisions of individuals or institutions, such as how those decisions vary from those implied by classical economic theory.

...

. Users in behavioral and experimental economics studies decided to cease participation in iterative money-making games when the threat of loss was close to the expenditure of effort, even when the user stood to further their gains. Loss aversion coupled with myopia has been shown to explain macroeconomic phenomena, such as the equity premium puzzle

The equity premium puzzle refers to the inability of an important class of economic models to explain the average equity risk premium (ERP) provided by a diversified portfolio of U.S. equities over that of U.S. Treasury Bills, which has been obse ...

.

History

Daniel Kahneman and his associate Amos Tversky originally coined the term loss aversion in 1979 in a paper on subjective probability. “The response to losses is stronger than the response to corresponding gains” is Kahneman’s definition of loss aversion. “Losses loom larger than gains” meaning that people by nature are aversive to losses. Loss aversion gets stronger as the stakes of a gamble or choice grow larger. Prospect theory and utility theory follow and allow the person to feel regret and anticipated disappointment for that said gamble. A person’s adaption level is their evaluation from a neutral point where outcomes are based on personal reference points. Past associations play a contributing factor in how a person evaluates a choice. Heuristic judgments come into play when past associations influence present decisions. Evaluating is associated with the word bias because it tends to be a deciding factor in a “zero validity” situation. Bias tends to go hand in hand with seeking immediate gratification. Individuals seek patterns impulsively to gain that instant gratification of winning a gamble. Rationality is distinguished from intelligence when it comes to gratification. People are drawn by specific priming and memories to pick an option that benefits them the most. Loss aversion is an instinct that involves a person comparing, reasoning, and ultimately making a choice. Loss aversion also occurs when a person is in a situation where they have an absence of a required skill. Heuristics takes over and the person begins to problem solve and try to find a valid solution. Both systems work together to help a person avoid losses and gain what is possible.Prospect theory

Loss aversion is part ofprospect theory

Prospect theory is a theory of behavioral economics and behavioral finance that was developed by Daniel Kahneman and Amos Tversky in 1979. The theory was cited in the decision to award Kahneman the 2002 Nobel Memorial Prize in Economics.

Based ...

, a cornerstone in behavioral economics. The theory explored numerous behavioral biases leading to sub-optimal decisions making. Kahneman and Tversky found that people are biased in their real estimation of probability of events happening. They tend to over-weight both low and high probabilities and under-weight medium probabilities.

Consider the following example: which option is more attractive? Option A – $1500 with a probability of 33%, $1400 with a probability of 66% and $0 with a probability of 1%; or Option B – a guaranteed $920. Prospect theory and loss aversion suggests that most people would choose option B as they prefer the guaranteed $920 since there is a probability of winning $0, even though it is only 1%. This demonstrates that people think in terms of expected utility relative to a reference point (i.e. current wealth) as opposed to absolute payoffs. When choices are framed as risky (i.e. risk losing 1 out of 10 lives vs the opportunity to save 9 out of 10 lives), individuals tend to be loss-averse as they weight losses more heavily than comparable gains.

The endowment effect

Humans are theorized to be hardwired to be loss averse due to asymmetric evolutionary pressure on losses and gains: "for an organism operating close to the edge of survival, the loss of a day's food could cause death, whereas the gain of an extra day's food would not cause an extra day of life (unless the food could be easily and effectively stored)". Loss aversion was first proposed as an explanation for theendowment effect

In psychology and behavioral economics, the endowment effect (also known as divestiture aversion and related to the mere ownership effect in social psychology) is the finding that people are more likely to retain an object they own than acquire th ...

—the fact that people place a higher value on a good that they own than on an identical good that they do not own—by Kahneman, Knetsch, and Thaler (1990). Loss aversion and the endowment effect lead to a violation of the Coase theorem

In law and economics, the Coase theorem () describes the economic efficiency of an economic allocation or outcome in the presence of externalities. The theorem states that if trade in an externality is possible and there are sufficiently low tra ...

—that "the allocation of resources will be independent of the assignment of property rights when costless trades are possible" (p. 1326).

In several studies, the authors demonstrated that the endowment effect could be explained by loss aversion but not five alternatives:

#transaction costs

#misunderstandings

#habitual bargaining behaviors

#income effects

#trophy

A trophy is a tangible, durable reminder of a specific achievement, and serves as a recognition or evidence of merit. Trophies are often awarded for sporting events, from youth sports to professional level athletics. In many sports medals (or, i ...

effects.

In each experiment half of the subjects were randomly assigned a good and asked for the minimum amount they would be willing to sell it for while the other half of the subjects were given nothing and asked for the maximum amount they would be willing to spend to buy the good. Since the value of the good is fixed and individual valuation of the good varies from this fixed value only due to sampling variation, the supply and demand curves should be perfect mirrors of each other and thus half the goods should be traded. The authors also ruled out the explanation that lack of experience with trading would lead to the endowment effect by conducting repeated markets.

The first two alternative explanation are that under-trading was due to transaction costs or misunderstanding—were tested by comparing goods markets to induced-value markets under the same rules. If it was possible to trade to the optimal level in induced value markets, under the same rules, there should be no difference in goods markets.The results showed drastic differences between induced-value markets and goods markets. The median

In statistics and probability theory, the median is the value separating the higher half from the lower half of a data sample, a population, or a probability distribution. For a data set, it may be thought of as "the middle" value. The basic f ...

prices of buyers and sellers in induced-value markets matched almost every time leading to near perfect market efficiency, but goods markets sellers had much higher selling prices than buyers' buying prices. This effect was consistent over trials, indicating that this was not due to inexperience with the procedure or the market. Since the transaction cost that could have been due to the procedure was equal in the induced-value and goods markets, transaction costs were eliminated as an explanation for the endowment effect.

The third alternative explanation was that people have habitual bargaining behaviors, such as overstating their minimum selling price or understating their maximum bargaining price, that may spill over from strategic interactions where these behaviors are useful to the laboratory setting where they are sub-optimal. An experiment was conducted to address this by having the clearing prices selected at random. Buyers who indicated a willingness-to-pay higher than the randomly drawn price got the good, and vice versa for those who indicated a lower WTP. Likewise, sellers who indicated a lower willingness-to-accept than the randomly drawn price sold the good and vice versa. This incentive compatible value elicitation method did not eliminate the endowment effect but did rule out habitual bargaining behavior as an alternative explanation.

Income effects were ruled out by giving one third of the participants mugs, one third chocolates, and one third neither mug nor chocolate. They were then given the option of trading the mug for the chocolate or vice versa and those with neither were asked to merely choose between mug and chocolate. Thus, wealth effects were controlled for those groups who received mugs and chocolate. The results showed that 86% of those starting with mugs chose mugs, 10% of those starting with chocolates chose mugs, and 56% of those with nothing chose mugs. This ruled out income effects as an explanation for the endowment effect. Also, since all participants in the group had the same good, it could not be considered a "trophy", eliminating the final alternative explanation.

Thus, the five alternative explanations were eliminated in the following ways:

* 1 and 2: Induced-value market vs. consumption goods market;

* 3: Incentive compatible value elicitation procedure;

* 4 and 5: Choice between endowed or alternative good.

Criticisms of loss aversion

Multiple studies have questioned the existence of loss aversion. In several studies examining the effect of losses in decision-making, no loss aversion was found under risk and uncertainty. There are several explanations for these findings: one, is that loss aversion does not exist in small payoff magnitudes (called magnitude dependent loss aversion by Mukherjee et al.(2017); which seems to hold true for time as well. The other is that the generality of the loss aversion pattern is lower than previously thought.David Gal

David Gal iProfessor of Marketingat the University of Illinois at Chicago. He is best known for his critiques of behavioral economics, and in particular his critique of the behavioral economics concept of loss aversion. His forthcoming book is ti ...

(2006) argued that many of the phenomena commonly attributed to loss aversion, including the status quo bias, the endowment effect, and the preference for safe over risky options, are more parsimoniously explained by psychological inertia

Psychological inertia is the tendency to maintain the status-quo (or default option) unless compelled by a psychological motive to intervene or reject this.

Psychological inertia is similar to the status-quo bias but there is an important distin ...

than by a loss/gain asymmetry. Gal and Rucker (2018) made similar arguments. Mkrva, Johnson, Gächter, and Herrmann (2019) cast doubt on these critiques, replicating loss aversion in five unique samples while also showing how the magnitude of loss aversion varies in theoretically predictable ways. A paper by John Staddon, citing Claude Bernard

Claude Bernard (; 12 July 1813 – 10 February 1878) was a French physiologist. Historian I. Bernard Cohen of Harvard University called Bernard "one of the greatest of all men of science". He originated the term '' milieu intérieur'', and the ...

, pointed out that effects like loss aversion represent the average behavior of groups. There are many individual exceptions. To use these effects as something more than the results of an opinion poll means identifying the sources of variation, so that they can be demonstrated reliably in individual subjects.

Loss aversion may be more salient when people compete. Gill and Prowse (2012) provide experimental evidence that people are loss averse around reference points given by their expectations in a competitive environment with real effort. Losses may also have an effect on attention but not on the weighting of outcomes; losses lead to more autonomic arousal than gains even in the absence of loss aversion. This latter effect is sometimes known as Loss Attention.

Alternatives to loss aversion: Loss attention

Loss attention refers to the tendency of individuals to allocate more attention to a task or situation when it involve losses than when it does not involve losses. What distinguishes loss attention from loss aversion is that it does not imply that losses are given more subjective weight (orutility

As a topic of economics, utility is used to model worth or value. Its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or happiness as part of the theory of utilitarianism by moral philosophe ...

) than gains. Moreover, under loss aversion losses have a ''biasing'' effect whereas under loss attention they can have a ''debiasing'' effect. Loss attention was proposed as a distinct regularity from loss aversion by Eldad Yechiam and Guy Hochman.

Specifically, the effect of losses is assumed to be on general attention rather than plain visual or auditory attention. The loss attention account assumes that losses in a given task mainly increase the general attentional resource pool available for that task. The increase in attention is assumed to have an inverse-U shape effect on performance (following the so called Yerkes-Dodson law).

The inverse U-shaped effect implies that the effect of losses on performance is most apparent in settings where task attention is low to begin with, for example in a monotonous vigilance task or when a concurrent task is more appealing. Indeed, it was found that the positive effect of losses on performance in a given task was more pronounced in a task performed concurrently with another task which was primary in its importance.

Loss attention is consistent with several empirical findings in economics , finance, marketing, and decision making. Some of these effects have been previously attributed to loss aversion, but can be explained by a mere attention asymmetry between gains and losses. An example is the performance advantage attributed to

Specifically, the effect of losses is assumed to be on general attention rather than plain visual or auditory attention. The loss attention account assumes that losses in a given task mainly increase the general attentional resource pool available for that task. The increase in attention is assumed to have an inverse-U shape effect on performance (following the so called Yerkes-Dodson law).

The inverse U-shaped effect implies that the effect of losses on performance is most apparent in settings where task attention is low to begin with, for example in a monotonous vigilance task or when a concurrent task is more appealing. Indeed, it was found that the positive effect of losses on performance in a given task was more pronounced in a task performed concurrently with another task which was primary in its importance.

Loss attention is consistent with several empirical findings in economics , finance, marketing, and decision making. Some of these effects have been previously attributed to loss aversion, but can be explained by a mere attention asymmetry between gains and losses. An example is the performance advantage attributed to golf

Golf is a club-and-ball sport in which players use various clubs to hit balls into a series of holes on a course in as few strokes as possible.

Golf, unlike most ball games, cannot and does not use a standardized playing area, and coping wi ...

rounds where a player is under par (or in a disadvantage) compared to other rounds where a player is at an advantage.

Clearly, the difference could be attributed to increased attention in the former type of rounds.

Recently, studies have suggested that loss aversion mostly occur for very large losses though the exact boundaries of the effect are unclear. On the other hand, loss attention was found even for small payoffs, such as $1. This suggests that loss attention may be more robust than loss aversion. Still, one might argue that loss aversion is more parsimonious than loss attention.

Additional phenomena explained by loss attention:

''Increased expected value maximization with losses'' – It was found that individuals are more likely to select choice options with higher expected value

In probability theory, the expected value (also called expectation, expectancy, mathematical expectation, mean, average, or first moment) is a generalization of the weighted average. Informally, the expected value is the arithmetic mean of a ...

(namely, mean outcome) in tasks where outcomes are framed as losses than when they are framed as gains. Yechiam and Hochman found that this effect occurred even when the alternative producing higher expected value was the one that included minor losses. Namely, a highly advantageous alternative producing minor losses was more attractive compared when it did not produce losses. Therefore, paradoxically, in their study minor losses led to more selection from the alternative generating them (refuting an explanation of this phenomenon based on loss aversion).

''Loss arousal'' – Individuals were found to display greater Autonomic Nervous System

The autonomic nervous system (ANS), formerly referred to as the vegetative nervous system, is a division of the peripheral nervous system that supplies internal organs, smooth muscle and glands. The autonomic nervous system is a control system t ...

activation following losses than following equivalent gains. For example, pupil diameter and heart rate were found to increase following both gains and losses, but the size of the increase was higher following losses. Importantly, this was found even for small losses and gains where individuals do not show loss aversion. Similarly, a positive effect of losses compared to equivalent gains was found on activation of midfrontal cortical networks 200 to 400 milliseconds after observing the outcome. This effect as well was found in the absence of loss aversion.

''Increased hot stove effect for losses'' – The hot stove effect is the finding that individuals avoid a risky alternative when the available information is limited to the obtained payoffs. A relevant example (proposed by Mark Twain

Samuel Langhorne Clemens (November 30, 1835 – April 21, 1910), known by his pen name Mark Twain, was an American writer, humorist, entrepreneur, publisher, and lecturer. He was praised as the "greatest humorist the United States has pr ...

) is of a cat which jumped of a hot stove and will never do it again, even when the stove is cold and potentially contains food. Apparently, when a given option produces losses this increases the hot stove effect, a finding which is consistent with the notion that losses increase attention.

''The out of pocket phenomenon'' – In financial decision making, it has been shown that people are more motivated when their incentives are to avoid losing personal resources, as opposed to gaining equivalent resources. Traditionally, this strong behavioral tendency was explained by loss aversion. However, it could also be explained simply as increased attention.

''The allure of minor disadvantages'' – In marketing studies it has been demonstrated that products whose minor negative features are highlighted (in addition to positive features) are perceived as more attractive. Similarly, messages discussing both the advantages and disadvantages of a product were found to be more convincing than one-sided messages. Loss attention explains this as due to attentional competition between options, and increased attention following the highlighting of small negatives, which can increase the attractiveness of a product or a candidate either due to exposure or learning.

In nonhuman subjects

In 2005, experiments were conducted on the ability ofcapuchin monkey

The capuchin monkeys () are New World monkeys of the subfamily Cebinae. They are readily identified as the " organ grinder" monkey, and have been used in many movies and television shows. The range of capuchin monkeys includes some tropical fores ...

s to use money. After several months of training, the monkeys began showing behavior considered to reflect understanding of the concept of a medium of exchange. They exhibited the same propensity to avoid perceived losses demonstrated by human subjects and investors.

Chen, Lakshminarayanan and Santos (2006) also conducted experiments on capuchin monkeys to determine whether behavioral biases extend across species. In one of their experiments, subjects were presented with two choices that both delivered an identical payoff of one apple piece in exchange of their coins. Experimenter 1 displayed one apple piece and gave that exact amount. Experimenter 2 displayed two applies pieces initially but always removed one piece before delivering the remaining apple piece to the subject. Therefore, identical payoffs are yielded regardless of which experimenter the subject traded with. It was found a that subjects strongly preferred the experimenter who initially displayed only one apple piece, even though both experimenters yielded the same out come of one apple piece. This study suggests that capuchins weighted losses more heavily than equivalent gains. Expectation-based

Expectation-based loss aversion is a phenomenon in behavioral economics. When the expectations of an individual fail to match reality, they lose an amount of utility from the lack of experiencing fulfillment of these expectations. Analytical framework by Botond Kőszegi and Matthew Rabin provides a methodology through which such behavior can be classified and even predicted. An individual's most recent expectations influences loss aversion in outcomes outside the status quo; a shopper intending to buy a pair of shoes on sale experiences loss aversion when the pair they had intended to buy is no longer available. Subsequent research performed by Johannes Abeler,Armin Falk

Armin Falk (born 18 January 1968) is a German economist. He has held a chair at the University of Bonn since 2003.

Biography

Education and career

Falk studied economics as well as philosophy and history at the University of Cologne. In 1998 ...

, Lorenz Goette, and David Huffman in conjunction with the Institute of Labor Economics used the framework of Kőszegi and Rabin to prove that people experience expectation-based loss aversion at multiple thresholds. The study evinced that reference points of people causes a tendency to avoid expectations going unmet. Participants were asked to participate in an iterative money-making task given the possibilities that they would receive either an accumulated sum for each round of "work", or a predetermined amount of money. With a 50% chance of receiving the "fair" compensation, participants were more likely to quit the experiment as this amount approached the fixed payment. They chose to stop when the values were equal as no matter which random result they received, their expectations would be matched. Participants were reluctant to work for more than the fixed payment as there was an equal chance their expected compensation would not be met.

Within education

Loss aversion experimentation has most recently been applied within an educational setting in an effort to improve achievement within the U.S. In this latest experiment, Fryer et al. posits framing merit pay in terms of a loss in order to be most effective. This study was performed in the city of Chicago Heights within nine K-8 urban schools, which included 3,200 students. 150 out of 160 eligible teachers participated and were assigned to one of four treatment groups or a control group. Teachers in the incentive groups received rewards based on their students' end of the year performance on the ThinkLink Predictive Assessment and K-2 students took the Iowa Test of Basic Skills (ITBS). The control group followed the traditional merit pay process of receiving "bonus pay" at the end of the year based on student performance on standardized exams. However, the experimental groups received a lump sum given at beginning of the year, that would have to be paid back. The bonus was equivalent to approximately 8% of the average teacher salary in Chicago Heights, approximately $8,000. According to the authors, 'this suggests that there may be significant potential for exploiting loss aversion in the pursuit of both optimal public policy and the pursuit of profits'. Thomas Amadio, superintendent of Chicago Heights Elementary School District 170, where the experiment was conducted, stated that "the study shows the value of merit pay as an encouragement for better teacher performance".Neural aspect of loss aversion

In earlier studies, both bidirectionalmesolimbic

The mesolimbic pathway, sometimes referred to as the reward pathway, is a dopaminergic pathway in the brain. The pathway connects the ventral tegmental area in the midbrain to the ventral striatum of the basal ganglia in the forebrain. The ventra ...

responses of activation for gains and deactivation for losses (or vica versa) and gain or loss-specific responses have been seen. While reward anticipation is associated with ventral striatum

The striatum, or corpus striatum (also called the striate nucleus), is a nucleus (a cluster of neurons) in the subcortical basal ganglia of the forebrain. The striatum is a critical component of the motor and reward systems; receives gluta ...

activation, negative outcome anticipation engages the amygdala

The amygdala (; plural: amygdalae or amygdalas; also '; Latin from Greek, , ', 'almond', 'tonsil') is one of two almond-shaped clusters of nuclei located deep and medially within the temporal lobes of the brain's cerebrum in complex ver ...

. However, only some studies have shown involvement of amygdala during negative outcome anticipation but not others which has led to some inconsistencies. It has later been proven that inconsistencies may only have been due to methodological issues including the utilisation of different tasks and stimuli, coupled with ranges of potential gains or losses sampled from either payoff matrices rather than parametric designs, and most of the data are reported in groups, therefore ignoring the variability amongst individuals. Thus later studies rather than focusing on subjects in groups, focus more on individual differences in the neural bases by jointly looking at behavioural analyses and neuroimaging.

Neuroimaging

Neuroimaging is the use of quantitative (computational) techniques to study the structure and function of the central nervous system, developed as an objective way of scientifically studying the healthy human brain in a non-invasive manner. Incr ...

studies on loss aversion involves measuring brain activity with functional magnetic resonance imaging

Functional magnetic resonance imaging or functional MRI (fMRI) measures brain activity by detecting changes associated with blood flow. This technique relies on the fact that cerebral blood flow and neuronal activation are coupled. When an area o ...

(fMRI) to investigate whether individual variability in loss aversion were reflected in differences in brain activity through bidirectional or gain or loss specific responses, as well as multivariate source-based morphometry (SBM) to investigate a structural network of loss aversion and univariate voxel-based morphometry

Voxel-based morphometry is a computational approach to neuroanatomy that measures differences in local concentrations of brain tissue, through a voxel-wise comparison of multiple brain images.

In traditional morphometry, volume of the whole br ...

(VBM) to identify specific functional regions within this network.

Brain activity in a right ventral striatum cluster increases particularly when anticipating gains. This involves the ventral caudate nucleus

The caudate nucleus is one of the structures that make up the corpus striatum, which is a component of the basal ganglia in the human brain. While the caudate nucleus has long been associated with motor processes due to its role in Parkinson's d ...

, pallidum, putamen

The putamen (; from Latin, meaning "nutshell") is a round structure located at the base of the forebrain (telencephalon). The putamen and caudate nucleus together form the dorsal striatum. It is also one of the structures that compose the basal ...

, bilateral orbitofrontal cortex

The orbitofrontal cortex (OFC) is a prefrontal cortex region in the frontal lobes of the brain which is involved in the cognitive process of decision-making. In non-human primates it consists of the association cortex areas Brodmann area 11, 1 ...

, superior frontal and middle gyri

In neuroanatomy, a gyrus (pl. gyri) is a ridge on the cerebral cortex. It is generally surrounded by one or more sulci (depressions or furrows; sg. ''sulcus''). Gyri and sulci create the folded appearance of the brain in humans and other ...

, posterior cingulate cortex

The posterior cingulate cortex (PCC) is the caudal part of the cingulate cortex, located posterior to the anterior cingulate cortex. This is the upper part of the " limbic lobe". The cingulate cortex is made up of an area around the midline of th ...

, dorsal anterior cingulate cortex

In the human brain, the anterior cingulate cortex (ACC) is the frontal part of the cingulate cortex that resembles a "collar" surrounding the frontal part of the corpus callosum. It consists of Brodmann areas 24, 32, and 33.

It is involve ...

, and parts of the dorsomedial thalamus

The thalamus (from Greek θάλαμος, "chamber") is a large mass of gray matter located in the dorsal part of the diencephalon (a division of the forebrain). Nerve fibers project out of the thalamus to the cerebral cortex in all direct ...

connecting to temporal and prefrontal cortex

In mammalian brain anatomy, the prefrontal cortex (PFC) covers the front part of the frontal lobe of the cerebral cortex. The PFC contains the Brodmann areas BA8, BA9, BA10, BA11, BA12, BA13, BA14, BA24, BA25, BA32, BA44, BA45, BA ...

. There is a significant correlation between degree of loss aversion and strength of activity in both the frontomedial cortex and the ventral striatum. This is shown by the slope of brain activity deactivation for increasing losses being significantly greater than the slope of activation for increasing gains in the appetitive system involving the ventral striatum in the network of reward-based behavioural learning. On the other hand, when anticipating loss, the central and basal nuclei of amygdala, right posterior insula extending into the supramarginal gyrus

The supramarginal gyrus is a portion of the parietal lobe. This area of the brain is also known as Brodmann area 40 based on the brain map created by Korbinian Brodmann to define the structures in the cerebral cortex. It is probably involved wi ...

mediate the output to other structures involved in the expression of fear and anxiety, such as the right parietal operculum and supramarginal gyrus. Consistent with gain anticipation, the slope of the activation for increasing losses was significantly greater than the slope of the deactivation for increasing gains.

Multiple neural mechanisms are recruited while making choices, showing functional and structural individual variability. Biased anticipation of negative outcomes leading to loss aversion involves specific somatosensory

In physiology, the somatosensory system is the network of neural structures in the brain and body that produce the perception of touch (haptic perception), as well as temperature (thermoception), body position ( proprioception), and pain. It ...

and limbic structures. fMRI test measuring neural responses in striatal

The striatum, or corpus striatum (also called the striate nucleus), is a nucleus (a cluster of neurons) in the subcortical basal ganglia of the forebrain. The striatum is a critical component of the motor and reward systems; receives glutamate ...

, limbic and somatosensory brain regions help track individual differences in loss aversion. Its limbic component involved the amygdala (associated with negative emotion and plays a role in the expression of fear) and putamen

The putamen (; from Latin, meaning "nutshell") is a round structure located at the base of the forebrain (telencephalon). The putamen and caudate nucleus together form the dorsal striatum. It is also one of the structures that compose the basal ...

in the right hemisphere

The lateralization of brain function is the tendency for some neural functions or cognitive processes to be specialized to one side of the brain or the other. The median longitudinal fissure separates the human brain into two distinct cerebr ...

. The somatosensory component included the middle cingulate cortex

The cingulate cortex is a part of the brain situated in the medial aspect of the cerebral cortex. The cingulate cortex includes the entire cingulate gyrus, which lies immediately above the corpus callosum, and the continuation of this in the c ...

, as well as the posterior insula and rolandic operculum bilaterally. The latter cluster partially overlaps with the right hemispheric one displaying the loss-oriented bidirectional response previously described, but, unlike that region, it mostly involved the posterior insula bilaterally. All these structures play a critical role in detecting threats and prepare the organism for appropriate action, with the connections between amygdala nuclei and the striatum controlling the avoidance of aversive events. There are functional differences between the right and left amygdala. Overall, the role of amygdala in loss anticipation suggested that loss aversion may reflect a Pavlovian

Classical conditioning (also known as Pavlovian or respondent conditioning) is a behavioral procedure in which a biologically potent stimulus (e.g. food) is paired with a previously neutral stimulus (e.g. a triangle). It also refers to the learn ...

conditioned approach-avoidance response. Hence, there is a direct link between individual differences in the structural properties of this network and the actual consequences of its associated behavioral defense responses.

The neural activity involved in the processing of aversive experience and stimuli is not just a result of a temporary fearful overreaction prompted by choice-related information, but rather a stable component of one's own preference function, reflecting a specific pattern of neural activity encoded in the functional and structural construction of a limbic-somatosensory neural system anticipating heightened aversive state of the brain. Even when no choice is required, individual differences in the intrinsic responsiveness of this interoceptive system reflect the impact of anticipated negative effects on evaluative processes, leading preference for avoiding losses rather than acquiring greater but riskier gains.

Individual differences in loss aversion are related to variables such as age, gender, and genetic factors affecting thalamic norepinephrine transmission, as well as neural structure and activities. Outcome anticipation and ensuing loss aversion involve multiple neural systems, showing functional and structural individual variability directly related to the actual outcomes of choices.

In a study, adolescents and adults are found to be similarly loss-averse on behavioural level but they demonstrated different underlying neural responses to the process of rejecting gambles. Although adolescents rejected the same proportion of trials as adults, adolescents displayed greater caudate and frontal pole activation than adults to achieve this. These findings suggest a difference in neural development during the avoidance of risk. It is possible that adding affectively arousing factors (e.g. peer influences) may overwhelm the reward-sensitive regions of the adolescent decision making system leading to risk-seeking behaviour. On the other hand, although men and women did not differ on their behavioural task performance, men showed greater neural activation than women in various areas during the task. Loss of striatal dopamine neurons is associated with reduced risk-taking behaviour. Acute administration of D2 dopamine agonists may cause an increase in risky choices in humans. This suggests dopamine acting on stratum and possibly other mesolimbic structures can modulate loss aversion by reducing loss prediction signalling.

See also

*Prospect theory

Prospect theory is a theory of behavioral economics and behavioral finance that was developed by Daniel Kahneman and Amos Tversky in 1979. The theory was cited in the decision to award Kahneman the 2002 Nobel Memorial Prize in Economics.

Based ...

* Equity premium puzzle

The equity premium puzzle refers to the inability of an important class of economic models to explain the average equity risk premium (ERP) provided by a diversified portfolio of U.S. equities over that of U.S. Treasury Bills, which has been obse ...

* Escalation of commitment

Escalation of commitment is a human behavior pattern in which an individual or group facing increasingly negative outcomes from a decision, action, or investment nevertheless continue the behavior instead of altering course. The actor maintains ...

* List of cognitive biases

Cognitive biases are systematic patterns of deviation from norm and/or rationality in judgment. They are often studied in psychology, sociology and behavioral economics.

Although the reality of most of these biases is confirmed by reproducible re ...

* Risk aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more ...

* Status quo bias

Status quo bias is an emotional bias; a preference for the maintenance of one's current or previous state of affairs, or a preference to not undertake any action to change this current or previous state. The current baseline (or status quo) is tak ...

* Sunk cost fallacy

References

Sources

* * * * * * * * * * * * * * * * {{cite journal , doi=10.1016/j.dcn.2012.09.007, pmid=23245222, title=Behavioral and neural correlates of loss aversion and risk avoidance in adolescents and adults, journal=Developmental Cognitive Neuroscience, volume=3, pages=72–83, year=2013, last1=Barkley-Levenson, first1=Emily E., last2=Van Leijenhorst, first2=Linda, last3=Galván, first3=Adriana, pmc=6987718, doi-access=free Cognitive biases Consumer theory Decision theory Prospect theory