Latin American debt crisis on:

[Wikipedia]

[Google]

[Amazon]

The Latin American debt crisis ( es, Crisis de la deuda latinoamericana; pt, Crise da dívida latino-americana) was a financial crisis that originated in the early 1980s (and for some countries starting in the 1970s), often known as ''

The Latin American debt crisis ( es, Crisis de la deuda latinoamericana; pt, Crise da dívida latino-americana) was a financial crisis that originated in the early 1980s (and for some countries starting in the 1970s), often known as ''

In the 1960s and 1970s, many

In the 1960s and 1970s, many

As interest rates increased in the United States of America and in

As interest rates increased in the United States of America and in

The debt crisis of 1982 was the most serious of Latin America's history. Incomes and imports dropped; economic growth stagnated; unemployment rose to high levels; and inflation reduced the buying power of the middle classes.García Bernal, Manuela Cristina (1991). "Iberoamérica: Evolución de una Economía Dependiente". In Luís Navarro García (Coord.), ''Historia de las Américas'', vol. IV, pp. 565–619. Madrid/Sevilla: Alhambra Longman/Universidad de Sevilla. In fact, in the ten years after 1980, real wages in urban areas actually dropped between 20 and 40 percent. Additionally, investment that might have been used to address social issues and poverty was instead being used to pay the debt. Losses to bankers in the United States were catastrophic, perhaps more than the banking industry's entire collective profits since the nation's founding in the late 1700s.

In response to the crisis, most nations abandoned their import substitution industrialization (ISI) models of economy and adopted an export-oriented industrialization strategy, usually the

The debt crisis of 1982 was the most serious of Latin America's history. Incomes and imports dropped; economic growth stagnated; unemployment rose to high levels; and inflation reduced the buying power of the middle classes.García Bernal, Manuela Cristina (1991). "Iberoamérica: Evolución de una Economía Dependiente". In Luís Navarro García (Coord.), ''Historia de las Américas'', vol. IV, pp. 565–619. Madrid/Sevilla: Alhambra Longman/Universidad de Sevilla. In fact, in the ten years after 1980, real wages in urban areas actually dropped between 20 and 40 percent. Additionally, investment that might have been used to address social issues and poverty was instead being used to pay the debt. Losses to bankers in the United States were catastrophic, perhaps more than the banking industry's entire collective profits since the nation's founding in the late 1700s.

In response to the crisis, most nations abandoned their import substitution industrialization (ISI) models of economy and adopted an export-oriented industrialization strategy, usually the

Latin American Debt Crisis: Effects on Mexico

from th

Dean Peter Krogh Foreign Affairs Digital Archives

International Monetary Fund

{{Financial crises 1970s economic history 1980s economic history Economic history of Mexico Financial crises History of government debt Latin American history Economy of Central America Economy of South America Economy of the Caribbean 1970s in South America 1980s in South America 1970s in Central America 1980s in Central America

La Década Perdida

"La Década Perdida" ("The Lost Decade") of Latin America is a Spanish term used to describe the economic crisis suffered in Latin America during the 1980s, which continued for some countries into the next decade. In general, the crisis wa ...

'' (The Lost Decade), when Latin America

Latin America or

* french: Amérique Latine, link=no

* ht, Amerik Latin, link=no

* pt, América Latina, link=no, name=a, sometimes referred to as LatAm is a large cultural region in the Americas where Romance languages — languages derived ...

n countries reached a point where their foreign debt exceeded their earning power, and they were not able to repay it.

Origins

In the 1960s and 1970s, many

In the 1960s and 1970s, many Latin America

Latin America or

* french: Amérique Latine, link=no

* ht, Amerik Latin, link=no

* pt, América Latina, link=no, name=a, sometimes referred to as LatAm is a large cultural region in the Americas where Romance languages — languages derived ...

n countries, notably Brazil

Brazil ( pt, Brasil; ), officially the Federative Republic of Brazil (Portuguese: ), is the largest country in both South America and Latin America. At and with over 217 million people, Brazil is the world's fifth-largest country by area ...

, Argentina

Argentina (), officially the Argentine Republic ( es, link=no, República Argentina), is a country in the southern half of South America. Argentina covers an area of , making it the List of South American countries by area, second-largest ...

, and Mexico

Mexico (Spanish language, Spanish: México), officially the United Mexican States, is a List of sovereign states, country in the southern portion of North America. It is borders of Mexico, bordered to the north by the United States; to the so ...

, borrowed huge sums of money from international creditor

A creditor or lender is a party (e.g., person, organization, company, or government) that has a claim on the services of a second party. It is a person or institution to whom money is owed. The first party, in general, has provided some property ...

s for industrialization

Industrialisation ( alternatively spelled industrialization) is the period of social and economic change that transforms a human group from an agrarian society into an industrial society. This involves an extensive re-organisation of an econo ...

, especially infrastructure

Infrastructure is the set of facilities and systems that serve a country, city, or other area, and encompasses the services and facilities necessary for its economy, households and firms to function. Infrastructure is composed of public and priv ...

programs. These countries had soaring economies at the time, so the creditors were happy to provide loans. Initially, developing countries typically garnered loans through public routes like the World Bank

The World Bank is an international financial institution that provides loans and grants to the governments of low- and middle-income countries for the purpose of pursuing capital projects. The World Bank is the collective name for the Inte ...

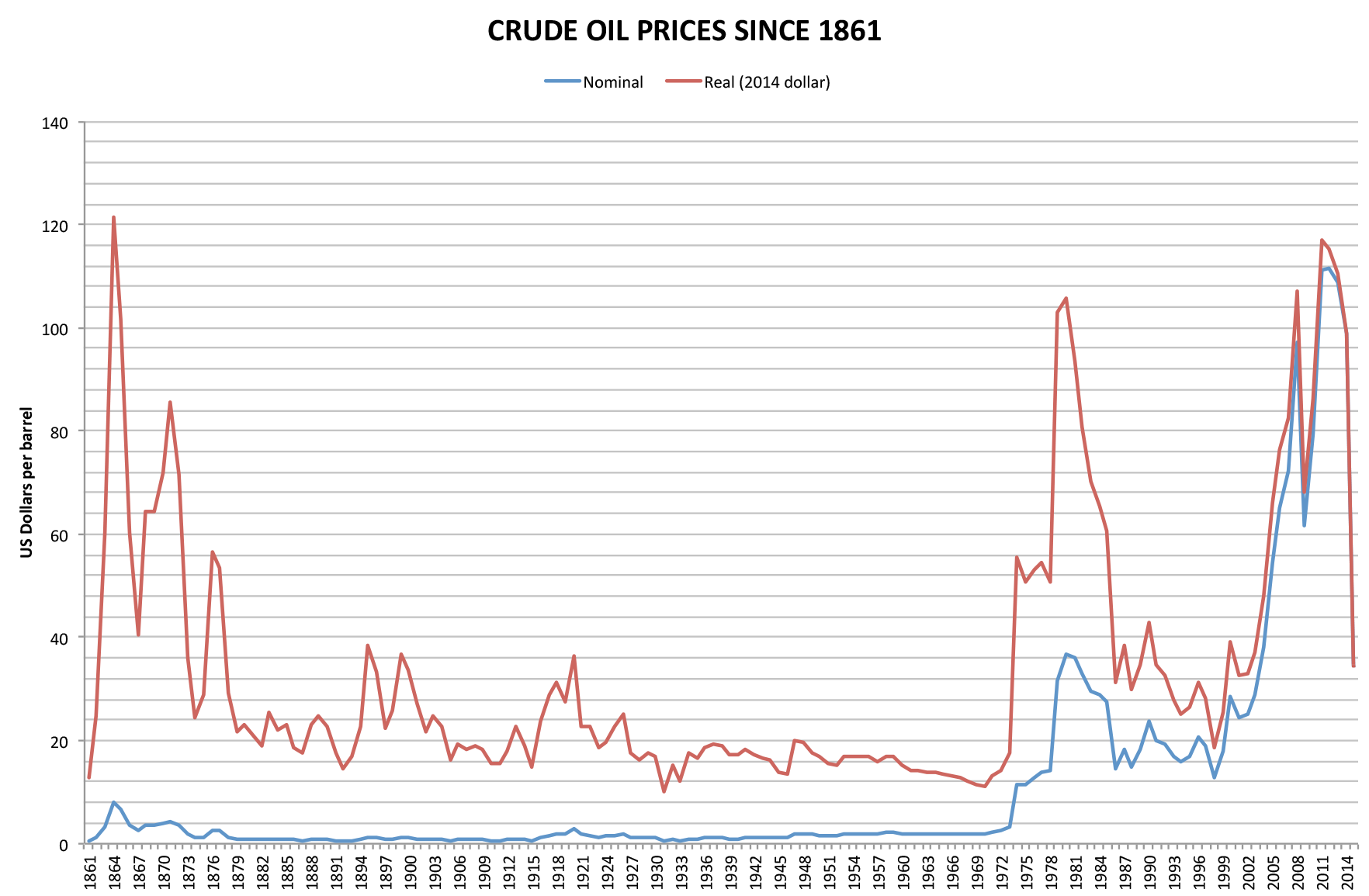

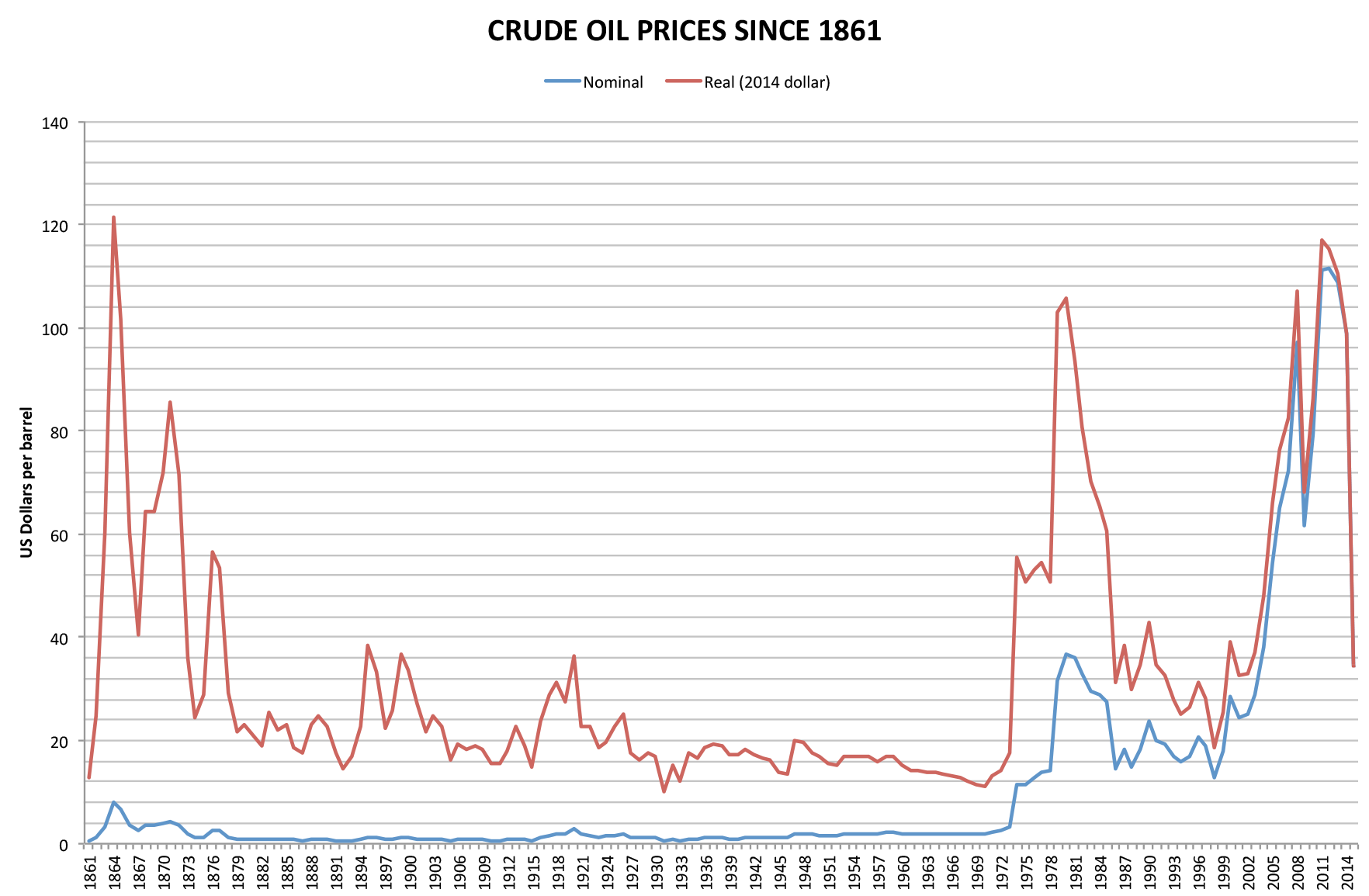

. After 1973, private banks had an influx of funds from oil-rich countries which believed that sovereign debt was a safe investment. Mexico borrowed against future oil revenues with the debt valued in US dollars, so that when the price of oil collapsed, so did the Mexican economy.

Between 1975 and 1982, Latin American debt to commercial bank

A commercial bank is a financial institution which accepts deposits from the public and gives loans for the purposes of consumption and investment to make profit.

It can also refer to a bank, or a division of a large bank, which deals with ...

s increased at a cumulative annual rate of 20.4 percent. This heightened borrowing led Latin America to quadruple its external debt from US$75 billion in 1975 to more than $315 billion in 1983, or 50 percent of the region's gross domestic product

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is of ...

(GDP). Debt service (interest payments and the repayment of principal) grew even faster as global interest rates surged, reaching $66 billion in 1982, up from $12 billion in 1975.

History

When the world economy went intorecession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

in the 1970s and 1980s, and oil prices skyrocketed, it created a breaking point for most countries in the region. Developing countries

A developing country is a sovereign state with a lesser developed industrial base and a lower Human Development Index (HDI) relative to other countries. However, this definition is not universally agreed upon. There is also no clear agreem ...

found themselves in a desperate liquidity crunch. Petroleum

Petroleum, also known as crude oil, or simply oil, is a naturally occurring yellowish-black liquid mixture of mainly hydrocarbons, and is found in geological formations. The name ''petroleum'' covers both naturally occurring unprocessed crud ...

-exporting countries, flush with cash after the oil price increases of 1973–1980, invested their money with international banks, which "recycled" a major portion of the capital

Capital may refer to:

Common uses

* Capital city, a municipality of primary status

** List of national capital cities

* Capital letter, an upper-case letter Economics and social sciences

* Capital (economics), the durable produced goods used fo ...

as syndicated loans to Latin American governments. The sharp increase in oil prices caused many countries to search out more loans to cover the high prices, and even some oil-producing countries took on substantial debt for economic development, hoping that high prices would persist and allow them to pay off their debt.

As interest rates increased in the United States of America and in

As interest rates increased in the United States of America and in Europe

Europe is a large peninsula conventionally considered a continent in its own right because of its great physical size and the weight of its history and traditions. Europe is also considered a Continent#Subcontinents, subcontinent of Eurasia ...

in 1979, debt payments also increased, making it harder for borrowing countries to pay back their debts. Deterioration in the exchange rate with the US dollar meant that Latin American governments ended up owing tremendous quantities of their national currencies, as well as losing purchasing power. The contraction of world trade in 1981 caused the prices of primary resources (Latin America's largest export) to fall.

While the dangerous accumulation of foreign debt occurred over a number of years, the debt crisis began when the international capital markets became aware that Latin America would not be able to pay back its loans. This occurred in August 1982 when Mexico's Finance Minister, Jesús Silva-Herzog, declared that Mexico would no longer be able to service its debt. Mexico stated that it could not meet its payment due dates, and announced unilaterally a moratorium of 90 days; it also requested a renegotiation of payment periods and new loans in order to fulfill its prior obligations.

In the wake of Mexico's sovereign default, most commercial banks reduced significantly or halted new lending to Latin America. As much of Latin America's loans were short-term, a crisis ensued when their refinancing was refused. Billions of dollars of loans that previously would have been refinanced, were now due immediately.

The banks had to somehow restructure the debts to avoid financial panic; this usually involved new loans with very strict conditions, as well as the requirement that the debtor countries accept the intervention of the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

(IMF). There were several stages of strategies to slow and end the crisis. The IMF moved to restructure the payments and reduce government spending in debtor countries. Later it and the World Bank encouraged open markets. Finally, the US and the IMF pushed for debt relief, recognizing that countries would not be able to pay back in full the large sums they owed.

However, some unorthodox economists like Stephen Kanitz

Stephen Charles Kanitz (born in São Paulo) is a Brazilian business consultant, lecturer, professor and writer.

Academic life

He holds a D.Sc. in Accounting from University of São Paulo, Master's degree in Business Administration from Harvar ...

attribute the debt crisis not to the high level of indebtedness nor to the disorganization of the continent's economy. They say that the cause of the crisis was leverage limits such as US government banking regulations which forbid its banks from lending over ten times the amount of their capital, a regulation that, when the inflation eroded their lending limits, forced them to cut the access of underdeveloped countries to international savings.

Effects

The debt crisis of 1982 was the most serious of Latin America's history. Incomes and imports dropped; economic growth stagnated; unemployment rose to high levels; and inflation reduced the buying power of the middle classes.García Bernal, Manuela Cristina (1991). "Iberoamérica: Evolución de una Economía Dependiente". In Luís Navarro García (Coord.), ''Historia de las Américas'', vol. IV, pp. 565–619. Madrid/Sevilla: Alhambra Longman/Universidad de Sevilla. In fact, in the ten years after 1980, real wages in urban areas actually dropped between 20 and 40 percent. Additionally, investment that might have been used to address social issues and poverty was instead being used to pay the debt. Losses to bankers in the United States were catastrophic, perhaps more than the banking industry's entire collective profits since the nation's founding in the late 1700s.

In response to the crisis, most nations abandoned their import substitution industrialization (ISI) models of economy and adopted an export-oriented industrialization strategy, usually the

The debt crisis of 1982 was the most serious of Latin America's history. Incomes and imports dropped; economic growth stagnated; unemployment rose to high levels; and inflation reduced the buying power of the middle classes.García Bernal, Manuela Cristina (1991). "Iberoamérica: Evolución de una Economía Dependiente". In Luís Navarro García (Coord.), ''Historia de las Américas'', vol. IV, pp. 565–619. Madrid/Sevilla: Alhambra Longman/Universidad de Sevilla. In fact, in the ten years after 1980, real wages in urban areas actually dropped between 20 and 40 percent. Additionally, investment that might have been used to address social issues and poverty was instead being used to pay the debt. Losses to bankers in the United States were catastrophic, perhaps more than the banking industry's entire collective profits since the nation's founding in the late 1700s.

In response to the crisis, most nations abandoned their import substitution industrialization (ISI) models of economy and adopted an export-oriented industrialization strategy, usually the neoliberal

Neoliberalism (also neo-liberalism) is a term used to signify the late 20th century political reappearance of 19th-century ideas associated with free-market capitalism after it fell into decline following the Second World War. A prominent f ...

strategy encouraged by the IMF, although there were exceptions such as Chile

Chile, officially the Republic of Chile, is a country in the western part of South America. It is the southernmost country in the world, and the closest to Antarctica, occupying a long and narrow strip of land between the Andes to the eas ...

and Costa Rica

Costa Rica (, ; ; literally "Rich Coast"), officially the Republic of Costa Rica ( es, República de Costa Rica), is a country in the Central American region of North America, bordered by Nicaragua to the north, the Caribbean Sea to the no ...

, which adopted reformist strategies. A massive process of capital outflow, particularly to the United States, served to depreciate the exchange rates, thereby raising the real interest rate. Real GDP growth rate for the region was only 2.3 percent between 1980 and 1985, but in per capita terms Latin America experienced negative growth of almost 9 percent. Between 1982 and 1985, Latin America paid back US$108 billion.

International Monetary Fund

Before the crisis, Latin American countries such as Brazil and Mexico borrowed money to enhance economic stability and reduce the poverty rate. However, as their inability to pay back their foreign debts became apparent, loans ceased, stopping the flow of resources previously available for the innovations and improvements of the previous few years. This rendered several half-finished projects useless, contributing to infrastructure problems in the affected countries. During the international recession of the 1970s, many major countries attempted to slow down and stop inflation in their countries by raising the interest rates of the money that they loaned, causing Latin America's already enormous debt to increase further. Between the years of 1970 to 1980, Latin America's debt levels increased by more than one-thousand percent. The crisis caused the per capita income to drop and also increased poverty as the gap between the wealthy and poor increased dramatically. Due to the plummeting employment rate, children and young adults were forced into the drug trade, prostitution and terrorism. The low employment rate also worsened many problems like homicides and crime and made the affected countries undesirable places to live. Frantically trying to solve these problems, debtor countries felt pressured to constantly pay back the money that they owed, which made it hard to rebuild an economy already in ruins. Latin American countries, unable to pay their debts, turned to the IMF (International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

), which provided money for loans and unpaid debts. In return, the IMF forced Latin America to make reforms that would favor free-market capitalism, further aggravating inequalities and poverty conditions. The IMF also forced Latin America to implement austerity plans and programs that lowered total spending in an effort to recover from the debt crisis. This reduction in government spending further deteriorated social fractures in the economy and halted industrialisation efforts.

Latin America's growth rate fell dramatically due to government austerity plans that restricted further spending. Living standards also fell alongside the growth rate, which caused intense anger from the people towards the IMF, a symbol of "outsider" power over Latin America. Government leaders and officials were ridiculed and some even discharged due to involvement and defending of the IMF. In the late 1980s, Brazilian officials planned a debt negotiation meeting where they decided to "never again sign agreements with the IMF". The result of IMF intervention caused greater financial deepening ( Financialization) and dependence on the developed world capital flows, as well as increased exposure to international volatility. The application of structural adjustment programs entailed high social cost

Social cost in neoclassical economics is the sum of the private costs resulting from a transaction and the costs imposed on the consumers as a consequence of being exposed to the transaction for which they are not compensated or charged. In other w ...

s in terms of rising unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the refe ...

and underemployment

Underemployment is the underuse of a worker because a job does not use the worker's skills, is part-time, or leaves the worker idle. Examples include holding a part-time job despite desiring full-time work, and overqualification, in which the ...

, falling real wages and incomes, and increased poverty.

2015 levels of external debt

The following is a list of external debt for Latin America based on a 2015 report by The World Factbook.The World Factbook, 2015See also

* Chilean crisis of 1982 * 1998–2002 Argentine great depression * South American economic crisis of 2002 * Latin American economy *List of sovereign debt crises

The list of sovereign debt crises involves the inability of independent countries to meet its liabilities as they become due. These include:

*A sovereign default, where a government suspends debt repayments

*A debt restructuring plan, where the ...

* Odious debt

References

Further reading

* Signoriello, Vincent J. (1991), Commercial Loan Practices and Operations, Chapter 8 Servicing Foreign Debt, Latin American Debt Crisis, Performing a Vital Service, . * Signoriello, Vincent J. (1985, Jan–Feb) International Correspondent Banker Magazine, London, England, Performing a Vital Service, The Future for Debt Rescheduling, pp. 44–45. * Sunkel, Osvald andStephany Griffith-Jones

Stephany Griffith-Jones (born Stepanka Novy Kafka; June 5, 1947) is an economist specialising in international finance and development, with emphasis on reform of the international financial system, specifically in relation to financial regulat ...

(1986), ''Debt and Development Crises in Latin America: The End of an Illusion'', Oxford University Press.

*

External links

Latin American Debt Crisis: Effects on Mexico

from th

Dean Peter Krogh Foreign Affairs Digital Archives

International Monetary Fund

{{Financial crises 1970s economic history 1980s economic history Economic history of Mexico Financial crises History of government debt Latin American history Economy of Central America Economy of South America Economy of the Caribbean 1970s in South America 1980s in South America 1970s in Central America 1980s in Central America