Ireland as a tax haven on:

[Wikipedia]

[Google]

[Amazon]

Ireland has been associated with the term "tax haven" since the U.S.

Ireland has been associated with the term "tax haven" since the U.S.

Ireland ranks in all non-political " tax haven lists" going back to the first lists in 1994, and features in all " proxy tests" for tax havens and " quantitative measures" of tax havens. The level of base erosion and profit shifting (BEPS) by U.S. multinationals in Ireland is so large, that in 2017 the

Ireland ranks in all non-political " tax haven lists" going back to the first lists in 1994, and features in all " proxy tests" for tax havens and " quantitative measures" of tax havens. The level of base erosion and profit shifting (BEPS) by U.S. multinationals in Ireland is so large, that in 2017 the  Ireland has received the most U.S. corporate

Ireland has received the most U.S. corporate

Apple's Q1 2015 Irish restructure, post their €13 billion EU tax fine for 2004–2014, is one of the most advanced OECD-compliant BEPS tools in the world. It integrates Irish IP–based BEPS tools, and Jersey Debt–based BEPS tools, to materially amplify the tax sheltering effects, by a factor of circa 2. Apple Ireland bought circa $300 billion of a "virtual" IP–asset from Apple Jersey in Q1 2015 (see leprechaun economics). The Irish "

Apple's Q1 2015 Irish restructure, post their €13 billion EU tax fine for 2004–2014, is one of the most advanced OECD-compliant BEPS tools in the world. It integrates Irish IP–based BEPS tools, and Jersey Debt–based BEPS tools, to materially amplify the tax sheltering effects, by a factor of circa 2. Apple Ireland bought circa $300 billion of a "virtual" IP–asset from Apple Jersey in Q1 2015 (see leprechaun economics). The Irish "

There is evidence Ireland meets the captured state criteria for tax havens. When the EU investigated Apple in Ireland in 2016 they found private tax rulings from the Irish

There is evidence Ireland meets the captured state criteria for tax havens. When the EU investigated Apple in Ireland in 2016 they found private tax rulings from the Irish

Two of the world's main , estimated Ireland's ''effective corporate tax rate'' to be 4%:

Two of the world's main , estimated Ireland's ''effective corporate tax rate'' to be 4%:

In a less technical manner to the rebuttals by the Irish State, the labels have also drawn responses from leaders in the Irish business community who attribute the value of U.S. investment in Ireland to Ireland's unique talent base. At €334 billion, the value of U.S. investment in Ireland is larger than Ireland's 2016 GDP of €291 billion (or 2016 GNI* of €190 billion), and larger than total ''aggregate'' U.S. investment into all BRIC countries. This unique talent base is also noted by

In a less technical manner to the rebuttals by the Irish State, the labels have also drawn responses from leaders in the Irish business community who attribute the value of U.S. investment in Ireland to Ireland's unique talent base. At €334 billion, the value of U.S. investment in Ireland is larger than Ireland's 2016 GDP of €291 billion (or 2016 GNI* of €190 billion), and larger than total ''aggregate'' U.S. investment into all BRIC countries. This unique talent base is also noted by  Irish education does not appear to be distinctive. Ireland has a high % of third-level graduates, but this is because it re-classified many technical colleges into degree-issuing institutions in 2005–08. This is believed to have contributed to the decline of its leading universities, of which there are two in the top 200 (i.e. a quality over quantity issue). Ireland continues to pursue this strategy and is considering re-classifying the remaining Irish technical institutes as universities for 2019.

Ireland shows no apparent distinctiveness in any non-tax related metrics of business competitiveness including cost of living, league tables of favoured EU FDI locations, league tables of favoured EU destinations for London-based financials post-

Irish education does not appear to be distinctive. Ireland has a high % of third-level graduates, but this is because it re-classified many technical colleges into degree-issuing institutions in 2005–08. This is believed to have contributed to the decline of its leading universities, of which there are two in the top 200 (i.e. a quality over quantity issue). Ireland continues to pursue this strategy and is considering re-classifying the remaining Irish technical institutes as universities for 2019.

Ireland shows no apparent distinctiveness in any non-tax related metrics of business competitiveness including cost of living, league tables of favoured EU FDI locations, league tables of favoured EU destinations for London-based financials post-

In another less technical rebuttal, the State explains Ireland's high ranking in the established " proxy tests" for tax havens as a by–product of Ireland's position as preferred hub for global "knowledge economy" multinationals (e.g. technology and life sciences), "selling into EU–28 markets". When the

In another less technical rebuttal, the State explains Ireland's high ranking in the established " proxy tests" for tax havens as a by–product of Ireland's position as preferred hub for global "knowledge economy" multinationals (e.g. technology and life sciences), "selling into EU–28 markets". When the

Before the passing of the TCJA in December 2017, the U.S. was one of eight remaining jurisdictions to run a "worldwide" taxation system, which was the principal obstacle to U.S. corporate tax reform, as it was not possible to differentiate between the source of income. The seven other "worldwide" tax systems, are: Chile, Greece, Ireland, Israel, Korea, Mexico, and Poland.

Tax experts expect the anti-BEPS provisions of the TCJA's new hybrid "territorial" taxation system, the GILTI and BEAT tax regimes, to neutralize some Irish BEPS tools (e.g. the double Irish and the single malt). In addition, the TCJA's FDII tax regime makes U.S.–controlled multinationals indifferent as to whether they charge-out their IP from the U.S. or from Ireland, as net effective tax rates on IP, under the FDII and GILTI regimes, are very similar. Post-TCJA, S&P500 IP–heavy U.S.–controlled multinationals, have guided 2019 tax rates that are similar, whether legally headquartered in Ireland or the U.S.

Tax academic,

Before the passing of the TCJA in December 2017, the U.S. was one of eight remaining jurisdictions to run a "worldwide" taxation system, which was the principal obstacle to U.S. corporate tax reform, as it was not possible to differentiate between the source of income. The seven other "worldwide" tax systems, are: Chile, Greece, Ireland, Israel, Korea, Mexico, and Poland.

Tax experts expect the anti-BEPS provisions of the TCJA's new hybrid "territorial" taxation system, the GILTI and BEAT tax regimes, to neutralize some Irish BEPS tools (e.g. the double Irish and the single malt). In addition, the TCJA's FDII tax regime makes U.S.–controlled multinationals indifferent as to whether they charge-out their IP from the U.S. or from Ireland, as net effective tax rates on IP, under the FDII and GILTI regimes, are very similar. Post-TCJA, S&P500 IP–heavy U.S.–controlled multinationals, have guided 2019 tax rates that are similar, whether legally headquartered in Ireland or the U.S.

Tax academic,

Tax Justice Network: Ireland SectionOECD Global Forum on Tax TransparencyTax Havens: How Globalisation Really Works by Ronen PalenIreland is the world’s biggest corporate ‘tax haven’, say academics

''

Is Ireland a tax haven? European Parliament says yes

''

Ireland is a tax haven – and that's becoming controversial at home

''

Ireland

Ireland ( ; ga, Éire ; Ulster-Scots: ) is an island in the North Atlantic Ocean, in north-western Europe. It is separated from Great Britain to its east by the North Channel, the Irish Sea, and St George's Channel. Ireland is the s ...

has been labelled as a tax haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

or corporate tax haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly du ...

in multiple financial reports, an allegation which the state has rejected in response. Ireland is on all academic " tax haven lists", including the , and tax NGOs

A non-governmental organization (NGO) or non-governmental organisation (see spelling differences) is an organization that generally is formed independent from government. They are typically nonprofit entities, and many of them are active in ...

. Ireland does not meet the 1998 OECD definition of a tax haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

, but no OECD member, including Switzerland, ever met this definition; only Trinidad & Tobago met it in 2017. Similarly, no EU–28 country is amongst the 64 listed in the 2017 EU tax haven blacklist and greylist.

In September 2016, Brazil became the first G20 country to "blacklist" Ireland as a tax haven.

Ireland's base erosion and profit shifting (BEPS) tools give some foreign corporates ' of 0% to 2.5% on global profits re-routed to Ireland via their tax treaty network. Ireland's ''aggregate '' for foreign corporates is 2.2–4.5%. Ireland's BEPS tools are the world's largest BEPS flows, exceed the entire Caribbean system, and artificially inflate the US–EU trade deficit. Ireland's tax-free QIAIF & L–QIAIF regimes, and Section 110 SPVs, enable foreign investors to avoid Irish taxes on Irish assets, and can be combined with Irish BEPS tools to create confidential routes out of the Irish corporate tax system. As these structures are OECD–whitelisted, Ireland's laws and regulations allow the use of data protection and data privacy provisions, and opt-outs from filing of public accounts, to obscure their effects. There is arguable evidence that Ireland acts as a , fostering tax strategies.

Ireland's situation is attributed to arising from the historical U.S. "worldwide" corporate tax system, which has made U.S. multinationals the largest users of tax havens

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, o ...

, and BEPS

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic a ...

tools, in the world. The U.S. Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs A ...

("TCJA"), and move to a hybrid "territorial" tax system, removed the need for some of these compromises. In 2018, IP–heavy S&P500 multinationals guided similar post-TCJA ''effective'' tax rates, whether they are legally based in the U.S. (e.g. Pfizer

Pfizer Inc. ( ) is an American multinational pharmaceutical and biotechnology corporation headquartered on 42nd Street in Manhattan, New York City. The company was established in 1849 in New York by two German entrepreneurs, Charles Pfize ...

), or Ireland (e.g. Medtronic

Medtronic plc is an American medical device company. The company's operational and executive headquarters are in Minneapolis, Minnesota, and its legal headquarters are in Ireland due to its acquisition of Irish-based Covidien in 2015. While it ...

). While TCJA neutralised some Irish BEPS tools, it enhanced others (e.g. Apple's " CAIA"). A reliance on U.S. corporates ( 80% of Irish corporation tax, 25% of Irish labour, 25 of top 50 Irish firms, and 57% of Irish value-add), is a concern in Ireland.

Ireland's weakness in attracting corporates from "territorial" tax systems ('' Table 1''), was apparent in its failure to attract material financial services jobs moving due to Brexit (e.g. no US investment banks or material financial services franchise). Ireland's diversification into full tax haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

tools (e.g. QIAIF, L–QIAIF, and ICAV), has seen tax-law firms, and offshore magic circle

The offshore magic circle is the set of the largest multi-jurisdictional law firms who specialise in offshore financial centres, especially the laws of the British Overseas Territories of Bermuda, Cayman Islands, and British Virgin Islands, and ...

firms, set up Irish offices to handle Brexit-driven tax restructuring. These tools made Ireland the world's 3rd largest Shadow Banking OFC, and 5th largest Conduit OFC.

Context

Ireland has been associated with the term "tax haven" since the U.S.

Ireland has been associated with the term "tax haven" since the U.S. IRS

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax ...

produced a list on the 12 January 1981. Ireland has been a consistent feature on almost every non-governmental tax haven list from Hines in February 1994, to Zucman in June 2018 (and each one in-between). However, Ireland has never been considered a tax haven by either the OECD or the EU Commission. These two contrasting facts are used by various sides, to allegedly prove or disprove that Ireland is a tax haven, and much of the detail in-between is discarded, some of which can explain the EU and OCED's position. Confusing scenarios have emerged, for example:

* In April 2000, the FSF–IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glob ...

listed Ireland as an offshore financial centre

An offshore financial centre (OFC) is defined as a "country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy."

"Offshore" does not refer ...

("OFC"), based on criteria which academics and the OECD support. The Irish State has never refuted the OFC label, and there are Irish State documents that note Ireland as an OFC. Yet, the terms OFC and "tax haven" are often considered synonymous.

* In December 2017, the EU did not consider Ireland to be a tax haven, and Ireland is not in the ; in January 2017 the EU Commissioner for Taxation, Pierre Moscovici, stated this publicly. However, the same Commissioner in January 2018, described Ireland to the EU Parliament as a ''tax black hole''.

* In September 2018, the 29th Chair of the U.S. President's Council of Economic Advisors

The Council of Economic Advisers (CEA) is a United States agency within the Executive Office of the President established in 1946, which advises the President of the United States on economic policy. The CEA provides much of the empirical resea ...

, tax-expert Kevin Hassett

Kevin Allen Hassett (born March 20, 1962) is an American economist who is a former Senior Advisor and Chairman of the Council of Economic Advisers in the Trump administration from 2017 to 2019. He has written several books and coauthored ''Dow 36 ...

, said that: "It’s not Ireland’s fault U.S. tax law was written by someone on acid". Hassett, however, had labelled Ireland as a tax haven in November 2017, when advocating for the Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs A ...

("TCJA").

The next sections chronicle the detail regarding Ireland's label as a tax haven (most cited ''Sources'' and ''Evidence''), and detail regarding the Irish State's official ''Rebuttals'' of the label (both technical and non-technical). The final section chronicles the academic research on the drivers of U.S., EU, and OCED, decision making regarding Ireland.

Labels

Ireland has been labelled atax haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

, or a corporate tax haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly du ...

(or Conduit OFC), by:

Ireland has also been labelled related terms to being a tax haven:

The term tax haven has been used by the Irish mainstream media and leading Irish commentators. Irish elected TDs have asked the question: "Is Ireland a tax haven?". A search of Dáil Éireann

Dáil Éireann ( , ; ) is the lower house, and principal chamber, of the Oireachtas (Irish legislature), which also includes the President of Ireland and Seanad Éireann (the upper house).Article 15.1.2º of the Constitution of Ireland rea ...

debates lists 871 references to the term. Some established Irish political parties accuse the Irish State of tax haven activities.

OECD plans

While Ireland has been considered a tax haven by many for decades, the global tax system that Ireland depends on to incentivize multinational corporations to move there is receiving an overhaul by a coalition of 130 nations. This would cause changes to Ireland’s official corporate tax rate of 12.5%, and the associated rules sometimes described as helping companies based there avoid paying taxes to other countries where they make profits. Originally Ireland was one of the few countries (one of nine) to oppose signing up for reform to a global minimum corporate tax rate of 15% and to force technology and retail companies to pay taxes based on where their goods and services were sold, rather than where the company was located. The Irish government would eventually agree to the terms of the deal after some debate. As of October 7, 2021 Ireland dropped its opposition too an overhaul of global corporate tax rules giving up its 12.5% tax rate. The Irish Cabinet approved an increase from 12.5% to 15% in corporation tax for companies with turnover in excess of 750 million euros. Additionally, the Irish Department of Finance has estimated that joining this global deal would reduce the country’s tax take by 2 billion euros ($2.3 billion) a year, according to RTE. The other countries party to this deal did have to agree to compromise on a few key issues involved in the reform, dropping the “at least” in the statement “minimum corporate tax rate of at least 15%” updating it to just 15% — signaling that the rate would not be pushed up at a later date. Ireland was also given assurances that it could keep the lower rate for smaller firms located in the country.Evidence

Global U.S. BEPS hub

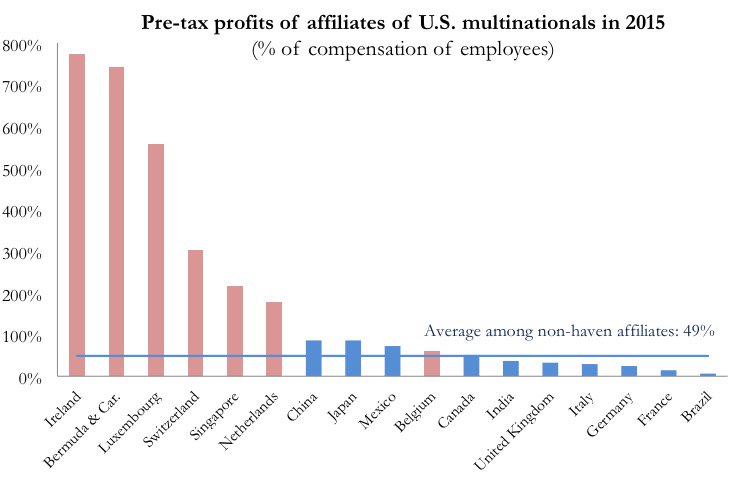

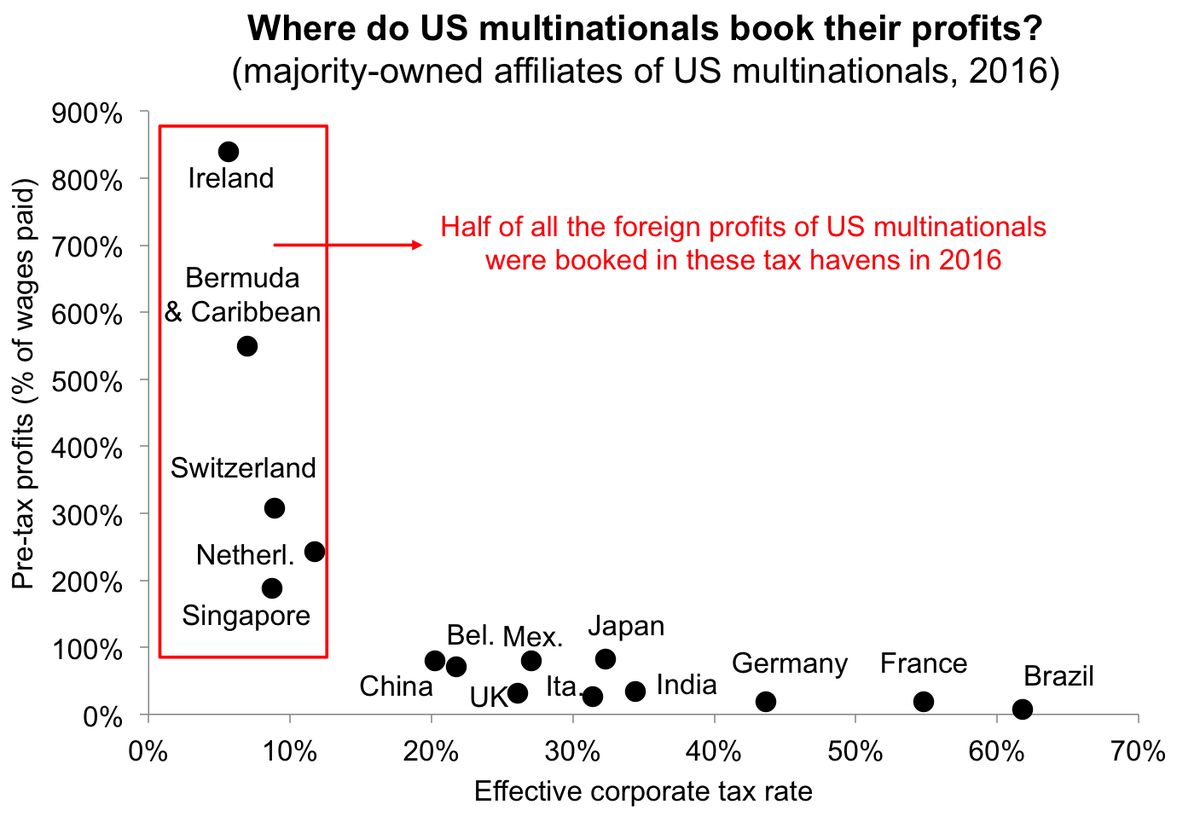

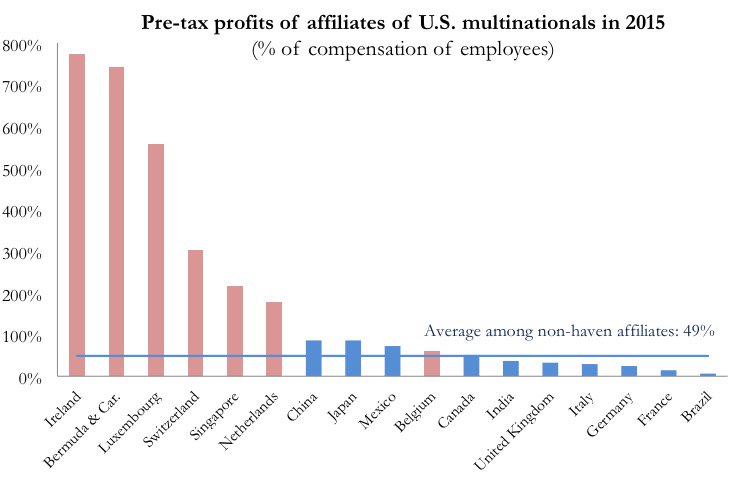

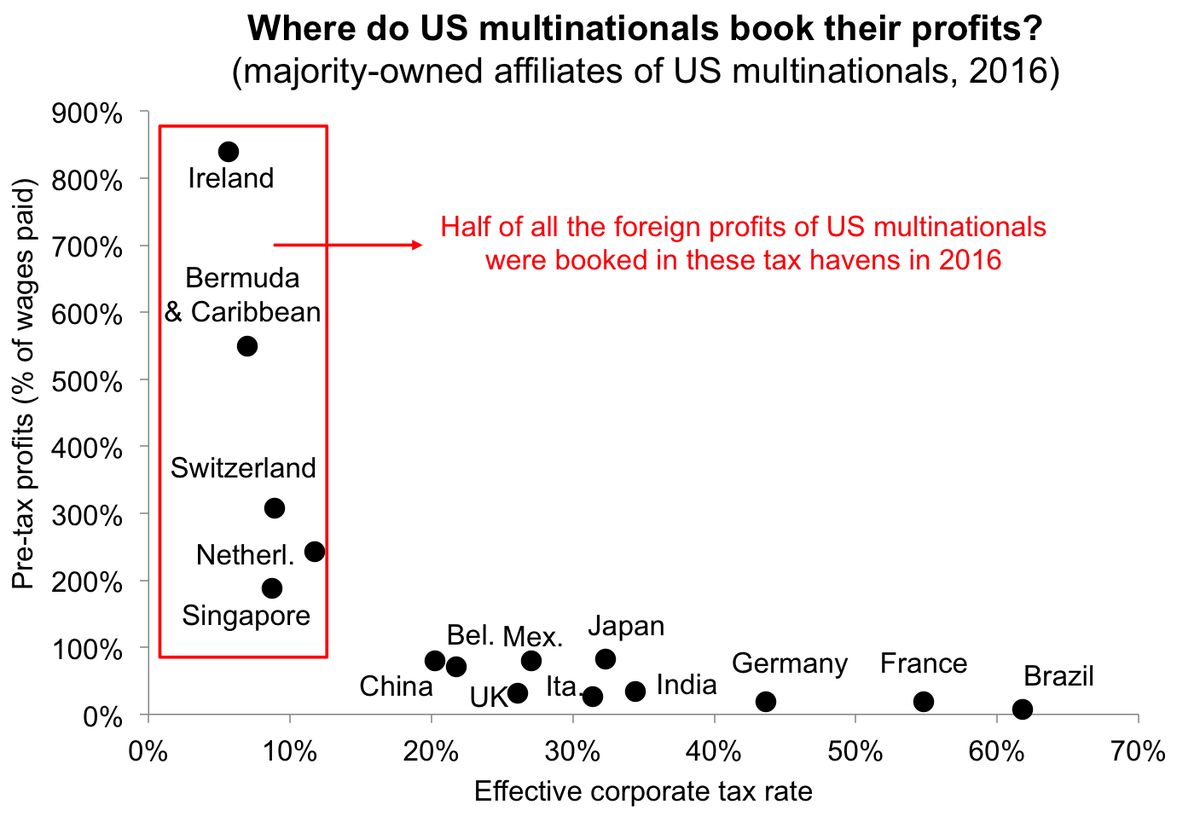

Ireland ranks in all non-political " tax haven lists" going back to the first lists in 1994, and features in all " proxy tests" for tax havens and " quantitative measures" of tax havens. The level of base erosion and profit shifting (BEPS) by U.S. multinationals in Ireland is so large, that in 2017 the

Ireland ranks in all non-political " tax haven lists" going back to the first lists in 1994, and features in all " proxy tests" for tax havens and " quantitative measures" of tax havens. The level of base erosion and profit shifting (BEPS) by U.S. multinationals in Ireland is so large, that in 2017 the Central Bank of Ireland

The Central Bank of Ireland ( ga, Banc Ceannais na hÉireann) is Ireland's central bank, and as such part of the European System of Central Banks (ESCB). It is the country's financial services regulator for most categories of financial firms ...

abandoned GDP/GNP as a statistic to replace it with Modified gross national income (GNI*). Economists note that Ireland's distorted GDP is now distorting the EU's aggregate GDP, and has artificially inflated the trade-deficit between the EU and the US. (see '' Table 1'').

Ireland's IP–based BEPS tools use "intellectual property

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, co ...

" ("IP") to "shift profits" from higher-tax locations, with whom Ireland has bilateral tax treaties

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritan ...

, back to Ireland. Once in Ireland, these tools reduce Irish corporate taxes by re-routing to say Bermuda with the Double Irish BEPS tool (e.g. as Google

Google LLC () is an American Multinational corporation, multinational technology company focusing on Search Engine, search engine technology, online advertising, cloud computing, software, computer software, quantum computing, e-commerce, ar ...

and Facebook

Facebook is an online social media and social networking service owned by American company Meta Platforms. Founded in 2004 by Mark Zuckerberg with fellow Harvard College students and roommates Eduardo Saverin, Andrew McCollum, Dust ...

did), or to Malta with the Single Malt BEPS tool (e.g. as Microsoft and Allergan did), or by writing-off internally created virtual assets against Irish corporate tax with the Capital Allowances for Intangible Assets

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest ta ...

("CAIA") BEPS tool (e.g. as Apple did post 2015). These BEPS tools give an Irish corporate ''effective tax rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, and effective. These rates can also be p ...

'' (ETR) of 0–2.5%. They are the world's largest BEPS tools, and exceed the aggregate flows of the Caribbean tax system.

Ireland has received the most U.S. corporate

Ireland has received the most U.S. corporate tax inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus mov ...

s of any global jurisdiction, or tax haven, since the first U.S. tax inversion in 1983.

While IP–based BEPS tools are the majority of Irish BEPS flows, they were developed from Ireland's traditional expertise in inter-group contract manufacturing

A contract manufacturer (CM) is a manufacturer that contracts with a firm for components or products (in which case it is a turnkey supplier). It is a form of outsourcing. A contract manufacturer performing packaging operations is called copacker o ...

, or transfer pricing

In taxation and accounting, transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. Because of the potential for cross-border controlled transactions to distort ...

–based (TP) BEPS tools (e.g. capital allowance schemes, inter-group cross-border charging), which still provide material employment in Ireland (e.g. from U.S. life sciences firms). Some corporates like Apple maintain expensive Irish contract manufacturing TP–based BEPS operations (versus cheaper options in Asia, like Apple's Foxconn

Hon Hai Precision Industry Co., Ltd., trading as Hon Hai Technology Group in China and Taiwan and Foxconn internationally, is a Taiwanese multinational electronics contract manufacturer established in 1974 with headquarters in Tucheng, New ...

), to give " substance" to their larger Irish IP–based BEPS tools.

By refusing to implement the 2013 EU Accounting Directive (and invoking exemptions on reporting holding company structures until 2022), Ireland enables their TP and IP–based BEPS tools to structure as "unlimited liability companies" ("ULC") which do not have to file public accounts with the Irish CRO.

Ireland's Debt–based BEPS tools (e.g. the Section 110 SPV), have made Ireland the 3rd largest global Shadow Banking OFC, and have been used by Russian banks to circumvent sanctions. Irish Section 110 SPVs offer " orphaning" to protect the identity of the owner, and to shield the owner from Irish tax (the Section 110 SPV is an Irish company). They were used by U.S. distressed debt funds to avoid billions in Irish taxes, assisted by Irish tax-law firms using in-house Irish children's charities to complete the orphan structure, that enabled the U.S. distressed debt funds to export the gains on their Irish assets, free of any Irish taxes or duties, to Luxembourg and the Caribbean (see Section 110 abuse).

Unlike the TP and IP–based BEPS tools, Section 110 SPVs must file public accounts with the Irish CRO, which was how the above abuses were discovered in 2016–17. In February 2018 the Central Bank of Ireland

The Central Bank of Ireland ( ga, Banc Ceannais na hÉireann) is Ireland's central bank, and as such part of the European System of Central Banks (ESCB). It is the country's financial services regulator for most categories of financial firms ...

upgraded the little-used L–QIAIF regime to give the same tax benefits as Section 110 SPVs but without having to file public accounts. In June 2018, the Central Bank reported that €55 billion of U.S.–owned distressed Irish assets, equivalent to 25% of Irish GNI*, moved out of Irish Section 110 SPVs and into L–QIAIFs.

Green Jersey BEPS tool

Apple's Q1 2015 Irish restructure, post their €13 billion EU tax fine for 2004–2014, is one of the most advanced OECD-compliant BEPS tools in the world. It integrates Irish IP–based BEPS tools, and Jersey Debt–based BEPS tools, to materially amplify the tax sheltering effects, by a factor of circa 2. Apple Ireland bought circa $300 billion of a "virtual" IP–asset from Apple Jersey in Q1 2015 (see leprechaun economics). The Irish "

Apple's Q1 2015 Irish restructure, post their €13 billion EU tax fine for 2004–2014, is one of the most advanced OECD-compliant BEPS tools in the world. It integrates Irish IP–based BEPS tools, and Jersey Debt–based BEPS tools, to materially amplify the tax sheltering effects, by a factor of circa 2. Apple Ireland bought circa $300 billion of a "virtual" IP–asset from Apple Jersey in Q1 2015 (see leprechaun economics). The Irish "capital allowances for intangible assets

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest ta ...

" ("CAIA") BEPS tool allows Apple Ireland to write-off this virtual IP–asset against future Irish corporation tax. The €26.220 billion jump in intangible capital allowances claimed in 2015, showed Apple Ireland is writing-off this IP–asset over a 10–year period. In addition, Apple Jersey gave Apple Ireland the $300 billion "virtual" loan to buy this virtual IP–asset from Apple Jersey. Thus, Apple Ireland can claim additional Irish corporation tax relief on this loan interest, which is circa $20 billion per annum (Apple Jersey pays no tax on the loan interest it receives from Apple Ireland). These tools, created entirely from virtual internal assets financed by virtual internal loans, give Apple circa €45 billion per annum in relief against Irish corporation tax. In June 2018 it was shown that Microsoft is preparing to copy this Apple scheme, known as "the Green Jersey".

As the IP is a virtual internal asset, it can be replenished with each technology (or life sciences) product cycle

In industry, Product Lifecycle Management (PLM) is the process of managing the entire lifecycle of a product from its inception through the engineering, design and manufacture, as well as the service and disposal of manufactured products. ...

(e.g. new virtual IP assets created offshore and then bought by the Irish subsidiary, with internal virtual loans, for higher prices). The Green Jersey thus gives a perpetual BEPS tool, like the double Irish, but at a much greater scale than the double Irish, as the full BEPS effect is capitalised on day one.

Experts expect the U.S Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs A ...

("TCJA") GILTI-regime to neutralise some Irish BEPS tools, including the single malt and the double Irish. Because Irish intangible capital allowances are accepted as U.S. GILTI deductions, the "Green Jersey" now enables U.S. multinationals to achieve net effective ''U.S. corporate tax rates'' of 0% to 2.5% via TCJA's participation relief. As Microsoft's main Irish BEPS tools are the single malt and the double Irish, in June 2018, Microsoft was preparing a "Green Jersey" Irish BEPS scheme. Irish experts, including Seamus Coffey

Seamus Coffey is an Irish economist and media contributor with a focus on the performance of the Irish economy and Irish macroeconomic and fiscal policy.

He is a lecturer at University College Cork. He was chair of the Irish Fiscal Advisory Co ...

, Chairman of the Irish Fiscal Advisory Council

Irish Fiscal Advisory Council (Fiscal Council; ga, Comhairle Chomhairleach Bhuiséadach na hÉireann) is a non-departmental statutory body providing independent assessments and analysis of the Irish Government's fiscal stance, its economic and ...

and author of the Irish State's 2017 ''Review of Ireland's Corporation Tax Code'', expects a boom in U.S. on-shoring of virtual internal IP assets to Ireland, via the Green Jersey BEPS tool (e.g. under the capital allowances for intangible assets scheme).

Domestic tax tools

Ireland's Qualifying Investor Alternative Investment Fund ("QIAIF") regime is a range of five tax-free legal wrappers ( ICAV, Investment Company, Unit Trust, Common Contractual Fund, Investment Limited Partnership). Four of the five wrappers do not file public accounts with the Irish CRO, and therefore offer tax confidentiality and tax secrecy. While they are regulated by theCentral Bank of Ireland

The Central Bank of Ireland ( ga, Banc Ceannais na hÉireann) is Ireland's central bank, and as such part of the European System of Central Banks (ESCB). It is the country's financial services regulator for most categories of financial firms ...

, like the Section 110 SPV, it has been shown many are effectively unregulated " brass plate" entities. The Central Bank has no mandate to investigate tax avoidance or tax evasion, and under the 1942 ''Central Bank Secrecy Act'', the Central Bank of Ireland

The Central Bank of Ireland ( ga, Banc Ceannais na hÉireann) is Ireland's central bank, and as such part of the European System of Central Banks (ESCB). It is the country's financial services regulator for most categories of financial firms ...

cannot send the confidential information which QIAIFs must file with the Bank to the Irish Revenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business.

Commercial revenue may also be referred to as sales or as turnover. Some companies receive rev ...

.

QIAIFs have been used in tax avoidance on Irish assets, on circumventing international regulations, on avoiding tax laws in the EU and the U.S. QIAIFs can be combined with Irish corporate BEPS tools (e.g. the Orphaned Super–QIF), to create routes out of the Irish corporate tax system to Luxembourg, the main Sink OFC for Ireland. It is asserted that a material amount of assets in Irish QIAIFs, and the ICAV wrapper in particular, are Irish assets being shielded from Irish taxation. Offshore magic circle

The offshore magic circle is the set of the largest multi-jurisdictional law firms who specialise in offshore financial centres, especially the laws of the British Overseas Territories of Bermuda, Cayman Islands, and British Virgin Islands, and ...

law firms (e.g. Walkers and Maples and Calder

Maples Group (previously Maples and Calder) is a multi-jurisdictional firm providing legal and financial services, headquartered in the Cayman Islands. It has offices in many financial centres around the world, including several tax neutral jur ...

, who have set up offices in Ireland), market the Irish ICAV as a superior wrapper to the Cayman SPC (Maples and Calder

Maples Group (previously Maples and Calder) is a multi-jurisdictional firm providing legal and financial services, headquartered in the Cayman Islands. It has offices in many financial centres around the world, including several tax neutral jur ...

claim to be a major architect of the ICAV), and there are explicit QIAIF rules to help with re-domiciling of Cayman/BVI funds into Irish ICAVs.

Captured state

There is evidence Ireland meets the captured state criteria for tax havens. When the EU investigated Apple in Ireland in 2016 they found private tax rulings from the Irish

There is evidence Ireland meets the captured state criteria for tax havens. When the EU investigated Apple in Ireland in 2016 they found private tax rulings from the Irish Revenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business.

Commercial revenue may also be referred to as sales or as turnover. Some companies receive rev ...

giving Apple a tax rate of 0.005% on over EUR€110 billion of cumulative Irish profits from 2004 to 2014.

When the Irish Finance Minister Michael Noonan was alerted by an Irish MEP in 2016 to a new Irish BEPS

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic a ...

tool to replace the Double Irish (called the Single Malt), he was told to "put on the green jersey

'Put on the green jersey' is a phrase to represent putting the Irish national interest first. The phrase can be used in a positive sense, for example evoking feelings of national unity during times of crisis. The phrase can also be used in a negat ...

". When Apple executed the largest BEPS

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic a ...

transaction in history in Q1 2015, the Central Statistics Office suppressed data to hide Apple's identity.

Noonan changed the capital allowances for intangible assets

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest ta ...

scheme rules, the IP–based BEPS tool Apple used in Q1 2015, to reduce Apple's effective tax rate from 2.5% to 0%. When it was discovered in 2016 that U.S. distressed debt funds abused Section 110 SPVs to shield €80 billion in Irish loan balances from Irish taxes, the Irish State did not investigate or prosecute (see Section 110 abuse). In February 2018, the Central Bank of Ireland

The Central Bank of Ireland ( ga, Banc Ceannais na hÉireann) is Ireland's central bank, and as such part of the European System of Central Banks (ESCB). It is the country's financial services regulator for most categories of financial firms ...

, which regulates Section 110 SPVs, upgraded the little used tax-free L-QIAIF regime, which has stronger privacy from public scrutiny. In June 2018, U.S. distressed debt funds transferred €55 billion of Irish assets (or 25% of Irish GNI*), out of Section 110 SPVs and into L–QIAIFs.

The June 2017 OECD Anti-BEPS MLI was signed by 70 jurisdictions. The corporate tax haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly du ...

s, including Ireland, opted out of the key Article 12.

Tax haven investigator Nicholas Shaxson documented how Ireland's captured state uses a complex and "siloed" network of Irish privacy and data protection laws to navigate around the fact that its tax tools are OECD–whitelisted, and therefore must be transparent to some State entity. For example, Irish tax-free QIAIFs (and L–QIAIFs) are regulated by the Central Bank of Ireland

The Central Bank of Ireland ( ga, Banc Ceannais na hÉireann) is Ireland's central bank, and as such part of the European System of Central Banks (ESCB). It is the country's financial services regulator for most categories of financial firms ...

and must provide the Bank with details of their financials. However, the 1942 ''Central Bank Secrecy Act'' prevents the Central Bank from sending this data to the Revenue Commissioners

The Revenue Commissioners ( ga, Na Coimisinéirí Ioncaim), commonly called Revenue, is the Irish Government agency responsible for customs, excise, taxation and related matters. Though Revenue can trace itself back to predecessors (with the ...

. Similarly, the Central Statistics Office (Ireland)

The Central Statistics Office (CSO; ga, An Phríomh-Oifig Staidrimh) is the statistical agency responsible for the gathering of "information relating to economic, social and general activities and conditions" in Ireland, in particular the Nationa ...

stated it had to restrict its public data release in 2016–17 to protect the Apple's identity during its 2015 BEPS action, because the 1993 ''Central Statistics Act'' prohibits use of economic data for revealing such activities. When the EU Commission fined Apple €13 billion for illegal State aid in 2016, there were no official records of any discussion of the tax deal given to Apple outside of the Irish Revenue Commissioners

The Revenue Commissioners ( ga, Na Coimisinéirí Ioncaim), commonly called Revenue, is the Irish Government agency responsible for customs, excise, taxation and related matters. Though Revenue can trace itself back to predecessors (with the ...

as such data is also protected.

When Tim Cook

Timothy Donald Cook (born November 1, 1960) is an American business executive who has been the chief executive officer of Apple Inc. since 2011. Cook previously served as the company's chief operating officer under its co-founder Steve Jobs ...

stated in 2016 that Apple was the largest tax-payer in Ireland, the Irish Revenue Commissioners

The Revenue Commissioners ( ga, Na Coimisinéirí Ioncaim), commonly called Revenue, is the Irish Government agency responsible for customs, excise, taxation and related matters. Though Revenue can trace itself back to predecessors (with the ...

quoted Section 815A of the ''1997 Tax Acts'' that prevents them disclosing such information, even to members of Dáil Éireann

Dáil Éireann ( , ; ) is the lower house, and principal chamber, of the Oireachtas (Irish legislature), which also includes the President of Ireland and Seanad Éireann (the upper house).Article 15.1.2º of the Constitution of Ireland rea ...

, or the Irish Department of Finance (despite the fact that Apple is circa one-fifth of Ireland's GDP).

Commentators note the plausible deniability provided by Irish privacy and data protection laws, that enable the State to function as a tax haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

while maintaining OECD compliance. They ensure the State entity regulating each tax tool are "siloed" from the Irish Revenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business.

Commercial revenue may also be referred to as sales or as turnover. Some companies receive rev ...

, and public scrutiny via FOI laws.

In February 2019, ''The Guardian

''The Guardian'' is a British daily newspaper. It was founded in 1821 as ''The Manchester Guardian'', and changed its name in 1959. Along with its sister papers '' The Observer'' and '' The Guardian Weekly'', ''The Guardian'' is part of the ...

'' reported on leaked Facebook internal reports revealing the influence Facebook had on the Irish State, to which Cambridge University

, mottoeng = Literal: From here, light and sacred draughts.

Non literal: From this place, we gain enlightenment and precious knowledge.

, established =

, other_name = The Chancellor, Masters and Schola ...

academic John Naughton stated: "the leak was “explosive” in the way it revealed the “vassalage” of the Irish state to the big tech companies". In April 2019, ''Politico

''Politico'' (stylized in all caps), known originally as ''The Politico'', is an American, German-owned political journalism newspaper company based in Arlington County, Virginia, that covers politics and policy in the United States and intern ...

'' reported on concerns that Ireland was protecting Facebook and Google from the new EU GDPR regulations, stating: "Despite its vows to beef up its threadbare regulatory apparatus, Ireland has a long history of catering to the very companies it is supposed to oversee, having wooed top Silicon Valley firms to the Emerald Isle with promises of low taxes, open access to top officials, and help securing funds to build glittering new headquarters."

Rebuttals

Effective tax rates

The Irish State refutestax haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

labels as unfair criticism of its low, but legitimate, 12.5% Irish corporate tax rate, which it defends as being the ''effective'' tax rate ("ETR"). Independent studies show that Ireland's ''aggregate'' effective corporate tax rate is between 2.2% to 4.5% (depending on assumptions made). This lower ''aggregate'' effective tax rate is consistent with the ''individual'' effective tax rates of U.S. multinationals in Ireland (U.S.–controlled multinationals are 14 of Ireland's largest 20 companies, and Apple alone is over one-fifth of Irish GDP; see " low tax economy"), as well as the IP–based BEPS tools openly marketed by the main tax-law firms in the Irish International Financial Services Centre

The International Financial Services Centre (IFSC) is an area of central Dublin and part of the CBD established in the 1980s as an urban regeneration area and special economic zone (SEZ) on the derelict state-owned former port authority lan ...

with ETRs of 0–2.5% (see "effective tax rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, and effective. These rates can also be p ...

").

Two of the world's main , estimated Ireland's ''effective corporate tax rate'' to be 4%:

Two of the world's main , estimated Ireland's ''effective corporate tax rate'' to be 4%: James R. Hines Jr.

James R. Hines Jr. (born July 9, 1958) is an American economist and a founder of academic research into corporate-focused tax havens, and the effect of U.S. corporate tax policy on the behaviors of U.S. multinationals. His papers were some of ...

in his 1994 Hines–Rice paper on tax havens, estimated Ireland's effective corporate rate was 4% (Appendix 4); Gabriel Zucman, 24 years later, in his June 2018 paper on corporate tax havens, also estimated Ireland's effective corporate tax to be 4% (Appendix 1).

The disconnect between the ETR of 12.5% claimed by the Irish State and its advisors, and the actual ETRs of 2.2–4.5% calculated by independent experts, is because the Irish tax code considers a high percentage of Irish income as not being subject to Irish taxation, due to various exclusions and deductions. The gap of 12.5% vs. 2.2–4.5% implies that well over two-thirds of corporate profits booked in Ireland are excluded from Irish corporate taxation (see Irish ETR).

The Irish State does not refer to QIAIFs (or L–QIAIFs), or Section 110 SPVs, which allow non-resident investors to hold Irish assets indefinitely without incurring Irish taxes, VAT or duties (e.g. permanent "base erosion" to the Irish exchequer as QIAIF units and SPV shares can be traded), and which can be combined with Irish BEPS

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic a ...

tools to avoid all Irish corporate taxation (see ).

Salary taxes, VAT, and CGT for Irish residents are in line with rates of other EU–28 countries, and tend to be slightly higher than EU–28 averages in many cases. Because of this, Ireland has a special lower salary tax rate scheme, and other tax bonuses, for employees of foreign multinationals earning over €75,000 ("SARP").

The OECD's "Hierarchy of Taxes" pyramid (from the Department of Finance Tax Strategy Group's 2011 tax policy document) summarises Ireland's tax strategy.

OECD 1998 definition

EU and U.S. studies that attempted to find a consensus on the definition of a tax haven, have concluded that there is no consensus (see tax haven definitions). The Irish State, and its advisors, have refuted thetax haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

label by invoking the 1998 OCED

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organization, intergovernmental organisation with 38 member countries ...

definition of a "tax haven" as the consensus definition:

Most Irish BEPS tools and QIAIFs are OECD–whitelisted (and can thus avail of Ireland's 70 bilateral tax treaties

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritan ...

), and therefore while Ireland could meet the first OECD test, it fails the second and third OECD tests. The fourth OECD test (‡) was withdrawn by the OECD in 2002 on protest from the U.S., which indicates is a political dimension to the definition. In 2017, only one jurisdiction, Trinidad & Tobago, met the 1998 OECD definition of a tax haven (Trinidad & Tobago is not one of the 35 OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate ...

member countries), and the definition has fallen into disrepute.

Tax haven academic James R. Hines Jr.

James R. Hines Jr. (born July 9, 1958) is an American economist and a founder of academic research into corporate-focused tax havens, and the effect of U.S. corporate tax policy on the behaviors of U.S. multinationals. His papers were some of ...

notes that OECD tax haven lists never include the 35 OECD member countries (Ireland is a founding OECD member). The OECD definition was produced in 1998 as part of the OECD's investigation into ''Harmful Tax Competition: An Emerging Global Issue''. By 2000, when the OECD published their first list of 35 tax havens, it included no OECD member countries as they were now all considered to have engaged in the OECD's Global Forum on Transparency and Exchange of Information for Tax Purposes (see ). Because the OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate ...

has never listed any of its 35 members as tax havens, Ireland, Luxembourg, the Netherlands and Switzerland are sometimes referred to as the "OECD tax havens".

Subsequent definitions of tax haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

, and/or offshore financial centre

An offshore financial centre (OFC) is defined as a "country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy."

"Offshore" does not refer ...

/corporate tax haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly du ...

(see definition of a "tax haven"), focus on effective taxes as the primary requirement, which Ireland would meet, and have entered the general lexicon. The Tax Justice Network, who places Ireland on its tax haven list, split the concept of ''tax rates'' from ''tax transparency'' by defining a secrecy jurisdiction and creating the Financial Secrecy Index

The Financial Secrecy Index (FSI) is a report published by the advocacy organization Tax Justice Network (TJN) which ranks countries by ''financial secrecy indicators'', weighted by the economic flows of each country.

It looks at how wealthy ...

. The OECD has never updated or amended its 1998 definition (apart from dropping the 4th criteria). The Tax Justice Network imply the U.S. may be the reason.

EU 2017 tax haven lists

While by 2017, the OECD only considered Trinidad and Tobago to be a tax haven, in 2017 the EU produced a list of 17 tax havens, plus another 47 jurisdictions on the "grey list", however, as with the OECD lists above, the EU list did not include any EU-28 jurisdictions. Only one of the EU's 17 blacklisted tax havens, namely Samoa, appeared in the July 2017 Top 20 tax havens list from CORPNET. The EU Commission was criticised for not including Ireland, Luxembourg, the Netherlands, Malta and Cyprus, and Pierre Moscovici, explicitly stated to an Irish State Oireachtas Finance Committee on 24 January 2017: ''Ireland is not a tax haven'', although he subsequently called Ireland and the Netherlands "tax black holes" on 18 January 2018. On 27 March 2019, ''RTÉ News

RTÉ News and Current Affairs ( ga, Nuacht agus Cúrsaí Reatha RTÉ), also known as RTÉ News (''Nuacht RTÉ''), is the national news service provided by Irish public broadcaster Raidió Teilifís Éireann. Its services include local, nationa ...

'' reported that the European Parliament had "overwhelmingly accepted" a new report that likened Ireland to a tax haven.

Hines–Rice 1994 definition

The first major wasJames R. Hines Jr.

James R. Hines Jr. (born July 9, 1958) is an American economist and a founder of academic research into corporate-focused tax havens, and the effect of U.S. corporate tax policy on the behaviors of U.S. multinationals. His papers were some of ...

, who in 1994, published a paper with Eric M Rice, listing 41 tax havens, of which Ireland was one of their ''major 7 tax havens''. The 1994 Hines–Rice paper is recognised as the first important paper on tax havens, and is the most cited paper in the history of research on tax havens. The paper has been cited by all subsequent, ''most cited'', research papers on tax havens, by other , including Desai, Dharmapala

A ''dharmapāla'' (, , ja, 達磨波羅, 護法善神, 護法神, 諸天善神, 諸天鬼神, 諸天善神諸大眷屬) is a type of wrathful god in Buddhism. The name means "'' dharma'' protector" in Sanskrit, and the ''dharmapālas'' are a ...

, Slemrod, and Zucman. Hines expanded his original 1994 list to 45 countries in 2007, and to 52 countries in the Hines 2010 list, and used quantitative techniques to estimate that Ireland was the third largest global tax haven. Other major papers on tax havens by Dharmapala

A ''dharmapāla'' (, , ja, 達磨波羅, 護法善神, 護法神, 諸天善神, 諸天鬼神, 諸天善神諸大眷屬) is a type of wrathful god in Buddhism. The name means "'' dharma'' protector" in Sanskrit, and the ''dharmapālas'' are a ...

(2008, 2009), and Zucman (2015, 2018), cite the 1994 Hines–Rice paper, but create their own tax haven lists, all of which include Ireland (e.g., the June 2018, Zucman–Tørsløv–Wier 2018 list).

The 1994 Hines–Rice paper was one of the first to use the term'' " profit shifting"''. Hines–Rice also introduced the first quantitative tests of a tax haven, which Hines felt were needed as many tax havens had non-trivial "headline" tax rates. These two tests are still the most widely quoted proxy tests for tax havens in the academic literature. The first test, extreme distortion of national accounts by BEPS

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic a ...

accounting flows, was used by the IMF in June 2000 when defining offshore financial centres ("OFCs"), a term the IMF used to capture both traditional tax havens

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, o ...

and emerging modern corporate tax havens

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly du ...

:

The Hines–Rice paper showed that ''low foreign tax rates rom tax havens

Rom, or ROM may refer to:

Biomechanics and medicine

* Risk of mortality, a medical classification to estimate the likelihood of death for a patient

* Rupture of membranes, a term used during pregnancy to describe a rupture of the amniotic sac

* R ...

ultimately enhance U.S. tax collections''. Hines' insight that the U.S. is the largest beneficiary from tax havens was confirmed by others, and dictated U.S. policy towards tax havens, including the 1996 " check-the-box" rules, and U.S. hostility to OECD attempts in curbing Ireland's BEPS tools. Under the 2017 U.S. TCJA, U.S. multinationals paid a 15.5% repatriation tax on the circa $1 trillion in untaxed cash built up in global tax havens from 2004 to 2017. Had these U.S. multinationals paid foreign taxes, they would have built up sufficient foreign tax credits to avoid paying U.S. taxes. By allowing U.S. multinationals to use global tax havens, the U.S. exchequer received more taxes, at the expense of other countries, as Hines predicted in 1994.

Several of Hines' papers on tax havens, including the calculations of the Hines–Rice 1994 paper, were used in the final report by the U.S. President's Council of Economic Advisors

The Council of Economic Advisers (CEA) is a United States agency within the Executive Office of the President established in 1946, which advises the President of the United States on economic policy. The CEA provides much of the empirical resea ...

that justified the U.S. Tax Cuts and Jobs Act of 2017, the largest U.S. tax reform in a generation.

The Irish State dismisses academic studies which list Ireland as a tax haven as being "out-of-date", because they cite the 1994 Hines–Rice paper. The Irish State ignores the fact that both Hines, and all the other academics, developed new lists; or that the Hines–Rice 1994 paper is still considered correct (e.g. per the 2017 U.S. TCJA legislation). In 2013, the Department of Finance (Ireland) co-wrote a paper with the Irish Revenue Commissioners

The Revenue Commissioners ( ga, Na Coimisinéirí Ioncaim), commonly called Revenue, is the Irish Government agency responsible for customs, excise, taxation and related matters. Though Revenue can trace itself back to predecessors (with the ...

, which they had published in the State-sponsored ESRI Quarterly, which found the only sources listing Ireland as a tax haven were:

This 2013 Irish State-written paper then invoked the of a tax haven, four years younger than Hines–Rice, and since discredited, to show that Ireland was not a tax haven.

The following is from a June 2018 Irish Independent

The ''Irish Independent'' is an Irish daily newspaper and online publication which is owned by Independent News & Media (INM), a subsidiary of Mediahuis.

The newspaper version often includes glossy magazines.

Traditionally a broadsheet new ...

article by the CEO of the key trade body that represents all U.S. multinationals in Ireland on the 1994 Hines–Rice paper:

Unique talent base

In a less technical manner to the rebuttals by the Irish State, the labels have also drawn responses from leaders in the Irish business community who attribute the value of U.S. investment in Ireland to Ireland's unique talent base. At €334 billion, the value of U.S. investment in Ireland is larger than Ireland's 2016 GDP of €291 billion (or 2016 GNI* of €190 billion), and larger than total ''aggregate'' U.S. investment into all BRIC countries. This unique talent base is also noted by

In a less technical manner to the rebuttals by the Irish State, the labels have also drawn responses from leaders in the Irish business community who attribute the value of U.S. investment in Ireland to Ireland's unique talent base. At €334 billion, the value of U.S. investment in Ireland is larger than Ireland's 2016 GDP of €291 billion (or 2016 GNI* of €190 billion), and larger than total ''aggregate'' U.S. investment into all BRIC countries. This unique talent base is also noted by IDA Ireland

Industrial Development Agency (IDA Ireland) ( ga, An Ghníomhaireacht Forbartha Tionscail) is the agency responsible for the attraction and retention of inward foreign direct investment (FDI) into Ireland. The agency was founded in 1949 as the ...

, the State body responsible for attracting inward investment, but never defined beyond the broad concept.

Irish education does not appear to be distinctive. Ireland has a high % of third-level graduates, but this is because it re-classified many technical colleges into degree-issuing institutions in 2005–08. This is believed to have contributed to the decline of its leading universities, of which there are two in the top 200 (i.e. a quality over quantity issue). Ireland continues to pursue this strategy and is considering re-classifying the remaining Irish technical institutes as universities for 2019.

Ireland shows no apparent distinctiveness in any non-tax related metrics of business competitiveness including cost of living, league tables of favoured EU FDI locations, league tables of favoured EU destinations for London-based financials post-

Irish education does not appear to be distinctive. Ireland has a high % of third-level graduates, but this is because it re-classified many technical colleges into degree-issuing institutions in 2005–08. This is believed to have contributed to the decline of its leading universities, of which there are two in the top 200 (i.e. a quality over quantity issue). Ireland continues to pursue this strategy and is considering re-classifying the remaining Irish technical institutes as universities for 2019.

Ireland shows no apparent distinctiveness in any non-tax related metrics of business competitiveness including cost of living, league tables of favoured EU FDI locations, league tables of favoured EU destinations for London-based financials post-Brexit

Brexit (; a portmanteau of "British exit") was the Withdrawal from the European Union, withdrawal of the United Kingdom (UK) from the European Union (EU) at 23:00 Greenwich Mean Time, GMT on 31 January 2020 (00:00 1 February 2020 Central Eur ...

(which are linked to quality of talent), and the key World Economic Forum

The World Economic Forum (WEF) is an international non-governmental and lobbying organisation based in Cologny, canton of Geneva, Switzerland. It was founded on 24 January 1971 by German engineer and economist Klaus Schwab. The foundation, ...

Global Competitiveness Report

The ''Global Competitiveness Report'' (GCR) is a yearly report published by the World Economic Forum. Since 2004, the ''Global Competitiveness Report'' ranks countries based on the Global Competitiveness Index, developed by Xavier Sala-i-Martin an ...

rankings.

Irish commentators provide a perspective on Ireland's "talent base". The State applies an " employment tax" to U.S. multinationals using Irish BEPs tools. To fulfil their Irish employment quotas, some U.S. technology firms perform low-grade localisation functions in Ireland which requires foreign employees speaking global languages (while many U.S. multinationals perform higher-value software engineering functions in Ireland, some do not). These employees must be sourced internationally. This is facilitated via a loose Irish work-visa programme. This Irish " employment tax" requirement for use of BEPS tools, and its fulfilment via foreign work-visas, is a driver of Dublin's housing crisis. This is consistent with a bias to property development-led economic growth, favoured by the main Irish political parties (see Abuse of QIAIFs).

Global "knowledge hub" for "selling into Europe"

In another less technical rebuttal, the State explains Ireland's high ranking in the established " proxy tests" for tax havens as a by–product of Ireland's position as preferred hub for global "knowledge economy" multinationals (e.g. technology and life sciences), "selling into EU–28 markets". When the

In another less technical rebuttal, the State explains Ireland's high ranking in the established " proxy tests" for tax havens as a by–product of Ireland's position as preferred hub for global "knowledge economy" multinationals (e.g. technology and life sciences), "selling into EU–28 markets". When the Central Statistics Office (Ireland)

The Central Statistics Office (CSO; ga, An Phríomh-Oifig Staidrimh) is the statistical agency responsible for the gathering of "information relating to economic, social and general activities and conditions" in Ireland, in particular the Nationa ...

suppressed its 2016–2017 data release to protect Apple's Q1 2015 BEPS action, it released a paper on "meeting the challenges of a modern globalised knowledge economy".

Ireland has no foreign corporates that are non–U.S./non–UK in its top 50 companies by revenue, and only one by employees (German Lidl

Lidl Stiftung & Co. KG (; ) is a German international discount retailer chain that operates over 11,000 stores across Europe and the United States. Headquartered in Neckarsulm, Baden-Württemberg, the company belongs to the Schwarz Group, whi ...

, which sells into Ireland). The UK multinationals in Ireland are either selling into Ireland (e.g. Tesco), or date pre–2009, after which the UK overhauled its tax system to a "territorial tax" model. Since 2009, the U.K has become a major tax haven (see U.K. transformation). Since this transformation, no major UK firms have moved to Ireland and most UK corporate tax inversions to Ireland returned; although Ireland has succeeded in attracting some financial services firms affected by Brexit

Brexit (; a portmanteau of "British exit") was the Withdrawal from the European Union, withdrawal of the United Kingdom (UK) from the European Union (EU) at 23:00 Greenwich Mean Time, GMT on 31 January 2020 (00:00 1 February 2020 Central Eur ...

.

In 2016, U.S. corporate tax expert, James R. Hines Jr.

James R. Hines Jr. (born July 9, 1958) is an American economist and a founder of academic research into corporate-focused tax havens, and the effect of U.S. corporate tax policy on the behaviors of U.S. multinationals. His papers were some of ...

, showed multinationals from "territorial" corporate taxation systems don't need tax havens, when researching behaviours of German multinationals with German academic tax experts.

U.S.–controlled multinationals constitute 25 of the top 50 Irish firms (including tax inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus mov ...

s), and 70% of top 50 revenue (see '' Table 1''). U.S.–controlled multinations pay 80% of Irish corporate taxes (see " low tax economy"). Irish–based U.S. multinationals may be selling into Europe, however, the evidence is that they route all non–U.S. business through Ireland. Ireland is more accurately described as a "U.S. corporate tax haven". The U.S. multinationals in Ireland are from "knowledge industries" (see '' Table 1''). This is because Ireland's BEPS

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic a ...

tools (e.g. the double Irish, the single malt and the capital allowances for intangible assets

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest ta ...

) require intellectual property

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, co ...

("IP") to execute the BEPS actions, which technology and life sciences possess in quantity (see IP–Based BEPS tools).

Rather than a "global knowledge hub" for "selling into Europe", it might be suggested that Ireland is a base for U.S. multinationals with sufficient IP to use Ireland's BEPS

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic a ...

tools to shield non–U.S. revenues from U.S. taxation.

In 2018, the U.S. converted into a hybrid "territorial" tax system (the U.S. was one of the last remaining pure "worldwide" tax systems). Post this conversion, U.S. ''effective'' tax rates for IP–heavy U.S. multinationals are very similar to the ''effective'' tax rates they would incur if legally headquartered in Ireland, even net of full Irish BEPS tools like the double Irish. This represents a substantive challenge to the Irish economy (see effect of U.S. Tax Cuts and Jobs Act). However, mean some Irish BEPS tools, such as Apple's , have been enhanced.

Ireland's recent expansion into traditional tax haven services (e.g. Cayman Island and Luxembourg type ICAVs and L–QIAIFs) is a diversifier from U.S. corporate tax haven services. Brexit

Brexit (; a portmanteau of "British exit") was the Withdrawal from the European Union, withdrawal of the United Kingdom (UK) from the European Union (EU) at 23:00 Greenwich Mean Time, GMT on 31 January 2020 (00:00 1 February 2020 Central Eur ...

was initially disappointing for Ireland in the area of attracting financial services firms from London, but the situation later improved. Brexit

Brexit (; a portmanteau of "British exit") was the Withdrawal from the European Union, withdrawal of the United Kingdom (UK) from the European Union (EU) at 23:00 Greenwich Mean Time, GMT on 31 January 2020 (00:00 1 February 2020 Central Eur ...

has led to growth in UK centric tax-law firms (including offshore magic circle

The offshore magic circle is the set of the largest multi-jurisdictional law firms who specialise in offshore financial centres, especially the laws of the British Overseas Territories of Bermuda, Cayman Islands, and British Virgin Islands, and ...

firms), setting up offices in Ireland to handle traditional tax haven services for clients.

From the above table:

Countermeasures

Background

Apparent contradictions

While Ireland's development into traditional tax haven tools (e.g. ICAVs and L–QIAIFs) is more recent, Ireland's status as acorporate tax haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly du ...

has been noted since 1994 (the first Hines–Rice tax haven paper), and discussed in the U.S. Congress for a decade. A lack of progress, and delays, in addressing Ireland's corporate tax BEPS tools is apparent:

Source of contradictions

Tax haven experts explain these contradictions as resulting from the different agendas of the major OECD taxing authorities, and particularly the U.S., and Germany, who while not themselves considered tax havens or corporate tax havens, rank #2 and #7 respectively in the 2018Financial Secrecy Index

The Financial Secrecy Index (FSI) is a report published by the advocacy organization Tax Justice Network (TJN) which ranks countries by ''financial secrecy indicators'', weighted by the economic flows of each country.

It looks at how wealthy ...

of tax secrecy jurisdictions:

Tax Cuts and Jobs Act

Impact

Before the passing of the TCJA in December 2017, the U.S. was one of eight remaining jurisdictions to run a "worldwide" taxation system, which was the principal obstacle to U.S. corporate tax reform, as it was not possible to differentiate between the source of income. The seven other "worldwide" tax systems, are: Chile, Greece, Ireland, Israel, Korea, Mexico, and Poland.

Tax experts expect the anti-BEPS provisions of the TCJA's new hybrid "territorial" taxation system, the GILTI and BEAT tax regimes, to neutralize some Irish BEPS tools (e.g. the double Irish and the single malt). In addition, the TCJA's FDII tax regime makes U.S.–controlled multinationals indifferent as to whether they charge-out their IP from the U.S. or from Ireland, as net effective tax rates on IP, under the FDII and GILTI regimes, are very similar. Post-TCJA, S&P500 IP–heavy U.S.–controlled multinationals, have guided 2019 tax rates that are similar, whether legally headquartered in Ireland or the U.S.

Tax academic,

Before the passing of the TCJA in December 2017, the U.S. was one of eight remaining jurisdictions to run a "worldwide" taxation system, which was the principal obstacle to U.S. corporate tax reform, as it was not possible to differentiate between the source of income. The seven other "worldwide" tax systems, are: Chile, Greece, Ireland, Israel, Korea, Mexico, and Poland.

Tax experts expect the anti-BEPS provisions of the TCJA's new hybrid "territorial" taxation system, the GILTI and BEAT tax regimes, to neutralize some Irish BEPS tools (e.g. the double Irish and the single malt). In addition, the TCJA's FDII tax regime makes U.S.–controlled multinationals indifferent as to whether they charge-out their IP from the U.S. or from Ireland, as net effective tax rates on IP, under the FDII and GILTI regimes, are very similar. Post-TCJA, S&P500 IP–heavy U.S.–controlled multinationals, have guided 2019 tax rates that are similar, whether legally headquartered in Ireland or the U.S.

Tax academic, Mihir A. Desai

Mihir A. Desai is an Indian-American economist currently the Mizuho Financial Group Professor of Finance at Harvard Business School and Professor at Harvard Law School. He graduated from Brown University with a bachelor's degree of history and ...

, in a post-TCJA interview in the ''Harvard Business Review

''Harvard Business Review'' (''HBR'') is a general management magazine published by Harvard Business Publishing, a wholly owned subsidiary of Harvard University. ''HBR'' is published six times a year and is headquartered in Brighton, M ...

'' said that: "So, if you think about a lot of technology companies that are housed in Ireland and have massive operations there, they’re not going to maybe need those in the same way, and those can be relocated back to the U.S.

It is expected Washington will be less accommodating to U.S. multinationals using Irish BEPS tools and locating IP in tax havens. The EU Commission has also become less tolerant of U.S. multinational use of Irish BEPS tools, as evidenced by the €13 billion fine on Apple for Irish tax avoidance from 2004 to 2014. There is widespread unhappiness of Irish BEPS tools in Europe, even from other tax havens.

Technical issues

While the Washington and EU political compromises tolerating Ireland as acorporate tax haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly du ...

may be eroding, tax experts point to various technical flaws in the TCJA which, if not resolved, may actually enhance Ireland as a U.S. corporate tax haven:

A June 2018 IMF country report on Ireland, while noting the significant exposure of Ireland's economy to U.S. corporates, concluded that the TCJA may not be as effective as Washington expects in addressing Ireland as a U.S. corporate tax haven. In writing its report, the IMF conducted confidential anonymous interviews with Irish corporate tax experts.

Some tax experts, noting Google and Microsoft's actions in 2018, assert these flaws in the TCJA are deliberate, and part of the U.S. Administration's original strategy to reduce ''aggregate'' effective global tax rates for U.S. multinationals to circa 10–15% (i.e. 21% on U.S. income, and 2.5% on non–U.S. income, via Irish BEPS tools). There has been an increase in U.S. multinational use of Irish intangible capital allowances, and some tax experts believe that the next few years will see a boom in U.S. multinationals using the Irish " Green Jersey" BEPS tool and on-shoring their IP to Ireland (rather than the U.S.).

As discussed in and , the U.S. Treasury's corporation tax policy seeks to maximise long-term U.S. taxes paid by using corporate tax havens to minimise near-term foreign taxes paid. In this regard, it is possible that Ireland still has a long-term future as a U.S. corporate tax haven.

In February 2019, Brad Setser

Brad W. Setser is an American economist and former staff economist at the United States Department of the Treasury. He worked at Roubini Global Economics Monitor ("RGE"), as Director of Global Research, where he co-authored the book "Bailouts o ...

from the Council on Foreign Relations

The Council on Foreign Relations (CFR) is an American think tank specializing in U.S. foreign policy and international relations. Founded in 1921, it is a nonprofit organization that is independent and nonpartisan. CFR is based in New York Ci ...

, wrote a ''New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid ...

'' article highlighting material issues with TCJA.

See also

*Criticism of Google

Criticism of Google includes concern for tax avoidance, misuse and manipulation of search results, its use of others' intellectual property, concerns that its compilation of data may violate people's privacy and collaboration with the US militar ...

* Criticism of Apple Inc.