History of United States debt ceiling on:

[Wikipedia]

[Google]

[Amazon]

The history of the United States debt ceiling deals with movements in the

The history of the United States debt ceiling deals with movements in the

/ref> A feature of the Public Debt Acts, unlike the 1919 Victory Liberty Bond Act which financed American costs in the First World War, was that the new ceiling was set about 10% above the actual federal debt at the time.

Note that this table does not go back to 1917 when the debt ceiling started.

Reference for values between 1993 and 2015:

Note that:

#The figures are unadjusted for the

"The Debt Limit Since 2011"

Congressional Research Service. * * * * * * * * * * * * *

History and Recent Increases

(2010)

History and Recent Increases

(2008)

US Treasury Debt to the Penny (Daily)

Estimated Debt to the Penny (Real Time)

{{Clear Debt ceiling history Debt ceiling history Financial history of the United States

The history of the United States debt ceiling deals with movements in the

The history of the United States debt ceiling deals with movements in the United States debt ceiling

The United States debt ceiling or debt limit is a legislative limit on the amount of national debt that can be incurred by the U.S. Treasury, thus limiting how much money the federal government may pay on the debt they already borrowed. The d ...

since it was created in 1917. Management of the United States public debt

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury sec ...

is an important part of the macroeconomics

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole.

For example, using interest rates, taxes, and ...

of the United States economy and finance system, and the debt ceiling is a limitation on the federal government's ability to manage the economy and finance system. The debt ceiling is also a limitation on the federal government's ability to finance government operations, and the failure of Congress to authorise an increase in the debt ceiling has resulted in crises, especially in recent years.

Overview

A statutorily imposed debt ceiling has been in effect since 1917 when the US Congress passed the ''Second Liberty Bond Act

A liberty bond (or liberty loan) was a war bond that was sold in the United States to support the Allied cause in World War I. Subscribing to the bonds became a symbol of patriotic duty in the United States and introduced the idea of financia ...

''. Before 1917 there was no debt ceiling in force, but there were parliamentary procedural limitations on the amount of debt that could be issued by the government.

Except for about a year during 1835–1836, the United States has continuously had a fluctuating public debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit oc ...

since the US Constitution legally went into effect on March 4, 1789. Debts incurred during the American Revolutionary War

The American Revolutionary War (April 19, 1775 – September 3, 1783), also known as the Revolutionary War or American War of Independence, was a major war of the American Revolution. Widely considered as the war that secured the independence of t ...

and under the Articles of Confederation

The Articles of Confederation and Perpetual Union was an agreement among the 13 Colonies of the United States of America that served as its first frame of government. It was approved after much debate (between July 1776 and November 1777) by ...

led to the first yearly report on the amount of the debt ($75,463,476.52 on January 1, 1791). The national debt, as expressed in absolute dollars, has increased under every presidential administration since Herbert Hoover

Herbert Clark Hoover (August 10, 1874 – October 20, 1964) was an American politician who served as the 31st president of the United States from 1929 to 1933 and a member of the Republican Party, holding office during the onset of the Gr ...

.

Early history

Prior to 1917, the United States did not have a debt ceiling, with Congress either authorizing specific loans or allowing the Treasury to issue certain debt instruments and individual debt issues for specific purposes. Sometimes Congress gave the Treasury discretion over what type of debt instrument would be issued. Between 1788 and 1917 Congress would authorise each bond issue by theUnited States Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and t ...

by passing a legislative act that approved the issue and the amount.

In 1917, during World War I, Congress created the debt ceiling with the Second Liberty Bond Act

A liberty bond (or liberty loan) was a war bond that was sold in the United States to support the Allied cause in World War I. Subscribing to the bonds became a symbol of patriotic duty in the United States and introduced the idea of financia ...

of 1917, which allowed the Treasury to issue bonds and take on other debt without specific Congressional approval, as long as the total debt fell under the statutory debt ceiling. The 1917 legislation set limits on the aggregate amount of debt that could be accumulated through individual categories of debt (such as bonds and bills).

Public Debt Acts

In 1939, Congress instituted the first limit on total accumulated debt over all kinds of instruments. The debt ceiling, in which an aggregate limit is applied to nearly all federal debt, was substantially established by Public Debt Acts passed in 1939 and 1941 and subsequently amended. The United States Public Debt Act of 1939 eliminated separate limits on different types of debt. The Public Debt Act of 1941 raised the aggregatedebt limit

A debt limit or debt ceiling is a legislative mechanism restricting the total amount that a country can borrow or how much debt it can be permitted to take on. Several countries have debt limitation restrictions.

Description

A debt limit is a l ...

on all obligations to $65 billion, and consolidated nearly all federal borrowing under the U.S. Treasury and eliminated the tax-exemption of interest and profit on government debt.

Subsequent Public Debt Acts amended the aggregate debt limit: the 1942, 1943, 1944, and 1945 acts raised the limit to $125 billion, $210 billion, $260 billion, and $300 billion respectively. In 1946, the Public Debt Act was amended to reduce the debt limit to $275 billion. The limit stayed unchanged until 1954, the Korean War

, date = {{Ubl, 25 June 1950 – 27 July 1953 (''de facto'')({{Age in years, months, weeks and days, month1=6, day1=25, year1=1950, month2=7, day2=27, year2=1953), 25 June 1950 – present (''de jure'')({{Age in years, months, weeks a ...

being financed through taxation.CRS Report for Congress/ref> A feature of the Public Debt Acts, unlike the 1919 Victory Liberty Bond Act which financed American costs in the First World War, was that the new ceiling was set about 10% above the actual federal debt at the time.

1970s

Prior to theBudget and Impoundment Control Act

The Congressional Budget and Impoundment Control Act of 1974 (, , ) is a United States federal law that governs the role of the Congress in the United States budget process.

The Congressional budget process

Titles I through IX of the law are als ...

of 1974, the debt ceiling played an important role since Congress had few opportunities to hold hearings and debates on the budget. James Surowiecki argued that the debt ceiling lost its usefulness after these reforms to the budget process.

In 1979, noting the potential problems of hitting a default, Dick Gephardt

Richard Andrew Gephardt (; born January 31, 1941) is an American attorney, lobbyist, and politician who served as a United States House of Representatives, United States Representative from Missouri from 1977 to 2005. A member of the Democratic ...

imposed the "Gephardt Rule," a parliamentary rule that deemed the debt ceiling raised when a budget was passed. This resolved the contradiction in voting for appropriations but not voting to fund them. The rule stood until it was repealed by Congress in 1995.

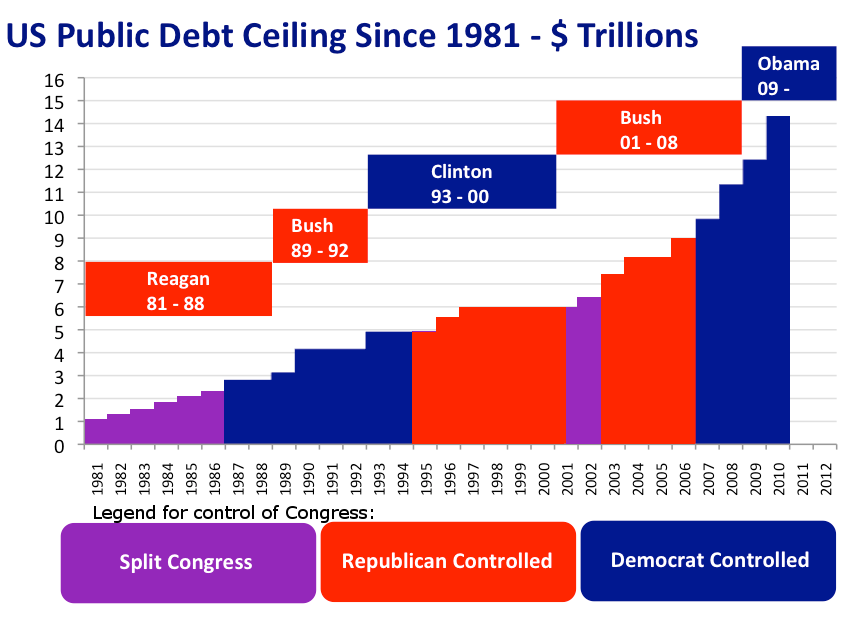

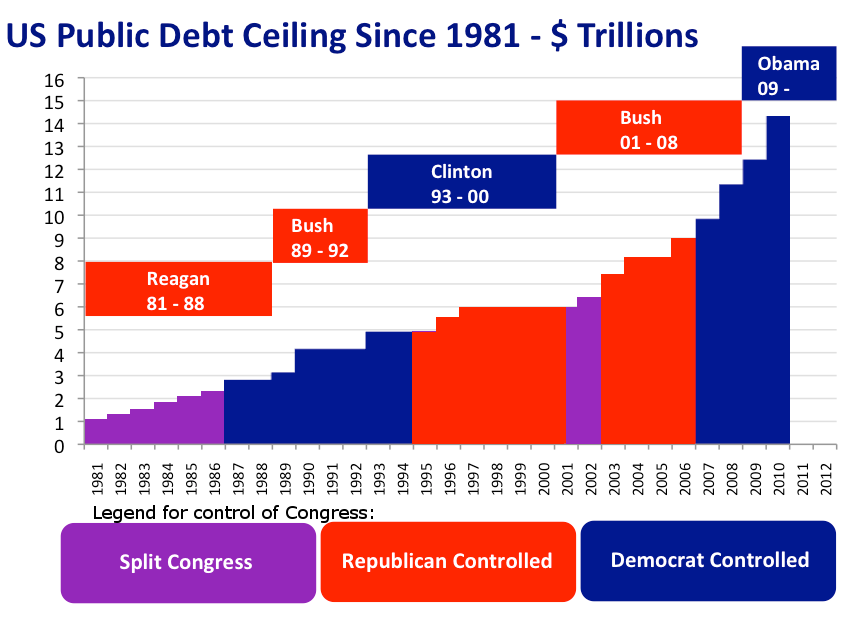

Number of requests for increase

Depending on who is doing the research, it is said that the US has raised its debt ceiling (in some form or other) at least 90 times in the 20th century. The debt ceiling was raised 74 times from March 1962 to May 2011, including 18 times underRonald Reagan

Ronald Wilson Reagan ( ; February 6, 1911June 5, 2004) was an American politician, actor, and union leader who served as the 40th president of the United States from 1981 to 1989. He also served as the 33rd governor of California from 1967 ...

, eight times under Bill Clinton

William Jefferson Clinton ( né Blythe III; born August 19, 1946) is an American politician who served as the 42nd president of the United States from 1993 to 2001. He previously served as governor of Arkansas from 1979 to 1981 and agai ...

, seven times under George W. Bush

George Walker Bush (born July 6, 1946) is an American politician who served as the 43rd president of the United States from 2001 to 2009. A member of the Republican Party, Bush family, and son of the 41st president George H. W. Bush, he ...

, and five times under Barack Obama

Barack Hussein Obama II ( ; born August 4, 1961) is an American politician who served as the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, Obama was the first African-American president of the U ...

. In practice, the debt ceiling has never been reduced, even though the public debt itself may have reduced.

Congress has raised the debt ceiling 14 times from 2001 to 2016. The debt ceiling was raised a total of 7 times (total increase of $5365bil) during Pres. Bush's eight-year term and it was raised 11 times (as of 03/2015 a total increase of $6498bil) during Pres. Obama's eight years in office.

1995 debt ceiling crisis

The 1995 request for a debt ceiling increase led to debate in Congress on reduction of the size of the federal government, which led to the non-passage of the federal budget, and theUnited States federal government shutdown of 1995–96

United may refer to:

Places

* United, Pennsylvania, an unincorporated community

* United, West Virginia, an unincorporated community

Arts and entertainment Films

* ''United'' (2003 film), a Norwegian film

* ''United'' (2011 film), a BBC Two fi ...

. The ceiling was eventually increased and the government shutdown resolved.

2011 debt ceiling crisis

In 2011, Republicans in Congress used the debt ceiling as leverage for deficit reduction because of the lack of Congressional normal order for fiscal year budget votes on the chamber floors and subsequent conference reconciliations between the House and the Senate for final budgets. The credit downgrade and debt ceiling debacle contributed to theDow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The DJIA is one of the oldest and most commonly followed equity inde ...

falling 2,000 points in late July and August. Following the downgrade itself, the DJIA had one of its worst days in history and fell 635 points on August 8. The GAO estimated that the delay in raising the debt ceiling raised borrowing costs for the government by $1.3 billion in 2011 and noted that the delay would also raise costs in later years. The Bipartisan Policy Center

The Bipartisan Policy Center (BPC) is a Washington, D.C.–based think tank that promotes bipartisanship. The organization aims to combine ideas from both the Republican and Democratic parties to address challenges in the U.S. BPC focuses on iss ...

extended the GAO's estimates and found that the delay raised borrowing costs by $18.9 billion over ten years.

2013 debt ceiling crisis

Following the increase in the debt ceiling to $16.394 trillion in 2011, the United States again reached the debt ceiling on December 31, 2012 and the Treasury began taking extraordinary measures. Thefiscal cliff

The United States fiscal cliff refers to the combined effect of several previously-enacted laws that came into effect simultaneously in January 2013, increasing taxes and decreasing spending.

The Bush tax cuts of 2001 and 2003, which had been ex ...

was resolved with the passage of the American Taxpayer Relief Act of 2012

The American Taxpayer Relief Act of 2012 (ATRA) was enacted and passed by the United States Congress on January 1, 2013, and was signed into law by US President Barack Obama the next day. ATRA gave permanence to the lower rates of much of the "Bu ...

(ATRA), but no action was taken on the debt ceiling. With the ATRA tax cuts, the government indicated that the debt ceiling needed to raise by $700 billion for it to continue financing operations for the rest of the 2013 fiscal year and that extraordinary measures were expected to be exhausted by February 15. Treasury has said it is not set up to prioritize payments, and it's not clear that it would be legal to do so. Given this situation, Treasury would simply delay payments if funds could not be raised through extraordinary measures and the debt ceiling had not been raised. This would put a freeze on 7% of the nation's GDP, a contraction greater than the Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

. The economic damage would worsen as recipients of social security benefits, government contracts, and other government payments cut back on spending in response to having the freeze in their revenue.

The No Budget, No Pay Act of 2013

The No Budget, No Pay Act of 2013 (; ) is a law passed during the 113th United States Congress. The Act temporarily suspended the US debt ceiling from February 4 to May 18, 2013. It also placed temporary restrictions on Congressional salaries.

B ...

suspended the debt ceiling from February 4, 2013 until May 19, 2013. On May 19, the debt ceiling was formally raised to approximately $16.699 trillion to accommodate the borrowing done during the suspension period. However, after the end of the suspension, the ceiling was raised only to the actual debt at that time, and Treasury needed to activate extraordinary measures to avoid a default. With the impacts of the American Taxpayer Relief Act of 2012

The American Taxpayer Relief Act of 2012 (ATRA) was enacted and passed by the United States Congress on January 1, 2013, and was signed into law by US President Barack Obama the next day. ATRA gave permanence to the lower rates of much of the "Bu ...

tax increases on those who make $400,000 per year, the 2013 sequester, and a $60 billion payment from Fannie Mae

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the N ...

and Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons Corner, Virginia.Jefferies Group

Jefferies Group LLC is an American multinational independent investment bank and financial services company that is headquartered in New York City. The firm provides clients with capital markets and financial advisory services, institutional br ...

said extraordinary measures might have lasted until the end of October while Credit Suisse

Credit Suisse Group AG is a global investment bank and financial services firm founded and based in Switzerland. Headquartered in Zürich, it maintains offices in all major financial centers around the world and is one of the nine global " ...

estimated mid-November.

Members of the Republican Party in Congress opposed raising the debt ceiling, which had been routinely raised previously on a bipartisan basis without conditions, without additional spending cuts. They refused to raise the debt ceiling unless President Obama would have defunded the Affordable Care Act (Obamacare), his signature legislative achievement. The US Treasury began taking extraordinary measures to enable payments, and stated that it would delay payments if funds could not be raised through extraordinary measures, and the debt ceiling was not raised. During the crisis, approval ratings for the Republican Party declined. The crisis ended on October 17, 2013 with the passing of the Continuing Appropriations Act, 2014, although debate continues about the appropriate level of government spending, and the use of the debt ceiling in such negotiations.

2021 debt ceiling crisis

In 2021, following the expiration of the suspension of the debt ceiling in July 2021, the U.S. Treasury began taking "extraordinary measures" which are set to expire around October 18. Senate Republicans refused to raise the debt ceiling, insisting that Democrats were act on their own as they controlled the House and Senate.Historical debt ceiling levels

time value of money

The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. It may be seen as an implication of the later-developed concept of time preference.

The t ...

, such as interest and inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

and the size of the economy that generated a debt.

#The debt ceiling is an aggregate of gross debt, which includes debt in hands of public and in Intragovernment accounts.

#The debt ceiling does not necessarily reflect the level of actual debt.

#From March 15 to October 30, 2015 there was a de facto

''De facto'' ( ; , "in fact") describes practices that exist in reality, whether or not they are officially recognized by laws or other formal norms. It is commonly used to refer to what happens in practice, in contrast with ''de jure'' ("by la ...

debt limit of $18.153 trillion, due to use of Extraordinary measures

''Extraordinary Measures'' is a 2010 American medical drama film starring Brendan Fraser, Harrison Ford, and Keri Russell. It was the first film produced by CBS Films, the film division of CBS Corporation, who released the film on January 22, ...

.

Notes

References

Sources

* * * * Austin, D. Andrew (5 June 2017)"The Debt Limit Since 2011"

Congressional Research Service. * * * * * * * * * * * * *

External links

History and Recent Increases

(2010)

History and Recent Increases

(2008)

US Treasury Debt to the Penny (Daily)

Estimated Debt to the Penny (Real Time)

{{Clear Debt ceiling history Debt ceiling history Financial history of the United States