Gold as an investment on:

[Wikipedia]

[Google]

[Amazon]

Of all the

Of all the

Gold has been used throughout history as

Gold has been used throughout history as

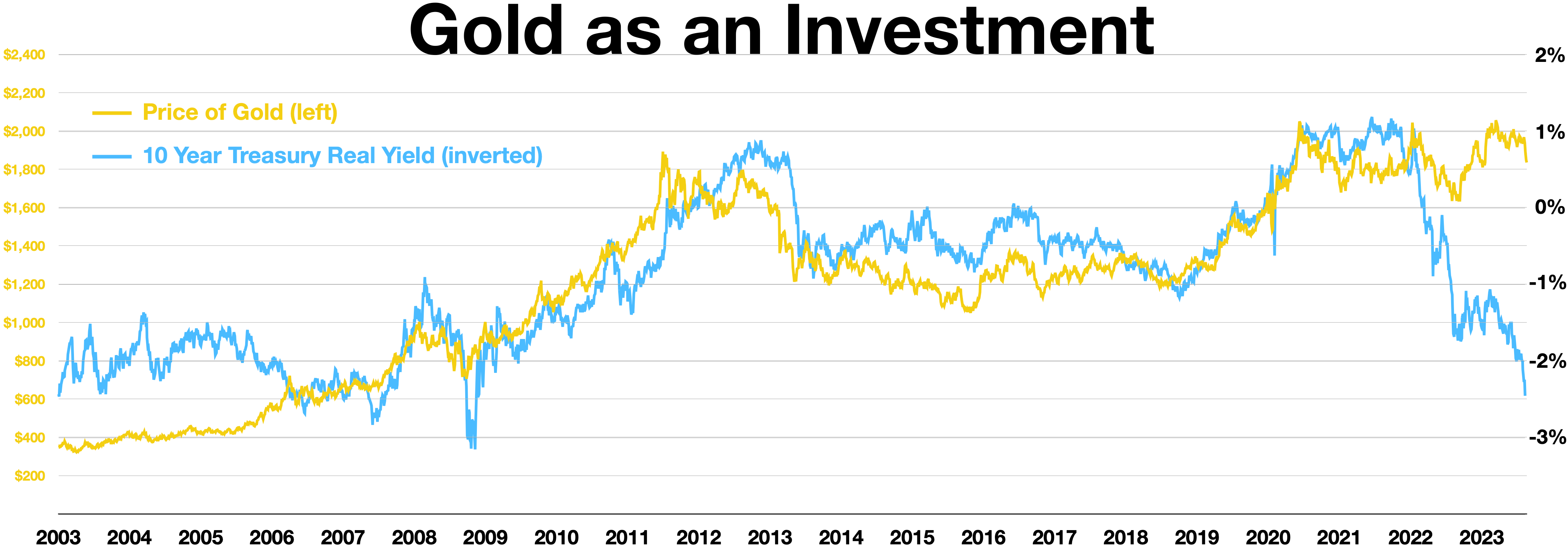

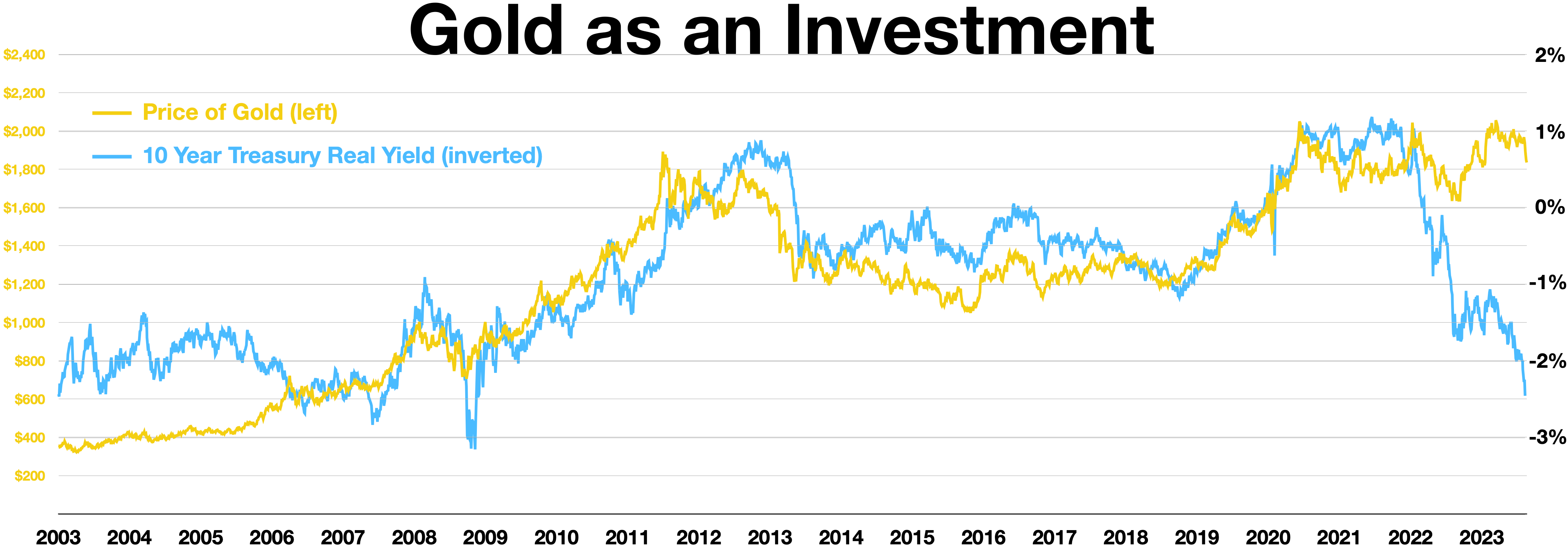

Like most commodities, the price of gold is driven by

Like most commodities, the price of gold is driven by

The most traditional way of investing in gold is by buying bullion

The most traditional way of investing in gold is by buying bullion

The performance of gold bullion is often compared to

The performance of gold bullion is often compared to

/ref> More recently, the fraud at e-Bullion resulted in a loss for investors.

Of all the

Of all the precious metal

Precious metals are rare, naturally occurring metallic chemical elements of high economic value.

Chemically, the precious metals tend to be less reactive than most elements (see noble metal). They are usually ductile and have a high lu ...

s, gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile ...

is the most popular as an investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing is ...

. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contract

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset ...

s and derivative

In mathematics, the derivative of a function of a real variable measures the sensitivity to change of the function value (output value) with respect to a change in its argument (input value). Derivatives are a fundamental tool of calculus. ...

s. The gold market is subject to speculation

In finance, speculation is the purchase of an asset (a commodity, goods, or real estate) with the hope that it will become more valuable shortly. (It can also refer to short sales in which the speculator hopes for a decline in value.)

Many ...

and volatility as are other markets. Compared to other precious metals used for investment, gold has been the most effective safe haven across a number of countries.

Gold price

money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money ar ...

and has been a relative standard for currency equivalents specific to economic regions or countries, until recent times. Many European countries implemented gold standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from th ...

s in the latter part of the 19th century until these were temporarily suspended in the financial crises involving World War I

World War I (28 July 1914 11 November 1918), often abbreviated as WWI, was List of wars and anthropogenic disasters by death toll, one of the deadliest global conflicts in history. Belligerents included much of Europe, the Russian Empire, ...

. After World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the World War II by country, vast majority of the world's countries—including all of the great power ...

, the Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the United States, Canada, Western European countries, Australia, and Japan after the 1944 Bretton Woods Agreement. The Bretto ...

pegged the United States dollar to gold at a rate of US$35 per troy ounce

Troy weight is a system of units of mass that originated in 15th-century England, and is primarily used in the precious metals industry. The troy weight units are the grain, the pennyweight (24 grains), the troy ounce (20 pennyweights), and th ...

. The system existed until the 1971 Nixon Shock, when the US unilaterally suspended the direct convertibility of the United States dollar to gold and made the transition to a fiat currency

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was some ...

system. The last major currency to be divorced from gold was the Swiss Franc

The Swiss franc is the currency and legal tender of Switzerland and Liechtenstein. It is also legal tender in the Italian exclave of Campione d'Italia which is surrounded by Swiss territory. The Swiss National Bank (SNB) issues banknotes and the ...

in 2000.

Since 1919 the most common benchmark for the price of gold has been the London gold fixing, a twice-daily telephone meeting of representatives from five bullion

Bullion is non-ferrous metal that has been refined to a high standard of elemental purity. The term is ordinarily applied to bulk metal used in the production of coins and especially to precious metals such as gold and silver. It comes fro ...

-trading firms of the London bullion market

The London bullion market is a wholesale over-the-counter market for the trading of gold and silver. Trading is conducted amongst members of the London Bullion Market Association (LBMA), loosely overseen by the Bank of England. Most of the member ...

. Furthermore, gold is traded continuously throughout the world based on the intra-day spot price

In finance, a spot contract, spot transaction, or simply spot, is a contract of buying or selling a commodity, security or currency for immediate settlement (payment and delivery) on the spot date, which is normally two business days after the ...

, derived from over-the-counter

Over-the-counter (OTC) drugs are medicines sold directly to a consumer without a requirement for a prescription from a healthcare professional, as opposed to prescription drugs, which may be supplied only to consumers possessing a valid prescr ...

gold-trading markets around the world (code

In communications and information processing, code is a system of rules to convert information—such as a letter, word, sound, image, or gesture—into another form, sometimes shortened or secret, for communication through a communicati ...

"XAU"). The following table sets out the gold price versus various assets and key statistics at five-year intervals.

Influencing factors

Like most commodities, the price of gold is driven by

Like most commodities, the price of gold is driven by supply and demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris paribus, holding all else equal, in a perfect competition, competitive market, the unit price for a ...

, including speculative demand. However, unlike most other commodities, saving and disposal play larger roles in affecting its price than its consumption. Most of the gold ever mined still exists in accessible form, such as bullion and mass-produced jewelry, with little value over its fine weight

The fineness of a precious metal object (coin, bar, jewelry, etc.) represents the weight of ''fine metal'' therein, in proportion to the total weight which includes alloying base metals and any impurities. Alloy metals are added to increase hardne ...

— so it is nearly as liquid as bullion, and can come back onto the gold market. At the end of 2006, it was estimated that all the gold ever mined totalled .

Given the huge quantity of gold stored above ground compared to the annual production, the price of gold is mainly affected by changes in sentiment, which affects market supply and demand equally, rather than on changes in annual production. According to the World Gold Council

The World Gold Council is the market development organisation for the gold industry. It works across all parts of the industry, from gold mining to investment, with the aim of stimulating and sustaining demand for gold.

They frequently publish ...

, annual mine production of gold over the last few years has been close to 2,500 tonnes. About 2,000 tonnes goes into jewelry, industrial and dental production, and around 500 tonnes goes to retail investors and exchange-traded gold funds.

Central banks

Central banks and theInternational Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

play an important role in the gold price. At the end of 2004, central banks

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central ba ...

and official organizations held 19% of all above-ground gold as official gold reserves

A gold reserve is the gold held by a national central bank, intended mainly as a guarantee to redeem promises to pay depositors, note holders (e.g. paper money), or trading peers, during the eras of the gold standard, and also as a store of v ...

. The ten-year Washington Agreement on Gold The Washington Agreement on Gold was signed on 26 September 1999 in Washington, D.C. during the International Monetary Fund (IMF) annual meeting, and the US Secretary of the Treasury, Lawrence Summers, and the Chairman of the Federal Reserve, Alan G ...

(WAG), which dates from September 1999, limited gold sales by its members (Europe, United States, Japan, Australia, the Bank for International Settlements

The Bank for International Settlements (BIS) is an international financial institution owned by central banks that "fosters international monetary and financial cooperation and serves as a bank for central banks".

The BIS carries out its work th ...

and the International Monetary Fund) to less than 400 tonnes a year. In 2009, this agreement was extended for five years, with a limit of 500 tonnes. European central banks, such as the Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government o ...

and the Swiss National Bank, have been key sellers of gold over this period. In 2014, the agreement was extended another five years at 400 tonnes per year. In 2019 the agreement was not extended again.

Although central banks do not generally announce gold purchases in advance, some, such as Russia, have expressed interest in growing their gold reserves again as of late 2005. In early 2006, China

China, officially the People's Republic of China (PRC), is a country in East Asia. It is the world's List of countries and dependencies by population, most populous country, with a Population of China, population exceeding 1.4 billion, slig ...

, which only holds 1.3% of its reserves in gold, announced that it was looking for ways to improve the returns on its official reserves. Some bulls hope that this signals that China might reposition more of its holdings into gold, in line with other central banks. Chinese investors began pursuing investment in gold as an alternative to investment in the Euro after the beginning of the Eurozone crisis in 2011. China has since become the world's top gold consumer .

The price of gold can be influenced by a number of macroeconomic variables. Such variables include the price of oil, the use of quantitative easing

Quantitative easing (QE) is a monetary policy action whereby a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary pol ...

, currency exchange rate movements and returns on equity markets.

Hedge against financial stress

Gold, like all precious metals, may be used as ahedge

A hedge or hedgerow is a line of closely spaced shrubs and sometimes trees, planted and trained to form a barrier or to mark the boundary of an area, such as between neighbouring properties. Hedges that are used to separate a road from adjoi ...

against inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

, deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflatio ...

or currency devaluation

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national curre ...

, though its efficacy as such has been questioned; historically, it has not proven itself reliable as a hedging instrument. A unique feature of gold is that it has no default risk. As Joe Foster, portfolio manager of the New York-based Van Eck International Gold Fund, explained in September 2010:

Jewelry and industrial demand

Jewelry

Jewellery ( UK) or jewelry ( U.S.) consists of decorative items worn for personal adornment, such as brooches, rings, necklaces, earrings, pendants, bracelets, and cufflinks. Jewellery may be attached to the body or the clothes. From a w ...

consistently accounts for over two-thirds of annual gold demand. India is the largest consumer in volume terms, accounting for 27% of demand in 2009, followed by China and the USA.

Industrial, dental and medical uses account for around 12% of gold demand. Gold has high thermal and electrical conductivity properties, along with a high resistance to corrosion and bacterial colonization. Jewelry and industrial demand have fluctuated over the past few years due to the steady expansion in emerging markets of middle classes aspiring to Western lifestyles, offset by the financial crisis of 2007–2010

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fi ...

.

Gold jewelry recycling

In recent years the recycling of second-hand jewelry has become a multibillion-dollar industry. The term "Cash for Gold" refers to offers of cash for selling old, broken, or mismatched gold jewelry to local and online gold buyers. There are many websites that offer these services. However, there are many companies that have been caught taking advantage of their customers, paying a fraction of what the gold or silver is really worth, leading to distrust in many companies.War, invasion and national emergency

When dollars were fully convertible into gold via thegold standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from th ...

, both were regarded as money. However, most people preferred to carry around paper banknotes

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes were originally issued ...

rather than the somewhat heavier and less divisible gold coin

A gold coin is a coin that is made mostly or entirely of gold. Most gold coins minted since 1800 are 90–92% gold (22karat), while most of today's gold bullion coins are pure gold, such as the Britannia, Canadian Maple Leaf, and American Buf ...

s. If people feared their bank would fail, a bank run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

might result. This happened in the USA during the Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

of the 1930s, leading President Roosevelt to impose a national emergency and issue Executive Order 6102

Executive Order 6102 is an executive order signed on April 5, 1933, by US President Franklin D. Roosevelt "forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States." The executive order w ...

outlawing the "hoarding" of gold by US citizens. There was only one prosecution under the order, and in that case the order was ruled invalid by federal judge John M. Woolsey

John Munro Woolsey (January 3, 1877 – May 4, 1945) was a United States district judge of the United States District Court for the Southern District of New York. He was known "for his brilliant and poignantly phrased decisions", including seve ...

, on the technical grounds that the order was signed by the President, not the Secretary of the Treasury as required.

Investment vehicles

Bars

The most traditional way of investing in gold is by buying bullion

The most traditional way of investing in gold is by buying bullion gold bar

A gold bar, also called gold bullion or gold ingot, is a quantity of refined metallic gold of any shape that is made by a bar producer meeting standard conditions of manufacture, labeling, and record keeping. Larger gold bars that are produced ...

s. In some countries, like Canada

Canada is a country in North America. Its ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, covering over , making it the world's second-largest country by to ...

, Austria

Austria, , bar, Östareich officially the Republic of Austria, is a country in the southern part of Central Europe, lying in the Eastern Alps. It is a federation of nine states, one of which is the capital, Vienna, the most populous ...

, Liechtenstein

Liechtenstein (), officially the Principality of Liechtenstein (german: link=no, Fürstentum Liechtenstein), is a German language, German-speaking microstate located in the Alps between Austria and Switzerland. Liechtenstein is a semi-constit ...

and Switzerland

). Swiss law does not designate a ''capital'' as such, but the federal parliament and government are installed in Bern, while other federal institutions, such as the federal courts, are in other cities (Bellinzona, Lausanne, Luzern, Neuchâtel ...

, these can easily be bought or sold at the major banks. Alternatively, there are bullion dealers that provide the same service. Bars are available in various sizes. For example, in Europe, Good Delivery

The Good Delivery specification is a set of rules issued by the London Bullion Market Association (LBMA) describing the physical characteristics of gold and silver bars used in settlement in the wholesale London bullion market. It also puts fort ...

bars are approximately . bars are also popular, although many other weights exist, such as the , , 10 g, 100 g, 1 kg, 1 (50 g in China), and 1 Tola

Tola may refer to:

Places

* Bella Tola, a mountain in the Pennine Alps in the Swiss canton of Valais

* La Tola, a town and municipality in the Nariño Department, Colombia

*Tola (Shakargarh), a village in Pakistan

* Tola, Rivas, a municipality ...

(11.3 g).

Bars generally carry lower price premiums than gold bullion coins. However larger bars carry an increased risk of forgery due to their less stringent parameters for appearance. While bullion coins can be easily weighed and measured against known values to confirm their veracity, most bars cannot, and gold buyers often have bars re-assay

An assay is an investigative (analytic) procedure in laboratory medicine, mining, pharmacology, environmental biology and molecular biology for qualitatively assessing or quantitatively measuring the presence, amount, or functional activity of ...

ed. Larger bars also have a greater volume in which to create a partial forgery using a tungsten

Tungsten, or wolfram, is a chemical element with the symbol W and atomic number 74. Tungsten is a rare metal found naturally on Earth almost exclusively as compounds with other elements. It was identified as a new element in 1781 and first isol ...

-filled cavity, which may not be revealed by an assay. Tungsten is ideal for this purpose because it is much less expensive than gold, but has the same density (19.3 g/cm3).

Good delivery bars that are held within the London bullion market

The London bullion market is a wholesale over-the-counter market for the trading of gold and silver. Trading is conducted amongst members of the London Bullion Market Association (LBMA), loosely overseen by the Bank of England. Most of the member ...

(LBMA) system each have a verifiable chain of custody, beginning with the refiner and assayer, and continuing through storage in LBMA recognized vaults. Bars within the LBMA system can be bought and sold easily. If a bar is removed from the vaults and stored outside of the chain of integrity, for example stored at home or in a private vault, it will have to be re-assayed before it can be returned to the LBMA chain. This process is described under the LBMA's "Good Delivery Rules".

The LBMA "traceable chain of custody" includes refiners as well as vaults. Both have to meet their strict guidelines. Bullion products from these trusted refiners are traded at face value by LBMA members without assay testing. By buying bullion from an LBMA member dealer and storing it in an LBMA recognized vault, customers avoid the need of re-assaying or the inconvenience in time and expense it would cost. However this is not 100% sure; for example, Venezuela moved its gold because of the political risk for them. And as the past shows, there may be risk even in countries considered democratic and stable; for example in the US in the 1930s gold was seized by the government and legal moving was banned.

Efforts to combat gold bar counterfeiting include kinebar

A kinebar is a gold bar which contains a hologram to protect its authenticity. Kinebars use a hologram called a "Kinegram", a diffractive optically variable image device (DOVID) which is embossed into the gold substrate. "Kinegram" is a trademar ...

s which employ a unique holographic technology and are manufactured by the Argor-Heraeus refinery in Switzerland.

Coins

Gold coin

A gold coin is a coin that is made mostly or entirely of gold. Most gold coins minted since 1800 are 90–92% gold (22karat), while most of today's gold bullion coins are pure gold, such as the Britannia, Canadian Maple Leaf, and American Buf ...

s are a common way of owning gold. Bullion coin

Bullion is non-ferrous metal that has been refined to a high standard of elemental purity. The term is ordinarily applied to bulk metal used in the production of coins and especially to precious metals such as gold and silver. It comes fro ...

s are priced according to their fine weight

The fineness of a precious metal object (coin, bar, jewelry, etc.) represents the weight of ''fine metal'' therein, in proportion to the total weight which includes alloying base metals and any impurities. Alloy metals are added to increase hardne ...

, plus a small premium based on supply and demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris paribus, holding all else equal, in a perfect competition, competitive market, the unit price for a ...

(as opposed to numismatic

Numismatics is the study or collection of currency, including coins, tokens, paper money, medals and related objects.

Specialists, known as numismatists, are often characterized as students or collectors of coins, but the discipline also incl ...

gold coins, which are priced mainly by supply and demand based on rarity and condition).

The sizes of bullion coins range from , with the size being most popular and readily available.

The Krugerrand

The Krugerrand (; ) is a South African coin, first minted on 3 July 1967 to help market South African gold and produced by Rand Refinery and the South African Mint. The name is a compound of ''Paul Kruger'', the former President of the South A ...

is the most widely held gold bullion coin, with in circulation. Other common gold bullion coins include the Australian Gold Nugget (Kangaroo), Austrian Philharmoniker ( Philharmonic), Austrian 100 Corona, Canadian Gold Maple Leaf

The Canadian Gold Maple Leaf (GML) is a gold bullion coin that is issued annually by the Government of Canada. It is produced by the Royal Canadian Mint.

The Gold Maple Leaf is legal tender with a face value of 50 Canadian dollars. The market ...

, Chinese Gold Panda

The Chinese Gold Panda () is a series of gold bullion coins issued by the People's Republic of China. The Official Mint of the People's Republic of China introduced the panda gold bullion coins in 1982. The panda design changes every year (with ...

, Malaysian Kijang Emas, French Napoleon or Louis d'Or, Mexican Gold 50 Peso, British Sovereign

The monarchy of the United Kingdom, commonly referred to as the British monarchy, is the constitutional form of government by which a hereditary sovereign reigns as the head of state of the United Kingdom, the Crown Dependencies (the Bailiwi ...

, American Gold Eagle, and American Buffalo.

Coins may be purchased from a variety of dealers both large and small. Fake gold coins are common and are usually made of gold-layered alloys.

Gold rounds

''Gold rounds'' look like gold coins, but they have nocurrency

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins.

A more general ...

value. They range in similar sizes as gold coin

A gold coin is a coin that is made mostly or entirely of gold. Most gold coins minted since 1800 are 90–92% gold (22karat), while most of today's gold bullion coins are pure gold, such as the Britannia, Canadian Maple Leaf, and American Buf ...

s, including , , and larger. Unlike gold coins, gold rounds commonly have no additional metals added to them for durability purposes and do not have to be made by a government mint

MiNT is Now TOS (MiNT) is a free software alternative operating system kernel for the Atari ST system and its successors. It is a multi-tasking alternative to TOS and MagiC. Together with the free system components fVDI device drivers, XaAE ...

, which allows the gold rounds to have a lower overhead price as compared to gold coins. On the other hand, gold rounds are normally not as collectible as gold coins.

Exchange-traded products

Gold exchange-traded products may includeexchange-traded fund

An exchange-traded fund (ETF) is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold from other owners throughout th ...

s (ETFs), exchange-traded note An exchange-traded product (ETP) is a regularly priced security which trades during the day on a national stock exchange. ETPs may embed derivatives but it is not a requirement that they do so - and the investment memorandum (or offering documents ...

s (ETNs), and closed-end fund

A closed-end fund (CEF) is a fund that raises capital by issuing a fixed number of shares which are not redeemable, and then invest that capital in financial assets such as stocks and bonds. Unlike open-end funds, new shares in a closed-end fund ...

s (CEFs), which are traded like shares on the major stock exchanges. The first gold ETF, Gold Bullion Securities

ETF Securities is an asset management firm that issues exchange-traded funds (ETFs) primarily in Australia.

History

The company was founded by Australian businessman and philanthropist Graham Tuckwell.

The company worked with the World Gold ...

(ticker symbol "GOLD"), was launched in March 2003 on the Australian Stock Exchange

Australian Securities Exchange Ltd or ASX, is an Australian public company that operates Australia's primary securities exchange, the Australian Securities Exchange (sometimes referred to outside of Australia as, or confused within Australia as ...

, and originally represented exactly of gold. , SPDR Gold Shares

SPDR Gold Shares (also known as SPDR Gold Trust) is part of the SPDR family of exchange-traded funds (ETFs) managed and marketed by State Street Global Advisors. For a few years, the fund was the second-largest exchange-traded fund in the world, an ...

is the second-largest exchange-traded fund in the world by market capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Market capitalization is equal to the market price per common share multiplied by ...

.

Gold exchange-traded products (ETPs) represent an easy way to gain exposure to the gold price, without the inconvenience of storing physical bars. However exchange-traded gold instruments, even those that hold physical gold for the benefit of the investor, carry risks beyond those inherent in the precious metal itself. For example, the most popular gold ETP (GLD) has been widely criticized, and even compared with mortgage-backed securities, due to features of its complex structure.

Typically a small commission is charged for trading in gold ETPs and a small annual storage fee is charged. The annual expenses of the fund such as storage, insurance, and management fees are charged by selling a small amount of gold represented by each certificate, so the amount of gold in each certificate will gradually decline over time.

Exchange-traded fund

An exchange-traded fund (ETF) is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold from other owners throughout th ...

s, or ETFs, are investment companies that are legally classified as open-end companies or unit investment trust

In U.S. financial law, a unit investment trust (UIT) is an investment product offering a fixed (unmanaged) portfolio of securities having a definite life. Unlike open-end and closed-end investment companies, a UIT has no board of directors. A ...

s (UITs), but that differ from traditional open-end companies and UITs. The main differences are that ETFs do not sell directly to investors and they issue their shares in what are called "Creation Units" (large blocks such as blocks of 50,000 shares). Also, the Creation Units may not be purchased with cash but a basket of securities that mirrors the ETF's portfolio. Usually, the Creation Units are split up and re-sold on a secondary market.

ETF shares can be sold in two ways: The investors

An investor is a person who allocates financial capital with the expectation of a future return (profit) or to gain an advantage (interest). Through this allocated capital most of the time the investor purchases some species of property. Type ...

can sell the individual shares to other investors, or they can sell the Creation Units back to the ETF. In addition, ETFs generally redeem Creation Units by giving investors the securities that comprise the portfolio instead of cash. Because of the limited redeemability of ETF shares, ETFs are not considered to be and may not call themselves mutual funds

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV ...

.

Certificates

Gold certificate

Gold certificates were issued by the United States Treasury as a form of representative money from 1865 to 1933. While the United States observed a gold standard, the certificates offered a more convenient way to pay in gold than the use of coin ...

s allow gold investors to avoid the risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environm ...

s and costs associated with the transfer and storage of physical bullion (such as theft, large bid–offer spread, and metallurgical assay

A metallurgical assay is a compositional analysis of an ore, metal, or alloy, usually performed in order to test for purity or quality.

Some assay methods are suitable for raw materials; others are more appropriate for finished goods. Raw pre ...

costs) by taking on a different set of risks and costs associated with the certificate itself (such as commissions, storage fees, and various types of credit risk

A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. In the first resort, the risk is that of the lender and includes lost principal and interest, disruption to cash flows, and increased ...

).

Banks may issue gold certificates for gold that is ''allocated'' (fully reserved) or ''unallocated'' (pooled). Unallocated gold certificates are a form of fractional reserve banking

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserv ...

and do not guarantee an equal exchange for metal in the event of a run

Run(s) or RUN may refer to:

Places

* Run (island), one of the Banda Islands in Indonesia

* Run (stream), a stream in the Dutch province of North Brabant

People

* Run (rapper), Joseph Simmons, now known as "Reverend Run", from the hip-hop group ...

on the issuing bank's gold on deposit. Allocated gold certificates should be correlated with specific numbered bars, although it is difficult to determine whether a bank is improperly allocating a single bar to more than one party.

The first paper bank notes were gold certificates

Gold certificates were issued by the United States Treasury as a form of representative money from 1865 to 1933. While the United States observed a gold standard, the certificates offered a more convenient way to pay in gold than the use of coin ...

. They were first issued in the 17th century when they were used by goldsmiths in England

England is a country that is part of the United Kingdom. It shares land borders with Wales to its west and Scotland to its north. The Irish Sea lies northwest and the Celtic Sea to the southwest. It is separated from continental Europe ...

and the Netherlands

)

, anthem = ( en, "William of Nassau")

, image_map =

, map_caption =

, subdivision_type = Sovereign state

, subdivision_name = Kingdom of the Netherlands

, established_title = Before independence

, established_date = Spanish Netherl ...

for customers who kept deposits of gold bullion in their vault for safe-keeping. Two centuries later, the gold certificates began being issued in the United States when the US Treasury issued such certificates that could be exchanged for gold. The United States Government first authorized the use of the gold certificates in 1863. On April 5, 1933, the US Government restricted the private gold ownership in the United States and therefore, the gold certificates stopped circulating as money (this restriction was reversed on January 1, 1975). Nowadays, gold certificates are still issued by gold pool programs in Australia

Australia, officially the Commonwealth of Australia, is a sovereign country comprising the mainland of the Australian continent, the island of Tasmania, and numerous smaller islands. With an area of , Australia is the largest country by ...

and the United States, as well as by banks in Germany

Germany,, officially the Federal Republic of Germany, is a country in Central Europe. It is the second most populous country in Europe after Russia, and the most populous member state of the European Union. Germany is situated betwee ...

, Switzerland

). Swiss law does not designate a ''capital'' as such, but the federal parliament and government are installed in Bern, while other federal institutions, such as the federal courts, are in other cities (Bellinzona, Lausanne, Luzern, Neuchâtel ...

and Vietnam

Vietnam or Viet Nam ( vi, Việt Nam, ), officially the Socialist Republic of Vietnam,., group="n" is a country in Southeast Asia, at the eastern edge of mainland Southeast Asia, with an area of and population of 96 million, making ...

.

Accounts

Many types of gold "accounts" are available. Different accounts impose varying types of intermediation between the client and their gold. One of the most important differences between accounts is whether the gold is held on an allocated (fully reserved) or unallocated (pooled) basis. Unallocated gold accounts are a form offractional reserve banking

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserv ...

and do not guarantee an equal exchange for metal in the event of a run

Run(s) or RUN may refer to:

Places

* Run (island), one of the Banda Islands in Indonesia

* Run (stream), a stream in the Dutch province of North Brabant

People

* Run (rapper), Joseph Simmons, now known as "Reverend Run", from the hip-hop group ...

on the issuer's gold on deposit. Another major difference is the strength of the account holder's claim on the gold, in the event that the account administrator faces gold-denominated liabilities (due to a short or naked short

Nudity is the state of being in which a human is without clothing.

The loss of body hair was one of the physical characteristics that marked the biological evolution of modern humans from their hominin ancestors. Adaptations related to ...

position in gold for example), asset forfeiture

Asset forfeiture or asset seizure is a form of confiscation of assets by the authorities. In the United States, it is a type of criminal-justice financial obligation. It typically applies to the alleged proceeds or instruments of crime. This ap ...

, or bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debto ...

.

Many banks offer gold accounts where gold can be instantly bought or sold just like any foreign currency on a fractional reserve basis. Swiss bank

Banking in Switzerland dates to the early eighteenth century through Switzerland's merchant trade and has, over the centuries, grown into a complex, regulated, and international industry. Banking is seen as emblematic of Switzerland, along wit ...

s offer similar service on a fully allocated basis. Pool accounts, such as those offered by some providers, facilitate highly liquid but unallocated claims on gold owned by the company. Digital gold currency systems operate like pool accounts and additionally allow the direct transfer of fungible gold between members of the service. Other operators, by contrast, allows clients to create a bailment

Bailment is a legal relationship in common law, where the owner transfers physical possession of personal property ("chattel") for a time, but retains ownership. The owner who surrenders custody to a property is called the "bailor" and the ind ...

on allocated (non-fungible) gold, which becomes the legal property of the buyer.

Other platforms provide a marketplace where physical gold is allocated to the buyer at the point of sale, and becomes their legal property. These providers are merely custodians of client bullion, which does not appear on their balance sheet.

Typically, bullion banks only deal in quantities of or more in either allocated or unallocated accounts. For private investors, vaulted gold

Vaulted gold denotes gold bullion stored in bank vaults. By acquiring vaulted gold, institutional or private investors obtain outright ownership of physical gold.

An investor who buys vaulted gold also acquires physical gold ownership. Vaulted g ...

offers private individuals to obtain ownership in professionally vaulted gold starting from minimum investment requirements of several thousand U.S.-dollars or denominations as low as one gram.

Derivatives, CFDs and spread betting

Derivative

In mathematics, the derivative of a function of a real variable measures the sensitivity to change of the function value (output value) with respect to a change in its argument (input value). Derivatives are a fundamental tool of calculus. ...

s, such as gold forwards, futures

Futures may mean:

Finance

*Futures contract, a tradable financial derivatives contract

*Futures exchange, a financial market where futures contracts are traded

* ''Futures'' (magazine), an American finance magazine

Music

* ''Futures'' (album), a ...

and options

Option or Options may refer to:

Computing

*Option key, a key on Apple computer keyboards

*Option type, a polymorphic data type in programming languages

*Command-line option, an optional parameter to a command

*OPTIONS, an HTTP request method

...

, currently trade on various exchanges around the world and over-the-counter

Over-the-counter (OTC) drugs are medicines sold directly to a consumer without a requirement for a prescription from a healthcare professional, as opposed to prescription drugs, which may be supplied only to consumers possessing a valid prescr ...

(OTC) directly in the private market. In the U.S., gold futures are primarily traded on the New York Commodities Exchange ( COMEX) and Euronext.liffe. In India

India, officially the Republic of India (Hindi: ), is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area, the List of countries and dependencies by population, second-most populous ...

, gold futures are traded on the National Commodity and Derivatives Exchange (NCDEX) and Multi Commodity Exchange (MCX).

As of 2009 holders of COMEX gold futures have experienced problems taking delivery of their metal. Along with chronic delivery delays, some investors have received delivery of bars not matching their contract in serial number and weight. The delays cannot be easily explained by slow warehouse movements, as the daily reports of these movements show little activity. Because of these problems, there are concerns that COMEX may not have the gold inventory to back its existing warehouse receipts.

Outside the US, a number of firms provide trading on the price of gold via contracts for difference (CFDs) or allow spread bets on the price of gold.

Mining companies

Instead of buying gold itself, investors can buy the companies that produce the gold asshares

In financial markets, a share is a unit of equity ownership in the capital stock of a corporation, and can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of ...

in gold mining companies. If the gold price rises, the profits of the gold mining company could be expected to rise and the worth of the company will rise and presumably the share price will also rise. However, there are many factors to take into account and it is not always the case that a share price will rise when the gold price increases. Mines are commercial enterprises and subject to problems such as flooding

A flood is an overflow of water ( or rarely other fluids) that submerges land that is usually dry. In the sense of "flowing water", the word may also be applied to the inflow of the tide. Floods are an area of study of the discipline hydrolog ...

, subsidence

Subsidence is a general term for downward vertical movement of the Earth's surface, which can be caused by both natural processes and human activities. Subsidence involves little or no horizontal movement, which distinguishes it from slope mov ...

and structural failure

Structural integrity and failure is an aspect of engineering that deals with the ability of a structure to support a designed structural load (weight, force, etc.) without breaking and includes the study of past structural failures in order t ...

, as well as mismanagement, negative publicity, nationalization, theft and corruption. Such factors can lower the share prices of mining companies.

The price of gold bullion is volatile, but unhedged gold shares and funds are regarded as even higher risk and even more volatile. This additional volatility is due to the inherent leverage in the mining

Mining is the extraction of valuable minerals or other geological materials from the Earth, usually from an ore body, lode, vein, seam, reef, or placer deposit. The exploitation of these deposits for raw material is based on the econom ...

sector. For example, if one owns a share in a gold mine where the costs of production are US and the price of gold is , the mine's profit margin

Profit margin is a measure of profitability. It is calculated by finding the profit as a percentage of the revenue.

\text = =

There are 3 types of profit margins: gross profit margin, operating profit margin and net profit margin.

* Gross Pro ...

will be $300. A 10% increase in the gold price to will push that margin up to $360, which represents a 20% increase in the mine's profitability, and possibly a 20% increase in the share price. Furthermore, at higher prices, more ounces of gold become economically viable to mine, enabling companies to add to their production. Conversely, share movements also amplify falls in the gold price. For example, a 10% fall in the gold price to will decrease that margin to $240, which represents a 20% fall in the mine's profitability, and possibly a 20% decrease in the share price.

To reduce this volatility, some gold mining companies hedge

A hedge or hedgerow is a line of closely spaced shrubs and sometimes trees, planted and trained to form a barrier or to mark the boundary of an area, such as between neighbouring properties. Hedges that are used to separate a road from adjoi ...

the gold price up to 18 months in advance. This provides the mining company and investors with less exposure to short-term gold price fluctuations, but reduces returns when the gold price is rising.

Investment strategies

Fundamental analysis

Investors usingfundamental analysis

Fundamental analysis, in accounting and finance, is the analysis of a business's financial statements (usually to analyze the business's assets, liabilities, and earnings); health; and competitors and markets. It also considers the overall sta ...

analyze the macroeconomic

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole.

For example, using interest rates, taxes, an ...

situation, which includes international economic indicator

An economic indicator is a statistic about an economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. Economic ...

s, such as GDP

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is ofte ...

growth rates, inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

, interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, t ...

s, productivity

Productivity is the efficiency of production of goods or services expressed by some measure. Measurements of productivity are often expressed as a ratio of an aggregate output to a single input or an aggregate input used in a production proces ...

and energy prices. They would also analyze the yearly global gold supply versus demand.

Gold versus stocks

The performance of gold bullion is often compared to

The performance of gold bullion is often compared to stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a compan ...

s as different investment vehicles. Gold is regarded by some as a store of value (without growth) whereas stocks are regarded as a return on value (i.e., growth from anticipated real price increase plus dividends). Stocks and bonds perform best in a stable political climate with strong property rights and little turmoil. The attached graph shows the value of Dow Jones Industrial Average divided by the price of an ounce of gold. Since 1800, stocks have consistently gained value in comparison to gold in part because of the stability of the American political system. This appreciation has been cyclical with long periods of stock outperformance followed by long periods of gold outperformance. The Dow Industrials bottomed out a ratio of 1:1 with gold during 1980 (the end of the 1970s bear market) and proceeded to post gains throughout the 1980s and 1990s. The gold price peak of 1980 also coincided with the Soviet Union's invasion of Afghanistan and the threat of the global expansion of communism. The ratio peaked on January 14, 2000, a value of 41.3 and has fallen sharply since.

One argument follows that in the long-term, gold's high volatility when compared to stocks and bonds, means that gold does not hold its value compared to stocks and bonds:Sowell, Thomas (2004). ''Basic Economics: A Citizen's Guide to the Economy''. Basic Books, .

Using leverage

Investors may choose to leverage their position by borrowing money against their existing assets and then purchasing or selling gold on account with the loaned funds. Leverage is also an integral part of trading gold derivatives and unhedged gold mining company shares (see gold mining companies). Leverage or derivatives may increase investment gains but also increases the corresponding risk of capital loss if the trend reverses.Taxation

Gold maintains a special position in the market with many tax regimes. For example, in theEuropean Union

The European Union (EU) is a supranational union, supranational political union, political and economic union of Member state of the European Union, member states that are located primarily in Europe, Europe. The union has a total area of ...

the trading of recognised gold coins and bullion products are free of VAT. Silver

Silver is a chemical element with the symbol Ag (from the Latin ', derived from the Proto-Indo-European ''h₂erǵ'': "shiny" or "white") and atomic number 47. A soft, white, lustrous transition metal, it exhibits the highest electrical ...

and other precious metals or commodities do not have the same allowance. Other taxes such as capital gains tax

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property.

Not all countries impose a c ...

may also apply for individuals depending on their tax residency

The criteria for residence for tax purposes vary considerably from jurisdiction to jurisdiction, and "residence" can be different for other, non-tax purposes. For individuals, physical presence in a jurisdiction is the main test. Some jurisdictio ...

. U.S. citizens may be taxed on their gold profits at collectibles or capital gains rates, depending on the investment vehicle used.

Scams and frauds

Gold attracts a fair share of fraudulent activity. Some of the most common are: * Cash for gold – With the rise in the value of gold due to the financial crisis of 2007–2010, there has been a surge in companies that will buy personal gold in exchange for cash, or sell investments in gold bullion and coins. Several of these have prolific marketing plans and high-value spokesmen, such as prior vice presidents. Many of these companies are under investigation for a variety ofsecurities fraud

Securities fraud, also known as stock fraud and investment fraud, is a deceptive practice in the stock or commodities markets that induces investors to make purchase or sale decisions on the basis of false information, frequently resulting in lo ...

claims, as well as laundering money for terrorist organization

A number of national governments and two international organizations have created lists of organizations that they designate as terrorist. The following list of designated terrorist groups lists groups designated as terrorist by current and fo ...

s. Also, given that ownership is often not verified, many companies are considered to be receiving stolen property, and multiple laws are under consideration as methods to curtail this.

* High-yield investment program

A high-yield investment program (HYIP) is a type of Ponzi scheme, an investment scam that promises unsustainably high return on investment by paying previous investors with the money invested by new investors.

Mechanics

Operators generally set ...

s – HYIPs are usually just dressed up pyramid scheme

A pyramid scheme is a business model that recruits members via a promise of payments or services for enrolling others into the scheme, rather than supplying investments or sale of products. As recruiting multiplies, recruiting becomes quickly i ...

s, with no real value underneath. Using gold in their prospectus makes them seem more solid and trustworthy.

* Advance fee fraud

An advance-fee scam is a form of fraud and is one of the most common types of confidence tricks. The scam typically involves promising the victim a significant share of a large sum of money, in return for a small up-front payment, which the fraud ...

– Various emails circulate on the Internet for buyers or sellers of up to 10,000 metric tonnes of gold (an amount greater than US Federal Reserve holdings). Through the use of fake legalistic phrases, such as "Swiss Procedure" or "FCO" (Full Corporate Offer), naive middlemen are drafted as hopeful brokers. The end-game of these scams varies, with some attempting to extract a small "validation" amount from the innocent buyer/seller (in hopes of hitting the big deal), and others focused on draining the bank accounts of their targeted dupes.

* Gold dust sellers – This scam persuades an investor to purchase a trial quantity of real gold, then eventually delivers brass

Brass is an alloy of copper (Cu) and zinc (Zn), in proportions which can be varied to achieve different mechanical, electrical, and chemical properties. It is a substitutional alloy: atoms of the two constituents may replace each other wi ...

filings or similar.

* Counterfeit gold coin

A gold coin is a coin that is made mostly or entirely of gold. Most gold coins minted since 1800 are 90–92% gold (22karat), while most of today's gold bullion coins are pure gold, such as the Britannia, Canadian Maple Leaf, and American Buf ...

s.

* Shares in fraudulent mining companies with no gold reserves, or potential of finding gold. For example, the Bre-X scandal in 1997.

* There have been instances of fraud when the seller keeps possession of the gold. In the early 1980s, when gold prices were high, two major frauds were International Gold Bullion Exchange and Bullion Reserve of North America.Audit After Gold Dealer's Suicide Suggests Customers Lost Millions ''New York Times'' October 5, 198/ref> More recently, the fraud at e-Bullion resulted in a loss for investors.

See also

*Gold fixing

The London Gold Fixing (or Gold Fix) is the setting of the price of gold that takes place via a dedicated conference line. It was formerly held on the London premises of Nathan Mayer Rothschild & Sons by the members of The London Gold Market Fixi ...

* Gold repatriation

* Full-reserve banking

* Gold exchange-traded product

* Inflation hedge An inflation hedge is an investment intended to protect the investor against (hedge) a decrease in the purchasing power of money (inflation). There is no investment known to be a successful hedge in all inflationary environments, just as there is n ...

* Vaulted gold

Vaulted gold denotes gold bullion stored in bank vaults. By acquiring vaulted gold, institutional or private investors obtain outright ownership of physical gold.

An investor who buys vaulted gold also acquires physical gold ownership. Vaulted g ...

* Peak gold

* Gold reserve

A gold reserve is the gold held by a national central bank, intended mainly as a guarantee to redeem promises to pay depositors, note holders (e.g. paper money), or trading peers, during the eras of the gold standard, and also as a store ...

* Traditional investments

* Alternative investments

An alternative investment, also known as an alternative asset or alternative investment fund (AIF), is an investment in any asset class excluding stocks, bonds, and cash. The term is a relatively loose one and includes tangible assets such a ...

* List of bullion dealers

This list of bullion dealers includes notable companies and organizations that deal in precious metals, such as gold and silver.

References

{{Reflist

bullion

Bullion is non-ferrous metal that has been refined to a high standard of eleme ...

Rare materials as investments

* Diamonds as an investment * Palladium as an investment *Platinum as an investment

Platinum as an investment has a much shorter history in the financial sector than gold or silver, which were known to ancient civilizations. Experts posit that platinum is about 15–20 times scarcer than gold, on the basis of annual mine produc ...

* Silver as an investment

Silver is a chemical element with the symbol Ag (from the Latin ', derived from the Proto-Indo-European ''h₂erǵ'': "shiny" or "white") and atomic number 47. A soft, white, lustrous transition metal, it exhibits the highest electrical cond ...

References

External links

* {{DEFAULTSORT:Gold As An Investment Gold investments Precious metals as investment Commodities used as an investment Security Precious metals Gold in China Gold in India