Financial position of the United States on:

[Wikipedia]

[Google]

[Amazon]

The financial position of the United States includes

The financial position of the United States includes

The

The

The financial position of the United States includes

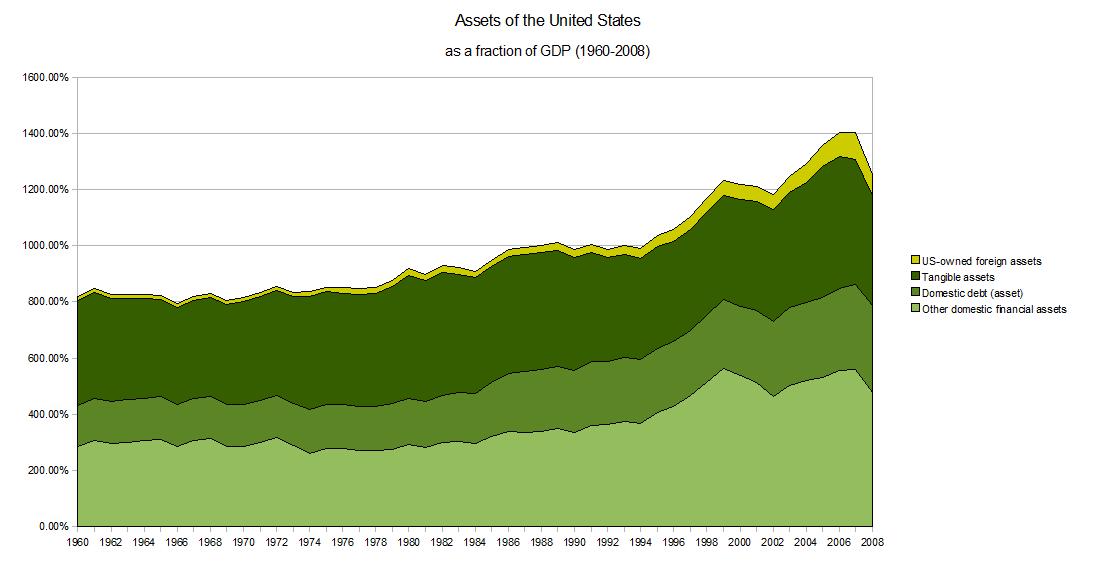

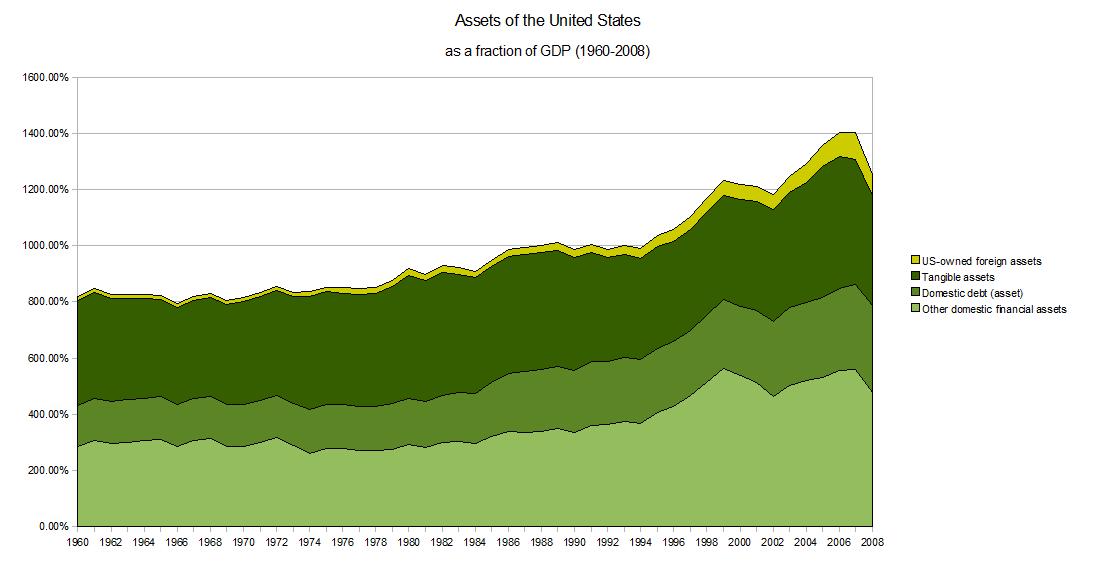

The financial position of the United States includes asset

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that c ...

s of at least $269.6 trillion

''Trillion'' is a number with two distinct definitions:

*1,000,000,000,000, i.e. one million million, or (ten to the twelfth power), as defined on the short scale. This is now the meaning in both American and British English.

* 1,000,000,000,00 ...

(1576% of GDP

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is ofte ...

) and debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The ...

s of $145.8 trillion (852% of GDP) to produce a net worth

Net worth is the value of all the non-financial and financial assets owned by an individual or institution minus the value of all its outstanding liabilities. Since financial assets minus outstanding liabilities equal net financial assets, net ...

of at least $123.8 trillion (723% of GDP) as of Q1 2014.

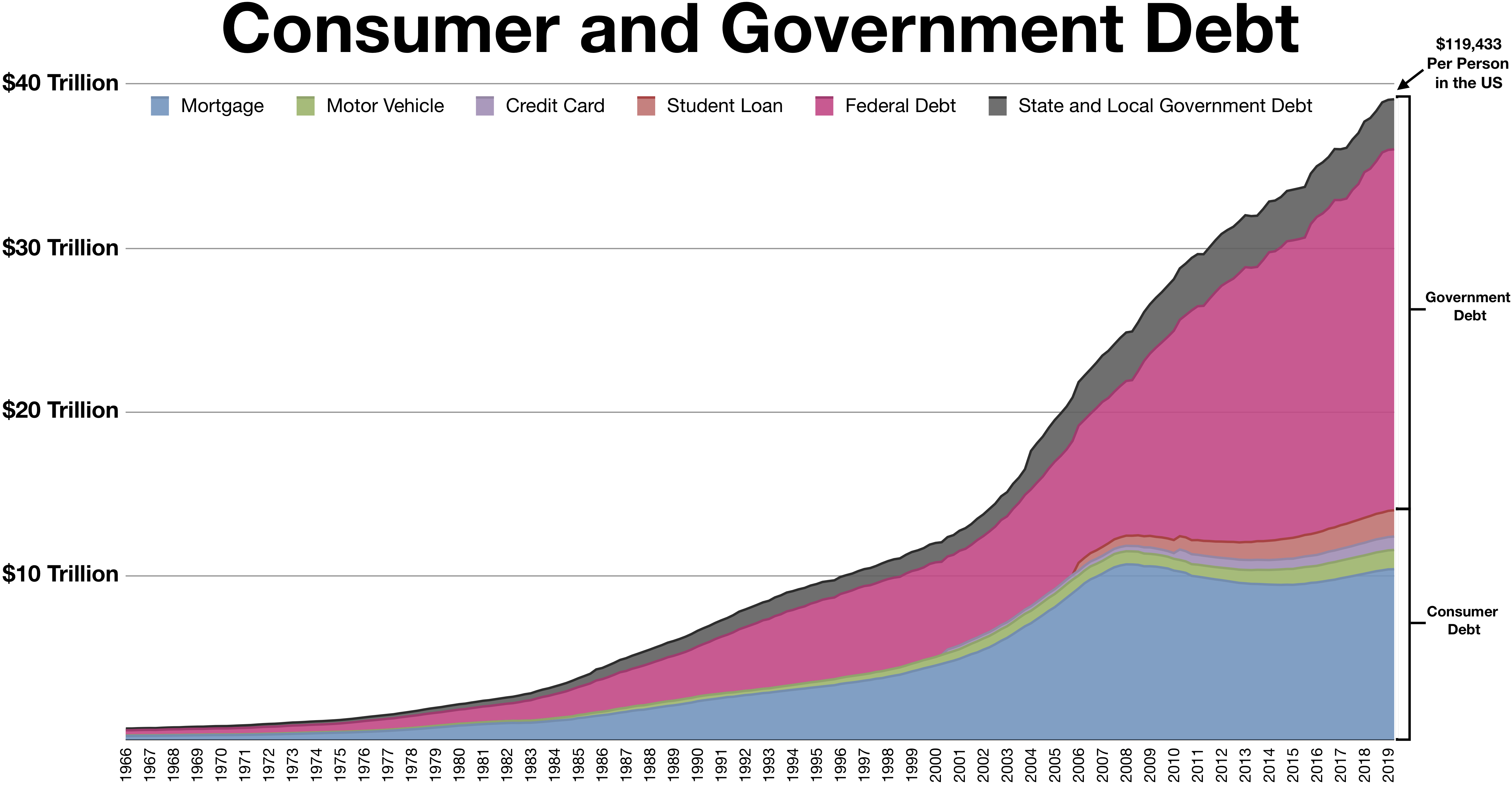

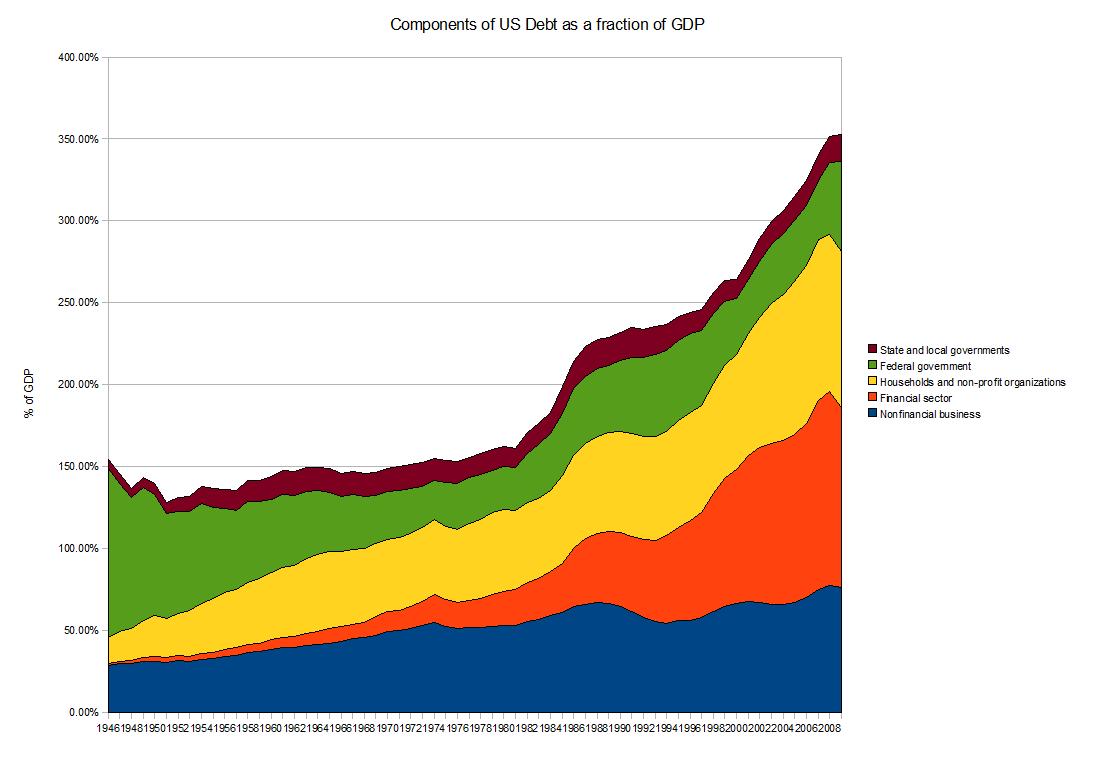

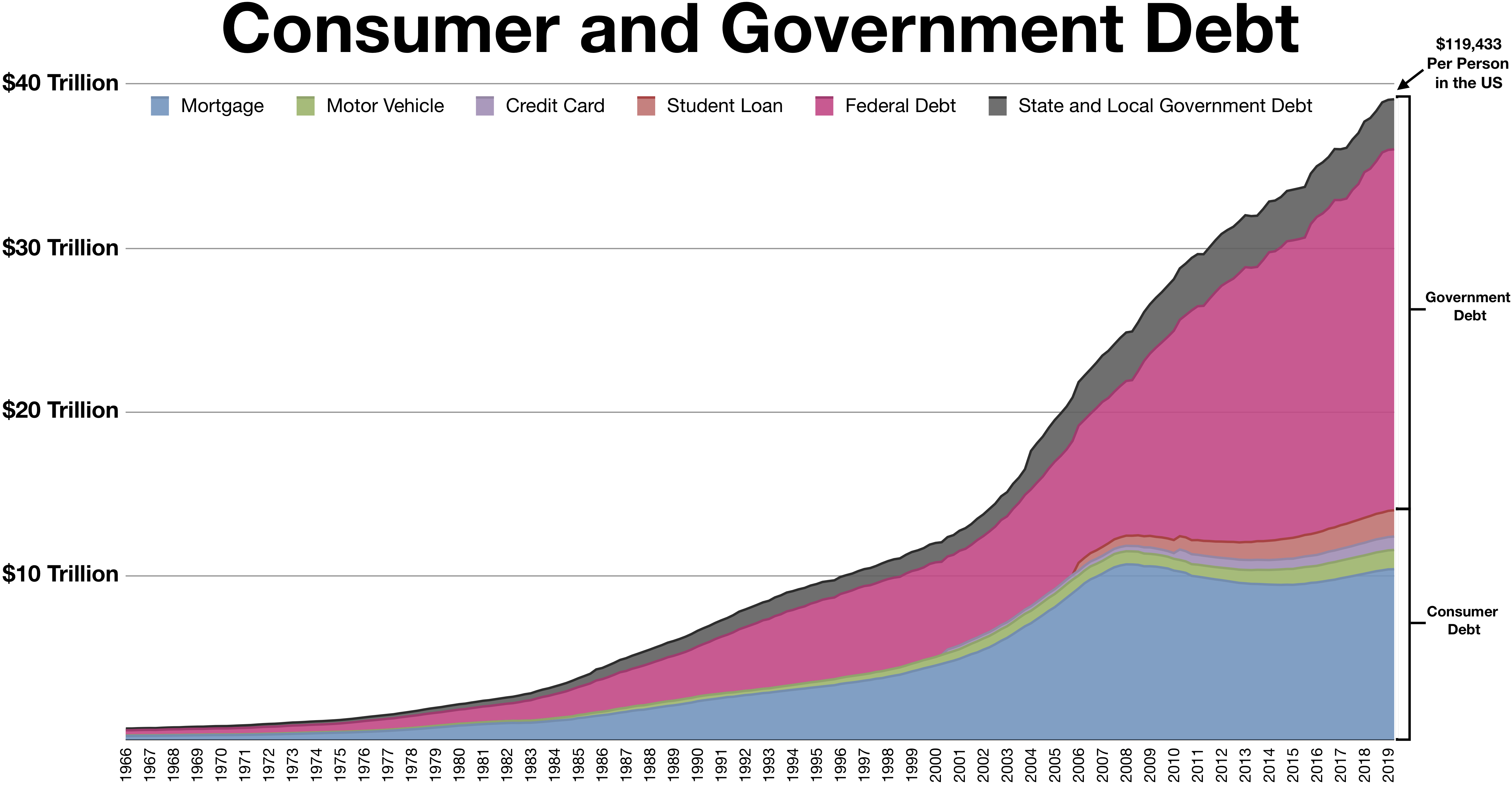

The U.S. increased the ratio of public and private debt from 152% GDP in 1980 to peak at 296% GDP in 2008, before falling to 279% GDP by Q2 2011. The 2009-2011 decline was due to foreclosures and increased rates of household saving. There were significant declines in debt to GDP in each sector except the government, which ran large deficits to offset deleveraging

At the micro-economic level, deleveraging refers to the reduction of the leverage ratio, or the percentage of debt in the balance sheet of a single economic entity, such as a household or a firm. It is the opposite of leveraging, which is the pr ...

or debt reduction in other sectors.

As of 2009, there was $50.7 trillion of debt owed by US households, businesses, and governments, representing more than 3.5 times the annual gross domestic product

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is of ...

of the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country Continental United States, primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., ...

. As of the first quarter of 2010, domestic financial assetsDomestic financial assets and liabilities are calculated as total assets and liabilities (table L.5) minus foreign assets and liabilities (table L.107) totaled $131 trillion and domestic financial liabilities $106 trillion. Tangible assets in 2008 (such as real estate

Real estate is property consisting of land and the buildings on it, along with its natural resources such as crops, minerals or water; immovable property of this nature; an interest vested in this (also) an item of real property, (more genera ...

and equipment

Equipment most commonly refers to a set of tools or other objects commonly used to achieve a particular objective. Different job

Work or labor (or labour in British English) is intentional activity people perform to support the needs and ...

) for selected sectors totaled an additional $56.3 trillion.

Net worth (or equity)

Net worth

Net worth is the value of all the non-financial and financial assets owned by an individual or institution minus the value of all its outstanding liabilities. Since financial assets minus outstanding liabilities equal net financial assets, net ...

is the sum of assets (both financial and tangible) minus liabilities for a given sector. Net worth is a valuable measure of creditworthiness

A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. In the first resort, the risk is that of the lender and includes lost principal and interest, disruption to cash flows, and increased ...

and financial health since the calculation includes both financial obligations and the capacity to service those obligations.

The net worth of the United States and its economic sectors has remained relatively consistent over time. The total net worth of the United States remained between 4.5 and 6 times GDP from 1960 until the 2000s, when it rose as high as 6.64 times GDP in 2006, principally due to an increase in the net worth of US households in the midst of the United States housing bubble

The 2000s United States housing bubble was a real-estate bubble affecting over half of the U.S. states. It was the impetus for the subprime mortgage crisis. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reac ...

. The net worth of the United States sharply declined to 5.2 times GDP by the end of 2008 due to declines in the values of US corporate equities and real estate in the wake of the subprime mortgage crisis

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. It was triggered by a large decline in US home prices after the col ...

and the global financial crisis

Global means of or referring to a globe and may also refer to:

Entertainment

* ''Global'' (Paul van Dyk album), 2003

* ''Global'' (Bunji Garlin album), 2007

* ''Global'' (Humanoid album), 1989

* ''Global'' (Todd Rundgren album), 2015

* Bruno ...

. Between 2008 and 2009, the net worth of US households had recovered from a low of 3.55 times GDP to 3.75 times GDP, while nonfinancial business fell from 1.37 times GDP to 1.22 times GDP.

The net worth of American households and non-profits constitutes three-quarters of total United States net worth – in 2008, 355% of GDP. Since 1960, US households have consistently held this position, followed by nonfinancial business (137% of GDP in 2008) and state and local governments (50% of GDP in 2008). The financial sector has hovered around zero net worth since 1960, reflecting its leverage, while the federal government has fluctuated from a net worth of -7% of GDP in 1946, a high of 6% of GDP in 1974, to -32% of GDP in 2008.

Estimated financial position, Q1 2014

Some figures are missing land and nonproduced nonfinancial assets.Gross domestic assets, and related gain (or loss), at end of 2011

''SOURCE: Federal Reserve Bank Z-1 Flow of Funds Statement, End of 2011 Accounts''Gross domestic income for 2010

''SOURCE: U.S. Bureau of Economic Analysis, 2010 Accounts''Gross domestic expense for 2010

''SOURCE: U.S. Bureau of Economic Analysis, 2010 Accounts''Debt

The

The Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

issues routine reports on the flows and levels of debt in the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country Continental United States, primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., ...

. As of the first quarter of 2010, the Federal Reserve estimated that total public and private debt owed by American households, businesses, and government totaled $50 trillion, or roughly $175,000 per American and 3.5 times GDP.

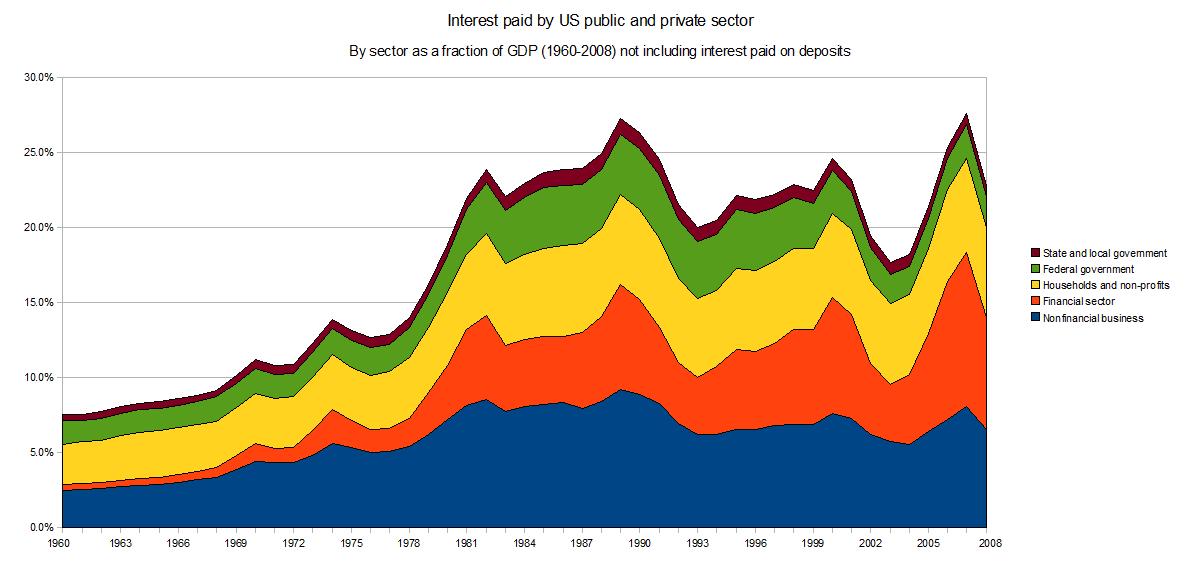

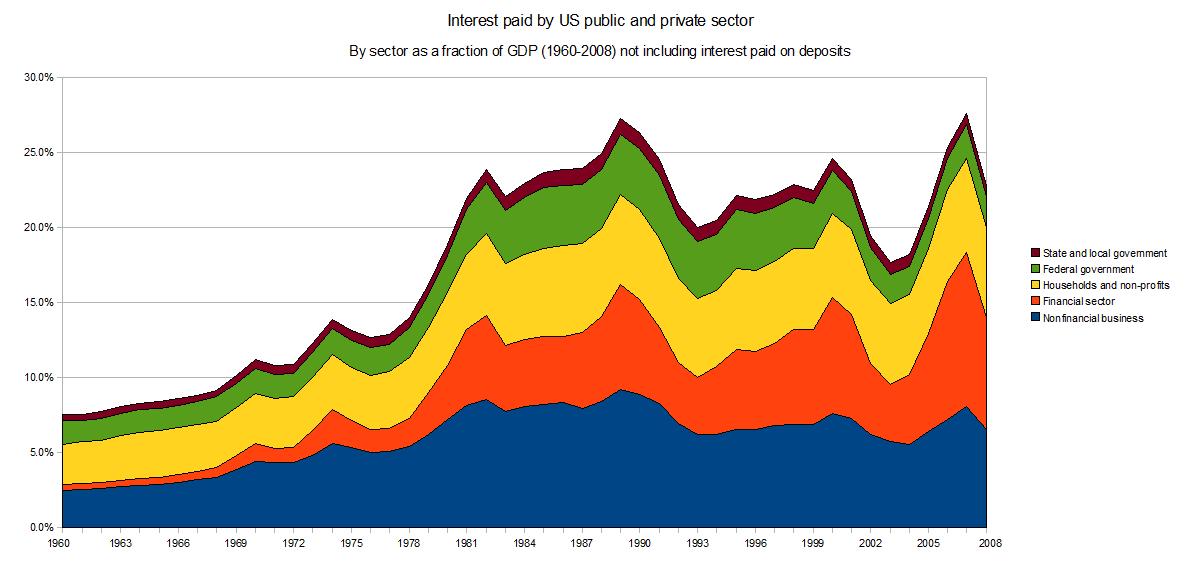

Interest

In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distin ...

payments on debt by US households, businesses, governments, and nonprofits totaled $3.29 trillion in 2008. The financial sector paid an additional $178.6 billion in interest on deposits.

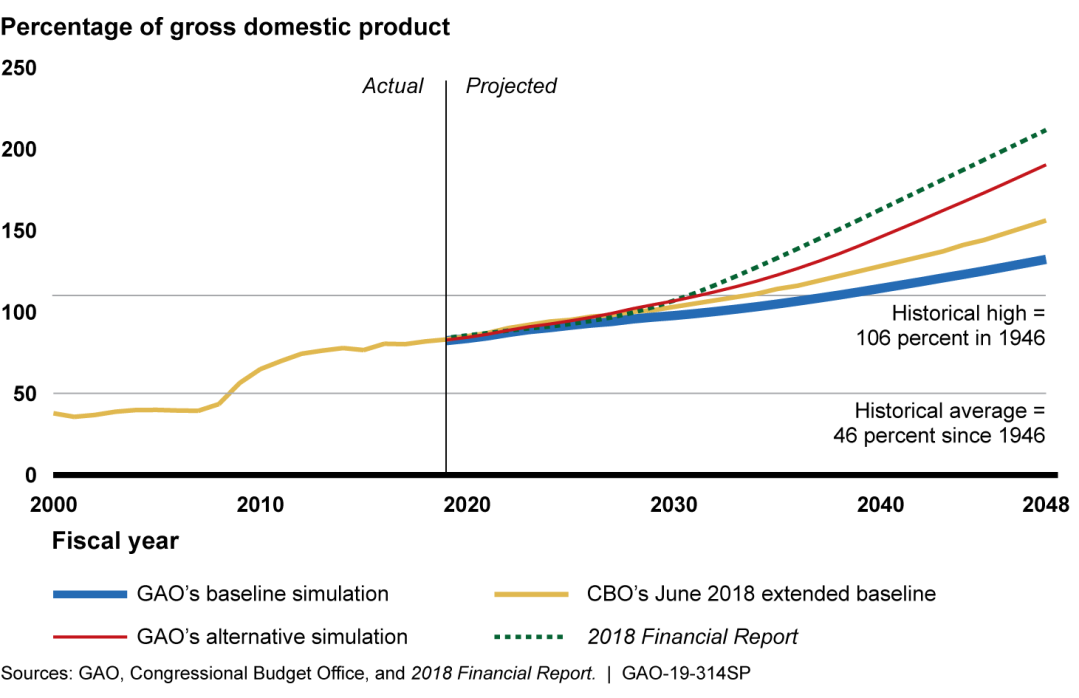

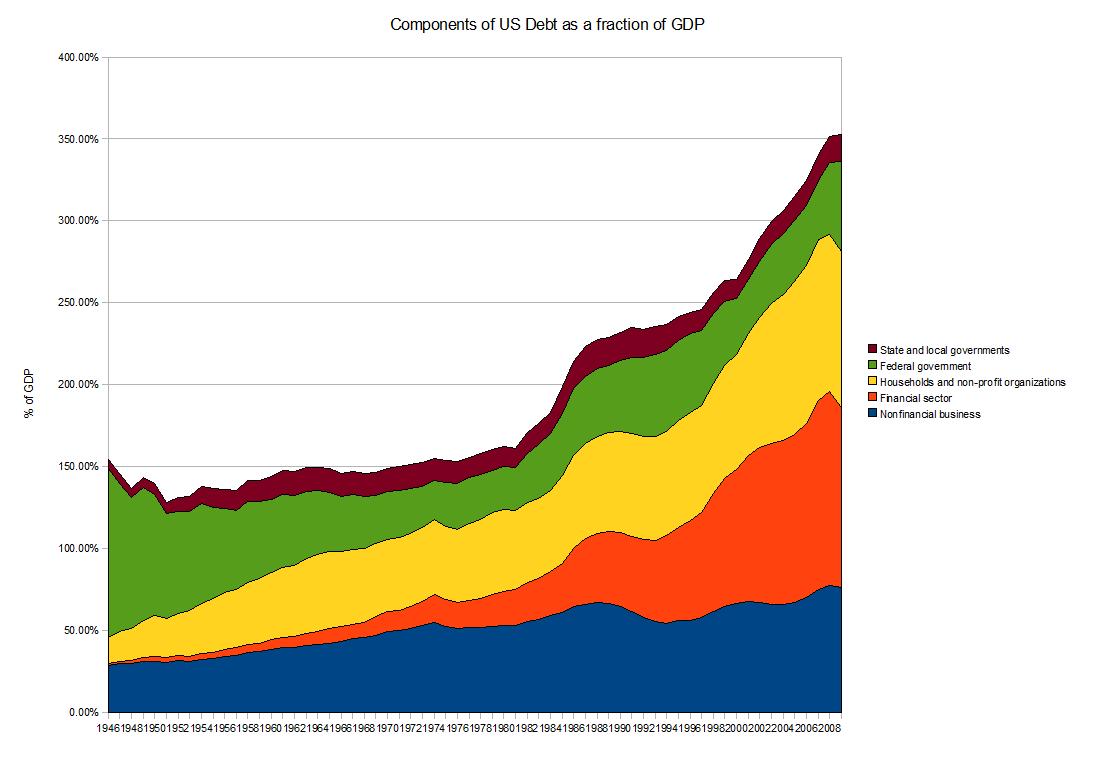

In 1946, the total US debt-to-GDP ratio

In economics, the debt-to-GDP ratio is the ratio between a country's government debt (measured in units of currency) and its gross domestic product (GDP) (measured in units of currency per year). While it is a "ratio", it is technically measured ...

was 150%, with two-thirds of that held by the federal government. Since 1946, the federal government's debt-to-GDP ratio has since fallen by nearly half, to 54.8% of GDP in 2009. The debt-to-GDP ratio of the financial sector, by contrast, has increased from 1.35% in 1946 to 109.5% of GDP in 2009. The ratio for households has risen nearly as much, from 15.84% of GDP to 95.4% of GDP.

In April 2011, International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

said that, "The US lacks a "credibility strategy" to stabilise its mounting public debt, posing a small but significant risk of a new global economic crisis.

Financial sector

In 1946, the US financial sector owed $3 billion of debt, or 1.35% of GDP. By 2009 this had increased to $15.6 trillion, or 109.5% of GDP. Most debt owed by the US financial sector is in the form of federal government sponsored enterprise (GSE) issues and agency-backed securities. This refers to securities guaranteed and mediated by federal agencies and GSEs such as Ginnie Mae,Fannie Mae

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the N ...

, and Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons Corner, Virginia.mortgage pools that are used as collateral in

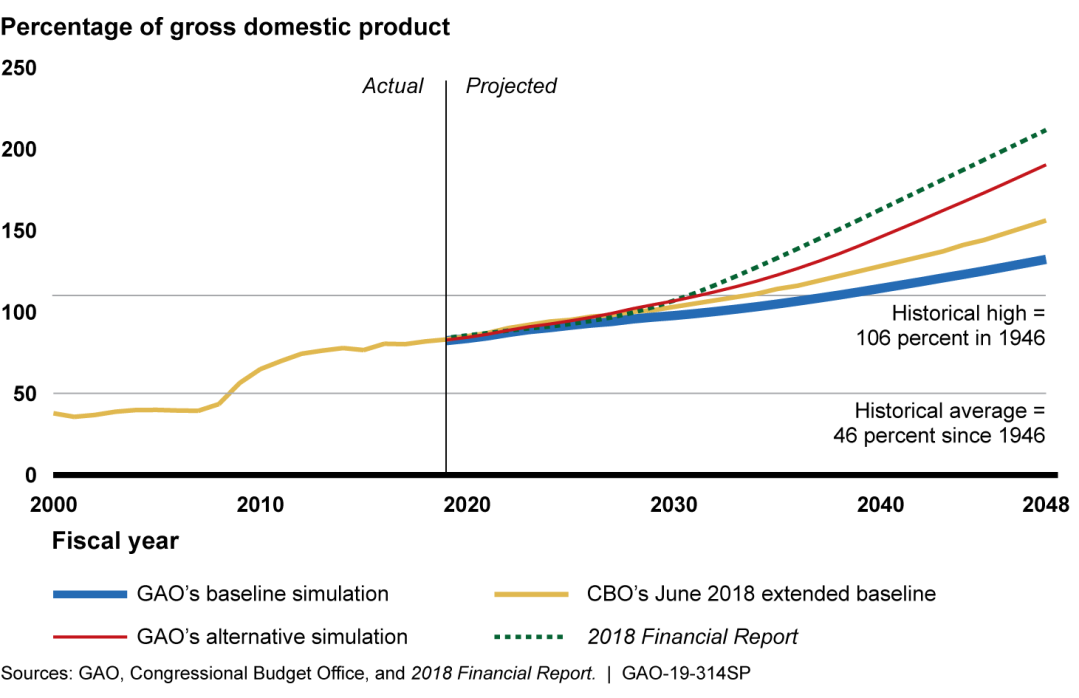

In 1946, the federal government owed $251 billion of debt or 102.7% of GDP. By 2009 this figure had risen to $7.8 trillion, but the federal government's debt-to-GDP ratio had fallen to 54.75%.

The federal government held $1.4 trillion in assets at the end of 2009. This is more than double the assets held by the federal government in 2007 ($686 billion), mainly due to the acquisition of corporate equities, credit market debt, and cash. The federal government held $223 billion in corporate equity at the beginning of 2009; this had fallen to $67.4 billion at the end of that year.

These figures do not include federal government retirement funds. Federal government retirement funds held $1.3 trillion in assets at the end of 2009.

In 1946, the federal government owed $251 billion of debt or 102.7% of GDP. By 2009 this figure had risen to $7.8 trillion, but the federal government's debt-to-GDP ratio had fallen to 54.75%.

The federal government held $1.4 trillion in assets at the end of 2009. This is more than double the assets held by the federal government in 2007 ($686 billion), mainly due to the acquisition of corporate equities, credit market debt, and cash. The federal government held $223 billion in corporate equity at the beginning of 2009; this had fallen to $67.4 billion at the end of that year.

These figures do not include federal government retirement funds. Federal government retirement funds held $1.3 trillion in assets at the end of 2009.

These figures also do not include debt that the federal government owes to federal funds and agencies such as the

These figures also do not include debt that the federal government owes to federal funds and agencies such as the

"The Liquidation of Government Debt"

National Bureau of Economic Research working paper No. 16893 In January, 2012, the U.S. Treasury Borrowing Advisory Committee of the Securities Industry and Financial Markets Association unanimously recommended that government debt be allowed to auction even lower, at negative absolute interest rates.

Economist

Economist

/ref> Wolf argued that the sudden shift in the private sector from deficit to surplus forced the government balance into deficit, writing: "The financial balance of the private sector shifted towards surplus by the almost unbelievable cumulative total of 11.2 per cent of gross domestic product between the third quarter of 2007 and the second quarter of 2009, which was when the financial deficit of US government (federal and state) reached its peak...No fiscal policy changes explain the collapse into massive fiscal deficit between 2007 and 2009, because there was none of any importance. The collapse is explained by the massive shift of the private sector from financial deficit into surplus or, in other words, from boom to bust." EconomistNYT-Paul Krugman-The Problem-December 2011

/ref>

U.S. Congressional Budget Office

Office of Management and Budget

Death and Taxes: 2009

A graphical representation of the 2009 United States federal discretionary budget, including the public debt.

United States – Deficit versus Savings rate from 1981

Historical graphical representation of the 12 month rolling Fiscal deficit versus the Savings rate of the United States. (since 1981) Derivatives, the great unknown with respect to its impact on the total US cumulative debt

190K Derivative burden per US person

* *

a non-US case of the Cumulate Debt Per Person reference frame.

collateralized mortgage obligation

A collateralized mortgage obligation (CMO) is a type of complex debt security that repackages and directs the payments of principal and interest from a collateral pool to different types and maturities of securities, thereby meeting investor need ...

s. The proportion of financial sector debt owed in the form of GSE and federally related mortgage pools has remained relatively constant – $863 million or 47% of total financial sector debt in 1946 was in such instruments; this has increased to 57% of financial sector debt in 2009, although this now represents over $8 trillion.

Bonds represent the next largest part of financial sector debt. In 1946, bonds represented 6% of financial sector debt, but by 1953 this proportion had risen to 24%. This remained relatively constant until the late 1970s; bonds fell to 14% of financial sector debt in 1981. This coincided with Federal Reserve chairman

The chair of the Board of Governors of the Federal Reserve System is the head of the Federal Reserve, and is the active executive officer of the Board of Governors of the Federal Reserve System. The chair shall preside at the meetings of the Boa ...

Paul Volcker

Paul Adolph Volcker Jr. (September 5, 1927 – December 8, 2019) was an American economist who served as the 12th chairman of the Federal Reserve from 1979 to 1987. During his tenure as chairman, Volcker was widely credited with having ended th ...

's strategy of combating stagflation

In economics, stagflation or recession-inflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for economic policy, since actio ...

by raising the federal funds rate; as a result the prime rate

A prime rate or prime lending rate is an interest rate used by banks, usually the interest rate at which banks lend to customers with good credit. Some variable interest rates may be expressed as a percentage above or below prime rate.

Use in dif ...

peaked at 21.5%, making financing through credit market

The bond market (also debt market or credit market) is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, ...

s prohibitively expensive. Bonds recovered in the 1980s, representing approximately 25% of financial sector debt throughout the 1990s; however, between 2000 and 2009, bonds issued by the financial sector had increased to 37% of financial sector debt, or $5.8 trillion.

Bonds and GSE/federal agency-backed issues represent all but 12% of financial sector debt in 2009.

Households and non-profits

In 1946, US households and non-profits owed $35 billion of debt or 15.8% of GDP. By 2009 this figure had risen to $13.6 trillion or 95.4% of GDP. Home mortgage debt in 1946 represented 66.5% of household debt;consumer credit

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt ...

represented another 24%. By 2009, home mortgage debt had risen to 76% of household debt and consumer credit had fallen to 18.22%. According to the McKinsey Global Institute, the 2008 financial crisis

8 (eight) is the natural number following 7 and preceding 9.

In mathematics

8 is:

* a composite number, its proper divisors being , , and . It is twice 4 or four times 2.

* a power of two, being 2 (two cubed), and is the first number of ...

was caused by "unsustainable levels of household debt." The ratio of debt to household income rose by about one-third from 2000 to 2007. The US currently has the twelfth highest debt to GDP ratio among advanced economies.

Nonfinancial business

In 1946, US nonfinancial businesses owed $63.9 billion of debt or 28.8% of GDP. By 2009 this figure had risen to $10.9 trillion or 76.4% of GDP.State and local governments

In 1946, US state and local governments owed $12.7 billion of debt or 5.71% of GDP. By 2009 this figure had risen to $2.4 trillion or 16.5% of GDP. In 2016, state and local governments owed $3 trillion and have another $5 trillion in unfunded liabilities. State and local governments have significant financial assets, totaling $2.7 trillion in 2009. In 2009, these included $1.3 trillion in credit market debt (that is, debt owed by other sectors to state and local governments). These figures do not include state and local retirement funds. State and local retirement funds held $2.7 trillion in assets at the end of 2009.Federal government

In 1946, the federal government owed $251 billion of debt or 102.7% of GDP. By 2009 this figure had risen to $7.8 trillion, but the federal government's debt-to-GDP ratio had fallen to 54.75%.

The federal government held $1.4 trillion in assets at the end of 2009. This is more than double the assets held by the federal government in 2007 ($686 billion), mainly due to the acquisition of corporate equities, credit market debt, and cash. The federal government held $223 billion in corporate equity at the beginning of 2009; this had fallen to $67.4 billion at the end of that year.

These figures do not include federal government retirement funds. Federal government retirement funds held $1.3 trillion in assets at the end of 2009.

In 1946, the federal government owed $251 billion of debt or 102.7% of GDP. By 2009 this figure had risen to $7.8 trillion, but the federal government's debt-to-GDP ratio had fallen to 54.75%.

The federal government held $1.4 trillion in assets at the end of 2009. This is more than double the assets held by the federal government in 2007 ($686 billion), mainly due to the acquisition of corporate equities, credit market debt, and cash. The federal government held $223 billion in corporate equity at the beginning of 2009; this had fallen to $67.4 billion at the end of that year.

These figures do not include federal government retirement funds. Federal government retirement funds held $1.3 trillion in assets at the end of 2009.

These figures also do not include debt that the federal government owes to federal funds and agencies such as the

These figures also do not include debt that the federal government owes to federal funds and agencies such as the Social Security Trust Fund

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund (collectively, the Social Security Trust Fund or Trust Funds) are trust funds that provide for payment of Social Security (Old-Age, Survivors, and D ...

. It also does not include "unfunded liabilities" to entitlement programs such as Social Security

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifical ...

and Medicare either as debt or accounting liabilities. According to official government projections, the Medicare is facing a $37 trillion unfunded liability over the next 75 years, and the Social Security is facing a $13 trillion unfunded liability over the same time frame.

Negative real interest rates

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt. Such low rates, outpaced by theinflation rate

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pension

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments ...

s, or bond, money market, and balanced mutual fund

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICA ...

s are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk. Lawrence Summers

Lawrence Henry Summers (born November 30, 1954) is an American economist who served as the 71st United States secretary of the treasury from 1999 to 2001 and as director of the National Economic Council from 2009 to 2010. He also served as pres ...

, Matthew Yglesias

Matthew Yglesias (; born May 18, 1981) is a liberal American blogger and journalist who writes about economics and politics. Yglesias has written columns and articles for publications such as ''The American Prospect'', ''The Atlantic'', and ''Sla ...

and other economists state that at such low rates, government debt borrowing saves taxpayer money, and improves creditworthiness. In the late 1940s through the early 1970s, the US and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay so low.Carmen M. Reinhart and M. Belen Sbrancia (March 2011"The Liquidation of Government Debt"

National Bureau of Economic Research working paper No. 16893 In January, 2012, the U.S. Treasury Borrowing Advisory Committee of the Securities Industry and Financial Markets Association unanimously recommended that government debt be allowed to auction even lower, at negative absolute interest rates.

Derivatives

Figures of total debt typically do not include other financial obligations such asderivative

In mathematics, the derivative of a function of a real variable measures the sensitivity to change of the function value (output value) with respect to a change in its argument (input value). Derivatives are a fundamental tool of calculus. ...

s. Partly this is due to the complexities of quantifying derivatives – the United States Comptroller of the Currency reports derivative contracts in terms of notional value, net current credit exposure

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt ...

, and fair value

In accounting and in most schools of economic thought, fair value is a rational and unbiased estimate of the potential market price of a good, service, or asset. The derivation takes into account such objective factors as the costs associated wi ...

, among others.

The number commonly used by the media

Media may refer to:

Communication

* Media (communication), tools used to deliver information or data

** Advertising media, various media, content, buying and placement for advertising

** Broadcast media, communications delivered over mass e ...

is notional value, which is a base value used to determine the size of the cash flows exchanged in the contract. Fair value (or market value

Market value or OMV (Open Market Valuation) is the price at which an asset would trade in a competitive auction setting. Market value is often used interchangeably with ''open market value'', '' fair value'' or ''fair market value'', although th ...

) is the value of the contract either on the open market or as it is appraised by accountants. Fair value can be positive or negative depending on the side of the contract the party is on. Credit exposure is defined as the net loss

Loss may refer to:

Arts, entertainment, and media Music

* ''Loss'' (Bass Communion album) (2006)

* ''Loss'' (Mull Historical Society album) (2001)

*"Loss", a song by God Is an Astronaut from their self-titled album (2008)

* Losses "(Lil Tjay son ...

which holders of derivatives would suffer if their counterparties in those derivatives contracts defaulted.

The notional value of derivative contracts held by US financial institutions is $216.5 trillion, or more than 15 times US GDP.

The fair value of US-held derivatives contracts in the first quarter of 2010 was $4,002 billion (28.1% of GDP) for positions with positive values (known as "derivatives receivables"), and $3,886 for positions with negative values (27.3% of GDP). Interest rate derivatives

In finance, an interest rate derivative (IRD) is a derivative whose payments are determined through calculation techniques where the underlying benchmark product is an interest rate, or set of different interest rates. There are a multitude of diff ...

form by far the largest part of US derivative contracts by all measures, accounting for $3,147 billion or 79% of derivatives receivables.

The measure preferred by the Office of the Comptroller is net current credit exposure (NCCE), which measures the risk to banks and the financial system in derivatives contracts. The net current credit exposure (NCCE) of American financial institutions to derivatives in the first quarter of 2010 to $359 billion or 2.5% of GDP, down from $800 billion at the end of 2008 in the wake of the global financial crisis

Global means of or referring to a globe and may also refer to:

Entertainment

* ''Global'' (Paul van Dyk album), 2003

* ''Global'' (Bunji Garlin album), 2007

* ''Global'' (Humanoid album), 1989

* ''Global'' (Todd Rundgren album), 2015

* Bruno ...

, when it stood at 5.5% of GDP. The difference between the market value of US derivatives and the credit exposure to the financial system is due to netting – financial institutions tend to have many positions with their counterparties that have positive ''and'' negative values, resulting in a much smaller exposure than the sum of the market values of their derivative positions. Netting reduces the credit exposure of the US financial system to derivatives by more than 90%, as compared to 50.6% at the beginning of 1998.

Derivatives contracts are overwhelmingly held by large financial institutions. The five largest US banks hold 97% of derivatives by notional value; the top 25 hold nearly 100%. Banks currently hold collateral

Collateral may refer to:

Business and finance

* Collateral (finance), a borrower's pledge of specific property to a lender, to secure repayment of a loan

* Marketing collateral, in marketing and sales

Arts, entertainment, and media

* ''Collate ...

against their derivative exposures amounting to 67% of their net current credit exposure.

Foreign debt, assets, and liabilities

Foreign holdings of US assets are concentrated in debt. Americans own more foreign equity andforeign direct investment

A foreign direct investment (FDI) is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. It is thus distinguished from a foreign portfolio investment by a notion of direct c ...

than foreigners own in the United States, but foreigners hold nearly four times as much US debt as Americans hold in foreign debt.

15.2% of all US debt is owed to foreigners. Of the $7.9 trillion Americans owe to foreigners, $3.9 trillion is owed by the federal government. 48% of US treasury securities

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. go ...

are held by foreigners. Foreigners hold $1.28 trillion in agency- and government sponsored enterprise-backed securities, and another $2.33 trillion in US corporate bond

A corporate bond is a bond issued by a corporation in order to raise financing for a variety of reasons such as to ongoing operations, M&A, or to expand business. The term is usually applied to longer-term debt instruments, with maturity of ...

s.

Foreigners hold 24% of domestic corporate debt and 17% of domestic corporate equity.

Sectoral financial balances

Economist

Economist Martin Wolf

Martin Harry Wolf (born 16 August 1946 in London) is a British journalist of Austrian-Dutch descent who focuses on economics. He is the associate editor and chief economics commentator at the '' Financial Times''.

Early life

Wolf was born ...

explained in July 2012 that government fiscal balance is one of three major financial sectoral balances

The sectoral balances (also called sectoral financial balances) are a sectoral analysis framework for macroeconomic analysis of national economies developed by British economist Wynne Godley. Sectoral analysis is based on the insight that when th ...

in the U.S. economy, the others being the foreign financial sector and the private financial sector. The sum of the surpluses or deficits across these three sectors must be zero by definition

A definition is a statement of the meaning of a term (a word, phrase, or other set of symbols). Definitions can be classified into two large categories: intensional definitions (which try to give the sense of a term), and extensional definiti ...

. In the U.S., a foreign financial surplus (or capital surplus) exists because capital is imported (net) to fund the trade deficit

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balanc ...

. Further, there is a private sector financial surplus due to household savings exceeding business investment. By definition, there must therefore exist a government budget deficit so all three net to zero. The government sector includes federal, state and local. For example, the government budget deficit in 2011 was approximately 10% GDP (8.6% GDP of which was federal), offsetting a capital surplus of 4% GDP and a private sector surplus of 6% GDP.Financial Times-Martin Wolf-The Balance Sheet Recession in the U.S.- July 2012/ref> Wolf argued that the sudden shift in the private sector from deficit to surplus forced the government balance into deficit, writing: "The financial balance of the private sector shifted towards surplus by the almost unbelievable cumulative total of 11.2 per cent of gross domestic product between the third quarter of 2007 and the second quarter of 2009, which was when the financial deficit of US government (federal and state) reached its peak...No fiscal policy changes explain the collapse into massive fiscal deficit between 2007 and 2009, because there was none of any importance. The collapse is explained by the massive shift of the private sector from financial deficit into surplus or, in other words, from boom to bust." Economist

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was t ...

also explained in December 2011 the causes of the sizable shift from private deficit to surplus: "This huge move into surplus reflects the end of the housing bubble, a sharp rise in household saving, and a slump in business investment due to lack of customers."/ref>

See also

*Economy of the United States

The United States is a highly developed mixed-market economy and has the world's largest nominal GDP and net wealth. It has the second-largest by purchasing power parity (PPP) behind China. It has the world's seventh-highest List of countr ...

– discusses U.S. national debt and economic context

* FRED (Federal Reserve Economic Data)

Federal Reserve Economic Data (FRED) is a database maintained by the Research division of the Federal Reserve Bank of St. Louis that has more than 816,000 economic time series from various sources. They cover banking, business/fiscal, consumer p ...

* History of the U.S. public debt – a table containing historical debt data

* National debt by U.S. presidential terms

* Proposed bailout of U.S. financial system (2008)

* United States federal budget

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. Th ...

– analysis of federal budget spending and long-term risks

* Starve the beast

"Starve the beast" is a political strategy employed by American conservatives to limit government spending by cutting taxes, to deprive the federal government of revenue in a deliberate effort to force it to reduce spending. The term "the beast" ...

(policy)

General:

* Balance of payments

In international economics, the balance of payments (also known as balance of international payments and abbreviated BOP or BoP) of a country is the difference between all money flowing into the country in a particular period of time (e.g., ...

* Government budget deficit

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a ''g ...

* Public debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit oc ...

– a general discussion of the topic

International:

* Global debt

* List of countries by current account balance

This is a list of countries by current account balance.

CIA World Factbook data Top 20 economies with the largest surplus

This is a list of the 20 countries and territories with the largest surplus in current account balance (CAB), based o ...

* List of public debt – list of the public debt for many nations, as a percentage of the GDP.

Notes

External links

United StatesU.S. Congressional Budget Office

Office of Management and Budget

Death and Taxes: 2009

A graphical representation of the 2009 United States federal discretionary budget, including the public debt.

United States – Deficit versus Savings rate from 1981

Historical graphical representation of the 12 month rolling Fiscal deficit versus the Savings rate of the United States. (since 1981) Derivatives, the great unknown with respect to its impact on the total US cumulative debt

190K Derivative burden per US person

* *

a non-US case of the Cumulate Debt Per Person reference frame.

References

{{DEFAULTSORT:Financial Position Of The United States Fiscal policy United States federal budgets Economy of the United States Government finances in the United States Debt