Financial impact of the 2019–20 coronavirus pandemic on:

[Wikipedia]

[Google]

[Amazon]

Economic turmoil associated with the

On Monday, 24 February 2020, the

On Monday, 24 February 2020, the

The reduction in the

The reduction in the

On 20 April 2020, the

On 20 April 2020, the

Coronavirus: A visual guide to the economic impact

BBC {{DEFAULTSORT:Financial impact of the COVID-19 pandemic Economic impact of the COVID-19 pandemic 2020 in economics 2020 in international relations International responses to the COVID-19 pandemic Financial markets

COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identi ...

has had wide-ranging and severe impacts upon financial market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial market ...

s, including stock, bond, and commodity (including crude oil and gold) markets. Major events included a described Russia–Saudi Arabia oil price war, which after failing to reach an OPEC+

The Organization of the Petroleum Exporting Countries (OPEC, ) is a cartel of countries. Founded on 14 September 1960 in Baghdad by the first five members (Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela), it has, since 1965, been headquart ...

agreement resulted in a collapse of crude oil prices and a stock market crash

A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often foll ...

in March 2020. The effects upon markets are part of the COVID-19 recession

The COVID-19 recession, also referred to as the Great Lockdown, is a global economic recession caused by the COVID-19 pandemic. The recession began in most countries in February 2020.

After a year of global economic slowdown that saw stagnati ...

and are among the many economic impacts of the pandemic.

Financial risk and country risk

As coronavirus put Europe and the United States in virtual lockdown, financial economists, credit rating and country risk experts have scrambled to rearrange their assessments in light of the unprecedented geo-economic challenges posed by the crisis. M. Nicolas Firzli, a director of the World Pensions Council (WPC) and advisory board member at theWorld Bank

The World Bank is an international financial institution that provides loans and grants to the governments of low- and middle-income countries for the purpose of pursuing capital projects. The World Bank is the collective name for the Inte ...

Global Infrastructure Facility, refers to it as "the greater financial crisis", and says it is bringing to the surface many pent-up financial and geopolitical dysfunctions:

The OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate e ...

points out that businesses in many countries have become highly indebted, while the very low cost of borrowing and accommodative monetary policy has contributed to unprecedented corporate debt issuance.

Businesses in European cohesion regions are more concerned about the pandemic's consequences. Companies in affected areas anticipate long-term effects on their supply chain from the outbreak. A bigger proportion of businesses anticipate permanent employment losses as a result of the digitalization transformation brought on by COVID-19.

Consequently, the corporate debt stands at very high levels in many G20

The G20 or Group of Twenty is an intergovernmental forum comprising 19 countries and the European Union (EU). It works to address major issues related to the global economy, such as international financial stability, climate change mitigatio ...

countries. Also, lower-rated credit issued in the form of BBB bonds, non-investment grade bonds, and leveraged loans has risen to elevated levels, the OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate e ...

warns, meaning businesses will have little choice but to reduce costs and employment to withstand insolvency pressures.

Economic activity decreased by almost 4% in the majority of sub-regions of Europe and Central Asia

Central Asia, also known as Middle Asia, is a subregion, region of Asia that stretches from the Caspian Sea in the west to western China and Mongolia in the east, and from Afghanistan and Iran in the south to Russia in the north. It includes t ...

in 2020, which was similar to the global average of 3.2%. However, the high infection and mortality rates of the pandemic in countries in the Western Balkans

The Balkans ( ), also known as the Balkan Peninsula, is a geographical area in southeastern Europe with various geographical and historical definitions. The region takes its name from the Balkan Mountains that stretch throughout the who ...

, the Eastern Neighbourhood, and Central and Eastern Europe

Eastern Europe is a subregion of the European continent. As a largely ambiguous term, it has a wide range of geopolitical, geographical, ethnic, cultural, and socio-economic connotations. The vast majority of the region is covered by Russia, whic ...

meant they faced deeper recessions

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

.

Central Asian countries are predicted to be hit the worst. Only 4% of permanently closed businesses anticipate to return in the future, with huge differences across sectors, ranging from 3% in lodging and food services to 27% in retail commerce.

At the international and national levels, however—as Helmut Ettl, head of the Austrian financial market authority, said—there is no reliable empirical data to gauge the ongoing effects of the COVID-19 disease

Coronavirus disease 2019 (COVID-19) is a contagious disease caused by a virus, the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The first known case was identified in Wuhan, China, in December 2019. The disease quickly ...

on the economy and the environment, as this type of crisis is unprecedented. Companies that were already financially weak before the crisis are now further destabilized. All that is known, Ettl said, is that the crisis will be profound.

Stock market

On Monday, 24 February 2020, the

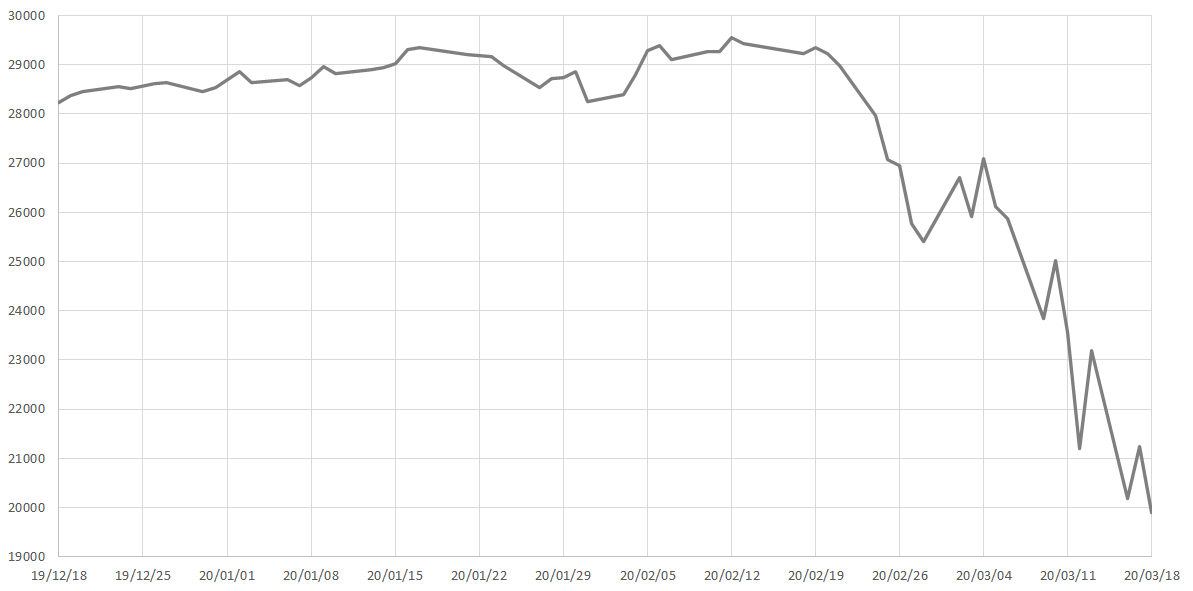

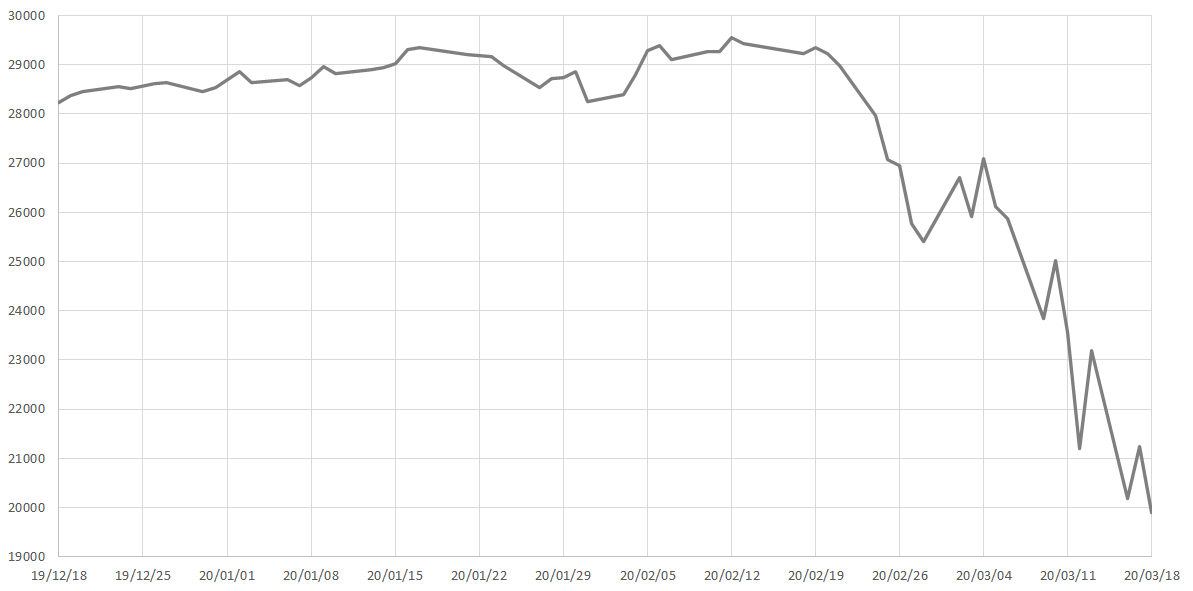

On Monday, 24 February 2020, the Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The DJIA is one of the oldest and most commonly followed equity inde ...

and FTSE 100

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie" , is a share index of the 100 companies listed on the London Stock Exchange with (in principle) the highest market ...

dropped more than 3% as the coronavirus outbreak spread worsened substantially outside of China over the weekend. This follows benchmark indices falling sharply in continental Europe after steep declines across Asia. The DAX, CAC 40, and IBEX 35 each fell by about 4%, and the FTSE MIB fell over 5%. There was a large fall in the price of oil and a large increase in the price of gold, to a 7-year high. On 27 February, due to mounting worries about the coronavirus outbreak, various U.S. stock market indices including the NASDAQ-100

The Nasdaq-100 (^NDX) is a stock market index made up of 101 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It is a modified capitalization-weighted index. The stocks' weights in the in ...

, the S&P 500 Index

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of D ...

, and the Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The DJIA is one of the oldest and most commonly followed equity inde ...

posted their sharpest falls since 2008, with the Dow falling 1,191 points, its largest one-day drop since the 2008 financial crisis. On 28 February 2020, stock markets worldwide reported their largest single-week declines since the 2008 financial crisis.

Following the second week of turbulence, on 6 March, stock markets worldwide closed down (although the Dow Jones Industrial Average, NASDAQ Composite, and S&P 500 closed up on the week), while the yields on 10-year and 30-year U.S. Treasury securities fell to new record lows under 0.7% and 1.26% respectively. U.S. President Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who served as the 45th president of the United States from 2017 to 2021.

Trump graduated from the Wharton School of the University of P ...

signed into law an emergency appropriations and pandemic countermeasures bill, including $8.3 billion in government spending. After OPEC and Russia failed to agree on oil production cuts on 5 March and Saudi Arabia and Russia both announced increases in oil production on 7 March, oil prices fell by 25 percent. The role of cross-border flows of goods in the modern economy, driven by decades of falling transport costs, falling communication costs, and, until recently, falling tariffs, also had a big role to play in impacting the stock market.

Overall, stock markets declined by over 30% by March; implied volatilities of equities

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company ...

and oil have spiked to crisis levels, and credit spreads on non-investment grade debt have widened sharply as investors reduce risks. This heightened turmoil in global financial markets is occurring despite the substantial and comprehensive financial reforms agreed by G20

The G20 or Group of Twenty is an intergovernmental forum comprising 19 countries and the European Union (EU). It works to address major issues related to the global economy, such as international financial stability, climate change mitigatio ...

financial authorities in the post-crisis era.

Week of 9 March 2020

On the morning of 9 March, the S&P 500 fell 7% in four minutes after the exchange opened, triggering acircuit breaker

A circuit breaker is an electrical safety device designed to protect an electrical circuit from damage caused by an overcurrent or short circuit. Its basic function is to interrupt current flow to protect equipment and to prevent the ris ...

for the first time since the financial crisis of 2007–08

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of f ...

and halting trading for 15 minutes. At the end of trading, stock markets worldwide saw massive declines (with the STOXX Europe 600 falling to more than 20% below its peak Peak or The Peak may refer to:

Basic meanings Geology

* Mountain peak

** Pyramidal peak, a mountaintop that has been sculpted by erosion to form a point Mathematics

* Peak hour or rush hour, in traffic congestion

* Peak (geometry), an (''n''-3)-di ...

earlier in the year), with the Dow Jones Industrial Average eclipsing the previous one-day decline record on 27 February by falling 2,014 points (or 7.8%). The yield on 10-year and 30-year U.S. Treasury securities hit new record lows, with the 30-year securities falling below 1% for the first time in history.

On 12 March, Asia-Pacific stock markets closed down (with the Nikkei 225

The Nikkei 225, or , more commonly called the ''Nikkei'' or the ''Nikkei index'' (), is a stock market index for the Tokyo Stock Exchange (TSE). It has been calculated daily by the '' Nihon Keizai Shimbun'' (''The Nikkei'') newspaper since 1950 ...

of the Tokyo Stock Exchange

The , abbreviated as Tosho () or TSE/TYO, is a stock exchange located in Tokyo, Japan. It is the third largest stock exchange in the world by aggregate market capitalization of its listed companies, and the largest in Asia. It had 2,292 listed ...

also falling to more than 20% below its 52-week high), European stock markets closed down 11% (their worst one-day decline in history), while the Dow Jones Industrial Average closed down an additional 10% (eclipsing the one-day record set on 9 March), the NASDAQ Composite was down 9.4%, and the S&P 500 was down 9.5% (with the NASDAQ and S&P 500 also falling to more than 20% below their peaks), and the declines activated the trading curb at the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed ...

for the second time that week. Oil prices dropped by 8%, while the yields on 10-year and 30-year U.S. Treasury securities increased to 0.86% and 1.45% (and their yield curve

In finance, the yield curve is a graph which depicts how the yields on debt instruments - such as bonds - vary as a function of their years remaining to maturity. Typically, the graph's horizontal or x-axis is a time line of months or ye ...

finished normal Normal(s) or The Normal(s) may refer to:

Film and television

* ''Normal'' (2003 film), starring Jessica Lange and Tom Wilkinson

* ''Normal'' (2007 film), starring Carrie-Anne Moss, Kevin Zegers, Callum Keith Rennie, and Andrew Airlie

* ''Norma ...

). On 15 March, the Fed cut its benchmark interest rate by a full percentage point, to a target range of 0 to 0.25%. However, in response, futures on the S&P 500 and crude oil dropped on continued market worries. Almost 75% of the hedge funds suffered steep losses during this timeline.

Oil prices

TheCOVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identi ...

and related confinement measures caused an unprecedented contraction in economic activity and a collapse in demand for oil and oil products. The result is one of the biggest price shocks the energy market experienced since the first oil shock of 1973. Oil prices dipped below US$20 (Brent Crude

Brent Crude may refer to any or all of the components of the Brent Complex, a physically and financially traded oil market based around the North Sea of Northwest Europe; colloquially, Brent Crude usually refers to the price of the ICE (Intercon ...

) a barrel, losing nearly 70% in value, with storage capacity approaching its limits (OilPrice). The reduction in the

The reduction in the demand

In economics, demand is the quantity of a good that consumers are willing and able to purchase at various prices during a given time. The relationship between price and quantity demand is also called the demand curve. Demand for a specific item ...

for travel and the lack of factory activity due to the outbreak significantly impacted demand for oil, causing its price to fall. In mid-February, the International Energy Agency forecasted that oil demand growth in 2020 would be the smallest since 2011. Chinese demand slump resulted in a meeting of the Organization of Petroleum Exporting Countries

The Organization of the Petroleum Exporting Countries (OPEC, ) is a cartel of countries. Founded on 14 September 1960 in Baghdad by the first five members (Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela), it has, since 1965, been headquart ...

(OPEC) to discuss a potential cut in production to balance the loss in demand. The cartel initially made a tentative agreement to cut oil production by 1.5 million barrels per day (bpd) following a meeting in Vienna on 5 March 2020, which would bring the production levels to the lowest it has been since the Iraq War

{{Infobox military conflict

, conflict = Iraq War {{Nobold, {{lang, ar, حرب العراق (Arabic) {{Nobold, {{lang, ku, شەڕی عێراق ( Kurdish)

, partof = the Iraq conflict and the War on terror

, image ...

. Meanwhile, analytics firm IHS Markit

IHS Markit Ltd was an information services provider that completed a merger with S&P Global in 2022. Headquartered in London, it was formed in 2016 with the merger of IHS Inc. and Markit Ltd.

History IHS

Information Handling Services (IHS) "wa ...

predicted a fall global demand for crude to fall by 3.8 million bpd in the first quarter of 2020, largely due to the halt to Chinese economic activity due to the virus; it also predicted the first annual reduction in demand for crude since the financial crisis of 2007–08

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of f ...

.

However, Russia refused to cooperate with the OPEC cuts, effectively ending the agreement it has maintained with OPEC since 2016. Russia balked as it believed that the growth of shale oil

Shale oil is an unconventional oil produced from oil shale rock fragments by pyrolysis, hydrogenation, or thermal dissolution. These processes convert the organic matter within the rock (kerogen) into synthetic oil and gas. The resulting oil c ...

extraction in the U.S., which was not party to any agreement with OPEC, would require continued cuts for the foreseeable future. Reduced prices would also damage the U.S. shale industry by forcing prices below operating costs for many shale producers, and thus retaliate for the damage inflicted on Russian and OPEC finances. The breakdown in talks also resulted in a failure to extend the cut in output of 2.1 million bpd that was scheduled to expire at the end of March.

On 8 March 2020, Saudi Arabia unexpectedly announced that it would instead increase production of crude oil and sell it at a discount (of $6–8 a barrel) to customers in Asia, the US and Europe, following the breakdown of negotiations. Prior to the announcement, the price of oil had fallen by more than 30% since the start of the year, and upon Saudi Arabia's announcement it dropped a further 30 percent, though later recovered somewhat. Brent Crude

Brent Crude may refer to any or all of the components of the Brent Complex, a physically and financially traded oil market based around the North Sea of Northwest Europe; colloquially, Brent Crude usually refers to the price of the ICE (Intercon ...

, used to price two-thirds of the world's crude oil supplies, experienced the largest drop since the 1991 Gulf War

The Gulf War was a 1990–1991 armed campaign waged by a Coalition of the Gulf War, 35-country military coalition in response to the Iraqi invasion of Kuwait. Spearheaded by the United States, the coalition's efforts against Ba'athist Iraq, ...

on the night of 8 March. Also, the price of West Texas Intermediate

West Texas Intermediate (WTI) is a grade or mix of crude oil; the term is also used to refer to the spot price, the futures price, or assessed price for that oil. In colloquial usage, WTI usually refers to the WTI Crude Oil futures contract tr ...

fell to its lowest level since February 2016. Fears of the Russian–Saudi Arabian oil price war caused a plunge in U.S. stocks, and have a particular impact on American producers of shale oil

Shale oil is an unconventional oil produced from oil shale rock fragments by pyrolysis, hydrogenation, or thermal dissolution. These processes convert the organic matter within the rock (kerogen) into synthetic oil and gas. The resulting oil c ...

. On 13 March, oil prices posted their largest single-week decline since 2008.

Plans announced on 13 March 2020 by U.S. President Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who served as the 45th president of the United States from 2017 to 2021.

Trump graduated from the Wharton School of the University of P ...

that he was directing the U.S. Department of Energy to purchase oil for the U.S. Strategic Petroleum Reserve were suspended less than two weeks later when funding for the purchase was not provided by Congress. This would have allowed the purchase of up to 92 million barrels. At the time, the Reserve held 635 million barrels with a capacity of 727 million. ''The Washington Post'' characterized this as "bail ngout domestic oil companies", though the effect on prices was expected to be minor in a 100 million barrel per day market.

In sharp contrast to US inaction, Australia announced on 22 April it would take advantage of the lowest oil prices in 21 years to build a fuel reserve by purchasing $60 million worth of crude and storing it in the US SPR.

Goldman Sachs predicted on 14 March that one-third of oil and oil service companies in the U.S. would be bought by competitors or driven out of business by the low crude prices. Oil companies that filed for bankruptcy during the pandemic include Whiting Petroleum (on 1 April) and Diamond Offshore

Diamond Offshore Drilling, Inc. is an offshore drilling contractor. The company is headquartered in Katy, Texas, United States, and has major offices in Australia, Brazil, Mexico, Scotland, Singapore, and Norway.

The company operates 15 drilling ...

(on 27 April).

On Thursday, 9 April, OPEC, Russia and other producers tentatively agreed to the biggest oil production cuts in history. They decided to withdraw 10 million barrels per day or 10% of global production from the market for the months of May and June, a step further supported by G20 Energy Ministers.

In March 2021, the oil prices ascended as high as $71.38 a barrel. It was for the first time since 8 January 2020, the beginning of the COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identi ...

. The oil prices climbed up after the Houthi rebels of Yemen attacked the Aramco

Saudi Aramco ( ar, أرامكو السعودية '), officially the Saudi Arabian Oil Company (formerly Arabian-American Oil Company) or simply Aramco, is a Saudi Arabian public petroleum and natural gas company based in Dhahran. , it is one of ...

oil facility of Saudi Arabia using missiles and drones.

Negative WTI futures (20 April 2020)

On 20 April 2020, the

On 20 April 2020, the futures

Futures may mean:

Finance

*Futures contract, a tradable financial derivatives contract

*Futures exchange, a financial market where futures contracts are traded

* ''Futures'' (magazine), an American finance magazine

Music

* ''Futures'' (album), a ...

price of West Texas Intermediate crude to be delivered in May actually went negative, an unprecedented event. This was a result of uninterrupted supply and a much reduced demand, as oil storage facilities reaching their maximum capacity. Analyst characterized the event as an anomaly of the closing of the May futures market coupled with the lack of available storage in that time frame. The two previous inflation-adjusted low points for oil are $6 in 1931 during the Great Depression and Texas oil boom

The Texas oil boom, sometimes called the gusher age, was a period of dramatic change and economic growth in the U.S. state of Texas during the early 20th century that began with the discovery of a large oil reserve, petroleum reserve near Beaum ...

; and $2.50 in January and February 1862 during the American Civil War

The American Civil War (April 12, 1861 – May 26, 1865; also known by other names) was a civil war in the United States. It was fought between the Union ("the North") and the Confederacy ("the South"), the latter formed by states ...

and Pennsylvania oil rush. WTI futures for May delivery recovered on the last day of trading, 21 April, ending at $10.01 a barrel. However, that day, Brent crude futures for June delivery fell 24% to $19.33 a barrel, the lowest level since 2002, while WTI June futures fell 43% to $11.57 a barrel. More than two million futures contracts were traded on 21 April, a new record. Oil industry analysts were pessimistic about near-term stability in the market; an analyst for the broker OANDA stated, "There is nothing to make energy traders believe that storage constraints, rising inventories, and demand concerns will be alleviated."

The finances of many oil-producing nations suffered severe stress. Iraq, which gets 90% of its budget from oil revenue and could profitably extract oil as long as it was above $60 a barrel, announced that it would have a $4.5 billion monthly shortfall starting in May. Other oil exporters – including Mexico, Venezuela, Ecuador, and Nigeria – are expected to contract economically or struggle to manage the fiscal fallout. Countries such as Saudi Arabia and Russia have cash reserves measured in years, but their leadership remain concerned.

Bond and debt markets

Prior to the coronavirus pandemic, a massive amount of borrowing by firms with ratings just above " junk", coupled with the growth of leveraged loans, which are made to companies with significant amount of debt, created a vulnerability in the financial system. The collapse of this corporate debt bubble would potentially endanger the solvency of firms, potentially worsening the nextrecession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

. In January, new U.S. corporate debt fell 10% from the previous year, potentially indicating more caution from investors. As the economic impact of the coronavirus began to be felt, numerous financial news sources warned of the potential cascade of impacts upon the outstanding $10 trillion in corporate debt. Between mid-February and early March, investors increased the premium, or additional yield, to hold junk bonds by four times the premium demanded of higher credit lenders, indicating increased wariness.

During the 2020 stock market crash that began the week of 9 March, bond prices unexpectedly moved in the same direction as stock prices. Bonds are generally considered safer than stocks, so confident investors will sell bonds to buy stocks and cautious investors will sell stocks to buy bonds. Along with the unexpected movement of bonds in concert with stocks, bond desks reported that it had become difficult to trade many different types of bonds, including municipal bonds, corporate bonds, and even U.S. Treasury bond

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. gov ...

s. ''The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid d ...

'' opined that this, coupled with the fall in gold futures, indicated that major investors were experiencing a cash crunch and were attempting to sell any asset they could. As big investors sought to sell, the spread between the prices sellers and buyers wanted has widened. As banks were unable to sell the bonds they were holding, they also stopped buying bonds. As the number of traders fell, the few trades remaining wildly swung the bond prices. Market depth in Treasuries, a measure of liquidity, fell to its lowest level since the 2008 crisis. Over the week of 9 March, investors pulled a weekly record of $15.9 billion from investment-grade bond funds, as well as $11.2 billion from high-yield bond funds, the second-highest on record. Also, prices for bond exchange-traded funds began dropping below their net asset values.

On 12 March, the U.S. Fed took almost unprecedented action to, in its words, "address highly unusual disruptions in Treasury financing markets associated with the coronavirus outbreak". The Federal Reserve Bank of New York announced that it would offer $1.5 trillion in repurchase agreement

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of short-term borrowing, mainly in government securities. The dealer sells the underlying security to investors and, by agreement between the two pa ...

s in U.S. Treasury securities to smooth the functioning of the short-term market that banks use to lend to each other. The New York Fed further announced that it would buy $60 billion of Treasury bonds over the next month to keep the bond market functioning. The seizing up of markets was a critical step in the subprime mortgage crisis that led to the financial crisis of 2007–08

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of f ...

and the Fed appeared to want to act quickly. On 15 March, as well as dropping interest rates, announced it would buy at least $500 billion in Treasures and at least $200 billion in government-backed mortgage securities over the next few months. On 16 March, as the stock market plunged, bond prices jumped according to their historical inverse relationship.

On 17 March, the Fed announced that they would use the Commercial Paper Funding Facility (CPFF). The CPFF was first used in the 2007–08 financial crisis to buy about $350 billion of commercial paper

Commercial paper, in the global financial market, is an unsecured promissory note with a fixed maturity of rarely more than 270 days. In layperson terms, it is like an " IOU" but can be bought and sold because its buyers and sellers have some ...

(CP), thereby increasing the amount of cash in the CP market, used by business to pay bills and other short-term demands. CP most directly affects the mortgage and auto loan markets, as well as credit to small and medium-sized businesses. The U.S. Treasury Department

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and ...

authorized $10 billion to backstop any losses incurred by the Fed using the Treasury's Exchange Stabilization Fund. U.S. stock markets rallied on the news.

On 19 March, the European Central Bank

The European Central Bank (ECB) is the prime component of the monetary Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's most important centr ...

announced a 750 billion euro ($820 billion) bond-buying program, named the Pandemic Emergency Purchase Programme, to mitigate market turmoil. Unlike in previous ECB asset-purchases, Greek government bonds were included. Markets reacted positively, with the yield on Italian government bonds dropping to 1.542% from 2.5% the day before.

In the week of 23 March, investors attracted by Fed guarantees of market liquidity and comparatively high bond yields rushed into the U.S. corporate debt market. Investment-grade firms issued $73 billion in debt, about 21% more than the previous weekly record. Many U.S. firms sold debt in an attempt to build cash reserves in anticipation of future financial strain.

Meanwhile, Chinese corporate bond defaults fell 30% in the first quarter, year on year, as the Chinese government directed banks to supply loans to corporations to avoid defaults and job losses. Interest rates in China fell to a 14-year low due to government efforts.

On 30 March, Moody's downgraded the outlook on U.S. corporate debt from 'stable' to 'negative,' focusing in particular on the global air travel, lodging and cruise ships, automobiles, oil and gas, and the banking sectors. Fitch forecast a doubling of defaults on U.S. leverage debt from 3% in 2019 to 5–6% in 2020, with a default rate up to 20% for retail and energy companies.

April 2020

In South Korea, the first on-shore debt offering in three weeks was successful on 9 April. However, the yields on won-denominated debt remained high amidst general pessimism about the economic outlook during the pandemic. Following passage of the U.S.Coronavirus Aid, Relief, and Economic Security Act

The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, is a $2.2trillion Stimulus (economics), economic stimulus bill passed by the 116th U.S. Congress and signed into law by President Donald Trump on March 27, 2 ...

, the Fed announced on 9 April that it would buy up to $2.3 trillion in debt from the U.S. market, including from so-called "fallen angels," companies that were downgraded from investment-grade to junk during the chaos of March. The announcement sparked a rally in junk bond exchange-traded funds, as well as individual junk bonds. ''The New York Times'' reported on 19 April that U.S. corporations had drawn more than $200 billion from existing credit lines during the COVID-19 crisis, far more than had been extended in the 2008 crisis.

On 9 April, Saudi Arabia and Russia agreed to oil production cuts. Reuters

Reuters ( ) is a news agency owned by Thomson Reuters Corporation. It employs around 2,500 journalists and 600 photojournalists in about 200 locations worldwide. Reuters is one of the largest news agencies in the world.

The agency was esta ...

reported that "If Saudi Arabia failed to rein in output, US senators called on the White House to impose sanctions on Riyadh, pull out US troops from the kingdom and impose import tariffs on Saudi oil."

Reporting following the May futures contracts for West Texas Intermediate

West Texas Intermediate (WTI) is a grade or mix of crude oil; the term is also used to refer to the spot price, the futures price, or assessed price for that oil. In colloquial usage, WTI usually refers to the WTI Crude Oil futures contract tr ...

crude oil falling into negative territory highlighted the financial strain on U.S. oil and oil services companies. As oil prices had plunged below the break even price for U.S. shale oil

Shale oil is an unconventional oil produced from oil shale rock fragments by pyrolysis, hydrogenation, or thermal dissolution. These processes convert the organic matter within the rock (kerogen) into synthetic oil and gas. The resulting oil c ...

of about $40 per bbl, companies were unable to fix their finances by extracting more. '' MarketWatch'' noted that now "investors are likely to focus less on the viability of a driller’s operations and how cheaply it could unearth oil. Instead, money managers would look to assess if a company’s finances were resilient enough to stay afloat during the current economic downturn."

Virgin Australia

Virgin Australia, the trading name of Virgin Australia Airlines Pty Ltd, is an Australian-based airline. It is the largest airline by fleet size to use the Virgin brand. It commenced services on 31 August 2000 as ''Virgin Blue'', with two ...

, one of two major airlines in Australia, entered voluntary administration

As a legal concept, administration is a procedure under the insolvency laws of a number of common law jurisdictions, similar to bankruptcy in the United States. It functions as a rescue mechanism for insolvent entities and allows them to carry o ...

on 21 April, after being unable to manage $4.59 billion in debt.

Assets for companies in the U.S. car rental

A car rental, hire car or car hire agency is a company that rents automobiles for short periods of time to the public, generally ranging from a few hours to a few weeks. It is often organized with numerous local branches (which allow a user to ...

market, which were not included in the CARES Act, were under severe stress on 24 April. S&P Global Ratings had downgraded Avis and Hertz

The hertz (symbol: Hz) is the unit of frequency in the International System of Units (SI), equivalent to one event (or cycle) per second. The hertz is an SI derived unit whose expression in terms of SI base units is s−1, meaning that o ...

to "highly speculative," while credit default swap

A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default (by the debtor) or other credit event. That is, the seller of the CDS insures the buyer against som ...

s for Hertz bonds indicated a 78% chance of default within 12 months and a 100% chance within five years.

The Bank of Japan increased its holdings of commercial paper

Commercial paper, in the global financial market, is an unsecured promissory note with a fixed maturity of rarely more than 270 days. In layperson terms, it is like an " IOU" but can be bought and sold because its buyers and sellers have some ...

by 27.8% in April 2020, which followed a rise of $16.9% in March. Efforts to alleviate strain on Japanese corporate finances also included increasing BoJ corporate bond holdings by 5.27% in April.

May 2020

Between 1 January and 3 May, a record $807.1 billion of U.S. investment-grade corporate bonds were issued. Similarly, U.S. corporations sold over $300 billion in debt in April 2020, a new record. This included Boeing, which sold $25 billion in bonds, stating that it would no longer need a bailout from the U.S. government. Apple, which borrowed $8.5 billion potentially to pay back the $8 billion in debt coming due later in 2020; Starbucks, which raised $3 billion.; Ford, which sold $8 billion in junk-rated bonds despite just losing its investment rating; and cruise line operator Carnival, which increased its offering to $4 billion to meet demand. The main reasons for the lively market are the low interest rates and the Fed's actions to ensure market liquidity. The iShares iBoxx USD Investment Grade Corporate Bond, an exchange-traded fund with assets directly benefiting from Fed actions, grew by a third between 11 March and the end of April. However, companies are growing increasingly leveraged as they increase their debt while earnings fall. Through the end of April 2020, investment-grade corporate bonds gained 1.4% versus Treasury bonds' 8.9%, indicating potential investor wariness about the risk of corporate bonds. Morgan Stanley estimated 2020 U.S. investment-grade bond issuance at $1.4 trillion, around 2017's record, while Barclays estimated the non-financial corporations will need to borrow $125–175 billion in additional debt to cover the drop in earnings from the pandemic recession. On 4 May, U.S. retailerJ.Crew

J.Crew Group, Inc., is an American multi-brand, multi-channel, specialty retailer. The company offers an assortment of women's, men's, and children's apparel and accessories, including swimwear, outerwear, lounge-wear, bags, sweaters, denim, dr ...

filed for bankruptcy protection to convert $1.6 billion in debt to equity. Its debt largely resulted from the 2011 leveraged buyout by its current owners. J.Crew became the first U.S. retailer to go bankrupt in the COVID-19 downturn. Also in the week of 4 May, the Chamber of Deputies in the National Congress of Brazil

The National Congress of Brazil ( pt, Congresso Nacional do Brasil) is the legislative body of Brazil's federal government. Unlike the state legislative assemblies and municipal chambers, the Congress is bicameral, composed of the Federal Sen ...

was seeking to pass an amendment to the Constitution

A constitution is the aggregate of fundamental principles or established precedents that constitute the legal basis of a polity, organisation or other type of entity and commonly determine how that entity is to be governed.

When these princ ...

that would allow the Brazil

Brazil ( pt, Brasil; ), officially the Federative Republic of Brazil (Portuguese: ), is the largest country in both South America and Latin America. At and with over 217 million people, Brazil is the world's fifth-largest country by area ...

to buy private sector securities. However, the Central Bank was concerned that bank officials could face accusations of corruption for buying assets from individual companies and were seeking personal liability protection for Central Bank purchases.

On 12 May, the Fed began buying corporate bond ETFs for the first time in its history. It stated its intention to buy bonds directly "in the near future." As companies must prove that they can not otherwise access normal credit to be eligible for the primary market facility, analysts opined that it may create a stigma for companies and be little used. However, the guarantee of a Fed backstop appears to have ensured market liquidity.

In its annual review on 14 May, the Bank of Canada concluded that its three interest rate cuts in March and first ever bond buying program had succeeded in stabilizing Canadian markets. However, it expressed concern about the ability of the energy sector to refinance its debt given historically low oil prices. About C$17 billion in Canadian corporate bonds was sold in April 2020, one of the largest volumes since 2010.

June/July 2020

Credit ratings for industries such as energy/oil, retail, entertainment, travel/leisure and banking were affected most heavily by the pandemic. By July 2020,S&P Global

S&P Global Inc. (prior to April 2016 McGraw Hill Financial, Inc., and prior to 2013 The McGraw–Hill Companies, Inc.) is an American publicly traded corporation headquartered in Manhattan, New York City. Its primary areas of business are financ ...

and Fitch Ratings

Fitch Ratings Inc. is an American credit rating agency and is one of the " Big Three credit rating agencies", the other two being Moody's and Standard & Poor's. It is one of the three nationally recognized statistical rating organizations ( NRSRO ...

had initiated almost as many credit downgrades as the 2007-08 financial crisis. Canada was the first country to lose its triple "A" credit rating in June 2020.

August 2020

The sudden economic disruptions caused by the pandemic led to a significant increase in government debt as governments around the world implementedstimulus

A stimulus is something that causes a physiological response. It may refer to:

*Stimulation

**Stimulus (physiology), something external that influences an activity

**Stimulus (psychology), a concept in behaviorism and perception

*Stimulus (economi ...

measures to support their economies. This resulted in a surge in demand for government bonds, pushing bond prices up and yields down. At the same time, the uncertainty and volatility in financial markets led to a flight to safety, with investors increasingly turning to safe-haven assets such as bonds. This also contributed to the decline in bond yields. In addition, the downturn in the global economy and the drop in interest rates made it more difficult for businesses to access credit, leading to a decrease in corporate bond issuance. This, in turn, contributed to overall market volatility and uncertainty.

See also

*Economic impact of the COVID-19 pandemic

The COVID-19 pandemic has had far-reaching economic consequences including the COVID-19 recession, the second largest global recession in recent history, decreased business in the services sector during the COVID-19 lockdowns, the 2020 stock ...

* Impact of the COVID-19 pandemic on education

* Impact of the COVID-19 pandemic on religion

The COVID-19 pandemic has impacted religion in various ways, including the cancellation of the worship services of various faiths and the closure of Sunday schools, as well as the cancellation of pilgrimages, ceremonies and festivals. Many church ...

* Impact of the COVID-19 pandemic on politics

The political impact of the COVID-19 pandemic is the influence that the COVID-19 pandemic has had on politics around the world. The pandemic has affected the governing and political systems of multiple countries, reflected in states of emergenc ...

* Impact of the COVID-19 pandemic on sports

The COVID-19 pandemic has caused the most significant disruption to the worldwide sporting calendar since World War II. Across the world and to varying degrees, sports events have been cancelled or postponed. The 2020 Summer Olympics in Tokyo w ...

* Impact of the COVID-19 pandemic on science and technology

* Impact of the COVID-19 pandemic on cinema

The COVID-19 pandemic has had a substantial effect on certain films in the early 2020s, mirroring its impacts across all arts sectors. Across the world and to varying degrees, cinemas and movie theaters have been closed, festivals have been c ...

References

External links

Coronavirus: A visual guide to the economic impact

BBC {{DEFAULTSORT:Financial impact of the COVID-19 pandemic Economic impact of the COVID-19 pandemic 2020 in economics 2020 in international relations International responses to the COVID-19 pandemic Financial markets