European debt crisis contagion on:

[Wikipedia]

[Google]

[Amazon]

European debt crisis contagion refers to the possible spread of the ongoing

European debt crisis contagion refers to the possible spread of the ongoing

Besides Greece, Ireland, Portugal, Spain and Cyprus, various other countries have been affected by the sovereign-debt crisis in different ways. As of November 2012, none of the following countries is in danger of being cut off financial markets.

Besides Greece, Ireland, Portugal, Spain and Cyprus, various other countries have been affected by the sovereign-debt crisis in different ways. As of November 2012, none of the following countries is in danger of being cut off financial markets.

/ref> The city of Rome has debts of almost €14 billion, which it plans to pay off gradually by 2048. The city of Rome has approximately 2.6 mn people and has been bailed out by the central government each year since 2008. Local politicians have been accused of clientelism, a system under which the huge army of municipal employees is seen as a source of votes rather than as servants of the public. The city has around 25,000 employees of its own with another 30,000 or so working for some 20 municipal companies providing services running from electricity to garbage collection. ATAC SpA, which runs the city's loss-making buses and metros, employs more than 12,000 staff, almost as many staff as national airline

Europe in freefall – Belgium could be next to need help

The Scotsman, 26 November 2010, Retrieved 27 November 2010 and there were doubts about the financial stability of the banks,Robinson, Franci

Belgian Debt and Contagion

''The Wall Street Journal'', 26 November 2010, Retrieved 27 November 2010 following the country's major financial crisis in 2008–2009. After inconclusive elections in June 2010, by November 2011 the country still had only a caretaker government as parties from the two main language groups in the country (

Belgian budget breakthrough builds hopes for new government

Deutsche Welle, DW-World.DE, Retrieved 1 December 2011 Shortly after, Belgian negotiating parties reached an agreement to form a new government. The deal includes spending cuts and tax rises worth about , which should bring the budget deficit down to 2.8% of GDP by 2012, and to balance the books in 2015. Following the announcement Belgium 10-year bond yields fell sharply to 4.6%.

According to the Financial Policy Committee "Any associated disruption to bank funding markets could spill over to UK banks." The UK has the highest gross foreign debt of any European country (€7.3 trillion; €117,580 per person) due in large part to its highly

According to the Financial Policy Committee "Any associated disruption to bank funding markets could spill over to UK banks." The UK has the highest gross foreign debt of any European country (€7.3 trillion; €117,580 per person) due in large part to its highly

/ref> The banks own such businesses as supermarkets and newspapers. To obtain EU approval for the transaction, Slovenia needed to sell all of its second-largest lender Nova KBM and third largest player Abanka, along with at least 75 percent of the biggest player

nytimes.com: "Romania to Get Next Installment of Bailout" 1 Nov 2010

/ref> However, the GDP grew again by 2.2% in 2011 and 0.7% in 2012.

European debt crisis contagion refers to the possible spread of the ongoing

European debt crisis contagion refers to the possible spread of the ongoing European sovereign-debt crisis

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, is a multi-year debt crisis that took place in the European Union (EU) from 2009 until the mid to late 2010s. Several eurozone memb ...

to other Eurozone

The euro area, commonly called eurozone (EZ), is a currency union of 19 member states of the European Union (EU) that have adopted the euro ( €) as their primary currency and sole legal tender, and have thus fully implemented EMU polici ...

countries. This could make it difficult or impossible for more countries to repay or re-finance their government debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit oc ...

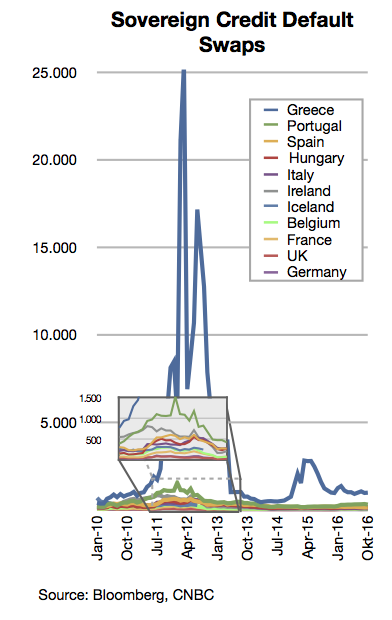

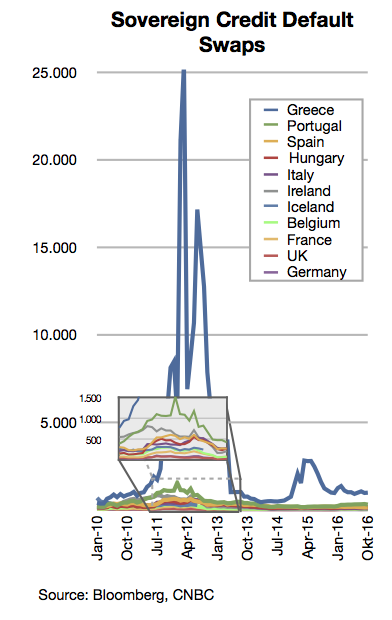

without the assistance of third parties. By 2012 the debt crisis forced 5 out of 17 Eurozone countries to seek help from other nations. Some believed that negative effects could spread further possibly forcing one or more countries into default.

However, as of October 2012 the contagion risk for other eurozone countries has greatly diminished due to a successful fiscal consolidation and implementation of structural reforms in the countries being most at risk. None of the following countries is in danger of being cut off from financial markets.

History

One of the central concerns prior to the bailout was that the crisis could spread to several other countries after reducing confidence in other European economies. In July 2011 the UKFinancial Policy Committee The Financial Policy Committee (FPC) is an official committee of the Bank of England, modelled on the already well established Monetary Policy Committee (United Kingdom), Monetary Policy Committee. It was announced in 2010 as a new body responsible ...

noted that "Market concerns remain over fiscal positions in a number of euro area countries and the potential for contagion to banking systems." Besides Ireland, with a government deficit in 2010 of 32.4% of GDP, and Portugal at 9.1%, other countries such as Spain with 9.2% are also at risk.

Greece has been the notable example of an industrialised country that has faced difficulties in the markets because of rising debt levels but even countries such as the US, Germany and the UK, have had fraught moments as investors shunned bond auctions due to concerns about public finances and the economy.

Affected countries

Besides Greece, Ireland, Portugal, Spain and Cyprus, various other countries have been affected by the sovereign-debt crisis in different ways. As of November 2012, none of the following countries is in danger of being cut off financial markets.

Besides Greece, Ireland, Portugal, Spain and Cyprus, various other countries have been affected by the sovereign-debt crisis in different ways. As of November 2012, none of the following countries is in danger of being cut off financial markets.

Italy

Italy's deficit of 4.6 % of GDP in 2010 was similar to Germany's at 4.3 % and less than that of the UK and France. Italy even has a surplus in its primary budget, which excludes debt interest payments. However, its debt has increased to almost 120 % of GDP (US$2.4 trillion in 2010) and economic growth was lower than the EU average for over a decade. This has led investors to view Italian bonds more and more as a risky asset. On the other hand, the public debt of Italy has a longer maturity and a substantial share of it is held domestically. Overall this makes the country more resilient to financial shocks, ranking better than France and Belgium. About 300 billion euros of Italy's 1.9 trillion euro debt matures in 2012. It will therefore have to go to the capital markets for significant refinancing in the near-term. On 15 July and 14 September 2011, Italy's government passed austerity measures meant to save . Nonetheless, by 8 November 2011 the Italian bond yield was 6.74 % for 10-year bonds, climbing above the 7 % level where the country is thought to lose access to financial markets. On 11 November 2011, Italian 10-year borrowing costs fell sharply from 7.5 to 6.7 % after Italian legislature approved further austerity measures and the formation of an emergency government to replace that of Prime MinisterSilvio Berlusconi

Silvio Berlusconi ( ; ; born 29 September 1936) is an Italian media tycoon and politician who served as Prime Minister of Italy in four governments from 1994 to 1995, 2001 to 2006 and 2008 to 2011. He was a member of the Chamber of Deputies f ...

.

The measures include a pledge to raise from real-estate sales over the next three years, a two-year increase in the retirement age to 67 by 2026, opening up closed professions within 12 months and a gradual reduction in government ownership of local services. The interim government expected to put the new laws into practice is led by former European Union Competition Commissioner Mario Monti.

One of the Renzi government's first official acts on 28 February 2014 was to issue a decree that released transfers of €570 million to the city of Rome

, established_title = Founded

, established_date = 753 BC

, founder = King Romulus (legendary)

, image_map = Map of comune of Rome (metropolitan city of Capital Rome, region Lazio, Italy).svg

, map_caption ...

in order to pay the salaries of municipal workers and ensure services such as public transport and garbage collection.reuters.com: "Italy approves decree to stave off bankruptcy for Rome council" (Jones) 28 Feb 2014/ref> The city of Rome has debts of almost €14 billion, which it plans to pay off gradually by 2048. The city of Rome has approximately 2.6 mn people and has been bailed out by the central government each year since 2008. Local politicians have been accused of clientelism, a system under which the huge army of municipal employees is seen as a source of votes rather than as servants of the public. The city has around 25,000 employees of its own with another 30,000 or so working for some 20 municipal companies providing services running from electricity to garbage collection. ATAC SpA, which runs the city's loss-making buses and metros, employs more than 12,000 staff, almost as many staff as national airline

Alitalia

Alitalia - Società Aerea Italiana S.p.A., operating as Alitalia (), was an Italian airline which was once the flag carrier and largest airline of Italy. The company had its head office in Fiumicino, Metropolitan City of Rome Capital. The ai ...

. The decree allowed municipalities such as Rome the ability to increase taxes in order to pay for their civil service employees.

As in other countries, the social effects have been severe, with child labour even re-emerging in poorer areas. By 2013, wages have hit a 25-year low and consumption has fallen to the level of 1950.

Belgium

In 2010, Belgium's public debt was 100% of its GDP—the third highest in the eurozone after Greece and ItalyMaddox, DaviEurope in freefall – Belgium could be next to need help

The Scotsman, 26 November 2010, Retrieved 27 November 2010 and there were doubts about the financial stability of the banks,Robinson, Franci

Belgian Debt and Contagion

''The Wall Street Journal'', 26 November 2010, Retrieved 27 November 2010 following the country's major financial crisis in 2008–2009. After inconclusive elections in June 2010, by November 2011 the country still had only a caretaker government as parties from the two main language groups in the country (

Flemish

Flemish (''Vlaams'') is a Low Franconian dialect cluster of the Dutch language. It is sometimes referred to as Flemish Dutch (), Belgian Dutch ( ), or Southern Dutch (). Flemish is native to Flanders, a historical region in northern Belgium; ...

and Walloon) were unable to reach agreement on how to form a majority government. In November 2010 financial analysts forecast that Belgium would be the next country to be hit by the financial crisis as Belgium's borrowing costs rose.

However, the government deficit of 5% was relatively modest and Belgian government 10-year bond yields in November 2010 of 3.7% were still below those of Ireland (9.2%), Portugal (7%) and Spain (5.2%). Furthermore, thanks to Belgium's high personal savings rate, the Belgian Government financed the deficit from mainly domestic savings, making it less prone to fluctuations of international credit markets. Nevertheless, on 25 November 2011, Belgium's long-term sovereign credit rating was downgraded from AA+ to AA by Standard and Poor and 10-year bond yields reached 5.66%.Bowen, Andrew and Connor, Richard (28 November 2011Belgian budget breakthrough builds hopes for new government

Deutsche Welle, DW-World.DE, Retrieved 1 December 2011 Shortly after, Belgian negotiating parties reached an agreement to form a new government. The deal includes spending cuts and tax rises worth about , which should bring the budget deficit down to 2.8% of GDP by 2012, and to balance the books in 2015. Following the announcement Belgium 10-year bond yields fell sharply to 4.6%.

France

France's public debt in 2010 was approximately US$2.1 trillion and 83% GDP, with a 2010 budget deficit of 7% GDP. By 16 November 2011, France's bond yield spreads vs. Germany had widened 450% since July 2011. France's C.D.S. contract value rose 300% in the same period. On 1 December 2011, France's bond yield had retreated and the country auctioned €4.3 billion worth of 10-year bonds at an average yield of 3.18%, well below the perceived critical level of 7%. By early February 2012, yields on French 10-year bonds had fallen to 2.84%. In April and May 2012, France held apresidential election

A presidential election is the election of any head of state whose official title is President.

Elections by country

Albania

The president of Albania is elected by the Assembly of Albania who are elected by the Albanian public.

Chile

The pre ...

in which the winner François Hollande had opposed austerity measures, promising to eliminate France's budget deficit by 2017 by cancelling recently enacted tax cuts and exemptions for the wealthy, raising the top tax bracket rate to 75% on incomes over a million euros, restoring the retirement age to 60 with a full pension for those who have worked 42 years, restoring 60,000 jobs recently cut from public education, regulating rent increases; and building additional public housing for the poor. In June, Hollande's Socialist Party

Socialist Party is the name of many different political parties around the world. All of these parties claim to uphold some form of socialism, though they may have very different interpretations of what "socialism" means. Statistically, most of t ...

won a supermajority in legislative elections capable of amending the French Constitution

The current Constitution of France was adopted on 4 October 1958. It is typically called the Constitution of the Fifth Republic , and it replaced the Constitution of the Fourth Republic of 1946 with the exception of the preamble per a Consti ...

and enabling the immediate enactment of the promised reforms. French government bond interest rates fell 30% to record lows, less than 50 basis point

A basis point (often abbreviated as bp, often pronounced as "bip" or "beep") is one hundredth of 1 percentage point. The related term '' permyriad'' means one hundredth of 1 percent. Changes of interest rates are often stated in basis points. If ...

s above German government bond rates.

United Kingdom

According to the Financial Policy Committee "Any associated disruption to bank funding markets could spill over to UK banks." The UK has the highest gross foreign debt of any European country (€7.3 trillion; €117,580 per person) due in large part to its highly

According to the Financial Policy Committee "Any associated disruption to bank funding markets could spill over to UK banks." The UK has the highest gross foreign debt of any European country (€7.3 trillion; €117,580 per person) due in large part to its highly leveraged

In finance, leverage (or gearing in the United Kingdom and Australia) is any technique involving borrowing funds to buy things, hoping that future profits will be many times more than the cost of borrowing. This technique is named after a lever ...

financial industry, which is closely connected with both the United States and the eurozone.

In 2012 the UK economy was in recession, being negatively impacted by reduced economic activity in Europe, and apprehensive regarding possible future impacts of the Eurozone crisis. The Bank of England made substantial funds available at reduced interest to UK banks for loans to domestic enterprises. The bank is also providing liquidity by purchase of large quantities of government bonds, a programme which may be expanded. Bank of England support of British banks with respect to the Eurozone crisis was backed by the British Treasury.

Bank of England governor Mervyn King stated in May 2012 that the Eurozone is "tearing itself apart without any obvious solution." He acknowledged that the Bank of England, the Financial Services Authority, and the British government were preparing contingency plans for a Greek exit from the euro or a collapse of the currency, but refused to discuss them to avoid adding to the panic. Known contingency plans include emergency immigration controls to prevent millions of Greek and other EU residents from entering the country to seek work, and the evacuation of Britons from Greece during civil unrest.

A euro collapse would damage London's role as a major financial centre because of the increased risk to UK banks. The pound and gilts

Gilt-edged securities are bonds issued by the UK Government. The term is of British origin, and then referred to the debt securities issued by the Bank of England on behalf of His Majesty's Treasury, whose paper certificates had a gilt (or gilde ...

would likely benefit, however, as investors seek safer investments. The London real estate market has similarly benefited from the crisis, with French, Greeks, and other Europeans buying property with capital moved out of their home countries, and a Greek exit from the euro would likely increase such transfer of capital.

Switzerland

Switzerland was affected by the Eurozone crisis as money was moved into Swiss assets seeking safety from the Eurozone crisis as well as by apprehension of further worsening of the crisis. This resulted in appreciation of the Swiss franc with respect to the euro and other currencies which drove down internal prices and raised the price of exports. Credit Suisse was required to increase its capitalisation by theSwiss National Bank

The Swiss National Bank (SNB; german: Schweizerische Nationalbank; french: Banque nationale suisse; it, Banca nazionale svizzera; rm, Banca naziunala svizra) is the central bank of Switzerland, responsible for the nation's monetary policy an ...

. The Swiss National Bank stated that the Swiss franc was massively overvalued, and that risk of deflation in Switzerland existed. It therefore announced that it would buy foreign currency in unlimited quantities if the euro/Swiss Franc exchange rate fell below 1.20 CHF. Purchases of the euro have the effect of maintaining the value of the euro. Real estate values in Switzerland are extremely high, thus posing a possible risk.

Germany

In relationship to the total amounts involved in the Eurozone crisis, the economy of Germany is relatively small and would be unable, even if it were willing, to guarantee payment of the sovereign debts of the rest of the Eurozone as Spain and even Italy and France are added to potentially defaulting nations. Thus, according to Chancellor Angela Merkel, German participation in rescue efforts is conditioned on negotiation of Eurozone reforms which have the potential to resolve the underlying imbalances which are driving the crisis.Slovenia

Slovenia

Slovenia ( ; sl, Slovenija ), officially the Republic of Slovenia (Slovene: , abbr.: ''RS''), is a country in Central Europe. It is bordered by Italy to the west, Austria to the north, Hungary to the northeast, Croatia to the southeast, an ...

joined the European Union in 2004. When it also joined the Euro area three years later interest rates went down. This led Slovenian banks to finance a construction boom and privatisation of state assets by sale to trusted members of the national elite. When the financial crisis hit the country construction has stalled and once-sound businesses began to struggle, leaving the banks with bad loans of more than 6 billion euros, or 12 %, of their lending portfolio. Eventually the Slovenian government helped its banking sector unwind bad loans by guaranteeing as much as 4 billion euros – more than 11 % of gross domestic product, which in turn led to rising borrowing costs for the government, with yields on its 10-year bonds rising above 6 %. In 2012, the government proposed an austerity budget and plans to adopt labour market reforms to cover the costs of the crisis. Despite these recent difficulties, Slovenia is nowhere close to actually requesting a bailout, according to the ''New York Times''.

Slovenia is hampered by a nexus between government and the banks: the banks received a €4.8 bn bailout in December 2013.chicagotribune.com: "Saved a state bailout, Slovenes question hefty banking bill" 16 Dec 2013/ref> The banks own such businesses as supermarkets and newspapers. To obtain EU approval for the transaction, Slovenia needed to sell all of its second-largest lender Nova KBM and third largest player Abanka, along with at least 75 percent of the biggest player

Nova Ljubljanska banka

NLB Group is the largest banking and financial group in Slovenia, with the core of its activity being in Southeast Europe.

History

Founded in 1994, the bank now covers markets with a population of approximately 17.4 million people. In addition to ...

.

Austria

The Eurozone crisis dented the economy of Austria as well. It caused, for example, the Hypo Alpe-Adria-Bank International to be purchased in December 2009 by the government for 1 euro owing to credit difficulties, thus wiping out the euro 1.63bn ofBayernLB

Bayerische Landesbank (BayernLB; Bavarian State Bank) is a publicly regulated bank based in Munich, Germany and one of the six Landesbanken. It is 75% owned by the Free State of Bavaria (indirectly via BayernLB Holding AG) and 25% owned by the ''S ...

, among others. As of February 2014, the HGAA situation was unsolved, causing Chancellor Werner Faymann

Werner Faymann (; born 4 May 1960) is an Austrian former politician who was Chancellor of Austria and chairman of the Social Democratic Party of Austria (SPÖ) from 2008 to 2016. On 9 May 2016, he resigned from both positions amid widening critic ...

to warn that its failure would be comparable to the 1931 Creditanstalt

The Creditanstalt (sometimes Credit-Anstalt, abbreviated as CA), full original name k. k. priv. Österreichische Credit-Anstalt für Handel und Gewerbe (), was a major Austrian bank, founded in 1855 in Vienna.

From its founding until 1931, th ...

event.

Romania

Romania fell into a recession in 2009 and 2010, when the GDP contracted −7.1% and −1.3% respectively, and a group including the IMF needed to finance a €20 billion bailout program, conditional on slashed public sector wages and hiked value added sales taxes./ref> However, the GDP grew again by 2.2% in 2011 and 0.7% in 2012.

See also

*European sovereign debt crisis

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, is a multi-year debt crisis that took place in the European Union (EU) from 2009 until the mid to late 2010s. Several eurozone memb ...

References

{{Economic Crisis, state=collapsed Stock market crashes Great Recession in Europe 2000s economic history Eurozone crisis 2010s economic history Articles containing video clips