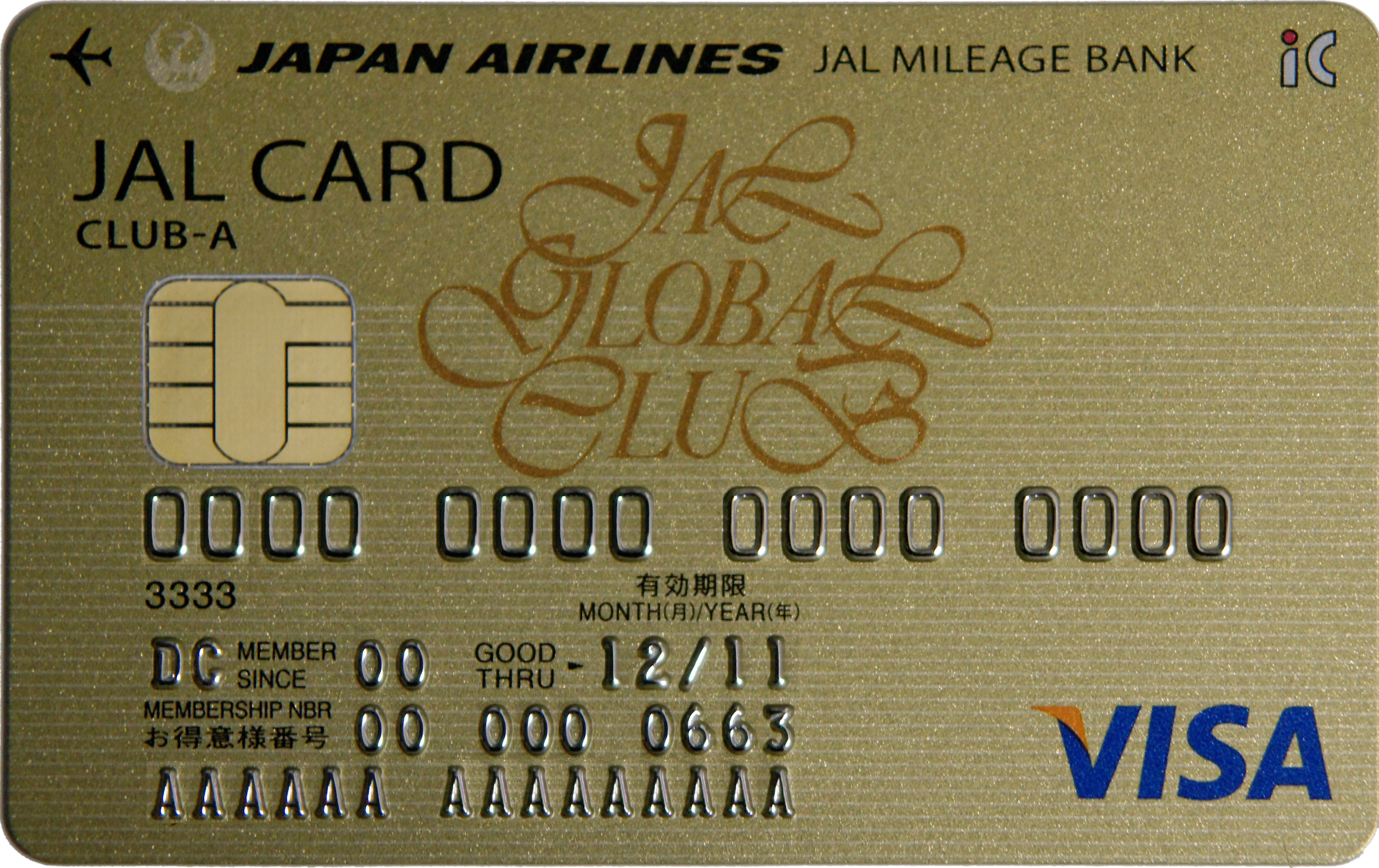

EMV is a payment method based on a technical standard for

smart

Smart or SMART may refer to:

Arts and entertainment

* ''Smart'' (Hey! Say! JUMP album), 2014

* Smart (Hotels.com), former mascot of Hotels.com

* ''Smart'' (Sleeper album), 1995 debut album by Sleeper

* '' SMart'', a children's television se ...

payment card

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner (the cardholder) to access the funds in the customer's designated bank accounts, or through a credit account and ...

s and for

payment terminal

A payment terminal, also known as a point of sale (POS) terminal, credit card terminal, EFTPOS terminal (or by the older term as PDQ terminal which stands for "Process Data Quickly"), is a device which interfaces with payment cards to make electro ...

s and

automated teller machine

An automated teller machine (ATM) or cash machine (in British English) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, fund ...

s which can accept them. EMV stands for "

Europay,

Mastercard, and

Visa", the three companies that created the standard.

[

EMV cards are ]smart cards

A smart card, chip card, or integrated circuit card (ICC or IC card) is a physical electronic authentication device, used to control access to a resource. It is typically a plastic credit card-sized card with an embedded integrated circuit (IC) c ...

, also called chip cards, integrated circuit cards, or IC cards, which store their data on integrated circuit

An integrated circuit or monolithic integrated circuit (also referred to as an IC, a chip, or a microchip) is a set of electronic circuits on one small flat piece (or "chip") of semiconductor material, usually silicon. Large numbers of tiny ...

chips, in addition to magnetic stripes for backward compatibility

Backward compatibility (sometimes known as backwards compatibility) is a property of an operating system, product, or technology that allows for interoperability with an older legacy system, or with input designed for such a system, especiall ...

. These include cards that must be physically inserted or "dipped" into a reader, as well as contactless cards that can be read over a short distance using near-field communication

Near-field communication (NFC) is a set of communication protocols that enables communication between two electronic devices over a distance of 4 cm (1 in) or less. NFC offers a low-speed connection through a simple setup that can be u ...

technology. Payment cards which comply with the EMV standard are often called chip and PIN or chip and signature cards, depending on the authentication methods employed by the card issuer, such as a personal identification number

A personal identification number (PIN), or sometimes redundantly a PIN number or PIN code, is a numeric (sometimes alpha-numeric) passcode used in the process of authenticating a user accessing a system.

The PIN has been the key to facilitati ...

(PIN) or digital signature

A digital signature is a mathematical scheme for verifying the authenticity of digital messages or documents. A valid digital signature, where the prerequisites are satisfied, gives a recipient very high confidence that the message was created b ...

. Standards exist, based on ISO/IEC 7816

ISO/IEC 7816 is an international standard related to electronic identification cards with contacts, especially smart cards, and more recently, contactless mobile devices, managed jointly by the International Organization for Standardization (ISO) ...

, for contact cards, and based on ISO/IEC 14443 for contactless cards ( Mastercard Contactless, Visa PayWave, American Express ExpressPay

American Express Company (Amex) is an American multinational corporation specialized in payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founde ...

).

History

Until the introduction of Chip & PIN, all face-to-face credit

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt) ...

or debit card

A debit card, also known as a check card or bank card is a payment card that can be used in place of cash to make purchases. The term '' plastic card'' includes the above and as an identity document. These are similar to a credit card, but ...

transactions involved the use of a magnetic stripe or mechanical imprint to read and record account data, and a signature for purposes of identity verification. The customer hands their card to the cashier at the point of sale

The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice f ...

who then passes the card through a magnetic reader or makes an imprint from the raised text of the card. In the former case, the system verifies account details and prints a slip for the customer to sign. In the case of a mechanical imprint, the transaction details are filled in, a list of stolen numbers is consulted, and the customer signs the imprinted slip. In both cases the cashier must verify that the customer's signature matches that on the back of the card to authenticate the transaction.

Using the signature on the card as a verification method has a number of security flaws, the most obvious being the relative ease with which cards may go missing before their legitimate owners can sign them. Another involves the erasure and replacement of legitimate signature, and yet another involves the forgery

Forgery is a white-collar crime that generally refers to the false making or material alteration of a legal instrument with the specific intent to defraud anyone (other than themself). Tampering with a certain legal instrument may be forb ...

of the correct signature.

The invention of the silicon

Silicon is a chemical element with the symbol Si and atomic number 14. It is a hard, brittle crystalline solid with a blue-grey metallic luster, and is a tetravalent metalloid and semiconductor. It is a member of group 14 in the periodic ...

integrated circuit

An integrated circuit or monolithic integrated circuit (also referred to as an IC, a chip, or a microchip) is a set of electronic circuits on one small flat piece (or "chip") of semiconductor material, usually silicon. Large numbers of tiny ...

chip in 1959 led to the idea of incorporating it onto a plastic smart card

A smart card, chip card, or integrated circuit card (ICC or IC card) is a physical electronic authentication device, used to control access to a resource. It is typically a plastic credit card-sized card with an embedded integrated circuit (IC) c ...

in the late 1960s by two German engineers, Helmut Gröttrup and Jürgen Dethloff.MOS integrated circuit

upright=1.6, gate (G), body (B), source (S), and drain (D) terminals. The gate is separated from the body by an gate oxide">insulating layer (pink).

The metal–oxide–semiconductor field-effect transistor (MOSFET, MOS-FET, or MOS FET), also ...

chips, along with MOS memory technologies such as flash memory

Flash memory is an electronic non-volatile computer memory storage medium that can be electrically erased and reprogrammed. The two main types of flash memory, NOR flash and NAND flash, are named for the NOR and NAND logic gates. Both use ...

and EEPROM

EEPROM (also called E2PROM) stands for electrically erasable programmable read-only memory and is a type of non-volatile memory used in computers, usually integrated in microcontrollers such as smart cards and remote keyless systems, or ...

(electrically erasable programmable read-only memory).

The first standard for smart payment cards was the Carte Bancaire B0M4 from Bull-CP8 deployed in France in 1986, followed by the B4B0' (compatible with the M4) deployed in 1989. Geldkarte Geldkarte (german: "money card") is a stored-value card or electronic cash system used in Germany. It operates as an offline smart card for small payment at things like vending machines and to pay for public transport or parking tickets. The card i ...

in Germany also predates EMV. EMV was designed to allow cards and terminals to be backwardly compatible with these standards. France has since migrated all its card and terminal infrastructure to EMV.

EMV stands for Europay, Mastercard, and Visa, the three companies that created the standard. The standard is now managed by EMVCo, a consortium with control split equally among Visa, Mastercard, JCB, American Express

American Express Company (Amex) is an American multinational corporation, multinational corporation specialized in payment card industry, payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Man ...

, China UnionPay

UnionPay (), also known as China UnionPay () or by its abbreviation, CUP or UPI internationally, is a Chinese state-owned financial services corporation headquartered in Shanghai, China. It provides bank card services and a major card sc ...

, and Discover. EMVCo also refers to "Associates," companies able to provide input and receive feedback on detailed technical and operational issues connected to the EMV specifications and related processes. JCB joined the consortium in February 2009, China UnionPay

UnionPay (), also known as China UnionPay () or by its abbreviation, CUP or UPI internationally, is a Chinese state-owned financial services corporation headquartered in Shanghai, China. It provides bank card services and a major card sc ...

in May 2013, and Discover

Discover may refer to:

Art, entertainment, and media

* ''Discover'' (album), a Cactus Jack album

* ''Discover'' (magazine), an American science magazine

Businesses and brands

* DISCover, the ''Digital Interactive Systems Corporation''

* D ...

in September 2013.

The top vendors of EMV cards and chips are: ABnote (American Bank Corp), CPI Card Group, IDEMIA (from the merger of Oberthur Technologies

Oberthur Technologies was a French digital security company, providing secure technology solutions for Smart Transactions, Mobile Financial Services, Machine-to-Machine, Digital Identity and Transport & Access Control. As of 2008, Oberthur's reve ...

and Safran Identity & Security (Morpho) in 2017), Gemalto

Gemalto was an international digital security company providing software applications, secure personal devices such as smart cards and tokens, and managed services. It was formed in June 2006 by the merger of two companies, Axalto and Gemplu ...

(acquired by the Thales Group

Thales Group () is a French multinational company that designs, develops and manufactures electrical systems as well as devices and equipment for the aerospace, defence, transportation and security sectors. The company is headquartered in Pari ...

in 2019) Giesecke & Devrient

Giesecke+Devrient, also known as (G+D), is a German company headquartered in Munich that provides banknote and securities printing, smart cards, and cash handling systems.

History

Founded in 1852 by Hermann Giesecke and Alphonse Devrient, th ...

and Versatile Card Technology.

Differences and benefits

There are two major benefits to moving to smart-card-based credit card payment systems: improved security (with associated fraud reduction), and the possibility for finer control of "offline" credit-card transaction approvals. One of the original goals of EMV was to provide for multiple applications on a card: for a credit and debit card

A debit card, also known as a check card or bank card is a payment card that can be used in place of cash to make purchases. The term '' plastic card'' includes the above and as an identity document. These are similar to a credit card, but ...

application or an e-purse. New issue debit cards in the US contain two applications — a card association (Visa, Mastercard etc.) application, and a common debit application. The common debit application ID is somewhat of a misnomer as each "common" debit application actually uses the resident card association application.

EMV chip card transactions improve security against fraud compared to magnetic stripe card transactions that rely on the holder's signature and visual inspection of the card to check for features such as hologram

Holography is a technique that enables a wavefront to be recorded and later re-constructed. Holography is best known as a method of generating real three-dimensional images, but it also has a wide range of other applications. In principle, i ...

. The use of a PIN and cryptographic algorithms such as Triple DES

In cryptography, Triple DES (3DES or TDES), officially the Triple Data Encryption Algorithm (TDEA or Triple DEA), is a symmetric-key block cipher, which applies the DES cipher algorithm three times to each data block. The Data Encryption Standa ...

, RSA and SHA provide authentication of the card to the processing terminal and the card issuer's host system. The processing time is comparable to online transactions, in which communications delay accounts for the majority of the time, while cryptographic operations at the terminal take comparatively little time. The supposed increased protection from fraud has allowed banks and credit card issuers to push through a "liability shift", such that merchants are now liable (as of 1 January 2005 in the EU region and 1 October 2015 in the US) for any fraud that results from transactions on systems that are not EMV-capable.personal identification number

A personal identification number (PIN), or sometimes redundantly a PIN number or PIN code, is a numeric (sometimes alpha-numeric) passcode used in the process of authenticating a user accessing a system.

The PIN has been the key to facilitati ...

(PIN) rather than signing a paper receipt. Whether or not PIN authentication takes place depends upon the capabilities of the terminal and programming of the card.

When credit cards were first introduced, merchants used mechanical rather than magnetic portable card imprinters that required carbon paper

Carbon paper (originally carbonic paper) consists of sheets of paper which create one or more copies simultaneously with the creation of an original document when inscribed by a typewriter or ballpoint pen.

History

In 1801, Pellegrino Turri, ...

to make an imprint. They did not communicate electronically with the card issuer, and the card never left the customer's sight. The merchant had to verify transactions over a certain currency limit by telephoning the card issuer. During the 1970s in the United States, many merchants subscribed to a regularly-updated list of stolen or otherwise invalid credit card numbers. This list was commonly printed in booklet form on newsprint, in numerical order, much like a slender phone book, yet without any data aside from the list of invalid numbers. Checkout cashiers were expected to thumb through this booklet each and every time a credit card was presented for payment of any amount, prior to approving the transaction, which incurred a short delay.[

Later, ]equipment

Equipment most commonly refers to a set of tools or other objects commonly used to achieve a particular objective. Different job

Work or labor (or labour in British English) is intentional activity people perform to support the needs and ...

electronically contacted the card issuer, using information from the magnetic stripe to verify the card and authorize the transaction. This was much faster than before, but required the transaction to occur in a fixed location. Consequently, if the transaction did not take place near a terminal (in a restaurant, for example) the clerk or waiter had to take the card away from the customer and to the card machine. It was easily possible at any time for a dishonest employee to swipe the card surreptitiously through a cheap machine that instantly recorded the information on the card and stripe; in fact, even at the terminal, a thief could bend down in front of the customer and swipe the card on a hidden reader. This made illegal cloning of cards relatively easy and a more common occurrence than before.

Since the introduction of payment card Chip and PIN, cloning of the chip is not feasible; only the magnetic stripe can be copied, and a copied card cannot be used by itself on a terminal requiring a PIN. The introduction of Chip and PIN coincided with wireless

Wireless communication (or just wireless, when the context allows) is the transfer of information between two or more points without the use of an electrical conductor, optical fiber or other continuous guided medium for the transfer. The most ...

data transmission

Data transmission and data reception or, more broadly, data communication or digital communications is the transfer and reception of data in the form of a digital bitstream or a digitized analog signal transmitted over a point-to-point or ...

technology becoming inexpensive and widespread. In addition to mobile-phone-based magnetic readers, merchant personnel can now bring wireless PIN pads to the customer, so the card is never out of the cardholder's sight. Thus, both chip-and-PIN and wireless technologies can be used to reduce the risks of unauthorized swiping and card cloning.

Chip and PIN vis-à-vis chip and signature

Chip and PIN is one of the two verification methods that EMV enabled cards can employ.

Online, phone, and mail order transactions

While EMV technology has helped reduce crime at the point of sale, fraudulent transactions have shifted to more vulnerable telephone

A telephone is a telecommunications device that permits two or more users to conduct a conversation when they are too far apart to be easily heard directly. A telephone converts sound, typically and most efficiently the human voice, into e ...

, Internet

The Internet (or internet) is the global system of interconnected computer networks that uses the Internet protocol suite (TCP/IP) to communicate between networks and devices. It is a '' network of networks'' that consists of private, p ...

, and mail order

Mail order is the buying of goods or services by mail delivery. The buyer places an order for the desired products with the merchant through some remote methods such as:

* Sending an order form in the mail

* Placing a telephone call

* Placing ...

transactions—known in the industry as card-not-present

A card-not-present transaction (CNP, mail order / telephone order, MO/TO) is a payment card transaction made where the cardholder does not or cannot physically present the card for a merchant's visual examination at the time that an order is given ...

or CNP transactions. CNP transactions made up at least 50% of all credit card fraud. Because of physical distance, it is not possible for the merchant to present a keypad to the customer in these cases, so alternatives have been devised, including

* Software approaches for online transactions that involve interaction with the card-issuing bank or network's website, such as Verified by Visa and Mastercard SecureCode (implementations of Visa's 3-D Secure

3-D Secure is a protocol designed to be an additional security layer for online credit and debit card transactions. The name refers to the "three domains" which interact using the protocol: the merchant/acquirer domain, the issuer domain, and the ...

protocol). 3-D Secure is now being replaced by Strong Customer Authentication Strong customer authentication (SCA) is a requirement of the EU Revised Directive on Payment Services (PSD2) on payment service providers within the European Economic Area. The requirement ensures that electronic payments are performed with mult ...

as defined in the European Second Payment Services Directive.

* Creating a one-time virtual card linked to a physical card with a given maximum amount.

* Additional hardware with keypad and screen that can produce a one-time password

A one-time password (OTP), also known as a one-time PIN, one-time authorization code (OTAC) or dynamic password, is a password that is valid for only one login session or transaction, on a computer system or other digital device. OTPs avoid seve ...

, such as the Chip Authentication Program 250px, A Gemalto EZIO CAP device with Barclays PINsentry styling

The Chip Authentication Program (CAP) is a MasterCard initiative and technical specification for using EMV banking smartcards for authenticating users and transactions in online and ...

.

* Keypad and screen integrated into complex cards to produce a one-time password

A one-time password (OTP), also known as a one-time PIN, one-time authorization code (OTAC) or dynamic password, is a password that is valid for only one login session or transaction, on a computer system or other digital device. OTPs avoid seve ...

. Since 2008, Visa has been running pilot projects using the Emue card where the generated number replaces the code printed on the back of standard cards.

As for which is faster, ''The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid ...

'' explained that it's a matter of perception: While the chip method requires that the chip stay in the machine until the transaction and the authorization process is completed, the phone swipe method does the authorization in the background; a receipt starts coming out right away.

Commands

ISO/IEC 7816

ISO/IEC 7816 is an international standard related to electronic identification cards with contacts, especially smart cards, and more recently, contactless mobile devices, managed jointly by the International Organization for Standardization (ISO) ...

-3 defines the transmission protocol between chip cards and readers. Using this protocol, data is exchanged in '' application protocol data units'' (APDUs). This comprises sending a command to a card, the card processing it, and sending a response. EMV uses the following commands:

* application block

* application unblock

* card block

* external authenticate (7816-4)

* generate application cryptogram

* get data (7816-4)

* get processing options

* internal authenticate (7816-4)

* PIN change / unblock

* read record (7816-4)

* select (7816-4)

* verify (7816-4).

Commands followed by "7816-4" are defined in ISO/IEC 7816-4 and are interindustry commands used for many chip card applications such as GSM

The Global System for Mobile Communications (GSM) is a standard developed by the European Telecommunications Standards Institute (ETSI) to describe the protocols for second-generation ( 2G) digital cellular networks used by mobile devices such ...

SIM cards.

Transaction flow

An EMV transaction has the following steps:

* Application selection

* Initiate application processing

* Read application data

* Processing restrictions

* Offline data authentication

* Certificates

* Cardholder verification

* Terminal risk management

* Terminal action analysis

* First card action analysis

* Online transaction authorization (only carried out if required by the result of the previous steps; mandatory in ATMs)

* Second card action analysis

* Issuer script processing.

Application selection

ISO/IEC 7816

ISO/IEC 7816 is an international standard related to electronic identification cards with contacts, especially smart cards, and more recently, contactless mobile devices, managed jointly by the International Organization for Standardization (ISO) ...

defines a process for application selection. The intent of application selection was to let cards contain completely different applications—for example GSM

The Global System for Mobile Communications (GSM) is a standard developed by the European Telecommunications Standards Institute (ETSI) to describe the protocols for second-generation ( 2G) digital cellular networks used by mobile devices such ...

and EMV. However, EMV developers implemented application selection as a way of identifying the type of product, so that all product issuers (Visa, Mastercard, etc.) must have their own application. The way application selection is prescribed in EMV is a frequent source of interoperability problems between cards and terminals. Book 1Chase

Chase or CHASE may refer to:

Businesses

* Chase Bank, a national bank based in New York City, New York

* Chase Aircraft (1943–1954), a defunct American aircraft manufacturing company

* Chase Coaches, a defunct bus operator in England

* Chase C ...

, for example, renames the Visa application on its Visa cards to "CHASE VISA", and the Mastercard application on its Mastercard cards to "CHASE MASTERCARD". Capital One

Capital One Financial Corporation is an American bank holding company specializing in credit cards, auto loans, banking, and savings accounts, headquartered in McLean, Virginia with operations primarily in the United States. It is on the li ...

renames the Mastercard application on its Mastercard cards to "CAPITAL ONE", and the Visa application on its Visa cards to "CAPITAL ONE VISA". The applications are otherwise the same.

List of applications:

Initiate application processing

The terminal sends the ''get processing options'' command to the card. When issuing this command, the terminal supplies the card with any data elements requested by the card in the ''processing options data objects list'' (PDOL). The PDOL (a list of tags and lengths of data elements) is optionally provided by the card to the terminal during application selection. The card responds with the ''application interchange profile'' (AIP), a list of functions to perform in processing the transaction. The card also provides the ''application file locator'' (AFL), a list of files and records that the terminal needs to read from the card.

Read application data

Smart card

A smart card, chip card, or integrated circuit card (ICC or IC card) is a physical electronic authentication device, used to control access to a resource. It is typically a plastic credit card-sized card with an embedded integrated circuit (IC) c ...

s store data in files. The AFL contains the files that contain EMV data. These all must be read using the read record command. EMV does not specify which files data is stored in, so all the files must be read. Data in these files is stored in BER

''Ziziphus mauritiana'', also known as Indian jujube, Indian plum, Chinese date, Chinese apple, ber, and dunks is a tropical fruit tree species belonging to the family Rhamnaceae. It is often confused with the closely related Chinese jujube (' ...

TLV format. EMV defines tag values for all data used in card processing.

Processing restrictions

The purpose of the ''processing restrictions'' is to see if the card should be used. Three data elements read in the previous step are checked: Application version number, Application usage control (this shows whether the card is only for domestic use, etc.), Application effective/expiration dates checking.

If any of these checks fails, the card is not necessarily declined. The terminal sets the appropriate bit in the terminal verification results (TVR), the components of which form the basis of an accept/decline decision later in the transaction flow. This feature lets, for example, card issuers permit cardholders to keep using expired cards after their expiry date, but for all transactions with an expired card to be performed on-line.

Offline data authentication (ODA)

Offline data authentication is a cryptographic check to validate the card using public-key cryptography

Public-key cryptography, or asymmetric cryptography, is the field of cryptographic systems that use pairs of related keys. Each key pair consists of a public key and a corresponding private key. Key pairs are generated with cryptographic a ...

. There are three different processes that can be undertaken depending on the card:

*''Static data authentication'' (SDA) ensures data read from the card has been signed by the card issuer. This prevents modification of data, but does not prevent cloning.

*''Dynamic data authentication'' (DDA) provides protection against modification of data and cloning.

*''Combined DDA/generate application cryptogram'' (CDA) combines DDA with the generation of a card's ''application cryptogram'' to assure card validity. Support of CDA in devices may be needed, as this process has been implemented in specific markets. This process is not mandatory in terminals and can only be carried out where both card and terminal support it.

EMV certificates

To verify the authenticity of payment cards, EMV certificates are used. The EMV Certificate Authority

Cardholder verification

Cardholder verification is used to evaluate whether the person presenting the card is the legitimate cardholder. There are many cardholder verification methods (CVMs) supported in EMV. They are

*Signature

*Offline plaintext PIN

*Offline enciphered PIN

*Offline plaintext PIN and signature

*Offline enciphered PIN and signature

*Online PIN

*No CVM required

*Consumer Device CVM

*Fail CVM processing

The terminal uses a CVM list read from the card to determine the type of verification to perform. The CVM list establishes a priority of CVMs to use relative to the capabilities of the terminal. Different terminals support different CVMs. ATMs generally support online PIN. POS terminals vary in their CVM support depending on type and country.

For offline enciphered PIN methods, the terminal encrypts the cleartext PIN block with the card's public key before sending it to the card with the Verify

CONFIG.SYS is the primary configuration file for the DOS and OS/2 operating systems. It is a special ASCII text file that contains user-accessible setup or configuration directives evaluated by the operating system's DOS BIOS (typically residing ...

command. For the online PIN method, the cleartext PIN block is encrypted by the terminal using its point-to-point encryption key before sending it to the acquirer processor in the authorization request message.

All offline methods are vulnerable to man-in-the-middle attacks.

In 2017, EMVCo added support for biometric verification methods in version 4.3 of the EMV specifications.

Terminal risk management

Terminal risk management is only performed in devices where there is a decision to be made whether a transaction should be authorised on-line or offline. If transactions are always carried out on-line (e.g., ATMs) or always off-line, this step can be skipped. Terminal risk management checks the transaction amount against an offline ceiling limit (above which transactions should be processed on-line). It is also possible to have a 1 in an online counter, and a check against a hot card list (which is only necessary for off-line transactions). If the result of any of these tests is positive, the terminal sets the appropriate bit in the terminal verification results (TVR).

Terminal action analysis

The results of previous processing steps are used to determine whether a transaction should be approved offline, sent online for authorization, or declined offline. This is done using a combination of data object

In computer science, an object can be a variable, a data structure, a function, or a method. As regions of memory, they contain value and are referenced by identifiers.

In the object-oriented programming paradigm, ''object'' can be a combinati ...

s known as ''terminal action codes'' (TACs) held in the terminal and ''issuer action codes'' (IACs) read from the card. The TAC is logically OR'd with the IAC, to give the transaction acquirer a level of control over the transaction outcome. Both types of action code take the values Denial, Online, and Default. Each action code contains a series of bits which correspond to the bits in the Terminal verification results (TVR), and are used in the terminal's decision whether to accept, decline or go on-line for a payment transaction. The TAC is set by the card acquirer; in practice card schemes advise the TAC settings that should be used for a particular terminal type depending on its capabilities. The IAC is set by the card issuer; some card issuers may decide that expired cards should be rejected, by setting the appropriate bit in the Denial IAC. Other issuers may want the transaction to proceed on-line so that they can in some cases allow these transactions to be carried out.

When an online-only device performs IAC-Online and TAC-Online processing the only relevant TVR bit is "Transaction value exceeds the floor limit". Because the floor limit is set to zero, the transaction should always go online and all other values in TAC-Online or IAC-Online are irrelevant. Online-only devices do not need to perform IAC-default processing. An online-only device such as an ATM always attempts to go on-line with the authorization request, unless declined off-line due to IAC-Denial settings. During IAC-Denial and TAC-Denial processing, for an online only device, the only relevant Terminal verification results bit is "Service not allowed".

First card action analysis

One of the data objects read from the card in the Read application data stage is CDOL1 (Card Data object List). This object is a list of tags that the card wants to be sent to it to make a decision on whether to approve or decline a transaction (including transaction amount, but many other data objects too). The terminal sends this data and requests a cryptogram using the generate application cryptogram command. Depending on the terminal's decision (offline, online, decline), the terminal requests one of the following cryptograms from the card:

*Transaction certificate (TC)—offline approval

*Authorization Request Cryptogram (ARQC)—online authorization

*Application Authentication Cryptogram (AAC)—offline decline

This step gives the card the opportunity to accept the terminal's action analysis or to decline a transaction or force a transaction on-line. The card cannot return a TC when an ARQC has been asked for, but can return an ARQC when a TC has been asked for.[

]

Online transaction authorization

Transactions go online when an ARQC has been requested. The ARQC is sent in the authorisation message. The card generates the ARQC. Its format depends on the card application. EMV does not specify the contents of the ARQC. The ARQC created by the card application is a digital signature

A digital signature is a mathematical scheme for verifying the authenticity of digital messages or documents. A valid digital signature, where the prerequisites are satisfied, gives a recipient very high confidence that the message was created b ...

of the transaction details, which the card issuer can check in real time. This provides a strong cryptographic check that the card is genuine. The issuer responds to an authorization request with a response code (accepting or declining the transaction), an authorisation response cryptogram (ARPC) and optionally an issuer script (a string of commands to be sent to the card).[

ARPC processing is not performed in contact transactions processed with Visa Quick Chip]

Second card action analysis

CDOL2 (Card data object list) contains a list of tags that the card wanted to be sent after online transaction authorisation (response code, ARPC, etc.). Even if for any reason the terminal could not go online (e.g., communication failure), the terminal should send this data to the card again using the generate authorisation cryptogram command. This lets the card know the issuer's response. The card application may then reset offline usage limits.

Issuer script processing

If a card issuer wants to update a card post issuance it can send commands to the card using issuer script processing. Issuer scripts are meaningless to the terminal and can be encrypted between the card and the issuer to provide additional security. Issuer script can be used to block cards, or change card parameters.

Issuer script processing is not available in contact transactions processed with Visa Quick Chip

EMV chip specification

The first version of EMV standard was published in 1995. Now the standard is defined and managed by the privately owned corporation EMVCo LLC. The current members of EMVCo

The first version of EMV standard was published in 1995. Now the standard is defined and managed by the privately owned corporation EMVCo LLC. The current members of EMVCoAmerican Express

American Express Company (Amex) is an American multinational corporation, multinational corporation specialized in payment card industry, payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Man ...

, Discover Financial

Discover Financial Services is an American financial services company that owns and operates Discover Bank, which offers checking and savings accounts, personal loans, home equity loans, student loans and credit cards. It also owns and operates ...

, JCB International

, formerly Japan Credit Bureau, is a credit card company based in Tokyo, Japan.

Its cards are accepted at JCB merchants, and has strategic alliances with Discover Network merchants in the United States, UnionPay merchants in China, American Ex ...

, Mastercard, China UnionPay

UnionPay (), also known as China UnionPay () or by its abbreviation, CUP or UPI internationally, is a Chinese state-owned financial services corporation headquartered in Shanghai, China. It provides bank card services and a major card sc ...

, and Visa Inc.

Visa Inc. (; stylized as ''VISA'') is an American multinational financial services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded cred ...

Each of these organizations owns an equal share of EMVCo and has representatives in the EMVCo organization and EMVCo working groups.

Recognition of compliance with the EMV standard (i.e., device certification) is issued by EMVCo following submission of results of testing performed by an accredited testing house.

EMV Compliance testing has two levels: EMV Level 1, which covers physical, electrical and transport level interfaces, and EMV Level 2, which covers payment application selection and credit financial transaction processing.

After passing common EMVCo tests, the software must be certified by payment brands to comply with proprietary EMV implementations such as Visa VSDC, American Express AEIPS, Mastercard MChip, JCB JSmart, or EMV-compliant implementations of non-EMVCo members such as LINK in the UK, or Interac in Canada.

List of EMV documents and standards

As of 2011, since version 4.0, the official EMV standard documents which define all the components in an EMV payment system are published as four "books" and some additional documents:

* Book 1: Application Independent ICC to Terminal Interface Requirements

Versions

The first EMV standard came into view in 1995 as EMV 2.0. This was upgraded to EMV 3.0 in 1996 (sometimes referred to as EMV '96) with later amendments to EMV 3.1.1 in 1998. This was further amended to version 4.0 in December 2000 (sometimes referred to as EMV 2000). Version 4.0 became effective in June 2004. Version 4.1 became effective in June 2007. Version 4.2 is in effect since June 2008. Version 4.3 is in effect since November 2011.

Vulnerabilities

Opportunities to harvest PINs and clone magnetic stripes

In addition to the track-two data on the magnetic stripe, EMV cards generally have identical data encoded on the chip, which is read as part of the normal EMV transaction process. If an EMV reader is compromised to the extent that the conversation between the card and the terminal is intercepted, then the attacker may be able to recover both the track-two data and the PIN, allowing construction of a magnetic stripe card, which, while not usable in a Chip and PIN terminal, can be used, for example, in terminal devices that permit fallback to magstripe processing for foreign customers without chip cards, and defective cards. This attack is possible only where (a) the offline PIN is presented in plaintext by the PIN entry device to the card, where (b) magstripe fallback is permitted by the card issuer and (c) where geographic and behavioural checking may not be carried out by the card issuer.

APACS, representing the UK payment industry, claimed that changes specified to the protocol (where card verification values differ between the magnetic stripe and the chip – the iCVV) rendered this attack ineffective and that such measures would be in place from January 2008. Tests on cards in February 2008 indicated this may have been delayed.

Successful attacks

Conversation capturing is a form of attack which was reported to have taken place against Shell

Shell may refer to:

Architecture and design

* Shell (structure), a thin structure

** Concrete shell, a thin shell of concrete, usually with no interior columns or exterior buttresses

** Thin-shell structure

Science Biology

* Seashell, a hard o ...

terminals in May 2006, when they were forced to disable all EMV authentication in their filling station

A filling station, also known as a gas station () or petrol station (), is a facility that sells fuel and engine lubricants for motor vehicles. The most common fuels sold in the 2010s were gasoline (or petrol) and diesel fuel.

Ga ...

s after more than £1 million was stolen from customers.

In October 2008, it was reported that hundreds of EMV card readers for use in Britain, Ireland, the Netherlands, Denmark, and Belgium had been expertly tampered with in China during or shortly after manufacture. For 9 months details and PINs of credit and debit cards were sent over mobile phone

A mobile phone, cellular phone, cell phone, cellphone, handphone, hand phone or pocket phone, sometimes shortened to simply mobile, cell, or just phone, is a portable telephone that can make and receive calls over a radio frequency link whi ...

networks to criminals in Lahore

Lahore ( ; pnb, ; ur, ) is the second List of cities in Pakistan by population, most populous city in Pakistan after Karachi and 26th List of largest cities, most populous city in the world, with a population of over 13 million. It is th ...

, Pakistan. United States National Counterintelligence Executive Joel Brenner said, "Previously only a nation state

A nation state is a political unit where the state and nation are congruent. It is a more precise concept than "country", since a country does not need to have a predominant ethnic group.

A nation, in the sense of a common ethnicity, may ...

's intelligence agency

An intelligence agency is a government agency responsible for the collection, analysis, and exploitation of information in support of law enforcement, national security, military, public safety, and foreign policy objectives.

Means of inf ...

would have been capable of pulling off this type of operation. It's scary." Data were typically used a couple of months after the card transactions to make it harder for investigators to pin down the vulnerability. After the fraud was discovered it was found that tampered-with terminals could be identified as the additional circuitry increased their weight by about 100 g. Tens of millions of pounds sterling are believed to have been stolen. This vulnerability spurred efforts to implement better control of electronic POS devices over their entire life cycle, a practice endorsed by electronic payment security standards like those being developed by the Secure POS Vendor Alliance (SPVA).

PIN harvesting and stripe cloning

In a February 2008 BBC ''Newsnight

''Newsnight'' (or ''BBC Newsnight'') is BBC Two's news and current affairs programme, providing in-depth investigation and analysis of the stories behind the day's headlines. The programme is broadcast on weekdays at 22:30. and is also availa ...

'' programme Cambridge University researchers Steven Murdoch and Saar Drimer demonstrated one example attack, to illustrate that Chip and PIN is not secure enough to justify passing the liability to prove fraud from the banks onto customers. The Cambridge University exploit allowed the experimenters to obtain both card data to create a magnetic stripe and the PIN.

APACS, the UK payments association, disagreed with the majority of the report, saying "The types of attack on PIN entry devices detailed in this report are difficult to undertake and not currently economically viable for a fraudster to carry out." They also said that changes to the protocol (specifying different card verification values between the chip and magnetic stripe – the iCVV) would make this attack ineffective from January 2008. The fraud reported in October 2008 to have operated for 9 months (see above) was probably in operation at the time, but was not discovered for many months.

In August 2016, NCR Corporation

NCR Corporation, previously known as National Cash Register, is an American software, consulting and technology company providing several professional services and electronic products. It manufactures self-service kiosks, point-of-sale termin ...

security researchers showed how credit card thieves can rewrite the code of a magnetic strip to make it appear like a chipless card, which allows for counterfeiting.

2010: Hidden hardware disables PIN checking on stolen card

On 11 February 2010 Murdoch and Drimer's team at Cambridge University announced that they had found "a flaw in chip and PIN so serious they think it shows that the whole system needs a re-write" that was "so simple that it shocked them".man-in-the-middle attack

In cryptography and computer security, a man-in-the-middle, monster-in-the-middle, machine-in-the-middle, monkey-in-the-middle, meddler-in-the-middle, manipulator-in-the-middle (MITM), person-in-the-middle (PITM) or adversary-in-the-middle (AiTM) ...

"). Any four digits are typed in and accepted as a valid PIN.

A team from the BBC's ''Newsnight'' programme visited a Cambridge University cafeteria (with permission) with the system, and were able to pay using their own cards (a thief would use stolen cards) connected to the circuit, inserting a fake card and typing in "0000" as the PIN. The transactions were registered as normal, and were not picked up by banks' security systems. A member of the research team said, "Even small-scale criminal systems have better equipment than we have. The amount of technical sophistication needed to carry out this attack is really quite low." The announcement of the vulnerability said, "The expertise that is required is not high (undergraduate level electronics) ... We dispute the assertion by the banking industry that criminals are not sophisticated enough, because they have already demonstrated a far higher level of skill than is necessary for this attack in their miniaturized PIN entry device skimmers." It is not known if this vulnerability has been exploited.

EMVCo disagreed and published a response saying that, while such an attack might be theoretically possible, it would be extremely difficult and expensive to carry out successfully, that current compensating controls are likely to detect or limit the fraud, and that the possible financial gain from the attack is minimal while the risk of a declined transaction or exposure of the fraudster is significant.

When approached for comment, several banks (Co-operative Bank, Barclays and HSBC) each said that this was an industry-wide issue, and referred the ''Newsnight'' team to the banking trade association for further comment. According to Phil Jones of the Consumers' Association, Chip and PIN has helped to bring down instances of card crime, but many cases remain unexplained. "What we do know is that we do have cases that are brought forward from individuals which seem quite persuasive."

Because submission of the PIN is suppressed, this is the exact equivalent of a merchant performing a PIN bypass transaction. Such transactions cannot succeed offline, as a card never generates an offline authorisation without a successful PIN entry. As a result of this, the transaction ARQC must be submitted online to the issuer, who knows that the ARQC was generated without a successful PIN submission (since this information is included in the encrypted ARQC) and hence would be likely to decline the transaction if it were for a high value, out of character, or otherwise outside of the typical risk management parameters set by the issuer.

Originally, bank customers had to prove that they had not been negligent with their PIN before getting redress, but UK regulations in force from 1 November 2009 placed the onus firmly on the banks to prove that a customer has been negligent in any dispute, with the customer given 13 months to make a claim.

2011: CVM downgrade allows arbitrary PIN harvest

At the CanSecWest conference in March 2011, Andrea Barisani and Daniele Bianco presented research uncovering a vulnerability in EMV that would allow arbitrary PIN harvesting despite the cardholder verification configuration of the card, even when the supported CVMs data is signed.

The PIN harvesting can be performed with a chip skimmer. In essence, a CVM list that has been modified to downgrade the CVM to Offline PIN is still honoured by POS terminals, despite its signature being invalid.

PIN bypass

In 2020, researchers David Basin, Ralf Sasse, and Jorge Toro from ETH Zurich

(colloquially)

, former_name = eidgenössische polytechnische Schule

, image = ETHZ.JPG

, image_size =

, established =

, type = Public

, budget = CHF 1.896 billion (2021)

, rector = Günther Dissertori

, president = Joël Mesot

, a ...

reportedApple Pay

Apple Pay is a mobile payment service by Apple Inc. that allows users to make payments in person, in iOS apps, and on the web. It is supported on these Apple devices: iPhone, Apple Watch, iPad, and Mac. It digitizes and can replace a cred ...

, Google Pay) to perform PIN-free, high-value purchases. The attack is carried out using two NFC-enabled smartphones, one held near the physical card and the second held near the payment terminal. The attack might affect cards by Discover

Discover may refer to:

Art, entertainment, and media

* ''Discover'' (album), a Cactus Jack album

* ''Discover'' (magazine), an American science magazine

Businesses and brands

* DISCover, the ''Digital Interactive Systems Corporation''

* D ...

and China's UnionPay

UnionPay (), also known as China UnionPay () or by its abbreviation, CUP or UPI internationally, is a Chinese state-owned financial services corporation headquartered in Shanghai, China. It provides bank card services and a major card sc ...

but this was not demonstrated in practice, in contrast to Visa cards.

In early 2021, the same team disclosed that Mastercard cards are also vulnerable to a PIN bypass attack. They showed that criminals can trick a terminal into transacting with a Mastercard contactless card while believing it to be a Visa card. This ''card brand mixup'' has critical consequences since it can be used in combination with the PIN bypass for Visa to also bypass the PIN for Mastercard cards.

Tamarin

are up to the task since they can deal with the complexity of real-world systems like EMV.

Implementation

EMV stands for " Europay, Mastercard, and Visa", the three companies that created the standard. The standard is now managed by EMVCo, a consortium of financial companies. [ Additional widely known chips of the EMV standard are:

* AEIPS: American Express

* UICS: China Union Pay

* J Smart: JCB

* D-PAS: Discover/Diners Club International

* Rupay: NPCI

* Verve

Visa and Mastercard have also developed standards for using EMV cards in devices to support ]card not present transaction

A card-not-present transaction (CNP, mail order / telephone order, MO/TO) is a payment card transaction made where the cardholder does not or cannot physically present the card for a merchant's visual examination at the time that an order is given ...

s (CNP) over the telephone and Internet. Mastercard has the Chip Authentication Program 250px, A Gemalto EZIO CAP device with Barclays PINsentry styling

The Chip Authentication Program (CAP) is a MasterCard initiative and technical specification for using EMV banking smartcards for authenticating users and transactions in online and ...

(CAP) for secure e-commerce. Its implementation is known as EMV-CAP and supports a number of modes. Visa has the Dynamic Passcode Authentication (DPA) scheme, which is their implementation of CAP using different default values.

In many countries of the world, debit card and/or credit card payment networks have implemented liability shifts. Normally, the card issuer is liable for fraudulent transactions. However, after a liability shift is implemented, if the ATM or merchant's point of sale terminal does not support EMV, the ATM owner or merchant is liable for the fraudulent transaction.

Chip and PIN systems can cause problems for travellers from countries that do not issue Chip and PIN cards as some retailers may refuse to accept their chipless cards. While most terminals still accept a magnetic strip card, and the major credit card brands require vendors to accept them, some staff may refuse to take the card, under the belief that they are held liable for any fraud if the card cannot verify a PIN. Non-chip-and-PIN cards may also not work in some unattended vending machines at, for example, train stations, or self-service check-out tills at supermarkets.

Africa

*Mastercard's liability shift among countries within this region took place on 1 January 2006.

South Africa

*Mastercard's liability shift took place on 1 January 2005.

Asian and Pacific countries

*Mastercard's liability shift among countries within this region took place on 1 January 2006.

Australia

*Mastercard required that all point of sale terminals be EMV capable by April 2013. For ATMs, the liability shift took place in April 2012. ATMs must be EMV compliant by the end of 2015.

Malaysia

*Malaysia is the first country in the world to completely migrate to EMV-compliant smart cards two years after its implementation in 2005.

New Zealand

*Mastercard required all point of sale terminals to be EMV compliant by 1 July 2011. For ATMs, the liability shift took place in April 2012. ATMs are required to be EMV compliant by the end of 2015.

Europe

*Mastercard's liability shift took place on 1 January 2005.France

France (), officially the French Republic ( ), is a country primarily located in Western Europe. It also comprises of Overseas France, overseas regions and territories in the Americas and the Atlantic Ocean, Atlantic, Pacific Ocean, Pac ...

has cut card fraud by more than 80% since its introduction in 1992 (see Carte Bleue

''Carte Bleue'' ( en, Blue Card) was a major debit card payment system operating in France. Unlike Visa Electron or Maestro debit cards, Carte Bleue transactions worked without requiring authorization from the cardholder's bank. In many situa ...

).

United Kingdom

Chip and PIN was trialled in Northampton

Northampton () is a market town and civil parish in the East Midlands of England, on the River Nene, north-west of London and south-east of Birmingham. The county town of Northamptonshire, Northampton is one of the largest towns in England ...

, England

England is a country that is part of the United Kingdom. It shares land borders with Wales to its west and Scotland to its north. The Irish Sea lies northwest and the Celtic Sea to the southwest. It is separated from continental Europe ...

from May 2003, and as a result was rolled out nationwide in the United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the continental mainland. It comprises England, Scotland, Wales and ...

on 14 February 2006 with advertisements in the press and national television touting the "Safety in Numbers" slogan. During the first stages of deployment, if a fraudulent magnetic swipe card transaction was deemed to have occurred, the retailer was refunded by the issuing bank, as was the case prior to the introduction of Chip and PIN. On January 1, 2005, the liability for such transactions was shifted to the retailer; this acted as an incentive for retailers to upgrade their point of sale

The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice f ...

(PoS) systems, and most major high-street chains upgraded on time for the EMV deadline. Many smaller businesses were initially reluctant to upgrade their equipment, as it required a completely new PoS system—a significant investment.

New cards featuring both magnetic strips and chips are now issued by all major banks. The replacement of pre-Chip and PIN cards was a major issue, as banks simply stated that consumers would receive their new cards "when their old card expires" — despite many people having had cards with expiry dates as late as 2007. The card issuer Switch

In electrical engineering, a switch is an electrical component that can disconnect or connect the conducting path in an electrical circuit, interrupting the electric current or diverting it from one conductor to another. The most common type of ...

lost a major contract with HBOS

HBOS plc was a banking and insurance company in the United Kingdom, a wholly owned subsidiary of the Lloyds Banking Group, having been taken over in January 2009. It was the holding company for Bank of Scotland plc, which operated the Ba ...

to Visa, as they were not ready to issue the new cards as early as the bank wanted.

The Chip and PIN implementation was criticised as designed to reduce the liability of banks in cases of claimed card fraud by requiring the customer to prove that they had acted "with reasonable care" to protect their PIN and card, rather than on the bank having to prove that the signature matched. Before Chip and PIN, if a customer's signature was forged, the banks were legally liable and had to reimburse the customer. Until 1 November 2009 there was no such law protecting consumers from fraudulent use of their Chip and PIN transactions, only the voluntary Banking Code The Banking Code was a voluntary code of practice agreed by banks in certain countries. The code typically described how banks dealt with accepting deposits and withdrawals and with customer disputes on transactions. Banking codes have in most cou ...

. There were many reports that banks refused to reimburse victims of fraudulent card use, claiming that their systems could not fail under the circumstances reported, despite several documented successful large-scale attacks.

The Payment Services Regulations 2009 came into force on 1 November 2009 and shifted the onus onto the banks to prove, rather than assume, that the cardholder is at fault.Financial Services Authority

The Financial Services Authority (FSA) was a quasi-judicial body accountable for the regulation of the financial services industry in the United Kingdom between 2001 and 2013. It was founded as the Securities and Investments Board (SIB) in 19 ...

(FSA) said "It is for the bank, building society or credit card company to show that the transaction was made by you, and there was no breakdown in procedures or technical difficulty" before refusing liability.

Latin America and the Caribbean

*Mastercard's liability shift among countries within this region took place on 1 January 2005.

Brazil

*Mastercard's liability shift took place on 1 March 2008.

Colombia

*Mastercard's liability shift took place on 1 October 2008.

Mexico

*Discover implemented a liability shift on 1 October 2015. For pay at the pump at gas stations, the liability shift was on 1 October 2017.

Venezuela

*Mastercard's liability shift took place on 1 July 2009.

Middle East

*Mastercard's liability shift among countries within this region took place on 1 January 2006.

North America

Canada

*American Express implemented a liability shift on 31 October 2012.Interac

Interac is a Canadian interbank network that links financial institutions and other enterprises for the purpose of exchanging electronic financial transactions. Interac serves as the Canadian debit card system and the predominant funds transf ...

(Canada's debit card network) stopped processing non-EMV transactions at ATMs on 31 December 2012, and mandated EMV transactions at point-of-sale terminals on 30 September 2016, with a liability shift taking place on 31 December 2015.

*Mastercard implemented domestic transaction liability shift on 31 March 2011, and international liability shift on 15 April 2011. For pay at the pump at gas stations, the liability shift was implemented 31 December 2012.[

]

United States

After widespread identity theft

Identity theft occurs when someone uses another person's personal identifying information, like their name, identifying number, or credit card number, without their permission, to commit fraud or other crimes. The term ''identity theft'' was c ...

due to weak security in the point-of-sale terminals at Target

Target may refer to:

Physical items

* Shooting target, used in marksmanship training and various shooting sports

** Bullseye (target), the goal one for which one aims in many of these sports

** Aiming point, in field artillery, fi ...

, Home Depot

The Home Depot, Inc., is an American multinational home improvement retail corporation that sells tools, construction products, appliances, and services, including fuel and transportation rentals. Home Depot is the largest home improvement re ...

, and other major retailers, Visa, Mastercard and Discover in March 2012 – and American Express in June 2012 – announced their EMV migration plans for the United States. Since the announcement, multiple banks and card issuers have announced cards with EMV chip-and-signature technology, including American Express, Bank of America, Citibank, Wells Fargo

Wells Fargo & Company is an American multinational financial services company with corporate headquarters in San Francisco, California; operational headquarters in Manhattan; and managerial offices throughout the United States and intern ...

, JPMorgan Chase, U.S. Bank, and several credit unions.

In 2010, a number of companies began issuing pre-paid debit cards that incorporate Chip and PIN and allow Americans to load cash as euro

The euro ( symbol: €; code: EUR) is the official currency of 19 out of the member states of the European Union (EU). This group of states is known as the eurozone or, officially, the euro area, and includes about 340 million citizens . ...

s or pound sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and ...

.United Nations Federal Credit Union

The United Nations Federal Credit Union is an American credit union, with a head office in Long Island City, in New York State. It was founded in 1947 by United Nations employees.

In October 2010 UNFCU began issuing chip-and-PIN cards to its ...

was the first United States issuer to offer Chip and PIN credit cards. In May 2010, a press release from Gemalto

Gemalto was an international digital security company providing software applications, secure personal devices such as smart cards and tokens, and managed services. It was formed in June 2006 by the merger of two companies, Axalto and Gemplu ...

(a global EMV card producer) indicated that United Nations Federal Credit Union

The United Nations Federal Credit Union is an American credit union, with a head office in Long Island City, in New York State. It was founded in 1947 by United Nations employees.

In October 2010 UNFCU began issuing chip-and-PIN cards to its ...

in New York would become the first EMV card issuer in the United States, offering an EMV Visa credit card to its customers. JPMorgan was the first major bank to introduce a card with EMV technology, namely its Palladium card, in mid-2012.COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identi ...

.

*Discover implemented liability shift on 1 October 2015. For pay at the pump, at gas stations, the liability shift is 1 October 2020.[

]

Notes

See also

* Contactless payment

Contactless payment systems are credit cards and debit cards, key fobs, smart cards, or other devices, including smartphones and other mobile devices, that use radio-frequency identification (RFID) or near-field communication (NFC, e.g. Samsung ...

* Supply chain attack

A supply chain attack is a cyber-attack that seeks to damage an organization by targeting less secure elements in the supply chain. A supply chain attack can occur in any industry, from the financial sector, oil industry, to a government sector. ...

* Two-factor authentication

Multi-factor authentication (MFA; encompassing two-factor authentication, or 2FA, along with similar terms) is an electronic authentication method in which a user is granted access to a website or application only after successfully presenting ...

* MM code

References

External links

*

BBC: ''What's inside a bank card''

November 2022

{{DEFAULTSORT:Emv

German inventions

French inventions

1986 introductions

EMV is a payment method based on a technical standard for

EMV is a payment method based on a technical standard for  The first version of EMV standard was published in 1995. Now the standard is defined and managed by the privately owned corporation EMVCo LLC. The current members of EMVCo are

The first version of EMV standard was published in 1995. Now the standard is defined and managed by the privately owned corporation EMVCo LLC. The current members of EMVCo are