Business cycle on:

[Wikipedia]

[Google]

[Amazon]

Business cycles are intervals of expansion followed by

In 1860 French economist

In 1860 French economist

There were great increases in

There were great increases in

In 1946, economists Arthur F. Burns and Wesley C. Mitchell provided the now standard definition of business cycles in their book ''Measuring Business Cycles'':

According to A. F. Burns:

In the United States, it is generally accepted that the

In 1946, economists Arthur F. Burns and Wesley C. Mitchell provided the now standard definition of business cycles in their book ''Measuring Business Cycles'':

According to A. F. Burns:

In the United States, it is generally accepted that the

A Spectral Analysis of World GDP Dynamics: Kondratieff Waves, Kuznets Swings, Juglar and Kitchin Cycles in Global Economic Development, and the 2008–2009 Economic Crisis

. ''Structure and Dynamics''. 2010. Vol. 4. no. 1. pp. 3–57. Korotayev & Tsirel also detected shorter business cycles, dating the Kuznets to about 17 years and calling it the third sub-harmonic of the Kondratiev, meaning that there are three Kuznets cycles per Kondratiev.

This theory explains the nature and causes of economic cycles from the viewpoint of life-cycle of marketable goods. The theory originates from the work of Raymond Vernon, who described the development of international trade in terms of product life-cycle – a period of time during which the product circulates in the market. Vernon stated that some countries specialize in the production and export of technologically new products, while others specialize in the production of already known products. The most developed countries are able to invest large amounts of money in the technological innovations and produce new products, thus obtaining a dynamic comparative advantage over developing countries.

Recent research by Georgiy Revyakin proved initial Vernon theory and showed economic cycles in developed countries overran economic cycles in developing countries. He also presumed economic cycles with different periodicity can be compared to the products with various life-cycles. In case of Kondratiev waves such products correlate with fundamental discoveries implemented in production (inventions which form the technological paradigm: Richard Arkwright's machines, steam engines, industrial use of electricity, computer invention, etc.); Kuznets cycles describe such products as infrastructural components (roadways, transport, utilities, etc.); Juglar cycles may go in parallel with enterprise fixed capital (equipment, machinery, etc.), and Kitchin cycles are characterized by change in the society preferences (tastes) for

This theory explains the nature and causes of economic cycles from the viewpoint of life-cycle of marketable goods. The theory originates from the work of Raymond Vernon, who described the development of international trade in terms of product life-cycle – a period of time during which the product circulates in the market. Vernon stated that some countries specialize in the production and export of technologically new products, while others specialize in the production of already known products. The most developed countries are able to invest large amounts of money in the technological innovations and produce new products, thus obtaining a dynamic comparative advantage over developing countries.

Recent research by Georgiy Revyakin proved initial Vernon theory and showed economic cycles in developed countries overran economic cycles in developing countries. He also presumed economic cycles with different periodicity can be compared to the products with various life-cycles. In case of Kondratiev waves such products correlate with fundamental discoveries implemented in production (inventions which form the technological paradigm: Richard Arkwright's machines, steam engines, industrial use of electricity, computer invention, etc.); Kuznets cycles describe such products as infrastructural components (roadways, transport, utilities, etc.); Juglar cycles may go in parallel with enterprise fixed capital (equipment, machinery, etc.), and Kitchin cycles are characterized by change in the society preferences (tastes) for

"F. A. Hayek as 'Mr. Fluctooations:' In Defense of Hayek's 'Technical Economics'"

, ''Hayek Society Journal'' (LSE), 5(2), 1 (2003). Austrians claim that the boom-and-bust business cycle is caused by government intervention into the economy, and that the cycle would be comparatively rare and mild without central government interference.

The slope of the

The slope of the

Financial Stress Index

published by the St. Louis Fed. A different measure of the slope (i.e. the difference between 10-year Treasury bond rates and the

monthly recession probability prediction

derived from the yield curve and based on Estrella's work. All the recessions in the

mFilter

, while singular spectrum filters can be implemented using the R package

.

Abstract.

** Christian Hellwig. "monetary business cycles (imperfect information)."

Abstract.

** Ellen R. McGrattan "real business cycles."

Abstract.

* *

The Conference Board Business Cycle Indicators

– Indicators of Euro Area, United States, Japan, China and so on.

Historical documents relating to past business cycles, including charts, data publications, speeches, and analyses

{{authority control Business cycle theories Capitalism

recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production.

Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in arvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics'' such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm.

There are numerous sources of business cycle movements such as rapid and significant changes in the price of oil

The price of oil, or the oil price, generally refers to the spot price of a barrel () of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC ...

or variation in consumer sentiment that affects overall spending in the macroeconomy and thus investment and firms' profits. Usually such sources are unpredictable in advance and can be viewed as random "shocks" to the cyclical pattern, as happened during the 2007–2008 financial crises or the COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identi ...

. In past decades economists and statisticians have learned a great deal about business cycle fluctuations by researching the topic from various perspectives. Examples of methods that learn about business cycles from data include the Christiano–Fitzgerald, Hodrick–Prescott, and singular spectrum filters.

History

Theory

The first systematic exposition ofeconomic crises

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and man ...

, in opposition to the existing theory of economic equilibrium

In economics, economic equilibrium is a situation in which economic forces such as supply and demand are balanced and in the absence of external influences the ( equilibrium) values of economic variables will not change. For example, in the s ...

, was the 1819 by Jean Charles Léonard de Sismondi

Jean Charles Léonard de Sismondi (also known as Jean Charles Leonard Simonde de Sismondi) (; 9 May 1773 – 25 June 1842), whose real name was Simonde, was a Swiss historian and political economist, who is best known for his works on French and ...

. Prior to that point classical economics had either denied the existence of business cycles, blamed them on external factors, notably war, or only studied the long term. Sismondi found vindication in the Panic of 1825, which was the first unarguably international economic crisis, occurring in peacetime.

Sismondi and his contemporary Robert Owen, who expressed similar but less systematic thoughts in 1817 ''Report to the Committee of the Association for the Relief of the Manufacturing Poor,'' both identified the cause of economic cycles as overproduction

In economics, overproduction, oversupply, excess of supply or glut refers to excess of supply over demand of products being offered to the market. This leads to lower prices and/or unsold goods along with the possibility of unemployment.

The d ...

and underconsumption Underconsumption is a theory in economics that recessions and stagnation arise from an inadequate consumer demand, relative to the amount produced. In other words, there is a problem of overproduction and overinvestment during a demand crisis. The ...

, caused in particular by wealth inequality

The distribution of wealth is a comparison of the wealth of various members or groups in a society. It shows one aspect of economic inequality or heterogeneity in economics, economic heterogeneity.

The distribution of wealth differs from the i ...

. They advocated government intervention and socialism

Socialism is a left-wing Economic ideology, economic philosophy and Political movement, movement encompassing a range of economic systems characterized by the dominance of social ownership of the means of production as opposed to Private prop ...

, respectively, as the solution. This work did not generate interest among classical economists, though underconsumption theory developed as a heterodox branch in economics until being systematized in Keynesian economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output a ...

in the 1930s.

Sismondi's theory of periodic crises was developed into a theory of alternating ''cycles'' by Charles Dunoyer

Charles Dunoyer Barthélemy-Charles-Pierre-Joseph Dunoyer de Segonzac (20 May 1786 – 4 December 1862), better known as Charles Dunoyer, was a French economist of the French Liberal School.

Dunoyer gave one of the earliest theories of economic c ...

, and similar theories, showing signs of influence by Sismondi, were developed by Johann Karl Rodbertus

Johann Karl Rodbertus (August 12, 1805, Greifswald, Swedish Pomerania – December 6, 1875, Jagetzow), also known as Karl Rodbertus-Jagetzow, was a German economist and socialist and a leading member of the ''Linkes Zentrum'' (centre-left) i ...

. Periodic crises in capitalism formed the basis of the theory of Karl Marx

Karl Heinrich Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, economist, historian, sociologist, political theorist, journalist, critic of political economy, and socialist revolutionary. His best-known titles are the 1848 ...

, who further claimed that these crises were increasing in severity and, on the basis of which, he predicted a communist revolution

A communist revolution is a proletarian revolution often, but not necessarily, inspired by the ideas of Marxism that aims to replace capitalism with communism. Depending on the type of government, socialism can be used as an intermediate stag ...

. Though only passing references in ''Das Kapital

''Das Kapital'', also known as ''Capital: A Critique of Political Economy'' or sometimes simply ''Capital'' (german: Das Kapital. Kritik der politischen Ökonomie, link=no, ; 1867–1883), is a foundational theoretical text in materialist phi ...

'' (1867) refer to crises, they were extensively discussed in Marx's posthumously published books, particularly in ''Theories of Surplus Value

''Theories of Surplus Value'' (german: Theorien über den Mehrwert) is a draft manuscript written by Karl Marx between January 1862 and July 1863. It is mainly concerned with the Western European theorizing about ''Mehrwert'' (added value or sur ...

''. In ''Progress and Poverty

''Progress and Poverty: An Inquiry into the Cause of Industrial Depressions and of Increase of Want with Increase of Wealth: The Remedy'' is an 1879 book by social theorist and economist Henry George. It is a treatise on the questions of why pover ...

'' (1879), Henry George

Henry George (September 2, 1839 – October 29, 1897) was an American political economist and journalist. His writing was immensely popular in 19th-century America and sparked several reform movements of the Progressive Era. He inspired the eco ...

focused on land

Land, also known as dry land, ground, or earth, is the solid terrestrial surface of the planet Earth that is not submerged by the ocean or other bodies of water. It makes up 29% of Earth's surface and includes the continents and various isla ...

's role in crises – particularly land speculation

In finance, speculation is the purchase of an asset (a commodity, goods, or real estate) with the hope that it will become more valuable shortly. (It can also refer to short sales in which the speculator hopes for a decline in value.)

Many ...

– and proposed a single tax on land as a solution.

Statistical or econometric modelling and theory of business cycle movements can also be used. In this case a time series analysis is used to capture the regularities and the stochastic signals and noise in economic time series such as Real GDP or Investment. arvey and Trimbur, 2003, ''Review of Economics and Statistics''developed models for describing stochastic or pseudo- cycles, of which business cycles represent a leading case. As well-formed and compact – and easy to implement – statistical methods may outperform macroeconomic approaches in numerous cases, they provide a solid alternative even for rather complex economic theory.

Classification by periods

In 1860 French economist

In 1860 French economist Clément Juglar

Clément Juglar (15 October 1819 – 28 February 1905) was a French doctor and statistician.

Juglar cycles

He was one of the first to develop an economic theory of business cycles.The New Encyclopædia Britannica: Macropaedia 1998 "The first autho ...

first identified economic cycles 7 to 11 years long, although he cautiously did not claim any rigid regularity. This interval of periodicity is also commonplace, as an empirical finding, in time series models for stochastic cycles in economic data. Furthermore, methods like statistical modelling in a Bayesian framework – see e.g. arvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics''– can incorporate such a range explicitly by setting up priors that concentrate around say 6 to 12 years, such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm.

Later, economist Joseph Schumpeter

Joseph Alois Schumpeter (; February 8, 1883 – January 8, 1950) was an Austrian-born political economist. He served briefly as Finance Minister of German-Austria in 1919. In 1932, he emigrated to the United States to become a professor at H ...

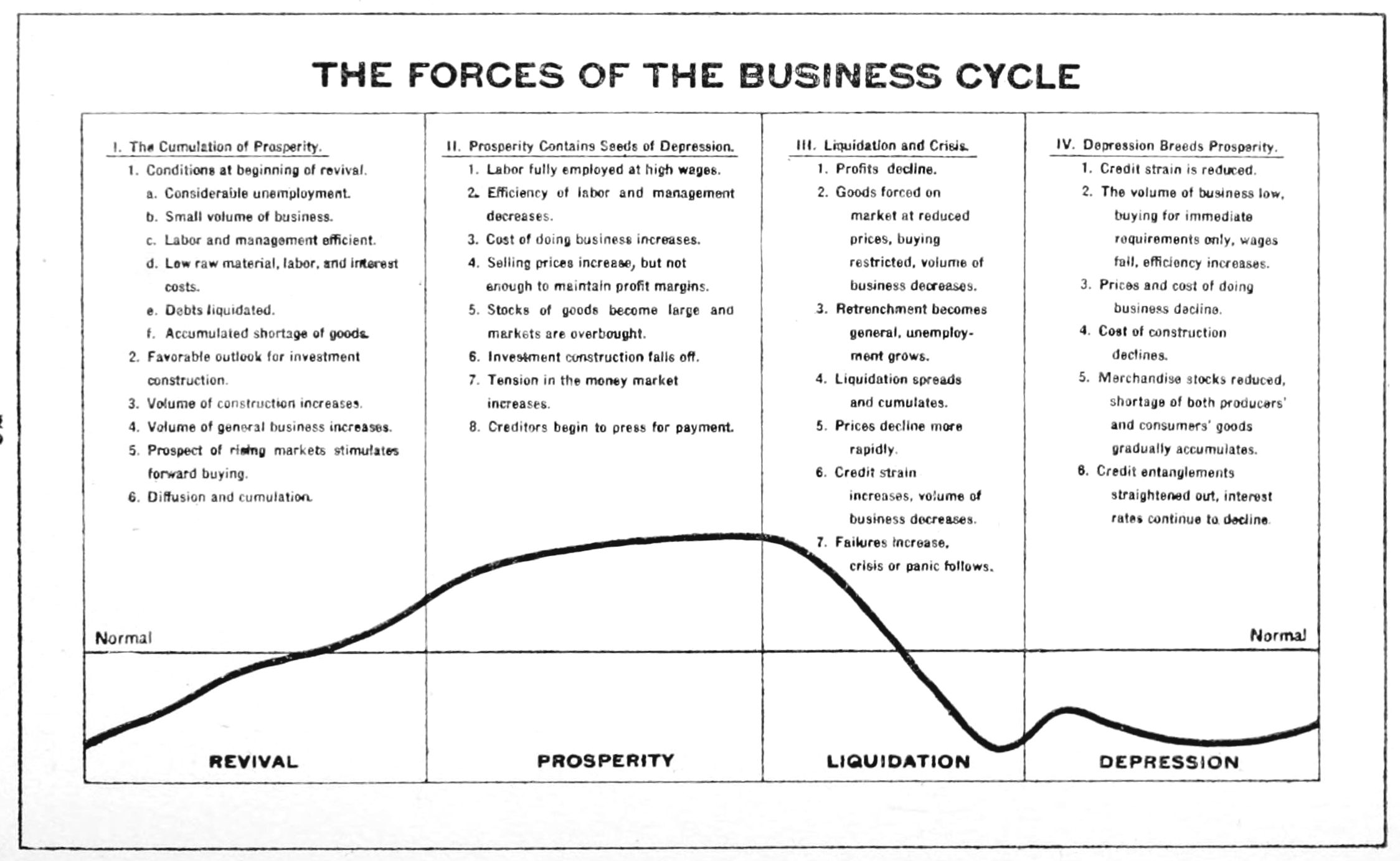

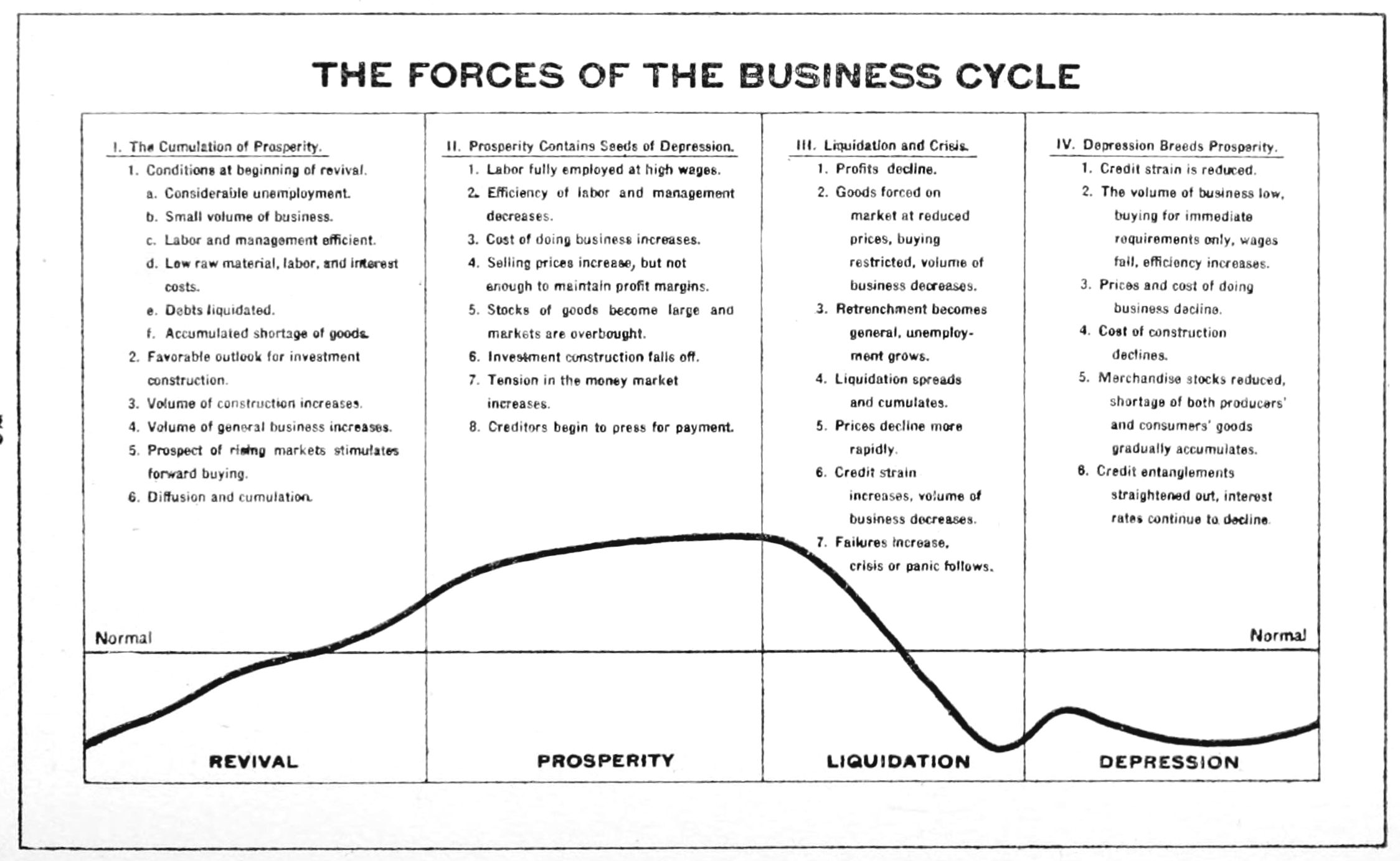

argued that a Juglar cycle has four stages:

# Expansion (increase in production and prices, low interest rates)

# Crisis

A crisis ( : crises; : critical) is either any event or period that will (or might) lead to an unstable and dangerous situation affecting an individual, group, or all of society. Crises are negative changes in the human or environmental affair ...

(stock exchanges crash and multiple bankruptcies of firms occur)

# Recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

(drops in prices and in output, high interest-rates)

# Recovery (stocks recover because of the fall in prices and incomes)

Schumpeter's Juglar model associates recovery and prosperity with increases in productivity, consumer confidence

Consumer confidence is an economic indicator that measures the degree of optimism that consumers feel about the overall state of the economy and their personal financial situation. If the consumer has confidence in the immediate and near future e ...

, aggregate demand, and prices.

In the 20th century, Schumpeter and others proposed a typology of business cycles according to their periodicity, so that a number of particular cycles were named after their discoverers or proposers:

* The Kitchin inventory cycle of 3 to 5 years (after Joseph Kitchin)

* The Juglar fixed-investment cycle of 7 to 11 years (often identified as "the" business cycle). A range of periods rather than one fixed period is needed to capture business cycle fluctuations, which may be done by using a random or irregular source as in an econometric or statistical framework.

* The Kuznets infrastructural investment cycle of 15 to 25 years (after Simon Kuznets – also called "building cycle")

* The Kondratiev wave

In economics, Kondratiev waves (also called supercycles, great surges, long waves, K-waves or the long economic cycle) are hypothesized cycle-like phenomena in the modern world economy. The phenomenon is closely connected with the technology li ...

or long technological cycle of 45 to 60 years (after the Soviet economist Nikolai Kondratiev

Nikolai Dmitriyevich Kondratiev (; also Kondratieff; Russian: Никола́й Дми́триевич Кондра́тьев; 4 March 1892 – 17 September 1938) was a Russian Soviet economist and proponent of the New Economic Policy (NEP) best ...

)

Some say interest in the different typologies of cycles has waned since the development of modern macroeconomics, which gives little support to the idea of regular periodic cycles. Further econometric studies such as the two works in 2003 and 2007 cited above demonstrate a clear tendency for cyclical components in macroeconomic times to behave in a stochastic rather than deterministic way.

Others, such as Dmitry Orlov Dmitry Orlov may refer to:

* Dmitry Orlov (banker) (1943–2014), Russian banker

* Dmitry Orlov (ice hockey) (born 1991), Russian professional ice hockey player

* Dmitry Orlov (writer) (born 1962), Russian-American engineer and a writer

* Dmitri ...

, argue that simple compound interest mandates the cycling of monetary systems. Since 1960, World GDP has increased by fifty-nine times, and these multiples have not even kept up with annual inflation over the same period. Social Contract (freedoms and absence of social problems) collapses may be observed in nations where incomes are not kept in balance with cost-of-living over the timeline of the monetary system cycle.

The Bible

The Bible (from Koine Greek , , 'the books') is a collection of religious texts or scriptures that are held to be sacred in Christianity, Judaism, Samaritanism, and many other religions. The Bible is an anthologya compilation of texts ...

(760 BCE) and Hammurabi

Hammurabi (Akkadian: ; ) was the sixth Amorite king of the Old Babylonian Empire, reigning from to BC. He was preceded by his father, Sin-Muballit, who abdicated due to failing health. During his reign, he conquered Elam and the city-states ...

's Code (1763 BCE) both explain economic remediations for cyclic sixty-year recurring great depressions, via fiftieth-year Jubilee (biblical) debt and wealth resets. Thirty major debt forgiveness events are recorded in history including the debt forgiveness given to most European nations in the 1930s to 1954.

Occurrence

productivity

Productivity is the efficiency of production of goods or services expressed by some measure. Measurements of productivity are often expressed as a ratio of an aggregate output to a single input or an aggregate input used in a production proces ...

, industrial production and real per capita product throughout the period from 1870 to 1890 that included the Long Depression

The Long Depression was a worldwide price and economic recession, beginning in 1873 and running either through March 1879, or 1896, depending on the metrics used. It was most severe in Europe and the United States, which had been experiencing st ...

and two other recessions. There were also significant increases in productivity in the years leading up to the Great Depression. Both the Long and Great Depressions were characterized by overcapacity and market saturation.Opening line of the Preface.

Over the period since the Industrial Revolution, technological progress has had a much larger effect on the economy than any fluctuations in credit or debt, the primary exception being the Great Depression, which caused a multi-year steep economic decline. The effect of technological progress can be seen by the purchasing power of an average hour's work, which has grown from $3 in 1900 to $22 in 1990, measured in 2010 dollars. There were similar increases in real wages during the 19th century. (''See: Productivity improving technologies (historical) The productivity-improving technologies are the technological innovations that have historically increased productivity.

Productivity is often measured as the ratio of (aggregate) output to (aggregate) input in the production of goods and services. ...

''.) A table of innovations and long cycles can be seen at: . Since surprising news in the economy, which has a random aspect, impact the state of the business cycle, any corresponding descriptions must have a random part at its root that motivates the use of statistical frameworks in this area.

There were frequent crises in Europe and America in the 19th and first half of the 20th century, specifically the period 1815–1939. This period started from the end of the Napoleonic wars

The Napoleonic Wars (1803–1815) were a series of major global conflicts pitting the French Empire and its allies, led by Napoleon I, against a fluctuating array of European states formed into various coalitions. It produced a period of Fren ...

in 1815, which was immediately followed by the Post-Napoleonic depression in the United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the European mainland, continental mainland. It comprises England, Scotlan ...

(1815–1830), and culminated in the Great Depression of 1929–1939, which led into World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposing ...

. See Financial crisis: 19th century for listing and details. The first of these crises not associated with a war was the Panic of 1825.

Business cycles in OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate e ...

countries after World War II were generally more restrained than the earlier business cycles. This was particularly true during the Golden Age of Capitalism

Capitalism is an economic system based on the private ownership of the means of production and their operation for profit. Central characteristics of capitalism include capital accumulation, competitive markets, price system, private pr ...

(1945/50–1970s), and the period 1945–2008 did not experience a global downturn until the Late-2000s recession. Economic stabilization policy using fiscal policy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variab ...

and monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

appeared to have dampened the worst excesses of business cycles, and automatic stabilization due to the aspects of the government

A government is the system or group of people governing an organized community, generally a state.

In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is ...

's budget also helped mitigate the cycle even without conscious action by policy-makers.

In this period, the economic cycle – at least the problem of depressions – was twice declared dead. The first declaration was in the late 1960s, when the Phillips curve

The Phillips curve is an economic model, named after William Phillips hypothesizing a correlation between reduction in unemployment and increased rates of wage rises within an economy. While Phillips himself did not state a linked relationship ...

was seen as being able to steer the economy. However, this was followed by stagflation

In economics, stagflation or recession-inflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for economic policy, since actio ...

in the 1970s, which discredited the theory. The second declaration was in the early 2000s, following the stability and growth in the 1980s and 1990s in what came to be known as the Great Moderation

The Great Moderation is a period in the United States of America starting from the mid-1980s until at least 2007 characterized by the reduction in the volatility of business cycle fluctuations in developed nations compared with the decades befor ...

. Notably, in 2003, Robert Lucas, in his presidential address to the American Economic Association, declared that the "central problem of depression-prevention asbeen solved, for all practical purposes." Unfortunately, this was followed by the 2008–2012 global recession.

Various regions have experienced prolonged depressions, most dramatically the economic crisis in former Eastern Bloc countries following the end of the Soviet Union

The Soviet Union,. officially the Union of Soviet Socialist Republics. (USSR),. was a List of former transcontinental countries#Since 1700, transcontinental country that spanned much of Eurasia from 1922 to 1991. A flagship communist state, ...

in 1991. For several of these countries the period 1989–2010 has been an ongoing depression, with real income still lower than in 1989. This has been attributed not to a cyclical pattern, but to a mismanaged transition from command economies to market economies

A market economy is an economic system in which the decisions regarding investment, production and distribution to the consumers are guided by the price signals created by the forces of supply and demand, where all suppliers and consumers are ...

.

Identifying

In 1946, economists Arthur F. Burns and Wesley C. Mitchell provided the now standard definition of business cycles in their book ''Measuring Business Cycles'':

According to A. F. Burns:

In the United States, it is generally accepted that the

In 1946, economists Arthur F. Burns and Wesley C. Mitchell provided the now standard definition of business cycles in their book ''Measuring Business Cycles'':

According to A. F. Burns:

In the United States, it is generally accepted that the National Bureau of Economic Research

The National Bureau of Economic Research (NBER) is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic c ...

(NBER) is the final arbiter of the dates of the peaks and troughs of the business cycle. An expansion is the period from a trough to a peak and a recession as the period from a peak to a trough. The NBER identifies a recession as "a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production".

Upper turning points of business cycle, commodity prices and freight rates

There is often a close timing relationship between the upper turning points of the business cycle, commodity prices, and freight rates, which is shown to be particularly tight in the grand peak years of 1873, 1889, 1900 and 1912. Hamilton expressed that in the post war era, a majority of recessions are connected to an increase in oil price. Commodity price shocks are considered to be a significant driving force of the US business cycle. Along these lines, the research in rimbur, 2010, ''International Journal of Forecasting''shows empirical results for the relation between oil-prices and real GDP. (The methodology uses a statistical model that incorporate level shifts in the price of crude oil; hence the approach describes the possibility of oil price shocks and forecasts the likelihood of such events.Indicators

Economic indicators are used to measure the business cycle:consumer confidence index

A consumer confidence index (CCI) is an economic indicator published by various organizations in several countries.

In simple terms, increased consumer confidence indicates economic growth in which consumers are spending money, indicating highe ...

, retail trade index, unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the refere ...

and industry/service production index. Stock and Watson claim that financial indicators' predictive ability is not stable over different time periods because of economic shocks, random fluctuations and development in financial systems. Ludvigson believes consumer confidence index is a coincident indicator as it relates to consumer's current situations. Winton & Ralph state that retail trade index is a benchmark for the current economic level because its aggregate value counts up for two-thirds of the overall GDP and reflects the real state of the economy. According to Stock and Watson, unemployment claim can predict when the business cycle is entering a downward phase. Banbura and Rüstler argue that industry production's GDP information can be delayed as it measures real activity with real number, but it provides an accurate prediction of GDP.

Series used to infer the underlying business cycle fall into three categories: lagging, coincident, and leading. They are described as main elements of an analytic system to forecast peaks and troughs in the business cycle. For almost 30 years, these economic data series are considered as "the leading index" or "the leading indicators"-were compiled and published by the U.S. Department of Commerce

The United States Department of Commerce is an executive department of the U.S. federal government concerned with creating the conditions for economic growth and opportunity. Among its tasks are gathering economic and demographic data for busin ...

.

A prominent coincident, or real-time, business cycle indicator is the Aruoba-Diebold-Scotti Index The Aruoba-Diebold-Scotti Business Conditions Index ("ADS Index" ) is a coincident business cycle Economic indicator, indicator used in macroeconomics in the United States. The index measures business activity, which may be correlated with periods o ...

.

Spectral analysis of business cycles

Recent research employing spectral analysis has confirmed the presence ofKondratiev wave

In economics, Kondratiev waves (also called supercycles, great surges, long waves, K-waves or the long economic cycle) are hypothesized cycle-like phenomena in the modern world economy. The phenomenon is closely connected with the technology li ...

s in the world GDP dynamics at an acceptable level of statistical significance.See, e.g. Korotayev, Andrey V., & Tsirel, Sergey VA Spectral Analysis of World GDP Dynamics: Kondratieff Waves, Kuznets Swings, Juglar and Kitchin Cycles in Global Economic Development, and the 2008–2009 Economic Crisis

. ''Structure and Dynamics''. 2010. Vol. 4. no. 1. pp. 3–57. Korotayev & Tsirel also detected shorter business cycles, dating the Kuznets to about 17 years and calling it the third sub-harmonic of the Kondratiev, meaning that there are three Kuznets cycles per Kondratiev.

Recurrence quantification analysis

Recurrence quantification analysis Recurrence quantification analysis (RQA) is a method of nonlinear data analysis (cf. chaos theory) for the investigation of dynamical systems. It quantifies the number and duration of recurrences of a dynamical system presented by its phase space tr ...

has been employed to detect the characteristic of business cycles and economic development

In the economics study of the public sector, economic and social development is the process by which the economic well-being and quality of life of a nation, region, local community, or an individual are improved according to targeted goals and ...

. To this end, Orlando et al. developed the so-called recurrence quantification correlation index to test correlations of RQA on a sample signal and then investigated the application to business time series. The said index has been proven to detect hidden changes in time series. Further, Orlando et al., over an extensive dataset, shown that recurrence quantification analysis may help in anticipating transitions from laminar (i.e. regular) to turbulent (i.e. chaotic) phases such as USA GDP in 1949, 1953, etc. Last but not least, it has been demonstrated that recurrence quantification analysis can detect differences between macroeconomic variables and highlight hidden features of economic dynamics.

Cycles or fluctuations?

The Business Cycle follows changes in stock prices which are mostly caused by external factors such as socioeconomic conditions, inflation, exchange rates.Intellectual capital Intellectual capital is the result of mental processes that form a set of intangible objects that can be used in economic activity and bring income to its owner ( organization), covering the competencies of its people ( human capital), the value rel ...

does not affect a company stock's current earnings. Intellectual capital Intellectual capital is the result of mental processes that form a set of intangible objects that can be used in economic activity and bring income to its owner ( organization), covering the competencies of its people ( human capital), the value rel ...

contributes to a stock's return growth.

Unlike long-term trends, medium-term data fluctuations are connected to the monetary policy transmission mechanism and its role in regulating inflation during an economic cycle. At the same time, the presence of nominal restrictions in price setting behavior might impact the short-term course of inflation.

In recent years economic theory has moved towards the study of ''economic fluctuation'' rather than a "business cycle" – though some economists use the phrase 'business cycle' as a convenient shorthand. For example, Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

said that calling the business cycle a "cycle" is a misnomer, because of its non-cyclical nature. Friedman believed that for the most part, excluding very large supply shocks, business declines are more of a monetary phenomenon. Arthur F. Burns and Wesley C. Mitchell define business cycle as a form of fluctuation. In economic activities, a cycle of expansions happening, followed by recessions, contractions, and revivals. All of which combine to form the next cycle's expansion phase; this sequence of change is repeated but not periodic.

Proposed explanations

The explanation of fluctuations in aggregate economic activity is one of the primary concerns of macroeconomics and a variety of theories have been proposed to explain them.Exogenous vs. endogenous

Within economics, it has been debated as to whether or not the fluctuations of a business cycle are attributable to external (exogenous) versus internal (endogenous) causes. In the first case shocks are stochastic, in the second case shocks are deterministically chaotic and embedded in the economic system. The classical school (now neo-classical) argues for exogenous causes and theunderconsumptionist Underconsumption is a theory in economics that recessions and stagnation arise from an inadequate consumer demand, relative to the amount produced. In other words, there is a problem of overproduction and overinvestment during a demand crisis. The ...

(now Keynesian) school argues for endogenous causes. These may also broadly be classed as "supply-side" and "demand-side" explanations: supply-side explanations may be styled, following Say's law

In classical economics, Say's law, or the law of markets, is the claim that the production of a product creates demand for another product by providing something of value which can be exchanged for that other product. So, production is the source ...

, as arguing that "supply creates its own demand

"Supply creates its own demand" is the formulation of Say's law. The rejection of this doctrine is a central component of '' The General Theory of Employment, Interest and Money'' (1936) and a central tenet of Keynesian economics. See Principle o ...

", while demand-side explanations argue that effective demand

In economics, effective demand (ED) in a market is the demand for a product or service which occurs when purchasers are constrained in a different market. It contrasts with notional demand, which is the demand that occurs when purchasers are not ...

may fall short of supply, yielding a recession or depression.

This debate has important policy consequences: proponents of exogenous causes of crises such as neoclassicals largely argue for minimal government policy or regulation (laissez faire

''Laissez-faire'' ( ; from french: laissez faire , ) is an economic system in which transactions between private groups of people are free from any form of economic interventionism (such as subsidies) deriving from special interest groups. ...

), as absent these external shocks, the market functions, while proponents of endogenous causes of crises such as Keynesians largely argue for larger government policy and regulation, as absent regulation, the market will move from crisis to crisis. This division is not absolute – some classicals (including Say) argued for government policy to mitigate the damage of economic cycles, despite believing in external causes, while Austrian School

The Austrian School is a heterodox school of economic thought that advocates strict adherence to methodological individualism, the concept that social phenomena result exclusively from the motivations and actions of individuals. Austrian schoo ...

economists argue against government involvement as only worsening crises, despite believing in internal causes.

The view of the economic cycle as caused exogenously dates to Say's law, and much debate on endogeneity or exogeneity of causes of the economic cycle is framed in terms of refuting or supporting Say's law; this is also referred to as the "general glut

In macroeconomics, a general glut is an excess of supply in relation to demand, specifically, when there is more production in all fields of production in comparison with what resources are available to consume (purchase) said production.

This exh ...

" (supply in relation to demand) debate.

Until the Keynesian revolution in mainstream economics in the wake of the Great Depression, classical and neoclassical explanations (exogenous causes) were the mainstream explanation of economic cycles; following the Keynesian revolution, neoclassical macroeconomics was largely rejected. There has been some resurgence of neoclassical approaches in the form of real business cycle (RBC) theory. The debate between Keynesians and neo-classical advocates was reawakened following the recession of 2007.

Mainstream economists working in the neoclassical tradition, as opposed to the Keynesian tradition, have usually viewed the departures of the harmonic working of the market economy as due to exogenous influences, such as the State or its regulations, labor unions, business monopolies, or shocks due to technology or natural causes.

Contrarily, in the heterodox tradition of Jean Charles Léonard de Sismondi

Jean Charles Léonard de Sismondi (also known as Jean Charles Leonard Simonde de Sismondi) (; 9 May 1773 – 25 June 1842), whose real name was Simonde, was a Swiss historian and political economist, who is best known for his works on French and ...

, Clément Juglar

Clément Juglar (15 October 1819 – 28 February 1905) was a French doctor and statistician.

Juglar cycles

He was one of the first to develop an economic theory of business cycles.The New Encyclopædia Britannica: Macropaedia 1998 "The first autho ...

, and Marx

Karl Heinrich Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, economist, historian, sociologist, political theorist, journalist, critic of political economy, and socialist revolutionary. His best-known titles are the 1848 ...

the recurrent upturns and downturns of the market system are an endogenous characteristic of it.

The 19th-century school of under consumptionism also posited endogenous causes for the business cycle, notably the paradox of thrift

The paradox of thrift (or paradox of saving) is a paradox of economics. The paradox states that an increase in autonomous saving leads to a decrease in aggregate demand and thus a decrease in gross output which will in turn lower ''total'' saving ...

, and today this previously heterodox school has entered the mainstream in the form of Keynesian economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output a ...

via the Keynesian revolution.

Mainstream economics

Mainstream economics views business cycles as essentially "the random summation of random causes". In 1927, Eugen Slutzky observed that summing random numbers, such as the last digits of the Russian state lottery, could generate patterns akin to that we see in business cycles, an observation that has since been repeated many times. This caused economists to move away from viewing business cycles as a cycle that needed to be explained and instead viewing their apparently cyclical nature as a methodological artefact. This means that what appear to be cyclical phenomena can actually be explained as just random events that are fed into a simple linear model. Thus business cycles are essentially random shocks that average out over time. Mainstream economists have built models of business cycles based the idea that they are caused by random shocks. Due to this inherent randomness, recessions can sometimes not occur for decades; for example, Australia did not experience any recession between 1991 and 2020. While economists have found it difficult to forecast recessions or determine their likely severity, research indicates that longer expansions do not cause following recessions to be more severe.Keynesian

According toKeynesian economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output a ...

, fluctuations in aggregate demand cause the economy to come to short run equilibrium at levels that are different from the full employment rate of output. These fluctuations express themselves as the observed business cycles. Keynesian models do not necessarily imply periodic business cycles. However, simple Keynesian models involving the interaction of the Keynesian multiplier and accelerator give rise to cyclical responses to initial shocks. Paul Samuelson

Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he " ...

's "oscillator model" is supposed to account for business cycles thanks to the multiplier and the accelerator. The amplitude of the variations in economic output depends on the level of the investment, for investment determines the level of aggregate output (multiplier), and is determined by aggregate demand (accelerator).

In the Keynesian tradition, Richard Goodwin accounts for cycles in output by the distribution of income between business profits and workers' wages. The fluctuations in wages are almost the same as in the level of employment (wage cycle lags one period behind the employment cycle), for when the economy is at high employment, workers are able to demand rises in wages, whereas in periods of high unemployment, wages tend to fall. According to Goodwin, when unemployment and business profits rise, the output rises.

Cyclical behavior of exports and imports

Exports

An export in international trade is a good produced in one country that is sold into another country or a service provided in one country for a national or resident of another country. The seller of such goods or the service provider is an ...

and imports

An import is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade.

In international trade, the importation and exportation of goods are limited ...

are large components of an economy's aggregate expenditure, especially one that is oriented toward international trade

International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services. (see: World economy)

In most countries, such trade represents a significant ...

. Income is an essential determinant of the level of imported goods. A higher GDP

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is ofte ...

reflects a higher level of spending on imported goods and services, and vice versa. Therefore, expenditure on imported goods and services fall during a recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

and rise during an economic expansion

An economic expansion is an increase in the level of economic activity, and of the goods and services available. It is a period of economic growth as measured by a rise in real GDP. The explanation of fluctuations in aggregate economic activit ...

or boom.

Import expenditures are commonly considered to be procyclical and cyclical in nature, coincident with the business cycle. Domestic export expenditures give a good indication of foreign business cycles as foreign import expenditures are coincident with the foreign business cycle.

Credit/debt cycle

One alternative theory is that the primary cause of economic cycles is due to thecredit cycle The credit cycle is the expansion and contraction of access to credit over time. Some economists, including Barry Eichengreen, Hyman Minsky, and other Post-Keynesian economists, and some members of the Austrian school, regard credit cycles as the f ...

: the net expansion of credit (increase in private credit, equivalently debt, as a percentage of GDP) yields economic expansions, while the net contraction causes recessions, and if it persists, depressions. In particular, the bursting of speculative bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be ...

s is seen as the proximate cause of depressions, and this theory places finance and banks at the center of the business cycle.

A primary theory in this vein is the debt deflation

Debt deflation is a theory that recessions and depressions are due to the overall level of debt rising in real value because of deflation, causing people to default on their consumer loans and mortgages. Bank assets fall because of the defaults an ...

theory of Irving Fisher, which he proposed to explain the Great Depression. A more recent complementary theory is the Financial Instability Hypothesis

Hyman Philip Minsky (September 23, 1919 – October 24, 1996) was an American economist, a professor of economics at Washington University in St. Louis, and a distinguished scholar at the Levy Economics Institute of Bard College. His research at ...

of Hyman Minsky, and the credit theory of economic cycles is often associated with Post-Keynesian economics

Post-Keynesian economics is a school of economic thought with its origins in '' The General Theory'' of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney ...

such as Steve Keen

Steve Keen (born 28 March 1953) is an Australian economist and author. He considers himself a post-Keynesian, criticising neoclassical economics as inconsistent, unscientific and empirically unsupported. The major influences on Keen's thinking ...

.

Post-Keynesian economist Hyman Minsky

Hyman Philip Minsky (September 23, 1919 – October 24, 1996) was an American economist, a professor of economics at Washington University in St. Louis, and a distinguished scholar at the Levy Economics Institute of Bard College. His research at ...

has proposed an explanation of cycles founded on fluctuations in credit, interest rates and financial frailty, called the Financial Instability Hypothesis. In an expansion period, interest rates are low and companies easily borrow money from banks to invest. Banks are not reluctant to grant them loans, because expanding economic activity allows business increasing cash flows and therefore they will be able to easily pay back the loans. This process leads to firms becoming excessively indebted, so that they stop investing, and the economy goes into recession.

While credit causes have not been a primary theory of the economic cycle within the mainstream, they have gained occasional mention, such as , cited approvingly by .

Real business-cycle theory

Within mainstream economics, Keynesian views have been challenged by real business cycle models in which fluctuations are due to random changes in the total productivity factor (which are caused by changes in technology as well as the legal and regulatory environment). This theory is most associated withFinn E. Kydland

Finn Erling Kydland (born 1 December 1943) is a Norwegian economist known for his contributions to business cycle theory. He is the Henley Professor of Economics at the University of California, Santa Barbara. He also holds the Richard P. Simmons ...

and Edward C. Prescott, and more generally the Chicago school of economics ( freshwater economics). They consider that economic crisis and fluctuations cannot stem from a monetary shock, only from an external shock, such as an innovation.

Product based theory of economic cycles

This theory explains the nature and causes of economic cycles from the viewpoint of life-cycle of marketable goods. The theory originates from the work of Raymond Vernon, who described the development of international trade in terms of product life-cycle – a period of time during which the product circulates in the market. Vernon stated that some countries specialize in the production and export of technologically new products, while others specialize in the production of already known products. The most developed countries are able to invest large amounts of money in the technological innovations and produce new products, thus obtaining a dynamic comparative advantage over developing countries.

Recent research by Georgiy Revyakin proved initial Vernon theory and showed economic cycles in developed countries overran economic cycles in developing countries. He also presumed economic cycles with different periodicity can be compared to the products with various life-cycles. In case of Kondratiev waves such products correlate with fundamental discoveries implemented in production (inventions which form the technological paradigm: Richard Arkwright's machines, steam engines, industrial use of electricity, computer invention, etc.); Kuznets cycles describe such products as infrastructural components (roadways, transport, utilities, etc.); Juglar cycles may go in parallel with enterprise fixed capital (equipment, machinery, etc.), and Kitchin cycles are characterized by change in the society preferences (tastes) for

This theory explains the nature and causes of economic cycles from the viewpoint of life-cycle of marketable goods. The theory originates from the work of Raymond Vernon, who described the development of international trade in terms of product life-cycle – a period of time during which the product circulates in the market. Vernon stated that some countries specialize in the production and export of technologically new products, while others specialize in the production of already known products. The most developed countries are able to invest large amounts of money in the technological innovations and produce new products, thus obtaining a dynamic comparative advantage over developing countries.

Recent research by Georgiy Revyakin proved initial Vernon theory and showed economic cycles in developed countries overran economic cycles in developing countries. He also presumed economic cycles with different periodicity can be compared to the products with various life-cycles. In case of Kondratiev waves such products correlate with fundamental discoveries implemented in production (inventions which form the technological paradigm: Richard Arkwright's machines, steam engines, industrial use of electricity, computer invention, etc.); Kuznets cycles describe such products as infrastructural components (roadways, transport, utilities, etc.); Juglar cycles may go in parallel with enterprise fixed capital (equipment, machinery, etc.), and Kitchin cycles are characterized by change in the society preferences (tastes) for consumer goods

A final good or consumer good is a final product ready for sale that is used by the consumer to satisfy current wants or needs, unlike a intermediate good, which is used to produce other goods. A microwave oven or a bicycle is a final good, b ...

, and time, which is necessary to start the production.

Highly competitive market conditions would determine simultaneous technological updates of all economic agents (as a result, cycle formation): in case if a manufacturing technology at an enterprise does not meet the current technological environment – such company loses its competitiveness and eventually goes bankrupt.

Political business cycle

Another set of models tries to derive the business cycle from political decisions. The political business cycle theory is strongly linked to the name ofMichał Kalecki

Michał Kalecki (; 22 June 1899 – 18 April 1970) was a Polish Marxian economist. Over the course of his life, Kalecki worked at the London School of Economics, University of Cambridge, University of Oxford and Warsaw School of Economics ...

who discussed "the reluctance of the 'captains of industry' to accept government intervention in the matter of employment". Persistent full employment would mean increasing workers' bargaining power to raise wages and to avoid doing unpaid labor, potentially hurting profitability. However, he did not see this theory as applying under fascism

Fascism is a far-right, authoritarian, ultra-nationalist political ideology and movement,: "extreme militaristic nationalism, contempt for electoral democracy and political and cultural liberalism, a belief in natural social hierarchy an ...

, which would use direct force to destroy labor's power.

In recent years, proponents of the "electoral business cycle" theory have argued that incumbent politicians encourage prosperity before elections in order to ensure re-election – and make the citizens pay for it with recessions afterwards. The political business cycle is an alternative theory stating that when an administration of any hue is elected, it initially adopts a contractionary policy to reduce inflation and gain a reputation for economic competence. It then adopts an expansionary policy in the lead up to the next election, hoping to achieve simultaneously low inflation and unemployment on election day.

The ''partisan business cycle'' suggests that cycles result from the successive elections of administrations with different policy regimes. Regime A adopts expansionary policies, resulting in growth and inflation, but is voted out of office when inflation becomes unacceptably high. The replacement, Regime B, adopts contractionary policies reducing inflation and growth, and the downwards swing of the cycle. It is voted out of office when unemployment is too high, being replaced by Party A.

Marxian economics

For Marx, the economy based on production of commodities to be sold in the market is intrinsically prone tocrisis

A crisis ( : crises; : critical) is either any event or period that will (or might) lead to an unstable and dangerous situation affecting an individual, group, or all of society. Crises are negative changes in the human or environmental affair ...

. In the heterodox

In religion, heterodoxy (from Ancient Greek: , "other, another, different" + , "popular belief") means "any opinions or doctrines at variance with an official or orthodox position". Under this definition, heterodoxy is similar to unorthodoxy, w ...

Marxian view, profit is the major engine of the market economy, but business (capital) profitability has a tendency to fall that recurrently creates crises in which mass unemployment occurs, businesses fail, remaining capital is centralized and concentrated and profitability is recovered. In the long run, these crises tend to be more severe and the system will eventually fail.

Some Marxist authors such as Rosa Luxemburg viewed the lack of purchasing power of workers as a cause of a tendency of supply to be larger than demand, creating crisis, in a model that has similarities with the Keynesian one. Indeed, a number of modern authors have tried to combine Marx's and Keynes's views. Henryk Grossman

Henryk Grossman (alternative spelling: ''Henryk Grossmann''; 14 April 1881 – 24 November 1950) was a Polish economist, historian, and Marxist revolutionary active in both Poland and Germany.

Grossman's key contribution to political-economic t ...

reviewed the debates and the counteracting tendencies and Paul Mattick

Paul Mattick Sr. (March 13, 1904 – February 7, 1981) was a German-American Marxist political writer and social revolutionary, whose thought can be placed within the council communist and left communist traditions.

Throughout his life, Mattic ...

subsequently emphasized the basic differences between the Marxian and the Keynesian perspective. While Keynes saw capitalism as a system worth maintaining and susceptible to efficient regulation, Marx viewed capitalism as a historically doomed system that cannot be put under societal control.

The American mathematician and economist Richard M. Goodwin formalised a Marxist model of business cycles known as the Goodwin Model The Goodwin model, sometimes called Goodwin's class struggle model, is a model of endogenous economic fluctuations first proposed by the American economist Richard M. Goodwin in 1967. It combines aspects of the Harrod–Domar growth model with the ...

in which recession was caused by increased bargaining power of workers (a result of high employment in boom periods) pushing up the wage share of national income, suppressing profits and leading to a breakdown in capital accumulation. Later theorists applying variants of the Goodwin model have identified both short and long period profit-led growth and distribution cycles in the United States and elsewhere. David Gordon provided a Marxist model of long period institutional growth cycles in an attempt to explain the Kondratiev wave

In economics, Kondratiev waves (also called supercycles, great surges, long waves, K-waves or the long economic cycle) are hypothesized cycle-like phenomena in the modern world economy. The phenomenon is closely connected with the technology li ...

. This cycle is due to the periodic breakdown of the social structure of accumulation, a set of institutions which secure and stabilize capital accumulation.

Austrian School

Economists of the heterodoxAustrian School

The Austrian School is a heterodox school of economic thought that advocates strict adherence to methodological individualism, the concept that social phenomena result exclusively from the motivations and actions of individuals. Austrian schoo ...

argue that business cycles are caused by excessive issuance of credit by banks in fractional reserve banking systems. According to Austrian economists, excessive issuance of bank credit may be exacerbated if central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central b ...

monetary policy sets interest rates too low, and the resulting expansion of the money supply causes a "boom" in which resources are misallocated or "malinvested" because of artificially low interest rates. Eventually, the boom cannot be sustained and is followed by a "bust" in which the malinvestments are liquidated (sold for less than their original cost) and the money supply contracts.

One of the criticisms of the Austrian business cycle theory is based on the observation that the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territori ...

suffered recurrent economic crises in the 19th century, notably the Panic of 1873

The Panic of 1873 was a financial crisis that triggered an economic depression in Europe and North America that lasted from 1873 to 1877 or 1879 in France and in Britain. In Britain, the Panic started two decades of stagnation known as the ...

, which occurred prior to the establishment of a U.S. central bank in 1913. Adherents of the Austrian School, such as the historian Thomas Woods, argue that these earlier financial crises were prompted by government and bankers' efforts to expand credit despite restraints imposed by the prevailing gold standard, and are thus consistent with Austrian Business Cycle Theory.

The Austrian explanation of the business cycle differs significantly from the mainstream understanding of business cycles and is generally rejected by mainstream economists. Mainstream economists generally do not support Austrian school explanations for business cycles, on both theoretical as well as real-world empirical grounds.R. W. Garrison"F. A. Hayek as 'Mr. Fluctooations:' In Defense of Hayek's 'Technical Economics'"

, ''Hayek Society Journal'' (LSE), 5(2), 1 (2003). Austrians claim that the boom-and-bust business cycle is caused by government intervention into the economy, and that the cycle would be comparatively rare and mild without central government interference.

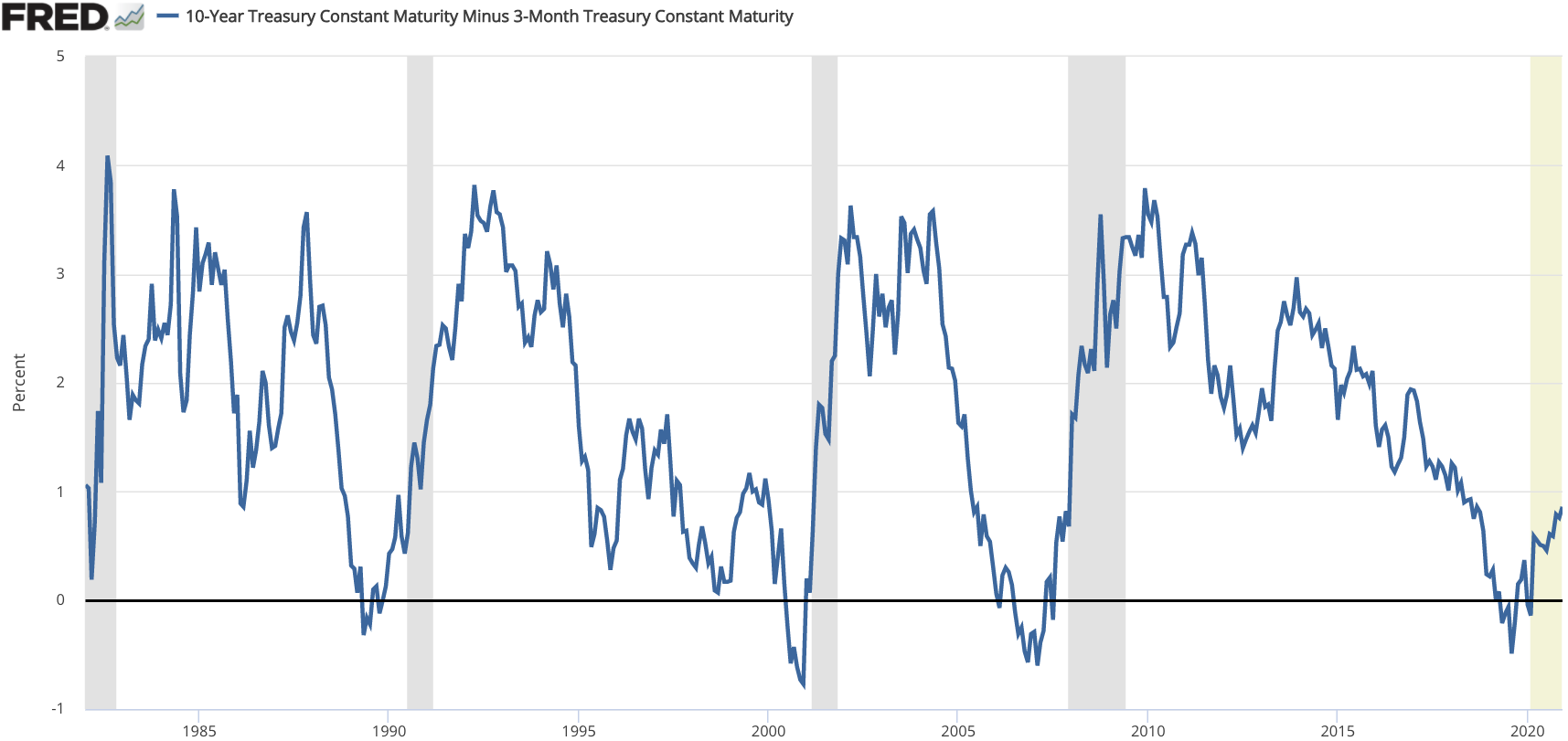

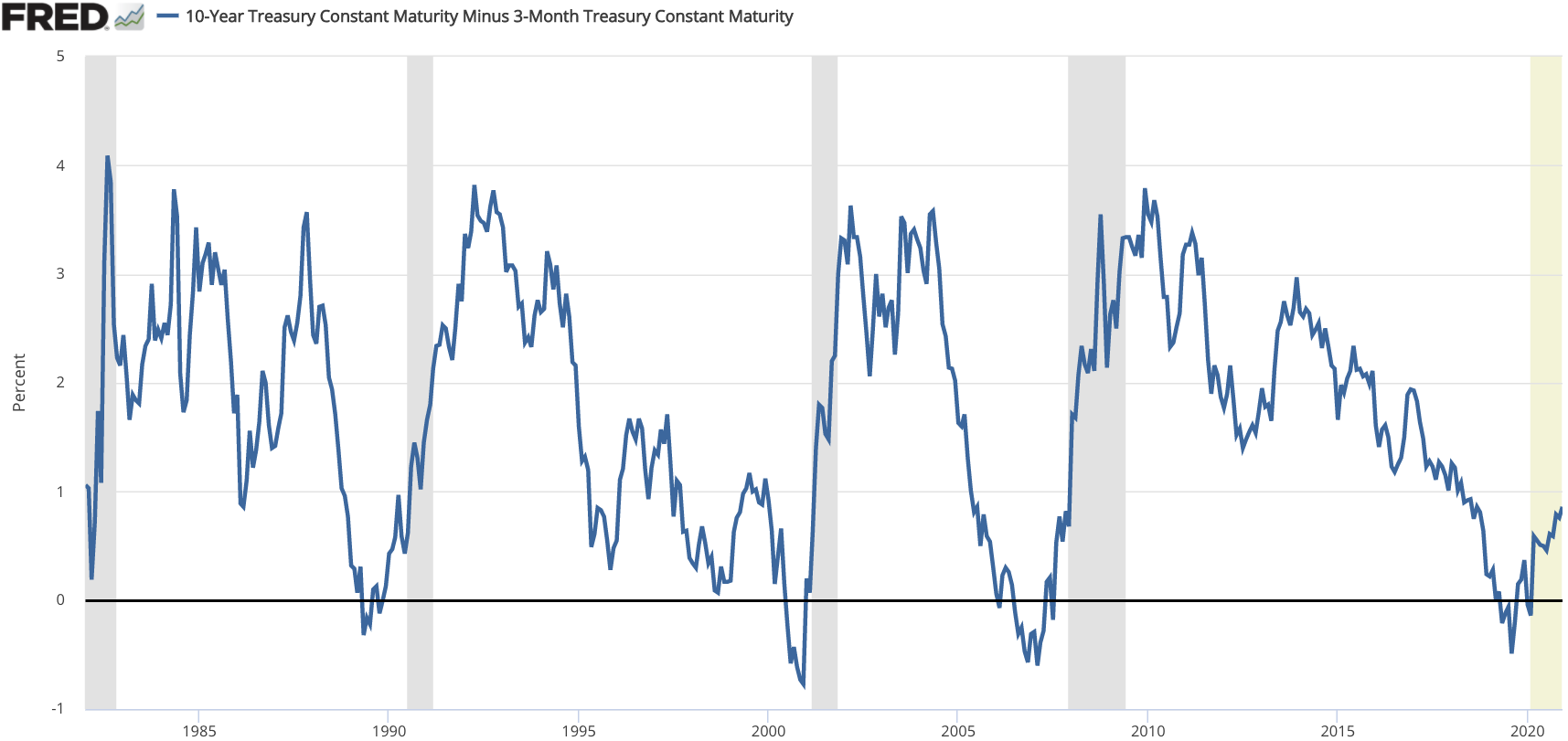

Yield curve

The slope of the

The slope of the yield curve

In finance, the yield curve is a graph which depicts how the yields on debt instruments - such as bonds - vary as a function of their years remaining to maturity. Typically, the graph's horizontal or x-axis is a time line of months or ye ...

is one of the most powerful predictors of future economic growth, inflation, and recessions. One measure of the yield curve slope (i.e. the difference between 10-year Treasury bond rate and the 3-month Treasury bond rate) is included in thFinancial Stress Index

published by the St. Louis Fed. A different measure of the slope (i.e. the difference between 10-year Treasury bond rates and the

federal funds rate

In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight on an uncollateralized basis. Reserve balances a ...

) is incorporated into the Index of Leading Economic Indicators published by The Conference Board

The Conference Board, Inc. is a 501(c)(3) non-profit business membership and research group organization. It counts over 1,000 public and private corporations and other organizations as members, encompassing 60 countries. The Conference Board co ...

.

An inverted yield curve is often a harbinger of recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

. A positively sloped yield curve is often a harbinger of inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

ary growth. Work by Arturo Estrella and Tobias Adrian has established the predictive power of an inverted yield curve to signal a recession. Their models show that when the difference between short-term interest rates (they use 3-month T-bills) and long-term interest rates (10-year Treasury bonds) at the end of a federal reserve tightening cycle is negative or less than 93 basis points positive that a rise in unemployment usually occurs. The New York Fed publishes monthly recession probability prediction

derived from the yield curve and based on Estrella's work. All the recessions in the

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territori ...

since 1970 (up through 2017) have been preceded by an inverted yield curve (10-year vs. 3-month). Over the same time frame, every occurrence of an inverted yield curve has been followed by recession as declared by the NBER

The National Bureau of Economic Research (NBER) is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic c ...

business cycle dating committee.

Estrella and others have postulated that the yield curve affects the business cycle via the balance sheet of banks (or bank-like financial institutions). When the yield curve is inverted banks are often caught paying more on short-term deposits (or other forms of short-term wholesale funding) than they are making on long-term loans leading to a loss of profitability and reluctance to lend resulting in a credit crunch

A credit crunch (also known as a credit squeeze, credit tightening or credit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from banks. A credit cr ...

. When the yield curve is upward sloping, banks can profitably take-in short term deposits and make long-term loans so they are eager to supply credit to borrowers. This eventually leads to a credit bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be ...

.

Georgism

Henry George

Henry George (September 2, 1839 – October 29, 1897) was an American political economist and journalist. His writing was immensely popular in 19th-century America and sparked several reform movements of the Progressive Era. He inspired the eco ...

claimed land price fluctuations were the primary cause of most business cycles.

Mitigating an economic downturn

Many social indicators, such as mental health, crimes, and suicides, worsen during economic recessions (though general mortality tends to fall, and it is in expansions when it tends to increase). As periods of economic stagnation are painful for the many who lose their jobs, there is often political pressure for governments to mitigate recessions. Since the 1940s, following the Keynesian revolution, most governments of developed nations have seen the mitigation of the business cycle as part of the responsibility of government, under the rubric of stabilization policy. Since in the Keynesian view, recessions are caused by inadequate aggregate demand, when a recession occurs the government should increase the amount of aggregate demand and bring the economy back into equilibrium. This the government can do in two ways, firstly by increasing the money supply (expansionarymonetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

) and secondly by increasing government spending or cutting taxes (expansionary fiscal policy).

By contrast, some economists, notably New classical economist Robert Lucas, argue that the welfare cost of business cycles are very small to negligible, and that governments should focus on long-term growth instead of stabilization.

However, even according to Keynesian theory

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

, managing economic policy to smooth out the cycle is a difficult task in a society with a complex economy. Some theorists, notably those who believe in Marxian economics, believe that this difficulty is insurmountable. Karl Marx

Karl Heinrich Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, economist, historian, sociologist, political theorist, journalist, critic of political economy, and socialist revolutionary. His best-known titles are the 1848 ...

claimed that recurrent business cycle crises were an inevitable result of the operations of the capitalistic system. In this view, all that the government can do is to change the ''timing'' of economic crises. The crisis could also show up in a different ''form'', for example as severe inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

or a steadily increasing government deficit. Worse, by delaying a crisis, government policy is seen as making it ''more dramatic'' and thus more painful.

Additionally, since the 1960s neoclassical economists have played down the ability of Keynesian policies to manage an economy. Since the 1960s, economists like Nobel Laureates Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

and Edmund Phelps

Edmund Strother Phelps (born July 26, 1933) is an American economist and the recipient of the 2006 Nobel Memorial Prize in Economic Sciences.

Early in his career, he became known for his research at Yale's Cowles Foundation in the first half of ...

have made ground in their arguments that inflationary expectations negate the Phillips curve

The Phillips curve is an economic model, named after William Phillips hypothesizing a correlation between reduction in unemployment and increased rates of wage rises within an economy. While Phillips himself did not state a linked relationship ...

in the long run. The stagflation of the 1970s provided striking support for their theories while proving a dilemma for Keynesian policies, which appeared to necessitate both expansionary policies to mitigate recession and contractionary policies to reduce inflation.

Friedman has gone so far as to argue that all the central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central b ...

of a country should do is to avoid making large mistakes, as he believes they did by contracting the money supply very rapidly in the face of the Wall Street Crash of 1929

The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange coll ...

, in which they made what would have been a recession into the Great Depression.

Software

The Hodrick-Prescott and the Christiano-Fitzgerald filters can be implemented using the R packagemFilter

, while singular spectrum filters can be implemented using the R package

.

See also

*Dynamic stochastic general equilibrium

Dynamic stochastic general equilibrium modeling (abbreviated as DSGE, or DGE, or sometimes SDGE) is a macroeconomic method which is often employed by monetary and fiscal authorities for policy analysis, explaining historical time-series data, as we ...

* Information revolution

The term information revolution describes current economic, social and technological trends beyond the Industrial Revolution.

Many competing terms have been proposed that focus on different aspects of this societal development.

The British polymat ...

* Inventory investment over the business cycle

* List of commodity booms

* List of financial crises in the United States

There have been as many as 48 recessions in the United States dating back to the Articles of Confederation, and although economists and historians dispute certain 19th-century recessions, the consensus view among economists and historians is that ...

* Market trend

A market trend is a perceived tendency of financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time-fram ...

* Skyscraper Index

* Welfare cost of business cycles

* World-systems theory

World-systems theory (also known as world-systems analysis or the world-systems perspective)Immanuel Wallerstein, (2004), "World-systems Analysis." In ''World System History'', ed. George Modelski, in ''Encyclopedia of Life Support Systems'' (E ...

Notes

References

* * From (2008) ''The New Palgrave Dictionary of Economics

''The New Palgrave Dictionary of Economics'' (2018), 3rd ed., is a twenty-volume reference work on economics published by Palgrave Macmillan. It contains around 3,000 entries, including many classic essays from the original Inglis Palgrave Diction ...

'', 2nd Edition:

** Christopher J. Erceg. "monetary business cycle models (sticky prices and wages).Abstract.

** Christian Hellwig. "monetary business cycles (imperfect information)."

Abstract.

** Ellen R. McGrattan "real business cycles."

Abstract.

* *

External links

The Conference Board Business Cycle Indicators

– Indicators of Euro Area, United States, Japan, China and so on.

Historical documents relating to past business cycles, including charts, data publications, speeches, and analyses

{{authority control Business cycle theories Capitalism