An Inquiry into the Nature and Causes of the Wealth of Nations on:

[Wikipedia]

[Google]

[Amazon]

''An Inquiry into the Nature and Causes of the Wealth of Nations'', generally referred to by its shortened title ''The Wealth of Nations'', is the '' magnum opus'' of the Scottish

Five editions of ''The Wealth of Nations'' were published during Smith's lifetime: in 1776, 1778, 1784, 1786 and 1789. Numerous editions appeared after Smith's death in 1790. To better understand the evolution of the work under Smith's hand, a team led by Edwin Cannan collated the first five editions. The differences were published along with an edited sixth edition in 1904. They found minor but numerous differences (including the addition of many footnotes) between the first and the second editions; the differences between the second and third editions are major.K. Sutherland ed., ''Wealth of Nations'' (Oxford 2008) pp. xlvi–xlvii In 1784, Smith annexed these first two editions with the publication of ''Additions and Corrections to the First and Second Editions of Dr. Adam Smith's Inquiry into the Nature and Causes of the Wealth of Nations'', and he also had published the three-volume third edition of the ''Wealth of Nations'', which incorporated ''Additions and Corrections'' and, for the first time, an index. Among other things, the ''Additions and Corrections'' included entirely new sections, particularly to book 4, chapters 4 and 5, and to book 5, chapter 1, as well as an additional chapter (8), "Conclusion of the Mercantile System", in book 4.

The fourth edition, published in 1786, had only slight differences from the third edition, and Smith himself says in the ''Advertisement'' at the beginning of the book, "I have made no alterations of any kind." Finally, Cannan notes only trivial differences between the fourth and fifth editions—a set of misprints being removed from the fourth and a different set of misprints being introduced.

Five editions of ''The Wealth of Nations'' were published during Smith's lifetime: in 1776, 1778, 1784, 1786 and 1789. Numerous editions appeared after Smith's death in 1790. To better understand the evolution of the work under Smith's hand, a team led by Edwin Cannan collated the first five editions. The differences were published along with an edited sixth edition in 1904. They found minor but numerous differences (including the addition of many footnotes) between the first and the second editions; the differences between the second and third editions are major.K. Sutherland ed., ''Wealth of Nations'' (Oxford 2008) pp. xlvi–xlvii In 1784, Smith annexed these first two editions with the publication of ''Additions and Corrections to the First and Second Editions of Dr. Adam Smith's Inquiry into the Nature and Causes of the Wealth of Nations'', and he also had published the three-volume third edition of the ''Wealth of Nations'', which incorporated ''Additions and Corrections'' and, for the first time, an index. Among other things, the ''Additions and Corrections'' included entirely new sections, particularly to book 4, chapters 4 and 5, and to book 5, chapter 1, as well as an additional chapter (8), "Conclusion of the Mercantile System", in book 4.

The fourth edition, published in 1786, had only slight differences from the third edition, and Smith himself says in the ''Advertisement'' at the beginning of the book, "I have made no alterations of any kind." Finally, Cannan notes only trivial differences between the fourth and fifth editions—a set of misprints being removed from the fourth and a different set of misprints being introduced.

The first edition of the book sold out in six months. The printer William Strahan wrote on 12 April 1776 that

The first edition of the book sold out in six months. The printer William Strahan wrote on 12 April 1776 that

The

The

George Stigler attributes to Smith "the most important substantive proposition in all of economics" and foundation of resource-allocation theory. It is that, under competition, owners of resources (labour, land, and capital) will use them most profitably, resulting in an equal rate of return in equilibrium for all uses (adjusted for apparent differences arising from such factors as training, trust, hardship, and unemployment). He also describes Smith's theorem that "the

George Stigler attributes to Smith "the most important substantive proposition in all of economics" and foundation of resource-allocation theory. It is that, under competition, owners of resources (labour, land, and capital) will use them most profitably, resulting in an equal rate of return in equilibrium for all uses (adjusted for apparent differences arising from such factors as training, trust, hardship, and unemployment). He also describes Smith's theorem that "the

59–62.

/ref> Economic anthropologist

The Wealth of Nations: A Translation into Modern English

* ''An Inquiry into the Nature and Causes of the Wealth of Nations: A Selected Edition'' Adam Smith (Author), Kathryn Sutherland (Editor), 2008, Oxford Paperbacks, Oxford. . *

''An Inquiry into the Nature and Causes of the Wealth of Nations''

at

Vol. IVol. II

''The Wealth of Nations''

at LibriVox (public domain audiobooks)

''Glossary: Adam Smith's the Wealth of Nations''

{{DEFAULTSORT:Wealth of Nations, The 1776 books 1776 in economics 1776 in Scotland Books about capitalism Books about wealth distribution Books by Adam Smith Classical liberalism Classical economics books History books about civilization Political philosophy literature Economics books

economist

An economist is a professional and practitioner in the social sciences, social science discipline of economics.

The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this ...

and moral philosopher

A philosopher is a person who practices or investigates philosophy. The term ''philosopher'' comes from the grc, φιλόσοφος, , translit=philosophos, meaning 'lover of wisdom'. The coining of the term has been attributed to the Greek th ...

Adam Smith

Adam Smith (baptized 1723 – 17 July 1790) was a Scottish economist and philosopher who was a pioneer in the thinking of political economy and key figure during the Scottish Enlightenment. Seen by some as "The Father of Economics"——� ...

. First published in 1776, the book offers one of the world's first collected descriptions of what builds nations' wealth

Wealth is the abundance of valuable financial assets or physical possessions which can be converted into a form that can be used for transactions. This includes the core meaning as held in the originating Old English word , which is from an I ...

, and is today a fundamental work in classical economics

Classical economics, classical political economy, or Smithian economics is a school of thought in political economy that flourished, primarily in Britain, in the late 18th and early-to-mid 19th century. Its main thinkers are held to be Adam S ...

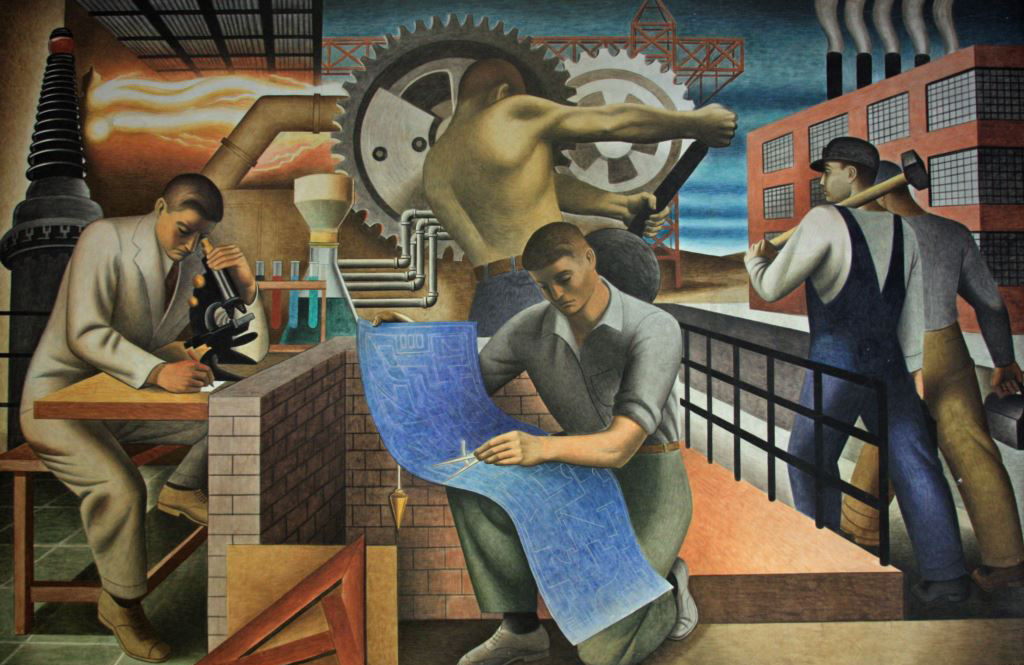

. By reflecting upon the economics at the beginning of the Industrial Revolution

The Industrial Revolution was the transition to new manufacturing processes in Great Britain, continental Europe, and the United States, that occurred during the period from around 1760 to about 1820–1840. This transition included going f ...

, the book touches upon such broad topics as the division of labour

The division of labour is the separation of the tasks in any economic system or organisation so that participants may specialise (specialisation). Individuals, organizations, and nations are endowed with, or acquire specialised capabilities, an ...

, productivity, and free market

In economics, a free market is an economic system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. Such markets, as modeled, operate without the intervention of government or any ot ...

s.

History

''The Wealth of Nations'' was published in two volumes on 9 March 1776 (with books I–III included in the first volume and books IV and V included in the second), during theScottish Enlightenment

The Scottish Enlightenment ( sco, Scots Enlichtenment, gd, Soillseachadh na h-Alba) was the period in 18th- and early-19th-century Scotland characterised by an outpouring of intellectual and scientific accomplishments. By the eighteenth century ...

and the Scottish Agricultural Revolution. It influenced several authors and economists, such as Karl Marx

Karl Heinrich Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, economist, historian, sociologist, political theorist, journalist, critic of political economy, and socialist revolutionary. His best-known titles are the 1848 ...

, as well as governments and organizations, setting the terms for economic debate and discussion for the next century and a half. For example, Alexander Hamilton was influenced in part by ''The Wealth of Nations'' to write his '' Report on Manufactures'', in which he argued against many of Smith's policies. Hamilton based much of this report on the ideas of Jean-Baptiste Colbert

Jean-Baptiste Colbert (; 29 August 1619 – 6 September 1683) was a French statesman who served as First Minister of State from 1661 until his death in 1683 under the rule of King Louis XIV. His lasting impact on the organization of the country ...

, and it was, in part, Colbert's ideas that Smith responded to, and criticised, with ''The Wealth of Nations''.

''The Wealth of Nations'' was the product of seventeen years of notes and earlier studies, as well as an observation of conversation among economists of the time (like Nicholas Magens) concerning economic and societal conditions during the beginning of the Industrial Revolution, and it took Smith some ten years to produce. The result was a treatise which sought to offer a practical application for reformed economic theory to replace the mercantilist

Mercantilism is an economic policy that is designed to maximize the exports and minimize the imports for an economy. It promotes imperialism, colonialism, tariffs and subsidies on traded goods to achieve that goal. The policy aims to reduc ...

and physiocratic economic theories that were becoming less relevant in the time of industrial progress and innovation. It provided the foundation for economists, politicians, mathematicians, and thinkers of all fields to build upon. Irrespective of historical influence, ''The Wealth of Nations'' represented a clear paradigm shift

A paradigm shift, a concept brought into the common lexicon by the American physicist and philosopher Thomas Kuhn, is a fundamental change in the basic concepts and experimental practices of a scientific discipline. Even though Kuhn restricted ...

in the field of economics, comparable to what Immanuel Kant

Immanuel Kant (, , ; 22 April 1724 – 12 February 1804) was a German philosopher and one of the central Enlightenment thinkers. Born in Königsberg, Kant's comprehensive and systematic works in epistemology, metaphysics, ethics, and ...

's '' Critique of Pure Reason'' was for philosophy

Philosophy (from , ) is the systematized study of general and fundamental questions, such as those about existence, reason, knowledge, values, mind, and language. Such questions are often posed as problems to be studied or resolved. ...

.

Synopsis

Book I: Of the Causes of Improvement in the productive Powers of Labour

Of theDivision of Labour

The division of labour is the separation of the tasks in any economic system or organisation so that participants may specialise (specialisation). Individuals, organizations, and nations are endowed with, or acquire specialised capabilities, an ...

:

Division of labour has caused a greater increase in production than any other factor. This diversification is greatest for nations with more industry and improvement, and is responsible for "universal opulence" in those countries. This is in part due to increased quality of production, but more importantly because of increased efficiency of production, leading to a higher nominal output of units produced per time unit. Agriculture is less amenable than manufacturing to division of labour; hence, rich nations are not so far ahead of poor nations in agriculture as in manufacturing.

Of the Principle which gives Occasion to the Division of Labour:

Division of labour arises not from innate wisdom, but from humans' propensity to barter.

That the Division of Labour is Limited by the Extent of the Market:

Limited opportunity for exchange discourages division of labour. Because "water-carriage" (i.e. transportation) extends the market, division of labour, with its improvements, comes earliest to cities near waterways. Civilization began around the highly navigable Mediterranean Sea

The Mediterranean Sea is a sea connected to the Atlantic Ocean, surrounded by the Mediterranean Basin and almost completely enclosed by land: on the north by Western and Southern Europe and Anatolia, on the south by North Africa, and on ...

.

Of the Origin and Use of Money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money ar ...

:

With division of labour, the produce of one's own labour can fill only a small part of one's needs. Different commodities have served as a common medium of exchange, but all nations have finally settled on metals, which are durable and divisible, for this purpose. Before coin

A coin is a small, flat (usually depending on the country or value), round piece of metal or plastic used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order ...

age, people had to weigh and assay with each exchange, or risk "the grossest frauds and impositions." Thus nations began stamping metal, on one side only, to ascertain purity, or on all sides, to stipulate purity and amount.

The quantity of real metal in coins has diminished, due to the "avarice and injustice of princes and sovereign states," enabling them to pay their debts in appearance only, and to the defraudment of creditors.

Of the Wages of Labour: In this section, Smith describes how the wages of labour are dictated primarily by the competition among labourers and masters. When labourers bid against one another for limited opportunities for employment, the wages of labour collectively fall, whereas when employers compete against one another for limited supplies of labour, the wages of labour collectively rise. However, this process of competition is often circumvented by combinations among labourers and among masters. When labourers combine and no longer bid against one another, their wages rise, whereas when masters combine, wages fall. In Smith's day, organised labour was dealt with very harshly by the law.

Smith himself wrote about the "severity" of such laws against worker actions, and made a point to contrast the "clamour" of the "masters" against workers associations, while associations and collusions of the masters "are never heard by the people" though such actions are "always" and "everywhere" taking place:

"We rarely hear, it has been said, of the combinations of masters, though frequently of those of workmen. But whoever imagines, upon this account, that masters rarely combine, is as ignorant of the world as of the subject. Masters are always and everywhere in a sort of tacit, but constant and uniform, combination, not to raise the wages of labour above their actual rate ..Masters, too, sometimes enter into particular combinations to sink the wages of labour even below this rate. These are always conducted with the utmost silence and secrecy till the moment of execution; and when the workmen yield, as they sometimes do without resistance, though severely felt by them, they are never heard of by other people". In contrast, when workers combine, "the masters ..never cease to call aloud for the assistance of the civil magistrate, and the rigorous execution of those laws which have been enacted with so much severity against the combination of servants, labourers, and journeymen."In societies where the amount of labour exceeds the amount of revenue available for waged labour, competition among workers is greater than the competition among employers, and wages fall. Conversely, where revenue is abundant, labour wages rise. Smith argues that, therefore, labour wages only rise as a result of greater revenue disposed to pay for labour. Smith thought labour the same as any other commodity in this respect: However, the amount of revenue must increase constantly in proportion to the amount of labour for wages to remain high. Smith illustrates this by juxtaposing England with the North American colonies. In England, there is more revenue than in the colonies, but wages are lower, because more workers flock to new employment opportunities caused by the large amount of revenue – so workers eventually compete against each other as much as they did before. By contrast, as capital continues to flow to the colonial economies at least at the same rate that population increases to "fill out" this excess capital, wages there stay higher than in England. Smith was highly concerned about the problems of poverty. He writes: The only way to determine whether a man is rich or poor is to examine the amount of labour he can afford to purchase. "Labour is the real exchange for commodities". Smith also describes the relation of cheap years and the production of manufactures versus the production in dear years. He argues that while some examples, such as the linen production in France, show a correlation, another example in Scotland shows the opposite. He concludes that there are too many variables to make any statement about this. Of the Profits of Stock: In this chapter, Smith uses

interest rates

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ...

as an indicator of the profits of stock. This is because interest can only be paid with the profits of stock, and so creditors will be able to raise rates in proportion to the increase or decrease of the profits of their debtors.

Smith argues that the profits of stock are inversely proportional to the wages of labour, because as more money is spent compensating labour, there is less remaining for personal profit. It follows that, in societies where competition among labourers is greatest relative to competition among employers, profits will be much higher. Smith illustrates this by comparing interest rates in England and Scotland. In England, government laws against usury

Usury () is the practice of making unethical or immoral monetary loans that unfairly enrich the lender. The term may be used in a moral sense—condemning taking advantage of others' misfortunes—or in a legal sense, where an interest rate is c ...

had kept maximum interest rates very low, but even the maximum rate was believed to be higher than the rate at which money was usually loaned. In Scotland, however, interest rates are much higher. This is the result of a greater proportion of capitalists in England, which offsets some competition among labourers and raises wages.

However, Smith notes that, curiously, interest rates in the colonies are also remarkably high (recall that, in the previous chapter, Smith described how wages in the colonies are higher than in England). Smith attributes this to the fact that, when an empire takes control of a colony, prices for a huge abundance of land and resources are extremely cheap. This allows capitalists to increase their profits, but simultaneously draws many capitalists to the colonies, increasing the wages of labour. As this is done, however, the profits of stock in the mother country rise (or at least cease to fall), as much of it has already flocked offshore.

Of Wages and Profit in the Different Employments of Labour and Stock: Smith repeatedly attacks groups of politically aligned individuals who attempt to use their collective influence to manipulate the government into doing their bidding. At the time, these were referred to as "factions", but are now more commonly called "special interests," a term that can comprise international bankers, corporate conglomerations, outright oligopolies

An oligopoly (from Greek ὀλίγος, ''oligos'' "few" and πωλεῖν, ''polein'' "to sell") is a market structure in which a market or industry is dominated by a small number of large sellers or producers. Oligopolies often result fr ...

, trade unions and other groups. Indeed, Smith had a particular distrust of the tradesman class. He felt that the members of this class, especially acting together within the guild

A guild ( ) is an association of artisans and merchants who oversee the practice of their craft/trade in a particular area. The earliest types of guild formed as organizations of tradesmen belonging to a professional association. They sometim ...

s they want to form, could constitute a power block and manipulate the state into regulating for special interests against the general interest:

Smith also argues against government subsidies of certain trades, because this will draw many more people to the trade than what would otherwise be normal, collectively lowering their wages.

Of the Rent of the Land: Chapter 10, part ii, motivates an understanding of the idea of feudalism

Feudalism, also known as the feudal system, was the combination of the legal, economic, military, cultural and political customs that flourished in medieval Europe between the 9th and 15th centuries. Broadly defined, it was a way of structu ...

. Rent, considered as the price paid for the use of land, is naturally the highest the tenant can afford in the actual circumstances of the land. In adjusting lease terms, the landlord endeavours to leave him no greater share of the produce than what is sufficient to keep up the stock from which he furnishes the seed, pays the labour, and purchases and maintains the cattle and other instruments of husbandry, together with the ordinary profits of farming stock in the neighbourhood.

This is evidently the smallest share with which the tenant can content himself without being a loser, and the landlord seldom means to leave him any more. Whatever part of the produce, or, what is the same thing, whatever part of its price, is over and above this share, he naturally endeavours to reserve to himself as the rent of his land, which is evidently the highest the tenant can afford to pay in the actual circumstances of the land. Sometimes, indeed, the liberality, more frequently the ignorance, of the landlord, makes him accept of somewhat less than this portion; and sometimes too, though more rarely, the ignorance of the tenant makes him undertake to pay somewhat more, or to content himself with somewhat less, than the ordinary profits of farming stock in the neighbourhood. This portion, however, may still be considered as the natural rent of land, or the rent for which it is naturally meant that land should for the most part be let.

Book II: Of the Nature, Accumulation, and Employment of Stock

Of the Division of Stock:When the stock which a man possesses is no more than sufficient to maintain him for a few days or a few weeks, he seldom thinks of deriving any revenue from it. He consumes it as sparingly as he can, and endeavours by his labour to acquire something which may supply its place before it be consumed altogether. His revenue is, in this case, derived from his labour only. This is the state of the greater part of the labouring poor in all countries.

But when he possesses stock sufficient to maintain him for months or years, he naturally endeavours to derive a revenue from the greater part of it; reserving only so much for his immediate consumption as may maintain him till this revenue begins to come in. His whole stock, therefore, is distinguished into two parts. That part which, he expects, is to afford him this revenue, is called his capital.Of Money Considered as a particular Branch of the General Stock of the Society: Of the

Accumulation of Capital

Capital accumulation is the dynamic that motivates the pursuit of profit, involving the investment of money or any financial asset with the goal of increasing the initial monetary value of said asset as a financial return whether in the form o ...

, or of Productive and Unproductive Labour:

Of Stock Lent at Interest:

Of the different employment of Capital:

Book III: Of the different Progress of Opulence in different Nations

Long-term economic growth

Adam Smith uses this example to address long-term economic growth. Smith states, "As subsistence is, in the nature of things, prior to conveniency and luxury, so the industry which procures the former, must necessarily be prior to that which ministers to the latter". In order for industrial success, subsistence is required first from the countryside. Industry and trade occur in cities while agriculture occurs in the countryside.Agricultural jobs

Agricultural work is a more desirable situation than industrial work because the owner is in complete control. Smith states that:In our North American colonies, where uncultivated land is still to be had upon easy terms, no manufactures for distant sale have ever yet been established in any of their towns. When an artificer has acquired a little more stock than is necessary for carrying on his own business in supplying the neighbouring country, he does not, in North America, attempt to establish with it a manufacture for more distant sale, but employs it in the purchase and improvement of uncultivated land. From artificer he becomes planter, and neither the large wages nor the easy subsistence which that country affords to artificers, can bribe him rather to work for other people than for himself. He feels that an artificer is the servant of his customers, from whom he derives his subsistence; but that a planter who cultivates his own land, and derives his necessary subsistence from the labour of his own family, is really a master, and independent of all the world.Where there is open countryside agriculture is much preferable to industrial occupations and ownership. Adam Smith goes on to say "According to the natural course of things, therefore, the greater part of the capital of every growing society is, first, directed to agriculture, afterwards to manufactures, and last of all to foreign commerce". This sequence leads to growth, and therefore opulence. Of the Discouragement of Agriculture: Chapter 2's long title is "Of the Discouragement of Agriculture in the Ancient State of Europe after the Fall of the Roman Empire". Of the Rise and Progress of Cities and Towns, after the Fall of the Roman Empire: How the Commerce of the Towns Contributed to the Improvement of the Country: Smith often harshly criticised those who act purely out of self-interest and greed, and warns that,

... l for ourselves, and nothing for other people, seems, in every age of the world, to have been the vile maxim of the masters of mankind.

Book IV: Of Systems of political Economy

Smith vigorously attacked the antiquated government restrictions he thought hindered industrial expansion. In fact, he attacked most forms of government interference in the economic process, includingtariff

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and p ...

s, arguing that this creates inefficiency and high prices in the long run. It is believed that this theory influenced government legislation in later years, especially during the 19th century.

Smith advocated a government that was active in sectors other than the economy. He advocated public education for poor adults, a judiciary, and a standing army—institutional systems not directly profitable for private industries.

Of the Principle of the Commercial or Mercantile System

Mercantilism is an economic policy that is designed to maximize the exports and minimize the imports for an economy. It promotes imperialism, colonialism, tariffs and subsidies on traded goods to achieve that goal. The policy aims to reduce a ...

: The book has sometimes been described as a critique of mercantilism

Mercantilism is an economic policy that is designed to maximize the exports and minimize the imports for an economy. It promotes imperialism, colonialism, tariffs and subsidies on traded goods to achieve that goal. The policy aims to reduce ...

and a synthesis of the emerging economic thinking of Smith's time. Specifically, ''The Wealth of Nations'' attacks, ''inter alia'', two major tenets of mercantilism:

# The idea that protectionist tariff

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and p ...

s serve the economic interests of a nation (or indeed any purpose whatsoever) and

# The idea that large reserves of gold bullion

A gold bar, also called gold bullion or gold ingot, is a quantity of refined metallic gold of any shape that is made by a bar producer meeting standard conditions of manufacture, labeling, and record keeping. Larger gold bars that are produce ...

or other precious metals are necessary for a country's economic success. This critique of mercantilism was later used by David Ricardo

David Ricardo (18 April 1772 – 11 September 1823) was a British political economist. He was one of the most influential of the classical economists along with Thomas Malthus, Adam Smith and James Mill. Ricardo was also a politician, and a ...

when he laid out his Theory of Comparative Advantage

In an economic model, agents have a comparative advantage over others in producing a particular good if they can produce that good at a lower relative opportunity cost or autarky price, i.e. at a lower relative marginal cost prior to trade. Com ...

.

Of Restraints upon the Importation: Chapter 2's full title is "Of Restraints upon the Importation from Foreign Countries of such Goods as can be Produced at Home". The "invisible hand

The invisible hand is a metaphor used by the British moral philosopher Adam Smith that describes the unintended greater social benefits and public good brought about by individuals acting in their own self-interests. Smith originally mention ...

" is a frequently referenced theme from the book, although it is specifically mentioned only once.

The metaphor of the "invisible hand" has been widely used out of context. In the passage above Smith is referring to "the support of domestic industry" and contrasting that support with the importation of goods. Neoclassical economic theory has expanded the metaphor beyond the domestic/foreign manufacture argument to encompass nearly all aspects of economics.

Of the extraordinary Restraints: Chapter 3's long title is "Of the extraordinary Restraints upon the Importation of Goods of almost all Kinds, from those Countries with which the Balance is supposed to be Disadvantageous".

Of Drawbacks: Merchants and manufacturers are not contented with the monopoly of the home market, but desire likewise the most extensive foreign sale for their goods. Their country has no jurisdiction in foreign nations, and therefore can seldom procure them any monopoly there. They are generally obliged, therefore, to content themselves with petitioning for certain encouragements to exportation.

Of these encouragements what are called Drawbacks seem to be the most reasonable. To allow the merchant to draw back upon exportation, either the whole or a part of whatever excise or inland duty is imposed upon domestic industry, can never occasion the exportation of a greater quantity of goods than what would have been exported had no duty been imposed. Such encouragements do not tend to turn towards any particular employment a greater share of the capital of the country than what would go to that employment of its own accord, but only to hinder the duty from driving away any part of that shares to other employments.

Of Bounties: Bounties upon exportation are, in Great Britain, frequently petitioned for, and sometimes granted to the produce of particular branches of domestic industry. By means of them our merchants and manufacturers, it is pretended, will be enabled to sell their goods as cheap, or cheaper than their rivals in the foreign market. A greater quantity, it is said, will thus be exported, and the balance of trade consequently turned more in favour of our own country. We cannot give our workmen a monopoly in the foreign as we have done in the home market. We cannot force foreigners to buy their goods as we have done our own countrymen. The next best expedient, it has been thought, therefore, is to pay them for buying. It is in this manner that the mercantile system proposes to enrich the whole country, and to put money into all our pockets by means of the balance of trade.

Of Treaties of Commerce:

Of Colonies:

''Of the Motives for establishing new Colonies'':

''Causes of Prosperity of new Colonies'':

''Of the Advantages which Europe has derived from the Discovery of America, and from that of a Passage to the East Indies by the Cape of Good Hope'':

Conclusion of the Mercantile System: Smith's argument about the international political economy opposed the idea of Mercantilism

Mercantilism is an economic policy that is designed to maximize the exports and minimize the imports for an economy. It promotes imperialism, colonialism, tariffs and subsidies on traded goods to achieve that goal. The policy aims to reduce ...

. While the Mercantile System encouraged each country to hoard gold, while trying to grasp hegemony, Smith argued that free trade eventually makes all actors better off. This argument is the modern 'Free Trade' argument.

Of the Agricultural Systems: Chapter 9's long title is "Of the Agricultural Systems, or of those Systems of Political Economy, which Represent the Produce of Land, as either the Sole or the Principal, Source of the Revenue and Wealth of Every Country".

Book V: Of the Revenue of the Sovereign or Commonwealth

Smith postulated four "maxims" of taxation: proportionality, transparency, convenience, and efficiency. Some economists interpret Smith's opposition to taxes on transfers of money, such as the Stamp Act, as opposition to capital gains taxes, which did not exist in the 18th century. Other economists credit Smith as one of the first to advocate a progressive tax. Smith wrote, "The necessaries of life occasion the great expense of the poor. They find it difficult to get food, and the greater part of their little revenue is spent in getting it. The luxuries and vanities of life occasion the principal expense of the rich, and a magnificent house embellishes and sets off to the best advantage all the other luxuries and vanities which they possess. A tax upon house-rents, therefore, would in general fall heaviest upon the rich; and in this sort of inequality there would not, perhaps, be anything very unreasonable. It is not very unreasonable that the rich should contribute to the public expense, not only in proportion to their revenue, but something more than in that proportion." Smith believed that an even "more proper" source of progressive taxation than property taxes wasground rent

As a legal term, ground rent specifically refers to regular payments made by a holder of a leasehold property to the freeholder or a superior leaseholder, as required under a lease. In this sense, a ground rent is created when a freehold piece ...

. Smith wrote that "nothing ouldbe more reasonable" than a land value tax.

Of the Expenses of the Sovereign or Commonwealth: Smith uses this chapter to comment on the concept of taxation and expenditure by the state. On taxation, Smith wrote,

Smith advocates a tax naturally attached to the "abilities" and habits of each echelon of society.

For the lower echelon, Smith recognised the intellectually erosive effect that the otherwise beneficial division of labour can have on workers, what Marx, though he mainly opposes Smith, later named "alienation"; therefore, Smith warns of the consequence of government failing to fulfill its proper role, which is to preserve against the innate tendency of human society to fall apart.

Under Smith's model, government involvement in any area other than those stated above negatively impacts economic growth. This is because economic growth is determined by the needs of a free market and the entrepreneurial nature of private persons. A shortage of a product makes its price rise, and so stimulates producers to produce more and attracts new people to that line of production. An excess supply of a product (more of the product than people are willing to buy) drives prices down, and producers refocus energy and money to other areas where there is a need.

Of the Sources of the General or Public Revenue of the Society: In his discussion of taxes in Book Five, Smith wrote:

He also introduced the distinction between a '' direct tax'', and by implication an ''indirect tax'' (although he did not use the word "indirect"):

And further:

This term was later used in United States, Article I, Section 2, Clause 3 of the U.S. Constitution, and James Madison

James Madison Jr. (March 16, 1751June 28, 1836) was an American statesman, diplomat, and Founding Father. He served as the fourth president of the United States from 1809 to 1817. Madison is hailed as the "Father of the Constitution" for h ...

, who wrote much of the Constitution, is known to have read Smith's book.

Of War and Public Debts:

Smith then goes on to say that even if money was set aside from future revenues to pay for the debts of war, it seldom actually gets used to pay down the debt. Politicians are inclined to spend the money on some other scheme that will win the favour of their constituents. Hence, interest payments rise and war debts continue to grow larger, well beyond the end of the war.

Summing up, if governments can borrow without check, then they are more likely to wage war without check, and the costs of the war spending will burden future generations, since war debts are almost never repaid by the generations that incurred them.

Reception and impact

Greater Britain

Intellectuals, critics, and reviewers

The first edition of the book sold out in six months. The printer William Strahan wrote on 12 April 1776 that

The first edition of the book sold out in six months. The printer William Strahan wrote on 12 April 1776 that David Hume

David Hume (; born David Home; 7 May 1711 NS (26 April 1711 OS) – 25 August 1776) Cranston, Maurice, and Thomas Edmund Jessop. 2020 999br>David Hume" '' Encyclopædia Britannica''. Retrieved 18 May 2020. was a Scottish Enlightenment ph ...

said ''The Wealth of Nations'' required too much thought to be as popular as Edward Gibbon

Edward Gibbon (; 8 May 173716 January 1794) was an English historian, writer, and member of parliament. His most important work, '' The History of the Decline and Fall of the Roman Empire'', published in six volumes between 1776 and 1788, i ...

's ''The History of the Decline and Fall of the Roman Empire

''The History of the Decline and Fall of the Roman Empire'' is a six-volume work by the English historian Edward Gibbon. It traces Western civilization (as well as the Islamic and Mongolian conquests) from the height of the Roman Empire to th ...

''. Strahan also wrote: "What you say of Mr. Gibbon's and Dr. Smith's book is exactly just. The former is the most popular work; but the sale of the latter, though not near so rapid, has been more than I could have expected from a work that requires much thought and reflection (qualities that do not abound among modern readers) to peruse to any purpose." Gibbon wrote to Adam Ferguson

Adam Ferguson, (Scottish Gaelic: ''Adhamh MacFhearghais''), also known as Ferguson of Raith (1 July N.S./20 June O.S. 1723 – 22 February 1816), was a Scottish philosopher and historian of the Scottish Enlightenment.

Ferguson was sympathet ...

on 1 April: "What an excellent work is that with which our common friend Mr. Adam Smith has enriched the public! An extensive science in a single book, and the most profound ideas expressed in the most perspicuous language". The review of the book in the '' Annual Register'' was probably written by Whig MP Edmund Burke

Edmund Burke (; 12 January NS.html"_;"title="New_Style.html"_;"title="/nowiki>New_Style">NS">New_Style.html"_;"title="/nowiki>New_Style">NS/nowiki>_1729_–_9_July_1797)_was_an_NS.html"_;"title="New_Style.html"_;"title="/nowiki>New_Style">N ...

. In 1791, the English-born radical Thomas Paine

Thomas Paine (born Thomas Pain; – In the contemporary record as noted by Conway, Paine's birth date is given as January 29, 1736–37. Common practice was to use a dash or a slash to separate the old-style year from the new-style year. In th ...

wrote in his '' Rights of Man'' that "Had Mr. Burke possessed talents similar to the author 'On the Wealth of Nations,' he would have comprehended all the parts which enter into, and, by assemblage, form a constitution."

In 1800, the ''Anti-Jacobin Review

''The Anti-Jacobin Review and Magazine, or, Monthly Political and Literary Censor'', was a conservative British political periodical active from 1798 to 1821. Founded founded by John Gifford (pseud. of John Richards Green) after the demise of Wi ...

'' criticized ''The Wealth of Nations''.J. J. Sack, ''From Jacobite to Conservative. Reaction and orthodoxy in Britain, c. 1760–1832'' (Cambridge University Press, 2004), p. 182. In 1803, ''The Times'' argued against war with Spain: She is our best customer; and by the gentle and peaceable stream of commerce, the treasures of the new world flow with greater certainty into English reservoirs, than it could do by the most successful warfare. They come in this way to support our manufactures, to encourage industry, to feed our poor, to pay taxes, to reward ingenuity, to diffuse riches among all classes of people. But for the full understanding of this beneficial circulation of wealth, we must refer to Dr. Adam Smith's incomparable ''Treatise on the Wealth of Nations''.In 1810, a correspondent writing under the pseudonym of Publicola included at the head of his letter Smith's line that "Exclusive Companies are ''nuisances'' in every respect" and called him "that learned writer". In 1812, Robert Southey of the ''Quarterly Review'' condemned ''The Wealth of Nations'' as a "tedious and hard-hearted book". In 1821, ''The Times'' quoted Smith's opinion that the interests of corn dealers and the people were the same. In 1826, the English radical William Cobbett criticised in his '' Rural Rides'' the political economists' hostility to the Poor Law: "Well, amidst all this suffering, there is one good thing; the Scotch political economy is blown to the devil, and the ''Edinburgh Review'' and Adam Smith along with it". The Liberal statesman

William Ewart Gladstone

William Ewart Gladstone ( ; 29 December 1809 – 19 May 1898) was a British statesman and Liberal politician. In a career lasting over 60 years, he served for 12 years as Prime Minister of the United Kingdom, spread over four non-con ...

chaired the meeting of the Political Economy Club

The Political Economy Club is the world's oldest economics association founded by James Mill and a circle of friends in 1821 in London, for the purpose of coming to an agreement on the fundamental principles of political economy. David Ricardo, ...

to celebrate the centenary of the publication of ''The Wealth of Nations''. The Liberal historian Lord Acton believed that ''The Wealth of Nations'' gave a "scientific backbone to liberal sentiment" and that it was the "classic English philosophy of history".

Legislators

Smith's biographer John Rae contends that ''The Wealth of Nations'' shaped government policy soon after it was published.=18th century

= In 1777, in the first budget after the book was published, Prime Minister Lord North got the idea for two new taxes from the book: one on man-servants and the other on property sold at auction. The budget of 1778 introduced the inhabited house duty and the malt tax, both recommended by Smith. In 1779, Smith was consulted by politicians Henry Dundas andLord Carlisle Lord Carlisle may refer to:

* Mark Carlisle, Baron Carlisle of Bucklow

* Earl of Carlisle, a title that has been created three times in the Peerage of England

See also

* Alex Carlile, Baron Carlile of Berriew

Alexander Charles Carlile, Baron C ...

on the subject of giving Ireland free trade.Rae, p. 294.

''The Wealth of Nations'' was first mentioned in Parliament by the Whig leader Charles James Fox

Charles James Fox (24 January 1749 – 13 September 1806), styled '' The Honourable'' from 1762, was a prominent British Whig statesman whose parliamentary career spanned 38 years of the late 18th and early 19th centuries. He was the arch-ri ...

on 11 November 1783: There was a maxim laid down in an excellent book upon the Wealth of Nations which had been ridiculed for its simplicity, but which was indisputable as to its truth. In that book it was stated that the only way to become rich was to manage matters so as to make one's income exceed one's expenses. This maxim applied equally to an individual and to a nation. The proper line of conduct therefore was by a well-directed economy to retrench every current expense, and to make as large a saving during the peace as possible.Rae, p. 290.However Fox once told

Charles Butler Charles or Charlie Butler may refer to:

Legal profession

*Charles Butler (lawyer) (1750–1832), English lawyer and writer

*Charles Butler (NYU) (1802–1897), American lawyer and philanthropist

* Charles C. Butler (1865 – after 1937), Chief Jus ...

sometime after 1785 that he had never read the book and that "There is something in all these subjects which passes my comprehension; something so wide that I could never embrace them myself nor find any one who did."Rae, p. 289. When Fox was dining with Lord Lauderdale in 1796, Lauderdale remarked that they knew nothing of political economy before Adam Smith wrote. "Pooh," replied Fox, "your Adam Smiths are nothing, but" (he added, turning to the company) "that is his love; we must spare him there." Lauderdale replied: "I think he is everything", to which Fox rejoined: "That is a great proof of your affection". Fox also found Adam Smith "tedious" and believed that one half of ''The Wealth of Nations'' could be "omitted with much benefit to the subject".

''The Wealth of Nations'' was next mentioned in Parliament by Robert Thornton MP in 1787 to support the Commercial Treaty with France. In the same year George Dempster MP referenced it in the debate on the proposal to farm the post-horse duties and in 1788 by a Mr. Hussy on the Wool Exportation Bill.

The prime minister, William Pitt, praised Smith in the House of Commons on 17 February 1792: "…an author of our own times now unfortunately no more (I mean the author of a celebrated treatise ''on the Wealth of Nations''), whose extensive knowledge of detail, and depth of philosophical research will, I believe, furnish the best solution to every question connected with the history of commerce, or with the systems of political economy." In the same year it was quoted by Samuel Whitbread MP and Fox (on the division of labour) in the debate on the armament against Russia and also by William Wilberforce

William Wilberforce (24 August 175929 July 1833) was a British politician, philanthropist and leader of the movement to abolish the slave trade. A native of Kingston upon Hull, Yorkshire, he began his political career in 1780, eventually becom ...

in introducing his Bill against the slave trade. The book was not mentioned in the House of Lords until a debate in 1793 between Lord Lansdowne and Lord Loughborough about revolutionary principles in France. On 16 May 1797, Pitt said in the debate on the suspension of cash payments by the Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government o ...

that Smith was "that great author" but his arguments, "though always ingenious", were "sometimes injudicious". In 1798, Sir John Mitford, the Solicitor-General, cited the book in his criticism of bills of exchange given in consideration of other bills.

During a debate on the price of corn in 1800 Lord Warwick said: There was hardly any kind of property on which the law did not impose some restraints and regulations with regard to the sale of them, except that of provisions. This was probably done on the principles laid down by a celebrated and able writer, Doctor Adam Smith, who had maintained that every thing ought to be left to its own level. He knew something of that Gentleman, whose heart he knew was as sound as his head; and he was sure that had he lived to this day and beheld the novel state of wretchedness to which the country was now reduced ...; that Great Man would have reason to blush for some of the doctrines he had laid down. He would now have abundant opportunities of observing that all those artificial means of enhancing the price of provisions, which he had considered as no way mischievous, were practised at this time to a most alarming extent. He would see the Farmer keeping up his produce while the poor were labouring under all the miseries of want, and he would see Forestallers, Regraters, and all kinds of Middle-men making large profits upon it.''The Times'' (6 December 1800), p. 2.

Lord Grenville

William Wyndham Grenville, 1st Baron Grenville, (25 October 175912 January 1834) was a British Pittite Tory politician who served as Prime Minister of the United Kingdom from 1806 to 1807, but was a supporter of the Whigs for the duration of ...

replied: en that great man lived, ... his book was first published at a period, previous to which there had been two or three seasons of great dearth and distress; and during those seasons there were speculators without number, who ... proposed that a certain price should be fixed on every article: but all their plans were wisely rejected, and the ''Treatise on the Wealth of Nations'', which came forward soon after, pointed out in the clearest light how absurd and futile they must have been.

=19th century

= The

The Radical

Radical may refer to:

Politics and ideology Politics

* Radical politics, the political intent of fundamental societal change

*Radicalism (historical), the Radical Movement that began in late 18th century Britain and spread to continental Europe an ...

MP Richard Cobden studied ''The Wealth of Nations'' as a young man; his copy is still in the library of his home at Dunford House and there are marginal notes on the places where Smith criticizes British colonial policies. There are none on the passage about the invisible hand. Cobden campaigned for free trade in his agitation against the Corn Laws. In 1843, Cobden quoted Smith's protest against the "plain violation of the most sacred property" of every man derived from his labour. In 1844, he cited Smith's opposition to slave labour and claimed that Smith had been misrepresented by protectionists as a monopolist. In 1849, Cobden claimed that he had "gone through the length and breadth of this country, with Adam Smith in my hand, to advocate the principles of Free Trade." He also said he had tried "to popularise to the people of this country, and of the Continent, those arguments with which Adam Smith ... and every man who has written on this subject, have demonstrated the funding system to be injurious to mankind."

Cobden believed it to be morally wrong to lend money to be spent on war. In 1849, when ''The Times'' claimed political economists were against Cobden on this, Cobden wrote: "I can quote Adam Smith whose authority is without appeal now in intellectual circles, it gives one the basis of science upon which to raise appeals to the moral feelings." In 1850, when the Russian government attempted to raise a loan to cover the deficit brought about by its war against Hungary, Cobden said: "I take my stand on one of the strongest grounds in stating that Adam Smith and other great authorities on political economy are opposed to the very principle of such loans." In 1863, during Cobden's dispute with ''The Times'' over its claims that his fellow Radical

Radical may refer to:

Politics and ideology Politics

* Radical politics, the political intent of fundamental societal change

*Radicalism (historical), the Radical Movement that began in late 18th century Britain and spread to continental Europe an ...

John Bright wanted to divide the land of the rich amongst the poor, Cobden read to a friend the passage in the ''Wealth of Nations'' which criticized primogeniture and entail. Cobden said that if Bright had been as plain-speaking as Smith, "how he would have been branded as an incendiary and Socialist". In 1864, Cobden proclaimed, "If I were five-and-twenty or thirty, ... I would take Adam Smith in hand, and I would have a League for free trade in Land just as we had a League for free trade in Corn. You will find just the same authority in Adam Smith for the one as for the other."

United States

After the conquest of New France in 1760 during theFrench and Indian War

The French and Indian War (1754–1763) was a theater of the Seven Years' War, which pitted the North American colonies of the British Empire against those of the French, each side being supported by various Native American tribes. At the st ...

, Charles Townshend suggested that the American colonists provide help to pay for the war debt by paying an additional tax on tea. During this time, Adam Smith was working for Townshend and developed a relationship with Benjamin Franklin

Benjamin Franklin ( April 17, 1790) was an American polymath who was active as a writer, scientist, inventor, statesman, diplomat, printer, publisher, and political philosopher. Encyclopædia Britannica, Wood, 2021 Among the leading int ...

, who played a vital role in the American Revolution

The American Revolution was an ideological and political revolution that occurred in British America between 1765 and 1791. The Americans in the Thirteen Colonies formed independent states that defeated the British in the American Revoluti ...

three months after Smith's ''The Wealth of Nations'' book was released.

James Madison

James Madison Jr. (March 16, 1751June 28, 1836) was an American statesman, diplomat, and Founding Father. He served as the fourth president of the United States from 1809 to 1817. Madison is hailed as the "Father of the Constitution" for h ...

, in a speech given in Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of ...

on 2 February 1791, cited ''The Wealth of Nations'' in opposing a national bank: "The principal disadvantages consisted in, 1st. banishing the precious metals, by substituting another medium to perform their office: This effect was inevitable. It was admitted by the most enlightened patrons of banks, particularly by Smith on the ''Wealth of Nations''." Thomas Jefferson

Thomas Jefferson (April 13, 1743 – July 4, 1826) was an American statesman, diplomat, lawyer, architect, philosopher, and Founding Fathers of the United States, Founding Father who served as the third president of the United States from 18 ...

, writing to John Norvell on 14 June 1807, claimed that on "the subjects of money & commerce, Smith's ''Wealth of Nations'' is the best book to be read, unless ''Say's Political Economy

''A Treatise on Political Economy; or The Production, Distribution, and Consumption of Wealth'' (in English) known as ''Traité D'économie Politique'' in French. is an industrial economics book written by Jean-Baptiste Say.

The first edition ...

'' can be had, which treats the same subject on the same principles, but in a shorter compass & more lucid manner."

Modern evaluation

With 36,331 citations, it is the second most cited book in economics published before 1950, behindKarl Marx

Karl Heinrich Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, economist, historian, sociologist, political theorist, journalist, critic of political economy, and socialist revolutionary. His best-known titles are the 1848 ...

's ''Das Kapital

''Das Kapital'', also known as ''Capital: A Critique of Political Economy'' or sometimes simply ''Capital'' (german: Das Kapital. Kritik der politischen Ökonomie, link=no, ; 1867–1883), is a foundational theoretical text in materialist phi ...

''.

George Stigler attributes to Smith "the most important substantive proposition in all of economics" and foundation of resource-allocation theory. It is that, under competition, owners of resources (labour, land, and capital) will use them most profitably, resulting in an equal rate of return in equilibrium for all uses (adjusted for apparent differences arising from such factors as training, trust, hardship, and unemployment). He also describes Smith's theorem that "the

George Stigler attributes to Smith "the most important substantive proposition in all of economics" and foundation of resource-allocation theory. It is that, under competition, owners of resources (labour, land, and capital) will use them most profitably, resulting in an equal rate of return in equilibrium for all uses (adjusted for apparent differences arising from such factors as training, trust, hardship, and unemployment). He also describes Smith's theorem that "the division of labour

The division of labour is the separation of the tasks in any economic system or organisation so that participants may specialise (specialisation). Individuals, organizations, and nations are endowed with, or acquire specialised capabilities, an ...

is limited by the extent of the market" as the "core of a theory of the functions of firm and industry" and a "fundamental principle of economic organisation."

Paul Samuelson finds in Smith's pluralist use of supply and demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris paribus, holding all else equal, in a perfect competition, competitive market, the unit price for a ...

—as applied to wages, rents, and profit—a valid and valuable anticipation of the general equilibrium

In economics, general equilibrium theory attempts to explain the behavior of supply, demand, and prices in a whole economy with several or many interacting markets, by seeking to prove that the interaction of demand and supply will result in an o ...

modelling of Walras a century later. Moreover, Smith's allowance for wage increases in the short and intermediate term from capital accumulation and invention added a realism missed later by Malthus

Thomas Robert Malthus (; 13/14 February 1766 – 29 December 1834) was an English cleric, scholar and influential economist in the fields of political economy and demography.

In his 1798 book ''An Essay on the Principle of Population'', Mal ...

and Ricardo in their propounding a rigid subsistence-wage theory of labour supply.

In noting the last words of the ''Wealth of Nations'',

Ronald Coase suggests that if Smith's earlier proposal of granting colonies representation in the British parliament proportional to their contributions to public revenues had been followed, "there would have been no 1776, … America would now be ruling England, and we n Americawould be today celebrating Adam Smith not simply as the author of the ''Wealth of Nations'', but hailing him as a founding father."

Mark Blaug argues that it was Smith's achievement to shift the burden of proof against those maintaining that the pursuit of self-interest does not achieve social good. But he notes Smith's relevant attention to definite institutional arrangements and process as disciplining self-interest to widen the scope of the market, accumulate capital, and grow income.Mark Blaug (1997). ''Economic Theory in Retrospect'', 5th ed., in ch. 2, sect. 19, "Adam Smith as an Economist, pp59–62.

/ref> Economic anthropologist

David Graeber

David Rolfe Graeber (; February 12, 1961September 2, 2020) was an American anthropologist and anarchist activist. His influential work in economic anthropology, particularly his books '' Debt: The First 5,000 Years'' (2011) and ''Bullshit Job ...

argues that throughout antiquity one can identify many different systems of credit and later monetary exchange, drawing evidence for his argument from historical and also ethnographical records, that the traditional explanation for the origins of monetary economies from primitive bartering systems, as laid out by Adam Smith, does not find empirical support. The author argues that credit systems developed as means of account long before the advent of coinage around 600 BCE, and can still be seen operating in non-monetary economies. The idea of barter, on the other hand, seems only to apply to limited exchanges between societies that had infrequent contact and often in a context of ritualised warfare, rendering its conceptualisation among economists as a myth. As an alternative explanation for the creation of economic life, the author suggests that it originally related to social currencies, closely related to non-market quotidian interactions among a community and based on the "everyday communism" that is based on mutual expectations and responsibilities among individuals. This type of economy is, then, contrasted with the moral foundations of exchange based on formal equality and reciprocity (but not necessarily leading to market relations) and hierarchy, based on clear inequalities that tend to crystallise in customs and castes.

See also

* ''The Theory of Moral Sentiments

''The Theory of Moral Sentiments'' is a 1759 book by Adam Smith. It provided the ethical, philosophical, economic, and methodological underpinnings to Smith's later works, including '' The Wealth of Nations'' (1776), ''Essays on Philosophica ...

'' (1759), Adam Smith's other major work

* ''The National Gain

''The National Gain'' ( Swedish title: ''Den Nationnale Winsten'') is the main work of the Swedish-Finnish scientist, philosopher and politician Anders Chydenius, published in 1765. In this thesis Chydenius argues in favour of free export trade ...

'', a pamphlet by Finnish–Swedish economist and politician Anders Chydenius which preceded ''The Wealth of Nations'' and which had similar ideas.

References

Citations

Sources

* Smith, Adam. ''The Wealth of Nations: A Translation into Modern English'', Industrial Systems Research, 2015.The Wealth of Nations: A Translation into Modern English

* ''An Inquiry into the Nature and Causes of the Wealth of Nations: A Selected Edition'' Adam Smith (Author), Kathryn Sutherland (Editor), 2008, Oxford Paperbacks, Oxford. . *

External links

*''An Inquiry into the Nature and Causes of the Wealth of Nations''

at

Project Gutenberg

Project Gutenberg (PG) is a volunteer effort to digitize and archive cultural works, as well as to "encourage the creation and distribution of eBooks."

It was founded in 1971 by American writer Michael S. Hart and is the oldest digital libr ...

* Facsimile of the first edition, from the Internet Archive

The Internet Archive is an American digital library with the stated mission of "universal access to all knowledge". It provides free public access to collections of digitized materials, including websites, software applications/games, music, ...

Vol. I

''The Wealth of Nations''

at LibriVox (public domain audiobooks)

''Glossary: Adam Smith's the Wealth of Nations''

{{DEFAULTSORT:Wealth of Nations, The 1776 books 1776 in economics 1776 in Scotland Books about capitalism Books about wealth distribution Books by Adam Smith Classical liberalism Classical economics books History books about civilization Political philosophy literature Economics books