|

Taxation In Albania

In Albania, taxes are levied by both national and local governments. Most important revenue sources, include the income tax, social security, corporate tax and the value added tax, which are all applied on the national level. The Albanian Taxation Office is the revenue service of Albania Albania ( ; sq, Shqipëri or ), or , also or . officially the Republic of Albania ( sq, Republika e Shqipërisë), is a country in Southeastern Europe. It is located on the Adriatic and Ionian Seas within the Mediterranean Sea and shares .... , income tax is progressive, with three brackets. Earlier, Albania had a flat tax of 10%, which was implemented in 2008. Value-Added Tax is levied at two different rates of 20% as standard rate, and 10% on medicinal products. Social security and health insurance contributions are paid on employment, civil and management income. Contributions is paid on a monthly income, from a minimum of 22,000 to a maximum amount of 95,130. The employees c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Albania

Albania ( ; sq, Shqipëri or ), or , also or . officially the Republic of Albania ( sq, Republika e Shqipërisë), is a country in Southeastern Europe. It is located on the Adriatic and Ionian Seas within the Mediterranean Sea and shares land borders with Montenegro to the northwest, Kosovo to the northeast, North Macedonia to the east and Greece to the south. Tirana is its capital and largest city, followed by Durrës, Vlorë, and Shkodër. Albania displays varied climatic, geological, hydrological, and morphological conditions, defined in an area of . It possesses significant diversity with the landscape ranging from the snow-capped mountains in the Albanian Alps as well as the Korab, Skanderbeg, Pindus and Ceraunian Mountains to the hot and sunny coasts of the Albanian Adriatic and Ionian Sea along the Mediterranean Sea. Albania has been inhabited by different civilisations over time, such as the Illyrians, Thracians, Greeks, Romans, Byzantines, Veneti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed (e.g. most pension systems), as opposed to ''social assistance'' programs which provide support on the basis of need alone (e.g. most disability benefits). The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury. More broadly, welfare may also encompass efforts to provide a basic level of well-being through free or subsidized ''social services'' such as healthcare, education, infrastructure, vocational training, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. A country's corporate tax may apply to: * corporations incorporated in the country, * corporations doing business in the country on income from that country, * foreign corporations who have a permanent establishment in the country, or * corporations deemed to be resident for tax purposes in the country. Company income subject to tax is often determined much like taxable income for individual taxpayers. Generally, the tax is imposed on net profits. In some jurisdictions, rules for taxing companies may differ significantly from rules for taxing individuals. Certain corporate acts or types of entities may be exempt from tax. The incidence of corpor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

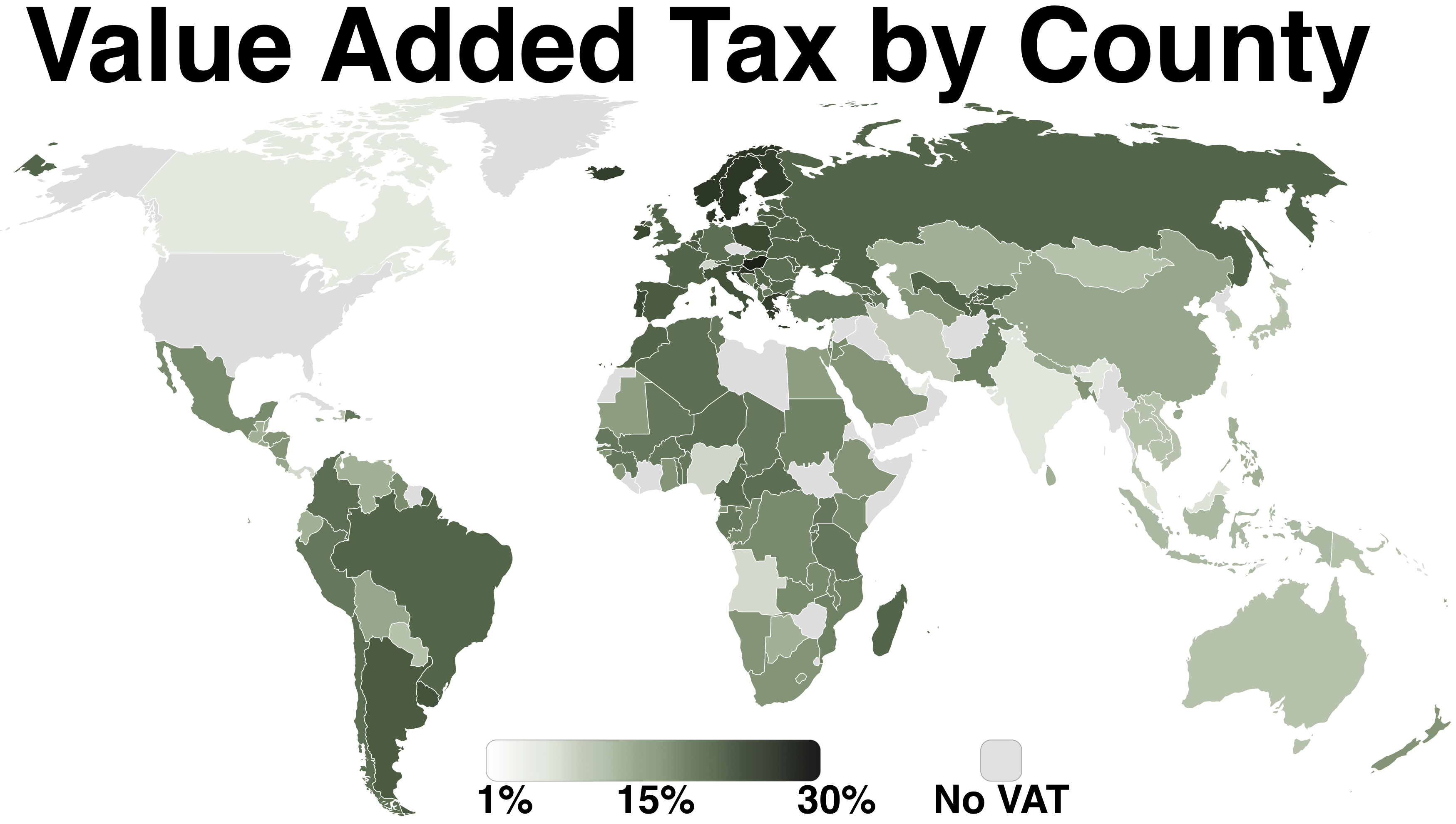

Value Added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Albanian Taxation Office

{{Albania-gov ...

The General Directorate of Taxation () is a revenue collection agency of the Albanian Government. Its mission is to collect tax revenues through simple and minimal cost procedures, uniformly applying tax legislation to finance the Albanian state budget. To achieve these goals, the Directorate assists taxpayers with high quality services so they can fulfill their own tax obligations under the applicable legislation. The administration is tasked to monitor, evaluate and penalize any conduct by the taxpayer who does not enforce or deliberately misappropriate the fulfillment of their legal obligations. See also *Taxation in Albania References Revenue services Financial system of Albania Directorate Taxation A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Progressive Tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases.Sommerfeld, Ray M., Silvia A. Madeo, Kenneth E. Anderson, Betty R. Jackson (1992), ''Concepts of Taxation'', Dryden Press: Fort Worth, TX The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate.Hyman, David M. (1990) ''Public Finance: A Contemporary Application of Theory to Policy'', 3rd, Dryden Press: Chicago, ILJames, Simon (1998) ''A Dictionary of Taxation'', Edgar Elgar Publishing Limited: Northampton, MA The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flat Tax

A flat tax (short for flat-rate tax) is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax. Implementations are often progressive due to exemptions, or regressive in case of a maximum taxable amount. There are various tax systems that are labeled "flat tax" even though they are significantly different. The defining characteristic is the existence of only one tax rate other than zero, as opposed to multiple non-zero rates that vary depending on the amount subject to taxation. A flat tax system is usually discussed in the context of an income tax, where progressivity is common, but it may also apply to taxes on consumption, property or transfers. Unlike progressive taxes, which include complex and numerous exceptions left to the tax collectors’ discretion, the flat tax is clear cut. In combination with the low rate, its simplicity considerably reduces the st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Politics Of Albania

Albania is a unitary parliamentary constitutional republic, where the President of Albania is the head of state and the Prime Minister of Albania the head of government in a multi-party system. The executive power is exercised by the Government and the Prime Minister with its Cabinet. Legislative power is vested in the Parliament of Albania. The judiciary is independent of the executive and the legislature. The political system of Albania is laid out in the 1998 constitution. The Parliament adopted the current constitution on 28 November 1998. Historically Albania has had many constitutions. Initially constituted as a monarchy in 1913, Albania became briefly a republic in 1925, and then a democratic monarchy in 1928. In 1939 Albania was invaded by Fascist Italian forces, imposing a puppet state, and later occupied by Nazi German forces. Following the partisan liberation from the Nazis in 1944 a provisional government was formed, which by 1946 had transformed into a Communis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)