|

Secondary Market

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of the security by the issuer to a purchaser, who pays proceeds to the issuer, is the primary market. All sales after the initial sale of the security are sales in the secondary market. Whereas the term primary market refers to the market for new issues of securities, and " market is primary if the proceeds of sales go to the issuer of the securities sold," the secondary market in contrast is the market created by the later trading of such securities. With primary issuances of securities or financial instruments (the primary market), often an underwriter purchases these securities directly from issuers, such as corporations issuing shares in an initial public offering (IPO) or private placement. Then the underwriter re-sells the securi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Financial Markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', that is, organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Bombay Stock Exchange (BSE) or Johannesburg Stock Exchange (JSE Limited)) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (mergers, spinoffs) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

New York Stock Exchange Facade 2015

New or NEW may refer to: Music * New, singer of K-pop group The Boyz * ''New'' (album), by Paul McCartney, 2013 ** "New" (Paul McCartney song), 2013 * ''New'' (EP), by Regurgitator, 1995 * "New" (Daya song), 2017 * "New" (No Doubt song), 1999 * "new", a song by Loona from the 2017 single album '' Yves'' * "The New", a song by Interpol from the 2002 album ''Turn On the Bright Lights'' Transportation * Lakefront Airport, New Orleans, U.S., IATA airport code NEW * Newcraighall railway station, Scotland, station code NEW Other uses * ''New'' (film), a 2004 Tamil movie * New (surname), an English family name * NEW (TV station), in Australia * new and delete (C++), in the computer programming language * Net economic welfare, a proposed macroeconomic indicator * Net explosive weight, also known as net explosive quantity * Network of enlightened Women, an American organization * Newar language, ISO 639-2/3 language code new * Next Entertainment World, a South Korean media com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Asset

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetaryThere are different methods of assessing the monetary value of the assets recorded on the Balance Sheet. In some cases, the ''Historical Cost'' is used; such that the value of the asset when it was bought in the past is used as the monetary value. In other instances, the present fair market value of the asset is used to determine the value shown on the balance sheet. value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business. ''Total assets'' can also be called the ''balance sheet total''. Assets can be grouped into two major classes: Tangible property, tangib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Used Goods

Used goods, also known as secondhand goods, are any item of personal property that have been previously owned by someone else and are offered for sale not as new, including metals in any form except coins that are legal tender. Used goods may also be handed down, especially among family or close friends, as a hand-me-down. Risks Furniture, especially bedding or upholstered items, may have Bed bug, bedbugs, if they have not been examined by an expert and some goods may be of poor quality. Benefits Recycling goods through the secondhand market reduces use of resources in manufacturing new goods and diminishes waste which must be disposed of, both of which are significant environmental benefits. Another benefit of recycling clothes is for the creation for new pieces of clothing from combining parts of recycled clothes to make a whole new piece. This has been done by multiple fashion designers recently and has been growing in recent years. However, manufacturers who profit from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is an American publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons, Virginia.Tysons Corner CDP, Virginia ". United States Census Bureau. Retrieved on May 7, 2009. The FHLMC was created in 1970 to expand the secondary market for Mortgage loan, mortgages in the US. Along with its sister organization, the Federal National Mortgage Association (Fannie Mae), Freddie Mac buys mortgages, pools them, and sells them as a mortgage-backed security (MBS) to private investors on the open market. This secondary mortgage market increases the supply of money available for mortgage lending and increases the money available for new home purcha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Fannie Mae

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal, the corporation's purpose is to expand the secondary mortgage market by securitization, securitizing mortgage loans in the form of mortgage-backed security, mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations (or "thrifts"). Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac. In 2024, with over $4.3 trillion in assets, Fannie Mae is the largest company in the United States and the fifth largest company in the world, by assets. Fannie Mae was ranked number 27 on the Fortune 500, ''Fortune'' 50 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Mortgage Bank

A mortgage bank is a bank that specializes in originating and/or servicing mortgage loans. In the United States, a mortgage bank is a state-licensed banking entity that makes mortgage loans directly to consumers. The difference between a mortgage banker and a mortgage broker is that the mortgage banker funds loans with its own capital. Generally, a mortgage bank originates a loan and places it on a pre-established warehouse line of credit until the loan can be sold to an investor, which are typically large institutions. The credit risk is typically absorbed by the Agencies, which include Fannie Mae, Freddie Mac, and Ginnie Mae. The process of selling a loan from the mortgage bank to another investor is referred to as selling the loan on the secondary market. This is in contrast to the primary market, which for mortgages typically refers to the bank buying the mortgage deed of trust from the homeowner for the face amount of the loan, adjusted for discount points and other price ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Broker-dealer

In financial services, a broker-dealer is a natural person, company or other organization that engages in the business of trading securities for its own account or on behalf of its customers. Broker-dealers are at the heart of the securities and derivatives trading process. Although many broker-dealers are "independent" firms solely involved in broker-dealer services, many others are business units or subsidiaries of commercial banks, investment banks or investment companies. When executing trade orders on behalf of a customer, the institution is said to be acting as a broker. When executing trades for its own account, the institution is said to be acting as a dealer. Securities bought from clients or other firms in the capacity of dealer may be sold to clients or other firms acting again in the capacity of dealer, or they may become a part of the firm's holdings. In addition to execution of securities transactions, broker-dealers are also the main sellers and distributors o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Over-the-counter (finance)

Over-the-counter (OTC) or off-exchange trading or pink sheet trading is done directly between two parties, without the supervision of an exchange. It is contrasted with exchange trading, which occurs via exchanges. A stock exchange has the benefit of facilitating liquidity, providing transparency, and maintaining the current market price. In an OTC trade, the price is not necessarily publicly disclosed. OTC trading, as well as exchange trading, occurs with commodities, financial instruments (including stocks), and derivatives of such products. Products traded on traditional stock exchanges, and other regulated bourse platforms, must be well standardized. This means that exchanged deliverables match a narrow range of quantity, quality, and identity which is defined by the exchange and identical to all transactions of that product. This is necessary for there to be transparency in stock exchange-based equities trading. The OTC market does not have this limitation. Parties may ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Structured Product

A structured product, also known as a market-linked investment, is a pre-packaged structured finance investment strategy based on a single security, a basket of securities, options, indices, commodities, debt issuance or foreign currencies, and to a lesser extent, derivatives. Structured products are not homogeneous — there are numerous varieties of derivatives and underlying assets — but they can be classified under the aside categories. Typically, a desk will employ a specialized " structurer" to design and manage its structured-product offering. Formal definitions U.S. Securities and Exchange Commission (SEC) Rule 434 (regarding certain prospectus deliveries) defines structured securities as "securities whose cash flow characteristics depend upon one or more indices or that have embedded forwards or options or securities where an investor's investment return and the issuer's payment obligations are contingent on, or highly sensitive to, changes in the value of under ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

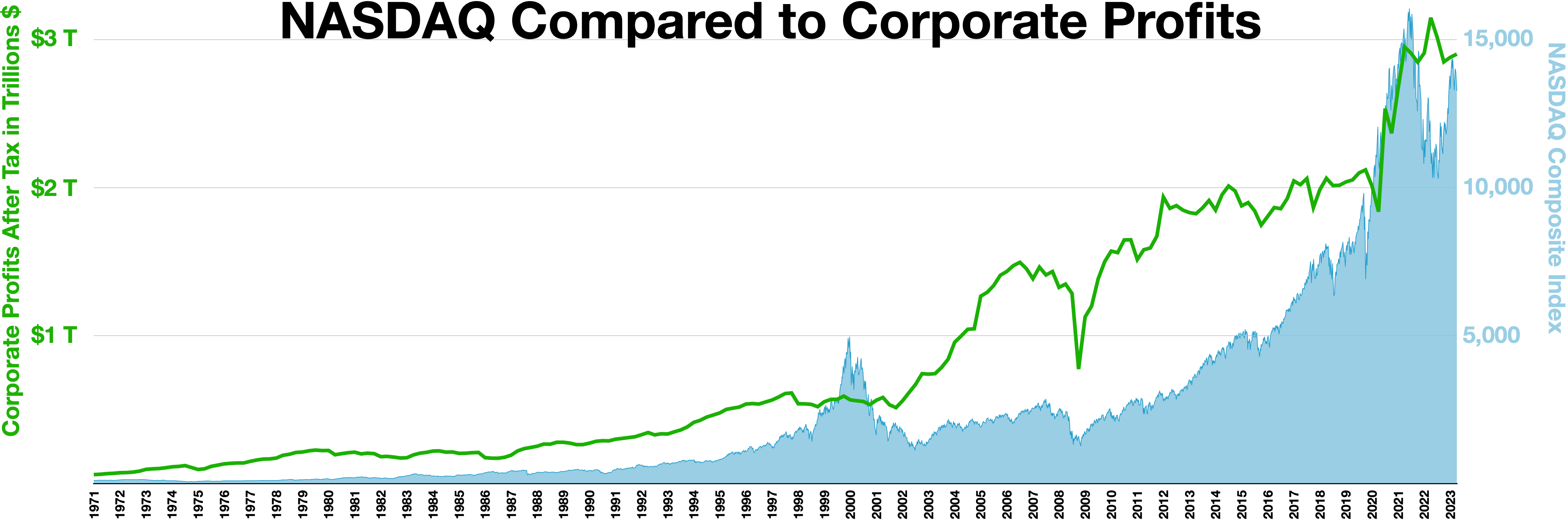

Nasdaq Stock Market

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory Au ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

London Stock Exchange

The London Stock Exchange (LSE) is a stock exchange based in London, England. the total market value of all companies trading on the LSE stood at US$3.42 trillion. Its current premises are situated in Paternoster Square close to St Paul's Cathedral. Since 2007, it has been part of the London Stock Exchange Group (LSEG, which the exchange also lists (ticker symbol LSEG)). Despite a post-Brexit exodus of stock listings from the LSE, it was the most valued stock exchange in Europe as of 2023. According to the 2020 Office for National Statistics report, approximately 12% of UK-resident individuals reported having investments in stocks and shares. According to a 2020 Financial Conduct Authority report, approximately 15% of British adults reported having investments in stocks and shares. History Coffee House The Royal Exchange, London, Royal Exchange had been founded by the English financier Thomas Gresham and Sir Richard Clough on the model of the The Belgian bourse of Antwerp, An ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |