|

Merger

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is a legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. A deal may be euphemistically called a ''merger of equals'' if both CEOs agree that joining together is in the best interest of both of their companies. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. In most countries, mergers and acquisitions must comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Antitrust Law

In the United States, antitrust law is a collection of mostly federal laws that regulate the conduct and organization of businesses to promote competition and prevent unjustified monopolies. The three main U.S. antitrust statutes are the Sherman Act of 1890, the Clayton Act of 1914, and the Federal Trade Commission Act of 1914. These acts serve three major functions. First, Section 1 of the Sherman Act prohibits price fixing and the operation of cartels, and prohibits other collusive practices that unreasonably restrain trade. Second, Section 7 of the Clayton Act restricts the mergers and acquisitions of organizations that may substantially lessen competition or tend to create a monopoly. Third, Section 2 of the Sherman Act prohibits monopolization. Federal antitrust laws provide for both civil and criminal enforcement. Civil antitrust enforcement occurs through lawsuits filed by the Federal Trade Commission, the United States Department of Justice Antitrust Division, and private ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competition Law

Competition law is the field of law that promotes or seeks to maintain market competition by regulating anti-competitive conduct by companies. Competition law is implemented through public and private enforcement. It is also known as antitrust law (or just antitrust), anti-monopoly law, and trade practices law. The history of competition law reaches back to the Roman Empire. The business practices of market traders, guilds and governments have always been subject to scrutiny, and sometimes severe sanctions. Since the 20th century, competition law has become global. The two largest and most influential systems of competition regulation are United States antitrust law and European Union competition law. National and regional competition authorities across the world have formed international support and enforcement networks. Modern competition law has historically evolved on a national level to promote and maintain fair competition in markets principally within the territorial boun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reverse Merger

A reverse takeover (RTO), reverse merger, or reverse IPO is the acquisition of a public company by a private company so that the private company can bypass the lengthy and complex process of going public. Sometimes, conversely, the public company is bought by the private company through an asset swap and share issue. The transaction typically requires reorganization of capitalization of the acquiring company. Process In a reverse takeover, shareholders of the private company purchase control of the public shell company/ SPAC and then merge it with the private company. The publicly traded corporation is called a "shell" since all that exists of the original company is its organizational structure. The private company shareholders receive a substantial majority of the shares of the public company and control of its board of directors. The transaction can be accomplished within weeks. The transaction involves the private and shell company exchanging information on each other, negot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reverse Takeover

A reverse takeover (RTO), reverse merger, or reverse IPO is the acquisition of a public company by a private company so that the private company can bypass the lengthy and complex process of going public. Sometimes, conversely, the public company is bought by the private company through an asset swap and share issue. The transaction typically requires reorganization of capitalization of the acquiring company. Process In a reverse takeover, shareholders of the private company purchase control of the public shell company/ SPAC and then merge it with the private company. The publicly traded corporation is called a "shell" since all that exists of the original company is its organizational structure. The private company shareholders receive a substantial majority of the shares of the public company and control of its board of directors. The transaction can be accomplished within weeks. The transaction involves the private and shell company exchanging information on each other, neg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hart–Scott–Rodino Antitrust Improvements Act

The Hart–Scott–Rodino Antitrust Improvements Act of 1976 (Public Law 94-435, known commonly as the HSR Act) is a set of amendments to the antitrust laws of the United States, principally the Clayton Antitrust Act. The HSR Act was signed into law by president Gerald R. Ford on September 30, 1976. The context in which the HSR Act is usually cited is , title II of the original law. The HSR Act is named after senators Philip A. Hart and Hugh D. Scott, Jr. and representative Peter W. Rodino. The HSR Act provides that parties must not complete certain mergers, acquisitions or transfers of securities or assets, including grants of executive compensation, until they have made a detailed filing with the U.S. Federal Trade Commission and Department of Justice and waited for those agencies to determine that the transaction will not adversely affect U.S. commerce under the antitrust laws. While parties can carry out due diligence and plan for post-merger integration, they may not take any ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clayton Antitrust Act Of 1914

The Clayton Antitrust Act of 1914 (, codified at , ), is a part of United States antitrust law with the goal of adding further substance to the U.S. antitrust law regime; the Clayton Act seeks to prevent anticompetitive practices in their incipiency. That regime started with the Sherman Antitrust Act of 1890, the first Federal law outlawing practices that were harmful to consumers (monopolies, cartels, and trusts). The Clayton Act specified particular prohibited conduct, the three-level enforcement scheme, the exemptions, and the remedial measures. Like the Sherman Act, much of the substance of the Clayton Act has been developed and animated by the U.S. courts, particularly the Supreme Court. Background Since the Sherman Antitrust Act of 1890, courts in the United States had interpreted the law on cartels as applying against trade unions. This had created a problem for workers, who needed to organize to balance the equal bargaining power against their employers. The Sherman Act ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Trade Commission

The Federal Trade Commission (FTC) is an independent agency of the United States government whose principal mission is the enforcement of civil (non-criminal) antitrust law and the promotion of consumer protection. The FTC shares jurisdiction over federal civil antitrust enforcement with the Department of Justice Antitrust Division. The agency is headquartered in the Federal Trade Commission Building in Washington, DC. The FTC was established in 1914 with the passage of the Federal Trade Commission Act, signed in response to the 19th-century monopolistic trust crisis. Since its inception, the FTC has enforced the provisions of the Clayton Act, a key antitrust statute, as well as the provisions of the FTC Act, et seq. Over time, the FTC has been delegated with the enforcement of additional business regulation statutes and has promulgated a number of regulations (codified in Title 16 of the Code of Federal Regulations). The broad statutory authority granted to the FTC provide ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demerger

A demerger is a form of corporate restructuring in which the entity's business operations are segregated into one or more components. It is the converse of a merger or acquisition. A demerger can take place through a spin-off by distributed or transferring the shares in a subsidiary holding the business to company shareholders carrying out the demerger. The demerger can also occur by transferring the relevant business to a new company or business to which then that company's shareholders are issued shares of. In contrast, divestment can also "undo" a merger or acquisition, but the assets are sold off rather than retained under a renamed corporate entity. Demergers can be undertaken for various business and non-business reasons, such as government intervention, by way of antitrust law, or through decartelization. See also * Equity carve-out *Successor company A successor company takes the business (products and services) of the previous companies with the goal to maintain th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Takeover

In business, a takeover is the purchase of one company (the ''target'') by another (the ''acquirer'' or ''bidder''). In the UK, the term refers to the acquisition of a public company whose shares are listed on a stock exchange, in contrast to the acquisition of a private company. Management of the target company may or may not agree with a proposed takeover, and this has resulted in the following takeover classifications: friendly, hostile, reverse or back-flip. Financing a takeover often involves loans or bond issues which may include junk bonds as well as a simple cash offers. It can also include shares in the new company. Types Friendly A ''friendly takeover'' is an acquisition which is approved by the management of the target company. Before a bidder makes an offer for another company, it usually first informs the company's board of directors. In an ideal world, if the board feels that accepting the offer serves the shareholders better than rejecting it, it recommend ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hostile Takeover

In business, a takeover is the purchase of one company (the ''target'') by another (the ''acquirer'' or ''bidder''). In the UK, the term refers to the acquisition of a public company whose shares are listed on a stock exchange, in contrast to the acquisition of a private company. Management of the target company may or may not agree with a proposed takeover, and this has resulted in the following takeover classifications: friendly, hostile, reverse or back-flip. Financing a takeover often involves loans or bond issues which may include junk bonds as well as a simple cash offers. It can also include shares in the new company. Types Friendly A ''friendly takeover'' is an acquisition which is approved by the management of the target company. Before a bidder makes an offer for another company, it usually first informs the company's board of directors. In an ideal world, if the board feels that accepting the offer serves the shareholders better than rejecting it, it recom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly

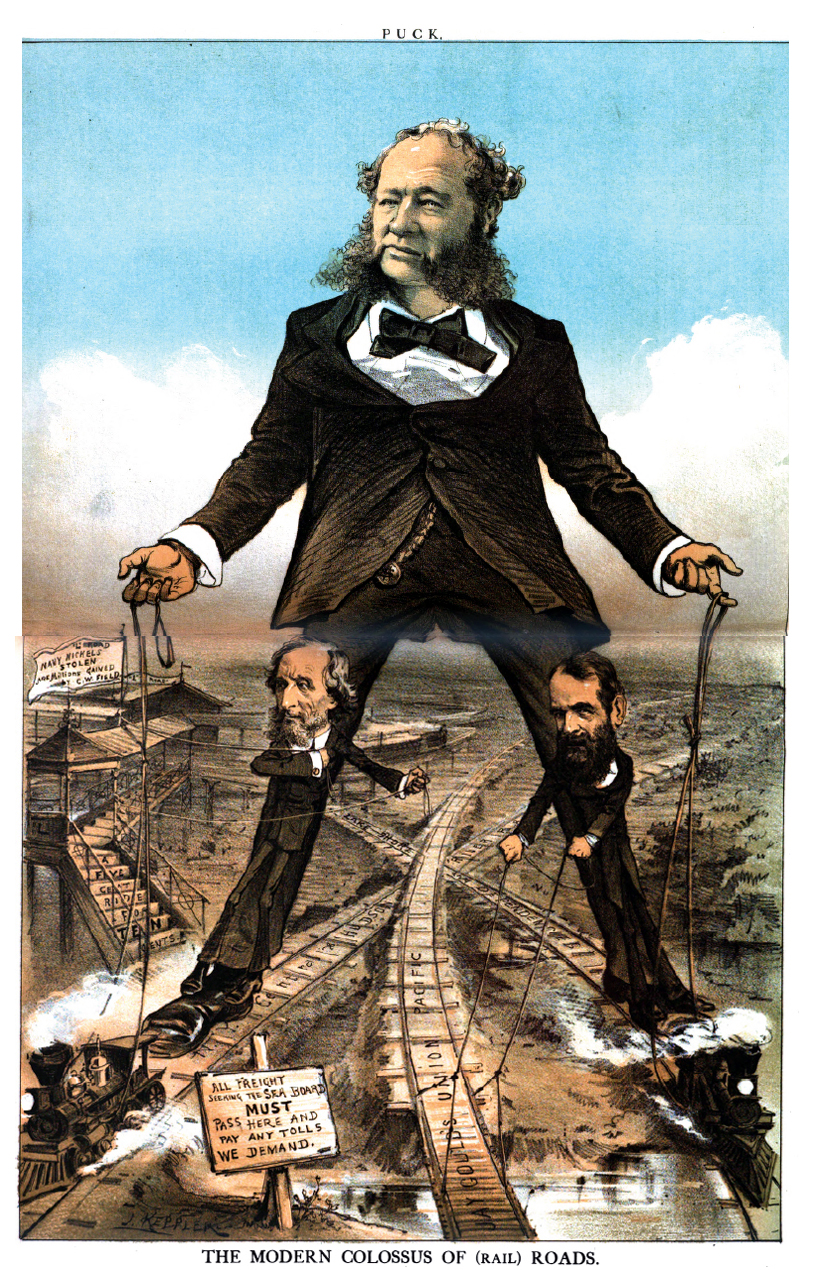

A monopoly (from Greek language, Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or company, enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a Market (economics), market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic Competition (economics), competition to produce the good (economics), good or Service (economics), service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb ''monopolise'' or ''monopolize'' refers to the ''process'' by which a company gains the ability to raise ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Spin-off

A corporate spin-off, also known as a spin-out, or starburst or hive-off, is a type of corporate action where a company "splits off" a section as a separate business or creates a second incarnation, even if the first is still active. Characteristics Spin-offs are divisions of companies or organizations that then become independent businesses with assets, employees, intellectual property, technology, or existing products that are taken from the parent company. Shareholders of the parent company receive equivalent shares in the new company in order to compensate for the loss of equity in the original stocks. However, shareholders may then buy and sell stocks from either company independently; this potentially makes investment in the companies more attractive, as potential share purchasers can invest narrowly in the portion of the business they think will have the most growth. In contrast, divestment can also sever one business from another, but the assets are sold off rather t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)