|

Internal Contradictions Of Capital Accumulation

The internal contradictions of capital accumulation is an essential concept of crisis theory, which is associated with Marxist economic theory. While the same phenomenon is described in neoclassical economic theory, in that literature it is referred to as systemic risk. The process of economic crises Economic geographer David Harvey argues that the multi-stage process of capital accumulation reveals a number of internal contradictions: *Step 1 – The power of labor is broken down and wages fall. This is referred to as "wage repression" or "wage deflation" and is accomplished by outsourcing and offshoring production. *Step 2 – Corporate profits—especially in the financial sector—increase, roughly in proportion to the degree to which wages fall in some sectors of the economy. *Step 3 – In order to maintain the growth of profits catalyzed by wage deflation, it is necessary to sell or "supply" the market with more goods. *Step 4 – However, increasing supply is increasingly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crisis Theory

Crisis theory, concerning the causes and consequences of the tendency for the rate of profit to fall in a capitalist system, is associated with Marxian critique of political economy, and was further popularised through Marxist economics. History Earlier analysis by Jean Charles Léonard de Sismondi provided the first suggestions of the systemic roots of Crisis. "The distinctive feature of Sismondi's analysis is that it is geared to an explicit dynamic model in the modern sense of this phrase ... Sismondi's great merit is that he used, systematically and explicitly, a schema of periods, that is, that he was the first to practice the particular method of dynamics that is called period analysis". Marx praised and built on Sismondi's theoretical insights. Rosa Luxemburg and Henryk Grossman both subsequently drew attention to both Sismondi's work on the nature of capitalism, and as a reference point for Karl Marx. Grossman in particular pointed out how Sismondi had contributed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accumulation By Dispossession

Accumulation by dispossession is a concept presented by the Marxist geographer David Harvey. It defines neoliberal capitalist policies that result in a centralization of wealth and power in the hands of a few by dispossessing the public and private entities of their wealth or land. Such policies are visible in many western nations from the 1970s and to the present day. Harvey argues these policies are guided mainly by four practices: privatization, financialization, management and manipulation of crises, and state redistributions. Practices Privatization Privatization and commodification of public assets have been among the most criticized and disputed aspects of neoliberalism. Summed up, they could be characterized by the process of transferring property from public ownership to private ownership. According to Marxist theory, this serves the interests of the capitalist class, or bourgeoisie, as it moves power from the nation's governments to private parties. At the same time, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taleb Distribution

In economics and finance, a Taleb distribution is the statistical profile of an investment which normally provides a payoff of small positive returns, while carrying a small but significant risk of catastrophic losses. The term was coined by journalist Martin Wolf and economist John Kay to describe investments with a "high probability of a modest gain and a low probability of huge losses in any period." The concept is named after Nassim Nicholas Taleb, based on ideas outlined in his book '' Fooled by Randomness''. According to Taleb in ''Silent Risk'', the term should be called "payoff" to reflect the importance of the payoff function of the underlying probability distribution, rather than the distribution itself. The term is meant to refer to an investment returns profile in which there is a high probability of a small gain, and a small probability of a very large loss, which more than outweighs the gains. In these situations the expected value is very much less than zero, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Systemic Risk

In finance, systemic risk is the risk of collapse of an entire financial system or entire market, as opposed to the risk associated with any one individual entity, group or component of a system, that can be contained therein without harming the entire system.Banking and currency crises and systemic risk George G. Kaufman (World Bank), It can be defined as "financial ''system'' instability, potentially catastrophic, caused or exacerbated by idiosyncratic events or conditions in financial intermediaries". It refers to the risks imposed by ''interlinkage ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Modeling

Financial risk modeling is the use of formal mathematical and econometric techniques to measure, monitor and control the market risk, credit risk, and operational risk on a firm's balance sheet, on a bank's trading book, or re a fund manager's portfolio value; see Financial risk management. Risk modeling is one of many subtasks within the broader area of financial modeling. Application Risk modeling uses a variety of techniques including market risk, value at risk (VaR), historical simulation (HS), or extreme value theory (EVT) in order to analyze a portfolio and make forecasts of the likely losses that would be incurred for a variety of risks. As above, such risks are typically grouped into credit risk, market risk, model risk, liquidity risk, and operational risk categories. Many large financial intermediary firms use risk modeling to help portfolio managers assess the amount of capital reserves to maintain, and to help guide their purchases and sales of various clas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Primitive Accumulation Of Capital

In Marxian economics and preceding theories,Perelman, p. 25 (ch. 2) the problem of primitive accumulation (also called previous accumulation, original accumulation) of capital concerns the origin of capital, and therefore of how class distinctions between possessors and non-possessors came to be. Adam Smith's account of primitive-original accumulation depicted a peaceful process, in which some workers laboured more diligently than others and gradually built up wealth, eventually leaving the less diligent workers to accept living wages for their labour. Karl Marx rejected this account as "childish" for its omission of the role of violence, war, enslavement and colonialism in the historical accumulation of land and wealth. Marxist scholar David Harvey explains Marx's primitive accumulation as a process which principally "entailed taking land, say, enclosing it, and expelling a resident population to create a landless proletariat, and then releasing the land into the privatised mai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moral Hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. For example, when a corporation is insured, it may take on higher risk knowing that its insurance will pay the associated costs. A moral hazard may occur where the actions of the risk-taking party change to the detriment of the cost-bearing party after a financial transaction has taken place. Moral hazard can occur under a type of information asymmetry where the risk-taking party to a transaction knows more about its intentions than the party paying the consequences of the risk and has a tendency or incentive to take on too much risk from the perspective of the party with less information. One example is a principal–agent problem, where one party, called an agent, acts on behalf of another party, called the principal. If the agent has more information about his or her actions or intentions than the princi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Economics

Monetary economics is the branch of economics that studies the different competing theories of money: it provides a framework for analyzing money and considers its functions (such as medium of exchange, store of value and unit of account), and it considers how money can gain acceptance purely because of its convenience as a public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects. Modern analysis has attempted to provide microfoundations for the demand for money and to distinguish valid nominal and real monetary relationships for micro or macro uses, including their influence on the aggregate demand for output. Its methods include deriving and testing the implications of money as a substitute for other assets and as based on explicit frictions. History The foundationa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modern Portfolio Theory

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of diversification in investing, the idea that owning different kinds of financial assets is less risky than owning only one type. Its key insight is that an asset's risk and return should not be assessed by itself, but by how it contributes to a portfolio's overall risk and return. It uses the variance of asset prices as a proxy for risk. Economist Harry Markowitz introduced MPT in a 1952 essay, for which he was later awarded a Nobel Memorial Prize in Economic Sciences; see Markowitz model. Mathematical model Risk and expected return MPT assumes that investors are risk averse, meaning that given two portfolios that offer the same expected return, investors will prefer the less risky one. Thus, an investor will take on increased risk only if compen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroprudential Policy

Macroprudential regulation is the approach to financial regulation that aims to mitigate risk to the financial system as a whole (or " systemic risk"). In the aftermath of the late-2000s financial crisis, there is a growing consensus among policymakers and economic researchers about the need to re-orient the regulatory framework towards a macroprudential perspective. History As documented by Clement (2010), the term "macroprudential" was first used in the late 1970s in unpublished documents of the Cooke Committee (the precursor of the Basel Committee on Banking Supervision) and the Bank of England. But only in the early 2000s—after two decades of recurrent financial crises in industrial and, most often, emerging market countries—did the macroprudential approach to the regulatory and supervisory framework become increasingly promoted, especially by authorities of the Bank for International Settlements. A wider agreement on its relevance has been reached as a result of the l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

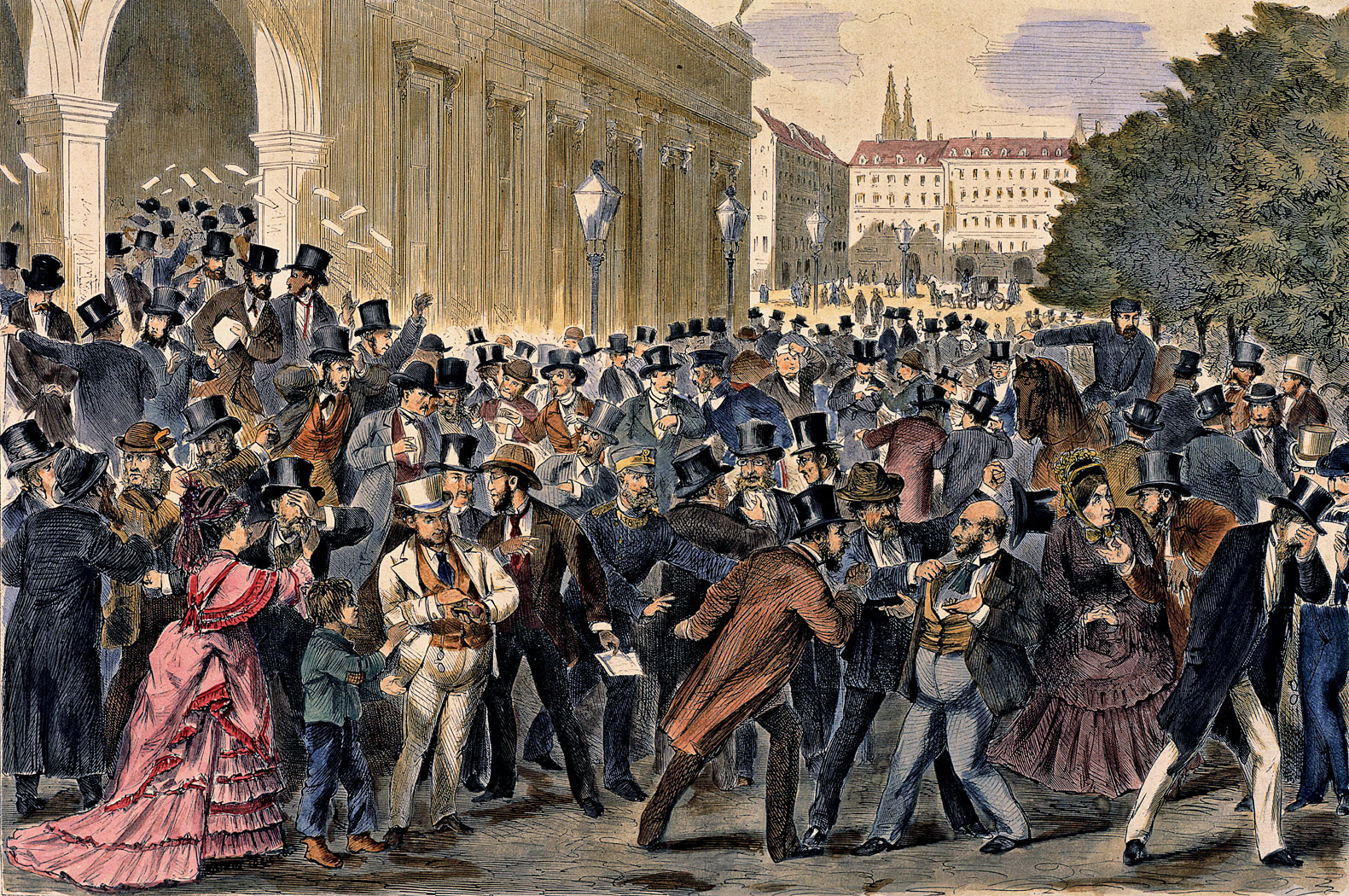

Financial Crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (e.g. the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is no consensus, however, and financial crises continue to occur from time to time. Types Banking crisis When a bank suffers a sudden rush of withdrawals by depositors, this is called a ''bank run''. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |