|

Fiscal Imbalance In Australia

The fiscal imbalance in Australia is the disparity between the revenue generation ability of the three levels of governments in Australia relative to their spending obligations; but in Australia the term is commonly used to refer more specifically to the vertical fiscal imbalance, the discrepancy between the federal government's extensive capacity to raise revenue and the responsibility of the States to provide most public services, such as physical infrastructure, health care, education etc., despite having only limited capacity to raise their own revenue. In Australia, vertical fiscal imbalance is addressed by the transfer of funds as grants from the federal government to the states and territories. Vertical fiscal imbalance Vertical fiscal imbalance in Australia is largely the product of the Commonwealth's takeover of income taxes in 1942, during World War II, and rulings of the High Court of Australia that made various state taxes unconstitutional under the Australian Co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australia

Australia, officially the Commonwealth of Australia, is a Sovereign state, sovereign country comprising the mainland of the Australia (continent), Australian continent, the island of Tasmania, and numerous List of islands of Australia, smaller islands. With an area of , Australia is the largest country by area in Oceania and the world's List of countries and dependencies by area, sixth-largest country. Australia is the oldest, flattest, and driest inhabited continent, with the least fertile soils. It is a Megadiverse countries, megadiverse country, and its size gives it a wide variety of landscapes and climates, with Deserts of Australia, deserts in the centre, tropical Forests of Australia, rainforests in the north-east, and List of mountains in Australia, mountain ranges in the south-east. The ancestors of Aboriginal Australians began arriving from south east Asia approximately Early human migrations#Nearby Oceania, 65,000 years ago, during the Last Glacial Period, last i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Horizontal Fiscal Equalisation

Equalization payments are cash payments made in some federal systems of government from the federal government to subnational governments with the objective of offsetting differences in available revenue or in the cost of providing services. Many federations use fiscal equalisation to reduce the inequalities in the fiscal capacities of sub-national governments arising from the differences in their geography, demography, natural endowments and economies. The level of equalisation sought can vary, however. The payments are generally calculated based on the magnitude of the subnational "fiscal gap": essentially the difference between fiscal need and fiscal capacity. Fiscal capacity and fiscal need are not equivalent to measures of fiscal revenue and expenditure, as making them so would induce perverse incentives to subnational governments to reduce fiscal effort. Australia Australia introduced a formal system of horizontal fiscal equalisation (HFE) in 1933 to compensate states/terri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of Australia

Australia is a highly developed country with a mixed-market economy. As of 2022, Australia was the 14th-largest national economy by nominal GDP (Gross Domestic Product), the 20th-largest by PPP-adjusted GDP, and was the 22nd-largest goods exporter and 24th-largest goods importer. Australia took the record for the longest run of uninterrupted GDP growth in the developed world with the March 2017 financial quarter. It was the 103rd quarter and the 26th year since the country had a technical recession (two consecutive quarters of negative growth). As of June 2021, the country's GDP was estimated at 1.98 trillion. The Australian economy is dominated by its service sector, which in 2017 comprised 62.7% of the GDP and employed 78.8% of the labour force. At the height of the mining boom in 2009–10, the total value-added of the mining industry was 8.4% of GDP. Despite the recent decline in the mining sector, the Australian economy had remained resilient and stable and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federalism In Australia

Federalism was adopted, as a constitutional principle, in Australia on 1 January 1901 – the date upon which the six self-governing Australian Colonies of New South Wales, Queensland, South Australia, Tasmania, Victoria, and Western Australia federated, formally constituting the Commonwealth of Australia. It remains a federation of those six "original States" under the Constitution of Australia. Australia is the sixth oldest surviving federation in the world after the United States (1789), Mexico (1824), Switzerland (1848), Canada (1867), and Brazil (1891). Relatively few changes have been made in terms of the formal (written) constitution since Australian federation occurred; in practice, however, the way the federal system functions has changed enormously. The most significant respect in which it has changed is in the degree to which the Commonwealth government has assumed a position of dominance. Federation Instigated by Henry Parkes' Tenterfield Oration of 24 October 1889 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australian Federal Budget

An Australian federal budget is a document that sets out the estimated revenues and expenditures of the Australian Treasury in the following financial year, proposed conduct of Australian government operations in that period, and its fiscal policy for the forward years. Budgets are called by the year in which they are presented to Parliament and relate to a financial year that commences on the following 1 July and ends on 30 June of the following year, so that the budget brought down in May relates to the / financial year (1 July – 30 June , FY). Revenue estimates detailed in the budget are raised through the Australian taxation system, with government spending (including transfers to the states) representing a sizeable proportion of the overall economy. Besides presenting the government's expected revenues and expenditures, the federal budget is also a political statement of the government's intentions and priorities, and has profound m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

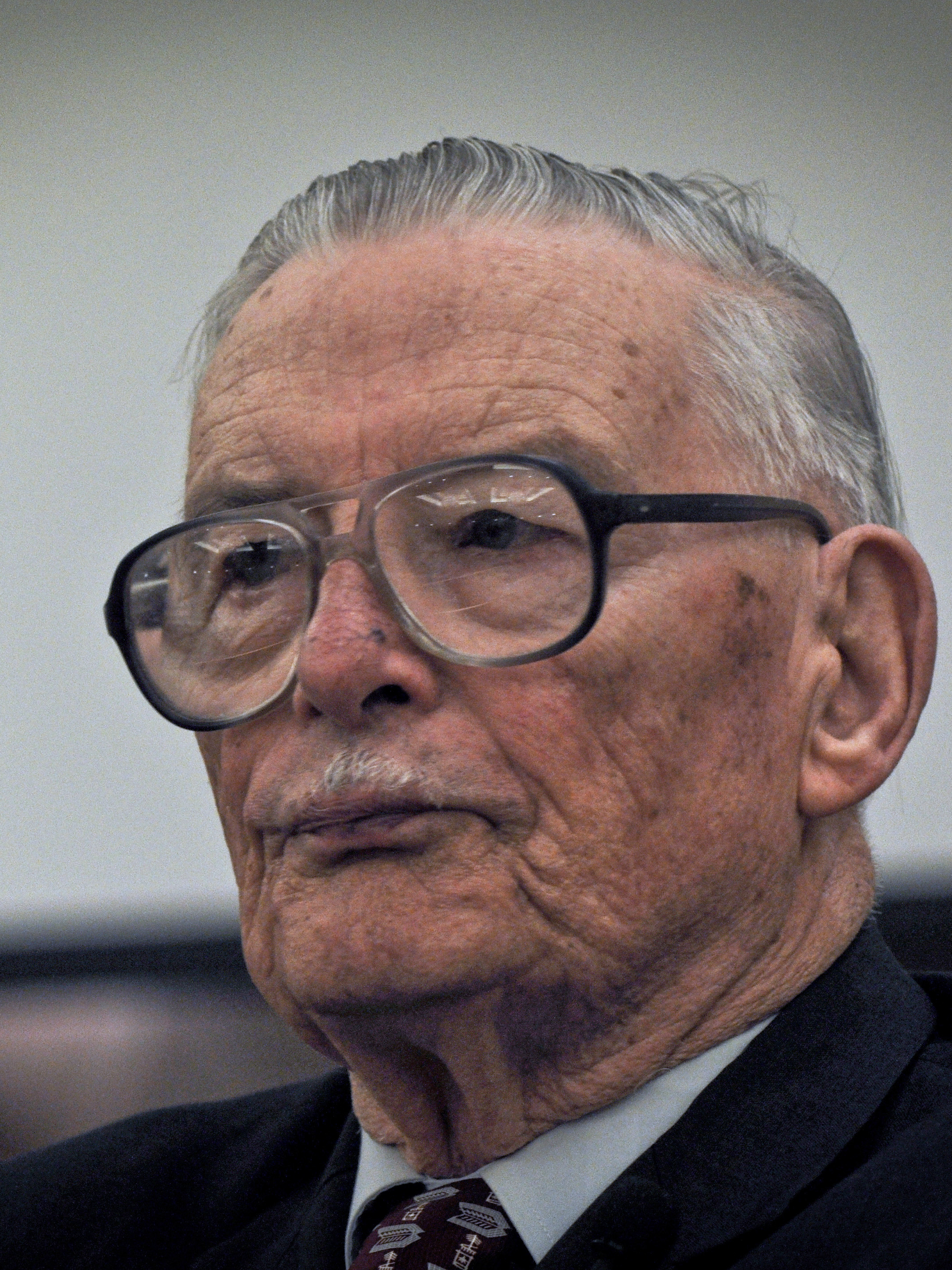

Constitutional Economics

Constitutional economics is a research program in economics and constitutionalism that has been described as explaining the choice "of alternative sets of legal-institutional-constitutional rules that constrain the choices and activities of economic and political agents". This extends beyond the definition of "the economic analysis of constitutional law" and is distinct from explaining the choices of economic and political agents within those rules, a subject of orthodox economics. Instead, constitutional economics takes into account the impacts of political economic decisions as opposed to limiting its analysis to economic relationships as functions of the dynamics of distribution of marketable goods and services. Constitutional economics was pioneered by the work of James M. Buchanan. He argued that "The political economist who seeks to offer normative advice, must, of necessity, concentrate on the process or structure within which political decisions are observed to be made. Ex ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Constitutional Basis Of Taxation In Australia

The constitutional basis of taxation in Australia is predominantly found in sections 51(ii), Legislative powers of the Parliament. 90, Exclusive power over customs, excise, and bounties. 53, Powers of the Houses in respect of legislation. 55, Tax Bill. and 96, of the Constitution of Australia. Their interpretation by the High Court of Australia has been integral to the functioning and evolution of federalism in Australia. The constitutional scheme as well as judicial interpretations have created a vertical fiscal imbalance, whereby the Commonwealth has the revenue-raising abilities while the States have major spending responsibilities. For example, primarily, Australian states fund schools and hospitals. The result of the limitations on state taxing power is that the Commonwealth collects the money through taxes, and distributes that money to states. The power to distribute funds to states, on conditions, is contained in section 96. Financial assistance to States. As a result, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Council Of Australian Governments

The Council of Australian Governments (COAG) was the primary intergovernmental forum in Australia from 1992 to 2020. Comprising the federal government, the governments of the six states and two mainland territories and the Australian Local Government Association, it managed governmental relations within Australia's federal system within the scope of matters of national importance. On 29 May 2020, Prime Minister Scott Morrison announced that COAG would be replaced by a new structure based on the National Cabinet implemented during the COVID-19 pandemic. History COAG grew out of the Premiers' Conferences, which had been held for many decades. These were limited to the premiers of the six states and the Prime Minister. A related organisation is the Loan Council, which coordinates borrowing by the federal and state and territorial governments of Australia. COAG was established in May 1992 after agreement by the then Prime Minister (Paul Keating), premiers and chief minist ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canada Pension Plan

The Canada Pension Plan (CPP; french: Régime de pensions du Canada) is a contributory, earnings-related social insurance program. It forms one of the two major components of Canada's public retirement income system, the other component being Old Age Security (OAS). Other parts of Canada's retirement system are private pensions, either employer-sponsored or from tax-deferred individual savings (known in Canada as a Registered Retirement Savings Plan). As of Jun 30, 2022, the CPP Investment Board manages over C$523 billion in investment assets for the Canada Pension Plan on behalf of 20 million Canadians. CPPIB is one of the world's biggest pension funds. Description The CPP mandates all employed Canadians who are 18 years of age and over to contribute a prescribed portion of their earnings income to a federally administered pension plan. The plan is administered by Employment and Social Development Canada on behalf of employees in all provinces and territories except Quebec, w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equalization Payments

Equalization payments are cash payments made in some federal systems of government from the federal government to subnational governments with the objective of offsetting differences in available revenue or in the cost of providing services. Many federations use fiscal equalisation to reduce the inequalities in the fiscal capacities of sub-national governments arising from the differences in their geography, demography, natural endowments and economies. The level of equalisation sought can vary, however. The payments are generally calculated based on the magnitude of the subnational "fiscal gap": essentially the difference between fiscal need and fiscal capacity. Fiscal capacity and fiscal need are not equivalent to measures of fiscal revenue and expenditure, as making them so would induce perverse incentives to subnational governments to reduce fiscal effort. Australia Australia introduced a formal system of horizontal fiscal equalisation (HFE) in 1933 to compensate states/terri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Imbalance

Fiscal imbalance is a mismatch in the revenue powers and expenditure responsibilities of a government. In the literature on fiscal federalism, two types of fiscal imbalances are measured: Vertical Fiscal Imbalance and Horizontal Fiscal Imbalance. When the fiscal imbalance is measured between the two levels of government (Center and States or Provinces) it is called Vertical Fiscal Imbalance. When the fiscal imbalance is measured between the governments at the same level it is called Horizontal Fiscal imbalance. This imbalance is also known as regional disparity. While Horizontal Fiscal Imbalance requires equalization transfers, Vertical Fiscal Imbalance is a structural issue and thus needs to be corrected by reassignment of revenue and expenditure responsibilities between the two senior order of the governments. Horizontal Fiscal Imbalances as Differences in Net Fiscal Benefits A horizontal fiscal imbalance (HFI) emerges when sub-national governments have different abilities to r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Section 61 Of The Constitution Of Australia

Chapter II of the Constitution of Australia establishes the executive branch of the Government of Australia. It provides for the exercise of executive power by the Governor-General advised by a Federal Executive Council. Sections Section 61: Executive power Section 61 vests the executive power of the Commonwealth in the monarch of Australia, and establishes the Governor-General as being able to exercise this power on behalf of the monarch as their representative. In practice, the Governor-General only exercises this power on the advice of the Federal Executive Council which he or she presides over. Section 62: Federal Executive Council Section 62 establishes the Federal Executive Council which advises the Governor-General. In practice the Governor-General is bound by convention to follow this advice, and although he or she is described as having the power to choose the members of the Federal Executive Council, generally all parliamentarians who are appointed a ministerial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |