|

GDP Real Growth.svg

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is often revised before being considered a reliable indicator. GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation rates of the countries; therefore, using a basis of GDP per capita at purchasing power parity (PPP) may be more useful when comparing living standards between nations, while nominal GDP is more useful comparing national economies on the international market. Total GDP can also be broken down into the contribution of each industry or sector of the economy. The ratio of GDP to the total population of the region is the per capita GDP (also called the Mean Standard of Living). GDP definitions are maintained by a number of national and international economic organizations. The Organisa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Countries By GDP (Nominal) In 2014

List of countries by Gross domestic product, GDP (gross domestic product) may refer to: *List of countries by GDP (nominal), a list using the current exchange rates for national currencies **List of countries by GDP (nominal) per capita *List of countries by GDP (PPP), a list using the concept of purchasing power parity to derive GDP estimates **List of countries by GDP (PPP) per capita *List of countries by real GDP growth rate See also *List of countries by past and projected GDP (nominal) (IMF data: 1980–2027) *List of countries by past and projected GDP (PPP) (IMF data: 1980–2027) *List of countries by past and projected GDP (nominal) per capita (IMF data: 1980–2027) *List of countries by past and projected GDP (PPP) per capita (IMF data: 1980–2027) *List of IMF ranked countries by GDP, IMF ranked GDP (nominal), GDP (nominal) per capita, GDP (PPP), GDP (PPP) per capita, Population, and PPP (data not current) *List of regions by past GDP (PPP) per capita *List of re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Externality

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced goods involved in either consumer or producer market transactions. Air pollution from motor vehicles is one example. The cost of air pollution to society is not paid by either the producers or users of motorized transport to the rest of society. Water pollution from mills and factories is another example. All consumers are all made worse off by pollution but are not compensated by the market for this damage. A positive externality is when an individual's consumption in a market increases the well-being of others, but the individual does not charge the third party for the benefit. The third party is essentially getting a free product. An example of this might be the apartment above a bakery receiving the benefit of enjoyment from smelling fresh pastries every mornin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Congress

The United States Congress is the legislature of the federal government of the United States. It is bicameral, composed of a lower body, the House of Representatives, and an upper body, the Senate. It meets in the U.S. Capitol in Washington, D.C. Senators and representatives are chosen through direct election, though vacancies in the Senate may be filled by a governor's appointment. Congress has 535 voting members: 100 senators and 435 representatives. The U.S. vice president has a vote in the Senate only when senators are evenly divided. The House of Representatives has six non-voting members. The sitting of a Congress is for a two-year term, at present, beginning every other January. Elections are held every even-numbered year on Election Day. The members of the House of Representatives are elected for the two-year term of a Congress. The Reapportionment Act of 1929 establishes that there be 435 representatives and the Uniform Congressional Redistricting Act requires ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Simon Kuznets

Simon Smith Kuznets (; rus, Семён Абра́мович Кузне́ц, p=sʲɪˈmʲɵn ɐˈbraməvʲɪtɕ kʊzʲˈnʲɛts; April 30, 1901 – July 8, 1985) was an American economist and statistician who received the 1971 Nobel Memorial Prize in Economic Sciences "for his empirically founded interpretation of economic growth which has led to new and deepened insight into the economic and social structure and process of development." Kuznets made a decisive contribution to the transformation of economics into an empirical science and to the formation of quantitative economic history. Biography Early life Simon Kuznets was born in Pinsk in 1901, in the Russian Empire, or what is today Belarus, to Lithuanian-Jewish parents. He completed his schooling, first at the Rivne, then, Kharkiv Realschule of present-day Ukraine. In 1918, Kuznets entered the Kharkiv Institute of Commerce where he studied economic sciences, statistics, history and mathematics under the guidance of prof ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Charles Davenant

Charles Davenant (1656–1714) was an English mercantilist economist, politician, and pamphleteer. He was Tory member of Parliament for St Ives (Cornwall), and for Great Bedwyn. Life He was born in London as the eldest son of Sir William Davenant, the poet. He was educated at Cheam grammar school and Balliol College, Oxford, but left the university without taking a degree. He became manager of his father's theatre. Having taken the degree of LL.D., he became a member of Doctors' Commons. In 1678 Davenant was appointed Commissioner of the Excise, earning £500 per year (); taxes were collected using the "farming system". In 1683 when Britain ended the tax farming system, Davenant received £1000 per year as Commissioner. In 1685 he was elected to Parliament as M.P. for St Ives. However, the revolution of 1688 saw James II exiled to France and William of Orange installed as king by Parliament. In 1689 Davenant lost his position as Commissioner of the Excise, and his loan to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Anglo-Dutch Wars

The Anglo–Dutch Wars ( nl, Engels–Nederlandse Oorlogen) were a series of conflicts mainly fought between the Dutch Republic and England (later Great Britain) from mid-17th to late 18th century. The first three wars occurred in the second half of the 17th century over trade and overseas colonies, while the fourth was fought a century later. Almost all the battles were naval engagements. The English were successful in the first, while the Dutch were successful in the second and third clashes. However, by the time of the fourth war, the British Royal Navy had become the most powerful maritime force in the world. There would be more battles in the late 18th and early 19th centuries, mainly won by the British, but these are generally considered to be separate conflicts. Background The English and the Dutch were both participants in the 16th-century European religious conflicts between the Catholic Habsburg Dynasty and the opposing Protestant states. At the same time, as t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

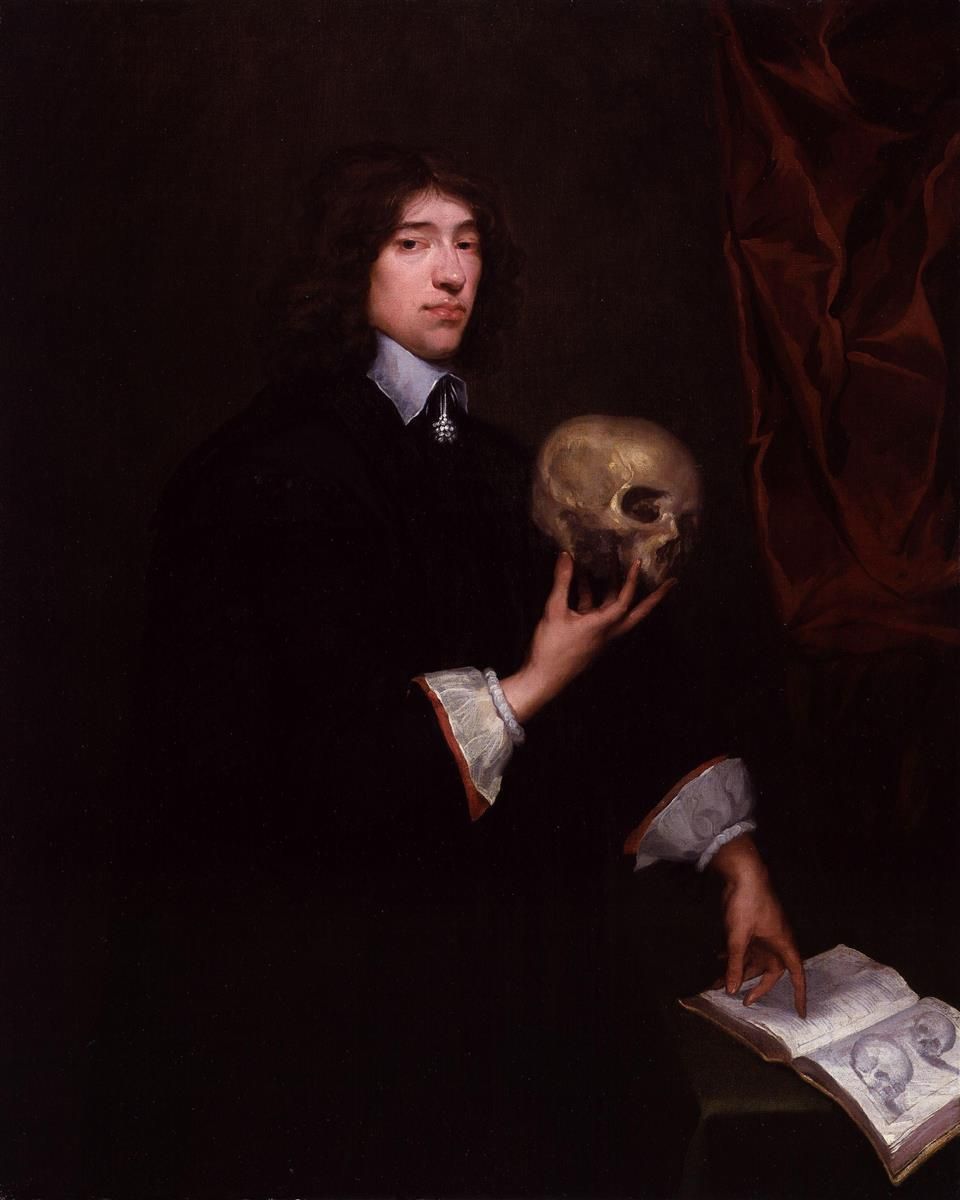

William Petty

Sir William Petty FRS (26 May 1623 – 16 December 1687) was an English economist, physician, scientist and philosopher. He first became prominent serving Oliver Cromwell and the Commonwealth in Ireland. He developed efficient methods to survey the land that was to be confiscated and given to Cromwell's soldiers. He also remained a significant figure under King Charles II and King James II, as did many others who had served Cromwell. Petty was also a scientist, inventor, and merchant, a charter member of the Royal Society, and briefly a Member of the Parliament of England. However, he is best remembered for his theories on economics and his methods of ''political arithmetic''. He is attributed with originating the laissez-faire economic philosophy. He was knighted in 1661. He was the great-grandfather of the 1st Marquess of Lansdowne (better known to history as the 2nd Earl of Shelburne), who served as Prime Minister of Great Britain, 1782–1783. Life Early life Petty ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quarterly Gross Domestic Product

A magazine is a periodical publication, generally published on a regular schedule (often weekly or monthly), containing a variety of content. They are generally financed by advertising, purchase price, prepaid subscriptions, or by a combination of the three. Definition In the technical sense a ''journal'' has continuous pagination throughout a volume. Thus ''Business Week'', which starts each issue anew with page one, is a magazine, but the '' Journal of Business Communication'', which continues the same sequence of pagination throughout the coterminous year, is a journal. Some professional or trade publications are also peer-reviewed, for example the '' Journal of Accountancy''. Non-peer-reviewed academic or professional publications are generally ''professional magazines''. That a publication calls itself a ''journal'' does not make it a journal in the technical sense; ''The Wall Street Journal'' is actually a newspaper. Etymology The word "magazine" derives from Arabic , th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Well-being

Well-being, or wellbeing, also known as wellness, prudential value or quality of life, refers to what is intrinsically valuable relative ''to'' someone. So the well-being of a person is what is ultimately good ''for'' this person, what is in the self-interest of this person. Well-being can refer to both positive and negative well-being. In its positive sense, it is sometimes contrasted with ill-being as its opposite. The term "subjective well-being" denotes how people experience and evaluate their lives, usually measured in relation to self-reported well-being obtained through questionnaires. Overview Sometimes different types of well-being are distinguished, such as mental well-being, physical well-being, economic well-being or emotional well-being. The different forms of well-being are often closely interlinked. For example, improved physical well-being (e.g., by reducing or ceasing an addiction) is associated with improved emotional well-being. As for another example, better ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Human Development (economics)

Human development involves studies of the human condition with its core being the capability approach. The inequality adjusted Human Development Index is used as a way of measuring actual progress in human development by the United Nations. It is an alternative approach to a single focus on economic growth, and focused more on social justice, as a way of understanding progress The United Nations Development Programme defines human development as "the process of enlarging people's choices", said choices allowing them to "lead a long and healthy life, to be educated, to enjoy a decent standard of living", as well as "political freedom, other guaranteed human rights and various ingredients of self-respect". Thus, human development is about much more than economic growth, which is only a means of enlarging people's choices. Fundamental to enlarging these choices is building human capabilities—the range of things that people can do or be in life. Capabilities are "the substantive fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD Better Life Index

The OECD Better Life Index, created in May 2011 by the Organisation for Economic Co-operation and Development, is an initiative pioneering the development of economic indicators which better capture multiple dimensions of economic and social progress. The platform consists of a dashboard, that provides data and insights into key indicators - measuring areas such as wellbeing, environmental quality, quality of public services and security - alongside an interactive tool ''Your Better Life Index (BLI)'', which encourages citizens to create their own indexes by ranking each of the indicators according to the importance in their own lives. The index and tool were created as part of the OECD Better Life Initiative. This initiative began in 2011 in line with the recommendations of the Commission on the Measurement of Economic Performance and Social Progress, also known as the Stiglitz-Sen-Fitoussi Commission, whose recommendations sought to address concerns that standard macroeconomic sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Doughnut (economic Model)

The Doughnut, or Doughnut economics, is a visual framework for sustainable development – shaped like a doughnut or lifebelt – combining the concept of planetary boundaries with the complementary concept of social boundaries. The name derives from the shape of the diagram, i.e. a disc with a hole in the middle. The centre hole of the model depicts the proportion of people that lack access to life's essentials (healthcare, education, equity and so on) while the crust represents the ecological ceilings (planetary boundaries) that life depends on and must not be overshot. The diagram was developed by University of Oxford economist Kate Raworth in her 2012 Oxfam paper ''A Safe and Just Space for Humanity'' and elaborated upon in her 2017 book '' Doughnut Economics: Seven Ways to Think Like a 21st-Century Economist'' and paper. The framework was proposed to regard the performance of an economy by the extent to which the needs of people are met without overshooting Earth's ecolog ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)