|

Bailout

A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of bankruptcy. A bailout differs from the term ''bail-in'' (coined in 2010) under which the bondholders or depositors of global systemically important financial institutions (G-SIFIs) are forced to participate in the recapitalization process, but taxpayers are not. Some governments also have the power to participate in the insolvency process: for instance, the U.S. government intervened in the General Motors bailout of 2009–2013. A bailout can, but does not necessarily, avoid an insolvency process. The term ''bailout'' is maritime in origin and describes the act of removing water from a sinking vessel using a bucket. Overview A bailout could be done for profit motives, such as when a new investor resurrects a floundering company by buying its shares at firesale prices, or for social objectives, such as when, hypothetically speaking, a wealthy philanthropist reinven ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Troubled Asset Relief Program

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George Bush. It was a component of the government's measures in 2009 to address the subprime mortgage crisis. The TARP originally authorized expenditures of $700 billion. The Emergency Economic Stabilization Act of 2008 created the TARP. The Dodd–Frank Wall Street Reform and Consumer Protection Act, signed into law in 2010, reduced the amount authorized to $475 billion. By October 11, 2012, the Congressional Budget Office (CBO) stated that total disbursements would be $431 billion, and estimated the total cost, including grants for mortgage programs that have not yet been made, would be $24 billion. On December 19, 2014, the U.S. Treasury sold its remaining holdings of Ally Financial, essentially ending the program. Purpose TARP ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American International Group

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. , AIG companies employed 49,600 people.https://www.aig.com/content/dam/aig/america-canada/us/documents/investor-relations/2019/aig-2018-annual-report.pdf page 7 The company operates through three core businesses: General Insurance, Life & Retirement, and a standalone technology-enabled subsidiary. General Insurance includes Commercial, Personal Insurance, U.S. and International field operations. Life & Retirement includes Group Retirement, Individual Retirement, Life, and Institutional Markets. AIG is a sponsor of the AIG Women's Open golf tournament. AIG's corporate headquarters are in New York City and the company also has offices around the world. AIG serves 87% of the Fortune Global 500 and 83% of the Forbes 2000. AIG was ranked 60th on the 2018 Fortune 500 list. According to the 2016 Forbes Global 2000 list, A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Michael Noonan (Fine Gael Politician)

Michael Noonan (born 21 May 1943) is an Irish former Fine Gael politician who served as Minister for Finance from 2011 to 2017, Leader of the Opposition and Leader of Fine Gael from 2001 to 2002, Minister for Health from 1994 to 1997, Minister for Industry and Commerce from 1986 to 1987, Minister for Energy from January 1987 to March 1987 and Minister for Justice from 1982 to 1986. He served as a Teachta Dála (TD) from 1981 to 2020. Noonan had been a member of every Fine Gael cabinet since 1982, serving in the cabinets of Garret FitzGerald, John Bruton and Enda Kenny. During these terms of office he held the positions of Justice, Energy, Industry and Commerce, Health and Finance. When Fine Gael lost power after the 1997 general election, Noonan remained an important figure in the party when he became Opposition Spokesperson for Finance. He succeeded John Bruton as Leader of Fine Gael and Leader of the Opposition in 2001, however, he resigned following Fine Gael's disastrou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Too Big To Fail

"Too big to fail" (TBTF) and "too big to jail" is a theory in banking and finance that asserts that certain corporations, particularly financial institutions, are so large and so interconnected that their failure would be disastrous to the greater economic system, and that they therefore must be supported by governments when they face potential failure. The colloquial term "too big to fail" was popularized by U.S. Congressman Stewart McKinney in a 1984 Congressional hearing, discussing the Federal Deposit Insurance Corporation's intervention with Continental Illinois. The term had previously been used occasionally in the press, and similar thinking had motivated earlier bank bailouts. The term emerged as prominent in public discourse following the global financial crisis of 2007–2008. Critics see the policy as counterproductive and that large banks or other institutions should be left to fail if their risk management is not effective. Some critics, such as economist Alan G ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Too Big To Fail Policy

"Too big to fail" (TBTF) and "too big to jail" is a theory in banking and finance that asserts that certain corporations, particularly financial institutions, are so large and so interconnected that their failure would be disastrous to the greater economic system, and that they therefore must be supported by governments when they face potential failure. The colloquial term "too big to fail" was popularized by U.S. Congressman Stewart McKinney in a 1984 Congressional hearing, discussing the Federal Deposit Insurance Corporation's intervention with Continental Illinois. The term had previously been used occasionally in the press, and similar thinking had motivated earlier bank bailouts. The term emerged as prominent in public discourse following the global financial crisis of 2007–2008. Critics see the policy as counterproductive and that large banks or other institutions should be left to fail if their risk management is not effective. Some critics, such as economist Alan Gr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moral Hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. For example, when a corporation is insured, it may take on higher risk knowing that its insurance will pay the associated costs. A moral hazard may occur where the actions of the risk-taking party change to the detriment of the cost-bearing party after a financial transaction has taken place. Moral hazard can occur under a type of information asymmetry where the risk-taking party to a transaction knows more about its intentions than the party paying the consequences of the risk and has a tendency or incentive to take on too much risk from the perspective of the party with less information. One example is a principal–agent problem, where one party, called an agent, acts on behalf of another party, called the principal. If the agent has more information about his or her actions or intentions than the princi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

General Motors Chapter 11 Reorganization

The 2009 General Motors Chapter 11 sale of the assets of automobile manufacturer General Motors and some of its subsidiaries was implemented through Chapter 11, Title 11, United States Code in the United States bankruptcy court for the Southern District of New York. The United States government-endorsed sale enabled the NGMCO Inc.GM 363 Asset Sale Approved by U.S. Bankruptcy Court July 6, 2009. Accessed September 8, 2012. ("New GM") to purchase the continuing operational assets of the old GM. Normal operations, including [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 United Kingdom Bank Rescue Package

In the period September 2007 to December 2009, during the events now widely known as the Global Financial Crisis, the UK government enacted a number of financial interventions in support of the UK banking sector and four UK banks in particular. At peak, the cash cost of these interventions was £137 billion, paid to the banks in the form of loans and new capital. Most of this outlay has been recouped over the years. As at October 2021, the UK Office for Budget Responsibility reported the cost of these interventions as £33 billion, comprising a loss of £35.5 billion on the NatWest (formerly Royal Bank of Scotland) rescue, offset by some net gains elsewhere. The first public indication of the crisis was in July 2007, when two Bear Stearns hedge funds became insolvent. This initiated a series of global events that led to the seizure of interbank credit markets. The UK retail bank Northern Rock, which relied heavily on short term funding, sought emergency assistance from the Ban ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

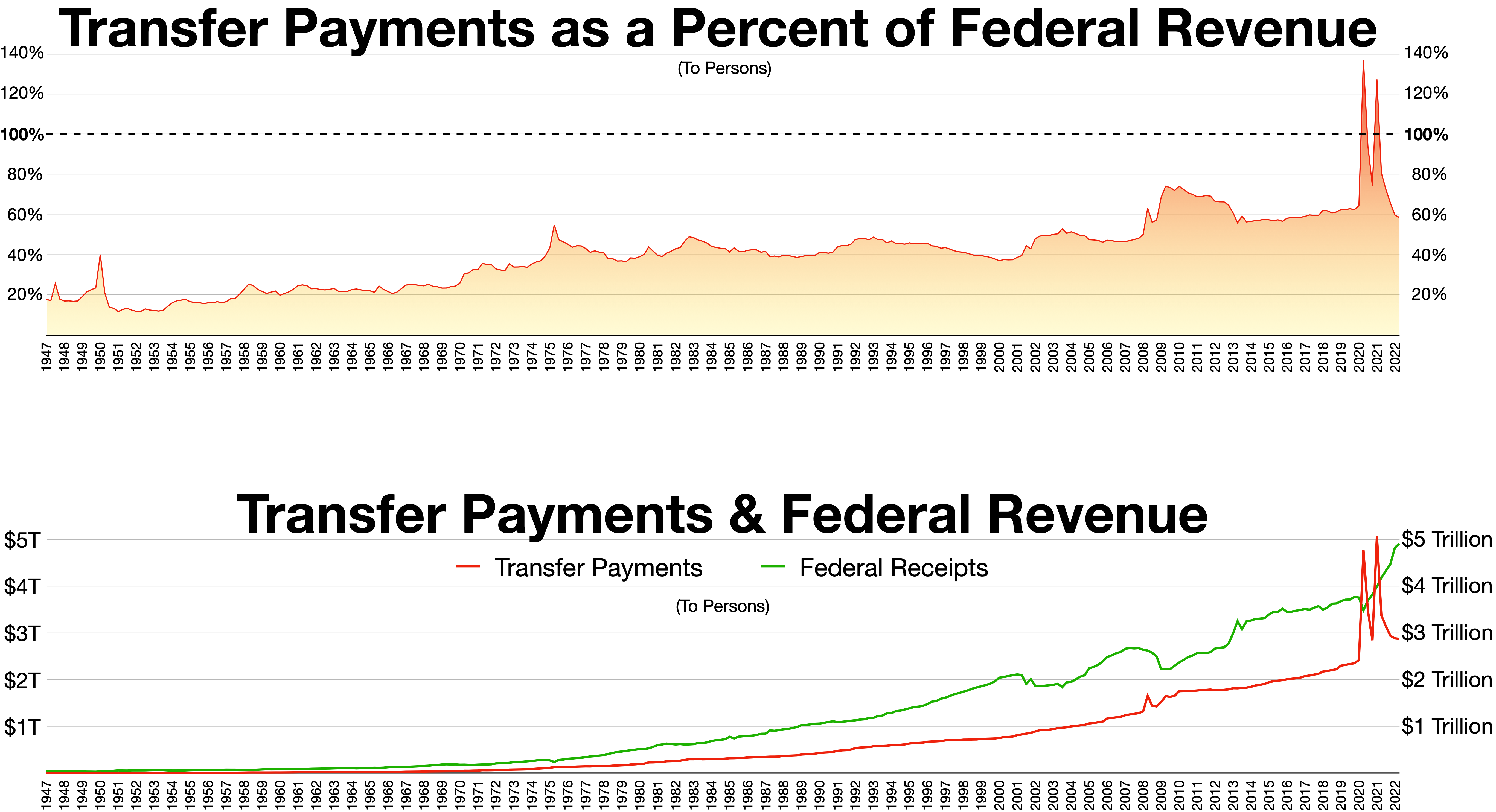

Corporate Welfare

Corporate welfare is a phrase used to describe a government's bestowal of money grants, tax breaks, or other special favorable treatment for corporations. The definition of corporate welfare is sometimes restricted to direct government subsidies of major corporations, excluding tax loopholes and all manner of regulatory and trade decisions. Origin of term The term "corporate welfare" was reportedly coined in 1956 by Ralph Nader. Alternative adages "Socialism for the rich, capitalism for the poor" Believed to have been first popularised by Michael Harrington's 1962 book '' The Other America'' in which Harrington cited Charles Abrams, a noted authority on housing. Variations on this adage have been used in criticisms of the United States' economic policy by Joe Biden, Martin Luther King Jr., Gore Vidal, Joseph P. Kennedy II, Robert F. Kennedy, Jr., Dean Baker, Noam Chomsky, Robert Reich, John Pilger, Bernie Sanders, and Yanis Varoufakis. "Privatizing profits and soc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lehman Brothers

Lehman Brothers Holdings Inc. ( ) was an American global financial services firm founded in 1847. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, and Merrill Lynch), with about 25,000 employees worldwide. It was doing business in investment banking, equity, fixed-income and derivatives sales and trading (especially U.S. Treasury securities), research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008. On September 15, 2008, Lehman Brothers filed for Chapter 11 bankruptcy protection following the exodus of most of its clients, drastic declines in its stock price, and the devaluation of assets by credit rating agencies. The collapse was largely due to Lehman's involvement in the subprime mortgage crisis and its exposure to less liquid assets. Lehman's bankruptcy filing was the largest in US ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

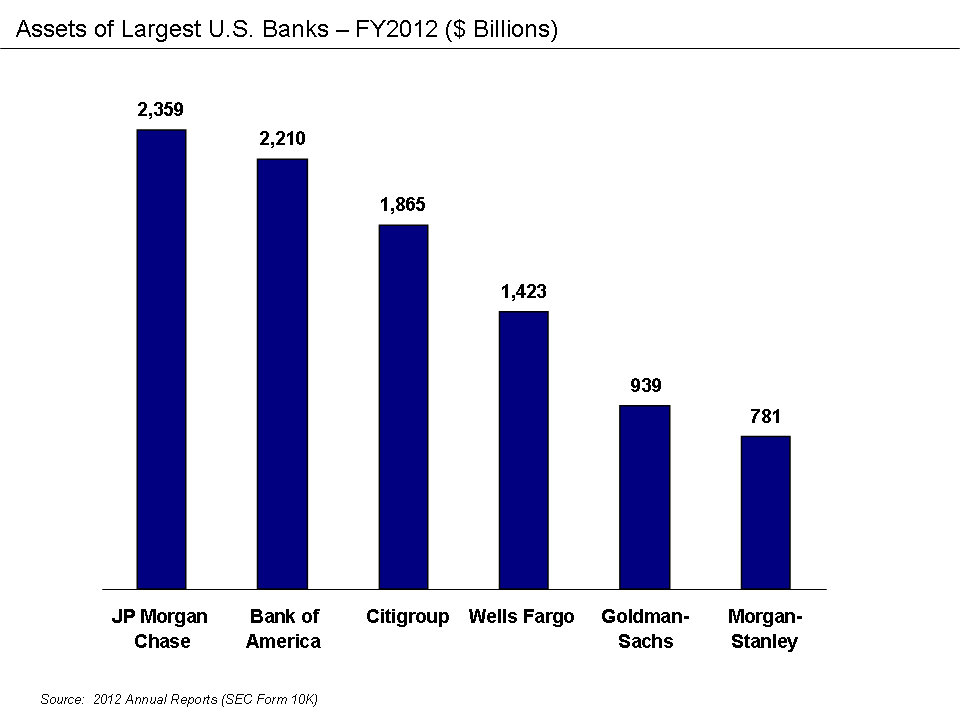

Systemically Important Financial Institution

A systemically important financial institution (SIFI) is a bank, insurance company, or other financial institution whose failure might trigger a financial crisis. They are colloquially referred to as " too big to fail". As the financial crisis of 2007–2008 unfolded, the international community moved to protect the global financial system through preventing the failure of SIFIs, or, if one does fail, limiting the adverse effects of its failure. In November 2011, the Financial Stability Board (FSB) published a list of global systemically important financial institutions (G-SIFIs). Also in November 2010, the Basel Committee on Banking Supervision (BCBS) introduced new guidance (known as Basel III) that also specifically target SIFIs. The main focus of the Basel III guidance is to increase bank capital requirements and to introduce capital surcharges for G-SIFIs. However, some economists warned in 2012 that the tighter Basel III capital regulation, which is primarily based ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SoFFin

The SoFFin (Sonderfonds Finanzmarktstabilisierung - Special Financial Market Stabilization Funds) is a program of the German government with the purpose to stabilize and restore confidence in the financial system. It was created in the middle of the Financial crisis of 2007–2010 on October 17, 2008 by the German Parliament and enacted on October 20, 2008. As of December 31, 2010, it stopped offering new services but continued managing existing guarantees. In November 2011, it was announced that it would be revived for potential new issues if necessary. Initially it was established as an agency of the Deutsche Bundesbank and was supervised by the federal ministry of finance. The fund was managed by Dr. Hannes Rehm (speaker), Dr. Christopher Pleister and Gerhard Strattthaus. Operations were conducted through three tasks * Providing Liquidity by means of guarantees for specially issued debt by eligible financial institutions * Investing in Equity (recapitalization) * Purchasing sec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)