|

Australian Property Market

The Australian property market comprises the trade of land and its permanent fixtures located within Australia. The average Australian property price grew 0.5% per year from 1890 to 1990 after inflation,Stapledon, Nigel. A History of Housing Prices in Australia 1880-2010. School of Economics Discussion Paper: 2010/18. Sydney, Australia: The University of New South Wales Australian School of Business. . Retrieved 1 May 2011 however rose from 1990 to 2017 at a faster rate and may be showing signs of a contracting economic bubble. House prices in Australia receive considerable attention from the media and the Reserve Bank and some commentators have argued that there is an Australian property bubble. The residential housing market has seen drastic changes in prices in the past few decades. The property prices are soaring in major cities like Sydney, Melbourne, Adelaide, Perth, Brisbane and Hobart. The median house price in Sydney peaked at $780,000 in 2016. However, with stricter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shortage

In economics, a shortage or excess demand is a situation in which the demand for a product or service exceeds its supply in a market. It is the opposite of an excess supply ( surplus). Definitions In a perfect market (one that matches a simple microeconomic model), an excess of demand will prompt sellers to increase prices until demand at that price matches the available supply, establishing market equilibrium. In economic terminology, a shortage occurs when for some reason (such as government intervention, or decisions by sellers not to raise prices) the price does not rise to reach equilibrium. In this circumstance, buyers want to purchase more at the market price than the quantity of the good or service that is available, and some non-price mechanism (such as "first come, first served" or a lottery) determines which buyers are served. So in a perfect market the only thing that can cause a shortage is price. In common use, the term "shortage" may refer to a situation wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of Australia

Australia is a highly developed country with a mixed-market economy. As of 2022, Australia was the 14th-largest national economy by nominal GDP (Gross Domestic Product), the 20th-largest by PPP-adjusted GDP, and was the 22nd-largest goods exporter and 24th-largest goods importer. Australia took the record for the longest run of uninterrupted GDP growth in the developed world with the March 2017 financial quarter. It was the 103rd quarter and the 26th year since the country had a technical recession (two consecutive quarters of negative growth). As of June 2021, the country's GDP was estimated at 1.98 trillion. The Australian economy is dominated by its service sector, which in 2017 comprised 62.7% of the GDP and employed 78.8% of the labour force. At the height of the mining boom in 2009–10, the total value-added of the mining industry was 8.4% of GDP. Despite the recent decline in the mining sector, the Australian economy had remained resilient and stable and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Estate In Australia

The Australian property market comprises the trade of land and its permanent fixtures located within Australia. The average Australian property price grew 0.5% per year from 1890 to 1990 after inflation,Stapledon, Nigel. A History of Housing Prices in Australia 1880-2010. School of Economics Discussion Paper: 2010/18. Sydney, Australia: The University of New South Wales Australian School of Business. . Retrieved 1 May 2011 however rose from 1990 to 2017 at a faster rate and may be showing signs of a contracting economic bubble. House prices in Australia receive considerable attention from the media and the Reserve Bank of Australia, Reserve Bank and some commentators have argued that there is an Australian property bubble. The residential housing market has seen drastic changes in prices in the past few decades. The property prices are soaring in major cities like Sydney, Melbourne, Adelaide, Perth, Brisbane and Hobart. The median house price in Sydney peaked at $780,000 in 2016. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Housing In Victoria, Australia

Housing in the state of Victoria, Australia is characterised by high rates of private housing ownership, minimal and lack of public housing and high demand for, and largely unaffordable, rental housing. Outside of Melbourne, home to 70% of the state's population, housing and rent is more affordable. In Melbourne, access to public housing is generally better, but housing and rent are less affordable. Public housing in Victoria is usually provided by departments of the Victorian state government and operates within the framework of the Commonwealth-State Housing Agreement, by which funding for public housing is provided by both federal and state governments. Since 2010, both Victoria and Melbourne have been experiencing a rapid increase in population, generating high demand for housing. This has created a housing boom, pushing housing prices up and having an effect on rental prices as well as availability of all types of housing. Private housing Private housing in Victoria is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Home Ownership In Australia

Home ownership in Australia is considered a key cultural icon, and part of the Australian tradition known as the Great Australian Dream of "owning a detached house on a fenced block of land."Winter, Ian and Wendy StoneSocial Polarisation and Housing Careers: Exploring the Interrelationship of Labour and Housing Markets in Australia Australian Institute of Family Studies. March 1998. Home ownership has been seen as creating a responsible citizenry; according to a former Premier of Victoria: "The home owner feels that he has a stake in the country, and that he has something worth working for, living for, fighting for."Kemeny, Jim. "The Ideology of Home Ownership." Urban Planning in Australia: Critical Readings, ed. J. Brian McLoughlin and Margo Huxley. Melbourne: Longman Cheshire Pty Limited, 1986. p256-7. In 2016 there were about 9.9 million private dwellings in Australia, each with, on average, 2.6 occupants. In 1966 about 70% of dwellings were owner-occupiedAustralian Bur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Remote Working

Remote work, also called work from home (WFH), work from anywhere, telework, remote job, mobile work, and distance work is an employment arrangement in which employees do not commute to a central place of work, such as an office building, warehouse, or retail store. Instead, work can be accomplished in the home, such as in a study, a small office/home office and/or a telecentre. A company in which all workers perform remote work is known as a distributed company. History In the early 1970s, technology was developed that linked satellite offices to downtown mainframes through dumb terminals using telephone lines as a network bridge. The terms "telecommuting" and "telework" were coined by Jack Nilles in 1973. In 1979, five IBM employees were allowed to work from home as an experiment. By 1983, the experiment was expanded to 2,000 people. By the early 1980s, branch offices and home workers were able to connect to organizational mainframes using personal computers and terminal em ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Covid-19

Coronavirus disease 2019 (COVID-19) is a contagious disease caused by a virus, the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The first known case was identified in Wuhan, China, in December 2019. The disease quickly spread worldwide, resulting in the COVID-19 pandemic. The symptoms of COVID‑19 are variable but often include fever, cough, headache, fatigue, breathing difficulties, loss of smell, and loss of taste. Symptoms may begin one to fourteen days after exposure to the virus. At least a third of people who are infected do not develop noticeable symptoms. Of those who develop symptoms noticeable enough to be classified as patients, most (81%) develop mild to moderate symptoms (up to mild pneumonia), while 14% develop severe symptoms (dyspnea, hypoxia, or more than 50% lung involvement on imaging), and 5% develop critical symptoms (respiratory failure, shock, or multiorgan dysfunction). Older people are at a higher risk of developing se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Airbnb

Airbnb, Inc. ( ), based in San Francisco, California, operates an online marketplace focused on short-term homestays and experiences. The company acts as a broker and charges a commission from each booking. The company was founded in 2008 by Brian Chesky, Nathan Blecharczyk, and Joe Gebbia. Airbnb is a shortened version of its original name, AirBedandBreakfast.com. The company has been the subject of criticism for lack of regulations and enabling increases in home rents. History After moving to San Francisco in October 2007, roommates and former schoolmates Brian Chesky and Joe Gebbia came up with the idea of putting an air mattress in their living room and turning it into a bed and breakfast. In February 2008, Nathan Blecharczyk, Chesky's former roommate, joined as the Chief Technology Officer and the third co-founder of the new venture, which they named AirBed & Breakfast. They put together a website that offered short-term living quarters and breakfast for those wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

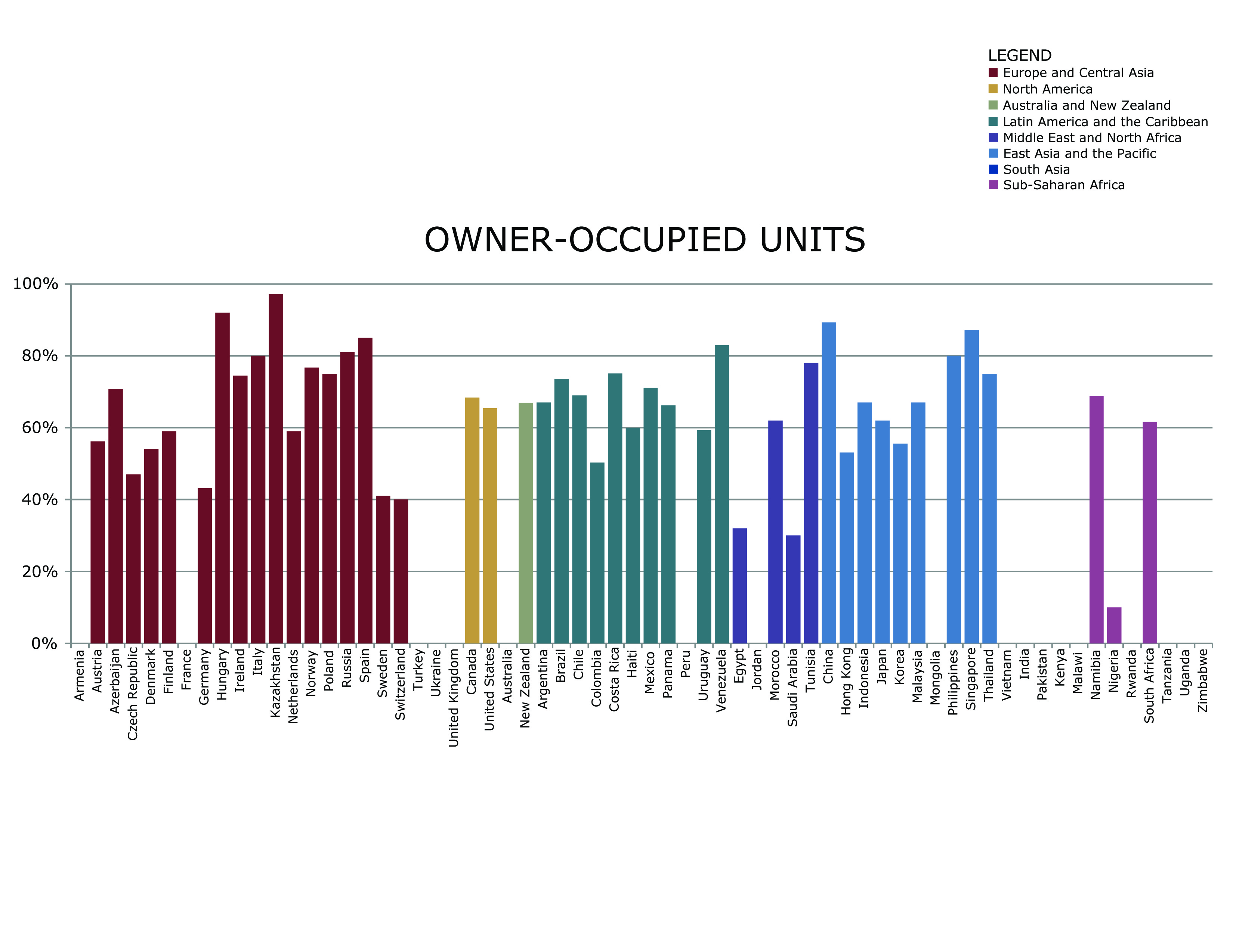

Owner-occupier

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inherited. A large number are purchased, as new homes from a real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes, and often costs several times the annual household income. Given the high cost, most individuals do not have enough savings on hand to pay the entire amount outright. In developed countries, mortgage loans are available from financial institutions in return for interest. If the home owner ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Landlords

A landlord is the owner of a house, apartment, condominium, land, or real estate which is rented or leased to an individual or business, who is called a tenant (also a ''lessee'' or ''renter''). When a juristic person is in this position, the term landlord is used. Other terms include lessor and owner. The term landlady may be used for the female owners. The manager of a pub in the United Kingdom, strictly speaking a licensed victualler, is referred to as the landlord/landlady. In political economy it refers to the owner of natural resources alone (e.g., land, not buildings) from which an economic rent is the income received. History The concept of a landlord may be traced back to the feudal system of manoralism (seignorialism), where a landed estate is owned by a Lord of the Manor (mesne lords), usually members of the lower nobility which came to form the rank of knights in the high medieval period, holding their fief via subinfeudation, but in some cases the land may als ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tenants

A leasehold estate is an ownership of a temporary right to hold land or property in which a lessee or a tenant holds rights of real property by some form of title from a lessor or landlord. Although a tenant does hold rights to real property, a leasehold estate is typically considered personal property. Leasehold is a form of land tenure or property tenure where one party buys the right to occupy land or a building for a given length of time. As a lease is a legal estate, leasehold estate can be bought and sold on the open market. A leasehold thus differs from a freehold or fee simple where the ownership of a property is purchased outright and thereafter held for an indeterminate length of time, and also differs from a tenancy where a property is let (rented) on a periodic basis such as weekly or monthly. Terminology and types of leasehold vary from country to country. Sometimes, but not always, a residential tenancy under a lease agreement is colloquially known as renting. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |