|

Affluence In The United States

Affluence refers to an individual's or household's economical and financial advantage in comparison to others. It may be assessed through either income or wealth. In absolute terms affluence is a relatively widespread phenomenon in the United States, with over 30% of households having an income exceeding $100,000 per year and over 30% of households having a net worth exceeding $250,000, as of 2019. However, when looked at in relative terms, wealth is highly concentrated: the bottom 50% of Americans only share 2% of total household wealth while the top 1% hold 35% of that wealth. In the United States, as of 2019, the median household income is $60,030 per year and the median household net worth is $97,300, while the mean household income is $89,930 per year and the mean household net worth is $692,100. Income vs. wealth While income is often seen as a type of wealth in colloquial language use, wealth and income are two substantially different measures of economic prosperity ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Wealth Of The US

Net or net may refer to: Mathematics and physics * Net (mathematics), a filter-like topological generalization of a sequence * Net, a linear system of divisors of dimension 2 * Net (polyhedron), an arrangement of polygons that can be folded up to form a polyhedron * An incidence structure consisting of points and parallel classes of lines * Operator algebras in Local quantum field theory Others * Net (command), an operating system command * Net (device), a grid-like device or object such as that used in fishing or sports, commonly made from woven fibers * ''Net'' (film), 2021 Indian thriller drama film * Net (textile), a textile in which the warp and weft yarns are looped or knotted at their intersections * Net (economics) (nett), the sum or difference of two or more economic variables ** Net income (nett), an entity's income minus cost of goods sold, expenses and taxes for an accounting period * In electronic design, a connection in a netlist * In computing, the Internet * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Household Income In The United States

Household income is an economic standard that can be applied to one household, or aggregated across a large group such as a county, city, or the whole country. It is commonly used by the United States government and private institutions to describe a household's economic status or to track economic trends in the US. A key measure of household income is the median income, at which half of households have income above that level and half below. The U.S. Census Bureau reports two median household income estimates based on data from two surveys: the Current Population Survey (CPS) and the American Community Survey (ACS). The CPS is the recommended source for national-level estimates, whereas the ACS gives estimates for many geographic levels. According to the Current Population Survey, CPS, the median household income was $63,179 in 2018. According to the ACS, the U.S. median household income in 2018 was $61,937. Estimates for previous years are given in terms of real income, wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Retirement Account

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, ''Individual Retirement Arrangements (IRAs)''. Other arrangements include employer-established benefit trusts and individual retirement annuities, by which a taxpayer purchases an annuity contract or an endowment contract from a life insurance company. Types There are several types of IRAs: * Traditional IRA – Contributions are often tax-deductible (often simplified as "money is deposited before tax" or "contributions are made with pre-tax assets"), all transactions and earnings within the IRA have no tax impact, and withdrawals at retirement are taxed as income ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

403b Plans

In the United States, a 403(b) plan is a U.S. tax-advantaged retirement savings plan available for public education organizations, some non-profit employers (only Internal Revenue Code 501(c)(3) organizations), cooperative hospital service organizations, and self-employed ministers in the United States. It has tax treatment similar to a 401(k) plan, especially after the Economic Growth and Tax Relief Reconciliation Act of 2001. Employee salary deferrals into a 403(b) plan are made before income tax is paid and allowed to grow tax-deferred until the money is taxed as income when withdrawn from the plan. 403(b) plans are also referred to as a tax-sheltered annuity (TSA) although since 1974 they no longer are restricted to an annuity form and participants can also invest in mutual funds. Regulation The Employee Retirement Income Security Act (ERISA) does not require 403(b) plans to be technically "qualified" plans (i.e., plans governed by U.S. Tax Code 401(a)), but 403(b) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

401k Plans

In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. This legal option is what makes 401(k) plans attractive to employees, and many employers offer this option to their (full-time) workers. There are two types: traditional and Roth 401(k). For Roth accounts, contributions and withdrawals have no impact on income tax. For traditional accounts, contributions may be deducted from taxable income and withdrawals are added to taxable income. There are limits to contributions, rules governing withdrawals and possible penalties. The benefit of the Roth account is from tax-free capital gains. The net benefit of the traditional account is the sum of (1) a possible bonus (or penalty) from withdrawals at tax rates lower (or higher) than at contributio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Assets

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetaryThere are different methods of assessing the monetary value of the assets recorded on the Balance Sheet. In some cases, the ''Historical Cost'' is used; such that the value of the asset when it was bought in the past is used as the monetary value. In other instances, the present fair market value of the asset is used to determine the value shown on the balance sheet. value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business. Assets can be grouped into two major classes: tangible assets and intangible assets. Tangible assets contain various subclasses, inc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subprime Mortgage Crisis

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. It was triggered by a large decline in US home prices after the collapse of a housing bubble, leading to mortgage delinquencies, foreclosures, and the devaluation of housing-related securities. Declines in residential investment preceded the Great Recession and were followed by reductions in household spending and then business investment. Spending reductions were more significant in areas with a combination of high household debt and larger housing price declines. The housing bubble preceding the crisis was financed with mortgage-backed securities (MBSes) and collateralized debt obligations (CDOs), which initially offered higher interest rates (i.e. better returns) than government securities, along with attractive risk ratings from rating agencies. While elements of the crisis first became more vi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mariacristina De Nardi

Mariacristina De Nardi is an economist who was born in Treviso, Italy. She is the Thomas Sargent Professor at the University of Minnesota since 2019. In 2013, De Nardi was appointed professor of economics at University College London; since September 2018, she has been a senior scholar at the Opportunity and Inclusive Growth Institute of the Federal Reserve Bank of Minneapolis. Her research interests include macroeconomics, public economics, wealth distribution, savings, social-insurance reform, social security, household economics, health shocks, medical expenses, fertility and human capital. Education De Nardi received a B.A. in economics and commerce with highest honours from Ca' Foscari University of Venice in Italy in November 1993. She received an M.A. degree in June 1998 and a Ph.D. in August 1999, both from the University of Chicago. Career After receiving her B.A. degree, De Nardi was a research fellow at Ca' Foscari University of Venice. She became an economist at the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth Inequality In The United States

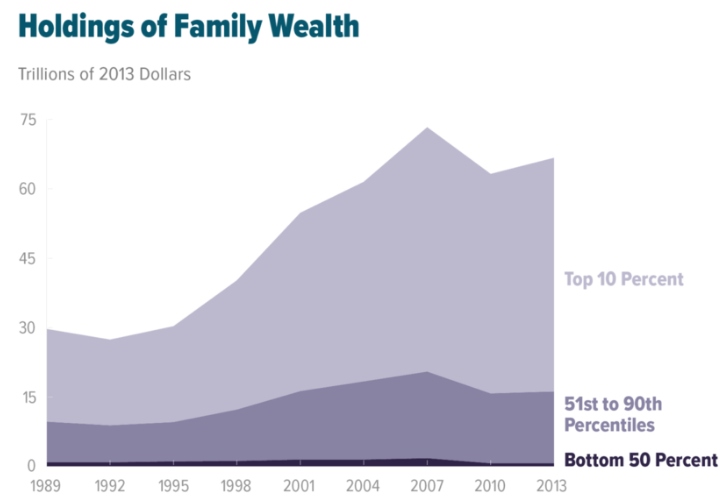

Wealth inequality in the United States is the unequal distribution of assets among residents of the United States. Wealth commonly includes the values of any homes, automobiles, personal valuables, businesses, savings, and investments, as well as any associated debts. Although different from income inequality, the two are related. Wealth is usually not used for daily expenditures or factored into household budgets, but combined with income, it represents a family's total opportunity to secure stature and a meaningful standard of living, or to pass their class status down to their children. Moreover, wealth provides for both short- and long-term financial security, bestows social prestige, contributes to political power, and can be leveraged to obtain more wealth. Hence, wealth provides mobility and agency—the ability to act. The accumulation of wealth enables a variety of freedoms, and removes limits on life that one might otherwise face. Federal Reserve data indicates that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Baby Boomers

Baby boomers, often shortened to boomers, are the Western demographic cohort following the Silent Generation and preceding Generation X. The generation is often defined as people born from 1946 to 1964, during the mid-20th century baby boom. The dates, the demographic context, and the cultural identifiers may vary by country. The baby boom has been described variously as a "shockwave" and as "the pig in the python". Most baby boomers are children of either the Greatest Generation or the Silent Generation, and are often parents of late Gen Xers and Millennials. Late baby boomers can also be the parents of older members of Generation Z. In the West, boomers' childhoods in the 1950s and 1960s had significant reforms in education, both as part of the ideological confrontation that was the Cold War, and as a continuation of the interwar period. In the 1960s and 1970s, as this relatively large number of young people entered their teens and young adulthood—the oldest turned 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liability (accounting)

In financial accounting, a liability is defined as the future sacrifices of economic benefits that the entity is ''obliged'' to make to other entities as a result of past transactions or other ''past'' events, the settlement of which may result in the transfer or use of assets, provision of services or other yielding of economic benefits in the future. Characteristics A liability is defined by the following characteristics: * Any type of borrowing from persons or banks for improving a business or personal income that is payable during short or long time; * A duty or responsibility to others that entails settlement by future transfer or use of assets, provision of services, or other transaction yielding an economic benefit, at a specified or determinable date, on occurrence of a specified event, or on demand; * A duty or responsibility that obligates the entity to another, leaving it little or no discretion to avoid settlement; and, * A transaction or event obligating the entity t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |