Natural monopolies on:

[Wikipedia]

[Google]

[Amazon]

A natural monopoly is a

A natural monopoly is a

All industries have costs associated with entering them. Often, a large portion of these costs is required for

All industries have costs associated with entering them. Often, a large portion of these costs is required for

The costs of laying tracks and building networks coupled with that of buying or leasing the trains prohibits or deters the entry of any competitor. Rail transport also fits other characteristics of a natural monopoly because it is assumed to be an industry with significant long run economies of scale. #

The costs of building telecommunication poles and growing a cell network would just be too exhausting for other competitors to exist. Electricity requires grids and cables whilst water services and gas both require pipelines whose costs are just too high to be able to have existing competitors in the public market. However, natural monopolies are usually regulated and they face increasing competition from private networks and specialty carriers.

"General Concepts: Introduction." In recent years, bodies of information have observed the correlation between utility subsidies and welfare improvements. Today, across the world,

monopoly

A monopoly (from Greek language, Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situati ...

in an industry in which high infrastructural costs and other barriers to entry

In theories of competition in economics, a barrier to entry, or an economic barrier to entry, is a fixed cost that must be incurred by a new entrant, regardless of production or sales activities, into a market that incumbents do not have or ha ...

relative to the size of the market give the largest supplier in an industry, often the first supplier in a market, an overwhelming advantage over potential competitor

Competition is a rivalry where two or more parties strive for a common goal which cannot be shared: where one's gain is the other's loss (an example of which is a zero-sum game). Competition can arise between entities such as organisms, indivi ...

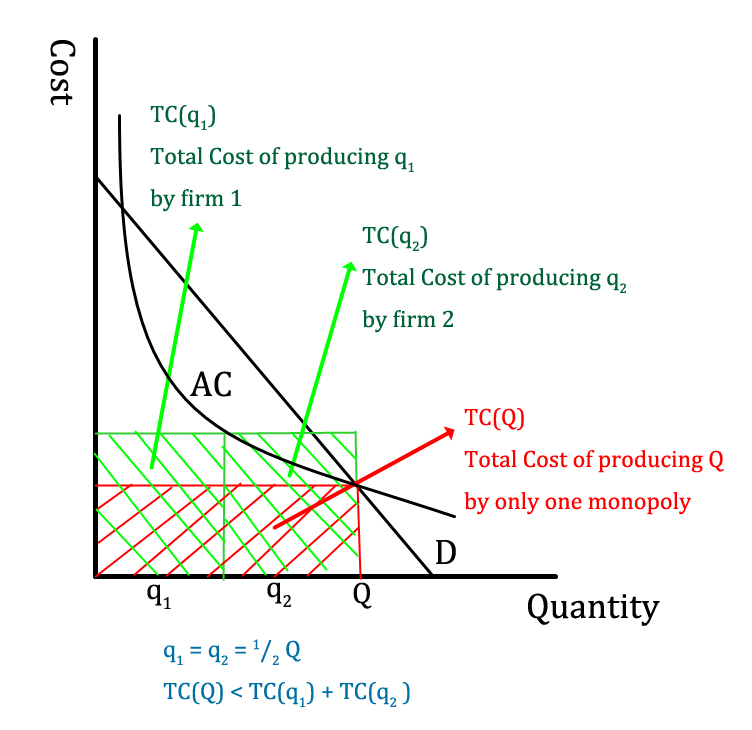

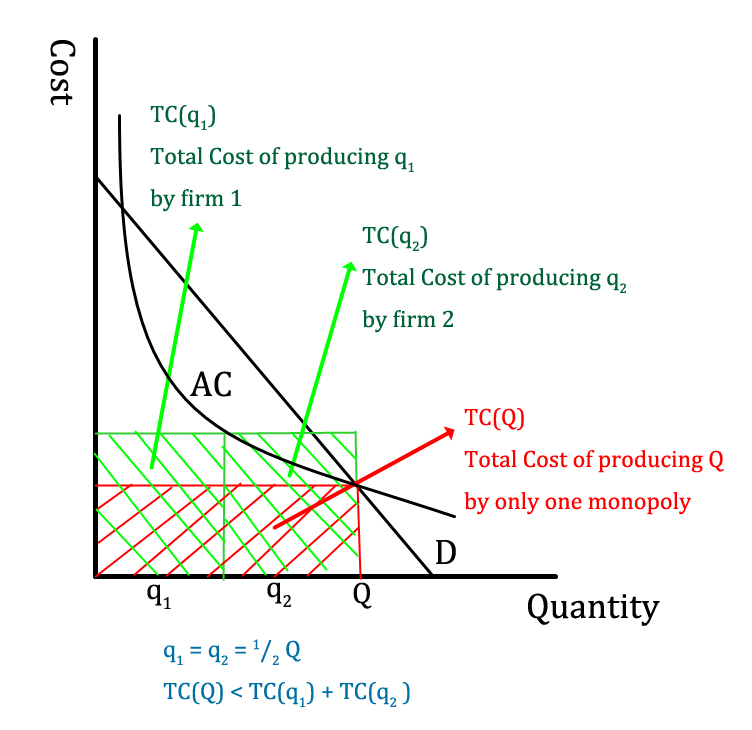

s. Specifically, an industry is a natural monopoly if the total cost of one firm, producing the total output, is lower than the total cost of two or more firms producing the entire production. In that case, it is very probable that a company (monopoly

A monopoly (from Greek language, Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situati ...

) or minimal number of companies (oligopoly

An oligopoly (from Greek ὀλίγος, ''oligos'' "few" and πωλεῖν, ''polein'' "to sell") is a market structure in which a market or industry is dominated by a small number of large sellers or producers. Oligopolies often result f ...

) will form, providing all or most relevant products and/or services. This frequently occurs in industries where capital cost

Capital costs are fixed, one-time expenses incurred on the purchase of land, buildings, construction, and equipment used in the production of goods or in the rendering of services. In other words, it is the total cost needed to bring a projec ...

s predominate, creating large economies of scale about the size of the market; examples include public utilities

A public utility company (usually just utility) is an organization that maintains the infrastructure for a public service (often also providing a service using that infrastructure). Public utilities are subject to forms of public control and ...

such as water services

The water industry provides drinking water and wastewater services (including sewage treatment) to residential, commercial, and industrial sectors of the economy. Typically public utilities operate water supply networks. The water industry doe ...

, electricity

Electricity is the set of physical phenomena associated with the presence and motion of matter that has a property of electric charge. Electricity is related to magnetism, both being part of the phenomenon of electromagnetism, as describe ...

, telecommunications

Telecommunication is the transmission of information by various types of technologies over wire, radio, optical, or other electromagnetic systems. It has its origin in the desire of humans for communication over a distance greater than that ...

, mail

The mail or post is a system for physically transporting postcards, letters, and parcels. A postal service can be private or public, though many governments place restrictions on private systems. Since the mid-19th century, national postal sys ...

, etc. Natural monopolies were recognized as potential sources of market failure

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value. Market failures can be viewed as scenarios where indiv ...

as early as the 19th century; John Stuart Mill

John Stuart Mill (20 May 1806 – 7 May 1873) was an English philosopher, political economist, Member of Parliament (MP) and civil servant. One of the most influential thinkers in the history of classical liberalism, he contributed widely to ...

advocated government regulation to make them serve the public good.

Definition

Two different types of cost are important inmicroeconomics

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics fo ...

: marginal cost

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is incremented, the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it ...

and fixed cost

In accounting and economics, 'fixed costs', also known as indirect costs or overhead costs, are business expenses that are not dependent on the level of goods or services produced by the business. They tend to be recurring, such as interest or r ...

. The marginal cost is the cost to the company of serving one more customer. In an industry where a natural monopoly does not exist, the vast majority of industries, the marginal cost decreases with economies of scale, then increases as the company has growing pains (overworking its employees, bureaucracy, inefficiencies, etc.). Along with this, the average cost of its products decreases and increases. A natural monopoly has a very different cost structure. A natural monopoly has a high fixed cost for a product that does not depend on output, but its marginal cost of producing one more good is roughly constant, and small.

It is generally believed that there are two reasons for natural monopolies: one is economies of scale, and the other is economies of scope.

All industries have costs associated with entering them. Often, a large portion of these costs is required for

All industries have costs associated with entering them. Often, a large portion of these costs is required for investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing is ...

. Larger industries, like utilities, require an enormous initial investment. This barrier to entry

In theories of competition in economics, a barrier to entry, or an economic barrier to entry, is a fixed cost that must be incurred by a new entrant, regardless of production or sales activities, into a market that incumbents do not have or have ...

reduces the number of possible entrants into the industry regardless of the earning of the corporations within. The production cost of an enterprise is not fixed, except for the effect of technology and other factors; even under the same conditions, the unit production cost of an enterprise can also tend to decrease with the increase in the total production output. The reason is that the actual product of the enterprise As it continues to expand, the original fixed costs are gradually diluted. This is particularly evident in companies with significant fixed-cost investments. Natural monopolies arise where the largest supplier in an industry, often the first supplier in a market, has an overwhelming cost advantage over other actual or potential competitors; this tends to be the case in industries where fixed costs predominate, creating economies of scale that are large in relation to the size of the market, as is the case in water and electricity services. The fixed cost of constructing a competing transmission network is so high, and the marginal cost of transmission for the incumbent so low, that it effectively bars potential competitors from the monopolist's market, acting as a nearly insurmountable barrier to entry into the market place.

A firm with high fixed costs requires a large number of customers in order to have a meaningful return on investment. This is where economies of scale become important. Since each firm has large initial costs, as the firm gains market share and increases its output the fixed cost (what they initially invested) is divided among a larger number of customers. Therefore, in industries with large initial investment requirements, average total cost In economics, average cost or unit cost is equal to total cost (TC) divided by the number of units of a good produced (the output Q):

AC=\frac.

Average cost has strong implication to how firms will choose to price their commodities. Firms’ sale ...

declines as output increases over a much larger range of output levels.

In real life, companies produce or provide single goods and services but often diversify their operations. Suppose the cost of having multiple products by one enterprise is lower than making them separately by several enterprises. In that case, it indicates that there is an economy of scope. Since the unit product price of a company that produces a specific product alone is higher than the corresponding unit product price of a joint production company, the companies that make it separately will lose money. These companies will either withdraw from the production field or be merged, forming a monopoly. Therefore, well-known American economists Samuelson and Nordhaus pointed out that economies of scope can also produce natural monopolies.

Companies that take advantage of economies of scale often run into problems of bureaucracy; these factors interact to produce an "ideal" size for a company, at which the company's average cost of production is minimized. If that ideal size is large enough to supply the whole market, then that market is a natural monopoly.

Once a natural monopoly has been established because of the large initial cost and that, according to the rule of economies of scale, the larger corporation (to a point) has a lower average cost and therefore an advantage over its competitors. With this knowledge, no firms will attempt to enter the industry and an oligopoly

An oligopoly (from Greek ὀλίγος, ''oligos'' "few" and πωλεῖν, ''polein'' "to sell") is a market structure in which a market or industry is dominated by a small number of large sellers or producers. Oligopolies often result f ...

or monopoly develops.

Formal definition

William Baumol (1977) provides the current formal definition of a natural monopoly. He defines a natural monopoly as " industry in which multi-firm production is more costly than production by a monopoly" (p. 810). Baumol linked the definition to the mathematical concept ofsubadditivity In mathematics, subadditivity is a property of a function that states, roughly, that evaluating the function for the sum of two elements of the domain always returns something less than or equal to the sum of the function's values at each element. ...

; specifically, subadditivity of the cost function. Baumol also noted that for a firm producing a single product, scale economies were a sufficient condition but not a necessary condition to prove subadditivity, the argument can be illustrated as follows:

Proposition: Strict economies of scale are sufficient but not necessary for ray average cost to be strictly declining.

Proposition: Strictly declining ray average cost implies strict ray subadditivity.

:

Proposition: Neither ray concavity nor ray average costs that decline everywhere are necessary for strict subadditivity.

:

Combining all propositions gives:

Proposition: Global scale economies are sufficient but not necessary for (strict) ray subadditivity, the condition for natural monopoly in the production of a single product or in any bundle of outputs produced in fixed proportions.

Multiproduct case

On the other hand if firms produce many products scale economies are neither sufficient nor necessary for subadditivity: Proposition: Strict concavity of a cost function is not sufficient to guarantee subadditivity. : Therefore: Proposition: Scale economies are neither necessary nor sufficient for subadditivity.Mathematical Notation of Subadditivity

A cost function ''c'' is ''subadditive'' at an output ''x'' if such that , with all x being non-negative. In other words, if all companies have the same production cost function, the one with the better technology should monopolize the entire market such that the total cost is minimized, thus causing natural monopoly due to its technological advantage or condition.Examples

#Railways

Rail transport (also known as train transport) is a means of transport that transfers passengers and goods on wheeled vehicles running on rails, which are incorporated in tracks. In contrast to road transport, where the vehicles run on a prep ...

:The costs of laying tracks and building networks coupled with that of buying or leasing the trains prohibits or deters the entry of any competitor. Rail transport also fits other characteristics of a natural monopoly because it is assumed to be an industry with significant long run economies of scale. #

Telecommunications

Telecommunication is the transmission of information by various types of technologies over wire, radio, optical, or other electromagnetic systems. It has its origin in the desire of humans for communication over a distance greater than that ...

and Utilities

A public utility company (usually just utility) is an organization that maintains the infrastructure for a public service (often also providing a service using that infrastructure). Public utilities are subject to forms of public control and ...

:The costs of building telecommunication poles and growing a cell network would just be too exhausting for other competitors to exist. Electricity requires grids and cables whilst water services and gas both require pipelines whose costs are just too high to be able to have existing competitors in the public market. However, natural monopolies are usually regulated and they face increasing competition from private networks and specialty carriers.

History

The development of the concept of natural monopoly is often attributed toJohn Stuart Mill

John Stuart Mill (20 May 1806 – 7 May 1873) was an English philosopher, political economist, Member of Parliament (MP) and civil servant. One of the most influential thinkers in the history of classical liberalism, he contributed widely to ...

, who (writing before the marginalist revolution

Marginalism is a theory of economics that attempts to explain the discrepancy in the value of goods and services by reference to their secondary, or marginal, utility. It states that the reason why the price of diamonds is higher than that of wa ...

) believed that prices would reflect the costs of production in absence of an artificial or natural monopoly. In '' Principles of Political Economy'' Mill criticised Smith's neglect of an area that could explain wage disparity (the term itself was already in use in Smith's times, but with a slightly different meaning). Taking up the examples of professionals such as jewellers, physicians and lawyers, he said,

The superiority of reward is not here the consequence of competition, but of its absence: not a compensation for disadvantages inherent in the employment, but an extra advantage; a kind of monopoly price, the effect not of a legal, but of what has been termed a natural monopoly... independently of... artificial monopolies .e. grants by government there is a natural monopoly in favour of skilled labourers against the unskilled, which makes the difference of reward exceed, sometimes in a manifold proportion, what is sufficient merely to equalize their advantages.Mill's initial use of the term concerned natural abilities. In contrast, common contemporary usage refers solely to market failure in a particular type of industry such as rail, post or electricity. Mill's development of the idea that 'what is true of labour, is true of capital'. He continues;

All the natural monopolies (meaning thereby those which are created by circumstances, and not by law) which produce or aggravate the disparities in the remuneration of different kinds of labour, operate similarly between different employments of capital. If a business can only be advantageously carried on by a large capital, this in most countries limits so narrowly the class of persons who can enter into the employment, that they are enabled to keep theirMill also applied the term to land, which can manifest a natural monopoly by virtue of it being the only land with a particular mineral, etc. Furthermore, Mill referred to network industries, such as electricity and water supply, roads, rail and canals, as "practical monopolies", where "it is the part of the government, either to subject the business to reasonable conditions for the general advantage or to retain such power over it, that the profits of the monopoly may at least be obtained for the public." So, a legal prohibition against non-government competitors is often advocated. Whereby the rates are not left to the market but are regulated by the government; maximising profits, and subsequently societal reinvestment. For a discussion of the historical origins of the term 'natural monopoly' see Mosca.rate of profit In economics and finance, the profit rate is the relative profitability of an investment project, a capitalist enterprise or a whole capitalist economy. It is similar to the concept of rate of return on investment. Historical cost ''vs.'' mark ...above the general level. A trade may also, from the nature of the case, be confined to so few hands, that profits may admit of being kept up by a combination among the dealers. It is well known that even among so numerous a body as the London booksellers, this sort of combination long continued to exist. I have already mentioned the case of the gas and water companies.

Regulation

As with all monopolies, a monopolist that has gained its position through natural monopoly effects may engage in behaviour that abuses its market position. In cases where exploitation occurs, it often leads to calls from consumers for government regulation. Government regulation may also come about at the request of a business hoping to enter a market otherwise dominated by a natural monopoly. Common arguments in favour of regulation include the desire to limit a company's potentially abusive or unfair market power, facilitate competition, promote investment or system expansion, or stabilise markets. This is especially true in the case of essential utilities like electricity where a monopoly creates a captive market for a product few can refuse. In general, though, regulation occurs when the government believes that the operator, left to his own devices, would behave in a way that is contrary to thepublic interest

The public interest is "the welfare or well-being of the general public" and society.

Overview

Economist Lok Sang Ho in his ''Public Policy and the Public Interest'' argues that the public interest must be assessed impartially and, therefor ...

. In some countries an early solution to this perceived problem was government provision of, for example, a utility service. Enabling a monopolistic company with the ability to change prices without regulation can have devastating effects in society. Ramifications of which can be displayed in Bolivia’s 2000 Cochabamba protests. A situation whereby a firm with a monopoly on the supply of water, excessively increased water rates to fund a dam; leaving many unable to afford the essential good.

History

A wave of nationalisation across Europe after World War II created state-owned companies in each of these areas, many of which operate internationally bidding on utility contracts in other countries. However, this approach can raise its own problems. In the past, some governments have used the state-provided utility services as a source of cash flow for funding other government activities, or as a means of obtaining hardcurrency

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins.

A more general ...

. As a result, governments seeking funding began to seek other solutions, namely regulation and providing services on a commercial basis, often through private participation.Body of Knowledge on Infrastructure Regulation"General Concepts: Introduction." In recent years, bodies of information have observed the correlation between utility subsidies and welfare improvements. Today, across the world,

public utilities

A public utility company (usually just utility) is an organization that maintains the infrastructure for a public service (often also providing a service using that infrastructure). Public utilities are subject to forms of public control and ...

are widely used to provide state-run water, electricity, gas, telecommunications, mass-transportation and postal services.

Alternative regulation

Alternatives to a state-owned response to natural monopolies include bothopen source

Open source is source code that is made freely available for possible modification and redistribution. Products include permission to use the source code, design documents, or content of the product. The open-source model is a decentralized so ...

licensed technology and co-operatives

A cooperative (also known as co-operative, co-op, or coop) is "an autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly owned and democratically-control ...

management where a monopoly's users or workers own the monopoly. For instance, the web's open-source architecture has both stimulated massive growth and avoided a single company controlling the entire market. The Depository Trust and Clearing Corporation

The Depository Trust & Clearing Corporation (DTCC) is an American post-trade financial services company providing clearing and settlement services to the financial markets. It performs the exchange of securities on behalf of buyers and seller ...

is an American co-op that provides the majority of clearing and financial settlement across the securities industry ensuring they cannot abuse their market position to raise costs. In recent years a combined cooperative and open-source alternative to emergent web monopolies has been proposed, a platform cooperative

A platform cooperative, or platform co-op, is a cooperatively owned, democratically governed business that establishes a computing platform, and uses a website, mobile app or a protocol to facilitate the sale of goods and services. Platform coopera ...

, where, for instance, Uber

Uber Technologies, Inc. (Uber), based in San Francisco, provides mobility as a service, ride-hailing (allowing users to book a car and driver to transport them in a way similar to a taxi), food delivery ( Uber Eats and Postmates), pa ...

could be a driver-owned cooperative developing and sharing open-source software.

See also

*LoopCo {{no footnotes, date=December 2018

LoopCo is an economic model created in the mid-1990s as a proposal to the Federal Communications Commission and the U.S. Congress for the healthy development of competition in the local and long distance telephon ...

* Market forms

Market structure, in economics, depicts how firms are differentiated and categorised based on the types of goods they sell (homogeneous/heterogeneous) and how their operations are affected by external factors and elements. Market structure makes i ...

* Price-cap regulation

Price-cap regulation is a form of regulation. Designed in the 1980s by UK Treasury economist Stephen Littlechild, it has been applied to all privatized British network utilities. It is contrasted with both rate-of-return regulation, with utilities ...

* Public good

* Quasi-rent

* Standardization

Standardization or standardisation is the process of implementing and developing technical standards based on the consensus of different parties that include firms, users, interest groups, standards organizations and governments. Standardizatio ...

References

Further reading

* * * * * * {{cite book , last=Waterson , first=Michael , year=1988 , title=Regulation of the Firm and Natural Monopoly , location=New York, NY, USA , publisher=Blackwell , isbn=0-631-14007-7 , url-access=registration , url=https://archive.org/details/regulationoffirm0000wate Market failure Monopoly (economics)