monetary aggregate on:

[Wikipedia]

[Google]

[Amazon]

In

In

Federal Reserve, November 10, 2005, revised March 9, 2006. However, there are still estimates produced by various private institutions. * : Money with zero maturity. It measures the supply of financial assets redeemable at par on demand.

Hong Kong's

Hong Kong's

The

The

The

The

There are just two official UK measures. M0 is referred to as the "wide monetary base" or "narrow money" and M4 is referred to as "

There are just two official UK measures. M0 is referred to as the "wide monetary base" or "narrow money" and M4 is referred to as "

The United States

The United States

The

The

The

The

The

The

Article in the New Palgrave on Money Supply

by

St. Louis Fed: Monetary Aggregates

Investopedia: Money Zero Maturity (MZM)

* ttps://fraser.stlouisfed.org/title/88 Historical H.3 releases

Money Stock Measures (H.6)

Monetary Survey

from

In

In macroeconomics

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output (econ ...

, money supply (or money stock) refers to the total volume of money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: m ...

held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation

In monetary economics, the currency in circulation in a country is the value of

currency or cash (banknotes and coins) that has ever been issued by the country’s monetary authority less the amount that has been removed. More broadly, money in ...

(i.e. physical cash

In economics, cash is money in the physical form of currency, such as banknotes and coins.

In book-keeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-i ...

) and demand deposits (depositors' easily accessed asset

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can b ...

s on the books of financial institution

A financial institution, sometimes called a banking institution, is a business entity that provides service as an intermediary for different types of financial monetary transactions. Broadly speaking, there are three major types of financial ins ...

s). Money supply data is recorded and published, usually by the national statistical agency or the central bank

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the mo ...

of the country. Empirical money supply measures are usually named M1, M2, M3, etc., according to how wide a definition of money they embrace. The precise definitions vary from country to country, in part depending on national financial institutional traditions.

Even for narrow aggregates like M1, by far the largest part of the money supply consists of deposits in commercial bank

A commercial bank is a financial institution that accepts deposits from the public and gives loans for the purposes of consumption and investment to make a profit.

It can also refer to a bank or a division of a larger bank that deals with whol ...

s, whereas currency

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific envi ...

(banknote

A banknote or bank notealso called a bill (North American English) or simply a noteis a type of paper money that is made and distributed ("issued") by a bank of issue, payable to the bearer on demand. Banknotes were originally issued by commerc ...

s and coin

A coin is a small object, usually round and flat, used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order to facilitate trade. They are most often issued by ...

s) issued by central banks only makes up a small part of the total money supply in modern economies. The public's demand for currency and bank deposits and commercial banks' supply of loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money.

The document evidencing the deb ...

s are consequently important determinants of money supply changes. As these decisions are influenced by central banks' monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rat ...

, not least their setting of interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...

s, the money supply is ultimately determined by complex interactions between non-banks, commercial banks and central banks.

According to the quantity theory supported by the monetarist school of thought, there is a tight causal

Causality is an influence by which one Event (philosophy), event, process, state, or Object (philosophy), object (''a'' ''cause'') contributes to the production of another event, process, state, or object (an ''effect'') where the cause is at l ...

connection between growth in the money supply and inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of curre ...

. In particular during the 1970s and 1980s this idea was influential, and several major central banks during that period attempted to control the money supply closely, following a monetary policy target of increasing the money supply stably. However, the strategy was generally found to be impractical because money demand turned out to be too unstable for the strategy to work as intended.

Consequently, the money supply has lost its central role in monetary policy, and central banks today generally do not try to control the money supply. Instead they focus on adjusting interest rates, in developed countries normally as part of a direct inflation target which leaves little room for a special emphasis on the money supply. Money supply measures may still play a role in monetary policy, however, as one of many economic indicators that central bankers monitor to judge likely future movements in central variables like employment

Employment is a relationship between two party (law), parties Regulation, regulating the provision of paid Labour (human activity), labour services. Usually based on a employment contract, contract, one party, the employer, which might be a cor ...

and inflation.

Measures of money supply

There are several standard measures of the money supply, classified along a spectrum or continuum between narrow and broad ''monetary aggregates''. Narrow measures include only the most liquid assets: those most easily used to spend (currency, checkable deposits). Broader measures add less liquid types of assets (certificates of deposit, etc.). This continuum corresponds to the way that different types of money are more or less controlled by monetary policy. Narrow measures include those more directly affected and controlled by monetary policy, whereas broader measures are less closely related to monetary-policy actions. The different types of money are typically classified as "M"s. The "M"s usually range from M0 (narrowest) to M3 (and M4 in some countries) (broadest), but which "M"s, if any, are actually focused on in central bank communications depends on the particular institution. A typical layout for each of the "M"s is as follows for the United States: * : In some countries, such as the United Kingdom, M0 includes bank reserves, so M0 is referred to as the monetary base, or narrow money. * : is referred to as the monetary base or total currency. This is the base from which other forms of money (like checking deposits, listed below) are created and is traditionally the most liquid measure of the money supply. * : Bank reserves are not included in M1. * : Represents M1 and "close substitutes" for M1. M2 is a broader classification of money than M1. * : M2 plus large and long-term deposits. Since March, 23, 2006, M3 is no longer published by the US central bank, as one of Alan Greenspan's last acts, because of its expense. Discontinuance of M3Federal Reserve, November 10, 2005, revised March 9, 2006. However, there are still estimates produced by various private institutions. * : Money with zero maturity. It measures the supply of financial assets redeemable at par on demand.

Creation of money

Both central banks and commercial banks play a role in the process ofmoney creation

Money creation, or money issuance, is the process by which the money supply of a country, or an economic or monetary region,Such as the Eurozone or ECCAS is increased. In most modern economies, money is created by both central banks and comm ...

. In short, in the fractional-reserve banking

Fractional-reserve banking is the system of banking in all countries worldwide, under which banks that take deposits from the public keep only part of their deposit liabilities in liquid assets as a reserve, typically lending the remainder to ...

system used throughout the world, money can be subdivided into two types:

* central bank money – obligations of a central bank, including currency

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific envi ...

and central bank depository accounts

* commercial bank money – obligations of commercial banks, including checking accounts and savings accounts.

In the money supply statistics, central bank money is MB while the commercial bank money is divided up into the M1–M3 components, where it makes up the non-M0 component.

By far the largest part of the money used by individuals and firms to execute economic actions are commercial bank money, i.e. deposits issued by banks and other financial institutions. In the United Kingdom, deposit money outweighs the central bank issued currency by a factor of more than 30 to 1. In the United States, where the country's currency has a special international role being used in many transactions around the world, legally as well as illegally, the ratio is still more than 8 to 1. Commercial banks create money whenever they make a loan and simultaneously create a matching deposit in the borrower's bank account. In return, money is destroyed when the borrower pays back the principal on the loan. Movements in the money supply therefore to a large extent depend on the decisions of commercial banks to supply loans and consequently deposits, and the public's behavior in demanding currency as well as bank deposits. These decisions are influenced by the monetary policy of central banks, so that money supply is ultimately created by complex interactions between banks, non-banks and central banks.

Even though central banks today rarely try to control the amount of money in circulation, their policies still impact the actions of both commercial banks and their customers. When setting the interest rate on central bank reserves, interest rates on bank loans are affected, which in turn affects their demand. Central banks may also affect the money supply more directly by engaging in various open market operations. They can increase the money supply by purchasing government securities, such as government bond

A government bond or sovereign bond is a form of Bond (finance), bond issued by a government to support government spending, public spending. It generally includes a commitment to pay periodic interest, called Coupon (finance), coupon payments' ...

s or treasury bill

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as a supplement to taxation. Since 2012, the U.S. ...

s. This increases the liquidity in the banking system by converting the illiquid securities of commercial banks into liquid deposits at the central bank. This also causes the price of such securities to rise due to the increased demand, and interest rates to fall. In contrast, when the central bank "tightens" the money supply, it sells securities on the open market, drawing liquid funds out of the banking system. The prices of such securities fall as supply is increased, and interest rates rise.

In some economics textbooks, the supply-demand equilibrium in the markets for money and reserves is represented by a simple so-called money multiplier relationship between the monetary base of the central bank and the resulting money supply including commercial bank deposits. This is a short-hand simplification which disregards several other factors determining commercial banks' reserve-to-deposit ratios and the public's money demand.

National definitions of "money"

East Asia

Hong Kong

TheHong Kong Basic Law

The Basic Law of the Hong Kong Special Administrative Region of the People's Republic of China is a national law of China that serves as the organic law for the Hong Kong Special Administrative Region (HKSAR). With nine chapters, 160 article ...

and the Sino-British Joint Declaration

The Sino-British Joint Declaration was a treaty between the governments of the United Kingdom and People's Republic of China signed in 1984 setting the conditions in which Hong Kong was transferred to Chinese control and for the governance o ...

provides that Hong Kong retains full autonomy with respect to currency issuance. Currency in Hong Kong is issued by the government and three local banks under the supervision of the territory's ''de facto'' central bank, the Hong Kong Monetary Authority. Bank notes are printed by Hong Kong Note Printing.

A bank can issue a Hong Kong dollar only if it has the equivalent exchange in US dollars on deposit. The currency board system ensures that Hong Kong's entire monetary base is backed with US dollars at the linked exchange rate. The resources for the backing are kept in Hong Kong's exchange fund, which is among the largest official reserves in the world. Hong Kong also has huge deposits of US dollars, with official foreign currency reserves of 331.3 billion USD .=Currency peg history

=exchange rate regime

An exchange rate regime is a way a monetary authority of a country or currency union manages the currency about other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many ...

has changed over time.

* 1967: Sterling was devalued, the peg was increased from 1 shilling 3 pence (£1 = HK$16) to 1 shilling 4½ pence (£1 = HK$14.5455). Valued in USD, the currency went from US$1 = HK$5.71 to US$1 = HK$6.06

* 1972: pegged to the US dollar, US$1 = HK$5.65

* 1973: US$1 = HK$5.085

* 1974 to 1983: The Hong Kong dollar was floated

* October 17, 1983: Pegged at US$1 = HK$7.80 through the currency board system

* May 18, 2005: A lower and upper guaranteed limit are in place at 7.75 to the US dollar. Lower limit was lowered from 7.80 to 7.85, between May 23 and June 20, 2005. The Monetary Authority indicated this was to narrow the gap between interest rates between Hong Kong and the US, and to avoid the HK dollar being used as a proxy for speculative bets on a renminbi

The renminbi ( ; currency symbol, symbol: Yen and yuan sign, ¥; ISO 4217, ISO code: CNY; abbreviation: RMB), also known as the Chinese yuan, is the official currency of the China, People's Republic of China. The renminbi is issued by the Peop ...

revaluation.

Japan

The

The Bank of Japan

The is the central bank of Japan.Louis Frédéric, Nussbaum, Louis Frédéric. (2005). "Nihon Ginkō" in The bank is often called for short. It is headquartered in Nihonbashi, Chūō, Tokyo, Chūō, Tokyo.

The said bank is a corporate entity ...

defines the monetary aggregates as:

* M1: cash currency in circulation, plus deposit money

* M2 + CDs: M1 plus quasi-money and CDs

* M3 + CDs: M2 + CDs plus deposits of post offices; other savings and deposits with financial institutions; and money trusts

* Broadly defined liquidity: M3 and CDs, plus money market, pecuniary trusts other than money trusts, investment trusts, bank debentures, commercial paper issued by financial institutions, repurchase agreements and securities lending

In finance, securities lending or stock lending refers to the lending of securities by one party to another.

The terms of the loan will be governed by a "Securities Lending Agreement", which requires that the borrower provides the lender with co ...

with cash collateral, government bonds and foreign bonds

Europe

Eurozone

The

The European Central Bank

The European Central Bank (ECB) is the central component of the Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's Big Four (banking)#International ...

's definition of euro area monetary aggregates:

* M1: Currency in circulation plus overnight deposits

* M2: M1 plus deposits with an agreed maturity up to two years plus deposits redeemable at a period of notice up to three months.

* M3: M2 plus repurchase agreements plus money market fund (MMF) shares/units, plus debt securities up to two yearsUnited Kingdom

broad money

In economics, broad money is a measure of the amount of money, or money supply, in a national economy including both highly liquid "narrow money" and less liquid forms. The European Central Bank, the OECD and the Bank of England all have their own ...

" or simply "the money supply".

* M0: Notes and coin in circulation plus banks' reserve balance with Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the Kingdom of England, English Government's banker and debt manager, and still one ...

. (When the bank introduced Money Market Reform in May 2006, the bank ceased publication of M0 and instead began publishing series for reserve balances at the Bank of England to accompany notes and coin in circulation.)

* M4: Cash outside banks (i.e. in circulation with the public and non-bank firms) plus private-sector retail bank and building society deposits plus private-sector wholesale bank and building society deposits and certificates of deposit. In 2010 the total money supply (M4) measure in the UK was £2.2 trillion while the actual notes and coins in circulation totalled only £47 billion, 2.1% of the actual money supply.

There are several different definitions of money supply to reflect the differing stores of money. Owing to the nature of bank deposits, especially time-restricted savings account deposits, M4 represents the most illiquid measure of money. M0, by contrast, is the most liquid measure of the money supply.

North America

United States

The United States

The United States Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

published data on three monetary aggregates until 2006, when it ceased publication of M3 data and only published data on M1 and M2. M1 consists of money commonly used for payment, basically currency in circulation

In monetary economics, the currency in circulation in a country is the value of

currency or cash (banknotes and coins) that has ever been issued by the country’s monetary authority less the amount that has been removed. More broadly, money in ...

and checking account

A transaction account (also called a checking account, cheque account, chequing account, current account, demand deposit account, or share account at credit unions) is a deposit account or bank account held at a bank or other financial instituti ...

balances; and M2 includes M1 plus balances that generally are similar to transaction accounts and that, for the most part, can be converted fairly readily to M1 with little or no loss of principal. The M2 measure is thought to be held primarily by households. Prior to its discontinuation, M3 comprised M2 plus certain accounts that are held by entities other than individuals and are issued by banks and thrift institutions to augment M2-type balances in meeting credit demands, as well as balances in money market mutual funds held by institutional investors. The aggregates have had different roles in monetary policy as their reliability as guides has changed. The principal components are:

* M0: The total of all physical currency including coinage. M0 = Federal Reserve Note

Federal Reserve Notes are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 and issues them to the Federal Re ...

s + US Notes + Coins

A coin is a small object, usually round and flat, used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order to facilitate trade. They are most often issued by ...

. It is not relevant whether the currency is held inside or outside of the private banking system as reserves.

* MB: The total of all physical currency plus Federal Reserve Deposits (special deposits that only banks can have at the Fed). MB = Coins

A coin is a small object, usually round and flat, used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order to facilitate trade. They are most often issued by ...

+ US Notes + Federal Reserve Note

Federal Reserve Notes are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 and issues them to the Federal Re ...

s + Federal Reserve Deposits

* M1: The total amount of M0 (cash/coin) outside of the private banking system plus the amount of demand deposit

Demand deposits or checkbook money are funds held in demand accounts in commercial banks. These account balances are usually considered money and form the greater part of the narrowly defined money supply of a country. Simply put, these are dep ...

s, travelers checks and other checkable deposits + most savings account

A savings account is a bank account at a retail banking, retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditi ...

s.

* M2: M1 + money market account

A money market account (MMA) or money market deposit account (MMDA) is a deposit account that pays interest based on current interest rates in the money markets. The interest rates paid are generally higher than those of savings accounts and tra ...

s, retail money market mutual funds, and small denomination time deposits ( certificates of deposit of under $100,000).

* MZM: 'Money Zero Maturity' is one of the most popular aggregates in use by the Fed because its velocity

Velocity is a measurement of speed in a certain direction of motion. It is a fundamental concept in kinematics, the branch of classical mechanics that describes the motion of physical objects. Velocity is a vector (geometry), vector Physical q ...

has historically been the most accurate predictor of inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of curre ...

. It is M2 – time deposits + money market funds

* M3: M2 + all other CDs (large time deposits, institutional money market mutual fund balances), deposits of eurodollars and repurchase agreement

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of secured short-term borrowing, usually, though not always using government securities as collateral. A contracting party sells a security to a lend ...

s.

* M4-: M3 + Commercial Paper

Commercial paper, in the global financial market, is an Unsecured debt, unsecured promissory note with a fixed Maturity (finance), maturity of usually less than 270 days. In layperson terms, it is like an "IOU" but can be bought and sold becaus ...

* M4: M4- + T-Bills (or M3 + Commercial Paper + T-Bills)

* L: The broadest measure of liquidity, that the Federal Reserve no longer tracks. L is very close to M4 + Bankers' Acceptance

* Money Multiplier: M1 / MB. As of December 3, 2015, it was 0.756. While a multiplier under one is historically an oddity, this is a reflection of the popularity of M2 over M1 and the massive amount of MB the government has created since 2008.

Prior to 2020, savings accounts were counted as M2 and not part of M1 as they were not considered "transaction accounts" by the Fed. (There was a limit of six transactions per cycle that could be carried out in a savings account without incurring a penalty.) On March 15, 2020, the Federal Reserve eliminated reserve requirements for all depository institutions and rendered the regulatory distinction between reservable "transaction accounts" and nonreservable "savings deposits" unnecessary. On April 24, 2020, the Board removed this regulatory distinction by deleting the six-per-month transfer limit on savings deposits. From this point on, savings account deposits were included in M1.

Although the Treasury can and does hold cash and a special deposit account at the Fed (TGA account), these assets do not count in any of the aggregates. So in essence, money paid in taxes paid to the Federal Government (Treasury) is excluded from the money supply. To counter this, the government created the Treasury Tax and Loan (TT&L) program in which any receipts above a certain threshold are redeposited in private banks. The idea is that tax receipts won't decrease the amount of reserves in the banking system. The TT&L accounts, while demand deposits, do not count toward M1 or any other aggregate either.

When the Federal Reserve announced in 2005 that they would cease publishing M3 statistics in March 2006, they explained that M3 did not convey any additional information about economic activity compared to M2, and thus, "has not played a role in the monetary policy process for many years." Therefore, the costs to collect M3 data outweighed the benefits the data provided. Some politicians have spoken out against the Federal Reserve's decision to cease publishing M3 statistics and have urged the U.S. Congress to take steps requiring the Federal Reserve to do so. Congressman Ron Paul

Ronald Ernest Paul (born August 20, 1935) is an American author, activist, and politician who served as the U.S. representative for Texas's 22nd congressional district from 1976 to 1977, and again from 1979 to 1985, as well as for Texas' ...

(R-TX) claimed that "M3 is the best description of how quickly the Fed is creating new money and credit. Common sense tells us that a government central bank creating new money out of thin air depreciates the value of each dollar in circulation." Some of the data used to calculate M3 are still collected and published on a regular basis. Current alternate sources of M3 data are available from the private sector.

In the United States, a bank's reserves consist of U.S. currency held by the bank (also known as "vault cash") plus the bank's balances in Federal Reserve accounts. For this purpose, cash on hand and balances in Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

("Fed") accounts are interchangeable (both are obligations of the Fed). Reserves may come from any source, including the federal funds market, deposits by the public, and borrowing from the Fed itself.

As of April 2013, the monetary base was $3 trillion and M2, the broadest measure of money supply, was $10.5 trillion.

Oceania

Australia

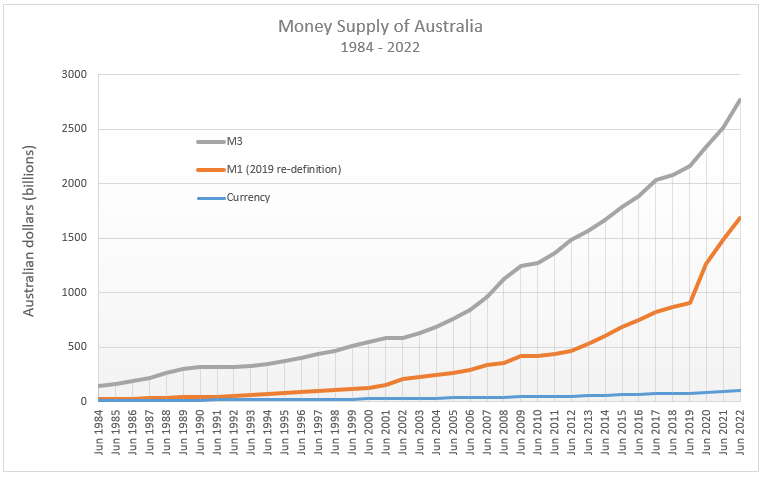

Reserve Bank of Australia

The Reserve Bank of Australia (RBA) is Australia's central bank and banknote issuing authority. It has had this role since 14 January 1960, when the ''Reserve Bank Act 1959'' removed the central banking functions from the Commonwealth Bank.

Th ...

defines the monetary aggregates as:

* M1: currency in circulation

In monetary economics, the currency in circulation in a country is the value of

currency or cash (banknotes and coins) that has ever been issued by the country’s monetary authority less the amount that has been removed. More broadly, money in ...

plus bank current deposits from the private non-bank sector

* M3: M1 plus all other bank deposits from the private non-bank sector, plus bank certificate of deposits, less inter-bank deposits

* Broad money: M3 plus borrowings from the private sector by NBFIs, less the latter's holdings of currency and bank deposits

* Money base: holdings of notes and coins by the private sector plus deposits of banks with the Reserve Bank of Australia (RBA) and other RBA liabilities to the private non-bank sector.

New Zealand

The

The Reserve Bank of New Zealand

The Reserve Bank of New Zealand (RBNZ) () is the central bank of New Zealand. It was established in 1934 and is currently constituted under the ''Reserve Bank of New Zealand Act 2021''. The current acting governor of the Reserve Bank, Christian ...

defines the monetary aggregates as:

* M1: notes and coins held by the public plus chequeable deposits, minus inter-institutional chequeable deposits, and minus central government deposits

* M2: M1 + all non-M1 call funding (call funding includes overnight money and funding on terms that can of right be broken without break penalties) minus inter-institutional non-M1 call funding

* M3: the broadest monetary aggregate. It represents all New Zealand dollar funding of M3 institutions and any Reserve Bank repos with non-M3 institutions. M3 consists of notes & coin held by the public plus NZ dollar funding minus inter-M3 institutional claims and minus central government deposits

South Asia

India

The

The Reserve Bank of India

Reserve Bank of India, abbreviated as RBI, is the central bank of the Republic of India, and regulatory body responsible for regulation of the Indian banking system and Indian rupee, Indian currency. Owned by the Ministry of Finance (India), Min ...

defines the monetary aggregates as:

* Reserve money (M0): Currency in circulation, plus bankers' deposits with the RBI and 'other' deposits with the RBI. Calculated from net RBI credit to the government plus RBI credit to the commercial sector, plus RBI's claims on banks and net foreign assets plus the government's currency liabilities to the public, less the RBI's net non-monetary liabilities. M0 outstanding was 30.297 trillion as on March 31, 2020.

* M1: Currency with the public plus deposit money of the public (demand deposits with the banking system and 'other' deposits with the RBI). M1 was 184 per cent of M0 in August 2017.

* M2: M1 plus savings deposits with post office savings banks. M2 was 879 per cent of M0 in August 2017.

* M3 (the broad concept of money supply): M1 plus time deposits with the banking system, made up of net bank credit to the government plus bank credit to the commercial sector, plus the net foreign exchange assets of the banking sector and the government's currency liabilities to the public, less the net non-monetary liabilities of the banking sector (other than time deposits). M3 was 555 per cent of M0 as on March 31, 2020(i.e. 167.99 trillion.)

* M4: M3 plus all deposits with post office savings banks (excluding National Savings Certificates).

Importance of money supply

The importance which has historically been attached to the money supply in the monetary policy of central banks is due to the suggestion that movements in money may determine important economic variables like prices (and hence inflation), output and employment. Indeed, two prominent analytical frameworks in the 20th century both built on this premise: theKeynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

IS-LM model and the monetarist quantity theory of money

The quantity theory of money (often abbreviated QTM) is a hypothesis within monetary economics which states that the general price level of goods and services is directly proportional to the amount of money in circulation (i.e., the money supply) ...

.

IS-LM model

The IS-LM model was introduced byJohn Hicks

Sir John Richard Hicks (8 April 1904 – 20 May 1989) was a British economist. He is considered one of the most important and influential economists of the twentieth century. The most familiar of his many contributions in the field of economics ...

in 1937 to describe Keynesian macroeconomic theory. Between the 1940s and mid-1970s, it was the leading framework of macroeconomic analysis and is still today an important conceptual introductory tool in many macroeconomics textbooks. In the traditional version of this model it is assumed that the central bank conducts monetary policy by increasing or decreasing the money supply, which affects interest rates and consequently investment

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broade ...

, aggregate demand

In economics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the ...

and output.

In light of the fact that modern central banks have generally ceased to target the money supply as an explicit policy variable, in some more recent macroeconomic textbooks the IS-LM model has been modified to incorporate the fact that rather than manipulating the money supply, central banks tend to conduct their policies by setting policy interest rates more directly.

Quantity theory of money

According to thequantity theory of money

The quantity theory of money (often abbreviated QTM) is a hypothesis within monetary economics which states that the general price level of goods and services is directly proportional to the amount of money in circulation (i.e., the money supply) ...

, inflation is caused by movements in the supply of money and hence can be controlled by the central bank if the bank controls the money supply. The theory builds upon Irving Fisher

Irving Fisher (February 27, 1867 – April 29, 1947) was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt de ...

's equation of exchange from 1911:

:

where

* is the total dollars in the nation's money supply,

* is the number of times per year each dollar is spent ( velocity of money),

* is the average price of all the goods and services sold during the year,

* is the quantity of assets, goods and services sold during the year.

In practice, macroeconomists almost always use real GDP to define , omitting the role of all other transactions. Either way, the equation in itself is an identity which is true by definition rather than describing economic behavior. That is, velocity

Velocity is a measurement of speed in a certain direction of motion. It is a fundamental concept in kinematics, the branch of classical mechanics that describes the motion of physical objects. Velocity is a vector (geometry), vector Physical q ...

is defined by the values of the other three variables. Unlike the other terms, the velocity of money has no independent measure and can only be estimated by dividing by . Adherents of the quantity theory of money assume that the velocity of money is stable and predictable, being determined mostly by financial institutions. If that assumption is valid, then changes in can be used to predict changes in . If not, then a model of is required in order for the equation of exchange to be useful as a macroeconomics model or as a predictor of prices.

Most macroeconomists replace the equation of exchange with equations for the demand for money which describe more regular economic behavior. However, predictability (or the lack thereof) of the velocity of money is equivalent to predictability (or the lack thereof) of the demand for money (since in equilibrium real money demand is simply ).

There is some empirical

Empirical evidence is evidence obtained through sense experience or experimental procedure. It is of central importance to the sciences and plays a role in various other fields, like epistemology and law.

There is no general agreement on how t ...

evidence of a direct relationship between the growth of the money supply and long-term price inflation, at least for rapid increases in the amount of money in the economy. The quantity theory was a cornerstone for the monetarists and in particular Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and ...

, who together with Anna Schwartz

Anna Jacobson Schwartz (pronounced ; November 11, 1915 – June 21, 2012) was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for ''The New York Times''. Paul Krugman has said that Sch ...

in 1963 in a pioneering work documented the relationship between money and inflation in the United States during the period 1867–1960. During the 1970s and 1980s the monetarist ideas were increasingly influential, and major central banks like the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

, the Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the Kingdom of England, English Government's banker and debt manager, and still one ...

and the German Bundesbank

The Deutsche Bundesbank (, , colloquially Buba, sometimes alternatively abbreviated as BBk or DBB) is the national central bank for Germany within the Eurosystem. It was the German central bank from 1957 to 1998, issuing the Deutsche Mark (DM). ...

officially followed a monetary policy objective of increasing the money supply in a stable way.

Declining importance

Starting in the mid-1970s and increasingly over the next decades, the empirical correlation between fluctuations in the money supply and changes in income or prices broke down, and there appeared clear evidence that money demand (or, equivalently, velocity) was unstable, at least in the short and medium run, which is the time horizon that is relevant to monetary policy. This made a money target less useful for central banks and led to the decline of money supply as a tool of monetary policy. Instead central banks generally switched to steering interest rates directly, allowing money supply to fluctuate to accommodate fluctuations in money demand. Concurrently, most central banks in developed countries implemented directinflation targeting

In macroeconomics, inflation targeting is a monetary policy where a central bank follows an explicit target for the inflation rate for the medium-term and announces this inflation target to the public. The assumption is that the best that moneta ...

as the foundation of their monetary policy, which leaves little room for a special emphasis on the money supply. In the United States, the strategy of targeting the money supply was tried under Federal Reserve chairman Paul Volcker

Paul Adolph Volcker Jr. (September 5, 1927 – December 8, 2019) was an American economist who served as the 12th chair of the Federal Reserve, chairman of the Federal Reserve from 1979 to 1987. During his tenure as chairman, Volcker was widely ...

from 1979, but was found to be impractical and later given up. According to Benjamin Friedman, the number of central banks that actively seek to influence money supply as an element of their monetary policy is shrinking to zero.

Even though today central banks generally do not try to determine the money supply, monitoring money supply data may still play a role in the preparation of monetary policy as part of a wide array of financial and economic data that policymakers review. Developments in money supply may contain information of the behavior of commercial banks and of the general economic stance which is useful for judging future movements in, say, employment and inflation. Also in this respect, however, money supply data have a mixed record. In the United States, for instance, the Conference Board Leading Economic Index

The Conference Board Leading Economic Index is an American economic leading indicator intended to forecast future economic activity. It is calculated by The Conference Board, a non-governmental organization, which determines the value of the inde ...

originally included a real money supply (M2) component as one of its 10 leading indicators, but removed it from the index in 2012 after having ascertained that it had performed poorly as a leading indicator since 1989.

See also

*Bank regulation

Banking regulation and supervision refers to a form of financial regulation which subjects banks to certain requirements, restrictions and guidelines, enforced by a financial regulatory authority generally referred to as banking supervisor, wit ...

* Capital requirement

A capital requirement (also known as regulatory capital, capital adequacy or capital base) is the amount of capital a bank or other financial institution has to have as required by its financial regulator. This is usually expressed as a capital ...

* Chartalism

* Chicago plan

The Chicago Plan was introduced by University of Chicago economists in 1933 as a comprehensive plan to reform the monetary and banking system of the United States. The Great Depression had been caused in part by excessive private bank lending ...

* Debt based monetary system

* Debt-to-GDP ratio

In economics, the debt-to-GDP ratio is the ratio of a country's accumulation of government debt (measured in units of currency) to its gross domestic product (GDP) (measured in units of currency per year). A low debt-to-GDP ratio indicates that an ...

* Economics terminology that differs from common usage

* Financial capital

Financial capital (also simply known as capital or equity in finance, accounting and economics) is any Economic resources, economic resource measured in terms of money used by entrepreneurs and businesses to buy what they need to make their prod ...

* FRED (Federal Reserve Economic Data)

* Full reserve banking

* Macroprudential regulation

* Monetary economics

Monetary economics is the branch of economics that studies the different theories of money: it provides a framework for analyzing money and considers its functions (as medium of exchange, store of value, and unit of account), and it considers how m ...

* Monetary reform

Monetary reform is any movement or theory that proposes a system of supplying money and financing the economy that is different from the current system.

Monetary reformers may advocate any of the following, among other proposals:

* A return to ...

* Money circulation

* Money market

The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year or less.

As short-term securities became a commodity, the money market became a compo ...

References

Further reading

Article in the New Palgrave on Money Supply

by

Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and ...

St. Louis Fed: Monetary Aggregates

Investopedia: Money Zero Maturity (MZM)

External links

* ttps://fraser.stlouisfed.org/title/88 Historical H.3 releases

Money Stock Measures (H.6)

Monetary Survey

from

People's Bank of China

The People's Bank of China (officially PBC and unofficially PBOC) is the central bank of the People's Republic of China. It is responsible for carrying out monetary policy as determined by the ''PRC People's Bank Law'' and the ''PRC Commercia ...

{{Authority control

Monetary policy

Inflation