A gold standard is a

monetary system

A monetary system is a system by which a government provides money in a country's economy. Modern monetary systems usually consist of the national treasury, the mint, the central banks and commercial banks.

Commodity money system

A commodity m ...

in which the standard

economic unit of account

In economics, unit of account is one of the money functions. A unit of account is a standard numerical monetary unit of measurement of the market value of goods, services, and other transactions. Also known as a "measure" or "standard" of rela ...

is based on a fixed quantity of

gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile me ...

. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932

as well as from 1944 until 1971 when the United States unilaterally terminated

convertibility

Convertibility is the quality that allows money or other financial instruments to be converted into other liquid stores of value. Convertibility is an important factor in international trade, where instruments valued in different currencies mus ...

of the US dollar to gold, effectively ending the

Bretton Woods system. Many states nonetheless hold substantial

gold reserves.

Historically, the

silver standard

The silver standard is a monetary system in which the standard economic unit of account is a fixed weight of silver. Silver was far more widespread than gold as the monetary standard worldwide, from the Sumerians 3000 BC until 1873. Following ...

and

bimetallism have been more common than the gold standard.

The shift to an international monetary system based on a gold standard reflected accident,

network externalities, and

path dependence.

Great Britain accidentally adopted a ''de facto'' gold standard in 1717 when Sir

Isaac Newton

Sir Isaac Newton (25 December 1642 – 20 March 1726/27) was an English mathematician, physicist, astronomer, alchemist, theologian, and author (described in his time as a " natural philosopher"), widely recognised as one of the grea ...

, then-master of the

Royal Mint, set the exchange rate of silver to gold too low, thus causing silver coins to go out of circulation.

As Great Britain became the world's leading financial and commercial power in the 19th century, other states increasingly adopted Britain's monetary system.

The gold standard was largely abandoned during the

Great Depression before being re-instated in a limited form as part of the post-

World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposing ...

Bretton Woods system. The gold standard was abandoned due to its propensity for volatility, as well as the constraints it imposed on governments: by retaining a

fixed exchange rate

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another ...

, governments were hamstrung in engaging in

expansionary policies to, for example, reduce unemployment during economic

recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

s.

According to a survey of 39 economists, the majority (93 percent) agreed that a return to the gold standard would not improve price-stability and employment outcomes,

and two-thirds of economic historians reject the idea that the gold standard "was effective in stabilizing prices and moderating business-cycle fluctuations during the nineteenth century."

Nonetheless, according to economist

Michael D. Bordo, the gold standard has three benefits: "its record as a stable nominal anchor; its automaticity; and its role as a credible commitment mechanism."

Implementation

The United Kingdom slipped into a gold specie standard in 1717 by over-valuing gold at 15.2 times its weight in silver. It was unique among nations to use gold in conjunction with clipped, underweight silver shillings, addressed only before the end of the 18th century by the acceptance of gold proxies like token silver coins and banknotes.

From the more widespread acceptance of paper money in the 19th century emerged the gold bullion standard, a system where gold coins do not circulate, but authorities like

central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central b ...

s agree to exchange circulating currency for gold bullion at a fixed price. First emerging in the late 18th century to regulate exchange between London and Edinburgh, Keynes (1913) noted how such a standard became the predominant means of implementing the gold standard internationally in the 1870s.

Restricting the free circulation of gold under the Classical Gold Standard period from the 1870s to 1914 was also needed in countries which decided to implement the gold standard while guaranteeing the exchangeability of huge amounts of legacy silver coins into gold at the fixed rate (rather than valuing publicly-held silver at its depreciated value). The term limping standard is often used in countries maintaining significant amounts of silver coin at par with gold, thus an additional element of uncertainty with the currency's value versus gold. The most common silver coins kept at limping standard parity included

French 5-franc coins,

German 3-mark thalers,

Dutch guilders,

Indian rupee

The Indian rupee ( symbol: ₹; code: INR) is the official currency in the republic of India. The rupee is subdivided into 100 ''paise'' (singular: ''paisa''), though as of 2022, coins of denomination of 1 rupee are the lowest value in use w ...

s, and U.S.

Morgan dollar

The Morgan dollar is a United States dollar coin minted from 1878 to 1904, in 1921, and beginning again in 2021. It was the first standard silver dollar minted since the passage of the Coinage Act of 1873, which ended the free coining of silve ...

s.

Lastly, countries may implement a gold exchange standard, where the government guarantees a fixed exchange rate, not to a specified amount of gold, but rather to the currency of another country that is under a gold standard. This became the predominant international standard under the

Bretton Woods Agreement

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the United States, Canada, Western European countries, Australia, and Japan after the 1944 Bretton Woods Agreement. The Bretto ...

from 1945 to 1971 by the fixing of world currencies to the

U.S. dollar, the only currency after World War II to be on the gold bullion standard.

History before 1873

Silver and bimetallic standards until the 19th century

The use of gold as money began around 600 BCE in Asia Minor and has been widely accepted ever since, together with various other commodities used as

money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are as ...

, with those that lose the least value over time becoming the accepted form. In the early and high

Middle Ages

In the history of Europe, the Middle Ages or medieval period lasted approximately from the late 5th to the late 15th centuries, similar to the post-classical period of global history. It began with the fall of the Western Roman Empire ...

, the

Byzantine

The Byzantine Empire, also referred to as the Eastern Roman Empire or Byzantium, was the continuation of the Roman Empire primarily in its eastern provinces during Late Antiquity and the Middle Ages, when its capital city was Constantinopl ...

gold

solidus

Solidus (Latin for "solid") may refer to:

* Solidus (coin), a Roman coin of nearly solid gold

* Solidus (punctuation), or slash, a punctuation mark

* Solidus (chemistry), the line on a phase diagram below which a substance is completely solid

* ...

or ''

bezant

In the Middle Ages, the term bezant (Old French ''besant'', from Latin ''bizantius aureus'') was used in Western Europe to describe several gold coins of the east, all derived ultimately from the Roman ''solidus''. The word itself comes from th ...

'' was used widely throughout Europe and the Mediterranean, but its use waned with the decline of the Byzantine Empire's economic influence.

However, economic systems using gold as the sole currency and unit of account never emerged before the 18th century. For millennia it was silver, not gold, which was the real basis of the domestic economies: the foundation for most money-of-account systems, for payment of wages and salaries, and for most local retail trade.

Gold functioning as currency and unit of account for daily transactions was not possible due to various hindrances which were only solved by tools that emerged in the 19th century, among them:

* Divisibility: Gold as currency was hindered by its small size and rarity, with the dime-sized

ducat of 3.4 grams representing 7 days’ salary for the highest-paid workers. In contrast, coins of silver and

billon (low-grade silver) easily corresponded to daily labor costs and food purchases, making silver more effective as currency and unit of account. In mid-15th century England, most highly paid skilled artisans earned 6d a day (six pence, or 5.4 g silver), and a whole sheep cost 12d. This made the ducat of 40d and the half-ducat of 20d of little use for domestic trade.

* Non-existence of token coinage for gold: Sargent and Velde (1997) explained how token coins of copper or billon exchangeable for silver or gold were almost non-existent before the 19th century. Small change was issued at almost full intrinsic value and without conversion provisions into specie. Tokens of little intrinsic value were widely mistrusted, were viewed as a precursor to currency devaluation, and were easily counterfeited in the pre-industrial era. This made the gold standard impossible anywhere with token silver coins; Britain itself only accepted the latter in the 19th century.

* Non-existence of banknotes: Banknotes were mistrusted as currency in the first half of the 18th century following France's failed banknote issuance in 1716 under

economist John Law. Banknotes only became accepted across Europe with the further maturing of banking institutions, and also as a result of the Napoleonic Wars of the early 19th century. Counterfeiting concerns also applied to banknotes.

The earliest European currency standards were therefore based on the

silver standard

The silver standard is a monetary system in which the standard economic unit of account is a fixed weight of silver. Silver was far more widespread than gold as the monetary standard worldwide, from the Sumerians 3000 BC until 1873. Following ...

, from the denarius of the Roman Empire, to the penny (denier) introduced by

Charlemagne

Charlemagne ( , ) or Charles the Great ( la, Carolus Magnus; german: Karl der Große; 2 April 747 – 28 January 814), a member of the Carolingian dynasty, was King of the Franks from 768, King of the Lombards from 774, and the first ...

throughout Western Europe, to the

Spanish dollar

The Spanish dollar, also known as the piece of eight ( es, Real de a ocho, , , or ), is a silver coin of approximately diameter worth eight Spanish reales. It was minted in the Spanish Empire following a monetary reform in 1497 with content ...

and the German

Reichsthaler

The ''Reichsthaler'' (; modern spelling Reichstaler), or more specifically the ''Reichsthaler specie'', was a standard thaler silver coin introduced by the Holy Roman Empire in 1566 for use in all German states, minted in various versions for the ...

and

Conventionsthaler

The ''Conventionstaler'' or ''Konventionstaler'' ("Convention ''thaler''"), was a standard silver coin in the Austrian Empire and the southern German states of the Holy Roman Empire from the mid-18th to early 19th-centuries. Its most famous exam ...

which survived well into the 19th century. Gold functioned as a medium for international trade and high-value transactions, but it generally fluctuated in price versus everyday silver money.

A

bimetallic standard emerged under a silver standard in the process of giving popular gold coins like

ducats a fixed value in terms of silver. In light of fluctuating gold-silver ratios in other countries, bimetallic standards were rather unstable and ''de facto'' transformed into a ''parallel bimetallic standard'' (where gold circulates at a floating exchange rate to silver) or reverted to a mono-metallic standard.

France was the most important country which maintained a bimetallic standard during most of the 19th century.

Gold standard origin in Britain

The English

pound sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and ...

introduced c 800 CE was initially a silver standard unit worth 20 shillings or 240 silver pennies. The latter initially contained 1.35 g fine silver, reducing by 1601 to 0.464 g (hence giving way to the shilling

2 penceof 5.57 g fine silver). Hence the pound sterling was originally 324 g fine silver reduced to 111.36 g by 1601.

The problem of clipped, underweight silver pennies and shillings was a persistent, unresolved issue from the late 17th century to the early 19th century. In 1717 the value of the

gold guinea (of 7.6885 g fine gold) was fixed at 21 shillings, resulting in a gold-silver ratio of 15.2 higher than prevailing ratios in Continental Europe. Great Britain was therefore ''de jure'' under a bimetallic standard with gold serving as the cheaper and more reliable currency compared to clipped silver

(full-weight silver coins did not circulate and went to Europe where 21 shillings fetched over a guinea in gold). Several factors helped extend the British gold standard into the 19th century, namely:

* The

Brazilian Gold Rush of the 18th century supplying significant quantities of gold to Portugal and Britain, with

Portuguese gold coins also legal tender in Britain.

* Ongoing trade deficits with China (which sold to Europe but had little use for European goods) drained silver from the economies of most of Europe. Combined with greater confidence in banknotes issued by the

Bank of England, it opened the way for gold as well as banknotes becoming acceptable currency in lieu of silver.

* The acceptability of token / subsidiary silver coins as substitutes for gold before the end of the 18th century. Initially issued by the Bank of England and other private companies, permanent issuance of subsidiary coinage from the

Royal Mint commenced after the

Great Recoinage of 1816.

A proclamation from

Queen Anne in 1704 introduced the

British West Indies

The British West Indies (BWI) were colonized British territories in the West Indies: Anguilla, the Cayman Islands, Turks and Caicos Islands, Montserrat, the British Virgin Islands, Antigua and Barbuda, The Bahamas, Barbados, Dominica, Grena ...

to the gold standard; however it did not result in the wide use of gold currency and the gold standard, given Britain's

mercantilist policy of hoarding gold and silver from its colonies for use at home. Prices were quoted ''de jure'' in gold pounds sterling but were rarely paid in gold; the colonists' ''de facto'' daily medium of exchange and unit of account was predominantly the

Spanish silver dollar. Also explained in the

history of the Trinidad and Tobago dollar.

Following the Napoleonic Wars, Britain legally moved from the bimetallic to the gold standard in the 19th century in several steps, namely:

* The 21-shilling guinea was discontinued in favor of the

20-shilling gold sovereign, or £1 coin, which contained 7.32238 g fine gold

* The permanent issuance of subsidiary, limited legal tender silver coinage, commencing with the

Great Recoinage of 1816

* The 1819 Act for the Resumption of Cash Payments, which set 1823 as the date for resumption of convertibility of Bank of England banknotes into gold sovereigns, and

* The

Peel Banking Act of 1844, which institutionalized the gold standard in Britain by establishing a ratio between gold reserves held by the

Bank of England versus the banknotes which it could issue, and by significantly curbing the privilege of other British banks to issue banknotes.

From the second half of the 19th century Britain then introduced its gold standard to Australia, New Zealand, and the

British West Indies

The British West Indies (BWI) were colonized British territories in the West Indies: Anguilla, the Cayman Islands, Turks and Caicos Islands, Montserrat, the British Virgin Islands, Antigua and Barbuda, The Bahamas, Barbados, Dominica, Grena ...

in the form of circulating gold sovereigns as well as banknotes that were convertible at par into sovereigns or Bank of England banknotes.

Canada introduced its own gold dollar in 1867 at par with the

U.S. gold dollar and with a fixed exchange rate to the gold sovereign.

Effects of the 19th century gold rush

Up until 1850 only Britain and a few of its colonies were on the gold standard, with the majority of other countries being on the silver standard. France and the United States were two of the more notable countries on the

bimetallic standard. France's actions in maintaining the

French franc

The franc (, ; sign: F or Fr), also commonly distinguished as the (FF), was a currency of France. Between 1360 and 1641, it was the name of coins worth 1 livre tournois and it remained in common parlance as a term for this amount of money. It w ...

at either 4.5 g fine silver or 0.29032 g fine gold stabilized world gold-silver price ratios close to the French ratio of 15.5 in the first three quarters of the 19th century by offering to mint the cheaper metal in unlimited quantities – gold 20-franc coins whenever the ratio is below 15.5, and silver 5-franc coins whenever the ratio is above 15.5. The

United States dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the officia ...

was also bimetallic ''de jure'' until 1900, worth either 24.0566 g fine silver, or 1.60377 g fine gold (ratio 15.0); the latter revised to 1.50463 g fine gold (ratio 15.99) from 1837 to 1934. The silver dollar was generally the cheaper currency before 1837, while the gold dollar was cheaper between 1837 and 1873.

The nearly-coincidental

California gold rush of 1849 and the

Australian gold rushes of 1851 significantly increased world gold supplies and the minting of gold francs and dollars as the gold-silver ratio went below 15.5, pushing France and the United States into the gold standard with Great Britain during the 1850s. The benefits of the gold standard were first felt by this larger bloc of countries, with Britain and France being the world's leading financial and industrial powers of the 19th century while the United States was an emerging power.

By the time the gold-silver ratio reverted to 15.5 in the 1860s, this bloc of gold-utilizing countries grew further and provided momentum to an international gold standard before the end of the 19th century.

* Portugal and several British colonies commenced with the gold standard in the 1850s and 1860s

* France was joined by Belgium, Switzerland and Italy in a larger

Latin Monetary Union

The Latin Monetary Union (LMU) was a 19th-century system that unified several European currencies into a single currency that could be used in all member states when most national currencies were still made out of gold and silver. It was establ ...

based on both the gold and silver

French franc

The franc (, ; sign: F or Fr), also commonly distinguished as the (FF), was a currency of France. Between 1360 and 1641, it was the name of coins worth 1 livre tournois and it remained in common parlance as a term for this amount of money. It w ...

s.

* Several international monetary conferences during the 1860s began to consider the merits of an international gold standard, albeit with concerns on its impact on the price of silver should several countries make the switch.

The international classical gold standard, 1873–1914

Rollout in Europe and the United States

The international classical gold standard commenced in 1873 after the

German Empire decided to transition from the silver

North German thaler

The North German thaler was a currency used by several states of Northern Germany from 1690 to 1873, first under the Holy Roman Empire, then by the German Confederation. Originally equal to the Reichsthaler specie or silver coin from 1566 until t ...

and

South German gulden to the

German gold mark, reflecting the sentiment of the monetary conferences of the 1860s, and utilizing the 5 billion gold francs (worth 4.05 billion marks or 1,451

metric tons) in indemnity demanded from France at the end of the

Franco-Prussian War. This transition done by a large, centrally located European economy also triggered a switch to gold by several European countries in the 1870s, and led as well to the suspension of the unlimited minting of silver 5-franc coins in the Latin Monetary Union in 1873.

The following countries switched from silver or bimetallic currencies to gold in the following years (Britain is included for completeness):

* 1816,

British Empire

The British Empire was composed of the dominions, colonies, protectorates, mandates, and other territories ruled or administered by the United Kingdom and its predecessor states. It began with the overseas possessions and trading posts e ...

: one

pound: from 111.37 g silver to 7.32238 g gold; ratio 15.21

* 1873,

German Empire: one

North German thaler

The North German thaler was a currency used by several states of Northern Germany from 1690 to 1873, first under the Holy Roman Empire, then by the German Confederation. Originally equal to the Reichsthaler specie or silver coin from 1566 until t ...

or 1

South German gulden of 16.67 g silver, converted to 3

German gold marks of 3/2.79 = 1.0753 g gold; ratio 15.5

* 1873,

Latin Monetary Union

The Latin Monetary Union (LMU) was a 19th-century system that unified several European currencies into a single currency that could be used in all member states when most national currencies were still made out of gold and silver. It was establ ...

franc: from 4.5 g silver to 9/31 = 0.29032 g gold; ratio 15.5

* 1873,

United States dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the officia ...

, by the

Coinage Act of 1873: from 24.0566 g silver to 1.50463 g gold; ratio 15.99

* 1875,

Scandinavian Monetary Union __NOTOC__

The Scandinavian Monetary Union was a monetary union formed by Denmark and Sweden on 5 May 1873, with Norway joining in 1875. It established a common currency unit, the krone/krona, based on the gold standard. It was one of the few tan ...

:

Rigsdaler specie of 25.28 g silver, converted to 4

krone (or

krona) of 4/2.48 = 1.6129 g gold; ratio 15.67

* 1875, Netherlands: the

Dutch Guilder from 9.45 g silver to 0.6048 g gold; ratio 15.625.

* 1881,

Ottoman Empire

The Ottoman Empire, * ; is an archaic version. The definite article forms and were synonymous * and el, Оθωμανική Αυτοκρατορία, Othōmanikē Avtokratoria, label=none * info page on book at Martin Luther University) ...

: the

Ottoman lira

* 1892,

Austria–Hungary

Austria-Hungary, often referred to as the Austro-Hungarian Empire,, the Dual Monarchy, or Austria, was a constitutional monarchy and great power in Central Europe between 1867 and 1918. It was formed with the Austro-Hungarian Compromise of 1 ...

: the

Austro-Hungarian florin

The florin (german: Gulden, hu, forint, hr, forinta/florin, cs, zlatý) was the currency of the lands of the House of Habsburg between 1754 and 1892 (known as the Austrian Empire from 1804 to 1867 and the Austro-Hungarian Monarchy after 1867), ...

of 11.11 g silver, converted to two

Austro-Hungarian krone

The crown (german: Krone, hu, korona, it, Corona, pl, korona, sl, krona, sh, kruna, cz, koruna, sk, koruna, ro, coroană) was the official currency of Austria-Hungary from 1892 (when it replaced the florin as part of the adoption of the ...

of 2/3.28 = 0.60976 g gold; ratio 18.22

* 1897,

Russian Empire

The Russian Empire was an empire and the final period of the Russian monarchy from 1721 to 1917, ruling across large parts of Eurasia. It succeeded the Tsardom of Russia following the Treaty of Nystad, which ended the Great Northern War. ...

: the

ruble

The ruble (American English) or rouble (Commonwealth English) (; rus, рубль, p=rublʲ) is the currency unit of Belarus and Russia. Historically, it was the currency of the Russian Empire and of the Soviet Union.

, currencies named ''rub ...

from 18 g silver to 0.7742 g gold; ratio 23.25.

The gold standard became the basis for the international monetary system after 1873.

According to economic historian

Barry Eichengreen

Barry Julian Eichengreen (born 1952) is an American economist and economic historian who holds the title of George C. Pardee and Helen N. Pardee Professor of Economics and Political Science at the University of California, Berkeley, where he ha ...

, "only then did countries settle on gold as the basis for their money supplies. Only then were pegged exchange rates based on the gold standard firmly established."

Adopting and maintaining a singular monetary arrangement encouraged international trade and investment by stabilizing international price relationships and facilitating foreign borrowing.

The gold standard was not firmly established in non-industrial countries.

Central banks and the gold exchange standard

As feared by the various international monetary conferences of the 1860s, the switch to gold, combined with record U.S. silver output from the

Comstock Lode

The Comstock Lode is a lode of silver ore located under the eastern slope of Mount Davidson, a peak in the Virginia Range in Virginia City, Nevada (then western Utah Territory), which was the first major discovery of silver ore in the Unit ...

, plunged the price of silver after 1873 with the gold-silver ratio climbing to historic highs of 18 by 1880. Most of continental Europe made the conscious decision to move to the gold standard while leaving the mass of legacy (and erstwhile depreciated) silver coins remaining unlimited legal tender and convertible at face value for new gold currency. The term limping standard was used to describe currencies whose nations’ commitment to the gold standard was put into doubt by the huge mass of silver coins still tendered for payment, the most numerous of which were

French 5-franc coins,

German 3-mark Vereinsthalers,

Dutch guilders and American

Morgan dollar

The Morgan dollar is a United States dollar coin minted from 1878 to 1904, in 1921, and beginning again in 2021. It was the first standard silver dollar minted since the passage of the Coinage Act of 1873, which ended the free coining of silve ...

s.

Britain's original gold specie standard with gold in circulation was not feasible anymore with the rest of Continental Europe also switching to gold. The problem of scarce gold and legacy silver coins was only resolved by national

central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central b ...

s taking over the replacement of silver with national bank notes and token coins, centralizing the nation's supply of scarce gold, providing for reserve assets to guarantee convertibility of legacy silver coins, and allowing the conversion of banknotes into gold bullion or other gold-standard currencies solely for external purchases. This system is known as either a gold bullion standard whenever gold bars are offered, or a gold exchange standard whenever other gold-convertible currencies are offered.

John Maynard Keynes referred to both standards above as simply the gold exchange standard in his 1913 book ''Indian Currency and Finance''. He described this as the predominant form of the international gold standard before the First World War, that a gold standard was generally impossible to implement before the 19th century due to the absence of recently developed tools (like central banking institutions, banknotes, and token currencies), and that a gold exchange standard was even superior to Britain's gold specie standard with gold in circulation. As discussed by Keynes:

The classical gold standard of the late 19th century was therefore not merely a superficial switch from circulating silver to circulating gold. The bulk of silver currency was actually replaced by banknotes and token currency whose gold value was guaranteed by gold bullion and other reserve assets held inside central banks. In turn, the gold exchange standard was just one step away from modern

fiat currency with banknotes issued by central banks, and whose value is secured by the bank's reserve assets, but whose exchange value is determined by the central bank's

monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

objectives on its purchasing power in lieu of a fixed equivalence to gold.

Rollout outside Europe

The final chapter of the classical gold standard ending in 1914 saw the gold exchange standard extended to many Asian countries by fixing the value of local currencies to gold or to the gold standard currency of a Western colonial power. The

Netherlands East Indies guilder was the first Asian currency pegged to gold in 1875 via a gold exchange standard which maintained its parity with the gold

Dutch guilder.

Various international monetary conferences were called up before 1890, with various countries actually pledging to maintain the limping standard of freely circulating legacy silver coins in order to prevent the further deterioration of the gold–silver ratio which reached 20 in the 1880s.

After 1890 however, silver's price decline could not be prevented further and the gold–silver ratio rose sharply above 30.

In 1893 the

Indian rupee

The Indian rupee ( symbol: ₹; code: INR) is the official currency in the republic of India. The rupee is subdivided into 100 ''paise'' (singular: ''paisa''), though as of 2022, coins of denomination of 1 rupee are the lowest value in use w ...

of 10.69 g fine silver was fixed at 16 British pence (or £1 = 15 rupees; gold-silver ratio 21.9), with legacy silver rupees remaining legal tender. In 1906 the

Straits dollar of 24.26 g silver was fixed at 28 pence (or £1 = 8 dollars; ratio 28.4).

Nearly similar gold standards were implemented in Japan in 1897, in the Philippines in 1903, and in Mexico in 1905 when the previous

yen

The is the official currency of Japan. It is the third-most traded currency in the foreign exchange market, after the United States dollar (US$) and the euro. It is also widely used as a third reserve currency after the US dollar and the e ...

or

peso of 24.26 g silver was redefined to approximately 0.75 g gold or half a

U.S. dollar (ratio 32.3). Japan gained the needed gold reserves after the Sino-Japanese War of 1894–1895. For Japan, moving to gold was considered vital for gaining access to Western capital markets.

"Rules of the Game"

In the 1920s

John Maynard Keynes retrospectively developed the phrase "rules of the game" to describe how central banks would ideally implement a gold standard during the prewar classical era, assuming international trade flows followed the ideal

price–specie flow mechanism

The price–specie flow mechanism is a model developed by Scottish economist David Hume (1711–1776) to illustrate how trade imbalances can self-correct and adjust under the gold standard. Hume expounded his argument in ''Of the Balance of Trade' ...

. Violations of the "rules" actually observed during the classical gold standard era from 1873 to 1914, however, reveal how much more powerful national central banks actually are in influencing price levels and specie flows, compared to the "self-correcting" flows predicted by the price-specie flow mechanism.

Keynes premised the "rules of the game" on best practices of central banks to implement the pre-1914 international gold standard, namely:

* To substitute gold with fiat currency in circulation, so that gold reserves may be centralized

* To actually allow a prudently-determined ratio of gold reserves to fiat currency of less than 100%, with the difference made up by other loans and invested assets, such reserve ratio amounts consistent with

fractional reserve banking practices

* To exchange circulating currency for gold or other foreign currencies at a fixed gold price, and to freely permit gold imports and exports

* Central banks were actually allowed modest margins in exchange rates to reflect gold delivery costs while still adhering to the gold standard. To illustrate this point, France may ideally allow the

pound sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and ...

(worth 25.22 francs based on ratios of their gold content) to trade between so-called ''gold points'' of 25.02F to 25.42F (plus or minus an assumed 0.20F/£ in gold delivery costs). France prevents sterling from climbing above 25.42F by delivering gold worth 25.22F or £1 (spending 0.20F for delivery), and from falling below 25.02F by the reverse process of ordering £1 in gold worth 25.22F in France (and again, minus 0.20F in costs).

* Finally, central banks were authorized to suspend the gold standard in times of war until it could be restored again as the contingency subsides.

Central banks were also expected to maintain the gold standard on the ideal assumption of international trade operating under the

price–specie flow mechanism

The price–specie flow mechanism is a model developed by Scottish economist David Hume (1711–1776) to illustrate how trade imbalances can self-correct and adjust under the gold standard. Hume expounded his argument in ''Of the Balance of Trade' ...

proposed by economist

David Hume wherein:

* Countries which exported more goods would receive specie (gold or silver) inflows, at the expense of countries which imported those goods.

* More specie in exporting countries will result in higher price levels there, and conversely in lower price levels amongst countries spending their specie.

* Price disparities will self-correct as lower prices in specie-deficient will attract spending from specie-rich countries, until price levels in both places equalize again.

In practice, however, specie flows during the classical gold standard era failed to exhibit the self-corrective behavior described above. Gold finding its way back from surplus to deficit countries to exploit price differences was a painfully slow process, and central banks found it far more effective to raise or lower domestic price levels by lowering or raising domestic interest rates. High price level countries may raise interest rates to lower domestic demand and prices, but it may also trigger gold inflows from investors – contradicting the premise that gold will flow out of countries with high price levels. Developed economies deciding to buy or sell domestic assets to international investors also turned out to be more effective in influencing gold flows than the self-correcting mechanism predicted by Hume.

Another set of violations to the "rules of the game" involved central banks not intervening in a timely manner even as exchange rates went outside the "gold points" (in the example above, cases existed of the pound climbing above 25.42 francs or falling below 25.02 francs). Central banks were found to pursue other objectives other than fixed exchange rates to gold (like e.g. lower domestic prices, or stopping huge gold outflows), though such behavior is limited by public credibility on their adherence to the gold standard. Keynes described such violations occurring before 1913 by French banks limiting gold payouts to 200 francs per head and charging a 1% premium, and by the German Reichsbank partially suspending free payment in gold, though "covertly and with shame".

Some countries had limited success in implementing the gold standard even while disregarding such "rules of the game" in its pursuit of other monetary policy objectives. Inside the

Latin Monetary Union

The Latin Monetary Union (LMU) was a 19th-century system that unified several European currencies into a single currency that could be used in all member states when most national currencies were still made out of gold and silver. It was establ ...

, the

Italian lira

The lira (; plural lire) was the currency of Italy between 1861 and 2002. It was first introduced by the Napoleonic Kingdom of Italy in 1807 at par with the French franc, and was subsequently adopted by the different states that would eventually ...

and the

Spanish peseta

The peseta (, ),

* ca, pesseta, was the currency of Spain between 1868 and 2002. Along with the French franc, it was also a ''de facto'' currency used in Andorra (which had no national currency with legal tender).

Etymology

The name of th ...

traded outside typical gold-standard levels of 25.02–25.42F/£ for extended periods of time.

* Italy tolerated in 1866 the issuance of (forced legal tender paper currency) worth less than the Latin Monetary Union franc. It also flooded the Union with low-valued subsidiary silver coins worth less than the franc. For the rest of the 19th century the

Italian lira

The lira (; plural lire) was the currency of Italy between 1861 and 2002. It was first introduced by the Napoleonic Kingdom of Italy in 1807 at par with the French franc, and was subsequently adopted by the different states that would eventually ...

traded at a fluctuating discount versus the standard gold franc.

* In 1883 the

Spanish peseta

The peseta (, ),

* ca, pesseta, was the currency of Spain between 1868 and 2002. Along with the French franc, it was also a ''de facto'' currency used in Andorra (which had no national currency with legal tender).

Etymology

The name of th ...

went off the gold standard and traded below parity with the gold

French franc

The franc (, ; sign: F or Fr), also commonly distinguished as the (FF), was a currency of France. Between 1360 and 1641, it was the name of coins worth 1 livre tournois and it remained in common parlance as a term for this amount of money. It w ...

. However, as the free minting of silver was suspended to the general public, the peseta had a floating exchange rate between the value of the gold franc and the silver franc. The Spanish government captured all profits from minting (5-peseta coins) out of silver bought for less than 5 ptas. While total issuance was limited to prevent the peseta from falling below the silver franc, the abundance of in circulation prevented the peseta from returning at par with the gold franc. Spain's system where the silver traded at a premium above its metallic value due to relative scarcity is called the ''fiduciary standard'', and was similarly implemented in the Philippines and other Spanish colonies in the end of the 19th century.

In the United States

Inception

John Hull was authorized by the

Massachusetts legislature to make the earliest coinage of the colony, the willow, the oak, and

the pine tree shilling in 1652, once again based on the silver standard.

In the 1780s,

Thomas Jefferson

Thomas Jefferson (April 13, 1743 – July 4, 1826) was an American statesman, diplomat, lawyer, architect, philosopher, and Founding Father who served as the third president of the United States from 1801 to 1809. He was previously the natio ...

,

Robert Morris and

Alexander Hamilton recommended to Congress that a decimal currency system be adopted by the United States. The initial recommendation in 1785 was a

silver standard

The silver standard is a monetary system in which the standard economic unit of account is a fixed weight of silver. Silver was far more widespread than gold as the monetary standard worldwide, from the Sumerians 3000 BC until 1873. Following ...

based on the

Spanish milled dollar (finalized at 371.25 grains or 24.0566 g fine silver), but in the final version of the

Coinage Act of 1792

The Coinage Act of 1792 (also known as the Mint Act; officially: ''An act establishing a mint, and regulating the Coins of the United States''), passed by the United States Congress on April 2, 1792, created the United States dollar as the countr ...

Hamilton's recommendation to include a

$10 gold eagle was also approved, containing 247.5 grains (16.0377 g) fine gold. Hamilton therefore put the

U.S. dollar on a

bimetallic standard with a gold-silver ratio of 15.0.

American-issued dollars and cents remained less common in circulation than Spanish dollars and

reales (1/8th dollar) for the next six decades until foreign currency was demonetized in 1857. $10 gold eagles were exported to Europe where it could fetch over ten Spanish dollars due to their higher gold ratio of 15.5. American silver dollars also compared favorably with Spanish dollars and were easily used for overseas purchases. In 1806 President Jefferson suspended the minting of exportable gold coins and silver dollars in order to divert the

United States Mint

The United States Mint is a bureau of the Department of the Treasury responsible for producing coinage for the United States to conduct its trade and commerce, as well as controlling the movement of bullion. It does not produce paper money; tha ...

’s limited resources into fractional coins which stayed in circulation.

Pre-Civil War

The United States also embarked on establishing a national bank with the

First Bank of the United States in 1791 and the

Second Bank of the United States

The Second Bank of the United States was the second federally authorized Hamiltonian national bank in the United States. Located in Philadelphia, Pennsylvania, the bank was chartered from February 1816 to January 1836.. The Bank's formal name, ...

in 1816. In 1836, President

Andrew Jackson

Andrew Jackson (March 15, 1767 – June 8, 1845) was an American lawyer, planter, general, and statesman who served as the seventh president of the United States from 1829 to 1837. Before being elected to the presidency, he gained fame as ...

failed to extend the Second Bank's charter, reflecting his sentiments against banking institutions as well as his preference for the use of gold coins for large payments rather than privately-issued banknotes. The return of gold could only be possible by reducing the dollar's gold equivalence, and in the

Coinage Act of 1834 the gold-silver ratio was increased to 16.0 (ratio finalized in 1837 to 15.99 when the fine gold content of the $10 eagle was set at 232.2 grains or 15.0463 g).

Gold discoveries in California in 1848 and later in Australia lowered the gold price relative to silver; this drove silver money from circulation because it was worth more in the market than as money. Passage of the Independent Treasury Act of 1848 placed the U.S. on a strict hard-money standard. Doing business with the American government required gold or silver coins.

Government accounts were legally separated from the banking system. However, the mint ratio (the fixed exchange rate between gold and silver at the mint) continued to overvalue gold. In 1853, silver coins 50 cents and below were reduced in silver content and cannot be requested for minting by the general public (only the U.S. government can request for it). In 1857 the legal tender status of Spanish dollars and other foreign coinage was repealed. In 1857 the final crisis of the free banking era began as American banks suspended payment in silver, with ripples through the developing international financial system.

Post-Civil War

Due to the inflationary finance measures undertaken to help pay for the U.S.

Civil War, the government found it difficult to pay its obligations in gold or silver and suspended payments of obligations not legally specified in specie (gold bonds); this led banks to suspend the conversion of bank liabilities (bank notes and deposits) into specie. In 1862 paper money was made legal tender. It was a

fiat money

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was sometim ...

(not convertible on demand at a fixed rate into specie). These notes came to be called "

greenbacks".

After the Civil War, Congress wanted to reestablish the metallic standard at pre-war rates. The market price of gold in greenbacks was above the pre-War fixed price ($20.67 per ounce of gold) requiring

deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflatio ...

to achieve the pre-War price. This was accomplished by growing the stock of money less rapidly than real output. By 1879 the market price of the greenback matched the mint price of gold, and according to Barry Eichengreen, the United States was effectively on the gold standard that year.

The

Coinage Act of 1873 (also known as the Crime of ‘73) suspended the minting of the standard silver dollar (of 412.5 grains, 90% fine), the only fully legal tender coin that individuals could convert silver bullion into in unlimited (or

Free silver) quantities, and right at the onset of the silver rush from the Comstock Lode in the 1870s. Political agitation over the inability of silver miners to monetize their produce resulted in the

Bland–Allison Act of 1878 and

Sherman Silver Purchase Act of 1890 which made compulsory the minting of significant quantities of the silver

Morgan dollar

The Morgan dollar is a United States dollar coin minted from 1878 to 1904, in 1921, and beginning again in 2021. It was the first standard silver dollar minted since the passage of the Coinage Act of 1873, which ended the free coining of silve ...

.

With the resumption of convertibility on June 30, 1879, the government again paid its debts in gold, accepted greenbacks for customs and redeemed greenbacks on demand in gold. While greenbacks made suitable substitutes for gold coins, American implementation of the gold standard was hobbled by the continued over-issuance of silver dollars and

silver certificates emanating from political pressures. Lack of public confidence in the ubiquitous silver currency resulted in a run on U.S. gold reserves during the

Panic of 1893.

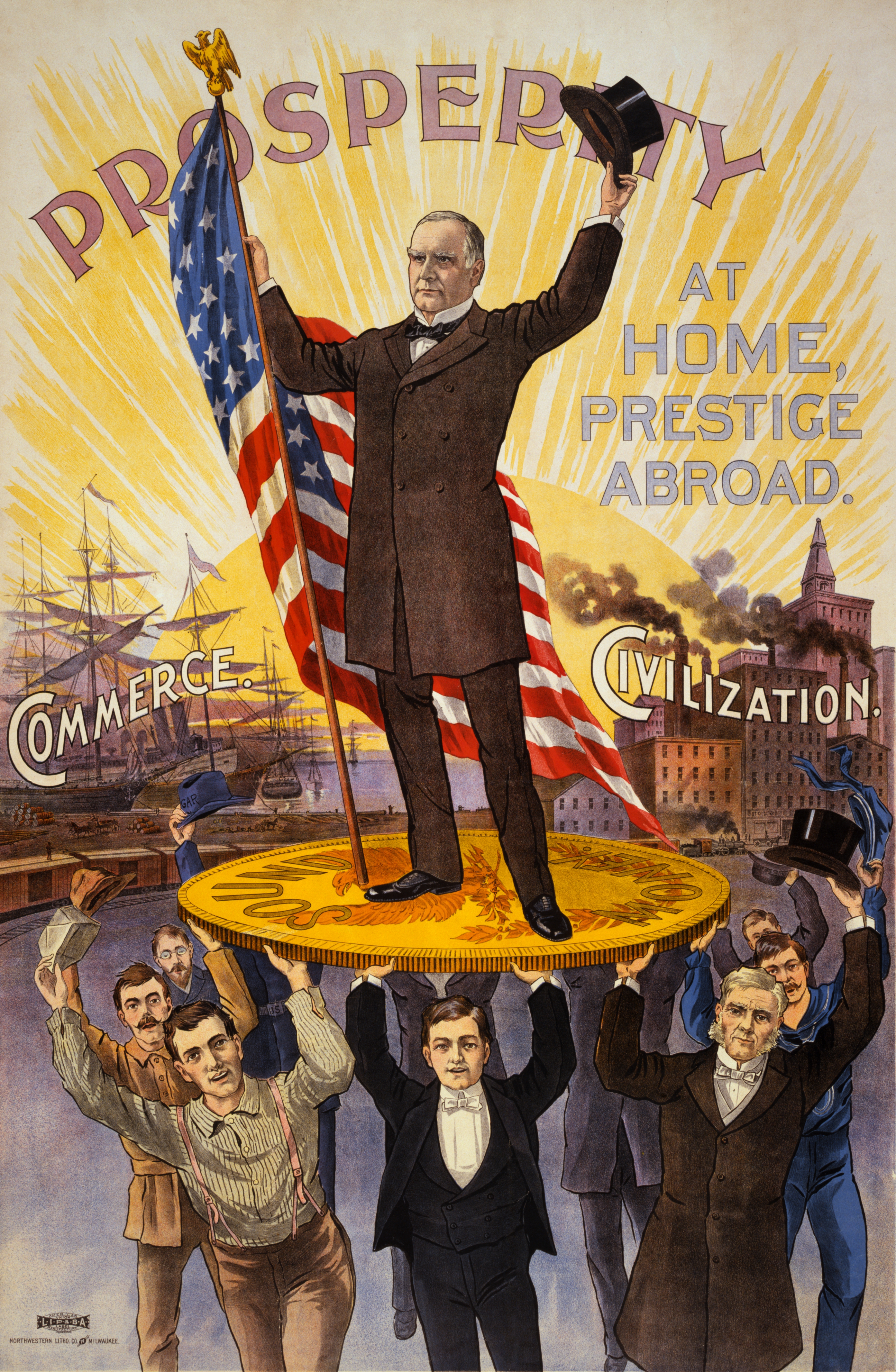

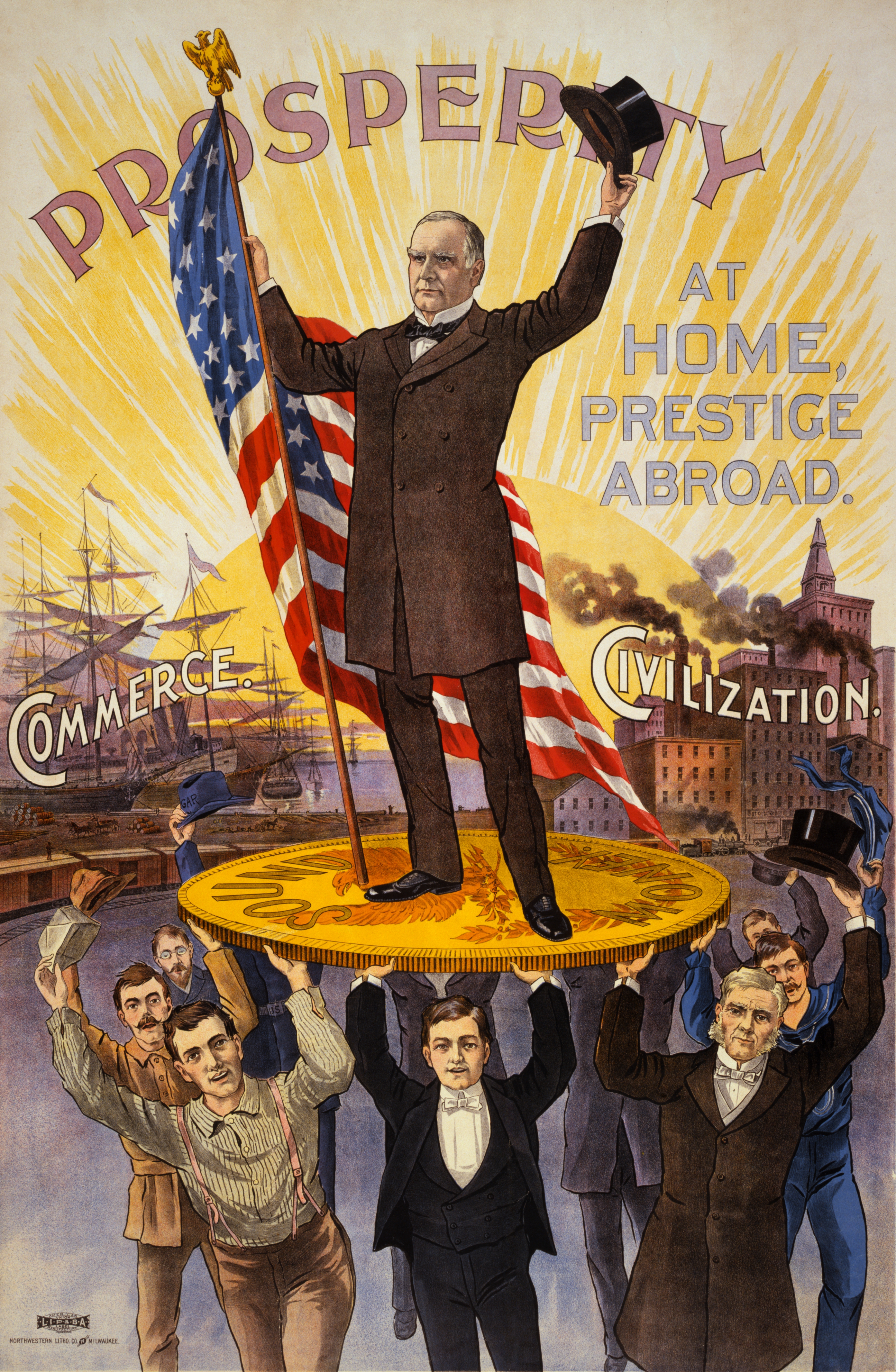

During the latter part of the nineteenth century the use of silver and a return to the bimetallic standard were recurrent political issues, raised especially by

William Jennings Bryan

William Jennings Bryan (March 19, 1860 – July 26, 1925) was an American lawyer, orator and politician. Beginning in 1896, he emerged as a dominant force in the Democratic Party, running three times as the party's nominee for President ...

, the

People's Party and the

Free Silver movement. In 1900 the gold dollar was declared the standard unit of account and a gold reserve for government issued paper notes was established. Greenbacks, silver certificates, and silver dollars continued to be legal tender, all redeemable in gold.

Fluctuations in the U.S. gold stock, 1862–1877

The U.S. had a gold stock of 1.9 million ounces (59 t) in 1862. Stocks rose to 2.6 million ounces (81 t) in 1866, declined in 1875 to 1.6 million ounces (50 t) and rose to 2.5 million ounces (78 t) in 1878. Net exports did not mirror that pattern. In the decade before the Civil War net exports were roughly constant; postwar they varied erratically around pre-war levels, but fell significantly in 1877 and became negative in 1878 and 1879. The net import of gold meant that the foreign demand for American currency to purchase goods, services, and investments exceeded the corresponding American demands for foreign currencies. In the final years of the greenback period (1862–1879), gold production increased while gold exports decreased. The decrease in gold exports was considered by some to be a result of changing monetary conditions. The demands for gold during this period were as a speculative vehicle, and for its primary use in the foreign exchange markets financing international trade. The major effect of the increase in gold demand by the public and Treasury was to reduce exports of gold and increase the Greenback price of gold relative to purchasing power.

Abandonment of the gold standard

Impact of World War I

Governments with insufficient tax revenue suspended

convertibility

Convertibility is the quality that allows money or other financial instruments to be converted into other liquid stores of value. Convertibility is an important factor in international trade, where instruments valued in different currencies mus ...

repeatedly in the 19th century. The real test, however, came in the form of

World War I

World War I (28 July 1914 11 November 1918), often abbreviated as WWI, was one of the deadliest global conflicts in history. Belligerents included much of Europe, the Russian Empire, the United States, and the Ottoman Empire, with fightin ...

, a test which "it failed utterly" according to economist

Richard Lipsey

Richard George Lipsey, (born August 28, 1928) is a Canadian academic and economist. He is best known for his work on the economics of the second-best, a theory that demonstrated that piecemeal establishing of individual first best conditions w ...

. The gold specie standard came to an end in the United Kingdom and the rest of the British Empire with the outbreak of

World War I

World War I (28 July 1914 11 November 1918), often abbreviated as WWI, was one of the deadliest global conflicts in history. Belligerents included much of Europe, the Russian Empire, the United States, and the Ottoman Empire, with fightin ...

.

By the end of 1913, the classical gold standard was at its peak but World War I caused many countries to suspend or abandon it. According to Lawrence Officer the main cause of the gold standard's failure to resume its previous position after World War I was "the Bank of England's precarious liquidity position and the gold-exchange standard". A

run on sterling caused Britain to impose

exchange controls that fatally weakened the standard; convertibility was not legally suspended, but gold prices no longer played the role that they did before. In financing the war and abandoning gold, many of the belligerents suffered drastic

inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

s. Price levels doubled in the U.S. and Britain, tripled in France and quadrupled in Italy. Exchange rates changed less, even though European inflation rates were more severe than America's. This meant that the costs of American goods decreased relative to those in Europe. Between August 1914 and spring of 1915, the dollar value of U.S. exports tripled and its trade surplus exceeded $1 billion for the first time.

Ultimately, the system could not deal quickly enough with the large

deficits and surpluses; this was previously attributed to downward wage rigidity brought about by the advent of

unionized labor, but is now considered as an inherent fault of the system that arose under the pressures of war and rapid technological change. In any case, prices had not reached equilibrium by the time of the

Great Depression, which served to kill off the system completely.

For example,

Germany

Germany,, officially the Federal Republic of Germany, is a country in Central Europe. It is the second most populous country in Europe after Russia, and the most populous member state of the European Union. Germany is situated betwe ...

had gone off the gold standard in 1914, and could not effectively return to it because

war reparations

War reparations are compensation payments made after a war by one side to the other. They are intended to cover damage or injury inflicted during a war.

History

Making one party pay a war indemnity is a common practice with a long history.

...

had cost it much of its gold reserves. During the

occupation of the Ruhr the German central bank (

Reichsbank

The ''Reichsbank'' (; 'Bank of the Reich, Bank of the Realm') was the central bank of the German Reich from 1876 until 1945.

History until 1933

The Reichsbank was founded on 1 January 1876, shortly after the establishment of the German Empi ...

) issued enormous sums of non-convertible marks to support workers who were on strike against the French occupation and to buy foreign currency for reparations; this led to the

German hyperinflation of the early 1920s and the decimation of the German middle class.

The U.S. did not suspend the gold standard during the war. The newly created

Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

intervened in currency markets and sold bonds to "

sterilize" some of the gold imports that would have otherwise increased the stock of money. By 1927 many countries had returned to the gold standard. As a result of World War I the United States, which had been a net debtor country, had become a net creditor by 1919.

Interwar period

The gold specie standard ended in the United Kingdom and the rest of the British Empire at the outbreak of World War I, when Treasury notes replaced the circulation of gold sovereigns and gold half sovereigns. Legally, the gold specie standard was not abolished. The end of the gold standard was successfully effected by the Bank of England through appeals to patriotism urging citizens not to redeem paper money for gold specie. It was only in 1925, when Britain returned to the gold standard in conjunction with Australia and South Africa, that the gold specie standard was officially ended.

The British Gold Standard Act 1925 both introduced the gold bullion standard and simultaneously repealed the gold specie standard. The new standard ended the circulation of gold specie coins. Instead, the law compelled the authorities to sell gold bullion on demand at a fixed price, but "only in the form of bars containing approximately four hundred

ounces troy 2 kgof

fine gold".

John Maynard Keynes, citing deflationary dangers, argued against resumption of the gold standard. By fixing the price at a level which restored the pre-war exchange rate of US$4.86 per pound sterling, as

Chancellor of the Exchequer,

Churchill is argued to have made an error that led to depression, unemployment and the

1926 general strike

The 1926 general strike in the United Kingdom was a general strike that lasted nine days, from 4 to 12 May 1926. It was called by the General Council of the Trades Union Congress (TUC) in an unsuccessful attempt to force the British governme ...

. The decision was described by

Andrew Turnbull as a "historic mistake".

The pound left the gold standard in 1931 and a number of currencies of countries that historically had performed a large amount of their trade in sterling were pegged to sterling instead of to gold. The Bank of England took the decision to leave the gold standard abruptly and unilaterally.

Great Depression

Many other countries followed Britain in returning to the gold standard, leading to a period of relative stability but also deflation. This state of affairs lasted until the

Great Depression (1929–1939) forced countries off the gold standard.

Primary-producing countries were first to abandon the gold standard.

In the summer of 1931, a Central European banking crisis led Germany and Austria suspend gold convertibility and impose exchange controls.

A May 1931

run on

Austria's largest commercial bank had caused it to

fail

Failure is the state or condition of not meeting a desirable or intended objective, and may be viewed as the opposite of success. The criteria for failure depends on context, and may be relative to a particular observer or belief system. One ...

. The run spread to Germany, where the central bank also collapsed. International financial assistance was too late and in July 1931 Germany adopted exchange controls, followed by Austria in October. The Austrian and German experiences, as well as British budgetary and political difficulties, were among the factors that destroyed confidence in sterling, which occurred in mid-July 1931. Runs ensued and the Bank of England lost much of its reserves.

On September 19, 1931, speculative attacks on the pound led the Bank of England to abandon the gold standard, ostensibly "temporarily".

However, the ostensibly temporary departure from the gold standard had unexpectedly positive effects on the economy, leading to greater acceptance of departing from the gold standard.

Loans from American and French central banks of £50 million were insufficient and exhausted in a matter of weeks, due to large gold outflows across the Atlantic. The British benefited from this departure. They could now use monetary policy to stimulate the economy. Australia and New Zealand had already left the standard and Canada quickly followed suit.

The interwar partially-backed gold standard was inherently unstable because of the conflict between the expansion of liabilities to foreign central banks and the resulting deterioration in the Bank of England's reserve ratio. France was then attempting to make Paris a world class financial center, and it received large gold flows as well.

Upon taking office in March 1933, U.S. President Franklin D. Roosevelt departed from the gold standard.

By the end of 1932, the gold standard had been abandoned as a global monetary system.

Czechoslovakia, Belgium, France, the Netherlands and Switzerland abandoned the gold standard in the mid-1930s.

According to Barry Eichengreen, there were three primary reasons for the collapse of the gold standard:

# Tradeoffs between currency stability and other domestic economic objectives: Governments in the 1920s and 1930s faced conflictual pressures between maintaining currency stability and reducing unemployment.

Suffrage,

trade union

A trade union (labor union in American English), often simply referred to as a union, is an organization of workers intent on "maintaining or improving the conditions of their employment", ch. I such as attaining better wages and benefits ...

s, and labor parties pressured governments to focus on reducing unemployment rather than maintaining currency stability.

# Increased risk of destabilizing capital flight: International finance doubted the credibility of national governments to maintain currency stability, which led to

capital flight

Capital flight, in economics, occurs when assets or money rapidly flow out of a country, due to an event of economic consequence or as the result of a political event such as regime change or economic globalization. Such events could be an increa ...

during crises, which aggravated the crises.

# The U.S., not Britain, was the main financial center: Whereas Britain had during past periods been capable of managing a harmonious international monetary system, the U.S. was not.

Causes of the Great Depression

Economists, such as

Barry Eichengreen

Barry Julian Eichengreen (born 1952) is an American economist and economic historian who holds the title of George C. Pardee and Helen N. Pardee Professor of Economics and Political Science at the University of California, Berkeley, where he ha ...

,

Peter Temin

Peter Temin (; born 17 December 1937) is an economist and economic historian, currently Gray Professor Emeritus of Economics, MIT and former head of the Economics Department.

Education

Temin graduated from Swarthmore College in 1959 before earnin ...

and

Ben Bernanke, blame the gold standard of the 1920s for prolonging the

economic depression which started in 1929 and lasted for about a decade. The gold standard theory of the Depression has been described as the "consensus view" among economists.

This view is based on two arguments: "(1) Under the gold standard, deflationary shocks were transmitted between countries and, (2) for most countries, continued adherence to gold prevented monetary authorities from offsetting banking panics and blocked their recoveries."

However, a 2002 paper argues that the second argument would only apply "to small open economies with limited gold reserves. This was not the case for the United States, the largest country in the world, holding massive gold reserves. The United States was not constrained from using expansionary policy to offset banking panics, deflation, and declining economic activity."

According to Edward C. Simmons, in the United States, adherence to the gold standard prevented the Federal Reserve from expanding the money supply to stimulate the economy, fund insolvent banks and fund government deficits that could "prime the pump" for an expansion. Once off the gold standard, it became free to engage in such

money creation. The gold standard limited the flexibility of the central banks' monetary policy by limiting their ability to expand the money supply. In the US, the central bank was required by the

Federal Reserve Act (1913) to have gold backing 40% of its demand notes.

Higher interest rates intensified the deflationary pressure on the dollar and reduced investment in U.S. banks. Commercial banks converted

Federal Reserve Notes to gold in 1931, reducing its gold reserves and forcing a corresponding reduction in the amount of currency in circulation. This

speculative

Speculative may refer to:

In arts and entertainment

*Speculative art (disambiguation)

*Speculative fiction, which includes elements created out of human imagination, such as the science fiction and fantasy genres

**Speculative Fiction Group, a Per ...

attack created a panic in the U.S. banking system. Fearing imminent devaluation many depositors withdrew funds from U.S. banks.

As bank runs grew, a reverse multiplier effect caused a contraction in the money supply. Additionally the New York Fed had loaned over in gold (over 240 tons) to European Central Banks. This transfer contracted the U.S. money supply. The foreign loans became questionable once

Britain

Britain most often refers to:

* The United Kingdom, a sovereign state in Europe comprising the island of Great Britain, the north-eastern part of the island of Ireland and many smaller islands

* Great Britain, the largest island in the United King ...

, Germany, Austria and other European countries went off the gold standard in 1931 and weakened confidence in the dollar.

The forced contraction of the money supply resulted in deflation. Even as nominal interest rates dropped, deflation-adjusted real interest rates remained high, rewarding those who held onto money instead of spending it, further slowing the economy. Recovery in the United States was slower than in Britain, in part due to Congressional reluctance to abandon the gold standard and float the U.S. currency as Britain had done.

In the early 1930s, the Federal Reserve defended the dollar by raising interest rates, trying to increase the demand for dollars. This helped attract international investors who bought foreign assets with gold.

Congress passed the

Gold Reserve Act

The United States Gold Reserve Act of January 30, 1934 required that all gold and gold certificates held by the Federal Reserve be surrendered and vested in the sole title of the United States Department of the Treasury. It also prohibited the Tr ...

on 30 January 1934; the measure nationalized all gold by ordering Federal Reserve banks to turn over their supply to the U.S. Treasury. In return, the banks received gold certificates to be used as reserves against deposits and Federal Reserve notes. The act also authorized the president to devalue the gold dollar. Under this authority, the president, on 31 January 1934, changed the value of the dollar from to the troy ounce to to the troy ounce, a devaluation of over 40%.

Other factors in the prolongation of the Great Depression include

trade wars and the reduction in

international trade

International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services. (see: World economy)

In most countries, such trade represents a significant ...

caused by barriers such as

Smoot–Hawley Tariff in the U.S. and the

Imperial Preference policies of Great Britain, the failure of central banks to act responsibly, government policies designed to prevent wages from falling, such as the

Davis–Bacon Act of 1931, during the deflationary period resulting in production costs dropping slower than sales prices, thereby injuring business profits and increases in taxes to reduce budget deficits and to support new programs such as

Social Security. The U.S. top marginal income tax rate went from 25% to 63% in 1932 and to 79% in 1936, while the bottom rate increased over tenfold, from .375% in 1929 to 4% in 1932. The concurrent massive drought resulted in the U.S.

Dust Bowl

The Dust Bowl was a period of severe dust storms that greatly damaged the ecology and agriculture of the American and Canadian prairies during the 1930s. The phenomenon was caused by a combination of both natural factors (severe drought) a ...

.

The

Austrian School

The Austrian School is a heterodox school of economic thought that advocates strict adherence to methodological individualism, the concept that social phenomena result exclusively from the motivations and actions of individuals. Austrian schoo ...

aruged that the Great Depression was the result of a credit bust.

Alan Greenspan wrote that the bank failures of the 1930s were sparked by Great Britain dropping the gold standard in 1931. This act "tore asunder" any remaining confidence in the banking system. Financial historian

wrote that what made the Great Depression truly 'great' was the

European banking crisis of 1931. According to Federal Reserve Chairman

Marriner Eccles

Marriner Stoddard Eccles (September 9, 1890 – December 18, 1977) was an American economist and banker who served as the 7th chairman of the Federal Reserve from 1934 to 1948. After his term as chairman, Eccles continued to serve as a member o ...

, the root cause was the concentration of wealth resulting in a stagnating or decreasing standard of living for the poor and middle class. These classes went into debt, producing the credit explosion of the 1920s. Eventually, the debt load grew too heavy, resulting in the massive defaults and financial panics of the 1930s.

Bretton Woods

Under the

Bretton Woods international monetary agreement of 1944, the gold standard was kept without domestic convertibility. The role of gold was severely constrained, as other countries' currencies were fixed in terms of the dollar. Many countries kept reserves in gold and settled accounts in gold. Still, they preferred to settle balances with other currencies, with the US dollar becoming the favorite. The

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

was established to help with the exchange process and assist nations in maintaining fixed rates. Within Bretton Woods adjustment was cushioned through credits that helped countries avoid deflation. Under the old standard, a country with an overvalued currency would lose gold and experience deflation until the currency was again valued correctly. Most countries defined their currencies in terms of dollars, but some countries imposed trading restrictions to protect reserves and exchange rates. Therefore, most countries' currencies were still basically inconvertible. In the late 1950s, the exchange restrictions were dropped and gold became an important element in international financial settlements.

After the

Second World War

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposi ...

, a system similar to a gold standard and sometimes described as a "gold exchange standard" was established by the Bretton Woods Agreements. Under this system, many countries fixed their exchange rates relative to the U.S. dollar and central banks could exchange dollar holdings into gold at the official exchange rate of per ounce; this option was not available to firms or individuals. All currencies pegged to the dollar thereby had a fixed value in terms of gold. Since private parties could not exchange gold at the official rate, market prices fluctuated. Large jumps in the market price 1960 lead to the creation of the

London Gold Pool.

Starting in the 1959–1969 administration of President

Charles de Gaulle and continuing until 1970, France reduced its dollar reserves, exchanging them for gold at the official exchange rate, reducing U.S. economic influence. This, along with the fiscal strain of federal expenditures for the

Vietnam War

The Vietnam War (also known by other names) was a conflict in Vietnam, Laos, and Cambodia from 1 November 1955 to the fall of Saigon on 30 April 1975. It was the second of the Indochina Wars and was officially fought between North Vietnam a ...

and persistent balance of payments deficits, led U.S. President

Richard Nixon

Richard Milhous Nixon (January 9, 1913April 22, 1994) was the 37th president of the United States, serving from 1969 to 1974. A member of the Republican Party, he previously served as a representative and senator from California and was ...

to end international convertibility of the U.S. dollar to gold on August 15, 1971 (the "

Nixon Shock").

This was meant to be a temporary measure, with the gold price of the dollar and the official rate of exchanges remaining constant. Revaluing currencies was the main purpose of this plan. No official revaluation or redemption occurred. The dollar subsequently floated. In December 1971, the "

Smithsonian Agreement" was reached. In this agreement, the dollar was devalued from per troy ounce of gold to . Other countries' currencies appreciated. However, gold convertibility did not resume. In October 1973, the price was raised to . Once again, the devaluation was insufficient. Within two weeks of the second devaluation the dollar was left to float. The par value was made official in September 1973, long after it had been abandoned in practice. In October 1976, the government officially changed the definition of the dollar; references to gold were removed from statutes. From this point, the

international monetary system

An international monetary system is a set of internationally agreed rules, conventions and supporting institutions that facilitate international trade, cross border investment and generally the reallocation of capital between states that have d ...

was made of pure

fiat money

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was sometim ...

. However, gold has persisted as a significant reserve asset since the collapse of the classical gold standard.

Modern gold production

An estimated total of 174,100

tonne

The tonne ( or ; symbol: t) is a unit of mass equal to 1000 kilograms. It is a non-SI unit accepted for use with SI. It is also referred to as a metric ton to distinguish it from the non-metric units of the short ton ( United State ...

s of gold have been mined in human history, according to

GFMS as of 2012. This is roughly equivalent to 5.6 billion

troy ounce

Troy weight is a system of units of mass that originated in 15th-century England, and is primarily used in the precious metals industry. The troy weight units are the grain, the pennyweight (24 grains), the troy ounce (20 pennyweights), and th ...

s or, in terms of volume, about , or a

cube on a side. There are varying estimates of the total volume of gold mined. One reason for the variance is that gold has been mined for thousands of years. Another reason is that some nations are not particularly open about how much gold is being mined. In addition, it is difficult to account for the gold output in illegal mining activities.

World production for 2011 was circa 2,700

tonne

The tonne ( or ; symbol: t) is a unit of mass equal to 1000 kilograms. It is a non-SI unit accepted for use with SI. It is also referred to as a metric ton to distinguish it from the non-metric units of the short ton ( United State ...

s. Since the 1950s, annual gold output growth has approximately kept pace with

world population

In demographics, the world population is the total number of humans currently living. It was estimated by the United Nations to have exceeded 8 billion in November 2022. It took over 200,000 years of human prehistory and history for th ...

growth (i.e. a doubling in this period)

although it has lagged behind world economic growth (an approximately eightfold increase since the 1950s, and fourfold since 1980).

Theory

Commodity money is inconvenient to store and transport in large amounts. Furthermore, it does not allow a government to manipulate the flow of commerce with the same ease that a fiat currency does. As such, commodity money gave way to

representative money

Representative money or receipt money is any medium of exchange, printed or digital, that represents something of Value (economics), value, but has little or no value of its own (intrinsic value). Unlike some forms of fiat money (which may have n ...

and gold and other

specie

Specie may refer to:

* Coins or other metal money in mass circulation

* Bullion coins

* Hard money (policy)

* Commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects ...

were retained as its backing.

Gold was a preferred form of money due to its rarity, durability, divisibility,

fungibility and ease of identification,

often in conjunction with silver. Silver was typically the main circulating medium, with gold as the monetary reserve. Commodity money was anonymous, as identifying marks can be removed. Commodity money retains its value despite what may happen to the monetary authority. After the fall of

South Vietnam, many refugees carried their wealth to the West in gold after the national currency became worthless.