Fiscal austerity on:

[Wikipedia]

[Google]

[Amazon]

Austerity is a set of political-economic policies that aim to reduce government budget deficits through spending cuts, tax increases, or a combination of both. There are three primary types of austerity measures: higher taxes to fund spending, raising taxes while cutting spending, and lower taxes and lower government spending. Austerity measures are often used by governments that find it difficult to borrow or meet their existing obligations to pay back loans. The measures are meant to reduce the budget deficit by bringing government revenues closer to expenditures. Proponents of these measures state that this reduces the amount of borrowing required and may also demonstrate a government's fiscal discipline to

In the 1930s during the

In the 1930s during the

"IMF: Austerity is much worse for the economy than we thought"

''Washington Post'' The IMF reported that this was due to fiscal multipliers that were considerably larger than expected: for example, the IMF estimated that fiscal multipliers based on data from 28 countries ranged between 0.9 and 1.7. In other words, a 1% GDP fiscal consolidation (i.e., austerity) would reduce GDP between 0.9% and 1.7%, thus inflicting far more economic damage than the 0.5 previously estimated in IMF forecasts. In many countries, little is known about the size of multipliers, as data availability limits the scope for empirical research. For these countries, Nicoletta Batini, Luc Eyraud and Anke Weber propose a simple method—dubbed the "bucket approach"—to come up with reasonable multiplier estimates. The approach bunches countries into groups (or "buckets") with similar multiplier values, based on their characteristics, and taking into account the effect of (some) temporary factors such as the state of the business cycle. Different tax and spending choices of equal magnitude have different economic effects: For example, the U.S.

According to economist

According to economist

A typical goal of austerity is to reduce the annual budget deficit without sacrificing growth. Over time, this may reduce the overall debt burden, often measured as the ratio of public debt to GDP.

A typical goal of austerity is to reduce the annual budget deficit without sacrificing growth. Over time, this may reduce the overall debt burden, often measured as the ratio of public debt to GDP.

"Inequality and Unsustainable Growth: Two Sides of the Same Coin"

''IMF Staff Discussion Note'' No. SDN/11/08 (International Monetary Fund) In 2013, it published a detailed analysis concluding that "if financial markets focus on the short-term behavior of the debt ratio, or if country authorities engage in repeated rounds of tightening in an effort to get the debt ratio to converge to the official target", austerity policies could slow or reverse economic growth and inhibit

"The Challenge of Debt Reduction during Fiscal Consolidation"

''IMF Working Paper Series'' No. WP/13/67 (International Monetary Fund) Keynesian economists and commentators such as

Austerity programs can be controversial. In the

Austerity programs can be controversial. In the

"Gauging the multiplier: Lessons from history"

''VoxEU.org'' On 3 February 2015,

J. Bloodworth, ''The Independent'', 25 June 2014 For a country that has its own currency, its government can create credits by itself, and its central bank can keep the interest rate close to or equal to the nominal risk-free rate. Former FRB chairman

J. Harvey, Forbes, Leadership, 10 September 2012 The FRB of St. Louis says that the US government's debt is denominated in US dollars; therefore the government will never go bankrupt.

"The Austerity Zone: Life in the New Europe"

– videos by ''

Socialist Studies Special Edition on Austerity (2011)

Panic-driven austerity in the Eurozone and its implications Paul De Grauwe, Yuemei Ji, 21 February 2013

''NYT Review of Books'' – Paul Krugman – "How the Case for Austerity Has Crumbled" – June 2013

IMF Working Paper-Olivier Blanchard and Daniel Leigh-Growth Forecast Errors and Fiscal Multipliers-January 2013

''

"The Austerity Delusion; Why a Bad Idea Won Over the West"

May/June 2013 ''

Video: Richard Koo debates Kenneth Rogoff about the need for austerity

"Debt may be 'Schuld' in German, but it's 'belief' in Italian and 'faith' in English" Interview with Mark Blyth

Science Portal L.I.S.A., 26 January 2015

"Austerity's Greek Death Toll: Study Connects Strict Measures to Rise in Suicides"

''

"Hundreds of mental health experts issue rallying call against austerity"

''

"The EuroDivision Contest"

a satire/parody of austerity

"Is austerity the new normal? A look at Greece and France", Tony Cross

"Life Under Austerity"

''

"Austerity policies do more harm than good, IMF study concludes"

''The Guardian''. 27 May 2016.

"When left-leaning parties support austerity, their voters start to embrace the far right"

''

Mongolia Human Development Report 1997, UNDP Mongolia Communications Office, 1997''Modern Mongolia: From Khans to Commissars to Capitalists'' by Morris Rossabi, University of California Press, 2005"Mongolians text 'no' to austerity: Vote for investment could prove fillip for stalled mining projects", ''Financial Times'', 4 February 2015

{{Authority control Government spending Macroeconomics Political economy Public finance Accounting Capitalism Economic policy Finance Neoliberalism

creditor

A creditor or lender is a party (e.g., person, organization, company, or government) that has a claim on the services of a second party. It is a person or institution to whom money is owed. The first party, in general, has provided some property ...

s and credit rating agencies

A credit rating agency (CRA, also called a ratings service) is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely principal and interest payments and the likelihood of default. An agency may ra ...

and make borrowing easier and cheaper as a result.

In most macroeconomic

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole.

For example, using interest rates, taxes, an ...

models, austerity policies which reduce government spending lead to increased unemployment in the short term. These reductions in employment usually occur directly in the public sector and indirectly in the private sector. Where austerity policies are enacted using tax increases, these can reduce consumption by cutting household disposable income. Reduced government spending can reduce GDP growth in the short term as government expenditure is itself a component of GDP. In the longer term, reduced government spending can reduce GDP growth if, for example, cuts to education spending leave a country's workforce less able to do high-skilled jobs or if cuts to infrastructure investment impose greater costs on business than they saved through lower taxes. In both cases, if reduced government spending leads to reduced GDP growth, austerity may lead to a higher debt-to-GDP ratio

In economics, the debt-to-GDP ratio is the ratio between a country's government debt (measured in units of currency) and its gross domestic product (GDP) (measured in units of currency per year). While it is a "ratio", it is technically measured ...

than the alternative of the government running a higher budget deficit. In the aftermath of the Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

, austerity measures in many European countries were followed by rising unemployment and slower GDP growth. The result was increased debt-to-GDP ratios despite reductions in budget deficits.

Theoretically in some cases, particularly when the output gap

The GDP gap or the output gap is the difference between actual GDP or actual output and potential GDP, in an attempt to identify the current economic position over the business cycle. The measure of output gap is largely used in macroeconomic ...

is low, austerity can have the opposite effect and stimulate economic growth. For example, when an economy is operating at or near capacity, higher short-term deficit spending

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget ...

(stimulus) can cause interest rates to rise, resulting in a reduction in private investment, which in turn reduces economic growth. Where there is excess capacity, the stimulus can result in an increase in employment and output. Alberto Alesina

Alberto Francesco Alesina (29 April 1957 – 23 May 2020) was an Italian political economist. Described as one of the leading political economists of his generation, he published many influential works in both the economics and political science ...

, Carlo Favero, and Francesco Giavazzi argue that austerity can be expansionary in situations where government reduction in spending is offset by greater increases in aggregate demand (private consumption, private investment, and exports).

Justifications

Austerity measures are typically pursued if there is a threat that a government cannot honour its debt obligations. This may occur when a government has borrowed in currencies that it has no right to issue, for example a South American country that borrows inUS Dollars

The United States dollar (symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official ...

. It may also occur if a country uses the currency of an independent central bank that is legally restricted from buying government debt, for example in the Eurozone

The euro area, commonly called eurozone (EZ), is a currency union of 19 member states of the European Union (EU) that have adopted the euro (€) as their primary currency and sole legal tender, and have thus fully implemented EMU pol ...

.

In such a situation, banks and investors may lose confidence in a government's ability or willingness to pay, and either refuse to roll over existing debts, or demand extremely high interest rates. International financial institutions

An international financial institution (IFI) is a financial institution that has been established (or chartered) by more than one country, and hence is subject to international law. Its owners or shareholders are generally national governments, a ...

such as the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

(IMF) may demand austerity measures as part of Structural Adjustment Programme

Structural adjustment programs (SAPs) consist of loans (structural adjustment loans; SALs) provided by the International Monetary Fund (IMF) and the World Bank (WB) to countries that experience economic crises. Their purpose is to adjust the coun ...

s when acting as lender of last resort

A lender of last resort (LOLR) is the institution in a financial system that acts as the provider of liquidity to a financial institution which finds itself unable to obtain sufficient liquidity in the interbank lending market when other faci ...

.

Austerity policies may also appeal to the wealthier class of creditors, who prefer low inflation and the higher probability of payback on their government securities by less profligate governments. More recently austerity has been pursued after governments became highly indebted by assuming private debts following banking crises. (This occurred after Ireland assumed the debts of its private banking sector during the European debt crisis

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, is a multi-year debt crisis that took place in the European Union (EU) from 2009 until the mid to late 2010s. Several eurozone me ...

. This rescue of the private sector resulted in calls to cut back the profligacy

A spendthrift (also profligate or prodigal) is someone who is extravagant and recklessly wasteful with money, often to a point where the spending climbs well beyond his or her means. "Spendthrift" derives from an obsolete sense of the word "thrift" ...

of the public sector.)

According to Mark Blyth

Mark McGann Blyth (born 29 September 1967) is a Scottish-American political scientist. He is currently the William R. Rhodes Professor of International Economics and Professor of International and Public Affairs at Brown University. At Brown ...

, the concept of austerity emerged in the 20th century, when large states acquired sizable budgets. However, Blyth argues that the theories and sensibilities about the role of the state and capitalist markets that underline austerity emerged from the 17th century onwards. Austerity is grounded in liberal economics

Economic liberalism is a political and economic ideology that supports a market economy based on individualism and private property in the means of production. Adam Smith is considered one of the primary initial writers on economic liberalism, ...

' view of the state and sovereign debt as deeply problematic. Blyth traces the discourse of austerity back to John Locke

John Locke (; 29 August 1632 – 28 October 1704) was an English philosopher and physician, widely regarded as one of the most influential of Enlightenment thinkers and commonly known as the "father of liberalism". Considered one of ...

's theory of private property and derivative theory of the state, David Hume

David Hume (; born David Home; 7 May 1711 NS (26 April 1711 OS) – 25 August 1776) Cranston, Maurice, and Thomas Edmund Jessop. 2020 999br>David Hume" '' Encyclopædia Britannica''. Retrieved 18 May 2020. was a Scottish Enlightenment ph ...

's ideas about money and the virtue of merchants

A merchant is a person who trades in commodities produced by other people, especially one who trades with foreign countries. Historically, a merchant is anyone who is involved in business or trade. Merchants have operated for as long as industry ...

, and Adam Smith

Adam Smith (baptized 1723 – 17 July 1790) was a Scottish economist and philosopher who was a pioneer in the thinking of political economy and key figure during the Scottish Enlightenment. Seen by some as "The Father of Economics"——� ...

's theories on economic growth and taxes. On the basis of classic liberal ideas, austerity emerged as a doctrine of neoliberalism

Neoliberalism (also neo-liberalism) is a term used to signify the late 20th century political reappearance of 19th-century ideas associated with free-market capitalism after it fell into decline following the Second World War. A prominent f ...

in the 20th century.

Economist David M. Kotz suggests that the implementation of austerity measures following the financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of ...

was an attempt to preserve the neoliberal capitalist model.

Theoretical considerations

In the 1930s during the

In the 1930s during the Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

, anti-austerity arguments gained more prominence. John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in ...

became a well known anti-austerity economist, arguing that "The boom, not the slump, is the right time for austerity at the Treasury."

Contemporary Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

economists argue that budget deficits are appropriate when an economy is in recession, to reduce unemployment and help spur GDP growth. According to Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was t ...

, since a government is not like a household, reductions in government spending during economic downturns worsen the crisis.

Across an economy, one person's spending is another person's income. In other words, if everyone is trying to reduce their spending, the economy can be trapped in what economists call the paradox of thrift

The paradox of thrift (or paradox of saving) is a paradox of economics. The paradox states that an increase in autonomous saving leads to a decrease in aggregate demand and thus a decrease in gross output which will in turn lower ''total'' saving ...

, worsening the recession as GDP falls. In the past this has been offset by encouraging consumerism to rely on debt, but after the 2008 crisis, this is looking like a less and less viable option for sustainable economics.

Krugman argues that, if the private sector is unable or unwilling to consume at a level that increases GDP and employment sufficiently, then the government should be spending more in order to offset the decline in private spending. Keynesian theory is proposed as being responsible for post-war boom years, before the 1970s, and when public sector investment was at its highest across Europe, partially encouraged by the Marshall Plan

The Marshall Plan (officially the European Recovery Program, ERP) was an American initiative enacted in 1948 to provide foreign aid to Western Europe. The United States transferred over $13 billion (equivalent of about $ in ) in economic re ...

.

An important component of economic output is business investment, but there is no reason to expect it to stabilize at full utilization of the economy's resources. High business profits do not necessarily lead to increased economic growth. (When businesses and banks have a disincentive to spend accumulated capital, such as cash repatriation taxes from profits in overseas tax haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

s and interest on excess reserves

Excess reserves are bank reserves held by a bank in excess of a reserve requirement for it set by a central bank.

In the United States, bank reserves for a commercial bank are represented by its cash holdings and any credit balance in an account ...

paid to banks, increased profits can lead to decreasing growth.)

Economists Kenneth Rogoff

Kenneth Saul Rogoff (born March 22, 1953) is an American economist and chess Grandmaster. He is the Thomas D. Cabot Professor of Public Policy and professor of economics at Harvard University.

Early life

Rogoff grew up in Rochester, New York. ...

and Carmen Reinhart

Carmen M. Reinhart (née Castellanos, born October 7, 1955) is a Cuban-American economist and the Minos A. Zombanakis Professor of the International Financial System at Harvard Kennedy School. Previously, she was the Dennis Weatherstone Senior Fe ...

wrote in April 2013, "Austerity seldom works without structural reforms – for example, changes in taxes, regulations and labor market policies – and if poorly designed, can disproportionately hit the poor and middle class. Our consistent advice has been to avoid withdrawing fiscal stimulus too quickly, a position identical to that of most mainstream economists."

To help improve the U.S. economy, they (Rogoff and Reinhart) advocated reductions in mortgage principal for 'underwater homes'—those whose negative equity

Negative equity is a deficit of owner's equity, occurring when the value of an asset used to secure a loan is less than the outstanding balance on the loan. In the United States, assets (particularly real estate, whose loans are mortgages) with ne ...

(where the value of the asset is less than the mortgage principal) can lead to a stagnant housing market with no realistic opportunity to reduce private debts.

Multiplier effects

In October 2012, the IMF announced that its forecasts for countries that implemented austerity programs have been consistently overoptimistic, suggesting that tax hikes and spending cuts have been doing more damage than expected and that countries that implementedfiscal stimulus

In economics, stimulus refers to attempts to use monetary policy or fiscal policy (or stabilization policy in general) to stimulate the economy. Stimulus can also refer to monetary policies such as lowering interest rates and quantitative easin ...

, such as Germany and Austria, did better than expected.Brad Plumer (12 October 2012"IMF: Austerity is much worse for the economy than we thought"

''Washington Post'' The IMF reported that this was due to fiscal multipliers that were considerably larger than expected: for example, the IMF estimated that fiscal multipliers based on data from 28 countries ranged between 0.9 and 1.7. In other words, a 1% GDP fiscal consolidation (i.e., austerity) would reduce GDP between 0.9% and 1.7%, thus inflicting far more economic damage than the 0.5 previously estimated in IMF forecasts. In many countries, little is known about the size of multipliers, as data availability limits the scope for empirical research. For these countries, Nicoletta Batini, Luc Eyraud and Anke Weber propose a simple method—dubbed the "bucket approach"—to come up with reasonable multiplier estimates. The approach bunches countries into groups (or "buckets") with similar multiplier values, based on their characteristics, and taking into account the effect of (some) temporary factors such as the state of the business cycle. Different tax and spending choices of equal magnitude have different economic effects: For example, the U.S.

Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

Ins ...

estimated that the payroll tax (levied on all wage earners) has a higher multiplier (impact on GDP) than does the income tax (which is levied primarily on wealthier workers). In other words, raising the payroll tax by $1 as part of an austerity strategy would slow the economy more than would raising the income tax by $1, resulting in less net deficit reduction.

In theory, it would stimulate the economy and reduce the deficit if the payroll tax were lowered and the income tax raised in equal amounts.

Crowding in or out

The term "crowding out" refers to the extent to which an increase in the budget deficit offsets spending in the private sector. Economist Laura D'Andrea Tyson wrote in June 2012, "By itself an increase in the deficit, either in the form of an increase in government spending or a reduction in taxes, causes an increase in demand". How this affects output, employment, and growth depends on what happens to interest rates: When the economy is operating near capacity, government borrowing to finance an increase in the deficit causes interest rates to rise and higher interest rates reduce or "crowd out" private investment, reducing growth. This theory explains why large and sustained government deficits take a toll on growth: they reduce capital formation. But this argument rests on how government deficits affect interest rates, and the relationship between government deficits and interest rates varies. When there is considerable excess capacity, an increase in government borrowing to finance an increase in the deficit does not lead to higher interest rates and does not crowd out private investment. Instead, the higher demand resulting from the increase in the deficit bolsters employment and output directly. The resultant increase in income and economic activity in turn encourages, or "crowds in", additional private spending. Some argue that the "crowding-in" model is an appropriate solution for current economic conditions.Government budget balance as a sectoral component

According to economist

According to economist Martin Wolf

Martin Harry Wolf (born 16 August 1946 in London) is a British journalist of Austrian-Dutch descent who focuses on economics. He is the associate editor and chief economics commentator at the '' Financial Times''.

Early life

Wolf was born ...

, the U.S. and many Eurozone countries experienced rapid increases in their budget deficits in the wake of the 2008 crisis as a result of significant private-sector retrenchment and ongoing capital account

In macroeconomics and international finance, the capital account, also known as the capital and financial account records the net flow of investment transaction into an economy. It is one of the two primary components of the balance of payments, ...

surpluses.

Policy choices had little to do with these deficit increases. This makes austerity measures counterproductive. Wolf explained that government fiscal balance is one of three major financial sectoral balances

The sectoral balances (also called sectoral financial balances) are a sectoral analysis framework for macroeconomic analysis of national economies developed by British economist Wynne Godley. Sectoral analysis is based on the insight that when th ...

in a country's economy, along with the foreign financial sector (capital account) and the private financial sector.

By definition

A definition is a statement of the meaning of a term (a word, phrase, or other set of symbols). Definitions can be classified into two large categories: intensional definitions (which try to give the sense of a term), and extensional definiti ...

, the sum of the surpluses or deficits across these three sectors must be zero. In the U.S. and many Eurozone countries other than Germany, a foreign financial surplus exists because capital is imported (net) to fund the trade deficit

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balanc ...

. Further, there is a private-sector financial surplus because household savings exceed business investment.

By definition, a government budget deficit must exist so all three net to zero: for example, the U.S. government budget deficit in 2011 was approximately 10% of GDP (8.6% of GDP of which was federal), offsetting a foreign financial surplus of 4% of GDP and a private-sector surplus of 6% of GDP.

Wolf explained in July 2012 that the sudden shift in the private sector from deficit to surplus forced the U.S. government balance into deficit: "The financial balance of the private sector shifted towards surplus by the almost unbelievable cumulative total of 11.2 per cent of gross domestic product between the third quarter of 2007 and the second quarter of 2009, which was when the financial deficit of US government (federal and state) reached its peak.... No fiscal policy changes explain the collapse into massive fiscal deficit between 2007 and 2009, because there was none of any importance. The collapse is explained by the massive shift of the private sector from financial deficit into surplus or, in other words, from boom to bust."

Wolf also wrote that several European economies face the same scenario and that a lack of deficit spending would likely have resulted in a depression. He argued that a private-sector depression (represented by the private- and foreign-sector surpluses) was being "contained" by government deficit spending.

Economist Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was t ...

also explained in December 2011 the causes of the sizable shift from private-sector deficit to surplus in the U.S.: "This huge move into surplus reflects the end of the housing bubble, a sharp rise in household saving, and a slump in business investment due to lack of customers."

One reason why austerity can be counterproductive in a downturn is due to a significant private-sector financial surplus, in which consumer savings is not fully invested by businesses. In a healthy economy, private-sector savings placed into the banking system by consumers are borrowed and invested by companies. However, if consumers have increased their savings but companies are not investing the money, a surplus develops.

Business investment is one of the major components of GDP. For example, a U.S. private-sector financial deficit from 2004 to 2008 transitioned to a large surplus of savings over investment that exceeded $1 trillion by early 2009, and remained above $800 billion into September 2012. Part of this investment reduction was related to the housing market, a major component of investment. This surplus explains how even significant government deficit spending would not increase interest rates (because businesses still have access to ample savings if they choose to borrow and invest it, so interest rates are not bid upward) and how Federal Reserve action to increase the money supply does not result in inflation (because the economy is awash with savings with no place to go).

Economist Richard Koo

Richard C. Koo ( ja, リチャード・クー, ; ; born 1954) is a Taiwanese-American economist living in Japan specializing in balance sheet recessions. He is Chief Economist at the Nomura Research Institute.

Early life and education

Koo was b ...

described similar effects for several of the developed world economies in December 2011: "Today private sectors in the U.S., the U.K., Spain, and Ireland (but not Greece) are undergoing massive deleveraging aying down debt rather than spendingin spite of record low interest rates. This means these countries are all in serious balance sheet recessions. The private sectors in Japan and Germany are not borrowing, either. With borrowers disappearing and banks reluctant to lend, it is no wonder that, after nearly three years of record low interest rates and massive liquidity injections, industrial economies are still doing so poorly. Flow of funds data for the U.S. show a massive shift away from borrowing to savings by the private sector since the housing bubble burst in 2007. The shift for the private sector as a whole represents over 9 percent of U.S. GDP at a time of zero interest rates. Moreover, this increase in private sector savings exceeds the increase in government borrowings (5.8 percent of GDP), which suggests that the government is not doing enough to offset private sector deleveraging."

Framing of the debate surrounding austerity

Many scholars have argued that how the debate surrounding austerity is framed has a heavy impact on the view of austerity in the public eye, and how the public understands macroeconomics as a whole. Wren-Lewis, for example, coined the term 'mediamacro', which refers to "the role of the media reproducing particularly corrosive forms of economic illiteracy—of which the idea that deficits are ipso facto 'bad' is a strong example." This can go as far as ignoring economists altogether; however, it often manifests itself as a drive in which a minority of economists whose ideas about austerity have been thoroughly debunked being pushed to the front to justify public policy, such as in the case of Alberto Alesina (2009), whose pro-austerity works were "thoroughly debunked by the likes of the economists, the IMF, and the Centre for Budget and Policy Priorities (CBPP)." Other anti-austerity economists, such as Seymour have argued that the debate must be reframed as a social and class movement, and its impact judged accordingly, since statecraft is viewed as the main goal. Further, critics such as Major have highlighted how the OECD and associated international finance organisations have framed the debate to promote austerity, for example, the concept of 'wage-push inflation' which ignores the role played by the profiteering of private companies, and seeks to blame inflation on wages being too high.Empirical considerations

According to a 2020 study, austerity increases the risk of default in situations of severe fiscal stress, but reduces the risk of default in situations of low fiscal stress.Europe

A typical goal of austerity is to reduce the annual budget deficit without sacrificing growth. Over time, this may reduce the overall debt burden, often measured as the ratio of public debt to GDP.

A typical goal of austerity is to reduce the annual budget deficit without sacrificing growth. Over time, this may reduce the overall debt burden, often measured as the ratio of public debt to GDP.

Eurozone

During theEuropean debt crisis

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, is a multi-year debt crisis that took place in the European Union (EU) from 2009 until the mid to late 2010s. Several eurozone me ...

, many countries embarked on austerity programs, reducing their budget deficits relative to GDP from 2010 to 2011.

According to the ''CIA World Factbook

''The World Factbook'', also known as the ''CIA World Factbook'', is a reference resource produced by the Central Intelligence Agency (CIA) with almanac-style information about the countries of the world. The official print version is available ...

'', Greece decreased its budget deficit from 10.4% of GDP in 2010 to 9.6% in 2011. Iceland, Italy, Ireland, Portugal, France, and Spain also decreased their budget deficits from 2010 to 2011 relative to GDP but the austerity policy of the Eurozone achieves not only the reduction of budget deficits. The goal of economic consolidation influences the future development of the European Social Model

The European social model is a concept that emerged in the discussion of economic globalization and typically contrasts the degree of employment regulation and social protection in European countries to conditions in the United States. It is comm ...

.

With the exception of Germany, each of these countries had public-debt-to-GDP ratios that increased from 2010 to 2011, as indicated in the chart at right. Greece's public-debt-to-GDP ratio increased from 143% in 2010 to 165% in 2011 Indicating despite declining budget deficits GDP growth was not sufficient to support a decline in the debt-to-GDP ratio for these countries during this period.

Eurostat

Eurostat ('European Statistical Office'; DG ESTAT) is a Directorate-General of the European Commission located in the Kirchberg, Luxembourg, Kirchberg quarter of Luxembourg City, Luxembourg. Eurostat's main responsibilities are to provide stati ...

reported that the overall debt-to-GDP ratio for the EA17 was 70.1% in 2008, 80.0% in 2009, 85.4% in 2010, 87.3% in 2011, and 90.6% in 2012.

Further, real GDP in the EA17 declined for six straight quarters from Q4 2011 to Q1 2013.

Unemployment is another variable considered in evaluating austerity measures. According to the ''CIA World Factbook'', from 2010 to 2011, the unemployment rates in Spain, Greece, Ireland, Portugal, and the UK increased. France and Italy had no significant changes, while in Germany and Iceland the unemployment rate declined. Eurostat reported that Eurozone unemployment reached record levels in March 2013 at 12.1%, up from 11.6% in September 2012 and 10.3% in 2011. Unemployment varied significantly by country.

Economist Martin Wolf

Martin Harry Wolf (born 16 August 1946 in London) is a British journalist of Austrian-Dutch descent who focuses on economics. He is the associate editor and chief economics commentator at the '' Financial Times''.

Early life

Wolf was born ...

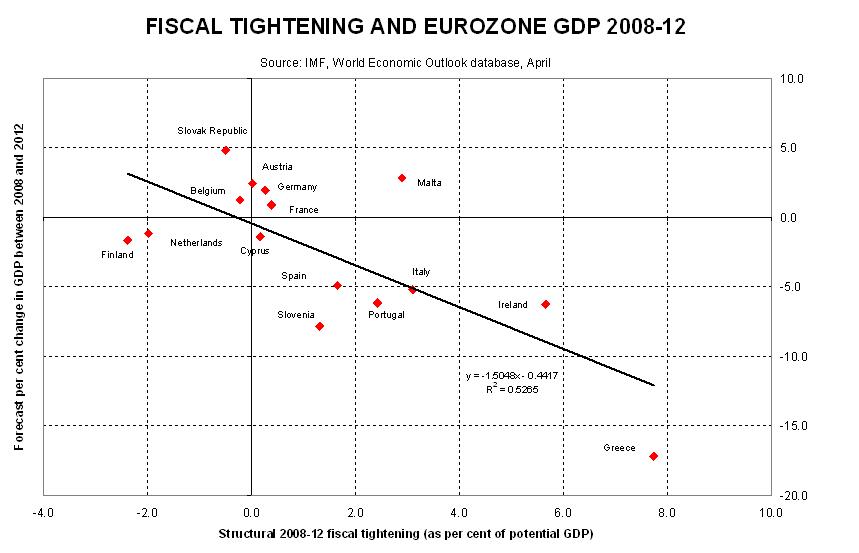

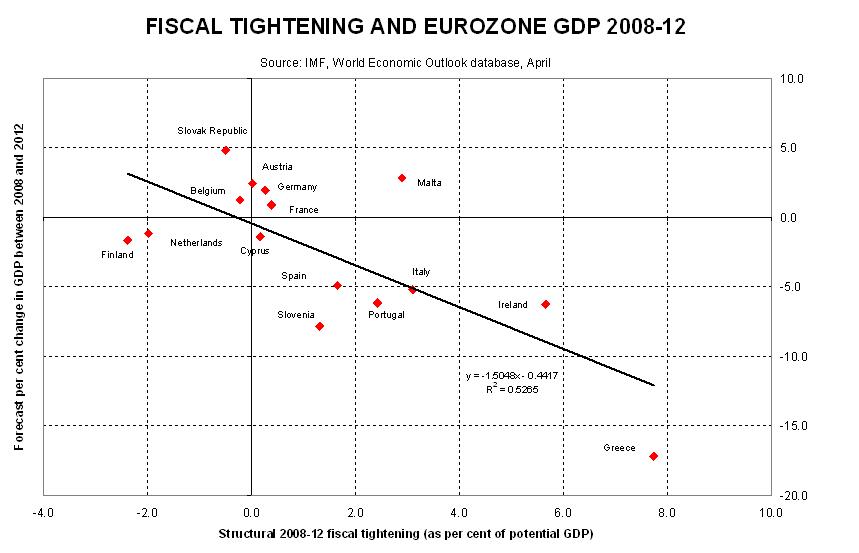

analyzed the relationship between cumulative GDP growth in 2008 to 2012 and total reduction in budget deficits due to austerity policies in several European countries during April 2012 (see chart at right). He concluded, "In all, there is no evidence here that large fiscal contractions budget deficit reductions bring benefits to confidence and growth that offset the direct effects of the contractions. They bring exactly what one would expect: small contractions bring recessions and big contractions bring depressions."

Changes in budget balances (deficits or surpluses) explained approximately 53% of the change in GDP, according to the equation derived from the IMF data used in his analysis.

Similarly, economist Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was t ...

analyzed the relationship between GDP and reduction in budget deficits for several European countries in April 2012 and concluded that austerity was slowing growth. He wrote: "this also implies that 1 euro of austerity yields only about 0.4 euros of reduced deficit, even in the short run. No wonder, then, that the whole austerity enterprise is spiraling into disaster."

=Greece

= TheGreek government-debt crisis

Greece faced a sovereign debt crisis in the aftermath of the financial crisis of 2007–2008. Widely known in the country as The Crisis ( Greek: Η Κρίση), it reached the populace as a series of sudden reforms and austerity measures that ...

brought a package of austerity measures, put forth by the EU and the IMF mostly in the context of the three successive bailouts the country endured from 2010 to 2018; it was met with great anger by the Greek public, leading to riots and social unrest. On 27 June 2011, trade union organizations began a 48-hour labour strike in advance of a parliamentary vote on the austerity package, the first such strike since 1974.

Massive demonstrations were organized throughout Greece, intended to pressure members of parliament into voting against the package. The second set of austerity measures was approved on 29 June 2011, with 155 out of 300 members of parliament voting in favor. However, one United Nations official warned that the second package of austerity measures in Greece could pose a violation of human rights.

Around 2011, the IMF started issuing guidance suggesting that austerity could be harmful when applied without regard to an economy's underlying fundamentals.Andrew Berg and Jonathan Ostry. (2011"Inequality and Unsustainable Growth: Two Sides of the Same Coin"

''IMF Staff Discussion Note'' No. SDN/11/08 (International Monetary Fund) In 2013, it published a detailed analysis concluding that "if financial markets focus on the short-term behavior of the debt ratio, or if country authorities engage in repeated rounds of tightening in an effort to get the debt ratio to converge to the official target", austerity policies could slow or reverse economic growth and inhibit

full employment

Full employment is a situation in which there is no cyclical or deficient-demand unemployment. Full employment does not entail the disappearance of all unemployment, as other kinds of unemployment, namely structural and frictional, may remain. F ...

.Luc Eyraud and Anke Weber. (2013"The Challenge of Debt Reduction during Fiscal Consolidation"

''IMF Working Paper Series'' No. WP/13/67 (International Monetary Fund) Keynesian economists and commentators such as

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was t ...

have suggested that this has in fact been occurring, with austerity yielding worse results in proportion to the extent to which it has been imposed.

Overall, Greece lost 25% of its GDP during the crisis. Although the government debt increased only 6% between 2009 and 2017 (from €300 bn to €318 bn) — thanks, in part, to the 2012 debt restructuring —, the critical debt-to-GDP ratio shot up from 127% to 179% mostly due to the severe GDP drop during the handling of the crisis. In all, the Greek economy suffered the longest recession of any advanced capitalist economy to date, overtaking the US Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

. As such, the crisis hit hardly the populace as the series of sudden reforms and austerity measures led to impoverishment and loss of income and property, as well as a small-scale humanitarian crisis

A humanitarian crisis (or sometimes humanitarian disaster) is defined as a singular event or a series of events that are threatening in terms of health, safety or well-being of a community or large group of people. It may be an internal or extern ...

. Unemployment shot up from 8% in 2008 to 27% in 2013 and remained at 22% in 2017. As a result of the crisis, Greek political system has been upended, social exclusion increased, and hundreds of thousands of well-educated Greeks left the country.

=France

= In April and May 2012, France held apresidential election

A presidential election is the election of any head of state whose official title is President.

Elections by country

Albania

The president of Albania is elected by the Assembly of Albania who are elected by the Albanian public.

Chile

The p ...

in which the winner, François Hollande

François Gérard Georges Nicolas Hollande (; born 12 August 1954) is a French politician who served as President of France from 2012 to 2017. He previously was First Secretary of the Socialist Party (France), First Secretary of the Socialist P ...

, had opposed austerity measures, promising to eliminate France's budget deficit by 2017 by canceling recently enacted tax cuts and exemptions for the wealthy, raising the top tax bracket rate to 75% on incomes over one million euros, restoring the retirement age to 60 with a full pension for those who have worked 42 years, restoring 60,000 jobs recently cut from public education, regulating rent increases, and building additional public housing for the poor. In the legislative elections in June, Hollande's Socialist Party

Socialist Party is the name of many different political parties around the world. All of these parties claim to uphold some form of socialism, though they may have very different interpretations of what "socialism" means. Statistically, most of ...

won a supermajority

A supermajority, supra-majority, qualified majority, or special majority is a requirement for a proposal to gain a specified level of support which is greater than the threshold of more than one-half used for a simple majority. Supermajority ru ...

capable of amending the French Constitution

The current Constitution of France was adopted on 4 October 1958. It is typically called the Constitution of the Fifth Republic , and it replaced the Constitution of the Fourth Republic of 1946 with the exception of the preamble per a Consti ...

and enabling the immediate enactment of the promised reforms. Interest rates on French government bonds fell by 30% to record lows, fewer than 50 basis point

A basis point (often abbreviated as bp, often pronounced as "bip" or "beep") is one hundredth of 1 percentage point. The related term ''permyriad'' means one hundredth of 1 percent. Changes of interest rates are often stated in basis points. If ...

s above German government bond rates.

=Latvia

= Latvia's economy returned to growth in 2011 and 2012, outpacing the 27 nations in the EU, while implementing significant austerity measures. Advocates of austerity argue that Latvia represents an empirical example of the benefits of austerity, while critics argue that austerity created unnecessary hardship with the output in 2013 still below the pre-crisis level. According to the CIA World Fact Book, "Latvia's economy experienced GDP growth of more than 10% per year during 2006–07, but entered a severe recession in 2008 as a result of an unsustainable current account deficit and large debt exposure amid the softening world economy. Triggered by the collapse of the second largest bank, GDP plunged 18% in 2009. The economy has not returned to pre-crisis levels despite strong growth, especially in the export sector in 2011–12. The IMF, EU, and other international donors provided substantial financial assistance to Latvia as part of an agreement to defend the currency's peg to the euro in exchange for the government's commitment to stringent austerity measures. The IMF/EU program successfully concluded in December 2011. The government of Prime Minister Valdis Dombrovskis remained committed to fiscal prudence and reducing the fiscal deficit from 7.7% of GDP in 2010, to 2.7% of GDP in 2012." The CIA estimated that Latvia's GDP declined by 0.3% in 2010, then grew by 5.5% in 2011 and 4.5% in 2012. Unemployment was 12.8% in 2011 and rose to 14.3% in 2012. Latvia's currency, the Lati, fell from $0.47 per U.S. dollar in 2008 to $0.55 in 2012, a decline of 17%. Latvia entered the euro zone in 2014. Latvia's trade deficit improved from over 20% of GDP in 2006 to 2007 to under 2% GDP by 2012. Eighteen months after harsh austerity measures were enacted (including both spending cuts and tax increases), economic growth began to return, although unemployment remained above pre-crisis levels. Latvian exports have skyrocketed and both the trade deficit and budget deficit have decreased dramatically. More than one-third of government positions were eliminated, and the rest received sharp pay cuts. Exports increased after goods prices were reduced due to private business lowering wages in tandem with the government.Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was t ...

wrote in January 2013 that Latvia had yet to regain its pre-crisis level of employment. He also wrote, "So we're looking at a Depression-level slump, and 5 years later only a partial bounceback; unemployment is down but still very high, and the decline has a lot to do with emigration. It's not what you'd call a triumphant success story, any more than the partial US recovery from 1933 to 1936—which was actually considerably more impressive—represented a huge victory over the Depression. And it's in no sense a refutation of Keynesianism, either. Even in Keynesian models, a small open economy can, in the long run, restore full employment through deflation and internal devaluation; the point, however, is that it involves many years of suffering".

Latvian Prime Minister Valdis Dombrovskis defended his policies in a television interview, stating that Krugman refused to admit his error in predicting that Latvia's austerity policy would fail. Krugman had written a blog post in December 2008 entitled "Why Latvia is the New Argentina", in which he argued for Latvia to devalue its currency as an alternative or in addition to austerity.

United Kingdom

=Post war austerity

= Following theSecond World War

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposi ...

the United Kingdom had huge debts, large commitments, and had sold many income producing assets. Rationing of food and other goods which had started in the war continued for some years.

=21st century austerity programme

= Following the financial crisis of 2007–2008 a period of economic recession began in the UK. The austerity programme was initiated in 2010 by the Conservative and Liberal Democrat coalition government, despite some opposition from the academic community. In his June 2010 budget speech, the ChancellorGeorge Osborne

George Gideon Oliver Osborne (born Gideon Oliver Osborne; 23 May 1971) is a former British politician and newspaper editor who served as Chancellor of the Exchequer from 2010 to 2016 and as First Secretary of State from 2015 to 2016 in the ...

identified two goals. The first was that the structural current budget deficit would be eliminated to "achieve cyclically-adjusted current balance by the end of the rolling, five-year forecast period". The second was that national debt as a percentage of GDP would fall. The government intended to achieve both of its goals through substantial reductions in public expenditure. This was to be achieved by a combination of public spending reductions and tax increases. Economists Alberto Alesina

Alberto Francesco Alesina (29 April 1957 – 23 May 2020) was an Italian political economist. Described as one of the leading political economists of his generation, he published many influential works in both the economics and political science ...

, Carlo A. Favero and Francesco Giavazzi

Francesco Giavazzi (born 11 August 1949 in Bergamo) is an Italian economist who is Professor of Economics at Bocconi University, and a regular visiting professor at MIT.

Biography

Giavazzi graduated in electrical engineering from the Politecnico ...

, writing in ''Finance & Development

''Finance & Development'' is a quarterly journal published by the International Monetary Fund (the IMF).

The journal publishes analysis on issues related to the financial system, monetary policy, economic development, poverty reduction, and ...

'' in 2018, argued that deficit reduction policies based on spending cuts typically have almost no effect on output, and hence form a better route to achieving a reduction in the debt-to-GDP ratio than raising taxes. The authors commented that the UK government austerity programme had resulted in growth that was higher than the European average and that the UK's economic performance had been much stronger than the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

had predicted. This claim was challenged most strongly by Mark Blyth, whose 2014 book on austerity claims that austerity not only fails to stimulate growth, but effectively passes that debt down to the working classes. As such, many academics such as Andrew Gamble view Austerity in Britain less as an economic necessity, and more as a tool of statecraft, driven by ideology and not economic requirements. A study published in ''The BMJ

''The BMJ'' is a weekly peer-reviewed medical trade journal, published by the trade union the British Medical Association (BMA). ''The BMJ'' has editorial freedom from the BMA. It is one of the world's oldest general medical journals. Origi ...

'' in November 2017 found the Conservative government austerity programme had been linked to approximately 120,000 deaths since 2010; however, this was disputed, for example on the grounds that it was an observational study which did not show cause and effect. More studies claim adverse effects of austerity on population health

Population health has been defined as "the health outcomes of a group of individuals, including the distribution of such outcomes within the group". It is an approach to health that aims to improve the health of an entire human population. It ha ...

, which include an increase in the mortality rate among pensioners which has been linked to unprecedented reductions in income support, an increase in suicides and the prescription of antidepressants for patients with mental health issues, and an increase in violence, self-harm, and suicide in prisons.

United States

The United States' response to the 2008 economic crash was largely influenced by Wall Street and IMF interests, who favored fiscal retrenchment in the face of the economic crash. Evidence exists to suggest thatPete Peterson

Douglas Brian "Pete" Peterson (born June 26, 1935) is an American politician and diplomat. He served as a United States Air Force pilot during the Vietnam War and spent over six years as a prisoner of the North Vietnamese army after his plane w ...

(and the Petersonites) have heavily influenced US policy on economic recovery since the Nixon era, and presented itself in 2008, despite austerity measures being "wildly out of step with public opinion and reputable economic policy... nd showinganti-Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

bias of supply-side economics

Supply-side economics is a Macroeconomics, macroeconomic theory that postulates economic growth can be most effectively fostered by Tax cuts, lowering taxes, Deregulation, decreasing regulation, and allowing free trade. According to supply-sid ...

and a political system skewed to favor Wall Street over Main Street". The nuance of the economic logic of Keynesianism is, however, difficult to put across to the American Public, and compares poorly to the simplistic message which blames government spending, which might explain Obama's preferred position of a halfway point between economic stimulus followed by austerity, which led to him being criticized by economists such as Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, and a full professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2001) and the Jo ...

.

Controversy

Austerity programs can be controversial. In the

Austerity programs can be controversial. In the Overseas Development Institute

ODI (formerly the 'Overseas Development Institute') is a global affairs think tank, founded in 1960. Its mission is "to inspire people to act on injustice and inequality through collaborative research and ideas that matter for people and the ...

(ODI) briefing paper "The IMF and the Third World", the ODI addresses five major complaints against the IMF's austerity conditions. Complaints include such measures being "anti-developmental", "self-defeating", and tending "to have an adverse impact on the poorest segments of the population".

In many situations, austerity programs are implemented by countries that were previously under dictatorial regimes, leading to criticism that citizens are forced to repay the debts of their oppressors.

In 2009, 2010, and 2011, workers and students in Greece and other European countries demonstrated against cuts to pensions, public services, and education spending as a result of government austerity measures.

Following the announcement of plans to introduce austerity measures in Greece, massive demonstrations occurred throughout the country aimed at pressing parliamentarians to vote against the austerity package. In Athens alone, 19 arrests were made, while 46 civilians and 38 policemen had been injured by 29 June 2011. The third round of austerity was approved by the Greek parliament on 12 February 2012 and met strong opposition, especially in Athens

Athens ( ; el, Αθήνα, Athína ; grc, Ἀθῆναι, Athênai (pl.) ) is both the capital and largest city of Greece. With a population close to four million, it is also the seventh largest city in the European Union. Athens dominates a ...

and Thessaloniki

Thessaloniki (; el, Θεσσαλονίκη, , also known as Thessalonica (), Saloniki, or Salonica (), is the second-largest city in Greece, with over one million inhabitants in its metropolitan area, and the capital of the geographic region of ...

, where police clashed with demonstrators.

Opponents argue that austerity measures depress economic growth and ultimately cause reduced tax revenues that outweigh the benefits of reduced public spending. Moreover, in countries with already anemic economic growth, austerity can engender deflation, which inflates existing debt. Such austerity packages can also cause the country to fall into a liquidity trap

A liquidity trap is a situation, described in Keynesian economics, in which, "after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rat ...

, causing credit markets to freeze up and unemployment to increase. Opponents point to cases in Ireland and Spain in which austerity measures instituted in response to financial crises in 2009 proved ineffective in combating public debt and placed those countries at risk of defaulting in late 2010.

In October 2012, the IMF announced that its forecasts for countries that implemented austerity programs have been consistently overoptimistic, suggesting that tax hikes and spending cuts have been doing more damage than expected and that countries that implemented fiscal stimulus

In economics, stimulus refers to attempts to use monetary policy or fiscal policy (or stabilization policy in general) to stimulate the economy. Stimulus can also refer to monetary policies such as lowering interest rates and quantitative easin ...

, such as Germany and Austria, did better than expected. These data have been scrutinized by the ''Financial Times'', which found no significant trends when outliers like Germany and Greece were excluded. Determining the multipliers used in the research to achieve the results found by the IMF was also described as an "exercise in futility" by Professor Carlos Vegh of the University of Michigan. Moreover, Barry Eichengreen of the University of California, Berkeley and Kevin H. O'Rourke of Oxford University write that the IMF's new estimate of the extent to which austerity restricts growth was much lower than historical data suggest.Barry Eichengreen and Kevin H O'Rourke (23 October 2012"Gauging the multiplier: Lessons from history"

''VoxEU.org'' On 3 February 2015,

Joseph Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, and a full professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2001) and the J ...

wrote: "Austerity had failed repeatedly from its early use under US president Herbert Hoover, which turned the stock-market crash into the Great Depression, to the IMF programs imposed on East Asia and Latin America in recent decades. And yet when Greece got into trouble, it was tried again." Government spending actually rose significantly under Hoover, while revenues were flat.

According to a 2020 study, which used survey experiments in the UK, Portugal, Spain, Italy and Germany, voters strongly disapprove of austerity measures, in particular spending cuts. Voters disapprove of fiscal deficits but not as strongly as austerity. A 2021 study found that incumbent European governments that implemented austerity measures in the Great Recession lost support in opinion polls.

Austerity has been blamed for at least 120,000 deaths between 2010 and 2017 in the UK, with one study putting it at 130,000 and another at 30,000 in 2015 alone. The first study added that "no firm conclusions can be drawn about cause and effect, but the findings back up other research in the field" and campaigners have claimed that cuts to benefits, healthcare and mental health services lead to more deaths including through suicide.

Balancing stimulus and austerity

Strategies that involve short-term stimulus with longer-term austerity are not mutually exclusive. Steps can be taken in the present that will reduce future spending, such as "bending the curve" on pensions by reducing cost of living adjustments or raising the retirement age for younger members of the population, while at the same time creating short-term spending or tax cut programs to stimulate the economy to create jobs. IMF managing directorChristine Lagarde

Christine Madeleine Odette Lagarde (; née Lallouette, ; born 1 January 1956) is a French politician and lawyer who has been serving as President of the European Central Bank since 2019. She previously served as the 11th managing director of the ...

wrote in August 2011, "For the advanced economies, there is an unmistakable need to restore fiscal sustainability through credible consolidation plans. At the same time we know that slamming on the brakes too quickly will hurt the recovery and worsen job prospects. So fiscal adjustment must resolve the conundrum of being neither too fast nor too slow. Shaping a Goldilocks fiscal consolidation is all about timing. What is needed is a dual focus on medium-term consolidation and short-term support for growth. That may sound contradictory, but the two are mutually reinforcing. Decisions on future consolidation, tackling the issues that will bring sustained fiscal improvement, create space in the near term for policies that support growth."

Federal Reserve Chair Ben Bernanke wrote in September 2011, "the two goals—achieving fiscal sustainability, which is the result of responsible policies set in place for the longer term, and avoiding creation of fiscal headwinds for the recovery—are not incompatible. Acting now to put in place a credible plan for reducing future deficits over the long term, while being attentive to the implications of fiscal choices for the recovery in the near term, can help serve both objectives."

"Age of austerity"

The term "age of austerity" was popularised by UK Conservative Party leaderDavid Cameron

David William Donald Cameron (born 9 October 1966) is a British former politician who served as Prime Minister of the United Kingdom from 2010 to 2016 and Leader of the Conservative Party from 2005 to 2016. He previously served as Leader o ...

in his keynote speech to the Conservative Party forum in Cheltenham

Cheltenham (), also known as Cheltenham Spa, is a spa town and borough on the edge of the Cotswolds in the county of Gloucestershire, England. Cheltenham became known as a health and holiday spa town resort, following the discovery of mineral s ...

on 26 April 2009, in which he committed to end years of what he called "excessive government spending". Theresa May claimed that "Austerity is over" as of 3 October 2018, a statement which was almost immediately met with criticism on the reality of its central claim, particularly in relation to the high possibility of a substantial economic downturn due to Brexit.

Word of the year

''Merriam-Webster's Dictionary

''Webster's Dictionary'' is any of the English language dictionaries edited in the early 19th century by American lexicographer Noah Webster (1758–1843), as well as numerous related or unrelated dictionaries that have adopted the Webster's ...

'' named the word ''austerity'' as its "Word of the Year

The word(s) of the year, sometimes capitalized as "Word(s) of the Year" and abbreviated "WOTY" (or "WotY"), refers to any of various assessments as to the most important word(s) or expression(s) in the public sphere

The public sphere (german: Ö ...

" for 2010 because of the number of web searches this word generated that year. According to the president and publisher of the dictionary, "''austerity'' had more than 250,000 searches on the dictionary's free online ebsitetool" and the spike in searches "came with more coverage of the debt crisis".

Examples of austerity

* Albania — 1962 * Argentina — 1952,1985

The year 1985 was designated as the International Youth Year by the United Nations.

Events January

* January 1

** The Internet's Domain Name System is created.

** Greenland withdraws from the European Economic Community as a result of a ...

, 1998–2003, 2012

File:2012 Events Collage V3.png, From left, clockwise: The passenger cruise ship Costa Concordia lies capsized after the Costa Concordia disaster; Damage to Casino Pier in Seaside Heights, New Jersey as a result of Hurricane Sandy; People gat ...

, 2018-2019

*Australia — 2014

* Brazil — 2003–2006, 2015–2018

* Canada — 1994

* China — 2013

* Cuba — 1991–1999, 2008

* Netherlands — 1982–1990, 2003–2006, 2011–2014

* Czech Republic — 2010

* Ecuador — 2017– ,

* European countries — 2012

* France — 1926–1929, 1932, 1934-1936, 1938–1940, 1958, 1976–1981, 1982–1986, 1995, 2010, 2014

* Germany — 1930, 2011

* Greece — 2010–2018

*Haiti — 1915–1934 ( American occupation)

* Ireland — 2010–2014

* Israel — 1949–1959

* Italy — 1922–1925, 2011–2013

* Japan — 1949 ( American Occupation), 2010

* Latvia — 2009–2013

* Mexico — 1985, 2020

* Nicaragua — 1997, 2018

* Palestinian Authority — 2006

* Portugal — 1977–1979, 1983–1985, 2002–2015,

* Puerto Rico — 2009–2018

* Romania — Ceaușescu's 1981–1989 austerity, 2010

* Spain — 1979, 2010–2014

* United States — 1921, 1937, 1946

* United Kingdom — during and after the two World Wars, 1976–1979, 2011–2019

* Venezuela — 1989

File:1989 Events Collage.png, From left, clockwise: The Cypress Street Viaduct, Cypress structure collapses as a result of the 1989 Loma Prieta earthquake, killing motorists below; The proposal document for the World Wide Web is submitted; The Exxo ...

, 2016

Criticism

According to economist David Stuckler and physician Sanjay Basu in their study ''The Body Economic: Why Austerity Kills'', a health crisis is being triggered by austerity policies, including up to 10,000 additional suicides that have occurred across Europe and the U.S. since the introduction of austerity programs. Much of the acceptance of austerity in the general public has centred on the way debate has been framed, and relates to an issue with representative democracy; since the public do not have widely available access to the latest economic research, which is highly critical of economic retrenchment in times of crisis, the public must rely on which politician sounds most plausible. This can unfortunately lead to authoritative leaders pursuing policies which make little, if any, economic sense. According to a 2020 study, austerity does not pay off in terms of reducing the default premium in situations of severe fiscal stress. Rather, austerity increases the default premium. However, in situations of low fiscal stress, austerity does reduce the default premium. The study also found that increases in government consumption had no substantial impact on the default premium. Clara E. Mattei, assistant professor of economics at theNew School for Social Research

The New School for Social Research (NSSR) is a graduate-level educational institution that is one of the divisions of The New School in New York City, United States. The university was founded in 1919 as a home for progressive era thinkers. NSS ...

, posits that austerity is less of a means to "fix the economy" and is more of an ideological weapon of class oppression wielded by economic and political elites in order to suppress revolts and unrest by the working class public and close off any alternatives to the capitalist system. She traces the origins of modern austerity to post-World War I

World War I (28 July 1914 11 November 1918), often abbreviated as WWI, was List of wars and anthropogenic disasters by death toll, one of the deadliest global conflicts in history. Belligerents included much of Europe, the Russian Empire, ...

Britain and Italy

Italy ( it, Italia ), officially the Italian Republic, ) or the Republic of Italy, is a country in Southern Europe. It is located in the middle of the Mediterranean Sea, and its territory largely coincides with the homonymous geographical ...

, when it served as a "powerful counteroffensive" to rising working class agitation and anti-capitalist

Anti-capitalism is a political ideology and movement encompassing a variety of attitudes and ideas that oppose capitalism. In this sense, anti-capitalists are those who wish to replace capitalism with another type of economic system, such as so ...

sentiment. In this, she quotes British economist G. D. H. Cole writing on the British response to the economic downturn of 1921:

"The big working-class offensive had been successfully stalled off; and British capitalism, though threatened with economic adversity, felt itself once more safely in the saddle and well able to cope, both industrially and politically, with any attempt that might still be made from the labour side to unseat it."

DeLong–Summers condition

J. Bradford DeLong

James Bradford "Brad" DeLong (born June 24, 1960) is an economic historian who is a professor of economics at the University of California, Berkeley. DeLong served as Deputy Assistant Secretary of the U.S. Department of the Treasury in the Clint ...

and Lawrence Summers

Lawrence Henry Summers (born November 30, 1954) is an American economist who served as the 71st United States secretary of the treasury from 1999 to 2001 and as director of the National Economic Council from 2009 to 2010. He also served as pres ...

explained why an expansionary fiscal policy is effective in reducing a government's future debt burden, pointing out that the policy has a positive impact on its future productivity level.J. DeLong and L. Summers, Brookings Papers on Economic Activity, 233 (2012) They pointed out that when an economy is depressed and its nominal interest rate is near zero, the real interest rate charged to firms is linked to the output as . This means that the rate decreases as the real GDP increases, and the actual fiscal multiplier is higher than that in normal times; a fiscal stimulus is more effective for the case where the interest rates are at the zero bound. As the economy is boosted by government spending, the increased output yields higher tax revenue, and so we have

:

where is a baseline marginal tax-and-transfer rate. Also, we need to take account of the economy's long-run growth rate , as a steady economic growth rate may reduce its debt-to-GDP ratio. Then we can see that an expansionary fiscal policy is self-financing:

:

:

as long as is less than zero. Then we can find that a fiscal stimulus makes the long-term budget in surplus if the real government borrowing rate satisfies the following condition:

:

Impacts on short-run budget deficit

Research by Gauti Eggertsson et al. indicates that a government's fiscal austerity measures actually increase its short-term budget deficit if the nominal interest rate is very low.M. Denes, G. Eggertsson and S. Gilbukh, Staff report, FRB of New York, 551 (2012) In normal time, the government sets the tax rates and the central bank controls the nominal interest rate . If the rate is so low that monetary policies cannot mitigate the negative impact of the austerity measures, the significant decrease of tax base makes the revenue of the government and the budget position worse.G. Eggertsson, German Economic Review, 1, 1 (2013) If the multiplier is : then we have , where : That is, the austerity measures are counterproductive in the short-run, as long as the multiplier is larger than a certain level . This erosion of the tax base is the effect of the endogenous component of the deficit. Therefore, if the government increases sales taxes, then it reduces the tax base due to its negative effect on the demand, and it upsets the budget balance.No credit risk

Supporters of austerity measures tend to use the metaphor that a government's debt is like a household's debt. They intend to convince people of the notion that the government's overspending leads to the government's default. But this metaphor has been shown to be inaccurate.Unreliable boyfriends and other dreadful political metaphorsJ. Bloodworth, ''The Independent'', 25 June 2014 For a country that has its own currency, its government can create credits by itself, and its central bank can keep the interest rate close to or equal to the nominal risk-free rate. Former FRB chairman

Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He works as a private adviser and provides consulting for firms through his company, Greenspan Associates LLC. ...

says that the probability that the US defaults on its debt repayment is zero, because the US government can print money.It Is Impossible For The US To DefaultJ. Harvey, Forbes, Leadership, 10 September 2012 The FRB of St. Louis says that the US government's debt is denominated in US dollars; therefore the government will never go bankrupt.

Alternatives to austerity

A number of alternative plans have been used and proposed as an alternative to implementing austerity measures, examples include: *Infrastructure-based development

Infrastructure-based economic development, also called infrastructure-driven development, combines key policy characteristics inherited from the Rooseveltian progressivist tradition and neo-Keynesian economics in the United States, France's Gau ...

* New Deal

The New Deal was a series of programs, public work projects, financial reforms, and regulations enacted by President Franklin D. Roosevelt in the United States between 1933 and 1939. Major federal programs agencies included the Civilian Con ...

(a series of programs, public work projects, financial reforms, and regulations

Regulation is the management of complex systems according to a set of rules and trends. In systems theory, these types of rules exist in various fields of biology and society, but the term has slightly different meanings according to context. Fo ...

enacted by President Franklin D. Roosevelt in the United States between 1933 and 1939 in response to the Great Depression in the United States

In the History of the United States, United States, the Great Depression began with the Wall Street Crash of 1929, Wall Street Crash of October 1929 and then spread worldwide. The nadir came in 1931–1933, and recovery came in 1940. The stock m ...

).

Alternatives to implementing austerity measures may utilise increased government borrowing in the short-term (such as for use in infrastructure development and public work projects) to attempt to achieve long-term economic growth

Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy in a financial year. Statisticians conventionally measure such growth as the percent rate o ...

. Alternately, instead of government borrowing, governments can raise taxes to fund public sector activity.

See also

*Functional finance Functional finance is an economic theory proposed by Abba P. Lerner, based on effective demand principles and chartalism. It states that government should finance itself to meet explicit goals, such as taming the business cycle, achieving full emp ...

* Fossil fuel subsidies

Fossil fuel subsidies are energy subsidies on fossil fuels. They may be tax breaks on consumption, such as a lower sales tax on natural gas for residential heating; or subsidies on production, such as tax breaks on exploration for oil. Or ...

* Neoliberalism

Neoliberalism (also neo-liberalism) is a term used to signify the late 20th century political reappearance of 19th-century ideas associated with free-market capitalism after it fell into decline following the Second World War. A prominent f ...

* Planned shrinkage

Municipal disinvestment is a term in the United States which describes an urban planning process in which a city or town or other municipal entity decides to abandon or neglect an area. It can happen when a municipality is in a period of economic ...

* Programme commun

The Programme commun (or 'Common Programme') was a reform programme, signed 27 June 1972 by the Socialist Party, the French Communist Party and the centrist Radical Movement of the Left, which provided a great upheaval in the economic, political ...

(French reform programme cancelled by austerity turn)

* Trickle-down economics

Trickle-down economics is a term used in critical references to economic policies that favor the upper income brackets, corporations, and individuals with substantial wealth or capital. In recent history, the term has been used by critics of ...

* ''Growth in a Time of Debt

''Growth in a Time of Debt'', also known by its authors' names as Reinhart–Rogoff, is an economics paper by American economists Carmen Reinhart and Kenneth Rogoff published in a non peer-reviewed issue of the ''American Economic Review'' in 2010. ...