Efficient frontier on:

[Wikipedia]

[Google]

[Amazon]

In

In

A combination of assets, i.e. a portfolio, is referred to as "efficient" if it has the best possible expected level of return for its level of

A combination of assets, i.e. a portfolio, is referred to as "efficient" if it has the best possible expected level of return for its level of

In

In modern portfolio theory

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of diversificati ...

, the efficient frontier (or portfolio frontier) is an investment portfolio

Portfolio may refer to:

Objects

* Portfolio (briefcase), a type of briefcase

Collections

* Portfolio (finance), a collection of assets held by an institution or a private individual

* Artist's portfolio, a sample of an artist's work or a c ...

which occupies the "efficient" parts of the risk–return spectrum.

Formally, it is the set of portfolios which satisfy the condition that no other portfolio exists with a higher expected return

Return may refer to:

In business, economics, and finance

* Return on investment (ROI), the financial gain after an expense.

* Rate of return, the financial term for the profit or loss derived from an investment

* Tax return, a blank document or t ...

but with the same standard deviation

In statistics, the standard deviation is a measure of the amount of variation or dispersion of a set of values. A low standard deviation indicates that the values tend to be close to the mean (also called the expected value) of the set, whil ...

of return (i.e., the risk).

The efficient frontier was first formulated by Harry Markowitz

Harry Max Markowitz (born August 24, 1927) is an American economist who received the 1989 John von Neumann Theory Prize and the 1990 Nobel Memorial Prize in Economic Sciences.

Markowitz is a professor of finance at the Rady School of Management ...

in 1952;

see Markowitz model.

Overview

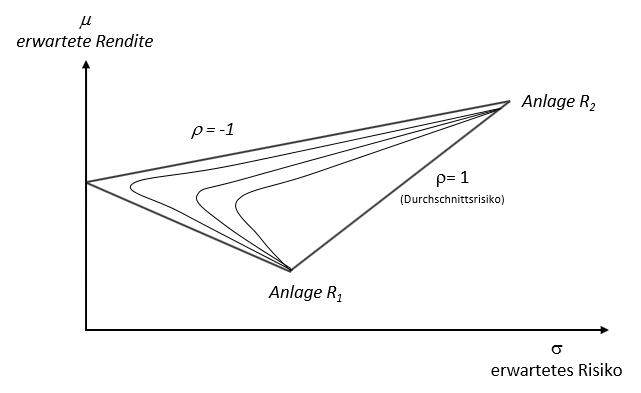

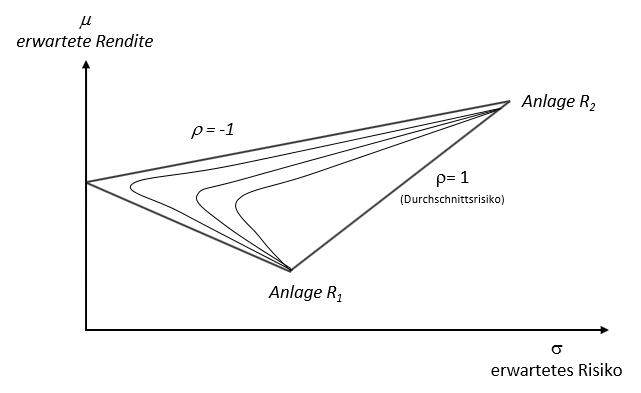

A combination of assets, i.e. a portfolio, is referred to as "efficient" if it has the best possible expected level of return for its level of

A combination of assets, i.e. a portfolio, is referred to as "efficient" if it has the best possible expected level of return for its level of risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environm ...

(which is represented by the standard deviation of the portfolio's return). Here, every possible combination of risky assets can be plotted in risk–expected return space, and the collection of all such possible portfolios defines a region in this space. In the absence of the opportunity to hold a risk-free asset, this region is the opportunity set (the feasible set

In mathematical optimization, a feasible region, feasible set, search space, or solution space is the set of all possible points (sets of values of the choice variables) of an optimization problem that satisfy the problem's constraints, potent ...

). The positively sloped (upward-sloped) top boundary of this region is a portion of a hyperbola

In mathematics, a hyperbola (; pl. hyperbolas or hyperbolae ; adj. hyperbolic ) is a type of smooth curve lying in a plane, defined by its geometric properties or by equations for which it is the solution set. A hyperbola has two pieces, ca ...

Merton, Robert. "An analytic derivation of the efficient portfolio frontier," ''Journal of Financial and Quantitative Analysis

The ''Journal of Financial and Quantitative Analysis'' is a peer-reviewed bimonthly academic journal published by the Michael G. Foster School of Business at the University of Washington in cooperation with the W. P. Carey School of Business at ...

'' 7, September 1972, 1851-1872. and is called the "efficient frontier".

If a risk-free asset is also available, the opportunity set is larger, and its upper boundary, the efficient frontier, is a straight line segment emanating from the vertical axis at the value of the risk-free asset's return and tangent to the risky-assets-only opportunity set. All portfolios between the risk-free asset and the tangency portfolio are portfolios composed of risk-free assets and the tangency portfolio, while all portfolios on the linear frontier above and to the right of the tangency portfolio are generated by borrowing at the risk-free rate and investing the proceeds into the tangency portfolio.

See also

* Markowitz model *Modern portfolio theory

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of diversificati ...

* Critical line method, an optimization algorithm developed by Markowitz for this problem

References

Financial economics Finance theories Mathematical finance Portfolio theories Théorie moderne du portefeuille {{finance-stub