Condor (options) on:

[Wikipedia]

[Google]

[Amazon]

A condor is a limited-risk, non-directional options trading strategy consisting of four options at four different

A condor is a limited-risk, non-directional options trading strategy consisting of four options at four different

A condor is a limited-risk, non-directional options trading strategy consisting of four options at four different

A condor is a limited-risk, non-directional options trading strategy consisting of four options at four different strike price

In finance, the strike price (or exercise price) of an option is a fixed price at which the owner of the option can buy (in the case of a call), or sell (in the case of a put), the underlying security or commodity. The strike price may be set ...

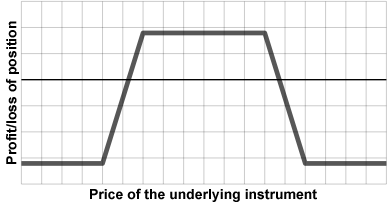

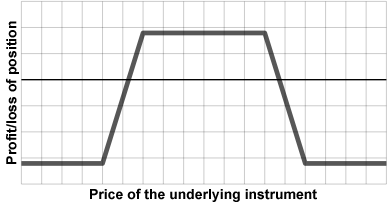

s. The buyer of a condor earns a profit if the underlying

In finance, a derivative is a contract that ''derives'' its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the "underlying". Derivatives can be use ...

is between or near the inner two strikes at expiry, but has a limited loss if the underlying is near or outside the outer two strikes at expiry. Therefore, long condors are used by traders who expect the underlying to stay within a limited range (low volatility), while short condors are used by traders who expect the underlying to make a large move in either direction. Compared to a butterfly

Butterflies are insects in the macrolepidopteran clade Rhopalocera from the order Lepidoptera, which also includes moths. Adult butterflies have large, often brightly coloured wings, and conspicuous, fluttering flight. The group comprises ...

, a condor is profitable at a wider range of potential underlying values, but has a higher premium and therefore a lower maximum profit.

A long condor consists of four options of the same type (all calls or all puts). The options at the outer strikes are bought and the inner strikes are sold (and the reverse is done for a short condor). The difference between the two lowest strikes must be the same as the difference between the two highest strikes. All four options must have the same underlying

In finance, a derivative is a contract that ''derives'' its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the "underlying". Derivatives can be use ...

and the same expiry date

An expiration date or expiry date is a previously determined date after which something should no longer be used, either by operation of law or by exceeding the anticipated shelf life for perishable goods. Expiration dates are applied to selecte ...

.

At expiry, a condor's value will be somewhere between 0 and the difference between the two higher (or two lower) strike prices. It achieves its maximum profit if the underlying is between the two inner strike prices at expiry, and it expires worthless if the underlying is outside the two outer strike prices (in the latter case the buyer's loss is the premium paid to enter the position). A long condor has a positive theta

Theta (, ; uppercase: Θ or ; lowercase: θ or ; grc, ''thē̂ta'' ; Modern: ''thī́ta'' ) is the eighth letter of the Greek alphabet, derived from the Phoenician letter Teth . In the system of Greek numerals, it has a value of 9.

...

when the underlying is near the inner strikes, but a negative theta when the underlying is near the outer strikes.

A condor can be thought of as a spread of two vertical spread

In options trading, a vertical spread is an options strategy involving buying and selling of multiple options of the same underlying security, same expiration date, but at different strike prices. They can be created with either all calls or all pu ...

s, as a modification of a strangle

Strangling is compression of the neck that may lead to unconsciousness or death by causing an increasingly hypoxic state in the brain. Fatal strangling typically occurs in cases of violence, accidents, and is one of two main ways that hangin ...

with limited risk, or as a modification of a butterfly

Butterflies are insects in the macrolepidopteran clade Rhopalocera from the order Lepidoptera, which also includes moths. Adult butterflies have large, often brightly coloured wings, and conspicuous, fluttering flight. The group comprises ...

where the options in the body have different strike prices. A condor is also known as a "stretched butterfly", as its maximum profit is reached on a wider range of underlying prices compared to a butterfly. Both butterflies and condors are known as "wingspreads".

The condor is so named because of its payoff diagram's perceived resemblance to a large bird such as a condor.

An iron condor

The iron condor is an options trading strategy utilizing two vertical spreads – a put spread and a call spread with the same expiration and four different strikes. A long iron condor is essentially selling both sides of the underlying instrume ...

is a strategy which replicates the payoff of a short condor, but with a different combination of options.

See also

*Ladder (option combination)

In finance, a ladder, also known as a Christmas tree, is a combination of three options of the same type (all calls or all puts) at three different strike prices. A long ladder is used by traders who expect low volatility, while a short ladder ...

References

{{Derivatives market Financial markets Options (finance) Derivatives (finance)