Yuan Renminbi on:

[Wikipedia]

[Google]

[Amazon]

The renminbi (;

The various currencies called yuan or dollar issued in mainland China as well as Taiwan, Hong Kong, Macau and Singapore were all derived from the Spanish American silver dollar, which China imported in large quantities from Spanish America from the 16th to 20th centuries. The first locally minted silver dollar or yuan accepted all over Qing dynasty China (1644–1912) was the silver dragon dollar introduced in 1889. Various banknotes denominated in dollars or yuan were also introduced, which were convertible to silver dollars until 1935 when the silver standard was discontinued and the Chinese yuan was made ''fabi'' (法币; legal tender

The various currencies called yuan or dollar issued in mainland China as well as Taiwan, Hong Kong, Macau and Singapore were all derived from the Spanish American silver dollar, which China imported in large quantities from Spanish America from the 16th to 20th centuries. The first locally minted silver dollar or yuan accepted all over Qing dynasty China (1644–1912) was the silver dragon dollar introduced in 1889. Various banknotes denominated in dollars or yuan were also introduced, which were convertible to silver dollars until 1935 when the silver standard was discontinued and the Chinese yuan was made ''fabi'' (法币; legal tender

The renminbi yuan has different names when used in ethnic minority regions of China.

* When used in Inner Mongolia and other Mongol autonomies, a yuan is called a tugreg ( mn, , төгрөг ''tügürig''). However, when used in the republic of Mongolia, it is still named yuani ( mn, юань) to differentiate it from Mongolian tögrög ( mn, төгрөг). One Chinese tügürig (tugreg) is divided into 100 mönggü ( mn, , мөнгө), one Chinese jiao is labeled "10 mönggü". In Mongolian, renminbi is called aradin jogos or arad-un jogos ( mn, , ардын зоос ''arad-un ǰoγos'').

* When used in Tibet and other Tibetan autonomies, a yuan is called a gor (). One gor is divided into 10 gorsur () or 100 gar (). In

The renminbi yuan has different names when used in ethnic minority regions of China.

* When used in Inner Mongolia and other Mongol autonomies, a yuan is called a tugreg ( mn, , төгрөг ''tügürig''). However, when used in the republic of Mongolia, it is still named yuani ( mn, юань) to differentiate it from Mongolian tögrög ( mn, төгрөг). One Chinese tügürig (tugreg) is divided into 100 mönggü ( mn, , мөнгө), one Chinese jiao is labeled "10 mönggü". In Mongolian, renminbi is called aradin jogos or arad-un jogos ( mn, , ардын зоос ''arad-un ǰoγos'').

* When used in Tibet and other Tibetan autonomies, a yuan is called a gor (). One gor is divided into 10 gorsur () or 100 gar (). In

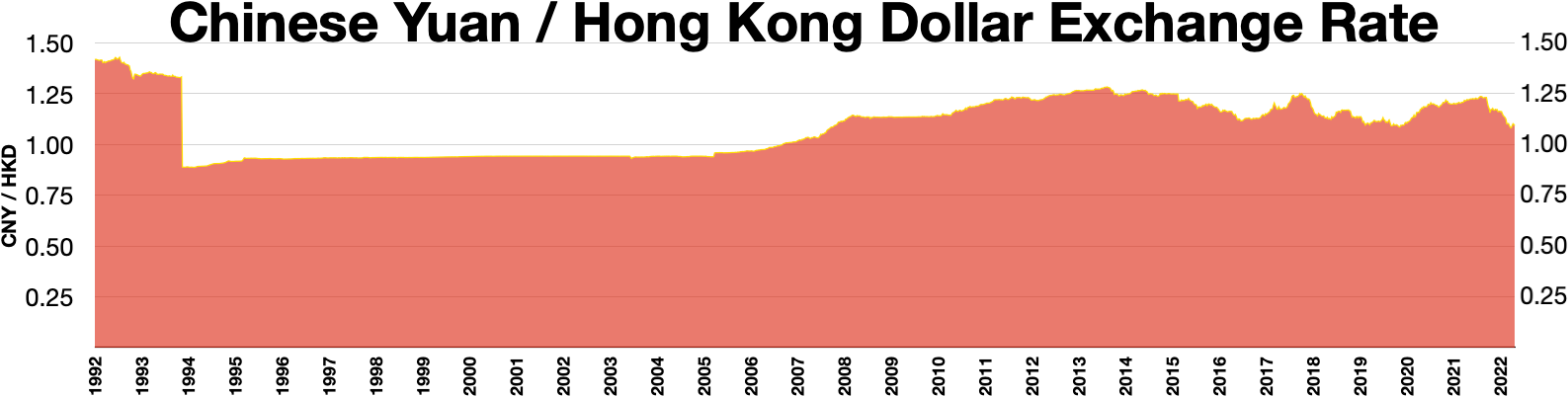

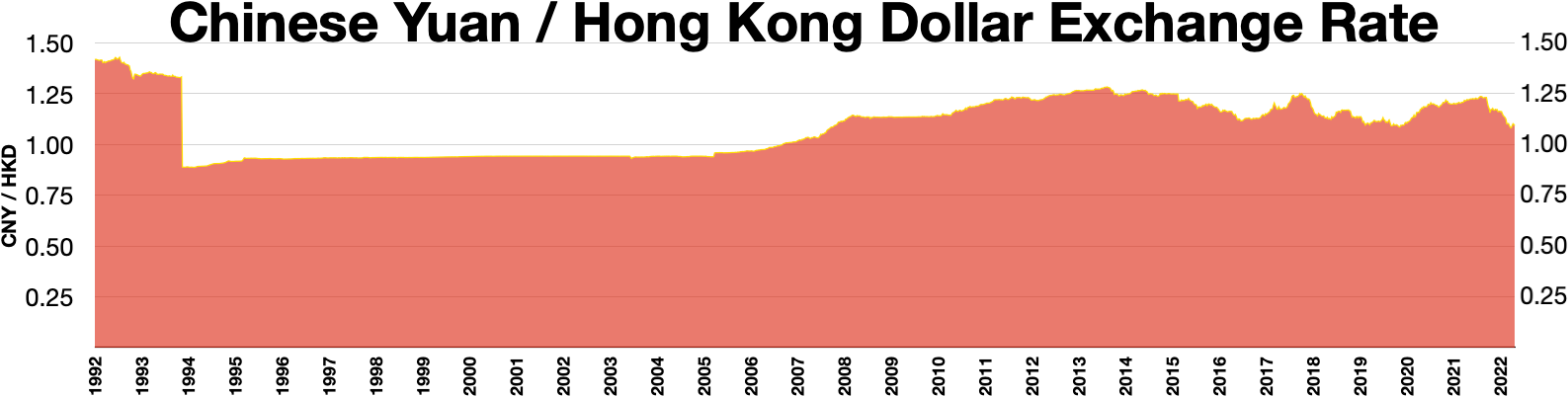

For most of its early history, the renminbi was pegged to the U.S. dollar at ¥2.46 per dollar. During the 1970s, it was revalued until it reached ¥1.50 per dollar in 1980. When China's economy gradually opened in the 1980s, the renminbi was devalued in order to improve the competitiveness of Chinese exports. Thus, the official exchange rate increased from ¥1.50 in 1980 to ¥8.62 by 1994 (the lowest rate on record). Improving current account balance during the latter half of the 1990s enabled the Chinese government to maintain a peg of ¥8.27 per US$1 from 1997 to 2005.

The renminbi reached a record high exchange value of ¥6.0395 to the US dollar on 14 January 2014. Chinese leadership have been raising the yuan to tame inflation, a step U.S. officials have pushed for years to lower the massive trade deficit with China. Strengthening the value of the renminbi also fits with the Chinese transition to a more consumer-led economic growth model.

In 2015 the People's Bank of China again devalued their country's currency. , the exchange rate for US$1 is ¥6.38.

For most of its early history, the renminbi was pegged to the U.S. dollar at ¥2.46 per dollar. During the 1970s, it was revalued until it reached ¥1.50 per dollar in 1980. When China's economy gradually opened in the 1980s, the renminbi was devalued in order to improve the competitiveness of Chinese exports. Thus, the official exchange rate increased from ¥1.50 in 1980 to ¥8.62 by 1994 (the lowest rate on record). Improving current account balance during the latter half of the 1990s enabled the Chinese government to maintain a peg of ¥8.27 per US$1 from 1997 to 2005.

The renminbi reached a record high exchange value of ¥6.0395 to the US dollar on 14 January 2014. Chinese leadership have been raising the yuan to tame inflation, a step U.S. officials have pushed for years to lower the massive trade deficit with China. Strengthening the value of the renminbi also fits with the Chinese transition to a more consumer-led economic growth model.

In 2015 the People's Bank of China again devalued their country's currency. , the exchange rate for US$1 is ¥6.38.

Before 2009, the renminbi had little to no exposure in the international markets because of strict government controls by the central Chinese government that prohibited almost all export of the currency, or use of it in international transactions. Transactions between Chinese companies and a foreign entity were generally denominated in US dollars. With Chinese companies unable to hold US dollars and foreign companies unable to hold Chinese yuan, all transactions would go through the People's Bank of China. Once the sum was paid by the foreign party in dollars, the central bank would pass the settlement in renminbi to the Chinese company at the state-controlled exchange rate.

In June 2009 the Chinese officials announced a pilot scheme where business and trade transactions were allowed between limited businesses in Guangdong province and Shanghai, and only counterparties in Hong Kong, Macau, and select ASEAN nations. Proving a success, the program was further extended to 20 Chinese provinces and counterparties internationally in July 2010, and in September 2011 it was announced that the remaining 11 Chinese provinces would be included.

In steps intended to establish the renminbi as an international

Before 2009, the renminbi had little to no exposure in the international markets because of strict government controls by the central Chinese government that prohibited almost all export of the currency, or use of it in international transactions. Transactions between Chinese companies and a foreign entity were generally denominated in US dollars. With Chinese companies unable to hold US dollars and foreign companies unable to hold Chinese yuan, all transactions would go through the People's Bank of China. Once the sum was paid by the foreign party in dollars, the central bank would pass the settlement in renminbi to the Chinese company at the state-controlled exchange rate.

In June 2009 the Chinese officials announced a pilot scheme where business and trade transactions were allowed between limited businesses in Guangdong province and Shanghai, and only counterparties in Hong Kong, Macau, and select ASEAN nations. Proving a success, the program was further extended to 20 Chinese provinces and counterparties internationally in July 2010, and in September 2011 it was announced that the remaining 11 Chinese provinces would be included.

In steps intended to establish the renminbi as an international

The two special administrative regions, Hong Kong and Macau, have their own respective currencies, according to the "

The two special administrative regions, Hong Kong and Macau, have their own respective currencies, according to the "

Since currency flows in and out of mainland China are still restricted, renminbi traded in off-shore markets, such as the Hong Kong market, can have a different value to renminbi traded on the mainland. The offshore RMB market is usually denoted as CNH, but there is another renminbi interbank and spot market in Taiwan for domestic trading known as CNT.

Other renminbi markets include the dollar-settled non-deliverable forward (NDF), and the trade-settlement exchange rate (CNT).

Note that the two CNTs mentioned above are different from each other.

Since currency flows in and out of mainland China are still restricted, renminbi traded in off-shore markets, such as the Hong Kong market, can have a different value to renminbi traded on the mainland. The offshore RMB market is usually denoted as CNH, but there is another renminbi interbank and spot market in Taiwan for domestic trading known as CNT.

Other renminbi markets include the dollar-settled non-deliverable forward (NDF), and the trade-settlement exchange rate (CNT).

Note that the two CNTs mentioned above are different from each other.

PDF-File; DIW Online

. * Hai Xin (2012)

''The RMB Handbook: Trading, Investing and Hedging''

Risk Books. * *

* ttps://www.bbc.com/news/10413076 Stephen Mulvey, Why China's currency has two names – BBC News, 2010-06-26

Historical and current banknotes of the People's Republic of China

{{Authority control Currencies of China Currencies introduced in 1949 Chinese numismatics Currency symbols

symbol

A symbol is a mark, sign, or word that indicates, signifies, or is understood as representing an idea, object, or relationship. Symbols allow people to go beyond what is known or seen by creating linkages between otherwise very different conc ...

: ¥; ISO code: CNY; abbreviation

An abbreviation (from Latin ''brevis'', meaning ''short'') is a shortened form of a word or phrase, by any method. It may consist of a group of letters or words taken from the full version of the word or phrase; for example, the word ''abbrevia ...

: RMB) is the official currency of the People's Republic of China and one of the world's most traded currencies, ranking as the fifth most traded currency in the world as of April 2022.

The yuan ( or ) is the basic unit of the renminbi, but the word is also used to refer to the Chinese currency generally, especially in international contexts. One yuan is divided into 10 jiao (), and the jiao is further subdivided into 10 fen (). The renminbi is issued by the People's Bank of China, the monetary authority of China.

Valuation

Until 2005, the value of the renminbi was pegged to the US dollar. As China pursued its transition from central planning to amarket economy

A market economy is an economic system in which the decisions regarding investment, production and distribution to the consumers are guided by the price signals created by the forces of supply and demand, where all suppliers and consumers ...

and increased its participation in foreign trade, the renminbi was devalued to increase the competitiveness of Chinese industry. It has previously been claimed that the renminbi's official exchange rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of ...

was undervalued by as much as 37.5% against its purchasing power parity

Purchasing power parity (PPP) is the measurement of prices in different countries that uses the prices of specific goods to compare the absolute purchasing power of the countries' currency, currencies. PPP is effectively the ratio of the price of ...

. However, more recently, appreciation actions by the Chinese government, as well as quantitative easing measures taken by the American Federal Reserve and other major central banks, have caused the renminbi to be within as little as 8% of its equilibrium value by the second half of 2012. Since 2006, the renminbi exchange rate has been allowed to float in a narrow margin around a fixed base rate determined with reference to a basket of world currencies. The Chinese government has announced that it will gradually increase the flexibility of the exchange rate. As a result of the rapid internationalization of the renminbi, it became the world's 8th most traded currency in 2013, 5th by 2015, but 6th in 2019.

On 1 October 2016, the renminbi became the first emerging market currency to be included in the IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster globa ...

's special drawing rights basket, the basket of currencies used by the IMF as a reserve currency.

Terminology

} , renminbi , "people's currency" , - , Formal name for 1 unit , or , zh, labels=no, p=yuán , yuan , "unit" , - , Formal name for unit , , zh, labels=no, p=jiǎo , jiao , "corner" , - , Formal name for unit , , zh, labels=no, p=fēn , fen , "fraction" , - , Colloquial name for 1 unit , , zh, labels=no, p=kuài , kuai or quay , "piece" , - , Colloquial name for unit , , zh, labels=no, p=máo , mao , "feather" The ISO code for the renminbi is ''CNY'', the PRC's country code (CN) plus "Y" from "yuan". Hong Kong markets that trade renminbi at free-floating rates use the unofficial code CNH. This is to distinguish the rates from those fixed by Chinese central banks on the mainland. The abbreviation ''RMB'' is not an ISO code but is sometimes used like one by banks and financial institutions. The currency symbol for the yuan unit is ¥, but when distinction from theJapanese yen

The is the official currency of Japan. It is the third-most traded currency in the foreign exchange market, after the United States dollar (US$) and the euro. It is also widely used as a third reserve currency after the US dollar and the ...

is required ''RMB'' (e.g. RMB 10,000) or ''¥ RMB'' (e.g. ¥10,000 RMB) is used. However, in written Chinese contexts, the Chinese character for yuan ( zh, links=no, c=元, l=beginning, s=, t=, p=) or, in formal contexts zh, links=no, c=圆, l=round, usually follows the number in lieu of a currency symbol.

''Renminbi'' is the name of the currency while '' yuan'' is the name of the primary unit of the renminbi. This is analogous to the distinction between " sterling" and "pound

Pound or Pounds may refer to:

Units

* Pound (currency), a unit of currency

* Pound sterling, the official currency of the United Kingdom

* Pound (mass), a unit of mass

* Pound (force), a unit of force

* Rail pound, in rail profile

Symbols

* Po ...

" when discussing the official currency of the United Kingdom. ''Jiao'' and ''fen'' are also units of renminbi.

In everyday Mandarin

Mandarin or The Mandarin may refer to:

Language

* Mandarin Chinese, branch of Chinese originally spoken in northern parts of the country

** Standard Chinese or Modern Standard Mandarin, the official language of China

** Taiwanese Mandarin, Stand ...

, kuai ( zh, links=no, c=块, p=''kuài'', l=piece) is usually used when discussing money and "renminbi" or "yuan" are rarely heard. Similarly, Mandarin speakers typically use mao ( zh, links=no, c=毛, p=máo) instead of jiao.

Renminbi is sometimes referred to as the "redback", a play on "greenback", a slang term for the US dollar.

History

The various currencies called yuan or dollar issued in mainland China as well as Taiwan, Hong Kong, Macau and Singapore were all derived from the Spanish American silver dollar, which China imported in large quantities from Spanish America from the 16th to 20th centuries. The first locally minted silver dollar or yuan accepted all over Qing dynasty China (1644–1912) was the silver dragon dollar introduced in 1889. Various banknotes denominated in dollars or yuan were also introduced, which were convertible to silver dollars until 1935 when the silver standard was discontinued and the Chinese yuan was made ''fabi'' (法币; legal tender

The various currencies called yuan or dollar issued in mainland China as well as Taiwan, Hong Kong, Macau and Singapore were all derived from the Spanish American silver dollar, which China imported in large quantities from Spanish America from the 16th to 20th centuries. The first locally minted silver dollar or yuan accepted all over Qing dynasty China (1644–1912) was the silver dragon dollar introduced in 1889. Various banknotes denominated in dollars or yuan were also introduced, which were convertible to silver dollars until 1935 when the silver standard was discontinued and the Chinese yuan was made ''fabi'' (法币; legal tender fiat currency

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was sometime ...

).

The renminbi was introduced by the People's Bank of China in December 1948, about a year before the establishment of the People's Republic of China. It was issued only in paper form at first, and replaced the various currencies circulating in the areas controlled by the Communists. One of the first tasks of the new government was to end the hyperinflation that had plagued China in the final years of the Kuomintang (KMT) era. That achieved, a revaluation occurred in 1955 at the rate of 1 new yuan = 10,000 old yuan.

As the Chinese Communist Party took control of ever larger territories in the latter part of the Chinese Civil War, its People's Bank of China began to issue a unified currency in 1948 for use in Communist-controlled territories. Also denominated in ''yuan'', this currency was identified by different names, including "People's Bank of China banknotes" (; from November 1948), "New Currency" (; from December 1948), "People's Bank of China notes" (; from January 1949), "People's Notes" (人民券, as an abbreviation of the last name), and finally "People's Currency", or "''renminbi''", from June 1949.

Era of the planned economy

From 1949 until the late 1970s, the state fixed China's exchange rate at a highly overvalued level as part of the country'simport-substitution

Import substitution industrialization (ISI) is a trade and economic policy that advocates replacing foreign imports with domestic production.''A Comprehensive Dictionary of Economics'' p.88, ed. Nelson Brian 2009. It is based on the premise that ...

strategy. During this time frame, the focus of the state's central planning was to accelerate industrial development and reduce China's dependence on imported manufactured goods. The overvaluation allowed the government to provide imported machinery and equipment to priority industries at a relatively lower domestic currency cost than otherwise would have been possible.

Transition to an equilibrium exchange rate

China's transition by the mid-1990s to a system in which the value of its currency was determined by supply and demand in aforeign exchange market

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspec ...

was a gradual process spanning 15 years that involved changes in the official exchange rate, the use of a dual exchange rate system, and the introduction and gradual expansion of markets for foreign exchange.

The most important move to a market-oriented exchange rate was an easing of controls on trade and other current account transactions, as occurred in several very early steps. In 1979, the State Council State Council may refer to:

Government

* State Council of the Republic of Korea, the national cabinet of South Korea, headed by the President

* State Council of the People's Republic of China, the national cabinet and chief administrative auth ...

approved a system allowing exporters and their provincial and local government owners to retain a share of their foreign exchange earnings, referred to as foreign exchange quotas. At the same time, the government introduced measures to allow retention of part of the foreign exchange earnings from non-trade sources, such as overseas remittances, port fees paid by foreign vessels, and tourism.

As early as October 1980, exporting firms that retained foreign exchange above their own import needs were allowed to sell the excess through the state agency responsible for the management of China's exchange controls and its foreign exchange reserves, the State Administration of Exchange Control. Beginning in the mid-1980s, the government sanctioned foreign exchange markets, known as swap centres, eventually in most large cities.

The government also gradually allowed market forces to take the dominant role by introducing an "internal settlement rate" of ¥2.8 to 1 US dollar which was a devaluation of almost 100%.

Foreign exchange certificates, 1980–1994

In the process of opening up China to external trade and tourism, transactions with foreign visitors between 1980 and 1994 were done primarily using Foreign exchange certificates (外汇券, ''waihuiquan'') issued by the Bank of China. Foreign currencies were exchangeable for FECs and vice versa at the renminbi's prevailing official rate which ranged from US$1 = ¥2.8 FEC to ¥5.5 FEC. The FEC was issued as banknotes from ¥0.1 to ¥100, and was officially at par with the renminbi. Tourists used FECs to pay for accommodation as well as tourist and luxury goods sold in Friendship Stores. However, given the non-availability of foreign exchange and Friendship Store goods to the general public, as well as the inability of tourists to use FECs at local businesses, an illegalblack market

A black market, underground economy, or shadow economy is a clandestine market or series of transactions that has some aspect of illegality or is characterized by noncompliance with an institutional set of rules. If the rule defines the se ...

developed for FECs where touts approached tourists outside hotels and offered over ¥1.50 RMB in exchange for ¥1 FEC. In 1994, as a result of foreign exchange management reforms approved by the 14th CPC Central Committee, the renminbi was officially devalued from US$1 = ¥5.5 to over ¥8, and the FEC was retired at ¥1 FEC = ¥1 RMB in favour of tourists directly using the renminbi.

Evolution of exchange policy since 1994

In November 1993, the Third Plenum of the FourteenthCPC Central Committee

The Central Committee of the Chinese Communist Party, officially the Central Committee of the Communist Party of China, is a political body that comprises the top leaders of the Chinese Communist Party (CCP). It is currently composed of 205 fu ...

approved a comprehensive reform strategy in which foreign exchange management reforms were highlighted as a key element for a market-oriented economy. A floating exchange rate regime and convertibility for renminbi were seen as the ultimate goal of the reform. Conditional convertibility under current account was achieved by allowing firms to surrender their foreign exchange earning from current account transactions and purchase foreign exchange as needed. Restrictions on Foreign Direct Investment

A foreign direct investment (FDI) is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. It is thus distinguished from a foreign portfolio investment by a notion of direct co ...

(FDI) was also loosened and capital inflows to China surged.

Convertibility

During the era of the command economy, the value of the renminbi was set to unrealistic values in exchange with Western currency and severe currency exchange rules were put in place, hence the dual-track currency system from 1980 to 1994 with the renminbi usable only domestically, and with Foreign Exchange Certificates (FECs) used by foreign visitors. In the late 1980s and early 1990s, China worked to make the renminbi more convertible. Through the use of swap centres, the exchange rate was eventually brought to more realistic levels of above ¥8/US$1 in 1994 and the FEC was discontinued. It stayed above ¥8/$1 until 2005 when the renminbi's peg to the dollar was loosened and it was allowed to appreciate. As of 2013, the renminbi is convertible oncurrent account Current account or Current Account may refer to:

* Current account (balance of payments), a country's balance of trade, net of factor income and cash transfers

* Current account (banking)

A transaction account, also called a checking account, ch ...

s but not capital accounts. The ultimate goal has been to make the renminbi fully convertible. However, partly in response to the Asian financial crisis in 1998, China has been concerned that the Chinese financial system would not be able to handle the potential rapid cross-border movements of hot money, and as a result, as of 2012, the currency trades within a narrow band specified by the Chinese central government.

Following the internationalization of the renminbi, on 30 November 2015, the IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster globa ...

voted to designate the renminbi as one of several main world currencies, thus including it in the basket of special drawing rights. The renminbi became the first emerging market currency to be included in the IMF's SDR basket on 1 October 2016. The other main world currencies are the dollar, the euro, sterling, and the yen.

Digital renminbi

In October 2019, China's central bank,PBOC

The People's Bank of China (officially PBC or informally PBOC; ) is the central bank of the People's Republic of China, responsible for carrying out monetary policy and regulation of financial institutions in mainland China, as determined by ...

, announced that a digital reminbi

Digital renminbi ( zh, 数字人民币; also abbreviated as digital RMB and e-CNY), or Digital Currency Electronic Payment (DCEP, ), is a central bank digital currency issued by China's central bank, the People's Bank of China. It is the first digi ...

is going to be released after years of preparation. This version of the currency, also called DCEP (Digital Currency Electronic Payment), can be “decoupled” from the banking system to give visiting tourists a taste of the nation's burgeoning cashless society. However, it is not based on cryptocurrency

A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it. It i ...

. The announcement received a variety of responses: some believe it is more about domestic control and surveillance. Some argue that the real barriers to internationalisation of the renminbi are China's capital controls, which it has no plans to remove. Maximilian Kärnfelt, an expert at the Mercator Institute for China Studies

The Mercator Institute for China Studies (MERICS) is a German think tank with a focus on China. The non-profit organisation was founded in 2013 by Stiftung Mercator, a private foundation in Germany. The institute’s focus is on political, econom ...

, said that a digital renminbi "would not banish many of the problems holding the renminbi back from more use globally". He went on to say, "Much of China's financial market is still not open to foreigners and property rights remain fragile."

The PBOC has filed more than 80 patents surrounding the integration of a digital currency

Digital currency (digital money, electronic money or electronic currency) is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital cu ...

system, choosing to embrace the blockchain

A blockchain is a type of distributed ledger technology (DLT) that consists of growing lists of records, called ''blocks'', that are securely linked together using cryptography. Each block contains a cryptographic hash of the previous block, a ...

technology. The patents reveal the extent of China's digital currency plans. The patents, seen and verified by the '' Financial Times'', include proposals related to the issuance and supply of a central bank digital currency, a system for interbank settlements that uses the currency, and the integration of digital currency wallets into existing retail bank accounts. Several of the 84 patents reviewed by the ''Financial Times'' indicate that China may plan to algorithmically adjust the supply of a central bank digital currency based on certain triggers, such as loan interest rates. Other patents are focused on building digital currency chip cards or digital currency wallets that banking consumers could potentially use, which would be linked directly to their bank accounts. The patent filings also point to the proposed ‘ tokenomics’ being considered by the DCEP working group. Some patents show plans towards programmed inflation control mechanisms. While the majority of the patents are attributed to the PBOC's Digital Currency Research Institute, some are attributed to state-owned corporations or subsidiaries of the Chinese central government.

Uncovered by the Chamber of Digital Commerce

The Chamber of Digital Commerce is an American advocacy group that promotes the emerging industry behind blockchain technology, bitcoin, digital currency and digital assets.

History

Headquartered in Washington, D.C., the organization was fou ...

(an American non-profit advocacy group), their contents shed light on Beijing's mounting efforts to digitise the renminbi, which has sparked alarm in the West and spurred central bankers around the world to begin exploring similar projects. Some commentators have said that the U.S., which has no current plans to issue a government-backed digital currency, risks falling behind China and risking its dominance in the global financial system. Victor Shih

The name Victor or Viktor may refer to:

* Victor (name), including a list of people with the given name, mononym, or surname

Arts and entertainment

Film

* Victor (1951 film), ''Victor'' (1951 film), a French drama film

* Victor (1993 film), ...

, a China expert and professor at the University of California San Diego, said that merely introducing a digital currency "doesn't solve the problem that some people holding renminbi offshore will want to sell that renminbi and exchange it for the dollar", as the dollar is considered to be a safer asset. Eswar Prasad

Eswar Shanker Prasad (born 1965) is an Indian-American economist. He is the Tolani Senior Professor of International Trade Policy at Cornell University and a senior fellow at the Brookings Institution, where he holds the New Century Chair in Econ ...

, an economics professor at Cornell University, said that the digital renminbi "will hardly put a dent in the dollar's status as the dominant global reserve currency" due to the United States' "economic dominance, deep and liquid capital markets, and still-robust institutional framework". The U.S. dollar's share as a reserve currency

A reserve currency (or anchor currency) is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international tran ...

is above 60%, while that of the renminbi is about 2%.

In April 2020, '' The Guardian'' reported that the digital currency e-RMB

Digital renminbi ( zh, 数字人民币; also abbreviated as digital RMB and e-CNY), or Digital Currency Electronic Payment (DCEP, ), is a central bank digital currency issued by China's central bank, the People's Bank of China. It is the first dig ...

had been adopted into multiple cities' monetary systems and "some government employees and public servants ill ILL may refer to:

* ''I Love Lucy'', a landmark American television sitcom

* Illorsuit Heliport (location identifier: ILL), a heliport in Illorsuit, Greenland

* Institut Laue–Langevin, an internationally financed scientific facility

* Interlibrar ...

receive their salaries in the digital currency from May. ''The Guardian'' quoted a '' China Daily'' report which stated "A sovereign digital currency provides a functional alternative to the dollar settlement system and blunts the impact of any sanctions or threats of exclusion both at a country and company level ... It may also facilitate integration into globally traded currency markets with a reduced risk of politically inspired disruption." There are talks of testing out the digital renminbi in the upcoming Beijing Winter Olympics

The 2022 Winter Olympics (2022年冬季奥林匹克运动会), officially called the XXIV Olympic Winter Games () and commonly known as Beijing 2022 (2022), was an international winter multi-sport event held from 4 to 20 February 2022 in Beij ...

in 2022, but China's overall timetable for rolling out the digital currency is unclear.

Issuance

As of 2019, renminbi banknotes are available in denominations from ¥0.1, ¥0.5 (1 and 5 jiao), ¥1, ¥5, ¥10, ¥20, ¥50 and ¥100. These denominations have been available since 1955, except for the ¥20 notes (added in 1999 with the fifth series) ¥50 and ¥100 notes (added in 1987 with the fourth series). Coins are available in denominations from ¥0.01 to ¥1 (¥0.01–1). Thus some denominations exist in both coins and banknotes. On rare occasions, larger yuan coin denominations such as ¥5 have been issued to commemorate events but use of these outside of collecting has never been widespread. The denomination of each banknote is printed in simplified written Chinese. The numbers themselves are printed in financial Chinese numeral characters, as well asArabic numerals

Arabic numerals are the ten numerical digits: , , , , , , , , and . They are the most commonly used symbols to write Decimal, decimal numbers. They are also used for writing numbers in other systems such as octal, and for writing identifiers ...

. The denomination and the words "People's Bank of China" are also printed in Mongolian, Tibetan

Tibetan may mean:

* of, from, or related to Tibet

* Tibetan people, an ethnic group

* Tibetan language:

** Classical Tibetan, the classical language used also as a contemporary written standard

** Standard Tibetan, the most widely used spoken dial ...

, Uyghur and Zhuang on the back of each banknote, in addition to the boldface Hanyu Pinyin

Hanyu Pinyin (), often shortened to just pinyin, is the official romanization system for Standard Mandarin Chinese in China, and to some extent, in Singapore and Malaysia. It is often used to teach Mandarin, normally written in Chinese for ...

"Zhongguo Renmin Yinhang" (without tones). The right front of the note has a tactile representation of the denomination in Chinese Braille starting from the fourth series. See corresponding section for detailed information.

The ''fen'' and ''jiao'' denominations have become increasingly unnecessary as prices have increased. Coins under ¥0.1 are used infrequently. Chinese retailers tend to avoid fractional values (such as ¥9.99), opting instead to round to the nearest yuan (such as ¥9 or ¥10).

Coins

In 1953, aluminium ¥0.01, ¥0.02, and ¥0.05 coins began being struck for circulation, and were first introduced in 1955. These depict the national emblem on the obverse (front) and the name and denomination framed by wheat stalks on the reverse (back). In 1980, brass ¥0.1, ¥0.2, and ¥0.5 and cupro-nickel ¥1 coins were added, although the ¥0.1 and ¥0.2 were only produced until 1981, with the last ¥0.5 and ¥1 issued in 1985. All jiǎo coins depicted similar designs to the fēn coins while the yuán depicted the Great Wall of China. In 1991, a new coinage was introduced, consisting of an aluminium ¥0.1, brass ¥0.5 and nickel-clad

Cladding is an outer layer of material covering another. It may refer to the following:

*Cladding (boiler), the layer of insulation and outer wrapping around a boiler shell

*Cladding (construction), materials applied to the exterior of buildings

...

steel

Steel is an alloy made up of iron with added carbon to improve its strength and fracture resistance compared to other forms of iron. Many other elements may be present or added. Stainless steels that are corrosion- and oxidation-resistant ty ...

¥1. These were smaller than the previous jiǎo and yuán coins and depicted flowers on the obverse and the national emblem on the reverse. Issuance of the aluminium ¥0.01 and ¥0.02 coins ceased in 1991, with that of the ¥0.05 halting in 1994. The small coins were still struck for annual uncirculated mint sets in limited quantities, and from the beginning of 2005, the ¥0.01 coin got a new lease on life by being issued again every year since then up to present.

New designs of the ¥0.1, ¥0.5 (now brass-plated

Plating is a surface covering in which a metal is deposited on a conductive surface. Plating has been done for hundreds of years; it is also critical for modern technology. Plating is used to decorate objects, for corrosion inhibition, to improv ...

steel), and ¥1 (nickel-plated steel) were again introduced in between 1999 and 2002. The ¥0.1 was significantly reduced in size, and in 2005 its composition was changed from aluminium to more durable nickel-plated steel. An updated version of these coins was announced in 2019. While the overall design is unchanged, all coins including the ¥0.5 are now of nickel-plated steel, and the ¥1 coin was reduced in size.

The frequency of usage of coins varies between different parts of China, with coins typically being more popular in urban areas (with ¥0.5 and ¥1 coins used in vending machines), and small notes being more popular in rural areas. Older fēn and large jiǎo coins are uncommonly still seen in circulation, but are still valid in exchange.

Banknotes

As of 2020, there have been five series of renminbi banknotes issued by the People's Republic of China: * The first series of renminbi banknotes was issued on 1 December 1948, by the newly founded People's Bank of China. It introduced notes in denominations of ¥1, ¥5, ¥10, ¥20, ¥50, ¥100 and ¥1,000 yuan. Notes for ¥200, ¥500, ¥5,000 and ¥10,000 followed in 1949, with ¥50,000 notes added in 1950. A total of 62 different designs were issued. The notes were officially withdrawn on various dates between 1 April and 10 May 1955. The name "first series" was given retroactively in 1950, after work began to design a new series. :These first renminbi notes were printed with the words " People's Bank of China", "Republic of China

Taiwan, officially the Republic of China (ROC), is a country in East Asia, at the junction of the East and South China Seas in the northwestern Pacific Ocean, with the People's Republic of China (PRC) to the northwest, Japan to the northeast ...

", and the denomination, written in Chinese characters by Dong Biwu.

* The second series of renminbi banknotes was introduced on 1 March 1955 (but dated 1953). Each note has the words "People's Bank of China" as well as the denomination in the Uyghur, Tibetan

Tibetan may mean:

* of, from, or related to Tibet

* Tibetan people, an ethnic group

* Tibetan language:

** Classical Tibetan, the classical language used also as a contemporary written standard

** Standard Tibetan, the most widely used spoken dial ...

, Mongolian and Zhuang languages on the back, which has since appeared in each series of renminbi notes. The denominations available in banknotes were ¥0.01, ¥0.02, ¥0.05, ¥0.1, ¥0.2, ¥0.5, ¥1, ¥2, ¥3, ¥5 and ¥10. Except for the three fen denominations and the ¥3 which were withdrawn, notes in these denominations continued to circulate. Good examples of this series have gained high status with banknote collectors.

* The third series of renminbi banknotes was introduced on 15 April 1962, though many denominations were dated 1960. New dates would be issued as stocks of older dates were gradually depleted. The sizes and design layout of the notes had changed but not the order of colours for each denomination. For the next two decades, the second and third series banknotes were used concurrently. The denominations were of ¥0.1, ¥0.2, ¥0.5, ¥1, ¥2, ¥5 and ¥10. The third series was phased out during the 1990s and then was recalled completely on 1 July 2000.

* The fourth series of renminbi banknotes was introduced between 1987 and 1997, although the banknotes were dated 1980, 1990, or 1996. They were withdrawn from circulation on 1 May 2019. Banknotes are available in denominations of ¥0.1, ¥0.2, ¥0.5, ¥1, ¥2, ¥5, ¥10, ¥50 and ¥100. Like previous issues, the colour designation for already existing denominations remained in effect. The second to fourth series of renminbi banknotes were designed by professors at the Central Academy of Art including Luo Gongliu and Zhou Lingzhao.

* The fifth series of renminbi banknotes and coins was progressively introduced from its introduction in 1999. This series also bears the issue years 2005 (all except ¥1), 2015 (¥100 only) and 2019 (¥1, ¥10, ¥20 and ¥50). As of 2019, it includes banknotes for ¥1, ¥5, ¥10, ¥20, ¥50 and ¥100. Significantly, the fifth series uses the portrait of Chinese Communist Party chairman Mao Zedong on all banknotes, in place of the various leaders, workers and representations of China's ethnic groups which had been featured previously. During this series new security features were added, the ¥2 denomination was discontinued, the colour pattern for each note was changed and a new denomination of ¥20 was introduced for this series. A revised series of coins of ¥0.1, ¥0.5 and ¥1 and banknotes of ¥1, ¥10, ¥20 and ¥50 were issued for general circulation on 30 August 2019. The ¥5 banknote of the fifth series will be issued with new printing technology in a bid to reduce counterfeiting of Chinese currency, and will be issued for circulation in November 2020.

Commemorative issues of the renminbi banknotes

In 1999, a commemorative red ¥50 note was issued in honour of the 50th anniversary of the establishment of the People's Republic of China. This note features Chinese Communist Partychairman

The chairperson, also chairman, chairwoman or chair, is the presiding officer of an organized group such as a board, committee, or deliberative assembly. The person holding the office, who is typically elected or appointed by members of the grou ...

Mao Zedong on the front and various animals on the back.

An orange polymer note

Polymer banknotes are banknotes made from a synthetic polymer such as biaxially oriented polypropylene (BOPP). Such notes incorporate many security features not available in paper banknotes, including the use of metameric inks. Polymer banknote ...

, commemorating the new millennium was issued in 2000 with a face value of ¥100. This features a dragon

A dragon is a reptilian legendary creature that appears in the folklore of many cultures worldwide. Beliefs about dragons vary considerably through regions, but dragons in western cultures since the High Middle Ages have often been depicted as ...

on the obverse and the reverse features the China Millennium monument (at the Center for Cultural and Scientific Fairs).

For the 2008 Beijing Olympics

The 2008 Summer Olympics (), officially the Games of the XXIX Olympiad () and also known as Beijing 2008 (), were an international multisport event held from 8 to 24 August 2008, in Beijing, China. A total of 10,942 athletes from 204 Nat ...

, a green ¥10 note was issued featuring the Bird's Nest Stadium

The National Stadium (), also known as the Bird's Nest (), is an 80,000-capacity stadium in Beijing. The stadium was jointly designed by architects Jacques Herzog and Pierre de Meuron from Basel-based architecture team Herzog & de Meuron, pr ...

on the front with the back showing a classical Olympic discus thrower and various other athletes.

On 26 November 2015, the People's Bank of China issued a blue ¥100 commemorative note to commemorate aerospace science and technology.

In commemoration of the 70th Anniversary of the issuance of the Renminbi, the People's Bank of China issued 120 million ¥50 banknotes on 28 December 2018.

In commemoration of the 2022 Winter Olympics

The 2022 Winter Olympics (2022年冬季奥林匹克运动会), officially called the XXIV Olympic Winter Games () and commonly known as Beijing 2022 (2022), was an international winter multi-sport event held from 4 to 20 February 2022 in Beij ...

, the People's Bank of China issued ¥20 commemorative banknotes in both paper and polymer in December 2021.

Use in ethnic minority regions of China

The renminbi yuan has different names when used in ethnic minority regions of China.

* When used in Inner Mongolia and other Mongol autonomies, a yuan is called a tugreg ( mn, , төгрөг ''tügürig''). However, when used in the republic of Mongolia, it is still named yuani ( mn, юань) to differentiate it from Mongolian tögrög ( mn, төгрөг). One Chinese tügürig (tugreg) is divided into 100 mönggü ( mn, , мөнгө), one Chinese jiao is labeled "10 mönggü". In Mongolian, renminbi is called aradin jogos or arad-un jogos ( mn, , ардын зоос ''arad-un ǰoγos'').

* When used in Tibet and other Tibetan autonomies, a yuan is called a gor (). One gor is divided into 10 gorsur () or 100 gar (). In

The renminbi yuan has different names when used in ethnic minority regions of China.

* When used in Inner Mongolia and other Mongol autonomies, a yuan is called a tugreg ( mn, , төгрөг ''tügürig''). However, when used in the republic of Mongolia, it is still named yuani ( mn, юань) to differentiate it from Mongolian tögrög ( mn, төгрөг). One Chinese tügürig (tugreg) is divided into 100 mönggü ( mn, , мөнгө), one Chinese jiao is labeled "10 mönggü". In Mongolian, renminbi is called aradin jogos or arad-un jogos ( mn, , ардын зоос ''arad-un ǰoγos'').

* When used in Tibet and other Tibetan autonomies, a yuan is called a gor (). One gor is divided into 10 gorsur () or 100 gar (). In Tibetan

Tibetan may mean:

* of, from, or related to Tibet

* Tibetan people, an ethnic group

* Tibetan language:

** Classical Tibetan, the classical language used also as a contemporary written standard

** Standard Tibetan, the most widely used spoken dial ...

, renminbi is called mimangxogngü () or mimang shog ngul.

* When used in the Uyghur autonomy region of Xinjiang, the renminbi is called Xelq puli ( ug, خەلق پۇلى)

Production and minting

Renminbi currency production is carried out by a state owned corporation,China Banknote Printing and Minting Corporation

China Banknote Printing and Minting Corporation (CBPMC), () is a state-owned corporation which carries out the minting of all renminbi coins and printing of renminbi banknotes for the People's Republic of China.

CBPMC uses a network of printing ...

(CBPMC; ) headquartered in Beijing. CBPMC uses several printing, engraving and minting facilities around the country to produce banknotes and coins for subsequent distribution. Banknote printing facilities are based in Beijing, Shanghai, Chengdu

Chengdu (, ; Simplified Chinese characters, simplified Chinese: 成都; pinyin: ''Chéngdū''; Sichuanese dialects, Sichuanese pronunciation: , Standard Chinese pronunciation: ), Chinese postal romanization, alternatively Romanization of Chi ...

, Xi'an, Shijiazhuang

Shijiazhuang (; ; Mandarin: ), formerly known as Shimen and romanized as Shihkiachwang, is the capital and most populous city of China’s North China's Hebei Province. Administratively a prefecture-level city, it is about southwest of Beijin ...

, and Nanchang. Mints are located in Nanjing, Shanghai, and Shenyang

Shenyang (, ; ; Mandarin pronunciation: ), formerly known as Fengtian () or by its Manchu language, Manchu name Mukden, is a major China, Chinese sub-provincial city and the List of capitals in China#Province capitals, provincial capital of Lia ...

. Also, high grade paper for the banknotes is produced at two facilities in Baoding and Kunshan. The Baoding facility is the largest facility in the world dedicated to developing banknote material according to its website. In addition, the People's Bank of China has its own printing technology research division that researches new techniques for creating banknotes and making counterfeiting more difficult.

Suggested future design

On 13 March 2006, some delegates to an advisory body at the National People's Congress proposed to includeSun Yat-sen

Sun Yat-sen (; also known by several other names; 12 November 1866 – 12 March 1925)Singtao daily. Saturday edition. 23 October 2010. section A18. Sun Yat-sen Xinhai revolution 100th anniversary edition . was a Chinese politician who serve ...

and Deng Xiaoping on the renminbi banknotes. However, the proposal was not adopted.

Economics

Value

Depegged from the US dollar

On 21 July 2005, the peg was finally lifted, which saw an immediate one-time renminbi revaluation to ¥8.11 per dollar. The exchange rate against the euro stood at ¥10.07060 per euro. However, the peg was reinstituted unofficially when the financial crisis hit: "Under intense pressure from Washington, China took small steps to allow its currency to strengthen for three years starting in July 2005. But China 're-pegged' its currency to the dollar as the financial crisis intensified in July 2008." On 19 June 2010, the People's Bank of China released a statement simultaneously in Chinese and English claiming that they would "proceed further with reform of the renminbi exchange rate regime and increase the renminbi exchange rate flexibility". The news was greeted with praise by world leaders including Barack Obama,Nicolas Sarkozy

Nicolas Paul Stéphane Sarközy de Nagy-Bocsa (; ; born 28 January 1955) is a French politician who served as President of France from 2007 to 2012.

Born in Paris, he is of Hungarian, Greek Jewish, and French origin. Mayor of Neuilly-sur-Se ...

and Stephen Harper

Stephen Joseph Harper (born April 30, 1959) is a Canadian politician who served as the 22nd prime minister of Canada from 2006 to 2015. Harper is the first and only prime minister to come from the modern-day Conservative Party of Canada, ...

. The PBoC

The People's Bank of China (officially PBC or informally PBOC; ) is the central bank of the People's Republic of China, responsible for carrying out monetary policy and regulation of financial institutions in mainland China, as determined by ...

maintained there would be no "large swings" in the currency. The renminbi rose to its highest level in five years and markets worldwide surged on Monday, 21 June following China's announcement.

In August 2015, Joseph Adinolfi, a reporter for MarketWatch

MarketWatch is a website that provides financial information, business news, analysis, and stock market data. Along with ''The Wall Street Journal'' and ''Barron's'', it is a subsidiary of Dow Jones & Company, a property of News Corp.

Histor ...

, reported that China had re-pegged the renminbi. In his article, he narrated that "Weak trade data out of China, released over the weekend, weighed on the currencies of Australia and New Zealand on Monday. But the yuan didn't budge. Indeed, the Chinese currency, also known as the renminbi, has been remarkably steady over the past month despite the huge selloff in China's stock market and a spate of disappointing economic data. Market strategists, including Simon Derrick, chief currency strategist at BNY Mellon, and Marc Chandler, head currency strategist at Brown Brothers Harriman, said that is because China's policy makers have effectively re-pegged the yuan. “When I look at the dollar-renminbi right now, that looks like a fixed exchange rate again. They’ve re-pegged it,” Chandler said."

Managed float

The renminbi has now moved to a managed floating exchange rate based on market supply and demand with reference to a basket of foreign currencies. In July 2005, the daily trading price of the US dollar against the renminbi in the inter-bank foreign exchange market was allowed to float within a narrow band of 0.3% around the central parity published by the People's Bank of China; in a later announcement published on 18 May 2007, the band was extended to 0.5%. On 14 April 2012, the band was extended to 1.0%. On 17 March 2014, the band was extended to 2%. China has stated that the basket is dominated by the United States dollar, euro,Japanese yen

The is the official currency of Japan. It is the third-most traded currency in the foreign exchange market, after the United States dollar (US$) and the euro. It is also widely used as a third reserve currency after the US dollar and the ...

and South Korean won

The Korean Republic won, unofficially the South Korean won ( Symbol: ₩; Code: KRW; Korean: 대한민국 원) is the official currency of South Korea. A single won is divided into 100 jeon, the monetary subunit. The jeon is no longer used f ...

, with a smaller proportion made up of sterling, Thai baht, roubles, Australian dollars, Canadian dollar

The Canadian dollar ( symbol: $; code: CAD; french: dollar canadien) is the currency of Canada. It is abbreviated with the dollar sign $, there is no standard disambiguating form, but the abbreviation Can$ is often suggested by notable style ...

s and Singaporean dollars.

On 10 April 2008, it traded at ¥6.9920 per US dollar, which was the first time in more than a decade that a dollar had bought less than ¥7, and at ¥11.03630 per euro.

Beginning in January 2010, Chinese and non-Chinese citizens have an annual exchange limit of a maximum of US$50,000. Currency exchange will only proceed if the applicant appears in person at the relevant bank and presents their passport or Chinese ID. Currency exchange transactions are centrally registered. The maximum dollar withdrawal is $10,000 per day, the maximum purchase limit of US dollars is $500 per day. This stringent management of the currency leads to a bottled-up demand for exchange in both directions. It is viewed as a major tool to keep the currency peg, preventing inflows of " hot money".

A shift of Chinese reserves into the currencies of their other trading partners has caused these nations to shift more of their reserves into dollars, leading to no great change in the value of the renminbi against the dollar.

Futures market

Renminbifutures

Futures may mean:

Finance

*Futures contract, a tradable financial derivatives contract

*Futures exchange, a financial market where futures contracts are traded

* ''Futures'' (magazine), an American finance magazine

Music

* ''Futures'' (album), a ...

are traded at the Chicago Mercantile Exchange

The Chicago Mercantile Exchange (CME) (often called "the Chicago Merc", or "the Merc") is a global derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board, an a ...

. The futures are cash-settled at the exchange rate published by the People's Bank of China.

Purchasing power parity

Scholarly studies suggest that the yuan is undervalued on the basis ofpurchasing power parity

Purchasing power parity (PPP) is the measurement of prices in different countries that uses the prices of specific goods to compare the absolute purchasing power of the countries' currency, currencies. PPP is effectively the ratio of the price of ...

analysis. One 2011 study suggests a 37.5% undervaluation.

* The World Bank estimated that, by purchasing power parity, one International dollar was equivalent to approximately ¥1.9 in 2004.

* The International Monetary Fund estimated that, by purchasing power parity, one International dollar was equivalent to approximately ¥3.462 in 2006, ¥3.621 in 2007, ¥3.798 in 2008, ¥3.872 in 2009, ¥3.922 in 2010, ¥3.946 in 2011, ¥3.952 in 2012, ¥3.944 in 2013 and ¥3.937 in 2014.

The People's Bank of China lowered the renminbi's daily fix to the US dollar by 1.9 per cent to ¥6.2298 on 11 August 2015. The People's Bank of China again lowered the renminbi's daily fix to the US dollar from ¥6.620 to ¥6.6375 after Brexit on 27 June 2016. It had not been this low since December 2010.

Internationalisation

Before 2009, the renminbi had little to no exposure in the international markets because of strict government controls by the central Chinese government that prohibited almost all export of the currency, or use of it in international transactions. Transactions between Chinese companies and a foreign entity were generally denominated in US dollars. With Chinese companies unable to hold US dollars and foreign companies unable to hold Chinese yuan, all transactions would go through the People's Bank of China. Once the sum was paid by the foreign party in dollars, the central bank would pass the settlement in renminbi to the Chinese company at the state-controlled exchange rate.

In June 2009 the Chinese officials announced a pilot scheme where business and trade transactions were allowed between limited businesses in Guangdong province and Shanghai, and only counterparties in Hong Kong, Macau, and select ASEAN nations. Proving a success, the program was further extended to 20 Chinese provinces and counterparties internationally in July 2010, and in September 2011 it was announced that the remaining 11 Chinese provinces would be included.

In steps intended to establish the renminbi as an international

Before 2009, the renminbi had little to no exposure in the international markets because of strict government controls by the central Chinese government that prohibited almost all export of the currency, or use of it in international transactions. Transactions between Chinese companies and a foreign entity were generally denominated in US dollars. With Chinese companies unable to hold US dollars and foreign companies unable to hold Chinese yuan, all transactions would go through the People's Bank of China. Once the sum was paid by the foreign party in dollars, the central bank would pass the settlement in renminbi to the Chinese company at the state-controlled exchange rate.

In June 2009 the Chinese officials announced a pilot scheme where business and trade transactions were allowed between limited businesses in Guangdong province and Shanghai, and only counterparties in Hong Kong, Macau, and select ASEAN nations. Proving a success, the program was further extended to 20 Chinese provinces and counterparties internationally in July 2010, and in September 2011 it was announced that the remaining 11 Chinese provinces would be included.

In steps intended to establish the renminbi as an international reserve currency

A reserve currency (or anchor currency) is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international tran ...

, China has agreements with Russia, Vietnam, Sri Lanka

Sri Lanka (, ; si, ශ්රී ලංකා, Śrī Laṅkā, translit-std=ISO (); ta, இலங்கை, Ilaṅkai, translit-std=ISO ()), formerly known as Ceylon and officially the Democratic Socialist Republic of Sri Lanka, is an ...

, Thailand, and Japan

Japan ( ja, 日本, or , and formally , ''Nihonkoku'') is an island country in East Asia. It is situated in the northwest Pacific Ocean, and is bordered on the west by the Sea of Japan, while extending from the Sea of Okhotsk in the north ...

, allowing trade with those countries to be settled directly in renminbi instead of requiring conversion to US dollars, with Australia

Australia, officially the Commonwealth of Australia, is a Sovereign state, sovereign country comprising the mainland of the Australia (continent), Australian continent, the island of Tasmania, and numerous List of islands of Australia, sma ...

and South Africa to follow soon.

International reserve currency

Currency restrictions regarding renminbi-denominated bank deposits and financial products were greatly liberalised in July 2010. In 2010 renminbi-denominated bonds were reported to have been purchased by Malaysia's central bank and that McDonald's had issued renminbi denominatedcorporate bond

A corporate bond is a bond issued by a corporation in order to raise financing for a variety of reasons such as to ongoing operations, M&A, or to expand business. The term is usually applied to longer-term debt instruments, with maturity of ...

s through Standard Chartered Bank

Standard Chartered plc is a multinational bank with operations in consumer, corporate and institutional banking, and treasury services. Despite being headquartered in the United Kingdom, it does not conduct retail banking in the UK, and around ...

of Hong Kong. Such liberalisation allows the yuan to look more attractive as it can be held with higher return on investment yields, whereas previously that yield was virtually none. Nevertheless, some national banks such as Bank of Thailand

The Bank of Thailand (BOT) ( Abrv: ธปท.; th, ธนาคารแห่งประเทศไทย, ) is the central bank of Thailand.

History

The Bank of Thailand (BOT) was first set up as the Thai National Banking Bureau. The Bank ...

(BOT) have expressed a serious concern about renminbi since BOT cannot substitute the deprecated US dollars in its US$200 billion foreign exchange reserves for renminbi as much as it wishes because:

#The Chinese government has not taken full responsibilities and commitments on economic affairs at global levels.

#The renminbi still has not become well-liquidated (fully convertible) yet.

#The Chinese government still lacks deep and wide vision about how to perform fund-raising to handle international loans at global levels.

To meet IMF requirements, China gave up some of its tight control over the currency.

Countries that are left-leaning in the political spectrum had already begun to use the renminbi as an alternative reserve currency to the United States dollar; the Central Bank of Chile

The Central Bank of Chile ( es, Banco Central de Chile) is the central bank of Chile. It was established in 1925 and is incorporated into the current Chilean Constitution as an autonomous institution of constitutional rank. Its monetary policy is ...

reported in 2011 to have US$91 million worth of renminbi in reserves, and the president of the Central Bank of Venezuela, Nelson Merentes, made statements in favour of the renminbi following the announcement of reserve withdrawals from Europe and the United States.

In Africa, the central banks of Ghana, Nigeria, and South Africa either hold renminbi as a reserve currency or have taken steps to purchase bonds denominated in renminbi. The "Report on the Internationalization of RMB in 2020", which was released by the People's Bank of China in August 2020, said that renminbi's function as international reserve currency has gradually emerged. In the first quarter 2020, the share of renminbi in global foreign exchange reserves rose to 2.02%, a record high. As of the end of 2019, the People's Bank of China has set up renminbi clearing banks in 25 countries and regions outside of Mainland China, which has made the use of renminbi more secure and transaction costs have decreased.

Use as a currency outside mainland China

The two special administrative regions, Hong Kong and Macau, have their own respective currencies, according to the "

The two special administrative regions, Hong Kong and Macau, have their own respective currencies, according to the "one country, two systems

"One country, two systems" is a constitutional principle of the People's Republic of China (PRC) describing the governance of the special administrative regions of Hong Kong and Macau.

The constitutional principle was formulated in the early ...

" principle and the basic laws of the two territories. Therefore, the Hong Kong dollar and the Macanese pataca remain the legal tenders in the two territories, and the renminbi, although sometimes accepted, is not legal tender. Banks in Hong Kong allow people to maintain accounts in RMB. Because of changes in legislation in July 2010, many banks around the world are now slowly offering individuals the chance to hold deposits in Chinese renminbi.

The renminbi had a presence in Macau even before the 1999 return to the People's Republic of China from Portugal. Banks in Macau can issue credit cards based on the renminbi, but not loans. Renminbi-based credit cards cannot be used in Macau's casinos.

The Republic of China, which governs Taiwan, believes wide usage of the renminbi would create an underground economy and undermine its sovereignty. Tourists are allowed to bring in up to ¥20,000 when visiting Taiwan. These renminbi must be converted to Taiwanese currency at trial exchange sites in Matsu and Kinmen. The Chen Shui-bian administration insisted that it would not allow full convertibility until the mainland signs a bilateral foreign exchange settlement agreement, though president Ma Ying-jeou, who served from 2008 to 2016, sought to allow full convertibility as soon as possible.

The renminbi circulates in some of China's neighbors, such as Pakistan, Mongolia and northern Thailand. Cambodia welcomes the renminbi as an official currency and Laos

Laos (, ''Lāo'' )), officially the Lao People's Democratic Republic ( Lao: ສາທາລະນະລັດ ປະຊາທິປະໄຕ ປະຊາຊົນລາວ, French: République démocratique populaire lao), is a socialist ...

and Myanmar

Myanmar, ; UK pronunciations: US pronunciations incl. . Note: Wikipedia's IPA conventions require indicating /r/ even in British English although only some British English speakers pronounce r at the end of syllables. As John C. Wells, Joh ...

allow it in border provinces such as Wa and Kokang and economic zones like Mandalay

Mandalay ( or ; ) is the second-largest city in Myanmar, after Yangon. Located on the east bank of the Irrawaddy River, 631km (392 miles) (Road Distance) north of Yangon, the city has a population of 1,225,553 (2014 census).

Mandalay was fo ...

. Though unofficial, Vietnam recognizes the exchange of the renminbi to the đồng. In 2017 ¥215 billion was circulating in Indonesia. In 2018 a Bilateral Currency Swap Agreement was made by the Bank of Indonesia

Bank Indonesia (BI) is the central bank of the Republic of Indonesia. It replaced in 1953 the Bank of Java ( nl, De Javasche Bank, DJB), which had been created in 1828 to serve the financial needs of the Dutch East Indies.

History

Bank of Jav ...

and the Bank of China which simplified business transactions, and in 2020 about 10% of Indonesia's global trade was in renminbi.

Since 2007, renminbi-nominated bonds have been issued outside mainland China; these are colloquially called "dim sum bond Dim sum bonds are bonds issued outside of China but denominated in Chinese renminbi, rather than the local currency. They are named after dim sum, a popular style of cuisine in southern China.

History and use

The first dim sum bond was issued b ...

s". In April 2011, the first initial public offering denominated in renminbi occurred in Hong Kong, when the Chinese property investment trust Hui Xian REIT

Hui Xian REIT () is a real estate investment trust demerged from Cheung Kong Holdings. It is the first product listed on the Hong Kong Stock Exchange denominated in yuan. When it launched its IPO in 2011, its main asset is , a business park

A ...

raised ¥10.48 billion ($1.6 billion) in its IPO. Beijing has allowed renminbi-denominated financial markets to develop in Hong Kong as part of the effort to internationalise the renminbi. There is limited (under 1%) issuing of renminbi bonds in Indonesia.

Other markets

Since currency flows in and out of mainland China are still restricted, renminbi traded in off-shore markets, such as the Hong Kong market, can have a different value to renminbi traded on the mainland. The offshore RMB market is usually denoted as CNH, but there is another renminbi interbank and spot market in Taiwan for domestic trading known as CNT.

Other renminbi markets include the dollar-settled non-deliverable forward (NDF), and the trade-settlement exchange rate (CNT).

Note that the two CNTs mentioned above are different from each other.

Since currency flows in and out of mainland China are still restricted, renminbi traded in off-shore markets, such as the Hong Kong market, can have a different value to renminbi traded on the mainland. The offshore RMB market is usually denoted as CNH, but there is another renminbi interbank and spot market in Taiwan for domestic trading known as CNT.

Other renminbi markets include the dollar-settled non-deliverable forward (NDF), and the trade-settlement exchange rate (CNT).

Note that the two CNTs mentioned above are different from each other.

See also

*Chinese lunar coins

In 1981, China began minting coins to commemorate the Chinese New Year. The Chinese lunar series consist of gold, silver, and platinum coins in a variety of sizes, denominations, and shapes. The reverse of each coin depicts the zodiac animal for t ...

* Economy of China

The China, People's Republic of China has an upper middle income Developing country, developing Mixed economy, mixed socialist market economy that incorporates economic planning through Industrial policy, industrial policies and strategic Five- ...

* List of Chinese cash coins by inscription

* List of renminbi exchange rates

The renminbi (RMB, also known as Chinese yuan; ISO code: CNY) is the official currency of the People's Republic of China. Although it is not a freely convertible currency, and has an official exchange rate, the CNY plays an important role in the w ...

* Tibetan coins and currency

Notes

References

Further reading

* Ansgar Belke, Christian Dreger und Georg Erber: ''Reduction of Global Trade Imbalances: Does China Have to Revalue Its Currency?'' In: ''Weekly Report.'' 6/2010, Nr. 30, 2010, , S. 222–229PDF-File; DIW Online

. * Hai Xin (2012)

''The RMB Handbook: Trading, Investing and Hedging''

Risk Books. * *

External links

* ttps://www.bbc.com/news/10413076 Stephen Mulvey, Why China's currency has two names – BBC News, 2010-06-26

Historical and current banknotes of the People's Republic of China

{{Authority control Currencies of China Currencies introduced in 1949 Chinese numismatics Currency symbols