Valeant Pharmaceuticals International, Inc. on:

[Wikipedia]

[Google]

[Amazon]

Bausch Health Companies Inc. (formerly Valeant Pharmaceuticals International, Inc.) is a Canadian multinational specialty pharmaceutical company based in Laval, Quebec, Canada. It develops, manufactures and markets

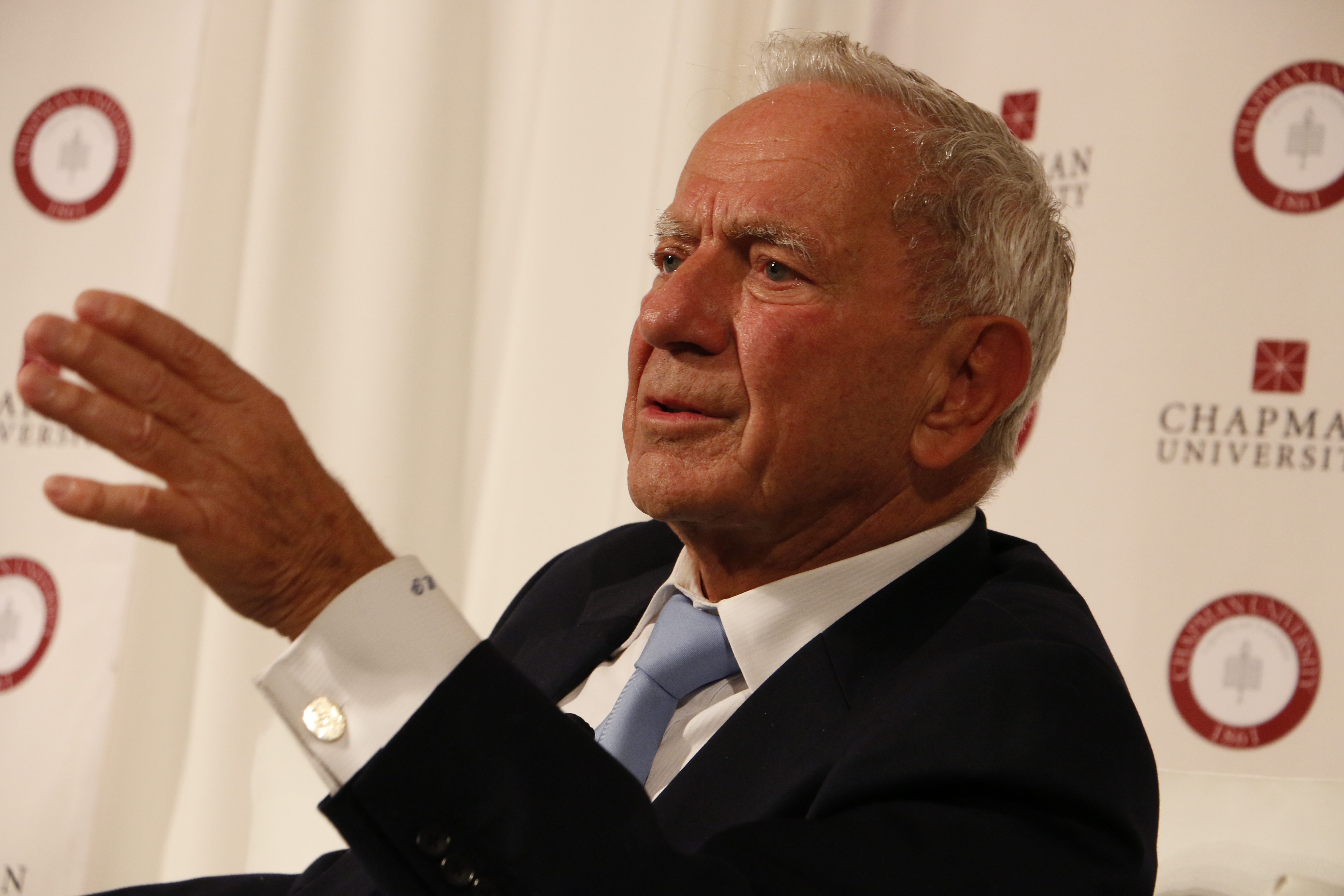

In 1959, Yugoslavian immigrant Milan Panić, who had defected to the US three years earlier, founded ICN Pharmaceuticals (International Chemical and Nuclear Corporation) in his Pasadena garage. Panić ran the company for 43 years, during which ICN established a foothold in the industry by acquiring niche pharmaceuticals and through the development of Ribavirin, an antiviral drug that became the standard treatment for

In 1959, Yugoslavian immigrant Milan Panić, who had defected to the US three years earlier, founded ICN Pharmaceuticals (International Chemical and Nuclear Corporation) in his Pasadena garage. Panić ran the company for 43 years, during which ICN established a foothold in the industry by acquiring niche pharmaceuticals and through the development of Ribavirin, an antiviral drug that became the standard treatment for

In January 2014, Valeant acquired

In January 2014, Valeant acquired

pharmaceutical product

A drug is any chemical substance that causes a change in an organism's physiology or psychology when consumed. Drugs are typically distinguished from food and substances that provide nutritional support. Consumption of drugs can be via insuffla ...

s and branded generic drug

A generic drug is a pharmaceutical drug that contains the same chemical substance as a drug that was originally protected by chemical patents. Generic drugs are allowed for sale after the patents on the original drugs expire. Because the active ch ...

s, primarily for skin diseases, gastrointestinal disorders, eye health and neurology. Bausch Health owns Bausch & Lomb, a supplier of eye health products.

The company in its present form is the result of a merger between Valeant and Canadian firm Biovail. The company retained the Valeant name and J. Michael Pearson as CEO, but was incorporated in Canada and kept Biovail's headquarters. Valeant was originally founded in 1959 as ICN Pharmaceuticals by Milan Panić in California. Under the leadership of J. Michael Pearson

J. Michael Pearson (born 1959) is a Canadian American pharmaceutical company executive. He is the former chairman and CEO of Valeant Pharmaceuticals International after being ousted in the aftermath of a report on pharmaceutical pricing publish ...

, Valeant adopted a strategy of buying up other pharmaceutical companies which manufactured effective medications for a variety of medical problems, and then increasing the price of those medications. As a result, the company grew rapidly and in 2015 was the most valuable company in Canada. Its largest acquisitions were Bausch & Lomb, in 2013, and Salix Pharmaceuticals, in 2015. Valeant also tried to acquire Actavis and Cephalon

Cephalon, Inc. was an American biopharmaceutical company co-founded in 1987 by pharmacologist Frank Baldino, Jr., neuroscientist Michael Lewis, and organic chemist James C. Kauer—all three former scientists with the DuPont Company. Baldino s ...

. An attempted merger with Allergan, in 2014, failed and resulted in the company being sued for insider trading

Insider trading is the trading of a public company's stock or other securities (such as bonds or stock options) based on material, nonpublic information about the company. In various countries, some kinds of trading based on insider information ...

prior to their bid.

In 2015, Valeant was involved in a number of controversies surrounding drug price hikes and the use of a specialty pharmacy for the distribution of its drugs. This led to an investigation by the U.S. Securities and Exchange Commission, causing its stock price to plummet more than 90 percent from its peak, while its debt surpassed $30 billion.

In 2016, Pearson was ousted and replaced by Joseph C. Papa

Joseph C. Papa (born October 1, 1955) is an American businessman and the chairman and chief executive officer (CEO) of Bausch & Lomb, a company formed from the initial public offering (IPO) of the eye health business of Bausch Health Companies ...

, while investor Bill Ackman joined the board. In 2017, Ackman's Pershing Square fund, which held a major stake in the company, sold out for a reported loss of $2.8 billion. Following Ackman's exit, Paulson & Co. increased its stake in the company, became its largest shareholder, with its founder, John Paulson

John Alfred Paulson (born December 14, 1955) is an American billionaire hedge fund manager. He leads Paulson & Co., a New York-based investment management firm he founded in 1994. He has been called "one of the most prominent names in high fina ...

, joining the board, and vowing to rebuild the company's core franchises and to reduce its debt. Under Papa's leadership, by early 2018, the company had become profitable again; had settled the Allergan case for less than expected; and had lowered its debt by $6.5 billion. In July 2018, the name of the company was changed to Bausch Health Companies Inc., in order to distance itself from the public outrage associated with massive price increases introduced by Valeant. At the same time, a new ticker symbol, BHC replaced VRX.

In December 2019, the company settled a shareholder class action lawsuit under Section 11 of the U.S. Securities Act of 1933

The Securities Act of 1933, also known as the 1933 Act, the Securities Act, the Truth in Securities Act, the Federal Securities Act, and the '33 Act, was enacted by the United States Congress on May 27, 1933, during the Great Depression and after ...

, alleging the company misled investors about its business operations and financial performance, for approximately $1.2 billion.

Current operations

Bausch Health's main products include drugs in the fields of dermatology, neurology, and infectious disease.Medications

The company's majorprescription drug

A prescription drug (also prescription medication or prescription medicine) is a pharmaceutical drug that legally requires a medical prescription to be dispensed. In contrast, over-the-counter drugs can be obtained without a prescription. The rea ...

s are:

* Rifaximin (Xifaxan), for treatment of traveler's diarrhea and irritable bowel syndrome with diarrhea

* Budesonide (Uceris), to help get mild to moderate ulcerative colitis under control

* Minocycline (Arestin, Solodyn), an antibiotic

An antibiotic is a type of antimicrobial substance active against bacteria. It is the most important type of antibacterial agent for fighting bacterial infections, and antibiotic medications are widely used in the treatment and prevention of ...

used for procedures related to periodontitis

* Efinaconazole (Jublia), for treatment of toenail fungus

* Acne drugs: clindamycin/tretinoin (Ziana), benzoyl peroxide/clindamycin (Acanya, Onexton), tretinoin (Atralin, Retin-A Micro), benzoyl peroxide

Benzoyl peroxide is a chemical compound (specifically, an organic peroxide) with structural formula , often abbreviated as (BzO)2. In terms of its structure, the molecule can be described as two benzoyl (, Bz) groups connected by a peroxide () ...

(Microsphere), tazarotene (Arazlo)

* Pimecrolimus (Elidel), used to treat atopic dermatitis

* Metformin (Glumetza), to improve glycemic control in adults with type 2 diabetes mellitus

* Bupropion

Bupropion, sold under the brand names Wellbutrin and Zyban among others, is an atypical antidepressant primarily used to treat major depressive disorder and to support smoking cessation. It is also popular as an add-on medication in the case ...

(Wellbutrin XL), for treatment of depression

* Isoprenaline (Isuprel), for treatment of mild or transient episodes of heart block

* Tetrabenazine (Xenazine), for treatment of chorea associated with Huntington’s disease

* Sodium nitroprusside (Nitropress), for the immediate reduction of blood pressure

Blood pressure (BP) is the pressure of circulating blood against the walls of blood vessels. Most of this pressure results from the heart pumping blood through the circulatory system. When used without qualification, the term "blood pressure" r ...

of patients in hypertensive

Hypertension (HTN or HT), also known as high blood pressure (HBP), is a long-term medical condition in which the blood pressure in the arteries is persistently elevated. High blood pressure usually does not cause symptoms. Long-term high bl ...

crises

* Penicillamine (Cuprimine), to treat Wilson's disease (a condition in which high levels of copper in the body cause damage to the liver, brain, and other organs), cystinuria (a condition which leads to cystine stones in the kidneys), and in people with severe, active rheumatoid arthritis who have failed to respond to an adequate trial of conventional therapy.

* Bexarotene (Targretin), a retinoid

The retinoids are a class of chemical compounds that are vitamers of vitamin A or are chemically related to it. Retinoids have found use in medicine where they regulate epithelial cell growth.

Retinoids have many important functions throughout t ...

for treatment of Cutaneous T-Cell Lymphoma

* Aciclovir (Zovirax), a topical antiviral used against herpes viruses

* Triethylenetetramine (Syprine), used for treatment of patients with Wilson's disease

* Loteprednol (Lotemax) gel, a topical corticosteroid

Corticosteroids are a class of steroid hormones that are produced in the adrenal cortex of vertebrates, as well as the synthetic analogues of these hormones. Two main classes of corticosteroids, glucocorticoids and mineralocorticoids, are involv ...

indicated for the treatment of inflammation and pain following ocular surgery

Eye surgery, also known as ophthalmic or ocular surgery, is surgery performed on the eye or its adnexa, by an ophthalmologist or sometimes, an optometrist. Eye surgery is synonymous with ophthalmology. The eye is a very fragile organ, and requ ...

Over the counter products

The company's major over the counter drugs are: * Ocuvite, an eye vitamin * PreserVision, an eye vitamin * ReNu Multiplus, for lubrication ofcontact lens

Contact lenses, or simply contacts, are thin lenses placed directly on the surface of the eyes. Contact lenses are ocular prosthetic devices used by over 150 million people worldwide, and they can be worn to correct vision or for cosmetic ...

es

* Biotrue, an eye lubricant

* Artelac, to treat dry eyes

* Boston, for cleaning of contact lenses

* SootheXP, an eye lubricant

History

1959–2002: the Panić years

hepatitis C

Hepatitis C is an infectious disease caused by the hepatitis C virus (HCV) that primarily affects the liver; it is a type of viral hepatitis. During the initial infection people often have mild or no symptoms. Occasionally a fever, dark urine, a ...

.

In 1994, ICN merged with SPI Pharmaceuticals Inc., Viratek Inc., and ICN Biomedicals Inc.

On June 12, 2002, following a series of controversies, Panić was forced to retire under pressure from shareholders.

2002–2010

In 2003, not long after Panić's ouster, ICN changed its name to Valeant. In 2006, the company received approval in the U.S. to marketCesamet

Nabilone, sold under the brand name Cesamet among others, is a synthetic cannabinoid with therapeutic use as an antiemetic and as an adjunct analgesic for neuropathic pain. It mimics tetrahydrocannabinol (THC), the primary psychoactive compoun ...

(nabilone), a synthetic cannabinoid

Synthetic cannabinoids are a class of designer drug molecules that bind to the same receptors to which cannabinoids (THC, CBD and many others) in cannabis plants attach. These novel psychoactive substances should not be confused with synthetic ...

. The company also acquired the European rights to the drug for $14 million.

In 2008, the Swedish pharmaceutical company Meda AB bought Western and Eastern Europe branches from Valeant for $392 million. In September 2008, Valeant acquired Coria Laboratories for $95 million. In November 2008, Valeant acquired DermaTech for $12.6 million.

In January 2009, Valeant acquired Dow Pharmaceutical Sciences for $285 million. In July 2009, Valeant announced its acquisition of Tecnofarma, a Mexican generic drug

A generic drug is a pharmaceutical drug that contains the same chemical substance as a drug that was originally protected by chemical patents. Generic drugs are allowed for sale after the patents on the original drugs expire. Because the active ch ...

company. In December 2009, Valeant announced its Canadian subsidiary would acquire Laboratoire Dr. Renaud, for C$23 million.

In March 2010, Valeant announced its acquisition of a Brazilian generics and over-the-counter company for $28 million and manufacturing plant for a further $28 million. In April 2010, Valeant announced that its Canadian subsidiary would acquire Vital Science Corp. for C$10.5 million. In May 2010, Valeant acquired Aton Pharmaceuticals for $318 million.

2010–2016: the Pearson years

On September 28, 2010, Valeant merged with Biovail. The company retained the Valeant name andJ. Michael Pearson

J. Michael Pearson (born 1959) is a Canadian American pharmaceutical company executive. He is the former chairman and CEO of Valeant Pharmaceuticals International after being ousted in the aftermath of a report on pharmaceutical pricing publish ...

as CEO, but was incorporated in Canada and temporarily kept Biovail's headquarters. Setting on a path of aggressive acquisitions, Pearson ultimately turned Valeant into a platform company that grows by systematically acquiring other companies.

In February 2011, Valeant acquired PharmaSwiss S.A. for €350 million. In March 2011, an attempt to buy drugmaker Cephalon

Cephalon, Inc. was an American biopharmaceutical company co-founded in 1987 by pharmacologist Frank Baldino, Jr., neuroscientist Michael Lewis, and organic chemist James C. Kauer—all three former scientists with the DuPont Company. Baldino s ...

Inc. for $5.7 billion was unsuccessful. In May 2011, former Biovail Corporation Chairman and CEO Eugene Melnyk was banned from senior roles at public companies in Canada for five years and penalized to pay $565,000 by the Ontario Securities Commission. In the year before the merger with Valeant, Melnyk had settled by the United States Securities and Exchange Commission (SEC), and agreed to pay a civil penalty of $150,000 after having previously paid $1 million to settle other claims with the SEC. In July 2011, Valeant acquired Ortho Dermatologics from Janssen Pharmaceuticals for $345 million. The acquisition included the products Retin-A

Tretinoin, also known as all-''trans'' retinoic acid (ATRA), is a medication used for the treatment of acne and acute promyelocytic leukemia. For acne, it is applied to the skin as a cream, gel or ointment. For leukemia, it is taken by mouth ...

Micro, Ertaczo

Sertaconazole, sold under the brand name Ertaczo among others, is an antifungal medication of the Benzothiophene class. It is available as a cream to treat skin infections such as athlete's foot.

It is also available in a vaginal tablet form. The ...

, and Renova, also known as tretinoin. In August 2011, Valeant acquired 87.2% of the outstanding shares of Sanitas Group for €314 million. In December 2011, Valeant acquired iNova Pharmaceuticals for A$625 million from Australian private equity firms Archer Capital with additional milestone payments of up to A$75 million. In December 2011, Valeant acquired Dermik, a dermatology unit of Sanofi.

In January 2012, Valeant acquired Brazilian sports nutrition company Probiotica for R$150 million. In February 2012, Valeant acquired ophthalmic biotechnology company Eyetech Inc. In April 2012, Valeant acquired Pedinol. In April 2012, Valeant acquired assets from Atlantis Pharma in Mexico for $71 million. In May 2012, Valeant acquired AcneFree for $64 million plus milestone payments. In June 2012, Valeant acquired OraPharma

Johnson & Johnson (J&J) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average and the company ...

for approximately $312 million with up to $144 million being paid in milestone payments. In August 2012, Valeant agreed to buy skin-care

Skin care is a range of practices that support skin integrity, enhance its appearance, and relieve skin conditions. They can include nutrition, avoidance of excessive sun exposure, and appropriate use of emollients. Practices that enhance appea ...

company Medicis Pharmaceutical for $2.6 billion. In January 2013, Valeant acquired the Russian company Natur Produkt for $163 million. In March 2013, Valeant acquired Obagi Medical Products, Inc. In May 2013, the company acquired Bausch & Lomb from Warburg Pincus for $8.7 billion in a move to dominate the market for specialty contact lenses and related products.

In January 2014, Valeant acquired

In January 2014, Valeant acquired Solta Medical

Bausch Health Companies Inc. (formerly Valeant Pharmaceuticals International, Inc.) is a Canadian multinational specialty pharmaceutical company based in Laval, Quebec, Canada. It develops, manufactures and markets pharmaceutical products and ...

for approximately $250 million. In May 2014, Nestle acquired the commercial rights to some of Valeant's products for $1.4 billion. In July 2014, Valeant acquired PreCision Dermatology Inc for $475 million, a deal aimed at strengthening the firm’s skin products business. Along with hedge fund manager Bill Ackman, Valeant made a bid to acquire Allergan; however, in November 2014, Allergan announced that it would be acquired by Actavis in a $66 billion transaction. Valeant and Pershing Square were subsequently accused of insider trading

Insider trading is the trading of a public company's stock or other securities (such as bonds or stock options) based on material, nonpublic information about the company. In various countries, some kinds of trading based on insider information ...

prior to their Allergan bid, and eventually settled the case in 2017.

On April 1, 2015, Valeant completed the purchase of gastrointestinal treatment drug developer Salix Pharmaceuticals for $14.5 billion after outbidding Endo Pharmaceuticals. On the final day of trading, Salix shares traded for $172.81, giving a market capitalisation of $10.9 billion. In July 2015, the company announced it would acquire Mercury (Cayman) Holdings, the holding company of Amoun Pharmaceutical, one of Egypt's largest drugmakers, for $800 million. In August 2015, Valeant said it would purchase Sprout Pharmaceuticals Inc for $1 billion, a day after Sprout received approval to market the women's libido drug Addyi

Flibanserin, sold under the brand name Addyi, is a medication approved for the treatment of pre-menopausal women with hypoactive sexual desire disorder (HSDD). The medication improves sexual desire, increases the number of satisfying sexual eve ...

. In September 2015, Valeant licensed psoriasis drug Brodalumab from AstraZeneca for up to $445 million. In September 2015, the company announced its intention to acquire eye surgery

Eye surgery, also known as ophthalmic or ocular surgery, is surgery performed on the eye or its adnexa, by an ophthalmologist or sometimes, an optometrist. Eye surgery is synonymous with ophthalmology. The eye is a very fragile organ, and requ ...

product manufacturer Synergetics USA, for $192 million in order to strengthen the company's Bausch & Lomb division. In October 2015, the company's Bausch & Lomb division acquired Doctor's Allergy Formula for an undisclosed sum.

In July 2015, Glass Lewis, a proxy advisory firm, called the $3 billion in compensation received by J. Michael Pearson "excessive".

Philidor controversy

On October 21, 2015, Citron Research founder Andrew Left, a short seller of Valeant shares, published claims that Valeant recorded false sales of products to specialty pharmacyPhilidor Rx Services

Philidor Rx Services is a Pennsylvania-licensed specialty pharmacy, specialty online pharmacy, which mainly sold Valeant Pharmaceuticals, Valeant Pharmaceuticals International Inc drugs directly to patients and handled insurance claims on the cus ...

and its affiliates. These specialty companies were controlled by Valeant, and allegedly resulted in improper bookkeeping of revenues. In addition, by controlling the pharmacy services offered by Philidor, Valeant allegedly steered Philidor's customers to expensive drugs sold by Valeant. One alleged practice entailed Valeant employees directly managing Philidor's business operations while posing as Philidor employees, and with all written communication under fictitious names. Valeant responded that the allegations by Citron Research were "erroneous." On October 30, 2015, Valeant said that it would cut ties with Philidor in response to allegations of aggressive billing practices. Walgreens Boots Alliance Inc, owner of Walgreens, took over distribution for Valeant.

In 2018, Gary Tanner, who was a former Valeant executive, and Andrew Davenport, the former chief executive of Philidor Rx Services, were prosecuted over a kickback scheme. They were sentenced to a year in prison after being convicted on four charges, including wire fraud and conspiracy to commit money laundering. They were also ordered to forfeit $9.7 million in kickbacks. Tanner had been responsible for managing Valeant’s relationship with Philidor as well as Valeant’s “alternative fulfillment” program, which the company used to increase prescriptions for its own (expensive) drugs instead of generic substitutes.

2015 drug price inflation controversy

An important part of the growth strategy for Valeant under Michael Pearson had been the acquisition of medical and pharmaceutical companies and the subsequent price increases for their products. Valeant's strategy of exponential price increases on life-saving medicines was at the time described by Berkshire Hathaway vice chairman Charlie Munger as "deeply immoral" and "similar to the worst abuses in for-profit education." This strategy had also attracted the attention of regulators in the United States, particularly after the publication in '' The New York Times'' of an article on price gouging of specialty drugs. In September 2015, an influential group of politicians criticized Valeant on its pricing strategies. The company raised prices on all its brand name drugs 66% in 2015, five times more than its closest industry peer. The cost of Valeant flucytosine was 10,000% higher in the United States than in Europe. In late September 2015, members of theUnited States House Committee on Oversight and Government Reform

The Committee on Oversight and Reform is the main investigative committee of the United States House of Representatives.

The committee's broad jurisdiction and legislative authority make it one of the most influential and powerful panels in the ...

urged the Committee to subpoena Valeant for their documents regarding the sharp increases in the price of "two heart medications it had just bought the rights to sell: Nitropress

Sodium nitroprusside (SNP), sold under the brand name Nitropress among others, is a medication used to lower blood pressure. This may be done if the blood pressure is very high and resulting in symptoms, in certain types of heart failure, and d ...

and Isuprel. Valeant had raised the price of Nitropress by 212% and Isuprel by 525%". ''The New York Times'' columnist Joe Nocera claimed that Valeant CEO J. Michael Pearson's "plan was to acquire pharmaceutical companies, fire most of their scientists, and jack up the price of their drugs".

After Valeant acquired Salix Pharmaceuticals in 2015, it raised the price of the diabetes pill Glumetza about 800%.

A ''The New York Times'' article on October 4, 2015 stated that:

Although it did not specifically mention Valeant, an October 2015 Twitter post by presidential candidate Hillary Clinton stated: "Price gouging like this in the specialty drug market is outrageous. Tomorrow I’ll lay out a plan to take it on." In January 2016, she said she would be "going after" Valeant for its price hikes, causing its stock price to fall 9 percent on the New York Stock Exchange. She was unsuccessful in having any impact on drug prices after a failed bid for Presidency in 2016.

By October 2015, Valeant had received subpoenas from the U.S. Attorney's Office for the District of Massachusetts and the United States Attorney for the Southern District of New York

The United States Attorney for the Southern District of New York is the chief federal law enforcement officer in eight New York counties: New York (Manhattan), Bronx, Westchester, Putnam, Rockland, Orange, Dutchess and Sullivan. Establishe ...

in regards to an investigation on Valeant's "drug pricing, distribution and patient assistance program." The House Oversight Committee also requested documents from Valeant amid public concern around drug prices.

Rigid contact-lens monopoly investigation

In October 2015, theFederal Trade Commission

The Federal Trade Commission (FTC) is an independent agency of the United States government whose principal mission is the enforcement of civil (non-criminal) antitrust law and the promotion of consumer protection. The FTC shares jurisdiction ov ...

began an investigation into Valeant's increasing control of the production of rigid gas permeable contact lenses. Valeant's acquisition of Bausch & Lomb in 2013, and Paragon Vision Services in 2015, is alleged to have given the company control of over 80% of the production pipeline for hard contact lenses. A series of unilateral price increases beginning in Fall 2015 spurred the FTC's investigation. On November 15, 2016, Valeant agreed to divest itself of Paragon Holdings and Pelican Products to settle charges that its May 2015 acquisition of Paragon reduced competition for the sale of FDA-approved "buttons", the polymer discs used to make gas permeable contact lenses.

Share price erosion and ousting of Pearson

From 2015 to 2017, Valeant shares plummeted more than 90 percent. Large hedge funds such as Bill Ackman's Pershing Square Capital Management, Paulson & Co., and Viking Global Investors lost billions. By April 2016, the market value of hedge fund holdings in Valeant had fallen by $7.3 billion. However, hedge fund herding continued to incite hedge fundportfolio manager A portfolio manager (PM) is a professional responsible for making investment decisions and carrying out investment activities on behalf of vested individuals or institutions. Clients invest their money into the PM's investment policy for future grow ...

s to continue to buy Valeant shares.

In March 2016, the Board of Directors

A board of directors (commonly referred simply as the board) is an executive committee that jointly supervises the activities of an organization, which can be either a for-profit or a nonprofit organization such as a business, nonprofit organiz ...

said that CEO J. Michael Pearson would be leaving the company as soon as a replacement was found and that investor Bill Ackman would be added as a director.

In their 2015 annual report

An annual report is a comprehensive report on a company's activities throughout the preceding year. Annual reports are intended to give shareholders and other interested people information about the company's activities and financial performance. ...

filed on April 29, 2016, Valeant said that it was the "subject of investigations" by the Securities and Exchange Commission, the U.S. Attorney’s Offices in Massachusetts and New York, the state of Texas, the North Carolina Department of Justice, the Senate’s Special Committee on Aging, and the House’s Committee on Oversight and Reform, and had received document requests from the Autorite de Marches Financiers in Canada and the New Jersey State Bureau of Securities."

On April 27, 2016, Bill Ackman, J. Michael Pearson, and Howard Schiller were forced to appear before the United States Senate Special Committee on Ageing to answer to concerns about the repercussions for patients and the health care system

Health, according to the World Health Organization, is "a state of complete physical, Mental health, mental and social well-being and not merely the absence of disease and infirmity".World Health Organization. (2006)''Constitution of the World H ...

faced with Valeant's business model.

2016–present: Valeant under Joseph Papa

On April 25, 2016, Valeant named Perrigo chief executiveJoseph Papa

Joseph C. Papa (born October 1, 1955) is an American businessman and the chairman and chief executive officer (CEO) of Bausch & Lomb, a company formed from the initial public offering (IPO) of the eye health business of Bausch Health Companies ...

as a permanent replacement for Pearson, and entrusted him with turning around the company. Papa set on a path of strategic sales, debt reduction, and organic growth.

By January 2017, the company had sold its skincare brands to L'Oréal for $1.3 billion and its Dendreon biotech unit to Sanpower for $819.9 million. In June, the company sold iNova Pharmaceuticals for $910 million. In July, the company also divested Obagi Medical Products for $190 million. In November, it announced it would sell Sprout Pharmaceuticals back to its original owners, two years after acquiring the business for $1 billion.

The company was featured in episode 3 of the first season of the Netflix documentary ''Dirty Money

Money laundering is the process of concealing the origin of money, obtained from illicit activities such as drug trafficking, corruption, embezzlement or gambling, by converting it into a legitimate source. It is a crime in many jurisdicti ...

''. “Drug Short” explains how Valeant lost 90 percent of its value between 2015 and 2016 taking down billionaires in the process and making an internet heroine of Fahmi Quadir, and a handful of other short sellers. They correctly bet that "the drug company’s price gouging, questionable tactics, and massive debt burden could not be sustained".

By January 2018, the company had divested itself of 13 non-core businesses, reducing its debt to $25 billion, and had settled or dismissed 70 pending lawsuits, including the Allergan insider trading case. On January 8, 2018, the company announced that its Bausch + Lomb unit had received a CE Mark indicating conformity with health, safety, and environmental protection standards from the European Commission for the distribution of its Stellaris product in Europe.

Class action settlement

On December 16, 2019, the company settled a shareholder class action lawsuit under Section 11 of the U.S.Securities Act of 1933

The Securities Act of 1933, also known as the 1933 Act, the Securities Act, the Truth in Securities Act, the Federal Securities Act, and the '33 Act, was enacted by the United States Congress on May 27, 1933, during the Great Depression and after ...

, alleging the company misled investors about its business operations and financial performance, for approximately $1.21 billion. The company denied allegations of all wrongdoing as part of the settlement.

SEC settlement

On July 31, 2020, the SEC announced that Bausch Health had agreed to pay a $45 million penalty to settle charges of improper revenue recognition and misleading disclosures in SEC filings and earnings presentations. It also announced that Pearson would pay $250,000 in civil penalties to the SEC, as well as $450,000 to reimburse Valeant. Howard Schiller and Tanya Carro, two other executives who settled, paid the SEC $100,000 and $75,000, respectively.Acquisitions

References

External links

* {{authority control, state=expanded Companies listed on the Toronto Stock Exchange Pharmaceutical companies of Canada Canadian brands Companies based in Laval, Quebec Pharmaceutical companies established in 1959 1959 establishments in California S&P/TSX 60 Life sciences industry Specialty drugs Tax inversions Pharmaceutical companies based in New Jersey