United Kingdom housing bubble on:

[Wikipedia]

[Google]

[Amazon]

The affordability of housing in the UK reflects the ability to rent or buy property. There are various ways to determine or estimate housing affordability. One commonly used metric is the median housing affordability ratio; this compares the median price paid for residential property to the median gross annual earnings for full-time workers. According to official government statistics, housing affordability worsened between 2020 and 2021, and since 1997 housing affordability has worsened overall, especially in London. The most affordable local authorities in 2021 were in the North West, Wales, Yorkshire and The Humber, West Midlands and North East.

Housing tenure in the UK has the following main types: Owner-occupied, private rented sector (PRS), and social rented sector (SRS). The affordability of housing in the UK varies widely on a regional basis – house prices and rents will differ as a result of market factors such as the state of the local economy, transport links, and the supply of housing.

The gap between average income and average housing prices changed between 1985 and 2015 from twice an average salary to up to six times average income. Median house prices in London the median house now cost up to 12 times the median London salary. In 1995, the median house price was £83,000, 4.4 times the median income. By 2012–13, the median income in London had increased to £24,600 and the median London house price had increased to £300,000, 12.2 times median income

In 1995, the Bank

The gap between average income and average housing prices changed between 1985 and 2015 from twice an average salary to up to six times average income. Median house prices in London the median house now cost up to 12 times the median London salary. In 1995, the median house price was £83,000, 4.4 times the median income. By 2012–13, the median income in London had increased to £24,600 and the median London house price had increased to £300,000, 12.2 times median income

In 1995, the Bank

Property companies state that land values follow house prices and that a developer assesses what new build house price is achievable in any particular location with reference to prices and sales rates in the second-hand market and on nearby comparable new build sites. At a basic level (assuming no

Property companies state that land values follow house prices and that a developer assesses what new build house price is achievable in any particular location with reference to prices and sales rates in the second-hand market and on nearby comparable new build sites. At a basic level (assuming no

UK Housing Review (September 2017

states, "Indeed as the evidence to the Redfern Review from Oxford Economics reminds us, it is unlikely to bring house prices down except in the very long term and with sustained high output of new homes relative to household growth. Even boosting (UK) housing supply to 310,000 homes per annum in their model only brings a five per cent fall in the baseline forecast of house prices". Therefore, the National Housing Federation (NHF) and Crisis from Heriot-Watt University argue that alongside the needed 340,000 new homes each year (until 2031), 145,000 of those “must be affordable homes”.

Trust for London

found that 24% of new housing completions in the three years to 2015/16 were affordable, which represented 21,500 homes. 6,700 affordable homes were completed in 2015/16, which is just 39% of the target set in the 2015 London Plan. They also found that the amount of affordable homes being built varies significantly between the London Boroughs. Tower Hamlets delivered 1830 affordable homes in the three years to 2015/16, the most in London, while Bexley only delivered 7, the fewest in London. Affordable housing is defined as housing that costs no more than 80% of the average local market rent.

Key determinants of affordability

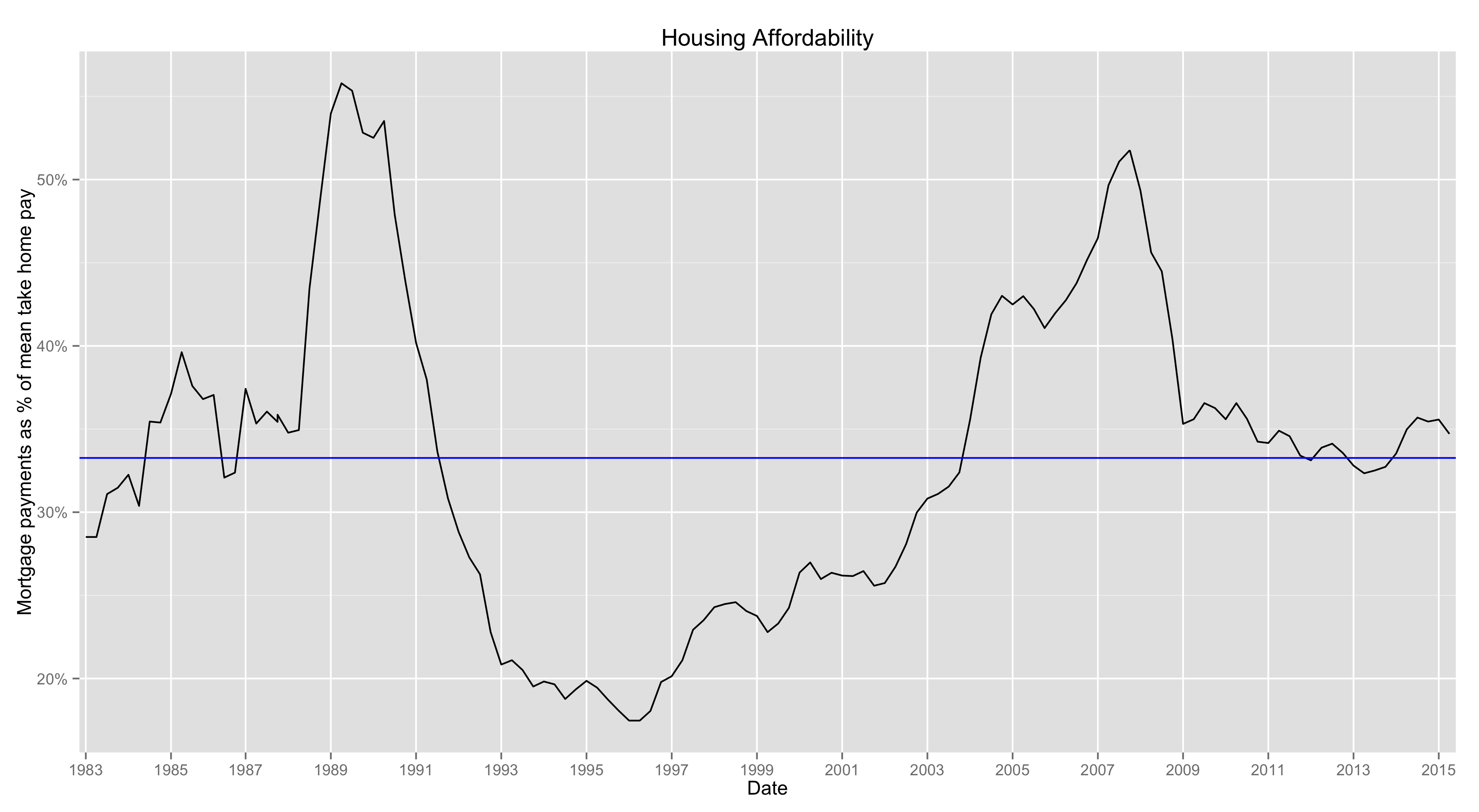

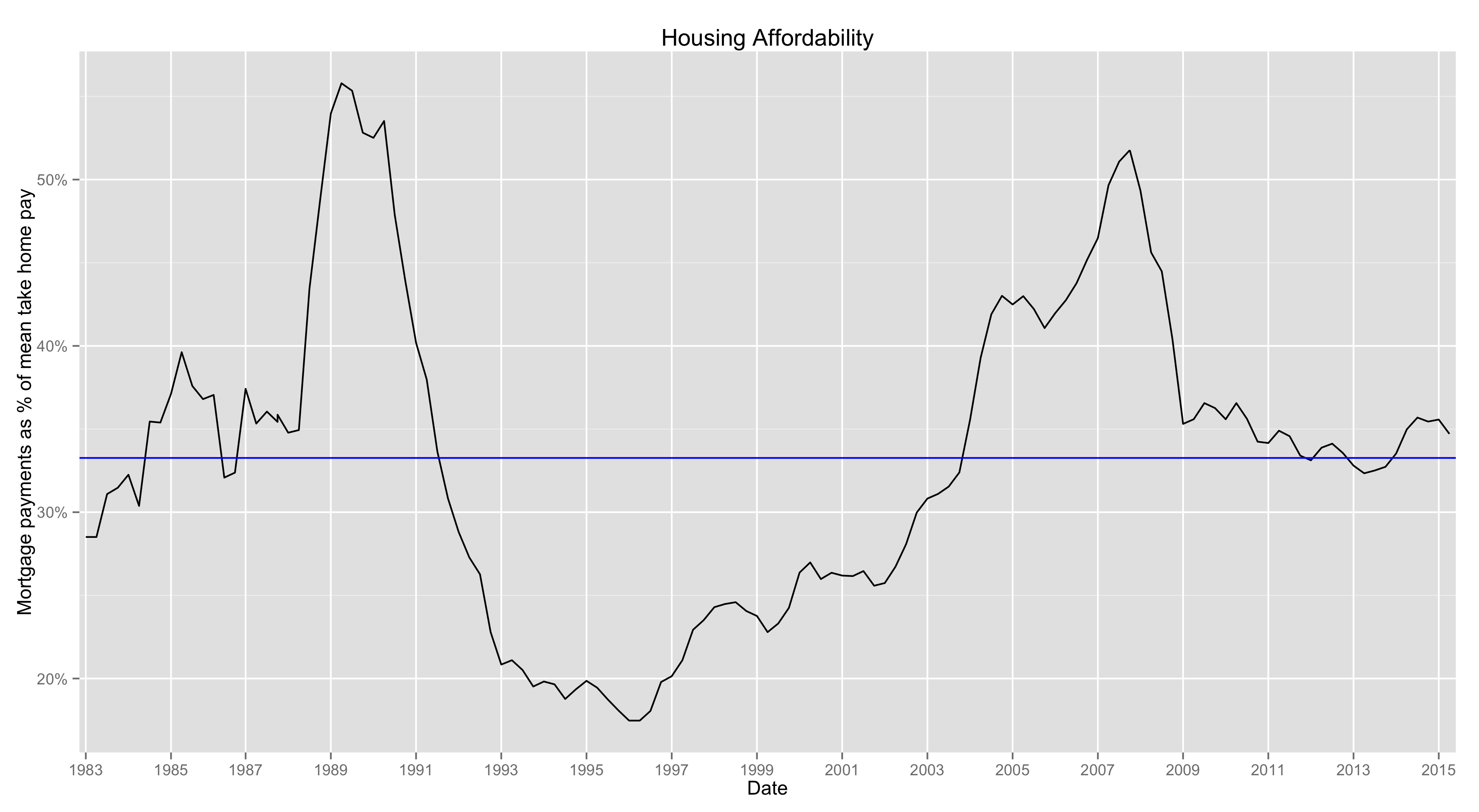

For owner-occupied properties, key determinants of affordability are house prices, income,interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...

s, and purchase costs. For rented property, PRS rents will largely be a reflection of house prices, while SRS rents are set by Local Authorities

Local government is a generic term for the lowest tiers of public administration within a particular sovereign state. This particular usage of the word government refers specifically to a level of administration that is both geographically-loca ...

, Housing Associations

In Ireland and the United Kingdom, housing associations are private, non-profit making organisations that provide low-cost "social housing" for people in need of a home. Any budget surplus is used to maintain existing housing and to help fin ...

or similar.

House prices

Land Registry figures for England and Wales show that housing prices rose from £70,000 to £224,000 in the 20 years between 1998 and 2018. Growth was almost continuous during the period, save for two years of decline around 2008 as a result of thebanking crisis

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

.

House price averages compared to average salary

The gap between average income and average housing prices changed between 1985 and 2015 from twice an average salary to up to six times average income. Median house prices in London the median house now cost up to 12 times the median London salary. In 1995, the median house price was £83,000, 4.4 times the median income. By 2012–13, the median income in London had increased to £24,600 and the median London house price had increased to £300,000, 12.2 times median income

In 1995, the Bank

The gap between average income and average housing prices changed between 1985 and 2015 from twice an average salary to up to six times average income. Median house prices in London the median house now cost up to 12 times the median London salary. In 1995, the median house price was £83,000, 4.4 times the median income. By 2012–13, the median income in London had increased to £24,600 and the median London house price had increased to £300,000, 12.2 times median income

In 1995, the Bank base rate

In probability and statistics, the base rate (also known as prior probabilities) is the class of probabilities unconditional on "featural evidence" (likelihoods).

For example, if 1% of the population were medical professionals, and remaining ...

was 6%, in March 2009 it stood at 0.5% until August 2016 when it was further reduced to 0.25%.

Impact of planning restrictions on house prices

An analysis by theLSE LSE may refer to:

Computing

* LSE (programming language), a computer programming language

* LSE, Latent sector error, a media assessment measure related to the hard disk drive storage technology

* Language-Sensitive Editor, a text editor used ...

and the Dutch Bureau for Economic Policy Analysis

The Bureau for Economic Policy Analysis ( nl, Centraal Planbureau, CPB, literal translation: Central Planning Bureau) is a part of the Ministry of Economic Affairs and Climate Policy of the Netherlands. Its goal is to deliver economic analysis an ...

found that house prices in England would have been 35% cheaper without regulatory constraints. A report by the Adam Smith Institute

The Adam Smith Institute (ASI) is a neoliberal UK-based think tank and lobbying group, named after Adam Smith, a Scottish moral philosopher and classical economist. The libertarian label was officially changed to neoliberal on 10 October 201 ...

found that by using 4% of London's green belt

A green belt is a policy and land-use zone designation used in land-use planning to retain areas of largely undeveloped, wild, or agricultural land surrounding or neighboring urban areas. Similar concepts are greenways or green wedges, which ...

, one million homes could be built within a 10-minute walk of a railway station.

''The Economist

''The Economist'' is a British weekly newspaper printed in demitab format and published digitally. It focuses on current affairs, international business, politics, technology, and culture. Based in London, the newspaper is owned by The Eco ...

'' has criticised green belt policy, saying that unless more houses are built through reforming planning laws and releasing green belt land, then housing space will need to be rationed out. It noted that if general inflation had risen as fast as housing prices had since 1971, a chicken would cost £51; and that Britain is "building less homes today than at any point since the 1920s". According to the independent Institute of Economic Affairs

The Institute of Economic Affairs (IEA) is a right-wing pressure group and think tank registered as a UK charity Associated with the New Right, the IEA describes itself as an "educational research institute", and says that it seeks to "further ...

, there is "overwhelming empirical evidence that planning restrictions have a substantial impact on housing costs" and are the main reason why housing was two and a half times more expensive in 2011 than it was in 1975.

The Campaign to Protect Rural England

CPRE, The Countryside Charity, formerly known by names such as the ''Council for the Preservation of Rural England'' and the ''Council for the Protection of Rural England'', is a charity in England with over 40,000 members and supporters. Forme ...

argued that "Green Belt land is important for our wider environment, providing us with the trees and the undeveloped land which reduce the effect of the heat generated by big cities. Instead of reducing this green space, we should be using it to its best effect. We know from our research that three-quarters (79%) of the population would like to see more trees planted and more food grown in the areas around towns and cities."

Valuation of land and impact on house prices

Property companies state that land values follow house prices and that a developer assesses what new build house price is achievable in any particular location with reference to prices and sales rates in the second-hand market and on nearby comparable new build sites. At a basic level (assuming no

Property companies state that land values follow house prices and that a developer assesses what new build house price is achievable in any particular location with reference to prices and sales rates in the second-hand market and on nearby comparable new build sites. At a basic level (assuming no affordable housing

Affordable housing is housing which is deemed affordable to those with a household income at or below the median as rated by the national government or a local government by a recognized housing affordability index. Most of the literature on af ...

, S106 or CIL), they then multiply that new build house price by the number of homes to be built on the land and to arrive at the gross development value (GDV) of the site. The underlying value of the land is then the GDV less the cost of development and less an allowance for profit.

According to a study by Knoll, Schularick and Steger, up to 80% of the rise in houses prices between 1950 and 2012 can be attributed to the increasing price of land. This is for two reasons. Firstly, before 1950 improving transport meant that more and more land was economically usable, but this effect subsided after 1950. Secondly, zoning restrictions did not allow the "utilisation of additional land".

In 2015, the Department for Communities and Local Government shared the land value estimates for residential land, agricultural land and industrial land. It found that the average price of a typical agricultural plot was £21,000.

Property costs

The principal taxes imposed by the central government are Stamp Duty and Value Added Tax (VAT). Other costs which are associated with the buying and selling of property areestate agent

An estate agent is a person or business that arranges the selling, renting, or management of properties and other buildings. An agent that specialises in renting is often called a letting or management agent. Estate agents are mainly engaged ...

fees, conveyancing

In law, conveyancing is the transfer of legal title of real property from one person to another, or the granting of an encumbrance such as a mortgage or a lien. A typical conveyancing transaction has two major phases: the exchange of contrac ...

and survey fees, mortgage arrangement fee Mortgage arrangement fee, also known as a completion fee or a mortgage product fee, is a term used to describe the fee charged by some lenders to cover administration and primarily the reserving of funds for fixed rate and/or discounted rate mortgag ...

s (where applicable), and removal costs.

Stamp Duty Land Tax

Stamp Duty Land Tax is payable on property transactions in England and Northern Ireland. Tax is paid at different rates on different portions of the purchase price. For example, on a £600,000 house, no tax is paid on the first £250,000, and the portion (£350,000) in the £250,000-£925,000 tax band is charged at 5%, i.e. £17,500. This gives a total tax of £17,500. Scotland and Wales apply their own tax to property transactions, replacing the Stamp Duty Land Tax. Scotland introduced theLand and Buildings Transaction Tax

Land and Buildings Transaction Tax (LBTT) is a property tax in Scotland. It replaced the Stamp Duty Land Tax from 1 April 2015.

LBTT is a tax applied to residential and commercial land and buildings transactions (including commercial purchases ...

in 2015, and Wales introduced the Land Transaction Tax

Land Transaction Tax (LTT) is a property tax in Wales. It replaced the Stamp Duty Land Tax from 1 April 2018. It became the first Welsh tax in almost 800 years.

LTT is a tax applied to residential and commercial land and buildings transaction ...

in 2018.

Estate Agent fees

In 2011, ''Which?

''Which?'' is a United Kingdom brand name that promotes informed consumer choice in the purchase of goods and services by testing products, highlighting inferior products or services, raising awareness of consumer rights and offering independe ...

'' magazine found the national average estate agents' fees to be 1.8%. But fees can range between 0.75% to 3% depending on where you are in the UK.

Survey

There are four main types of survey: a valuation survey, a condition report, a homebuyer report and a full structural survey.Legal fees

Conveyancing fees vary according to the value of the property and the service provided.Mortgage arrangement fees

In April 2013, ''The Daily Telegraph'' reported that research by ''Moneyfacts

Moneyfacts Group Plc is a financial information company founded in 1988 based in Norwich in the United Kingdom employing over 80 people.

History

Moneyfacts was founded in 1988 by current chairman John Woods, who led the Financial Industry Group ...

'' showed the average mortgage arrangement fee to be £1522.

Housing Shortage

In 2020, the BBC reported the UK's housing gap was in excess of one million homes, and previously (in 2019) that "An estimated 8.4 million people in England are living in an unaffordable, insecure or unsuitable home, according to the National Housing Federation". Unaffordable housing is defined by the Affordable Housing Commission as to where housing costs are above 30% of household income. In a government briefing paper, 'Tackling the under-supply of housing in England', Barton and Wilson describe England's housing need as being illustrated by issues "such as increased levels of overcrowding, acute affordability issues, more young people living with their parents for longer periods, impaired labour mobility resulting in businesses finding it difficult to recruit and retain staff, and increased levels of homelessness". Despite an added 244,000 homes to England's housing stock in 2019/20, the notion that an increased supply of housing will improve affordability has been challenged: thUK Housing Review (September 2017

states, "Indeed as the evidence to the Redfern Review from Oxford Economics reminds us, it is unlikely to bring house prices down except in the very long term and with sustained high output of new homes relative to household growth. Even boosting (UK) housing supply to 310,000 homes per annum in their model only brings a five per cent fall in the baseline forecast of house prices". Therefore, the National Housing Federation (NHF) and Crisis from Heriot-Watt University argue that alongside the needed 340,000 new homes each year (until 2031), 145,000 of those “must be affordable homes”.

Other factors impacting on affordability

Council Tax

TheJoseph Rowntree Foundation

The Joseph Rowntree Foundation (JRF) is a charity that conducts and funds research aimed at solving poverty in the UK. JRF's stated aim is to "inspire action and change that will create a prosperous UK without poverty."

Originally called the ...

has suggested replacing the current Council tax

Council Tax is a local taxation system used in England, Scotland and Wales. It is a tax on domestic property, which was introduced in 1993 by the Local Government Finance Act 1992, replacing the short-lived Community Charge, which in turn re ...

system based on bands of house prices with a system that would mean the tax was more closely related to property prices. This would increase taxes on the highest-priced properties and decrease them for the lowest. They claim it would also have the effect of reducing house price volatility.

Land value tax

A land value tax (LVT) is a levy on the value of land (economics), land without regard to buildings, personal property and other land improvement, improvements. It is also known as a location value tax, a point valuation tax, a site valuation ta ...

is suggested by some as a replacement for council tax; it would be based entirely on land (i.e. location) value and not on the value of buildings built on a piece of land or improvements made.

International investment demand

In 2015, theBow Group

The Bow Group is a UK-based think tank promoting conservative opinion. Founded in 1951, it is the oldest group of its kind, counting many senior Conservative Party MPs and peers among its members. It represents a forum for political debate with i ...

, a conservative think-tank, produced a report suggesting a reduction in international investment demand of property. The report proposed limiting foreign residents to the purchase of single new-build properties, with penalties if sold within five years. In 2016, London mayor Sadiq Khan launched an inquiry into housing costs in the city, also highlighting the impact of foreign investment.

Second home ownership

The government set up a £60 million fund to help councils deal with high levels of second home ownership. In 2016, a referendum in St Ives,Cornwall

Cornwall (; kw, Kernow ) is a historic county and ceremonial county in South West England. It is recognised as one of the Celtic nations, and is the homeland of the Cornish people. Cornwall is bordered to the north and west by the Atlantic ...

found 83.2% of voters in favour of new housing projects being reserved for full-time residents, as many tourists frequent the area and Cornwall is popular for second home and holiday property ownership.

Buy-to-let tax changes

From April 2016, a Stamp Duty surcharge of three per cent of the purchase price was required for those buying to let. From April 2017, buy-to-let mortgage interest payments will have higher rates of income tax relief phased out by the government. Although, companies would not be affected by the new rules.Rented homes

The English Housing Survey Bulletin 13 states that in 2013/14 there were 4.4 million households in the private rented sector and 3.9 million households in the social rented sector, of whom 2.3 million households (10%) were renting from a housing association and 1.6 million (7%) were renting from a local authority. Private renters had the highest weekly housing costs, paying on average £176 per week in rent. Mortgagors paid an average of £153 per week in mortgage payments while mean weekly rents in the social housing sector were £98 for housing association tenants and £89 for local authority tenants. When considering the gross weekly income, including benefits, of all household members, the proportion of income spent on housing costs was 18% for mortgagors, 29% for social renters, and 34% for private renters.London

The demand for more affordable housing has often been even higher in London than in the rest of the UK. Research froTrust for London

found that 24% of new housing completions in the three years to 2015/16 were affordable, which represented 21,500 homes. 6,700 affordable homes were completed in 2015/16, which is just 39% of the target set in the 2015 London Plan. They also found that the amount of affordable homes being built varies significantly between the London Boroughs. Tower Hamlets delivered 1830 affordable homes in the three years to 2015/16, the most in London, while Bexley only delivered 7, the fewest in London. Affordable housing is defined as housing that costs no more than 80% of the average local market rent.

See also

*Homelessness in the United Kingdom

Homelessness in the United Kingdom is measured and responded to in differing ways in England, in Scotland, Wales and Northern Ireland but affects people living in all areas of the countries.

Characteristics of people experiencing homelessness

T ...

*Gazumping

Gazumping occurs when a seller (especially of property) accepts a verbal offer (a promise to purchase) on the property from one potential buyer, but then accepts a higher offer from someone else. It can also refer to the seller raising the asking ...

*Green belt (United Kingdom)

In British town planning, the green belt is a policy for controlling urban growth. The term, coined by Octavia Hill in 1875, refers to a ring of countryside where urbanisation will be resisted for the foreseeable future, maintaining an area wher ...

*Housing in the United Kingdom

Housing in the United Kingdom represents the largest non-financial asset class in the UK; its overall net value passed the £5 trillion mark in 2014. About 30% of homes are owned outright by their occupants, and a further 40% are owner-occupied ...

*Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

*Help to Buy

Help to Buy is the name of a government programme in the United Kingdom that aims to help first time buyers, and those looking to move home, purchase residential property. It was announced in Chancellor of the Exchequer George Osborne's 2013 budg ...

* List of entities involved in 2007–2008 financial crises

*National Approved Letting Scheme

The National Approved Letting Scheme, NALS, is an accreditation scheme in the United Kingdom for lettings and management agents.

It aims to offer peace of mind to landlords and tenants

A leasehold estate is an ownership of a temporary right to ...

*Real estate economics

Real estate economics is the application of economic techniques to real estate markets. It tries to describe, explain, and predict patterns of prices, supply, and demand. The closely related field of housing economics is narrower in scope, conc ...

* Subprime mortgage crisis

References

{{population 2008 in economics Economic history of the United Kingdom Great Recession in the United Kingdom Housing in the United Kingdom Inflation in the United Kingdom