The

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territori ...

is a

highly developed mixed-market economy and has the world's largest

nominal GDP

Gross domestic product (GDP) is a money, monetary Measurement in economics, measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjec ...

and

net wealth

Net worth is the value of all the non-financial and financial assets owned by an individual or institution minus the value of all its outstanding liabilities. Since financial assets minus outstanding liabilities equal net financial assets, net ...

. It has the second-largest by

purchasing power parity (PPP) behind

China. It has the world's seventh-highest

per capita GDP (nominal) and the eighth-highest

per capita GDP (PPP) as of 2022. US share of Global economy is 15.78% in PPP terms in 2022. The United States has the most

technologically

Technology is the application of knowledge to reach practical goals in a specifiable and reproducible way. The word ''technology'' may also mean the product of such an endeavor. The use of technology is widely prevalent in medicine, science, ...

powerful and

innovative

Innovation is the practical implementation of ideas that result in the introduction of new goods or services or improvement in offering goods or services. ISO TC 279 in the standard ISO 56000:2020 defines innovation as "a new or changed entit ...

economy in the world. Its firms are at or near the forefront in

technological advances, especially in

artificial intelligence

Artificial intelligence (AI) is intelligence—perceiving, synthesizing, and inferring information—demonstrated by machines, as opposed to intelligence displayed by animals and humans. Example tasks in which this is done include speech r ...

,

computers,

pharmaceuticals, and

medical

Medicine is the science and practice of caring for a patient, managing the diagnosis, prognosis, prevention, treatment, palliation of their injury or disease, and promoting their health. Medicine encompasses a variety of health care practic ...

,

aerospace

Aerospace is a term used to collectively refer to the atmosphere and outer space. Aerospace activity is very diverse, with a multitude of commercial, industrial and military applications. Aerospace engineering consists of aeronautics and astr ...

, and

military equipment. The

U.S. dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the officia ...

is the currency of record most used in

international transactions and is the world's foremost

reserve currency, backed by the nation’s massive economy, stable government, extensive natural resources, highly advanced

military

A military, also known collectively as armed forces, is a heavily armed, highly organized force primarily intended for warfare. It is typically authorized and maintained by a sovereign state, with its members identifiable by their distinct ...

, its role as the reference standard for the

petrodollar system, and its linked

eurodollar

Eurodollars are U.S. dollars held in time deposit accounts in banks outside the United States, which thus are not subject to the legal jurisdiction of the U.S. Federal Reserve. Consequently, such deposits are subject to much less regulation than ...

and large

U.S. treasuries market.

Several countries

use it as their official currency and in others it is the

''de facto'' currency.

[Benjamin J. Cohen, ''The Future of Money'', Princeton University Press, 2006, ; ''cf.'' "the dollar is the de facto currency in Cambodia", Charles Agar, '']Frommer's

Frommer's is a travel guide book series created by Arthur Frommer in 1957. Frommer's has since expanded to include more than 350 guidebooks in 14 series, as well as other media including an eponymous radio show and a website. In 2017, the compan ...

Vietnam'', 2006, , p. 17 The

largest U.S. trading partners are China, the

European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been de ...

,

Canada

Canada is a country in North America. Its ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, covering over , making it the world's second-largest country by tot ...

,

Mexico

Mexico (Spanish: México), officially the United Mexican States, is a country in the southern portion of North America. It is bordered to the north by the United States; to the south and west by the Pacific Ocean; to the southeast by Guatema ...

,

India

India, officially the Republic of India (Hindi: ), is a country in South Asia. It is the seventh-largest country by area, the second-most populous country, and the most populous democracy in the world. Bounded by the Indian Ocean on the so ...

,

Japan,

South Korea

South Korea, officially the Republic of Korea (ROK), is a country in East Asia, constituting the southern part of the Korean Peninsula and sharing a land border with North Korea. Its western border is formed by the Yellow Sea, while its eas ...

, the

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the European mainland, continental mainland. It comprises England, Scotlan ...

, and

Taiwan

Taiwan, officially the Republic of China (ROC), is a country in East Asia, at the junction of the East and South China Seas in the northwestern Pacific Ocean, with the People's Republic of China (PRC) to the northwest, Japan to the nort ...

.

The U.S. is the world's

largest importer and

second-largest exporter. It has

free trade agreements

A free-trade agreement (FTA) or treaty is an agreement according to international law to form a free-trade area between the cooperating states. There are two types of trade agreements: bilateral and multilateral. Bilateral trade agreements occur ...

with

several countries, including the

USMCA, Australia, South Korea, Switzerland, Israel and several others that are in effect or under negotiation.

The nation's economy is fueled by abundant

natural resource

Natural resources are resources that are drawn from nature and used with few modifications. This includes the sources of valued characteristics such as commercial and industrial use, aesthetic value, scientific interest and cultural value. ...

s, a well-developed infrastructure, and high productivity.

[Wright, Gavin, and Jesse Czelusta, "Resource-Based Growth Past and Present", in ''Natural Resources: Neither Curse Nor Destiny'', ed. Daniel Lederman and William Maloney (World Bank, 2007), p. 185. .] It has the second-highest total-estimated value of natural resources, valued at

US$

The United States dollar (symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official ...

44.98trillion in 2019, although sources differ on their estimates. Americans have the highest average

household

A household consists of two or more persons who live in the same dwelling. It may be of a single family or another type of person group. The household is the basic unit of analysis in many social, microeconomic and government models, and is i ...

and

employee income among

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate e ...

member states. In 2013, they had the sixth-highest

median household income

The median income is the income amount that divides a population into two equal groups, half having an income above that amount, and half having an income below that amount. It may differ from the mean (or average) income. Both of these are ways o ...

, down from fourth-highest in 2010.

By

1890, the United States had overtaken the

British Empire

The British Empire was composed of the dominions, colonies, protectorates, mandates, and other territories ruled or administered by the United Kingdom and its predecessor states. It began with the overseas possessions and trading posts e ...

as the world's most productive economy.

It is the world's largest producer of

petroleum

Petroleum, also known as crude oil, or simply oil, is a naturally occurring yellowish-black liquid mixture of mainly hydrocarbons, and is found in geological formations. The name ''petroleum'' covers both naturally occurring unprocessed crud ...

and

natural gas

Natural gas (also called fossil gas or simply gas) is a naturally occurring mixture of gaseous hydrocarbons consisting primarily of methane in addition to various smaller amounts of other higher alkanes. Low levels of trace gases like carbo ...

.

In 2016, it was the world's largest trading country as well as its

third-largest manufacturer, representing a fifth of the global manufacturing output.

The U.S. not only has the largest internal market for goods, but also dominates the services trade. U.S. total trade amounted to $4.2trillion in 2018. Of the world's

500 largest companies, 121 are headquartered in the U.S. The U.S. has the world's

highest number of billionaires, with a total wealth of $3.0trillion. US commercial banks had $20trillion in assets as of August 2020. U.S.

global assets under management

Global assets under management consists of assets held by asset management firms, pension funds, sovereign wealth funds, hedge funds

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensiv ...

had more than $30trillion in assets.

The

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed ...

and

Nasdaq are the world's

largest stock exchanges by

market capitalization and

trade volume In capital markets, volume, or trading volume, is the amount (total number) of a security (or a given set of securities, or an entire market) that was traded during a given period of time. In the context of a single stock trading on a stock exch ...

.

[Table A – Market Capitalization of the World's Top Stock Exchanges (As at end of June 2012)](_blank)

Securities and Exchange Commission (China). Foreign investments made in the U.S. total almost $4.0trillion,

while American

investments in foreign countries total over $5.6trillion.

The U.S. economy is ranked first in international ranking on

venture capital

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to start-up company, startups, early-stage, and emerging companies that have been deemed to have high growth poten ...

and global

research and development funding.

Consumer spending

Consumer spending is the total money spent on final goods and services by individuals and households.

There are two components of consumer spending: induced consumption (which is affected by the level of income) and autonomous consumption (which ...

comprised 68% of the U.S. economy in 2018,

["Personal consumption expenditures (PCE)/gross domestic product (GDP)"]

''FRED Graph'', Federal Reserve Bank of St. Louis while its

labor share of income was 43% in 2017. The U.S. has the world's largest

consumer market.

The nation's labor market has attracted

immigrants from all over the world and its

net migration rate

Net or net may refer to:

Mathematics and physics

* Net (mathematics), a filter-like topological generalization of a sequence

* Net, a linear system of divisors of dimension 2

* Net (polyhedron), an arrangement of polygons that can be folded up ...

is among the highest in the world.

The U.S. is one of the top-performing economies in studies such as the

Ease of Doing Business Index

The ease of doing business index was an index created jointly by Simeon Djankov, Michael Klein, and Caralee McLiesh, three leading economists at the World Bank Group. The academic research for the report was done jointly with professors Edward ...

, the

Global Competitiveness Report

The ''Global Competitiveness Report'' (GCR) is a yearly report published by the World Economic Forum. Since 2004, the ''Global Competitiveness Report'' ranks countries based on the Global Competitiveness Index, developed by Xavier Sala-i-Martin an ...

, and others.

The U.S. economy experienced a serious economic downturn during the

Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

, defined as lasting from December 2007 to June 2009. However, real GDP regained its pre-crisis (late 2007) peak by 2011,

household net worth by Q2 2012,

non-farm payroll jobs by May 2014, and the unemployment rate by September 2015. Each of these variables continued into post-recession record territory following those dates, with the U.S. recovery becoming the second-longest on record by April 2018. The U.S. ranked 41st in

income inequality

There are wide varieties of economic inequality, most notably income inequality measured using the distribution of income (the amount of money people are paid) and wealth inequality measured using the distribution of wealth (the amount of we ...

among 156 countries in 2017, the highest in the

Western world

The Western world, also known as the West, primarily refers to the various nations and states in the regions of Europe, North America, and Oceania. .

History

Colonial era and 18th century

The economic history of the United States began with British settlements along the Eastern seaboard in the 17th and 18th centuries. America after 1700 gained population rapidly and

imports

An import is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade.

In international trade, the importation and exportation of goods are limited ...

, as well as

exports

An export in international trade is a good produced in one country that is sold into another country or a service provided in one country for a national or resident of another country. The seller of such goods or the service provider is an ...

, grew along with it. Africa, Asia, and most frequently Europe, contributed to the trade of the colonies. These

13 colonies gained independence from the

British Empire

The British Empire was composed of the dominions, colonies, protectorates, mandates, and other territories ruled or administered by the United Kingdom and its predecessor states. It began with the overseas possessions and trading posts e ...

in the late 18th century and quickly grew from colonial economies towards an economy focused on agriculture.

19th century

In 180 years the U.S. grew to a huge, integrated, and industrialized economy that made up around one-fifth of the

world economy. As a result, the U.S. GDP per capita converged on and eventually surpassed that of the

British Empire

The British Empire was composed of the dominions, colonies, protectorates, mandates, and other territories ruled or administered by the United Kingdom and its predecessor states. It began with the overseas possessions and trading posts e ...

, as well as other countries that it previously trailed economically. The economy maintained high wages, attracting immigrants by the millions from all over the world. Mass production replaced artisans with factories in the 1820s and 1830s. New government regulations strengthened

patents.

In the early 1800s, the United States was largely agricultural with more than 80 percent of the population in farming. Most of the manufacturing centered on the first stages of transformation of raw materials with lumber and sawmills, textiles, and boots and shoes leading the way. The rich resource endowments contributed to the rapid economic expansion during the nineteenth century. Ample land availability allowed the number of farmers to keep growing, but activity in manufacturing, services, transportation, and other sectors grew at a much faster pace. Thus, by 1860 the share of the rural population in the U.S. had fallen from over 80 percent to roughly 50 percent.

In the 19th century,

recessions

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

frequently coincided with

financial crises

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and man ...

. The

Panic of 1837 was followed by a five-year depression, with the failure of banks and then-record-high unemployment levels. Because of the great changes in the economy over the centuries, it is difficult to compare the severity of modern recessions to early recessions. Recessions after World War II appear to have been less severe than earlier recessions, but the reasons for this are unclear.

20th century

At the beginning of the century new

innovation

Innovation is the practical implementation of ideas that result in the introduction of new goods or services or improvement in offering goods or services. ISO TC 279 in the standard ISO 56000:2020 defines innovation as "a new or changed entit ...

s and improvements in existing innovations opened the door for improvements in the standard of living among American consumers. Many firms grew large by taking advantage of economies of scale and better communication to run nationwide operations. Concentration in these industries raised fears of monopoly that would drive prices higher and output lower, but many of these firms were cutting costs so fast that trends were towards lower price and more output in these industries. Many workers shared the success of these large firms, which typically offered the highest wages in the world.

The United States has been the world's largest national economy in terms of GDP since at least the 1920s.

For many years following the

Great Depression of the 1930s, when danger of

recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

appeared most serious, the government strengthened the economy by spending heavily itself or cutting taxes so that consumers would spend more, and by fostering rapid growth in the money supply, which also encouraged more spending. Ideas about the best tools for stabilizing the economy changed substantially between the 1930s and the 1980s. From the

New Deal era that began in 1933, to the

Great Society

The Great Society was a set of domestic programs in the United States launched by Democratic President Lyndon B. Johnson in 1964–65. The term was first coined during a 1964 commencement address by President Lyndon B. Johnson at the Universit ...

initiatives of the 1960s, national policy makers relied principally on

fiscal policy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variab ...

to influence the economy.

During the world wars of the twentieth century, the United States fared better than the rest of the combatants because none of the First World War and relatively little of the Second World War was fought on American territory (and none on the then 48 states). Yet, even in the United States, the wars meant sacrifice. During the peak of Second World War activity, nearly 40 percent of U.S. GDP was devoted to war production. Decisions about large swaths of the economy were largely made for military purposes and nearly all relevant inputs were allocated to the war effort. Many goods were rationed, prices and wages controlled and many durable consumer goods were no longer produced. Large segments of the workforce were inducted into the military, paid half wages, and roughly half of those were sent into harm's way.

The approach, advanced by British economist

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in ...

, gave elected officials a leading role in directing the economy since spending and taxes are controlled by the

U.S. president

The president of the United States (POTUS) is the head of state and head of government of the United States of America. The president directs the executive branch of the federal government and is the commander-in-chief of the United States ...

and the

Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of ...

. The

"Baby Boom" saw a dramatic increase in fertility in the period 1942–1957; it was caused by delayed marriages and childbearing during depression years, a surge in prosperity, a demand for suburban single-family homes (as opposed to inner city apartments) and new optimism about the future. The boom crested about 1957, then slowly declined.

[Steven Mintz and Susan Kellogg, ''Domestic Revolutions: a Social History of American Family Life'' (1988) ch 9] A period of high inflation, interest rates and unemployment after 1973 weakened confidence in fiscal policy as a tool for regulating the overall pace of economic activity.

The U.S. economy grew by an

average

In ordinary language, an average is a single number taken as representative of a list of numbers, usually the sum of the numbers divided by how many numbers are in the list (the arithmetic mean). For example, the average of the numbers 2, 3, 4, 7 ...

of 3.8% from 1946 to 1973, while real

median household income

The median income is the income amount that divides a population into two equal groups, half having an income above that amount, and half having an income below that amount. It may differ from the mean (or average) income. Both of these are ways o ...

surged 74% (or 2.1% a year).

The worst recession in recent decades, in terms of lost output, occurred during the

financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fi ...

, when GDP fell by 5.0% from the spring of 2008 to the spring of 2009. Other significant recessions took place in 1957–1958, when GDP fell 3.7%, following the

1973 oil crisis, with a 3.1% fall from late 1973 to early 1975, and in the 1981–1982 recession, when GDP dropped by 2.9%.

Recent, mild recessions have included the 1990–1991 downturn, when output fell by 1.3%, and the 2001 recession, in which GDP slid by 0.3%; the 2001 downturn lasted just eight months.

The most vigorous, sustained periods of growth, on the other hand, took place from early 1961 to mid-1969, with an expansion of 53% (5.1% a year), from mid-1991 to late in 2000, at 43% (3.8% a year), and from late 1982 to mid-1990, at 37% (4% a year).

In the 1970s and 1980s, it was popular in the U.S. to believe that

Japan's economy would surpass that of the U.S., but this did not occur.

Since the 1970s, several

emerging countries have begun to close the economic gap with the United States. In most cases, this has been due to moving the manufacture of goods formerly made in the U.S. to countries where they could be made for sufficiently less money to cover the cost of shipping plus a higher profit. In other cases, some countries have gradually learned to produce the same products and services that previously only the U.S. and a few other countries could produce. Real income growth in the U.S. has slowed.

21st century

The United States economy experienced a recession in 2001 with an unusually slow jobs recovery, with the number of jobs not regaining the February 2001 level until January 2005.

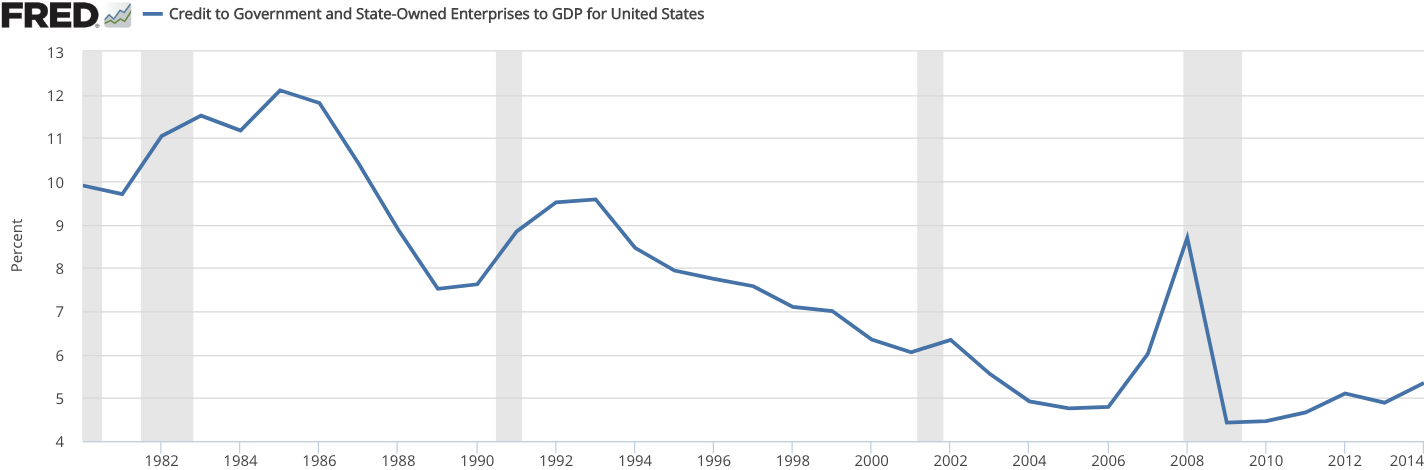

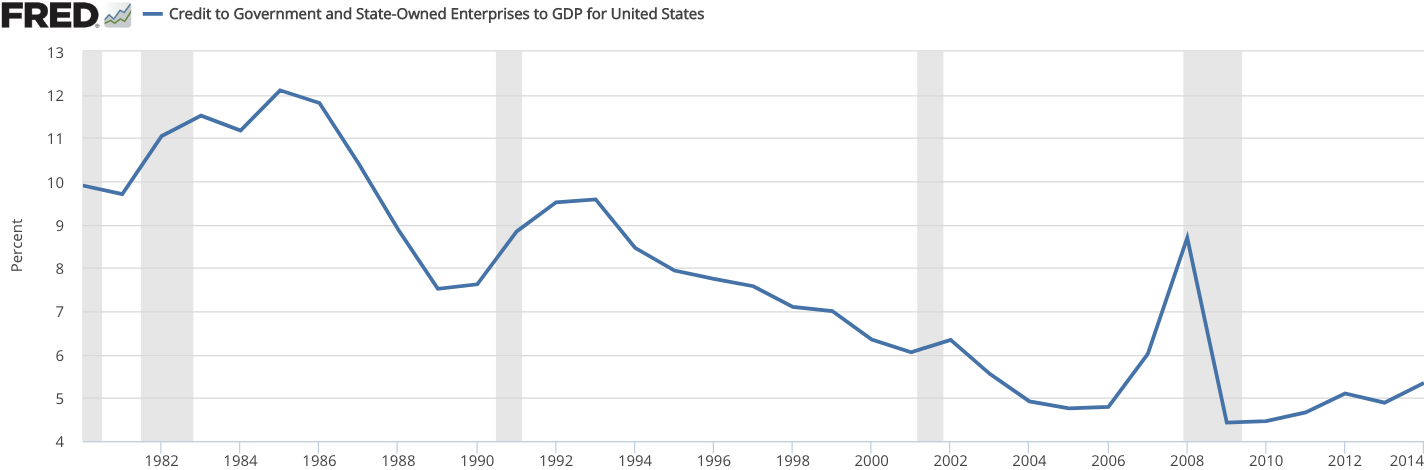

This "jobless recovery" overlapped with the building of a

housing bubble

A housing bubble (or a housing price bubble) is one of several types of asset price bubbles which periodically occur in the market. The basic concept of a housing bubble is the same as for other asset bubbles, consisting of two main phases. Firs ...

and arguably a wider debt bubble, as the ratio of household debt to GDP rose from a record level of 70% in Q1 2001 to 99% in Q1 2008. Homeowners were borrowing against their bubble-priced homes to fuel consumption, driving up their debt levels while providing an unsustainable boost to GDP. When housing prices began falling in 2006, the value of securities backed by mortgages fell dramatically, causing the equivalent of a

bank run in the essentially unregulated

non-depository banking system, which had outgrown the traditional, regulated depository banking system. Many mortgage companies and other non-depository banks (e.g., investment banks) faced a worsening crisis in 2007–2008, with the

banking crisis

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

peaking in September 2008, with the bankruptcy of

Lehman Brothers

Lehman Brothers Holdings Inc. ( ) was an American global financial services firm founded in 1847. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, a ...

and bailouts of several other financial institutions.

The Bush administration (2001–2009) and Obama administrations (2009–2017) applied banking

bailout programs and Keynesian

stimulus

A stimulus is something that causes a physiological response. It may refer to:

*Stimulation

**Stimulus (physiology), something external that influences an activity

**Stimulus (psychology), a concept in behaviorism and perception

*Stimulus (economi ...

via high government deficits, while the Federal Reserve maintained near-zero interest rates. These measures helped the economy recover, as households paid down debts in 2009–2012, the only years since 1947 where this occurred, presenting a significant barrier to recovery.

Real GDP regained its pre-crisis (late 2007) peak by 2011,

household net worth by Q2 2012,

non-farm payroll jobs by May 2014,

and the unemployment rate by September 2015. Each of these variables continued into post-recession record territory following those dates, with the U.S. recovery becoming the second longest on record in April 2018.

Debt held by the public, a measure of national debt, has risen throughout the 21st century. Rising from 31% in 2000 to 52% in 2009, and reaching 77% of GDP in 2017, the U.S. ranked 43rd highest in debt out of 207 countries. Income inequality peaked in 2007 and fell during the Great Recession, yet still ranked 41st highest among 156 countries in 2017 (i.e., 74% of countries had a more equal income distribution).

In the first two quarters of 2020 amid

Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who served as the 45th president of the United States from 2017 to 2021.

Trump graduated from the Wharton School of the University of P ...

's presidency,

the U.S. economy suffered major setbacks beginning in March 2020, due to the

novel coronavirus

Novel coronavirus (nCoV) is a provisional name given to coronaviruses of medical significance before a permanent name is decided upon. Although coronaviruses are endemic in humans and infections normally mild, such as the common cold (caused by ...

and having to "shut-down" major sectors of the American economy. As of March 2020, US exports of automobiles and industrial machines had plummeted as a result of the worldwide pandemic. Social distancing measures which took effect in March 2020, and which negatively impacted the demand for goods and services, resulted in the US

GDP

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is ofte ...

declining at a

4.8% annualized rate in the first quarter, the steepest pace of contraction in output since the fourth quarter of 2008. US retails sales dropped a record 8.7% in March alone. The US airline industry had also been hit hard, seeing a sharp decline in its revenues. The

COVID-19 recession

The COVID-19 recession, also referred to as the Great Lockdown, is a global economic recession caused by the COVID-19 pandemic. The recession began in most countries in February 2020.

After a year of global economic slowdown that saw stagnati ...

has been widely described as the most severe global economic downturn since the

Great Depression and "far worse" than the

Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

.

In May 2020,

CNN

CNN (Cable News Network) is a multinational cable news channel headquartered in Atlanta, Georgia, U.S. Founded in 1980 by American media proprietor Ted Turner and Reese Schonfeld as a 24-hour cable news channel, and presently owned by ...

gave an analysis based on unemployment data that the US economy was perhaps the worst that it had been since the 1930s. By May 8, the US had reached a record 14.7 percent unemployment, with 20.5 million jobs lost in April. The Chairman of the

US Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

,

Jerome Powell

Jerome Hayden "Jay" Powell (born February 4, 1953) is an American attorney and investment banker who has served as the 16th chair of the Federal Reserve since 2018.

After earning a degree in politics from Princeton University in 1975 and a ...

, warned that it may take "an extended time" before the US economy fully recovers from weak economic growth, due to the pandemic, and that in the foreseeable future the US can expect "low productivity growth and stagnant incomes". By 31 May 2020, more than forty million Americans had filed for unemployment benefits.

By June 2020, the slump in US continental flights due to the coronavirus pandemic had resulted in the US government temporarily halting service of fifteen US airlines to 75 domestic airports. ''

The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid d ...

'' reported on June 10, 2020, that "the United States budget deficit grew to a record $1.88trillion for the first eight months of this

fiscal year

A fiscal year (or financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Laws in many ...

."

The US economy increased 5.7% in 2021, which was its best performance since

Ronald Reagan's presidency (1981–1989).

2021–2022 marked a historical

inflation surge in the United States, with the

Consumer Price Index inflation rate hitting 9.1% higher in June 2022 than June 2021 constituting a 41-year high inflation rate with critics blaming the

Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

among other factors.

Data

The following table shows the main economic indicators in 1980–2021 (with IMF staff estimates in 2022–2027). Inflation below 5% is in green.

GDP

U.S. nominal GDP was $19.5trillion in 2017. Annualized, nominal GDP reached $20.1trillion in Q1 2018, the first time it exceeded $20trillion. About 70% of U.S. GDP is personal consumption, with business investment 18%, government 17% (federal, state and local but excluding transfer payments such as Social Security, which is in consumption) and net exports a negative 3% due to the U.S. trade deficit. Real

gross domestic product

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is oft ...

, a measure of both production and income, grew by 2.3% in 2017, vs. 1.5% in 2016 and 2.9% in 2015. Real GDP grew at a quarterly annualized rate of 2.2% in Q1 2018, 4.2% in Q2 2018, 3.4% in Q3 2018 and 2.2% in Q4 2018; the Q2 rate was the best growth rate since Q3 2014, and the overall yearly GDP growth of 2.9% in 2018 was the best performance of the economy in a decade.

In 2020, the growth rate of the GDP has started to drop as a result of the

COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identi ...

, resulting in the GDP shrinking at a quarterized annual growth rate of −5.0% in Q1 2020 and −32.9% in Q2 2020, respectively.

As of 2014, China passed the U.S. as the largest economy in GDP terms, measured at purchasing power parity conversion rates. The U.S. was the largest economy for more than a century prior to that milestone; China has more than tripled the U.S. growth rate for each of the past 40 years. As of 2017, the European Union as an aggregate had a GDP roughly 5% larger than the U.S.

Real GDP per capita (measured in 2009 dollars) was $52,444 in 2017 and has been growing each year since 2010. It grew 3.0% per year on average in the 1960s, 2.1% in the 1970s, 2.4% in the 1980s, 2.2% in the 1990s, 0.7% in the 2000s, and 0.9% from 2010 to 2017. Reasons for slower growth since 2000 are debated by economists and may include aging demographics, slower population and growth in labor force, slower productivity growth, reduced corporate investment, greater income inequality reducing demand, lack of major innovations, and reduced labor power. The U.S. ranked 20th out of 220 countries in GDP per capita in 2017. Among the modern U.S. Presidents, Bill Clinton had the highest cumulative percent real GDP increase during his two terms, Reagan second and Obama third.

The development of the nation's GDP according to

World Bank

The World Bank is an international financial institution that provides loans and grants to the governments of low- and middle-income countries for the purpose of pursuing capital projects. The World Bank is the collective name for the Inte ...

: U.S. real GDP grew by an average of 1.7% from 2000 to the first half of 2014, a rate around half the historical average up to 2000.

By economic sector

Nominal GDP sector composition

Nominal GDP sector composition, 2015 (in millions of dollars) at

2005 constant prices

Nominal GDP Sector Composition, 2016 (in millions of dollars) at current prices.

Employment

There were approximately 160.4 million people in the U.S. labor force in 2017, the fourth largest labor force in the world behind China, India, and the European Union.

The government (federal, state and local) employed 22 million in 2010.

Small businesses are the nation's largest employer, representing 37% of American workers.

The second-largest share of employment belongs to large businesses employing 36% of the U.S. workforce.

comprise 44% of the workforce as of 2022, up from 34% in 2000.

The nation's

private sector

The private sector is the part of the economy, sometimes referred to as the citizen sector, which is owned by private groups, usually as a means of establishment for profit or non profit, rather than being owned by the government.

Employment

The ...

employs 85% of working Americans.

Government

A government is the system or group of people governing an organized community, generally a state.

In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is ...

accounts for 14% of all U.S. workers. Over 99% of all private employing organizations in the U.S. are small businesses.

The 30 million small businesses in the U.S. account for 64% of newly created jobs (those created minus those lost).

Jobs in small businesses accounted for 70% of those created in the last decade.

The proportion of Americans employed by small business versus large business has remained relatively the same year by year as some small businesses become large businesses and just over half of small businesses survive for more than five years.

Amongst large businesses, several of the largest companies and employers in the world are American companies. Amongst them are

Walmart

Walmart Inc. (; formerly Wal-Mart Stores, Inc.) is an American multinational retail corporation that operates a chain of hypermarkets (also called supercenters), discount department stores, and grocery stores from the United States, headquarter ...

, which is both the largest company and the largest

private sector

The private sector is the part of the economy, sometimes referred to as the citizen sector, which is owned by private groups, usually as a means of establishment for profit or non profit, rather than being owned by the government.

Employment

The ...

employer in the world. Walmart employs 2.1 million people worldwide and 1.4 million in the U.S. alone.

There are nearly thirty million small businesses in the U.S.. Minorities such as

Hispanics

The term ''Hispanic'' ( es, hispano) refers to people, cultures, or countries related to Spain, the Spanish language, or Hispanidad.

The term commonly applies to countries with a cultural and historical link to Spain and to viceroyalties forme ...

, African Americans, Asian Americans, and Native Americans (35% of the country's population), own 4.1 million of the nation's businesses. Minority-owned businesses generate almost $700billion in revenue, and they employ almost five million workers in the U.S.

Americans have the highest average

employee income among

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate e ...

nations.

The median household income in the U.S. as of 2008 is $52,029. About 284,000 working people in the U.S. have two full-time jobs and 7.6 million have part-time ones in addition to their full-time employments.

Out of all working individuals in the U.S., 12% belong to a labor union and most union members work for the government.

The decline of

union membership in the U.S. over the last several decades parallels that of labor's share of the economy. The World Bank ranks the United States first in the ease of hiring and firing workers.

The United States is the only advanced economy that does not

legally guarantee its workers paid vacation or

paid sick days, and is one of just a few countries in the world without

paid family leave

Parental leave, or family leave, is an employee benefit available in almost all countries. The term "parental leave" may include maternity, paternity, and adoption leave; or may be used distinctively from "maternity leave" and "paternity le ...

as a

legal right

Some philosophers distinguish two types of rights, natural rights and legal rights.

* Natural rights are those that are not dependent on the laws or customs of any particular culture or government, and so are ''universal'', ''fundamental'' and ...

, with the others being

Papua New Guinea

Papua New Guinea (abbreviated PNG; , ; tpi, Papua Niugini; ho, Papua Niu Gini), officially the Independent State of Papua New Guinea ( tpi, Independen Stet bilong Papua Niugini; ho, Independen Stet bilong Papua Niu Gini), is a country i ...

,

Suriname and

Liberia. In 2014 and again in 2020, the

International Trade Union Confederation

The International Trade Union Confederation (ITUC); german: Internationaler Gewerkschaftsbund (IGB), link=no; es, Confederación Sindical Internacional (CSI), link=no. is the world's largest trade union federation.

History

The federation w ...

graded the U.S. a 4out of5+, its third-lowest score, on the subject of powers and

rights granted to labor unions. Some scholars, including business theorist

Jeffrey Pfeffer

Jeffrey Pfeffer (born July 23, 1946, St. Louis, Missouri) is an American business theorist and the Thomas D. Dee II Professor of Organizational Behavior at the Graduate School of Business, Stanford University, and is considered one of today's mo ...

and political scientist Daniel Kinderman, posit that contemporary employment practices in the United States relating to the increased performance pressure from management, and the hardships imposed on employees such as toxic working environments,

precarity, and long hours, could be responsible for 120,000 excess deaths annually, making the workplace the fifth leading cause of death in the United States.

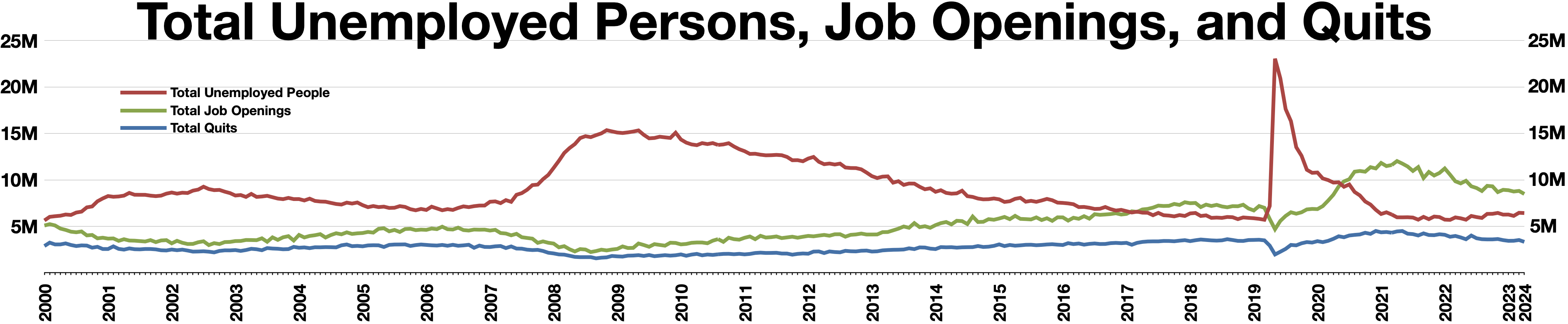

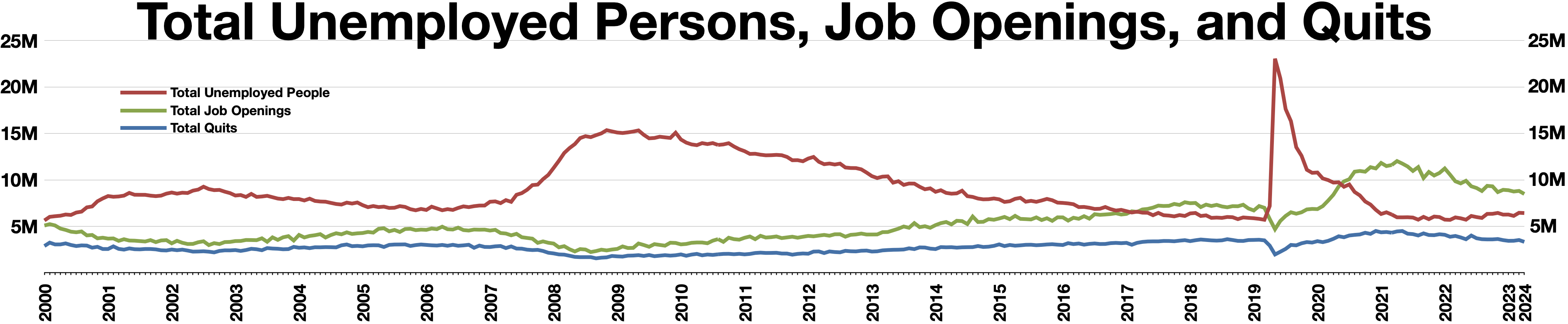

Unemployment

As of December 2017, the

unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the refere ...

rate in the U.S. was 4.1% or 6.6 million people. The government's broader U-6 unemployment rate, which includes the part-time

underemployed, was 8.1% or 8.2 million people. These figures were calculated with a civilian labor force of approximately 160.6 million people,

relative to a U.S. population of approximately 327 million people.

Between 2009 and 2010, following the Great Recession, the emerging problem of

jobless recoveries resulted in record levels of

long-term unemployment with more than six million workers looking for work for more than six months as of January 2010. This particularly affected older workers.

["Millions of Unemployed Face Years Without Jobs"](_blank)

article by Peter S. Goodman

Peter S. Goodman is an American economics journalist and author. Goodman has worked for ''The Washington Post'' and ''The Huffington Post'', was the editor of the ''International Business Times'', and is currently the European economics corresponde ...

in ''The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid d ...

'' February 20, 2010. A year after the recession ended in June 2009, immigrants gained 656,000 jobs in the U.S., while U.S.-born workers lost more than a million jobs, due in part to an aging country (relatively more white retirees) and demographic shifts. In April 2010, the official unemployment rate was 9.9%, but the government's broader

U-6 unemployment rate was 17.1%. Between February 2008 and February 2010, the number of people working part-time for economic reasons (i.e., would prefer to work full-time) increased by 4.0 million to 8.8 million, an 83% increase in part-time workers during the two-year period.

By 2013, although the unemployment rate had fallen below 8%, the record proportion of long term unemployed and continued decreasing household income remained indicative of a jobless recovery.

However, the number of payroll jobs returned to its pre-recession (November 2007) level by May 2014 as the economy recovered.

After being higher in the post-war period, the U.S. unemployment rate fell below the rising

eurozone

The euro area, commonly called eurozone (EZ), is a currency union of 19 member states of the European Union (EU) that have adopted the euro ( €) as their primary currency and sole legal tender, and have thus fully implemented EMU polici ...

unemployment rate in the mid-1980s and has remained significantly lower almost continuously since. In 1955, 55% of Americans worked in services, between 30% and 35% in industry, and between 10% and 15% in

agriculture

Agriculture or farming is the practice of cultivating plants and livestock. Agriculture was the key development in the rise of sedentary human civilization, whereby farming of domesticated species created food surpluses that enabled people t ...

. By 1980, over 65% were employed in services, between 25% and 30% in industry, and less than 5% in agriculture.

Male unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the refer ...

continued to be significantly higher than those of females (at 9.8% vs. 7.5% in 2009). The unemployment among Caucasians continues being much lower than those for African-Americans (at 8.5% vs. 15.8% also in 2009).

The

youth unemployment

Youth unemployment is the situation of young people who are looking for a job but cannot find a job, with the age range being defined by the United Nations as 15–24 years old. An unemployed person is defined as someone who does not have a job ...

rate was 18.5% in July 2009, the highest rate in that month since 1948. The unemployment rate of young African Americans was 28.2% in May 2013.

The unemployment rate reached an all-time high of 14.7% in April 2020 before falling back to 11.1% in June 2020. Due to the effects of the

COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identi ...

, Q2 GDP in the US fell 32.9% in 2020. The unemployment rate continued its rapid decline falling to 3.9% in 2021.

Employment by sector

U.S. employment, as estimated in 2012, is divided into 79.7% in the service sector, 19.2% in the manufacturing sector, and 1.1% in the agriculture sector.

United States non-farm employment by industry sector February 2013.

Income and wealth

Income measures

Real (i.e., inflation-adjusted) median household income, a good measure of middle-class income, was $59,039 in 2016, a record level. However, it was just above the previous record set in 1998, indicating the purchasing power of middle-class family income has been stagnant or down for much of the past twenty years. During 2013, employee compensation was $8.969trillion, while gross private investment totals $2.781trillion.

Americans have the highest average

household income

Household income is a measure of the combined incomes of all people sharing a particular household or place of residence. It includes every form of income, e.g., salaries and wages, retirement income, near cash government transfers like food stamp ...

among OECD nations, and in 2010 had the fourth-highest

median household income

The median income is the income amount that divides a population into two equal groups, half having an income above that amount, and half having an income below that amount. It may differ from the mean (or average) income. Both of these are ways o ...

, down from second-highest in 2007.

According to one analysis middle-class incomes in the United States fell into a tie with those in Canada in 2010, and may have fallen behind by 2014, while several other advanced economies have closed the gap in recent years.

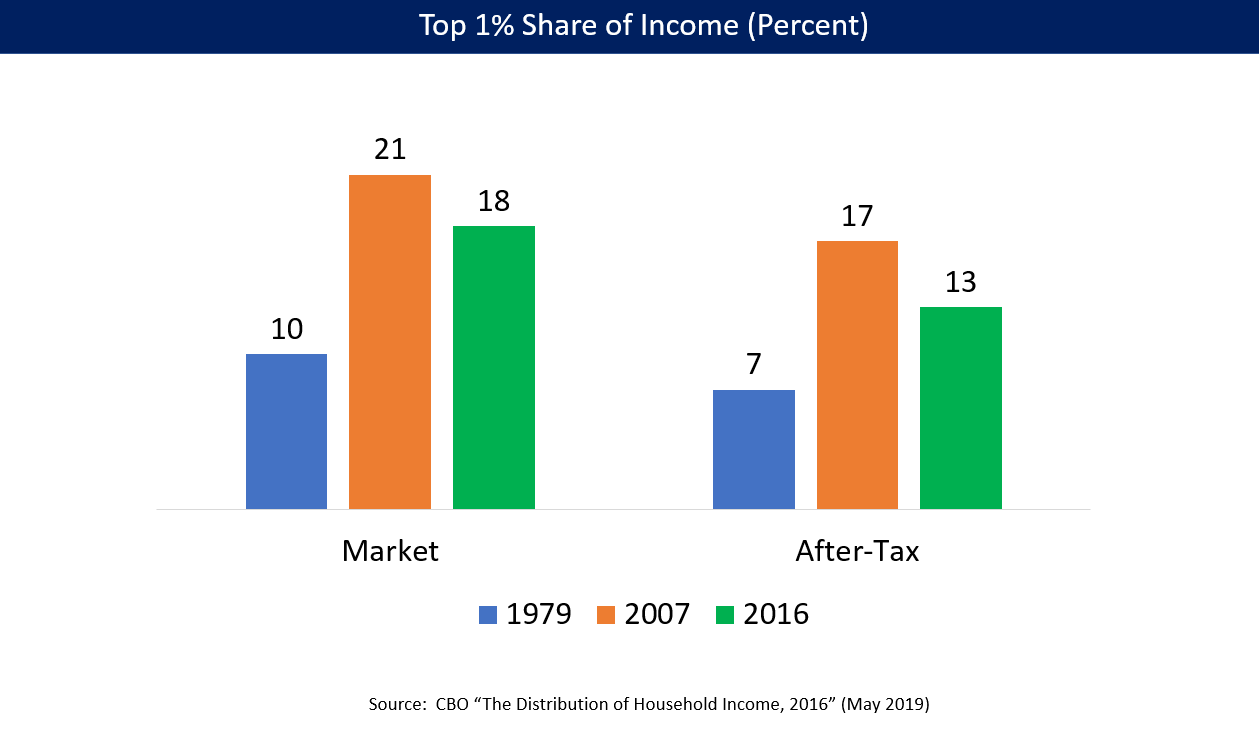

Income inequality

Income inequality has become a hotly debated topic globally. According to the ''CIA World Factbook'', U.S. income inequality ranked 41st highest among 156 countries in 2017 (i.e., 74% of countries have a more equal income distribution). According to the

Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

Ins ...

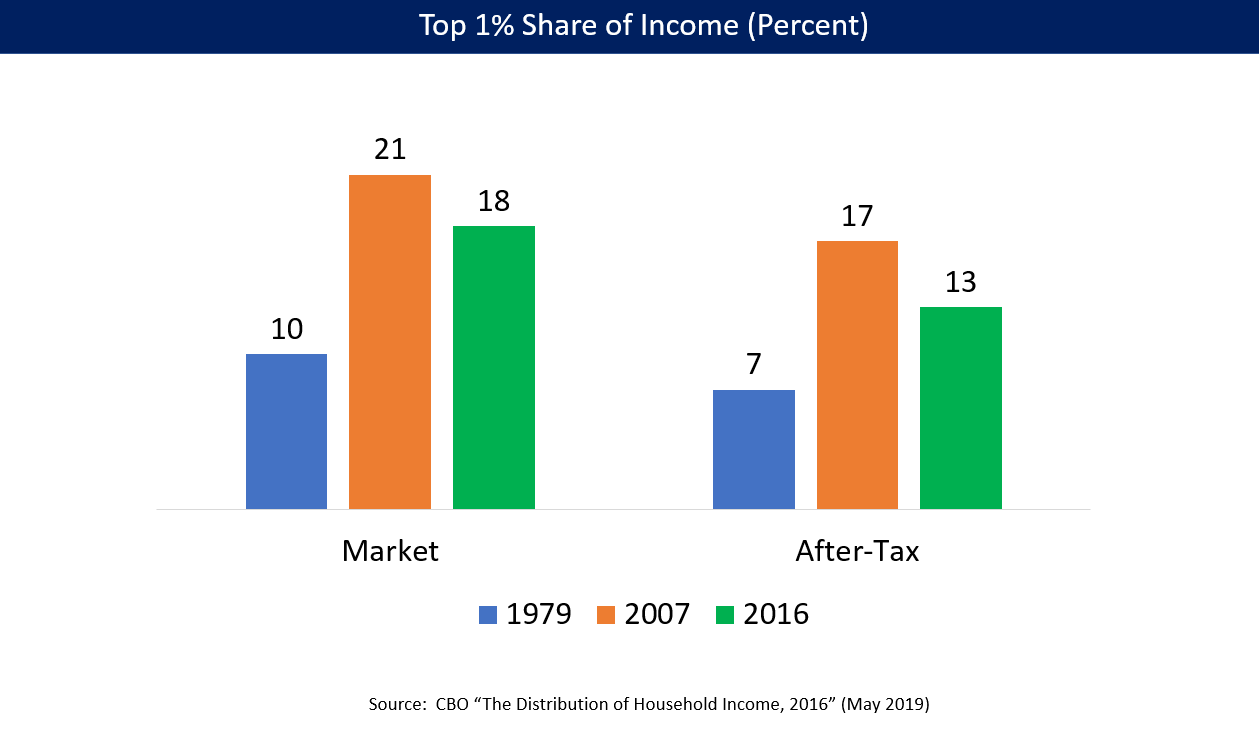

, the top 1% of income households earned about a 9% share of the pre-tax income in 1979, versus 19% in 2007 and 17% in 2014. For after-tax income, these figures were 7%, 17%, and 13%, respectively. These figures indicate the share of income earned by top earners more than doubled between 1979 and 2007, then fell somewhat following the

Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

, and the higher tax rates and re-distributive policies applied by President Barack Obama in 2013 (i.e., expiration of the

Bush Tax Cuts

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through:

* Economic Growth and Tax Relief Reconciliation Act o ...

for the top 1% and subsidies for lower income persons via the

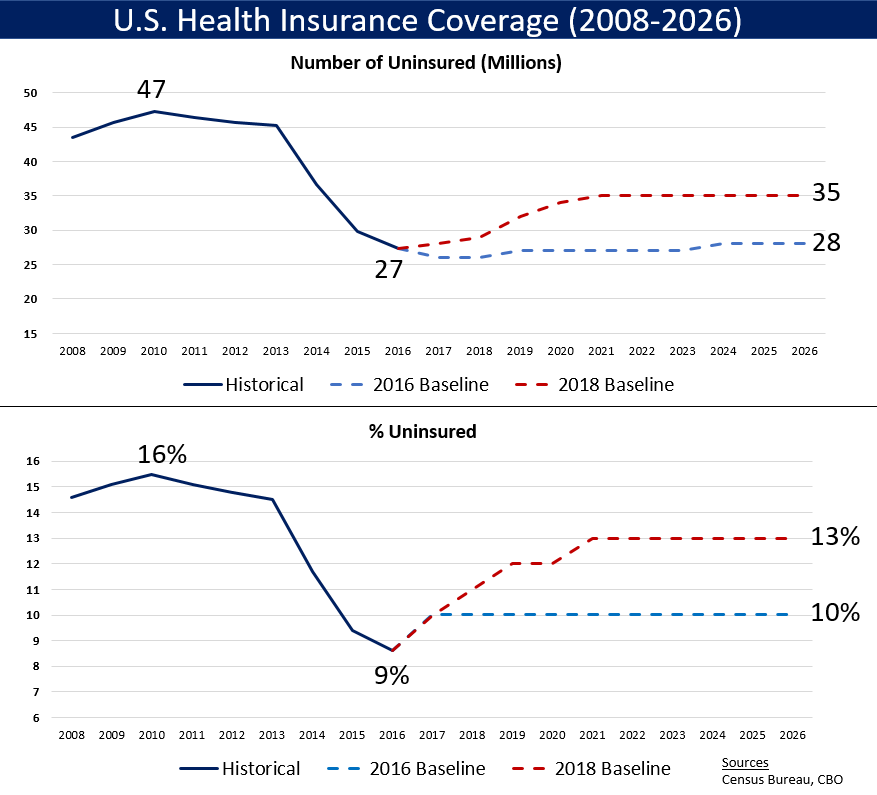

Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by Pres ...

).

Recasting the 2012 income using the 1979 income distribution (representing the more egalitarian 1950–1980 period), the bottom 99% of families would have averaged about $7,100 more income.

Income inequality in the United States has grown from 2005 to 2012 in more than two out of three metropolitan areas.

The

top 1 percent of income-earners accounted for 52 percent of the income gains from 2009 to 2015, where income is defined as market income excluding government transfers, while their share of total income has more than doubled from nine percent in 1976 to twenty percent in 2011.

[Alvaredo, Facundo; Atkinson, Anthony B.; Piketty, Thomas; Saez, Emmanuel (2013)]

"The Top 1Percent in International and Historical Perspective"

''Journal of Economic Perspectives.'' According to a 2014 OECD report, 80% of total pre-tax market income growth went to the top 10% from 1975 to 2007.

A number of economists and others have expressed growing concern about

income inequality

There are wide varieties of economic inequality, most notably income inequality measured using the distribution of income (the amount of money people are paid) and wealth inequality measured using the distribution of wealth (the amount of we ...

, calling it "deeply worrying",

[White House: Here's Why You Have To Care About Inequality]

Timothy Noah , tnr.com, January 13, 2012. unjust,

a danger to democracy/social stability,

Paul Krugman. November 3, 2011. or a sign of

national decline.

["The Broken Contract", By George Packer, '' Foreign Affairs'', November/December 2011] Yale professor

Robert Shiller

Robert James Shiller (born March 29, 1946) is an American economist, academic, and author. As of 2019, he serves as a Sterling Professor of Economics at Yale University and is a fellow at the Yale School of Management's International Center for ...

has said, "The most important problem that we are facing now today, I think, is rising inequality in the United States and elsewhere in the world."

Thomas Piketty

Thomas Piketty (; born 7 May 1971) is a French economist who is Professor of Economics at the School for Advanced Studies in the Social Sciences, Associate Chair at the Paris School of Economics and Centennial Professor of Economics in the I ...

of the

Paris School of Economics

The Paris School of Economics (PSE; French: ''École d'économie de Paris'') is a French research institute in the field of economics. It offers MPhil, MSc, and PhD level programmes in various fields of theoretical and applied economics, i ...

argues that the post-1980 increase in inequality played a role in the 2008 crisis by contributing to the nation's financial instability. In 2016, the economists Peter H. Lindert and

Jeffrey G. Williamson claimed that inequality is the highest it has been since the nation's founding. In 2018, income inequality was at the highest level ever recorded by the

Census Bureau

The United States Census Bureau (USCB), officially the Bureau of the Census, is a principal agency of the Federal Statistical System of the United States, U.S. Federal Statistical System, responsible for producing data about the Americans, Ame ...

, with a Gini index of 0.485.

Others disagree, saying that the inequality issue is a political distraction from what they consider real problems like chronic unemployment and sluggish growth.

economics professor

Tyler Cowen

Tyler Cowen (; born January 21, 1962) is an American economist, columnist and blogger. He is a professor at George Mason University, where he holds the Holbert L. Harris chair in the economics department. He hosts the economics blog ''Marginal R ...

has called inequality a "red herring", saying that factors driving its increase within a nation can simultaneously be driving its reduction globally, and arguing that redistributive policies intended to reduce inequality can do more harm than good regarding the real problem of stagnant wages.

Robert Lucas Jr. has argued that the salient problem American living standards face is a government that has grown too much, and that recent policy shifts in the direction of European-style taxation, welfare spending, and regulation may be indefinitely putting the U.S. on a significantly lower, European level income trajectory. Some researchers have disputed the accuracy of the underlying data regarding claims about inequality trends, and economists Michael Bordo and Christopher M. Meissner have argued that inequality cannot be blamed for the 2008 financial crisis.

According to a report by the

Congressional Research Service

The Congressional Research Service (CRS) is a public policy research institute of the United States Congress. Operating within the Library of Congress, it works primarily and directly for members of Congress and their committees and staff on a ...

, decreased progressiveness in

capital gains tax

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property.

Not all countries impose a c ...

es was the largest contributor to the increase in overall income inequality in the U.S. from 1996 to 2006.

As of 2010 The U.S. had the fourth-widest income distribution among

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate e ...

nations, behind Turkey, Mexico, and Chile.

The

Brookings Institution

The Brookings Institution, often stylized as simply Brookings, is an American research group founded in 1916. Located on Think Tank Row in Washington, D.C., the organization conducts research and education in the social sciences, primarily in e ...

said in March 2013 that income inequality was increasing and becoming permanent, sharply reducing

social mobility in the US.

The

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate e ...

ranks the U.S. 10th in social mobility, behind the

Nordic countries, Australia, Canada, Germany, Spain, and France. Of the major developed nations, only Italy and Great Britain have lower mobility. This has been partly attributed to the depth of

American poverty, which leaves poor children economically disadvantaged,

[DeParle, Jason (January 4, 2012)]

Harder for Americans to Rise From Lower Rungs

''The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid d ...

''. though others have observed that a relative rise in the U.S. is mathematically harder due to its higher and more widely distributed income range than in nations with artificial income compression, even if one enjoys more absolute mobility in the U.S., and have questioned how meaningful such international comparisons are.

There has been a widening gap between productivity and median incomes since the 1970s. The primary cause for the gap between productivity and income growth is the decline in per capita hours worked.

Other causes include the rise in non-cash benefits as a share of worker compensation (which aren't counted in CPS income data), immigrants entering the labor force, statistical distortions including the use of different inflation adjusters by the BLS and CPS, productivity gains being skewed toward less labor-intensive sectors, income shifting from labor to capital, a skill gap-driven wage disparity, productivity being falsely inflated by hidden technology-driven depreciation increases and import price measurement problems, and/or a natural period of adjustment following an income surge during aberrational post-war circumstances.

According to a 2018 study by the OECD, given that the unemployed and at-risk workers get almost no government support and are further set back by a very weak

collective bargaining

Collective bargaining is a process of negotiation between employers and a group of employees aimed at agreements to regulate working salaries, working conditions, benefits, and other aspects of workers' compensation and rights for workers. The ...

system, the U.S. has much higher income inequality and a larger percentage of low-income workers than almost any other developed nation.

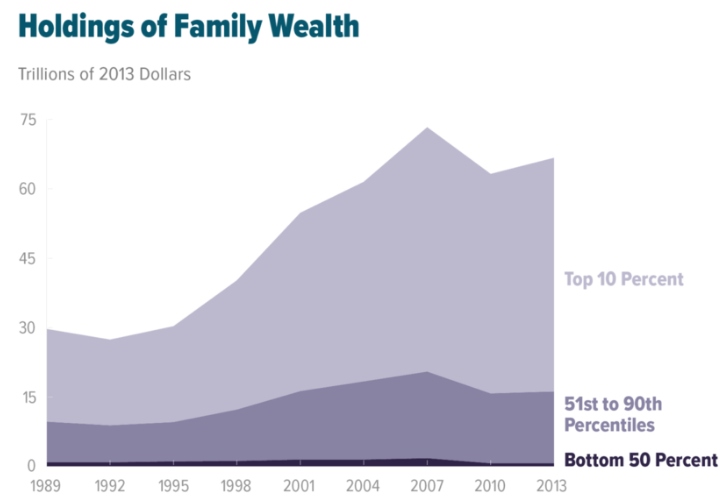

Household net worth and wealth inequality

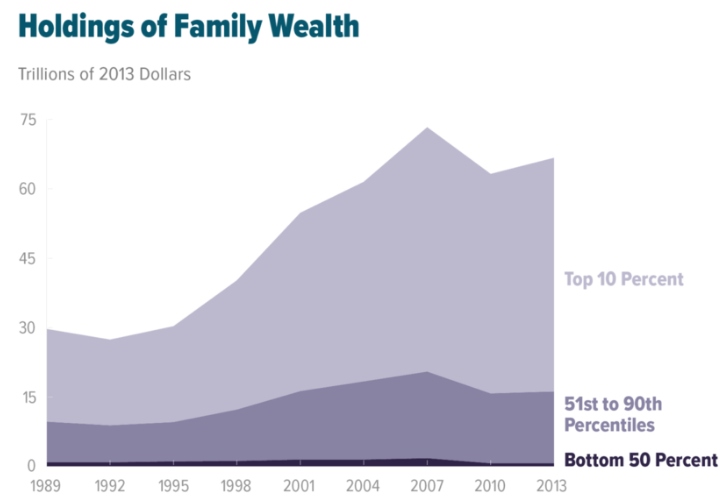

As of Q4 2017, total household net worth in the United States was a record $99trillion, an increase of $5.2trillion from 2016. This increase reflects both stock market and housing price gains. This measure has been setting records since Q4 2012. If divided evenly, the $99trillion represents an average of $782,000 per household (for about 126.2 million households) or $302,000 per person. However, median household net worth (i.e., half of the families above and below this level) was $97,300 in 2016. The bottom 25% of families had a median net worth of zero, while the 25th to 50th percentile had a median net worth of $40,000.

Wealth inequality is more unequal than income inequality, with the top 1% households owning approximately 42% of the net worth in 2012, versus 24% in 1979. According to a September 2017 report by the Federal Reserve, wealth inequality is at record highs; the top 1% controlled 38.6% of the country's wealth in 2016. The

Boston Consulting Group

Boston Consulting Group, Inc. (BCG) is an American global management consulting firm founded in 1963 and headquartered in Boston, Massachusetts. It is one of the Big Three (or MBB, the world’s three largest management consulting firms by re ...

posited in June 2017 report that 1% of the Americans will control 70% of country's wealth by 2021.

The top 10% wealthiest possess 80% of all financial assets.

is greater than in most developed countries other than Sweden.

may help explain why many Americans who have become rich may have had a "substantial head start".

In September 2012, according to the

Institute for Policy Studies

The Institute for Policy Studies (IPS) is an American progressive think tank started in 1963 that is based in Washington, D.C. It was directed by John Cavanagh from 1998 to 2021. In 2021 Tope Folarin was announced as new Executive Director. ...

, "over 60 percent" of the

Forbes richest 400 Americans "grew up in substantial privilege".

Median household wealth fell 35% in the U.S., from $106,591 to $68,839 between 2005 and 2011, due to the

Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

, but has since recovered as indicated above.

About 30% of the entire world's millionaire population resides in the United States ().

The

Economist Intelligence Unit

The Economist Intelligence Unit (EIU) is the research and analysis division of the Economist Group, providing forecasting and advisory services through research and analysis, such as monthly country reports, five-year country economic forecasts, ...

estimated in 2008 that there were 16,600,000 millionaires in the U.S. Furthermore, 34% of the world's billionaires are American (in 2011).

Home ownership

The U.S. home ownership rate in Q1 2018 was 64.2%, well below the all-time peak of 69.2% set in Q4 2004 during a

housing bubble

A housing bubble (or a housing price bubble) is one of several types of asset price bubbles which periodically occur in the market. The basic concept of a housing bubble is the same as for other asset bubbles, consisting of two main phases. Firs ...

. Millions of homes were lost to foreclosure during the

Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

of 2007–2009, bringing the ownership rate to a trough of 62.9% in Q2 2016. The average ownership rate from 1965 to 2017 was 65.3%.

The average home in the United States has more than 700 square feet per person (65 square meters), which is 50%–100% more than the average in other high-income countries. Similarly, ownership rates of gadgets and amenities are relatively high compared to other countries.

It was reported by Pew Research Center in 2016 that, for the first time in 130 years, Americans aged 18 to 34 are more likely to live with their parents than in any other housing situation.

In one study by ATTOM Data Solutions, in 70% of the counties surveyed, homes are increasingly unaffordable for the average U.S. worker.

As of 2018, the number of U.S. citizens residing in their vehicles because they can't find affordable housing has "exploded", particularly in cities with steep increases in the cost of housing such as

Los Angeles

Los Angeles ( ; es, Los Ángeles, link=no , ), often referred to by its initials L.A., is the List of municipalities in California, largest city in the U.S. state, state of California and the List of United States cities by population, sec ...

,

Portland

Portland most commonly refers to:

* Portland, Oregon, the largest city in the state of Oregon, in the Pacific Northwest region of the United States

* Portland, Maine, the largest city in the state of Maine, in the New England region of the northeas ...

and

San Francisco

San Francisco (; Spanish for " Saint Francis"), officially the City and County of San Francisco, is the commercial, financial, and cultural center of Northern California. The city proper is the fourth most populous in California and 17th ...

.

Profits and wages

Real wages

Real wages (wages adjusted for inflation) for most workers in the United States and median incomes have either declined or remained stagnant for the last twenty to forty years. A 2020 microanalysis demonstrated that in the preceding four decades labor's share of national output declined while over the same period the profit share of the same output increased.

In 1970,

wage

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as ''minimum wage'', '' prevailing wage'', and ''yearly bonuses,'' and remune ...

s represented more than 51% of the U.S. GDP and profits were less than 5%. But by 2013, wages had fallen to 44% of the economy, while profits had more than doubled to 11%.

Inflation-adjusted ("real") per capita

disposable personal income

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays (which includes the major c ...

rose steadily in the U.S. from 1945 to 2008, but has since remained generally level.

In 2005, median personal income for those over the age of 18 ranged from $3,317 for an unemployed, married

Asian American female

to $55,935 for a full-time, year-round employed Asian American male.

According to the U.S. Census men tended to have higher income than women while Asians and

Whites

White is a racialized classification of people and a skin color specifier, generally used for people of European origin, although the definition can vary depending on context, nationality, and point of view.

Description of populations as ...

earned more than

African American

African Americans (also referred to as Black Americans and Afro-Americans) are an ethnic group consisting of Americans with partial or total ancestry from sub-Saharan Africa. The term "African American" generally denotes descendants of ens ...

s and

Hispanics

The term ''Hispanic'' ( es, hispano) refers to people, cultures, or countries related to Spain, the Spanish language, or Hispanidad.

The term commonly applies to countries with a cultural and historical link to Spain and to viceroyalties forme ...

. The overall median personal income for all individuals over the age of 18 was $24,062

($32,140 for those age 25 or above) in the year 2005.

As a reference point, the minimum wage rate in 2009 and 2017 was $7.25 per hour or $15,080 for the 2080 hours in a typical work year. The minimum wage is a little more than the poverty level for a single person unit and about 50% of the

poverty level

The poverty threshold, poverty limit, poverty line or breadline is the minimum level of income deemed adequate in a particular country. The poverty line is usually calculated by estimating the total cost of one year's worth of necessities for t ...

for a family of four.

According to an October 2014 report by the

Pew Research Center,

real wages have been flat or falling for the last five decades for most U.S. workers, regardless of job growth. Bloomberg reported in July 2018 that real GDP per capita has grown substantially since the Great Recession, but real compensation per hour, including benefits, hasn't increased at all.

An August 2017 survey by

CareerBuilder

CareerBuilder is an employment website founded in 1995 with offices in the United States, Canada, Europe, and Asia. In 2008, it had the largest market share among online employment websites in the United States, where it was founded. CareerBu ...

found that eight out of ten U.S. workers live paycheck to paycheck. CareerBuilder spokesman Mike Erwin blamed "stagnant wages and the rising cost of everything from education to many consumer goods". According to a survey by the federal

Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau (CFPB) is an agency of the United States government responsible for consumer protection in the financial sector. CFPB's jurisdiction includes banks, credit unions, securities firms, payday lenders, mo ...

on the financial well-being of U.S. citizens, roughly half have trouble paying bills, and more than one third have faced hardships such as not being able to afford a place to live, running out of food, or not having enough money to pay for medical care. According to journalist and author

Alissa Quart, the cost of living is rapidly outpacing the growth of salaries and wages, including those for traditionally secure professions such as teaching. She writes that "middle-class life is now 30% more expensive than it was 20 years ago."

In February 2019, the

Federal Reserve Bank of New York reported that seven million U.S. citizens are three months or more behind on their car payments, setting a record. This is considered a red flag by economists, that Americans are struggling to pay bills in spite of a low unemployment rate. A May 2019 poll conducted by

NPR

National Public Radio (NPR, stylized in all lowercase) is an American privately and state funded nonprofit media organization headquartered in Washington, D.C., with its NPR West headquarters in Culver City, California. It differs from other ...

found that among rural Americans, 40% struggle to pay for healthcare, food and housing, and 49% could not pay cash for a $1,000 emergency, and would instead choose to borrow in order to pay for such an unexpected emergency expense. Some experts assert that the US has experienced a "two-tier recovery", which has benefitted 60% of the population, while the other 40% on the "lower tier" have been struggling to pay bills as the result of stagnant wages, increases in the cost of housing, education and healthcare, and growing debts.

A 2021 study by the

National Low Income Housing Coalition

The National Low Income Housing Coalition (NLIHC) is a non-profit organization dedicated to ending America's affordable housing crisis. It aims to expand and preserve housing for people with extremely low incomes. NLIHC provides current informat ...

found that workers would have to make at least $24.90 an hour to be able to afford (meaning 30% of a person's income or less) renting a standard two-bedroom home or $20.40 for a one-bedroom home anywhere in the US. The former is 3.4 times higher than the current federal minimum wage.

Poverty

Starting in the 1980s

relative poverty

The poverty threshold, poverty limit, poverty line or breadline is the minimum level of income deemed adequate in a particular country. The poverty line is usually calculated by estimating the total cost of one year's worth of necessities for t ...

rates have consistently exceeded those of other wealthy nations, though analyses using a common data set for comparisons tend to find that the U.S. has a lower absolute poverty rate by market income than most other wealthy nations.

in the United States, meaning households living on less than $2 per day before government benefits, doubled from 1996 levels to 1.5 million households in 2011, including 2.8 million children.

["Extreme Poverty in the United States, 1996 to 2011"]

''National Poverty Center'', February 2012. In 2013,

child poverty

Child poverty refers to the state of children living in poverty and applies to children from poor families and orphans being raised with limited or no state resources. UNICEF estimates that 356 million children live in extreme poverty. It's est ...

reached record high levels, with 16.7 million children living in

food insecure households, about 35% more than 2007 levels.

As of 2015, 44 percent of children in the United States live with low-income families.

In 2016, 12.7% of the U.S. population

lived in poverty, down from 13.5% in 2015. The poverty rate rose from 12.5% in 2007 before the

Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

to a 15.1% peak in 2010, before falling back to just above the 2007 level. In the 1959–1962 period, the poverty rate was over 20%, but declined to the all-time low of 11.1% in 1973 following the

War on Poverty

The war on poverty is the unofficial name for legislation first introduced by United States President Lyndon B. Johnson during his State of the Union address on January 8, 1964. This legislation was proposed by Johnson in response to a national ...

begun during the Lyndon Johnson presidency. In June 2016, The IMF warned the United States that its high poverty rate needs to be tackled urgently.

The population in extreme-poverty neighborhoods rose by one third from 2000 to 2009.

[Kneebone, Elizabeth; Nadeau, Carey; Berube, Alan (November 3, 2011)]

"The Re-Emergence of Concentrated Poverty: Metropolitan Trends in the 2000s"

''Brookings Institution

The Brookings Institution, often stylized as simply Brookings, is an American research group founded in 1916. Located on Think Tank Row in Washington, D.C., the organization conducts research and education in the social sciences, primarily in e ...

.'' People living in such neighborhoods tend to suffer from inadequate access to quality education; higher crime rates; higher rates of physical and psychological ailment; limited access to credit and wealth accumulation; higher prices for goods and services; and constrained access to job opportunities.

As of 2013, 44% of America's poor are considered to be in "deep poverty", with an income 50% or more below the government's official poverty line.

According to the US

Department of Housing and Urban Development's Annual Homeless Assessment Report, there were around 554,000 homeless people in the United States on a given night,

or 0.17% of the population. Almost two thirds stayed in an emergency shelter or transitional housing program and the other third were living on the street, in an abandoned building, or another place not meant for human habitation. About 1.56 million people, or about 0.5% of the U.S. population, used an emergency shelter or a transitional housing program between October 1, 2008, and September 30, 2009.

Around 44% of homeless people are employed.

The United States has one of the least extensive social safety nets in the developed world, reducing both relative poverty and absolute poverty by

considerably less than the mean for wealthy nations.

Some experts posit that those in poverty live in conditions rivaling the

developing world. A May 2018 report by the U.N. Special Rapporteur on extreme poverty and human rights found that over five million people in the United States live "in 'Third World' conditions". Over the last three decades the poor in America have been