U.S. Producer Price Index on:

[Wikipedia]

[Google]

[Amazon]

The Producer Price Index (PPI) is the official measure of producer prices in the economy of the United States. It measures average changes in prices received by domestic producers for their output. The PPI was known as the Wholesale Price Index, or WPI, up to 1978. It is published by the

The Producer Price Index (PPI) is the official measure of producer prices in the economy of the United States. It measures average changes in prices received by domestic producers for their output. The PPI was known as the Wholesale Price Index, or WPI, up to 1978. It is published by the

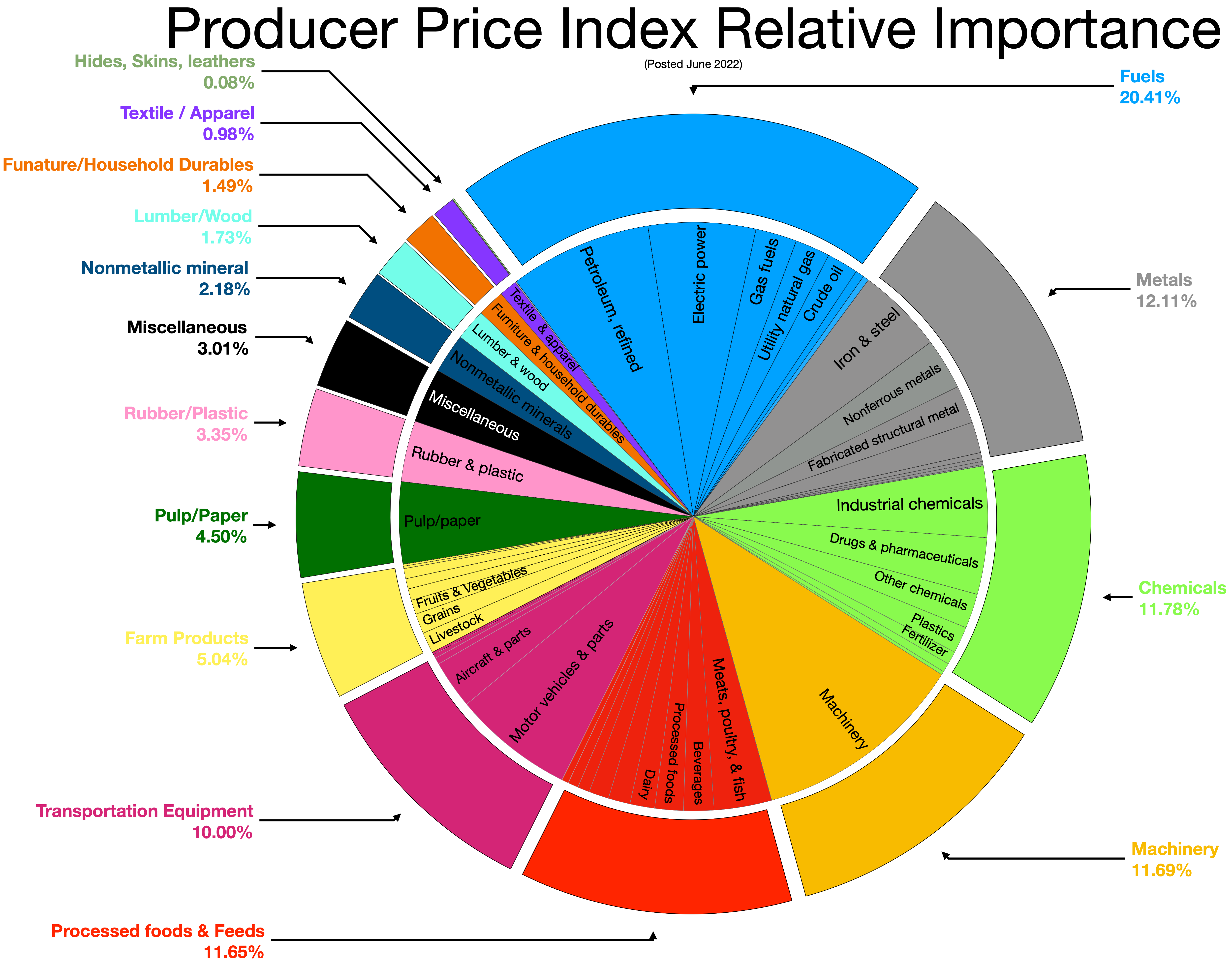

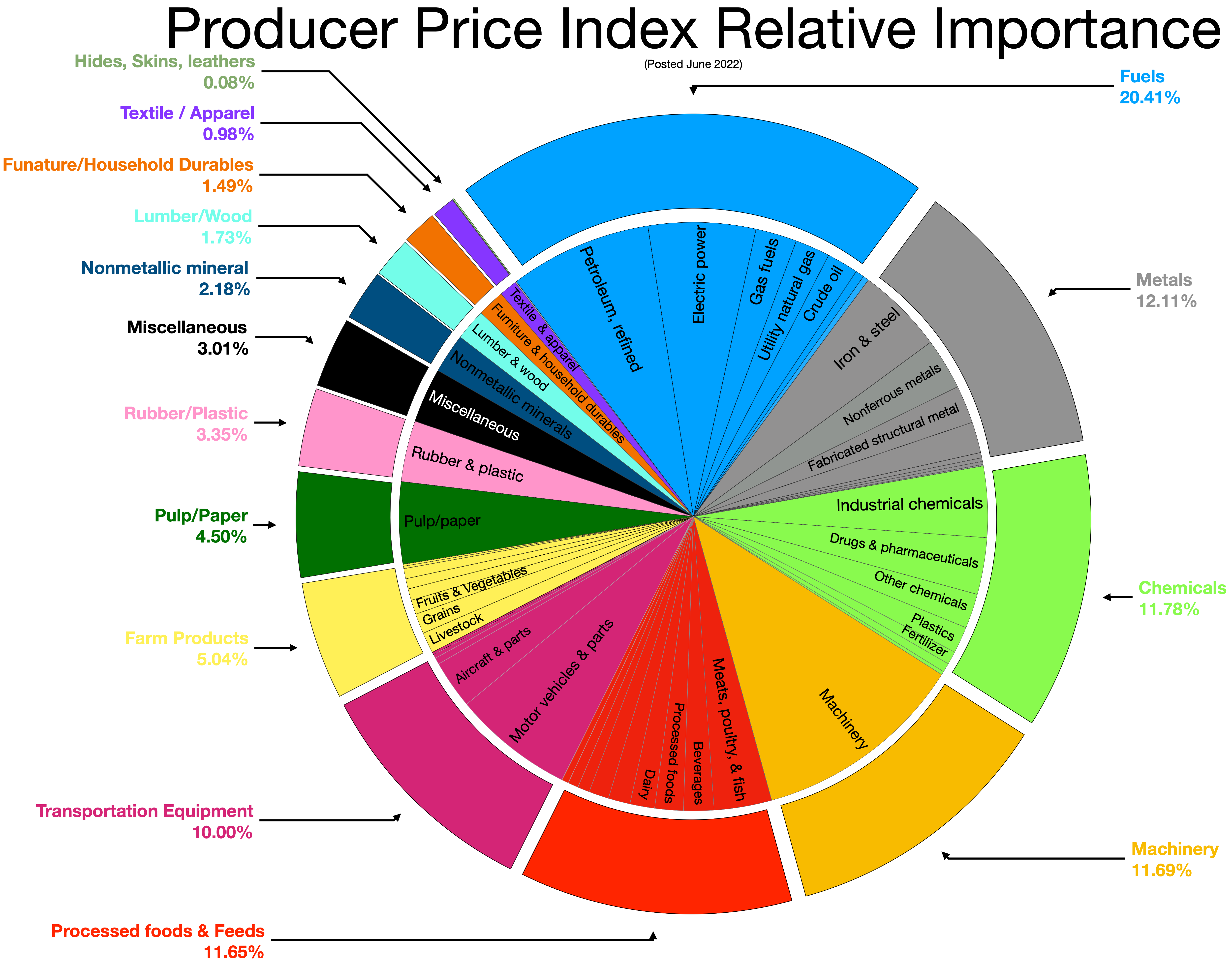

A PPI from the commodity classification system measures change in prices received for a product or service regardless of industry of origin. It organizes products by similarity, end use, or material composition. This system is unique to the PPI and does not match any other standard coding structure, such as the SIC or the U.N. Standard International Trade Classification (SITC). Historical continuity of index series, the needs of index users, and a variety of ad hoc factors were important in developing the PPI commodity classification.

A PPI from the commodity classification system measures change in prices received for a product or service regardless of industry of origin. It organizes products by similarity, end use, or material composition. This system is unique to the PPI and does not match any other standard coding structure, such as the SIC or the U.N. Standard International Trade Classification (SITC). Historical continuity of index series, the needs of index users, and a variety of ad hoc factors were important in developing the PPI commodity classification.

Index point change ÷ Previous period index level = Proportion of change

Proportion of change × 100 = Percent change For example, in the first quarter of 2016, the PPI for final demand increased 0.5 percent because the index levels were 109.7 in March 2016 and 109.1 in December 2015. The percent change is calculated as: 109.7 - 109.1 = 0.6

0.6 ÷ 109.1 = 0.005

0.005 × 100 = 0.5 percent

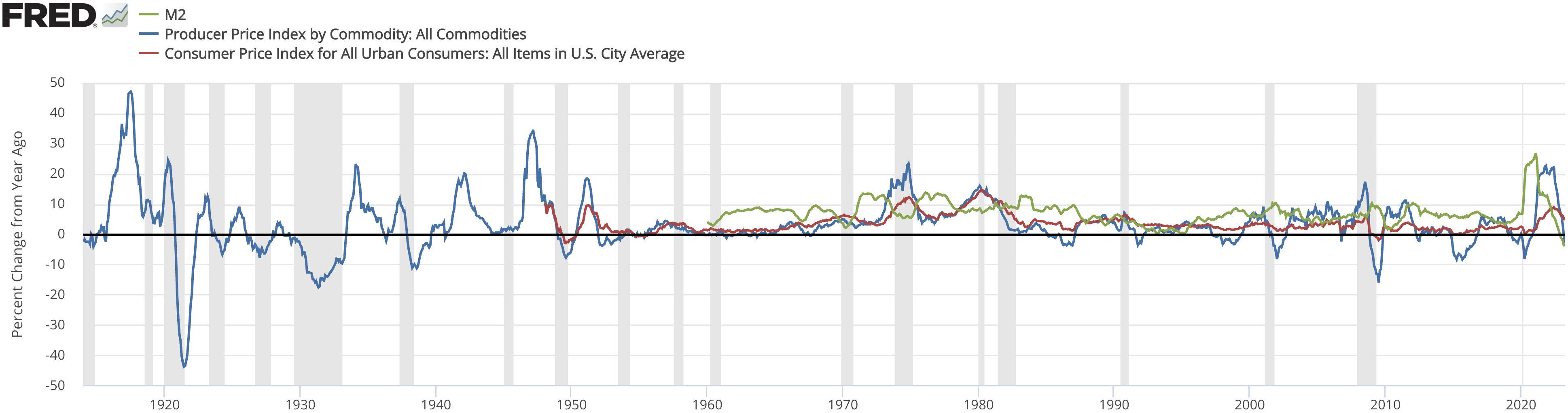

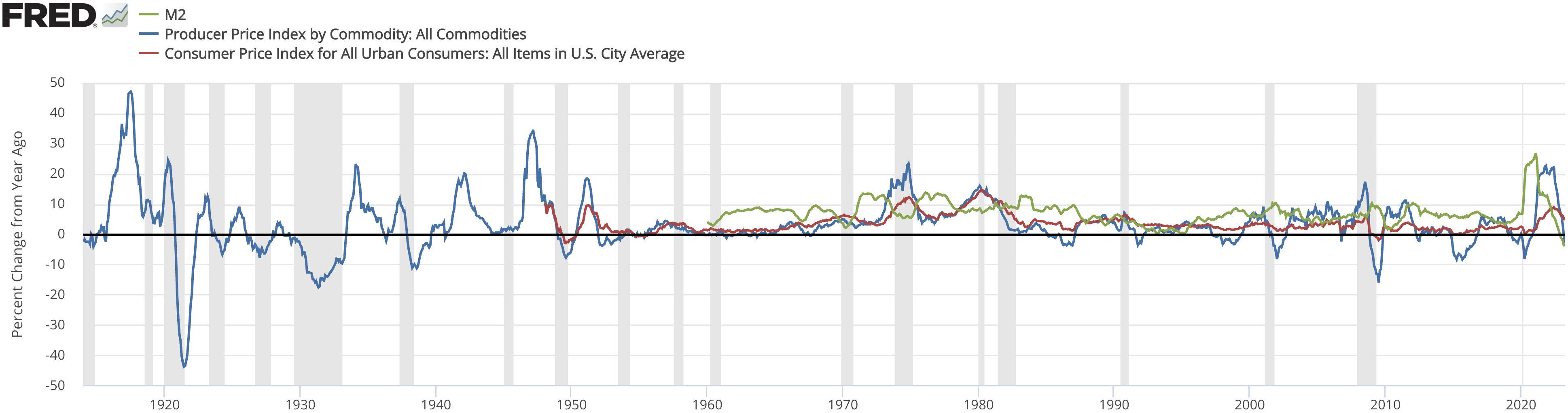

A change in the PPI often anticipates a change in the United States Consumer Price Index (CPI). However, there are times when the CPI exhibits a change of a significantly different magnitude (or direction) compared to the PPI. This is due to the different definition and uses of the two indices. A primary use of the PPI is to deflate revenue streams in order to measure real growth in output. A primary use of the CPI is to adjust income and expenditure streams for changes in the cost of living. Because of these differences, each uses prices from a different set of commodities and services.

A change in the PPI often anticipates a change in the United States Consumer Price Index (CPI). However, there are times when the CPI exhibits a change of a significantly different magnitude (or direction) compared to the PPI. This is due to the different definition and uses of the two indices. A primary use of the PPI is to deflate revenue streams in order to measure real growth in output. A primary use of the CPI is to adjust income and expenditure streams for changes in the cost of living. Because of these differences, each uses prices from a different set of commodities and services.

PPI Homepage

Price indices Economy of the United States Bureau of Labor Statistics

The Producer Price Index (PPI) is the official measure of producer prices in the economy of the United States. It measures average changes in prices received by domestic producers for their output. The PPI was known as the Wholesale Price Index, or WPI, up to 1978. It is published by the

The Producer Price Index (PPI) is the official measure of producer prices in the economy of the United States. It measures average changes in prices received by domestic producers for their output. The PPI was known as the Wholesale Price Index, or WPI, up to 1978. It is published by the Bureau of Labor Statistics

The Bureau of Labor Statistics (BLS) is a unit of the United States Department of Labor. It is the principal fact-finding agency for the U.S. government in the broad field of labor economics and statistics and serves as a principal agency of t ...

and is one of the oldest economic time series compiled by the Federal government of the United States

The federal government of the United States (U.S. federal government or U.S. government) is the national government of the United States, a federal republic located primarily in North America, composed of 50 states, a city within a fede ...

.

The origins of the index were in an 1891 U.S. Senate

The United States Senate is the upper chamber of the United States Congress, with the House of Representatives being the lower chamber. Together they compose the national bicameral legislature of the United States.

The composition and powe ...

resolution authorizing the Senate Committee on Finance

The United States Senate Committee on Finance (or, less formally, Senate Finance Committee) is a standing committee of the United States Senate. The Committee concerns itself with matters relating to taxation and other revenue measures generall ...

to investigate the effects of the tariff laws "upon the imports and exports, the growth, development, production, and prices of agricultural and manufactured articles at home and abroad".

The PPI for Final Demand is the headline index of the PPI News Release. It measures change in prices received by domestic producers for goods, services, and construction sold for personal consumption, capital investment, government, and export.

Most of the data for the PPI is collected through a systematic sampling of producers in manufacturing, mining, and service industries, and is published monthly by the Bureau of Labor Statistics. Virtually every type of mining and manufacturing industry and a majority of service industries are sampled.

Survey respondents participate voluntarily. The data provided by respondents to the BLS is strictly confidential, protected by the Confidential Information Protection and Statistical Efficiency Act

The Confidential Information Protection and Statistical Efficiency Act, ("CIPSEA"), is a United States federal law enacted in 2002 as Title V of the E-Government Act of 2002 (, , ).

CIPSEA establishes uniform confidentiality protections for info ...

(CIPSEA) of 2002.

Classifications

The Producer Price Index family of indexes consists of several classification systems, each with its own structure, history, and uses. However, indexes in all classification systems draw from the same pool of price information provided to the Bureau by survey respondents. The three most important classification structures are industry, commodity, and final demand-intermediate demand (FD-ID).Industry

The PPI for an industry measures the average change in prices received for an industry’s output sold to another industry. For more than 20 years, the PPI used the Standard Industrial Classification (SIC) system to collect and publish data. This system received criticism for its inability to adapt to changes in the United States economy. Consequently, in January 2004, the BLS began to publish the PPI data in accordance with the North American Industry Classification System (NAICS). This system was developed in cooperation with Canada and Mexico, and categorizes producers into industries based on the activity in which they are primarily engaged.Commodity

A PPI from the commodity classification system measures change in prices received for a product or service regardless of industry of origin. It organizes products by similarity, end use, or material composition. This system is unique to the PPI and does not match any other standard coding structure, such as the SIC or the U.N. Standard International Trade Classification (SITC). Historical continuity of index series, the needs of index users, and a variety of ad hoc factors were important in developing the PPI commodity classification.

A PPI from the commodity classification system measures change in prices received for a product or service regardless of industry of origin. It organizes products by similarity, end use, or material composition. This system is unique to the PPI and does not match any other standard coding structure, such as the SIC or the U.N. Standard International Trade Classification (SITC). Historical continuity of index series, the needs of index users, and a variety of ad hoc factors were important in developing the PPI commodity classification.

Final Demand-Intermediate Demand (FD-ID)

Final Demand-Intermediate Demand (FD-ID) indexes are made up of PPIs in the commodity system. This system regroups commodity indexes to create aggregate PPIs according to the type of buyer and the amount of physical processing or assembly products have undergone. The FD-ID system replaced the PPI "stage-of-processing" (SOP) system as PPI's primary aggregation model with the release of data for January 2014. The scope of the SOP system was narrower than the PPI index. Over 600 FD-ID PPIs are available measuring price change for goods, services, and construction sold to final demand and intermediate demand. The final demand portion of the FD-ID system measures price change for commodities sold as personal consumption, capital investment, government purchases, and exports. The intermediate demand portion of the FD-ID system tracks price change for goods, services, and construction products sold to businesses as inputs to production, excluding capital investment.Calculating Index Changes

Movements of price indexes from one month to another are expressed as percent changes, rather than as changes in index points. Each index measures price changes from a reference period defined to equal 100.0. Currently, some PPIs have an index base set at 1982 = 100, while the remainder have an index base that corresponds with the month prior to the month that the index was introduced. BLS measures price change in relation to that figure. An index level of 110, for example, means there has been a 10% increase in prices since the base period; similarly, an index level of 90 indicates a 10% decrease in prices. To calculate the percent change in prices between some previous period and a more current period using a PPI, the BLS uses the following formula: Current period index level - Previous period index level = Index point changeIndex point change ÷ Previous period index level = Proportion of change

Proportion of change × 100 = Percent change For example, in the first quarter of 2016, the PPI for final demand increased 0.5 percent because the index levels were 109.7 in March 2016 and 109.1 in December 2015. The percent change is calculated as: 109.7 - 109.1 = 0.6

0.6 ÷ 109.1 = 0.005

0.005 × 100 = 0.5 percent

Core PPI

The Core PPI is the headline PPI excluding high volatility items, such as energy. The more volatile components of the PPI for final demand are food, energy, and trade services. These indexes, including Final demand less foods and energy and Final demand less foods, energy, and trade services, exclude volatility from certain components.How PPI differs from CPI

A change in the PPI often anticipates a change in the United States Consumer Price Index (CPI). However, there are times when the CPI exhibits a change of a significantly different magnitude (or direction) compared to the PPI. This is due to the different definition and uses of the two indices. A primary use of the PPI is to deflate revenue streams in order to measure real growth in output. A primary use of the CPI is to adjust income and expenditure streams for changes in the cost of living. Because of these differences, each uses prices from a different set of commodities and services.

A change in the PPI often anticipates a change in the United States Consumer Price Index (CPI). However, there are times when the CPI exhibits a change of a significantly different magnitude (or direction) compared to the PPI. This is due to the different definition and uses of the two indices. A primary use of the PPI is to deflate revenue streams in order to measure real growth in output. A primary use of the CPI is to adjust income and expenditure streams for changes in the cost of living. Because of these differences, each uses prices from a different set of commodities and services.

See also

*Producer price index

A producer price index (PPI) is a price index that measures the average changes in prices received by domestic producers for their output.

Its importance is being undermined by the steady decline in manufactured goods as a share of spending.

...

* Bureau of Labor Statistics

The Bureau of Labor Statistics (BLS) is a unit of the United States Department of Labor. It is the principal fact-finding agency for the U.S. government in the broad field of labor economics and statistics and serves as a principal agency of t ...

* Consumer Price Index

A consumer price index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time.

Overview

A CPI is a statistica ...

* U.S. Import and Export Price Indices The U.S. Import and Export Price Indexes measure average changes in prices of goods and services that are imported to or exported from the U.S.. The indexes are produced monthly by the International Price Program (IPP) of the Bureau of Labor Stati ...

* Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

* Substitution

Substitution may refer to:

Arts and media

*Chord substitution, in music, swapping one chord for a related one within a chord progression

* Substitution (poetry), a variation in poetic scansion

* "Substitution" (song), a 2009 song by Silversun Pi ...

* FRED (Federal Reserve Economic Data)

Federal Reserve Economic Data (FRED) is a database maintained by the Research division of the Federal Reserve Bank of St. Louis that has more than 816,000 economic time series from various sources. They cover banking, business/fiscal, consumer pri ...

* 2000s commodities boom

The 2000s commodities boom or the commodities super cycle was the rise of many physical commodity prices (such as those of food, oil, metals, chemicals and fuels) during the early 21st century (2000–2014), following the Great Commodities Depress ...

* 2020s commodities boom

The 2020s commodities boom refers to the rise of many commodity prices in the early 2020s following the COVID-19 pandemic. The COVID-19 recession initially made commodity prices drop, but lockdowns, supply chain bottlenecks, and dovish monetary ...

References

{{ReflistExternal links

PPI Homepage

Price indices Economy of the United States Bureau of Labor Statistics