U.S. Bank National Association on:

[Wikipedia]

[Google]

[Amazon]

U.S. Bancorp (stylized as us bancorp) is an American bank holding company based in

The U.S. Bank name first appeared as United States National Bank of Portland, established in Portland, Oregon, in 1891. In 1902, it merged with Ainsworth National Bank of Portland, but kept the U.S. National Bank name. It changed its name to the United States National Bank of Oregon in 1964.

The central part of the franchise dates from 1864, with the formation of First National Bank of Minneapolis. In 1929, that bank merged with First National Bank of St. Paul (also formed in 1864) and several smaller Upper Midwest banks to form the First Bank Stock Corporation, which changed its name to First Bank System in 1968.

In the eastern part of the franchise, Farmers and Millers Bank in Milwaukee opened its doors in 1853, growing into the First National Bank of Milwaukee and eventually becoming First Wisconsin and ultimately Firstar Corporation. In Cincinnati, First National Bank of Cincinnati opened for business on July 13, 1863 under National Charter #24—the charter that U.S. Bancorp still operates under today, and one of the oldest active national bank charters in the nation. U.S. Bancorp claims 1863 as its founding date. Despite having started up in the midst of the Civil War, First National Bank of Cincinnati went on to survive many decades to grow into Star Bank.

The U.S. Bank name first appeared as United States National Bank of Portland, established in Portland, Oregon, in 1891. In 1902, it merged with Ainsworth National Bank of Portland, but kept the U.S. National Bank name. It changed its name to the United States National Bank of Oregon in 1964.

The central part of the franchise dates from 1864, with the formation of First National Bank of Minneapolis. In 1929, that bank merged with First National Bank of St. Paul (also formed in 1864) and several smaller Upper Midwest banks to form the First Bank Stock Corporation, which changed its name to First Bank System in 1968.

In the eastern part of the franchise, Farmers and Millers Bank in Milwaukee opened its doors in 1853, growing into the First National Bank of Milwaukee and eventually becoming First Wisconsin and ultimately Firstar Corporation. In Cincinnati, First National Bank of Cincinnati opened for business on July 13, 1863 under National Charter #24—the charter that U.S. Bancorp still operates under today, and one of the oldest active national bank charters in the nation. U.S. Bancorp claims 1863 as its founding date. Despite having started up in the midst of the Civil War, First National Bank of Cincinnati went on to survive many decades to grow into Star Bank.

via ProQuest.

In May 2020, the US Bancorp Center in downtown Minneapolis was damaged by rioting during the

In May 2020, the US Bancorp Center in downtown Minneapolis was damaged by rioting during the

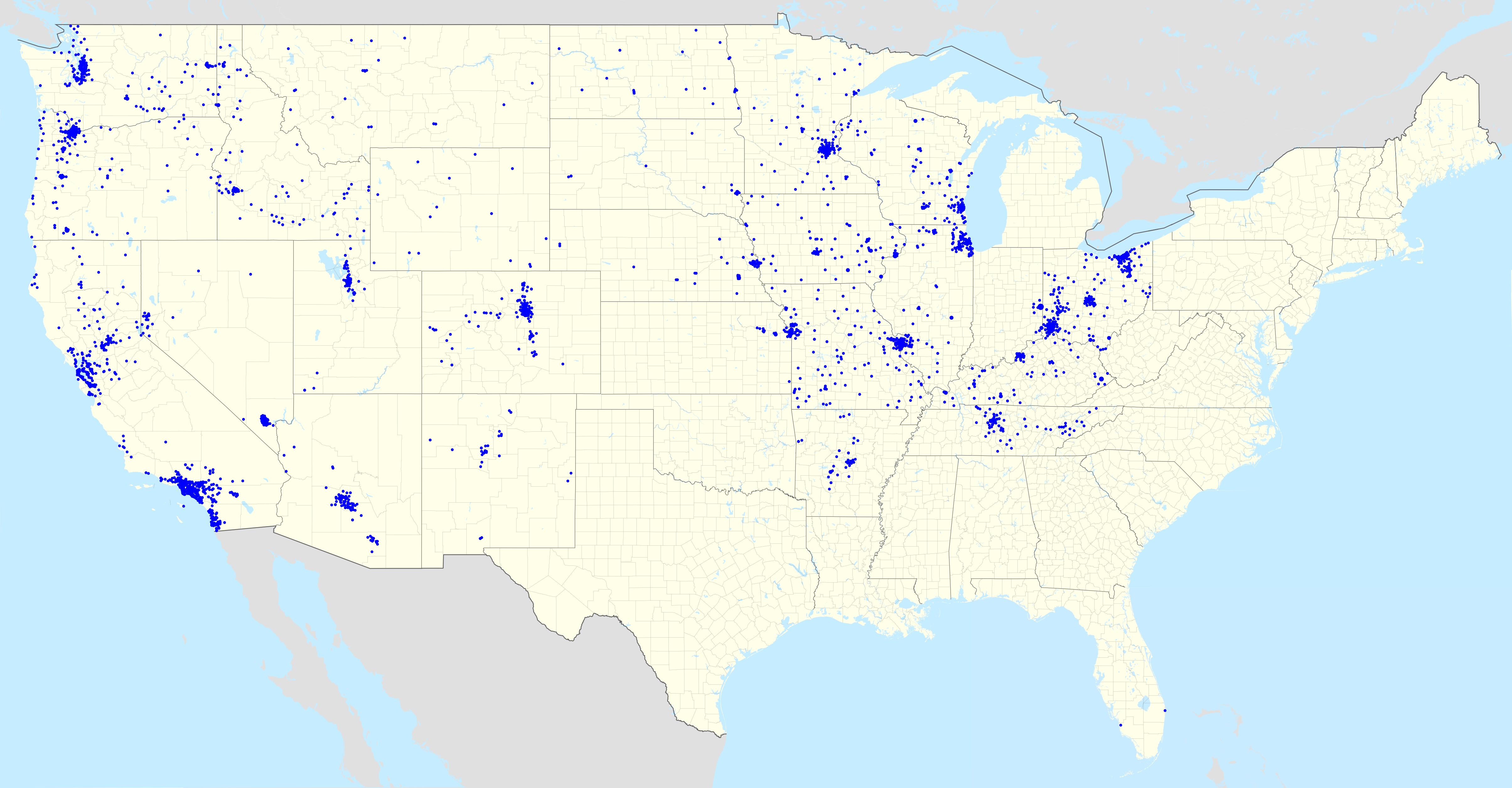

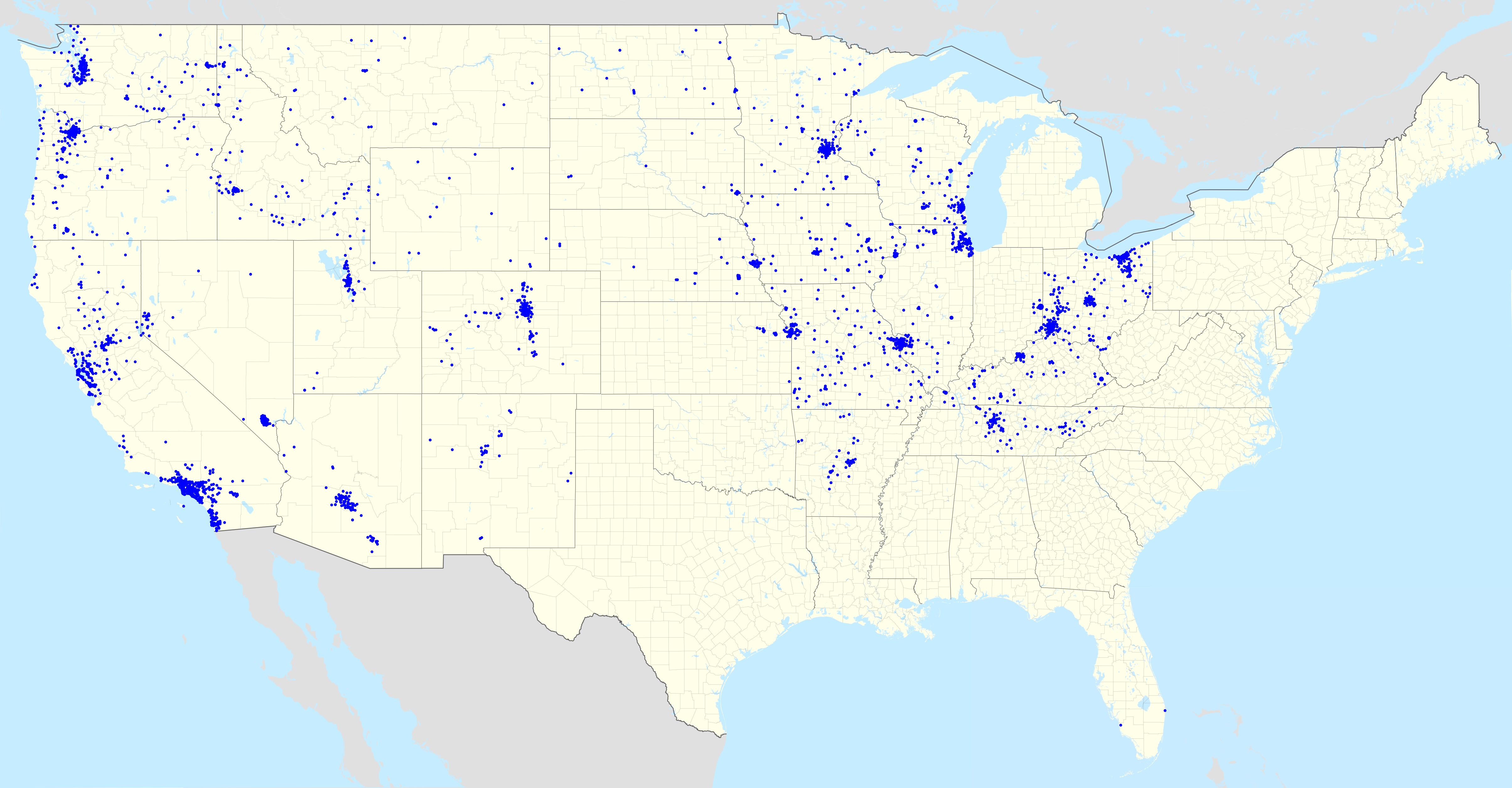

Map of Locations

{{Online brokerages Banks based in Minnesota Minneapolis American companies established in 1891 Banks established in 1891 Economy of the Midwestern United States Economy of the Northeastern United States Economy of the Northwestern United States Economy of the Southeastern United States Economy of the Southwestern United States Companies listed on the New York Stock Exchange Companies based in Minneapolis 1891 establishments in Oregon Online brokerages Primary dealers Subprime mortgage lenders Systemically important financial institutions Investment banks in the United States Mortgage lenders of the United States Rogue trading banks Subprime mortgage crisis

Minneapolis, Minnesota

Minneapolis () is the largest city in Minnesota, United States, and the county seat of Hennepin County. The city is abundant in water, with thirteen lakes, wetlands, the Mississippi River, creeks and waterfalls. Minneapolis has its origins ...

, and incorporated in Delaware. It is the parent company of U.S. Bank National Association, and is the fifth largest banking institution in the United States. The company provides banking, investment, mortgage, trust, and payment services products to individuals, businesses, governmental entities, and other financial institutions. It has 3,106 branches and 4,842 automated teller machines, primarily in the Western and Midwestern United States. It is ranked 117th on the Fortune 500

The ''Fortune'' 500 is an annual list compiled and published by ''Fortune'' magazine that ranks 500 of the largest United States corporations by total revenue for their respective fiscal years. The list includes publicly held companies, along ...

, and it is considered a systemically important bank by the Financial Stability Board. The company also owns Elavon, a processor of credit card transactions for merchants, and Elan Financial Services, a credit card issuer that issues credit card products on behalf of small credit unions and banks across the U.S.

U.S. Bancorp operates under the second-oldest continuous national charter, originally Charter #24, granted in 1863 following the passage of the National Bank Act. Earlier charters have expired as banks were closed or acquired, raising U.S. Bank's charter number from #24 to #2. The oldest national charter, originally granted to the First National Bank of Philadelphia

First National Bank was a bank in Philadelphia. Chartered in 1863, it was the first national bank created under the Civil War banking reforms that began to define the modern U.S. banking system, and the first commercial bank to issue a fede ...

, is held by Wells Fargo, which was obtained upon its merger with Wachovia.

History

The U.S. Bank name first appeared as United States National Bank of Portland, established in Portland, Oregon, in 1891. In 1902, it merged with Ainsworth National Bank of Portland, but kept the U.S. National Bank name. It changed its name to the United States National Bank of Oregon in 1964.

The central part of the franchise dates from 1864, with the formation of First National Bank of Minneapolis. In 1929, that bank merged with First National Bank of St. Paul (also formed in 1864) and several smaller Upper Midwest banks to form the First Bank Stock Corporation, which changed its name to First Bank System in 1968.

In the eastern part of the franchise, Farmers and Millers Bank in Milwaukee opened its doors in 1853, growing into the First National Bank of Milwaukee and eventually becoming First Wisconsin and ultimately Firstar Corporation. In Cincinnati, First National Bank of Cincinnati opened for business on July 13, 1863 under National Charter #24—the charter that U.S. Bancorp still operates under today, and one of the oldest active national bank charters in the nation. U.S. Bancorp claims 1863 as its founding date. Despite having started up in the midst of the Civil War, First National Bank of Cincinnati went on to survive many decades to grow into Star Bank.

The U.S. Bank name first appeared as United States National Bank of Portland, established in Portland, Oregon, in 1891. In 1902, it merged with Ainsworth National Bank of Portland, but kept the U.S. National Bank name. It changed its name to the United States National Bank of Oregon in 1964.

The central part of the franchise dates from 1864, with the formation of First National Bank of Minneapolis. In 1929, that bank merged with First National Bank of St. Paul (also formed in 1864) and several smaller Upper Midwest banks to form the First Bank Stock Corporation, which changed its name to First Bank System in 1968.

In the eastern part of the franchise, Farmers and Millers Bank in Milwaukee opened its doors in 1853, growing into the First National Bank of Milwaukee and eventually becoming First Wisconsin and ultimately Firstar Corporation. In Cincinnati, First National Bank of Cincinnati opened for business on July 13, 1863 under National Charter #24—the charter that U.S. Bancorp still operates under today, and one of the oldest active national bank charters in the nation. U.S. Bancorp claims 1863 as its founding date. Despite having started up in the midst of the Civil War, First National Bank of Cincinnati went on to survive many decades to grow into Star Bank.

U.S. Bancorp of Oregon era

In January 1969, the U.S. National Bank of Oregon reorganized as a holding company, U. S. Bancorp, after receiving authorization from its bank directors on September 9, 1968 and subsequently receiving legal approval to proceed from the Comptroller of the Currency on November 28, 1968. LeRoy B. Staver, president, and chief executive officer of the bank, was quickly appointed chairman and chief executive officer for the new holding company while Robert B. Wilson was appointed president of the holding company and also executive vice president for the bank. Wilson later resigned as president in December 1972 and his position was filled eight months later by John A. Elorriaga. Staver retired in October 1974 and was succeeded by John Elorriaga who was promoted to chairman and chief executive officer while Carl W. Mays Jr was named president in Elorriaga's place. A major change in the organization of leadership in the U.S. Bancorp of Oregon occurred in August 1983. Although Elorriaga remained as chairman and chief executive officer for the firm, Mays was appointed to the new position of executive assistant to the chairman while Edmund P. Jensen was appointed president as a replacement to Mays, and Roger L. Breezley was appointed to the new post of chief operating officer. In December 1986, U.S. Bancorp of Oregon announced the pending acquisition of the Forest Grove, Oregon-based Valley National Corporation (not to be confused with the Phoenix, Arizona, company of the same name) with its five-branch Valley National Bank of Forest Grove subsidiary for $13.7 million in stock. U.S. Bancorp of Oregon made its first acquisition outside the state of Oregon by announcing in December 1986 the pending acquisition of the Spokane, Washington-based Old National Bancorp with its Old National Bank of Washington and First National Bank of Spokane subsidiaries for $174 million. The acquisition was completed in July 1987 on the first day that the state of Washington had allowed bank acquisitions by out-of-state companies. In December 1986, U.S. Bancorp of Oregon announced the pending acquisition of theCamas, Washington

Camas is a city in Clark County, Washington, with a population of 26,065 at the 2020 census. The east side of town borders the city of Washougal, Washington, and the west side of town borders Vancouver, Washington. Camas lies along the Washing ...

-based Heritage Bank for $2.8 million.

In May 1987, U.S. Bancorp of Oregon announced the pending acquisition of the Seattle, Washington-based Peoples Bancorp with its Peoples National Bank subsidiary for $275 million in stock. The acquisition was completed in December 1987. After the acquisition, Peoples and Old National were combined to form U.S. Bank of Washington.

John Elorriaga retired as chairman of the board and chief executive officer in November 1987 and was replaced by Roger L. Breezley while Jensen continued as president.

In December 1987, U.S. Bancorp of Oregon announced the pending acquisition of the Bellingham, Washington-based Mt Baker Bank for $25 million.

U.S. Bancorp of Oregon entered the state of California by announcing in April 1988 the pending acquisition of the Eureka, California-based Bank of Loleta with seven branch offices in Humboldt Humboldt may refer to:

People

* Alexander von Humboldt, German natural scientist, brother of Wilhelm von Humboldt

* Wilhelm von Humboldt, German linguist, philosopher, and diplomat, brother of Alexander von Humboldt

Fictional characters

* ...

and Del Norte counties for $15.3 million in cash. The acquisition was completed in December 1988 and was renamed U.S. Bank of California.

In April 1988, U.S. Bancorp of Oregon announced the pending acquisition of the Bellingham, Washington-based Northwestern Commercial Bank for $15.5 million. The acquisition was completed in November 1988.

In July 1988, U.S. Bancorp of Oregon announced the pending acquisition of the Auburn, Washington

Auburn is a city in King County, Washington, United States (with a small portion crossing into neighboring Pierce County). The population was 87,256 at the 2020 Census. Auburn is a suburb in the Seattle metropolitan area, and is currently rank ...

-based Western Independent Bancshares with its Auburn Valley Bank subsidiary for $4.25 million in cash.

In October 1989, U.S. Bancorp of Oregon announced the pending acquisition of the Sacramento, California-based Mother Lode Savings Bank with three branch offices for $5.3 million. The acquisition was completed in August 1990. This acquisition was one of the first of a thrift

Thrift may refer to:

* Frugality

* A savings and loan association in the United States

* Apache Thrift, a remote procedure call (RPC) framework

* Thrift (plant), a plant in the genus ''Armeria''

* Syd Thrift (1929–2006), American baseball exec ...

by a commercial bank in the nation since legislation permitting such takeovers went into effect.

During the late 1980s, U.S. Bancorp of Oregon made several attempts to enter the state of Idaho by the acquisition of an existing Idaho-based bank, the only method then allowed under Idaho law, but failed when the price got too high. In March 1990, U.S. Bancorp of Oregon announced that they would establish a bank through a loophole in Federal banking law that allows the Office of the Comptroller of the Currency to allow the relocation of bank headquarters within 30 miles of their present location without regards to state boundaries and state regulations. So U.S. Bancorp of Oregon announced that they plan to transfer the existing branches of the First National Bank of Spokane to the U.S. Bancorp of Washington and then ask permission from the Office of the Comptroller of the Currency to move the headquarters of First National from Spokane, Washington, to Coeur d'Alene, Idaho. After receiving Federal approval, First National was finally moved in February 1992 and renamed U.S. Bank of Idaho.

In July 1990, U.S. Bancorp of Oregon announced the pending acquisition of the Auburn, California-based HeartFed Financial Corporation with its Heart Federal Savings and Loan subsidiary for $107.8 million in stock. At the time of the announcement, Heart Federal Savings had 29 branch offices in northern California. The acquisition was completed in March 1991 for $118 million.

In November 1991, Edmund P. Jensen was given the post of chief operating officer in addition to his duties as president, making him a possible successor to Breezley.

In February 1992, U.S. Bancorp of Oregon announced the pending acquisition of the 20 branch offices in Northern California

Northern California (colloquially known as NorCal) is a geographic and cultural region that generally comprises the northern portion of the U.S. state of California. Spanning the state's northernmost 48 counties, its main population centers incl ...

and 29 branch offices in Nevada for $70 million that were being divested by Bankamerica Corporation

The Bank of America Corporation (often abbreviated BofA or BoA) is an American multinational investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North Carolina. The bank ...

as a result of Bank of America's impending acquisition of Security Pacific Corporation. This acquisition gave U.S. Bancorp of Oregon its first presence in the state of Nevada.

Another major change in the organization of leadership in the U.S. Bancorp of Oregon occurred in January 1993. While retaining his position as chief operating officer, Edmund P. Jensen was appointed vice-chairman while giving his position of president to Kevin R. Kelly. At the same time, Gerry B. Cameron was appointed vice-chairman. Ten months later, Jensen resigned to become president of Visa Inc. In January 1994, Gerry Cameron was first appointed chief operating officer as a replacement to Jensen and later appointed chief executive officer just three weeks later. Kelly submitted his resignation as president in March 1994 and Breezley finally gave up the chairmanship to Cameron in April 1994.

In May 1995, U.S. Bancorp of Oregon announced the pending acquisition of the Boise, Idaho-based West One Bancorp for $1.8 billion. At the time of the announcement, West One had branch offices in Idaho, Oregon, Washington, and Utah while U.S. Bancorp of Oregon had branch offices in Oregon, Washington, California, Idaho, and Nevada. The acquisition was completed in December 1995 and gave U.S. Bancorp of Oregon its first entry into the state of Utah. As part of the acquisition deal, West One's chairman and chief executive Daniel R. Nelson would become the chief operating officer and president of U.S. Bancorp and he would later be Cameron's successor as chairman and CEO upon Cameron's planned retirement in three years. Since both U.S. Bancorp and West One had overlapping territories in Oregon and Washington, the U.S. Justice Department would only allow the acquisition to proceed if U.S. Bancorp would sell off 27 branch offices in Washington and Oregon. As a result of the regulatory ruling, U.S. Bancorp sold 25 branch offices in Oregon, four in central Washington and one in Idaho to First Hawaiian Bank for $38 million in cash.

In February 1996, U.S. Bancorp of Oregon announced the pending acquisition of the San Ramon, California

San Ramon (Spanish: ''San Ramón'', meaning "St. Raymond") is a city in Contra Costa County, California, United States, located within the San Ramon Valley, and east of San Francisco. San Ramon's population was 84,605 per the 2020 census, maki ...

-based California Bancshares for $309 million in stock. California Bancshares had a total of 38 branches in the East San Francisco Bay Area in nine separate banks that included Alameda First National, Community First National, Modesto Banking Co., Commercial Bank of Fremont, Lamorinda National Bank, Bank of San Ramon Valley, Westside Bank, Concord Commercial Bank and Bank of Milpitas. The acquisition was completed in June 1996.

In September 1996, U.S. Bancorp of Oregon announced the pending acquisition of the St. George, Utah-based Sun Capital Bancorp with its three-branch office Sun Capital Bank subsidiary for $15.5 million. The acquisition was completed in January 1997.

In December 1996, Daniel R. Nelson, president and chief operating officer of U.S. Bancorp of Oregon, unexpectedly announced his early retirement effective on New Year's Day 1997. Nelson was originally in line to be Gerry B. Cameron's successor as chairman and chief executive upon the Cameron's planned retirement on New Year's Day 1999.

In December 1996, U.S. Bancorp of Oregon announced the pending acquisition of the Sacramento, California-based Business & Professional Bank for $35 million in cash. The acquisition was completed in May 1997.

First Bank System era

In March 1997, the Minneapolis, Minnesota-based First Bank System announced the pending acquisition of U.S. Bancorp of Oregon for $9 billion in stock. At the time of the announcement, U.S. Bancorp of Oregon had banking offices in Oregon, Washington, California, Idaho and Utah while First Bank System had banking offices in Minnesota, Colorado, Nebraska, North Dakota, South Dakota, Montana, Iowa, Illinois, Wisconsin, Kansas, and Wyoming. Under the terms of the acquisition, First Bank System was the nominal survivor, and the newly merged company was headquartered in Minneapolis. However, it took the more recognizable U. S. Bancorp name.John F. Grundhofer

John F. Grundhofer (January 1, 1939 – January 24, 2021) was a director of Donaldson Company, Securian Financial Group Inc., and BJ's Restaurant & Brewery. He served as Chairman (1990–1997 and 1999–2002), Chief Executive Officer (1990–2001) ...

, chairman and chief executive of First Bank, was appointed president and chief executive of the new company while Gerry B. Cameron, chairman, and chief executive of U.S. Bancorp of Oregon, was appointed chairman of the new company, which he held until his retirement in 1998. The acquisition was completed in August 1997. Approximately 4000 jobs were eliminated, mostly in Portland.

Brief history of First Bank prior to acquisition

First Bank System can trace its roots to the formation of First National Bank of Minneapolis in 1864. In 1929, the First National Bank of Minneapolis joined with the First National Bank of St. Paul to form a joint holding company for both banks that was called the First Bank Stock Corporation, while keeping both subsidiary banks legally separate. The new holding company quickly grew by acquiring other banks in the four-state region before the Bank Holding Company Act of 1956 prohibited such actions. First Bank Stock Corporation was renamed First Bank System Inc. in 1968.Alternate Linkvia ProQuest.

U.S. Bancorp after takeover by First Bank System

In September 1997, the new U.S. Bancorp, formerly First Bank System, announced the pending acquisition of theSt. Cloud, Minnesota

St. Cloud is a city in the U.S. state of Minnesota and the largest population center in the state's central region. The population was 68,881 at the 2020 census, making it Minnesota's 12th-largest city. St. Cloud is the county seat of Stear ...

-based Zappco, Inc. with its three banks and six banking locations for an undisclosed amount. At the time of the announcement, U.S. Bancorp had more than 1,000 banking offices in the states of Minnesota, Oregon, Washington, Colorado, California, Idaho, Nebraska, North Dakota, Nevada, South Dakota, Montana, Iowa, Illinois, Utah, Wisconsin, Kansas, and Wyoming. The acquisition was completed in December 1997.

In March 1998, U.S. Bancorp announced the pending acquisition of the Vancouver, Washington-based Northwest Bancshares with its 10-branch offices Northwest National Bank subsidiary for an undisclosed amount. In October 1998, the U.S. Justice Department agreed to allow the acquisition to proceed on the condition that one of the Northwest National Bank branch offices was to be sold. The acquisition was completed in December 1998 after U.S. Bancorp sold the request banking office to Centennial Bank of Eugene.

At the end of 1998, Gerry Cameron retired as chairman and handed the position over to John Grundhofer who added the title of chairman to his other positions of president and chief executive officer.

In February 1999, U.S. Bancorp announced the pending acquisition of the San Diego-based Bank of Commerce with its 10 branch offices for $314 million in stock. The acquisition was finalized in July 1999.

In May 1999, U.S. Bancorp announced the pending acquisition of the Newport Beach, California

Newport Beach is a coastal city in South Orange County, California. Newport Beach is known for swimming and sandy beaches. Newport Harbor once supported maritime industries however today, it is used mostly for recreation. Balboa Island, Newport ...

-based Western Bancorp with its Santa Monica Bank and Southern California Bank subsidiaries and a total of 31 branch offices for $904 million in stock. At the time of the announcement, U.S. Bancorp had 98 branch offices within California. The acquisition was finalized in November 1999 for $1.04 billion in stock.

In July 1999, Philip G. Heasley was appointed president and chief operating officer of U.S. Bancorp. John Grundhofer had handed over the position of president to Heasley while still retaining the titles of chairman and chief executive officer. Heasley had assisted Grundhofer in turning the company around from near insolvency when the company was originally known as First Bank until it became a successful financial institution that became large enough to be absorb other banks, including U.S. Bancorp of Oregon in 1997. Heasley resigned the following year to join Bank One as the head of their First USA credit card unit around the same time Firstar was about to takeover U.S. Bancorp.

In September 1999, U.S. Bancorp announced the pending acquisition of the San Diego-based Peninsula Bank with its 11 branch offices for $104 million in stock. In early January 2000, a group of Peninsula Bank stockholders tried to stop the merger because the initial merger agreement was made prior to the huge 27% single-day drop in the value of U.S. Bancorp stock which effectively lowered the purchase price. The acquisition was later completed in January 2000 at a 10% reduction of the original price negotiated.

In June 2000, U.S. Bancorp announced the acquisition of the San Diego-based Scripps Financial Corporation with its nine-branch office Scripps Bank subsidiary for $155 million in stock. The acquisition was completed in October 2000.

Firstar era

In October 2000, Firstar Corporation of Milwaukee, Wisconsin, announced the pending acquisition of U.S. Bancorp for $21 billion in stock. The merger was completed on February 27, 2001. While Firstar was the nominal survivor, the merged company took the U.S. Bancorp name and moved to old U.S. Bancorp's headquarters in Minneapolis. Under the merger agreement,Jerry Grundhofer Jerry Grundhofer (born 1945) is the former CEO and Chairman of U.S. Bancorp.

Education

He graduated from Seattle University in 1965.

Career

Jerry was a vice president of Security Pacific Bank and Bank of America in the early 1990s. He left ...

, president and chief executive officer of Firstar, would continue in those positions in the combined company while his older brother, John Grundhofer

John F. Grundhofer (January 1, 1939 – January 24, 2021) was a director of Donaldson Company, Securian Financial Group Inc., and BJ's Restaurant & Brewery. He served as Chairman (1990–1997 and 1999–2002), Chief Executive Officer (1990–2001) ...

, chairman, president and chief executive officer of U.S. Bancorp, would serve as chairman of the board in the combined company until his planned retirement on December 31, 2002. The merged company retained some administrative functions in Milwaukee and Cincinnati.

To allow the merger to proceed, the U.S. Department of Justice required Firstar to sell 11 branch offices in the Minneapolis-area and 2 in Council Bluffs, Iowa

Council Bluffs is a city in and the county seat of Pottawattamie County, Iowa, Pottawattamie County, Iowa, United States. The city is the most populous in Southwest Iowa, and is the third largest and a primary city of the Omaha–Council Bluffs ...

. Bremer Bank of Saint Paul, Minnesota, purchased the 11 Minneapolis-area Firstar offices while Liberty Bank of West Des Moines, Iowa, purchased the 2 Council Bluffs offices.

Brief history of Firstar prior to acquisition

Firstar Corporation traced its roots to the founding of the Farmer's and Millers Bank in Milwaukee in 1853, which by 1919 evolved into First Wisconsin National Bank. However, the Firstar that took over U.S. Bancorp in 2001 was actually the same company and leadership that acquired Firstar 27 months earlier in 1998, namely Star Banc Corporation. That bank, in turn, traced its roots to the founding of First National Bank of Cincinnati in 1863. Jerry Grundhofer and his team from Star Banc were instrumental in both acquisitions. Present-day U.S. Bancorp retains Star Banc's pre-1998 stock price history. As mentioned above, it claims 1863 as its founding date, and operates under the charter originally granted to First National Bank of Cincinnati. Additionally, all SEC filings before 1998 are under Star Banc, and all filings from 1998 to 2000 are under Firstar.U.S. Bancorp after takeover by Firstar

In April 2001, the new U.S. Bancorp announced the pending acquisition of all 20 branch offices in California of the Encino-basedPacific Century Bank

The Bank of Hawaii Corporation ( haw, Panakō o Hawaii; abbreviated BOH) is a regional commercial bank headquartered in Honolulu, Hawaii. It is Hawaii's second oldest bank and its largest locally owned bank in that the majority of the voting st ...

from its Honolulu-based parent Pacific Century Financial Corporation

The Bank of Hawaii Corporation ( haw, Panakō o Hawaii; abbreviated BOH) is a Regional bank, regional commercial bank headquartered in Honolulu, Hawaii. It is Hawaii's second oldest bank and its largest locally owned bank in that the majority of ...

. The acquisition was completed in September 2001.

In July 2002, U.S. Bancorp announced the pending acquisition of all 57 retail banking branches of the San Mateo, California

San Mateo ( ; ) is a city in San Mateo County, California, on the San Francisco Peninsula. About 20 miles (32 km) south of San Francisco, the city borders Burlingame to the north, Hillsborough to the west, San Francisco Bay and Foster C ...

-based Bay View Bank from its Bay View Capital Corporation parent for $429 million. The acquisition was completed in November 2002.

On New Years Day 2003, John Grundhofer retired as chairman of U.S. Bancorp and handed the position to his younger brother Jerry Grundhofer, who added the title of chairman to his other positions of president and chief executive officer in the corporation.

In May 2004, U.S. Bancorp announced that it was acquiring the $34 billion corporate trust bond administration business from National City Corporation

National City Corporation was a regional bank holding company based in Cleveland, Ohio, USA, founded in 1845; it was once one of the ten largest banks in America in terms of deposits, mortgages and home equity lines of credit. Subsidiary Nation ...

.

In October 2004, Richard K. Davis

Richard K. Davis (born 1958) is an American businessman. Since January 2, 2019 Davis has served as the chief executive officer of Make-A-Wish America, having previously served as Executive Chairman and President of U.S. Bancorp.

Biography

Davis ...

was appointed chief operating officer and president of U.S. Bancorp. Jerry Grundhofer had handed over the position of president to Davis while still retaining the titles of chairman and chief executive officer. Davis had been a protege of Grundhofer since their days together at Star Banc Corporation and had assisted in the takeover of Firstar by Star Banc in 1998 and the later acquisition of U.S. Bancorp by Firstar in 2001.

U.S. Bancorp acquired Genpass along with its MoneyPass ATM network subsidiary for an undisclosed amount in May 2005.

In November 2005, U.S. Bancorp announced that it was acquiring the $410 billion corporate trust and institutional custody businesses of Wachovia Corporation for $720 million in cash.

In July 2006, U.S. Bancorp announced that it was acquiring the $123 billion municipal and corporate bond trustee business from SunTrust.

In June 2006, U.S. Bancorp announced the pending acquisition of the Avon, Colorado-based Vail Banks Inc. with its WestStar Bank subsidiary and 23 locations for $98.6 million in cash. The acquisition was completed in September 2006.

In November 2006, U.S. Bancorp announced that it was acquiring the $30 billion municipal bond trustee business from LaSalle Bank.

In November 2006, U.S. Bancorp announced the pending acquisition of the Great Falls, Montana

Great Falls is the third most populous city in the U.S. state of Montana and the county seat of Cascade County. The population was 60,442 according to the 2020 census. The city covers an area of and is the principal city of the Great Falls, M ...

-based United Financial Corporation with its Heritage Bank subsidiary for $71 million in stock. The acquisition was completed in February 2007 and nearly double the branch presence of U.S. Bank in Montana.

In December 2006, Jerry Grundhofer handed over the position of chief executive officer to president Richard Davis while Grundhofer remained chairman until his retirement the following year in December 2007. After Grundhofer retirement in December 2007, Davis added the position of chairman to his other titles of president and chief executive officer.

In March 2008, the U.S. Bancorp announced the pending acquisition of the seven-office Los Angeles-based Mellon 1st Business Bank from the Bank of New York Mellon for an undisclosed amount in cash. The acquisition was completed in June 2008.

On November 14, 2008, the U.S. Treasury invested $6,599,000,000 in preferred stock and warrants in the company via the Emergency Economic Stabilization Act of 2008. Weeks earlier, U.S. Bancorp has entered into acquisition talks with National City Corp.

National City Corporation was a regional bank holding company based in Cleveland, Ohio, USA, founded in 1845; it was once one of the ten largest banks in America in terms of deposits, mortgages and home equity lines of credit. Subsidiary Nation ...

and had made an offer to buy National City until PNC Financial Services

The PNC Financial Services Group, Inc. (stylized as PNC) is an American bank holding company and financial services corporation based in Pittsburgh, Pennsylvania. Its banking subsidiary, PNC Bank, operates in 27 U.S. state, states and the D ...

used its portion of TARP funds to outbid U.S. Bancorp and acquire National City instead. Had National City accepted U.S. Bancorp's offer, U.S. Bancorp would have expanded into Florida, Michigan and Pennsylvania (three states that as of 2021 still don't have a retail presence from U.S. Bancorp), but major divestments would've been made in Midwestern states, especially Ohio.

On November 21, 2008, the company acquired the failed Downey Savings & Loan Association and also the failed Pomona First Federal Bancorp in a transaction facilitated by the Federal Deposit Insurance Corporation for an undisclosed amount. Downey Savings had 170 branch offices in California and five branch offices in Arizona while PFF Bank had 38 branch offices in Southern California.

In April 2009, U.S. Bancorp acquired the assets and deposits of the failed Ketchum, Idaho-based First Bank of Idaho in a transaction facilitated by the FDIC. First Bank of Idaho had seven offices in Idaho and Wyoming, some of which operated under the name First Bank of the Tetons.

On June 17, 2009, the company redeemed the $6.6 billion of preferred stock and on July 15, 2009, it completed the purchase of a warrant held by the U.S. Treasury Department. This effectively concluded U.S. Bancorp's participation in the Capital Purchase Program. It was the first bank to repay the Troubled Asset Relief Program (TARP) funds.

On October 5, 2009, the company announced its acquisition of the $8 billion mutual fund administration and accounting servicing division of Fiduciary Management, Inc. for an undisclosed amount.

On October 7, 2009, the company agreed to buy the bond trustee business of First Citizens Bank, a subsidiary of First Citizens BancShares

First Citizens Bancshares, Inc. is a bank holding company based in Raleigh, North Carolina. Its primary subsidiary is First Citizens Bank. It is on the list of largest banks in the United States.

As of December 31, 2019, the company operated 57 ...

Inc. for an undisclosed amount.

On October 20, 2009, the company completed a transaction to purchase the failed FBOP Corporation's nine subsidiary banks from the FDIC for an undisclosed amount. The banks included BankUSA, National Association with 2 offices in Arizona, Cal National Bank

California National Bank was a consumer and business bank in the Southern California area.

Overview

Cal National Bank originally began in 1996 when FBOP Corporation acquired Torrance Bank. Two years later, FBOP acquired five branches of Topa Savi ...

with 68 offices in California, Citizens National Bank with 1 office in Texas, Community Bank of Lemont with 1 office in Illinois, Madisonville State Bank with 1 office in Texas, North Houston Bank with 1 office in Texas, Pacific National Bank with 17 offices in California, Park National Bank with 31 offices in Illinois, and San Diego National Bank with 28 offices in California.

Since the company did not have a previous presence in Texas nor want one in the near future, the company subsequently sold the three banks in Texas in 2010 to Houston-based Prosperity Bancshares

Prosperity Bancshares, Inc. is a bank holding company headquartered in Houston, Texas with operations in Texas and central Oklahoma. As of December 31, 2019, the company operated 285 branches: 65 in the Houston area, including The Woodlands, Texas ...

for an undisclosed amount. Each of the banks had one office each.

In October 2009, BB&T Corporation (now Truist Financial) announced the pending sale of its Nevada banking operations to U.S. Bancorp for an undisclosed amount. BB&T had just acquired the 21 offices in Nevada through a transaction facilitated by the FDIC for disposal of the assets and deposits of the failed Alabama-based Colonial BancGroup but BB&T had no desire to expand west of Texas while it wanted to keep the other Colonial former locations in the Southeastern United States. The acquisition was completed in January 2010.

In July 2010, U.S. Bancorp sold its FAF Advisors

Nuveen is an American asset manager and wholly owned subsidiary of financial planning firm TIAA, itself known for its legacy focus on managing money for not-for-profit institutions such as universities and their employees. As a consequence of int ...

subsidiary to Nuveen Investments for $80 million and a 9.5% stake in Nuveen.

In 2010, Huntington Bancshares announced it would take over the leases of bank branches inside Giant Eagle locations in Ohio, largely replacing U.S. Bancorp but also replacing branches from FirstMerit Corporation (which itself would be acquired by Huntington in 2016) and Citizens Financial Group; the deal didn't affect Citizens branches inside Giant Eagle locations in Pennsylvania. The deal mostly didn't affect U.S. Bancorp, but it did lead to the withdrawal from the Youngstown, Ohio market since U.S. Bancorp's only branches in the area were inside Giant Eagle locations; the branches had been a holdover from the Firstar days. By 2020, U.S. Bancorp had organically become Ohio's largest bank by deposits despite not having a presence in the Youngstown and Toledo

Toledo most commonly refers to:

* Toledo, Spain, a city in Spain

* Province of Toledo, Spain

* Toledo, Ohio, a city in the United States

Toledo may also refer to:

Places Belize

* Toledo District

* Toledo Settlement

Bolivia

* Toledo, Orur ...

markets and ahead of major banks based in Ohio (Huntington, Fifth Third Bank & KeyBank), PNC Bank, and Chase Bank.

In January 2011, U.S. Bancorp acquired the assets and deposits of the failed First Community Bank of New Mexico in a transaction facilitated by the FDIC for an asset discount of approximately $380 million. The acquisition had included 35 offices in New Mexico and 3 offices in Arizona.

In January 2012, the company acquired the assets and deposits of the failed Knoxville, Tennessee-based BankEast in a transaction facilitated by the FDIC for an asset discount of approximately $67.5 million. The acquisition had included 10 offices in the Knoxville area.

In March 2013, U.S. Bancorp announced that it was acquiring the $57 billion municipal bond trustee business from Deutsche Bank.

In January 2014, U.S. Bancorp announced the pending acquisition of 94 branch offices of the Charter One Bank

Citizens Financial Group, Inc. is an American bank headquartered in Providence, Rhode Island, which operates in the states of Connecticut, Delaware, Florida, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Ohio, Pennsy ...

in Chicago from the RBS Citizens Financial Group for $315 million, doubling its market share in Chicago. 13 Charter One branches were closed due to their close proximity to existing U.S. Bank offices. The acquisition was completed in June 2014.

In January 2015, chief financial officer Andrew Cecere was promoted to chief operating officer. A year later, Cecere was given the additional position of president.

In January 2017, U.S. Bancorp announced that chairman and CEO Richard Davis was going to hand over his CEO position to president and COO Andrew Cecere in April 2017 while remaining as chairman. Davis officially retired from the company in April 2018 and Cecere became chairman, president and CEO.

In February 2018, the bank was charged by the Department of Justice with failing to implement measures preventing illegal activities, including one case of abetting. U.S. Bancorp agreed to pay $613 million in fines and implement measures to improve the monitoring of its customer transactions. In September 2018, $505 million was distributed to customers of an illegal payday loan business whose suspicious activities US Bancorp had failed to report.

In September 2018, Fiserv announced that it would acquire MoneyPass from US Bancorp for $690 million. The deal was finalized in March 2019. The sale did not include Elan's credit card division, which issued some of the most prominent cards including Fidelity, BMW and Mercedes Benz. In December 2019, the bank dismissed Emily James, a Portland, Ore., call-center employee, and her supervisor, after James gave $20 of her own money to Marc Eugenio. On Christmas Eve, Eugenio ran out of gasoline and cash, and he was stranded at a gas station when his U.S. Bank debit card was rejected because funds he had deposited two days earlier had not yet been released into his account. After an unsuccessful attempt to release the funds, James met Eugenio at the gas station during her break and offered him $20 from her own pocket as a Christmas Eve act of kindness. She was fired from her job for violating company policy, but rehired after an investigation prompted by an article from Nicolas Kristof was published in '' The New York Times''.

In May 2020, the US Bancorp Center in downtown Minneapolis was damaged by rioting during the

In May 2020, the US Bancorp Center in downtown Minneapolis was damaged by rioting during the George Floyd protests in Minneapolis–Saint Paul

Local protests over the murder of George Floyd (sometimes called the Minneapolis riots or Minneapolis uprising) began on May 26, 2020, and quickly inspired a global protest movement against police brutality and racial inequality. The initial ...

. Two other bank branch locations on East Lake Street in Minneapolis were destroyed by arson

Arson is the crime of willfully and deliberately setting fire to or charring property. Although the act of arson typically involves buildings, the term can also refer to the intentional burning of other things, such as motor vehicles, wat ...

. US Bancorp rebuilt the damaged branch location at 919 East Lake Street and donated the property at 2800 East Lake Street for redevelopment as an affordable housing project.

On September 21, 2021, U.S. Bancorp agreed to purchase MUFG Union Bank's consumer business for $8 billion. It is the bank's biggest deal since 2001 when it merged with Milwaukee-based Firstar Corp. for $21 billion. The deal with MUFG Union Bank will add $58 billion in loans to U.S. Bancorp's current base of $294 billion and will give U.S. Bancorp a large presence on the U.S. West Coast, especially California. The combined bank will have $723 billion in assets. U.S. regulatory approval for the merger was announced on October 16 of 2022, and was completed as of December 1, 2022. The deal is scheduled to close by the end of 2022.

In May 2022, Bancorp announced a five-year community benefits plan, developed in coordination with the NCRC and the CRC as part of the planned acquisition of MUFG Union Bank. The $100 billion community plan is set over five years and is focusing on supporting equitable access to capital for low- and moderate-income communities and communities of color.

Notable corporate buildings

* U.S. Bank Center in Phoenix, Arizona * U.S. Bank Tower in Sacramento, California * One California in San Francisco, California, sports the U.S. Bank logo and houses bank offices * U.S. Bank Tower in Los Angeles, California, the third tallest building west of the Mississippi River * U.S. Bank Tower in Denver, Colorado * U.S. Bank Plaza in Boise, Idaho *U.S. Bank Building in Chicago, Illinois * U.S. Bank Building inDavenport, Iowa

Davenport is a city in and the county seat of Scott County, Iowa, United States. Located along the Mississippi River on the eastern border of the state, it is the largest of the Quad Cities, a metropolitan area with a population of 384,324 and a ...

*U.S. Bank Building in Duluth, Minnesota

* U.S. Bancorp Center in Minneapolis, Minnesota

Minneapolis () is the largest city in Minnesota, United States, and the county seat of Hennepin County. The city is abundant in water, with thirteen lakes, wetlands, the Mississippi River, creeks and waterfalls. Minneapolis has its origins ...

* U.S. Bank Plaza in Minneapolis, Minnesota

Minneapolis () is the largest city in Minnesota, United States, and the county seat of Hennepin County. The city is abundant in water, with thirteen lakes, wetlands, the Mississippi River, creeks and waterfalls. Minneapolis has its origins ...

*U.S. Bank Center in St. Paul, Minnesota

Saint Paul (abbreviated St. Paul) is the capital of the U.S. state of Minnesota and the county seat of Ramsey County. Situated on high bluffs overlooking a bend in the Mississippi River, Saint Paul is a regional business hub and the center o ...

* One U.S. Bank Plaza in St. Louis, Missouri

*U.S. Bank Building in Billings, Montana

*U.S. Bank Tower in Lincoln, Nebraska

*U.S. Bank Center in Las Vegas, Nevada

*U.S. Bank Tower in Cincinnati, Ohio

*U.S. Bank Centre

U.S. Bank Center, formerly U.S. Bank Centre, is a 44-story skyscraper in Seattle, in the U.S. state of Washington. The building opened as Pacific First Centre and was constructed from 1987 to 1989. At , it is currently the eighth-tallest buildin ...

in Cleveland, Ohio

Cleveland ( ), officially the City of Cleveland, is a city in the U.S. state of Ohio and the county seat of Cuyahoga County. Located in the northeastern part of the state, it is situated along the southern shore of Lake Erie, across the U.S. ...

* U.S. Bancorp Tower in Portland, Oregon

* U.S. Bank Building in Sioux Falls, South Dakota

*U.S. Bank Centre

U.S. Bank Center, formerly U.S. Bank Centre, is a 44-story skyscraper in Seattle, in the U.S. state of Washington. The building opened as Pacific First Centre and was constructed from 1987 to 1989. At , it is currently the eighth-tallest buildin ...

in Seattle, Washington

* U.S. Bank Building in Spokane, Washington

*U.S. Bank Building in La Crosse, Wisconsin

La Crosse is a city in the U.S. state of Wisconsin and the county seat of La Crosse County. Positioned alongside the Mississippi River, La Crosse is the largest city on Wisconsin's western border. La Crosse's population as of the 2020 census w ...

* U.S. Bank Center in Milwaukee, Wisconsin

*U.S. Bank Plaza in Madison, Wisconsin

*U.S. Bank Building in Sheboygan, Wisconsin

Naming rights and sponsorships

U.S. Bank owns corporate naming rights to the following: * U.S. Bank Stadium inMinneapolis, Minnesota

Minneapolis () is the largest city in Minnesota, United States, and the county seat of Hennepin County. The city is abundant in water, with thirteen lakes, wetlands, the Mississippi River, creeks and waterfalls. Minneapolis has its origins ...

U.S. Bank is a sponsor of:

* Denver Broncos – Official Bank of the Denver Broncos.

* Minnesota Twins

The Minnesota Twins are an American professional baseball team based in Minneapolis. The Twins compete in Major League Baseball (MLB) as a member club of the American League (AL) Central Division. The team is named after the Twin Cities area w ...

– Official Bank of the Minnesota Twins.

* Minnesota Timberwolves – Official Partner of the Minnesota Timberwolves.

* Minnesota Vikings – Official Bank of the Minnesota Vikings.

* Kansas City Royals

The Kansas City Royals are an American professional baseball team based in Kansas City, Missouri. The Royals compete in Major League Baseball (MLB) as a member club of the American League (AL) Central division. The team was founded as an expans ...

– Official Partner of the Kansas City Royals.

* San Diego Padres – Official Partner of the San Diego Padres.

* San Francisco 49ers – Official Bank of the San Francisco 49ers.

* Utah Jazz – Official Bank of the Utah Jazz.

* NHL – Official Partner of the NHL.

* University of Wisconsin–Stevens Point Pointers – Official Partner of the University of Wisconsin-Stevens Point Pointers.

* San Diego State University – Official Partner of the San Diego State University.

See also

*John F. Grundhofer

John F. Grundhofer (January 1, 1939 – January 24, 2021) was a director of Donaldson Company, Securian Financial Group Inc., and BJ's Restaurant & Brewery. He served as Chairman (1990–1997 and 1999–2002), Chief Executive Officer (1990–2001) ...

* Richard K. Davis

Richard K. Davis (born 1958) is an American businessman. Since January 2, 2019 Davis has served as the chief executive officer of Make-A-Wish America, having previously served as Executive Chairman and President of U.S. Bancorp.

Biography

Davis ...

References

External links

*Map of Locations

{{Online brokerages Banks based in Minnesota Minneapolis American companies established in 1891 Banks established in 1891 Economy of the Midwestern United States Economy of the Northeastern United States Economy of the Northwestern United States Economy of the Southeastern United States Economy of the Southwestern United States Companies listed on the New York Stock Exchange Companies based in Minneapolis 1891 establishments in Oregon Online brokerages Primary dealers Subprime mortgage lenders Systemically important financial institutions Investment banks in the United States Mortgage lenders of the United States Rogue trading banks Subprime mortgage crisis