The Bank of America Corporation (often abbreviated BofA or BoA) is an American multinational

investment bank and

financial services

Financial services are the Service (economics), economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, acco ...

holding company headquartered at the

Bank of America Corporate Center in

Charlotte, North Carolina. The bank was founded in

San Francisco. It is the

second-largest banking institution in the

United States, after

JPMorgan Chase, and the second largest bank in the world by market capitalization. Bank of America is one of the

Big Four Big Four or Big 4 may refer to:

Groups of companies

* Big Four accounting firms: Deloitte, Ernst & Young, KPMG, PwC

* Big Four (airlines) in the U.S. in the 20th century: American, Eastern, TWA, United

* Big Four (banking), several groupings ...

banking institutions of the United States. It serves approximately 10.73% of all American bank deposits, in direct competition with JPMorgan Chase,

Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking ...

, and

Wells Fargo. Its primary financial services revolve around

commercial banking,

wealth management, and investment banking.

One branch of its history stretches back to the U.S.-based

Bank of Italy, founded by

Amadeo Pietro Giannini in 1904, which provided various banking options to

Italian immigrants

The Italian diaspora is the large-scale emigration of Italians from Italy.

There were two major Italian diasporas in Italian history. The first diaspora began around 1880, two decades after the Risorgimento, Unification of Italy, and ended in the ...

who

faced service discrimination.

Originally headquartered in

San Francisco, California, Giannini acquired

Banca d'America e d'Italia

Deutsche Bank S.p.A. is an Italian bank based in Milan, Lombardy. It is a subsidiary of Deutsche Bank A.G..

History

Banca dell'Italia Meridionale was found in 1917. It was acquired by Amadeo Giannini, the founder of Bank of Italy (United States) i ...

(Bank of America and

Italy) in 1922. The passage of landmark federal banking legislation facilitated a rapid growth in the 1950s, quickly establishing a prominent market share. After suffering a significant loss after the

1998 Russian bond default, BankAmerica, as it was then known, was acquired by the Charlotte-based

NationsBank for

US$

The United States dollar (symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official ...

62 billion. Following what was then the

largest bank acquisition in history, the Bank of America Corporation was founded. Through a series of mergers and acquisitions, it built upon its commercial banking business by establishing

Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment bank ...

for wealth management and

Bank of America Merrill Lynch

BofA Securities, Inc., previously Bank of America Merrill Lynch (BAML), is an American multinational investment banking division under the auspices of Bank of America. It is not to be confused with Merrill, the stock brokerage and trading plat ...

for investment banking in 2008 and 2009, respectively (since renamed BofA Securities).

[Cohan, William D. (September 2009), "An offer he couldn't refuse", '' The Atlantic'']

Both Bank of America and Merrill Lynch Wealth Management retain large market shares in their respective offerings. The

investment bank is considered within the "

Bulge Bracket" as the

third largest investment bank in the world, . Its wealth management side manages

US$

The United States dollar (symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official ...

1.081 trillion in

assets under management (AUM) as the

second largest wealth manager in the world, after

UBS

UBS Group AG is a multinational Investment banking, investment bank and financial services company founded and based in Switzerland. Co-headquartered in the cities of Zürich and Basel, it maintains a presence in all major financial centres ...

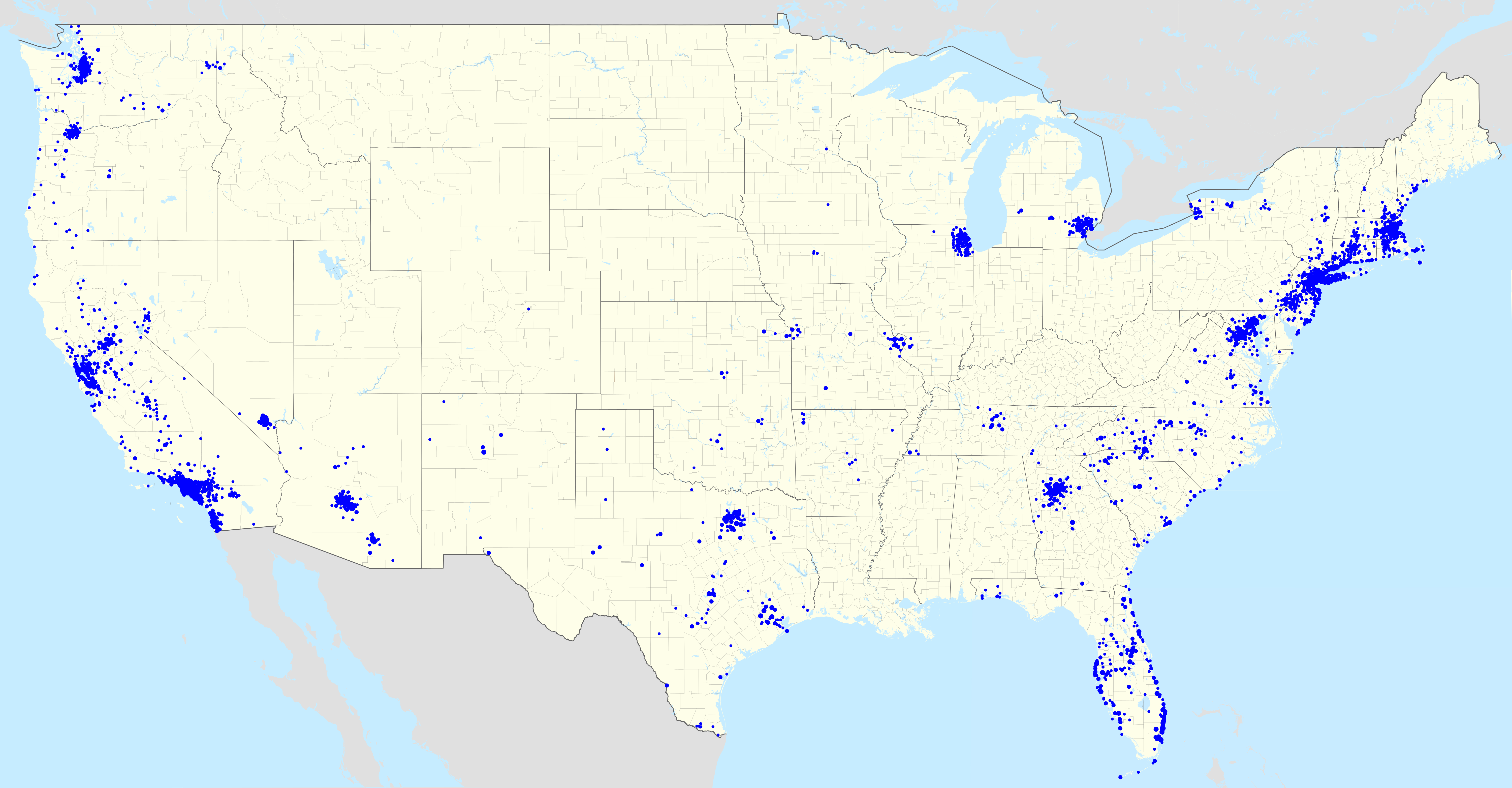

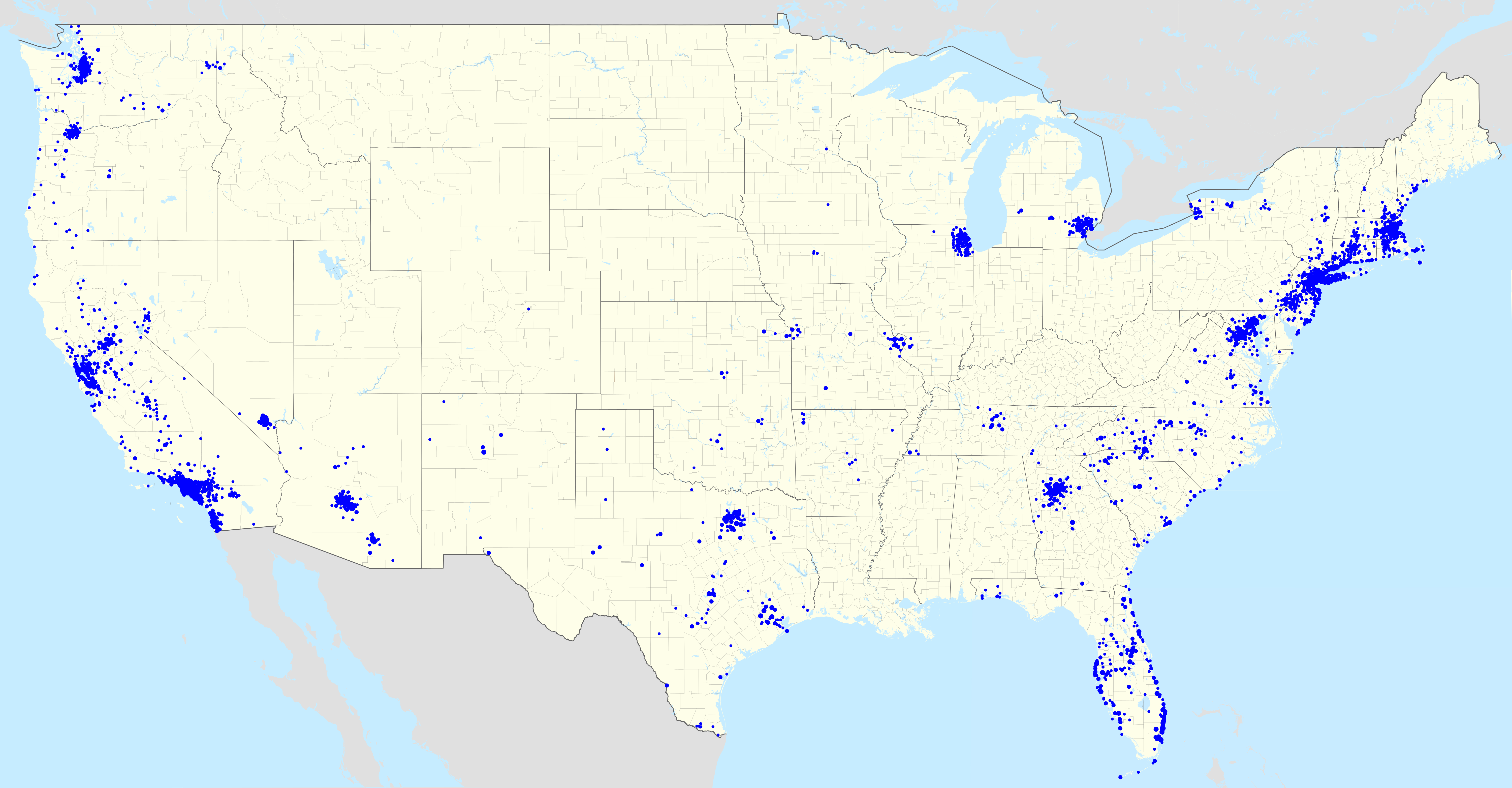

. In commercial banking, Bank of America operates—but does not necessarily maintain—retail branches in all 50 states of the United States, the

District of Columbia and more than 40 other countries. Its commercial banking footprint encapsulates 46 million consumer and small business relationships at 4,600 banking centers and 15,900

automated teller machines (ATMs).

The bank's large market share, business activities, and economic impact has led to numerous lawsuits and investigations regarding both mortgages and financial disclosures dating back to the

2008 financial crisis

8 (eight) is the natural number following 7 and preceding 9.

In mathematics

8 is:

* a composite number, its proper divisors being , , and . It is twice 4 or four times 2.

* a power of two, being 2 (two cubed), and is the first number of t ...

. Its corporate practices of servicing the

middle class and wider banking community has yielded a substantial market share since the early 20th century. , Bank of America has a $313.5 billion

market capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Market capitalization is equal to the market price per common share multiplied by t ...

, making it the

13th largest company in the world. As the sixth largest American public company, it garnered $102.98 billion in sales . Bank of America was ranked #25 on the 2020

Fortune 500

The ''Fortune'' 500 is an annual list compiled and published by ''Fortune'' magazine that ranks 500 of the largest United States corporations by total revenue for their respective fiscal years. The list includes publicly held companies, along ...

rankings of the largest US corporations by total revenue. Likewise, Bank of America was also ranked #8 on the 2020 Global 2000 rankings done by Forbes. Bank of America was named the "World's Best Bank" by the ''

Euromoney Institutional Investor

Euromoney Institutional Investor PLC is one of Europe's largest business and financial information companies which has interests in business and financial publishing and event organization. It was listed on the London Stock Exchange and was a c ...

'' in their 2018 Awards for Excellence.

History

The Bank of America name first appeared in 1923, with the formation of

Bank of America, Los Angeles. In 1928, it was acquired by

Bank of Italy of San Francisco, which took the Bank of America name two years later.

The eastern portion of the Bank of America franchise can be traced to 1784, when

Massachusetts Bank

BankBoston was a bank based in Boston, Massachusetts, which was created by the 1996 merger of Bank of Boston and BayBank. One of its predecessor banks started in 1784, but the merged BankBoston was short-lived, being acquired by Fleet Bank in 199 ...

was chartered, the first federally chartered joint-stock owned bank in the United States and only the second bank to receive a charter in the United States. This bank became

FleetBoston, with which Bank of America merged in 2004. In 1874,

Commercial National Bank was founded in Charlotte. That bank merged with American Trust Company in 1958 to form American Commercial Bank. Two years later it became

North Carolina National Bank when it merged with Security National Bank of Greensboro. In 1991, it merged with

C&S/

Sovran Corporation of

Atlanta and

Norfolk to form

NationsBank.

The central portion of the franchise dates to 1910, when Commercial National Bank and Continental National Bank of Chicago merged in 1910 to form Continental & Commercial National Bank, which evolved into

Continental Illinois National Bank & Trust

Continental may refer to:

Places

* Continent, the major landmasses of Earth

* Continental, Arizona, a small community in Pima County, Arizona, US

* Continental, Ohio, a small town in Putnam County, US

Arts and entertainment

* ''Continental'' (a ...

.

Bank of Italy

The history of Bank of America dates back to October 17, 1904, when

Amadeo Pietro Giannini founded the

Bank of Italy in San Francisco.

In 1922, Bank of America, Los Angeles was established with Giannini as a minority investor. The two banks merged in 1928 and consolidated with other bank holdings to create what would become the largest banking institution in the country.

In 1918, another corporation, Bancitaly Corporation, was organized by A. P. Giannini, the largest stockholder of which was Stockholders Auxiliary Corporation. This company acquired the stocks of various banks located in New York City and certain foreign countries.

In 1928, Giannini merged his bank with

Bank of America, Los Angeles, headed by

Orra E. Monnette Orra Eugene Monnette (1873–1936) was an attorney, author and banker. Monnette was also the founder of the Bank of America, L.A.

Early life

Orra E. Monnette was born in southern Crawford County, Ohio to Mervin J. Monnette and Olive Hull Monnette. ...

. Bank of Italy was renamed on November 3, 1930, to

Bank of America National Trust and Savings Association, which was the only such designated bank in the United States at that time. Giannini and Monnette headed the resulting company, serving as co-chairs.

Expansion in California

Giannini introduced branch banking shortly after 1909 legislation in California allowed for branch banking in the state, establishing the bank's first branch outside San Francisco in 1909 in San Jose. By 1929 the bank had 453 banking offices in California with aggregate resources of over US$1.4 billion. There is a replica of the 1909 Bank of Italy branch bank in

History Park

History Park at Kelley Park in San Jose, California, USA is designed as an indoor/outdoor museum, arranged to appear as a small US town might have in the early 1900s (decade). Since its inauguration in 1971, 32 historic buildings and other landmark ...

in San Jose, and the 1925

Bank of Italy Building Bank of Italy is the Bank of Italy or Banca d'Italia, the central bank of Italy.

Or it may refer to:

* Bank of Italy (United States), a bank established in San Francisco, California and the forerunner of the Bank of America.

Or Bank of Italy or B ...

is an important

downtown

''Downtown'' is a term primarily used in North America by English speakers to refer to a city's sometimes commercial, cultural and often the historical, political and geographic heart. It is often synonymous with its central business distric ...

landmark. Giannini sought to build a national bank, expanding into most of the western states as well as into the

insurance industry, under the aegis of his holding company,

Transamerica Corporation. In 1953 regulators succeeded in forcing the separation of

Transamerica Corporation and Bank of America under the

Clayton Antitrust Act. The passage of the

Bank Holding Company Act of 1956

The Bank Holding Company Act of 1956 (, ''et seq.'') is a United States Act of Congress that regulates the actions of bank holding companies.

The original law (subsequently amended), specified that the Federal Reserve Board of Governors must appr ...

prohibited banks from owning

non-banking subsidiaries such as insurance companies. Bank of America and Transamerica were separated, with the latter company continuing in the insurance sector. However, federal banking regulators prohibited Bank of America's interstate banking activity, and Bank of America's domestic banks outside California were forced into a separate company that eventually became

First Interstate Bancorp, later acquired by

Wells Fargo and Company

Wells Fargo & Company is an American multinational financial services company with corporate headquarters in San Francisco, California; operational headquarters in Manhattan; and managerial offices throughout the United States and intern ...

in 1996. Only in the 1980s, with a change in federal banking legislation and regulation, could Bank of America again expand its domestic consumer banking activity outside California.

New technologies also allowed the direct linking of

credit cards with individual bank accounts. In 1958, the bank introduced the BankAmericard, which changed its name to

Visa in 1977.

A coalition of regional bankcard associations introduced Interbank in 1966 to compete with BankAmericard. Interbank became Master Charge in 1966 and then

MasterCard in 1979.

[ Available through SpringerLink.]

Expansion outside California

Following the passage of the

Bank Holding Company Act of 1956

The Bank Holding Company Act of 1956 (, ''et seq.'') is a United States Act of Congress that regulates the actions of bank holding companies.

The original law (subsequently amended), specified that the Federal Reserve Board of Governors must appr ...

by the US Congress, BankAmerica Corporation was established for the purpose of owning and operating Bank of America and its subsidiaries.

Bank of America expanded outside

California in 1983, with its acquisition, orchestrated in part by

Stephen McLin Stephen McLin (born November 11, 1946, St. Louis), son of Leonard Dale and Hazel (Goodlett) McLin was a longtime executive in the banking industry who came to the industry from an engineering, rather than a finance background.

McLin, the oldest of ...

, of

Seafirst Corporation

Seafirst Corporation was an American bank holding company based in Seattle, Washington. Its banking subsidiary, Seafirst Bank, was the largest bank in Washington, with 235 branches and 497 ATMs across the state.

Formed in 1929 via the merger ...

of

Seattle,

Washington, and its wholly owned banking subsidiary, Seattle-First National Bank.

Seafirst was at risk of seizure by the federal government after becoming insolvent due to a series of bad loans to the

oil industry. BankAmerica continued to operate its new subsidiary as Seafirst rather than Bank of America until the 1998 merger with NationsBank.

BankAmerica experienced huge losses in 1986 and 1987 due to the placement of a series of bad loans in the

Third World, particularly in

Latin America. The company fired its CEO,

Sam Armacost in 1986. Though Armacost blamed the problems on his predecessor,

A.W. (Tom) Clausen, Clausen was appointed to replace Armacost. The losses resulted in a huge decline of BankAmerica stock, making it vulnerable to a hostile

takeover.

First Interstate Bancorp of Los Angeles (which had originated from banks once owned by BankAmerica), launched such a bid in the fall of 1986, although BankAmerica rebuffed it, mostly by selling operations. It sold its FinanceAmerica subsidiary to

Chrysler

Stellantis North America (officially FCA US and formerly Chrysler ()) is one of the " Big Three" automobile manufacturers in the United States, headquartered in Auburn Hills, Michigan. It is the American subsidiary of the multinational automoti ...

and the brokerage firm

Charles Schwab and Co. back to

Mr. Schwab. It also sold

Bank of America and Italy to

Deutsche Bank. By the time of the

1987 stock-market crash, BankAmerica's share price had fallen to $8, but by 1992 it had rebounded mightily to become one of the biggest gainers of that half-decade.

BankAmerica's next big acquisition came in 1992. The company acquired Security Pacific Corporation and its subsidiary

Security Pacific National Bank in California and other banks in

Arizona,

Idaho,

Oregon, and

Washington, which Security Pacific had acquired in a series of acquisitions in the late 1980s. This represented, at the time, the largest bank acquisition in history. Federal regulators, however, forced the sale of roughly half of Security Pacific's

Washington subsidiary, the former

Rainier Bank

Rainier Bancorporation was the Seattle-based parent corporation of Rainier National Bank, a Washington state bank with branches throughout the state. Rainier traced its roots back to the National Bank of Commerce, which was founded by Richard Ho ...

, as the combination of Seafirst and Security Pacific Washington would have given BankAmerica too large a share of the market in that state. The Washington branches were divided and sold to West One Bancorp (now

U.S. Bancorp

U.S. Bancorp (stylized as us bancorp) is an American bank holding company based in Minneapolis, Minnesota, and incorporated in Delaware. It is the parent company of U.S. Bank National Association, and is the fifth largest banking institution i ...

) and

KeyBank

KeyBank, the primary subsidiary of KeyCorp, is a regional bank headquartered in Cleveland, Ohio, and is the only major bank based in Cleveland. KeyBank is one of the largest banks in the United States.

Key's customer base spans retail, small b ...

. Later that year, BankAmerica expanded into Nevada by acquiring Valley Bank of Nevada.

In 1994 BankAmerica acquired the

Continental Illinois National Bank and Trust Co.

The Continental Illinois National Bank and Trust Company was at one time the seventh-largest commercial bank in the United States as measured by deposits, with approximately $40 billion in assets. In 1984, Continental Illinois became the largest ...

of Chicago. At the time, no bank possessed the resources to bail out Continental, so the federal government operated the bank for nearly a decade.

Illinois then regulated branch banking extremely heavily, so Bank of America Illinois was a single-unit bank until the 21st century. BankAmerica moved its national lending department to Chicago in an effort to establish a financial beachhead in the region.

These mergers helped BankAmerica Corporation to once again become the largest U.S. bank holding company in terms of deposits, but the company fell to second place in 1997 behind North Carolina's fast-growing

NationsBank Corporation

NationsBank was one of the largest banking corporations in the United States, based in Charlotte, North Carolina. The company named NationsBank was formed through the merger of several other banks in 1991, and prior to that had been through mul ...

, and to third in 1998 behind

First Union Corp.

On the capital markets side, the acquisition of Continental Illinois helped BankAmerica to build a leveraged finance origination- and distribution business, which allowed the firm's existing broker-dealer, BancAmerica Securities (originally named BA Securities), to become a full-service franchise. In addition, in 1997, BankAmerica acquired

Robertson Stephens

Robertson Stephens is a wealth management firm serving high net worth individuals and family offices. The firm is registered with the United States Securities and Exchange Commission as an investment advisor.

Robertson Stephens was founded as ...

, a San Francisco–based investment bank specializing in high technology for $540 million. Robertson Stephens was integrated into BancAmerica Securities, and the combined subsidiary was renamed "BancAmerica Robertson Stephens".

Merger of NationsBank and BankAmerica

In 1997, BankAmerica lent

hedge fund D. E. Shaw & Co. $1.4 billion in order to run various businesses for the bank. However, D.E. Shaw suffered significant loss after the

1998 Russia bond default.

NationsBank of Charlotte acquired BankAmerica in October 1998 in what was the largest bank acquisition in history at that time.

While NationsBank was the nominal survivor, the merged bank took the better-known name of Bank of America. Hence, the holding company was renamed Bank of America Corporation, while NationsBank, N.A. merged with Bank of America NT&SA to form Bank of America, N.A. as the remaining legal bank entity. The combined bank operates under Federal Charter 13044, which was granted to Giannini's Bank of Italy on March 1, 1927. However, the merged company was and still is headquartered in Charlotte, and retains NationsBank's pre-1998 stock price history. All

U.S. Securities and Exchange Commission (SEC) filings before 1998 are listed under NationsBank, not Bank of America. NationsBank president, chairman, and CEO

Hugh McColl, took on the same roles with the merged company.

In 1998, Bank of America possessed combined assets of $570 billion, as well as 4,800 branches in 22 states. Despite the size of the two companies, federal regulators insisted only upon the divestiture of 13 branches in

New Mexico, in towns that would be left with only a single bank following the combination. The broker-dealer, NationsBanc Montgomery Securities, was named

Banc of America Securities

In the English language, banq and banc are coined words pronounced identically to the word "bank". Both terms have been adopted by financial services companies and others to satisfy legal restrictions on the usage of the word ''bank''. The compo ...

in 1998.

2001 to present

In 2001, McColl stepped down and named

Ken Lewis as his successor.

In 2004, Bank of America announced it would purchase Boston-based bank

FleetBoston Financial for $47 billion in cash and stock.

By merging with Bank of America, all of its banks and branches were given the Bank of America logo. At the time of merger, FleetBoston was the seventh largest bank in United States with $197 billion in assets, over 20 million customers and revenue of $12 billion.

Hundreds of FleetBoston workers lost their jobs or were demoted, according to ''

The Boston Globe''.

On June 30, 2005, Bank of America announced it would purchase credit card giant

MBNA for $35 billion in cash and stock. The

Federal Reserve Board gave final approval to the merger on December 15, 2005, and the merger closed on January 1, 2006. The acquisition of MBNA provided Bank of America a leading domestic and foreign credit card issuer. The combined Bank of America Card Services organization, including the former MBNA, had more than 40 million U.S. accounts and nearly $140 billion in outstanding balances. Under Bank of America, the operation was renamed FIA Card Services.

Bank of America operated under the name BankBoston in many other Latin American countries, including Brazil. In May 2006, Bank of America and

Banco Itaú

Banco Itaú S.A. was a former Brazilian bank that merged with Unibanco on November 4, 2008, to form Banco Itaú Unibanco.

History

Banco Itaú began in 1945 under the name ''Banco Central de Crédito'' (Central Bank of Credit) and later changed ...

(Investimentos Itaú S.A.) entered into an acquisition agreement, through which Itaú agreed to acquire BankBoston's operations in Brazil, and was granted an exclusive right to purchase Bank of America's operations in

Chile and

Uruguay, in exchange for Itaú shares. The deal was signed in August 2006.

Prior to the transaction, BankBoston's Brazilian operations included asset management, private banking, a credit card portfolio, and small, middle-market, and large corporate segments. It had 66 branches and 203,000 clients in Brazil. BankBoston in Chile had 44 branches and 58,000 clients and in Uruguay, it had 15 branches. In addition, there was a credit card company, OCA, in Uruguay, which had 23 branches. BankBoston N.A. in Uruguay, together with OCA, jointly served 372,000 clients. While the BankBoston name and trademarks were not part of the transaction, as part of the sale agreement, they cannot be used by Bank of America in Brazil, Chile or Uruguay following the transactions. Hence, the BankBoston name has disappeared from Brazil, Chile and Uruguay. The Itaú stock received by Bank of America in the transactions has allowed Bank of America's stake in Itaú to reach 11.51%. Banco de Boston de Brazil had been founded in 1947.

On November 20, 2006, Bank of America announced the purchase of

The United States Trust Company

Bank of America Private Bank (formerly U.S. Trust) was founded in 1853 as the United States Trust Company of New York. It operated independently until 2000, when it was acquired by Charles Schwab, and Co. and subsequently sold to, and became a ...

for $3.3 billion, from the

Charles Schwab Corporation. US Trust had about $100 billion of

assets under management and over 150 years of experience. The deal closed July 1, 2007.

On September 14, 2007, Bank of America won approval from the Federal Reserve to acquire

LaSalle Bank Corporation

LaSalle Bank Corporation was the holding company for LaSalle Bank N.A. and LaSalle Bank Midwest N.A. (formerly Standard Federal Bank). With US$116 billion in assets, it was headquartered at 135 South LaSalle Street in Chicago, Illinois. LaS ...

from

ABN AMRO for $21 billion. With this purchase, Bank of America possessed $1.7 trillion in assets. A Dutch court blocked the sale until it was later approved in July. The acquisition was completed on October 1, 2007. Many of LaSalle's branches and offices had already taken over smaller regional banks within the previous decade, such as Lansing and Detroit-based

Michigan National Bank

Michigan National Bank was a bank founded in Lansing, Michigan, which was established on 31 December 1940 when Howard J Stoddard consolidated six Michigan banks: First National Bank and Trust Company of Grand Rapids, First National Trust and S ...

. The acquisition also included the

Chicago Marathon event, which ABN AMRO acquired in 1996. Bank of America took over the event starting with the 2007 race.

The deal increased Bank of America's presence in

Illinois,

Michigan, and

Indiana by 411 branches, 17,000 commercial bank clients, 1.4 million retail customers, and 1,500 ATMs. Bank of America became the largest bank in the Chicago market with 197 offices and 14% of the deposit share, surpassing

JPMorgan Chase.

LaSalle Bank and

LaSalle Bank Midwest

Standard Federal Bank was a Troy, Michigan-based bank serving Michigan and Northern Indiana in the United States which was acquired by Bank of America on 5 May 2008.

In 2005, Standard Federal was the largest bank in Michigan based on number of re ...

branches adopted the Bank of America name on May 5, 2008.

Ken Lewis, who had lost the title of chairman of the board, announced that he would retire as CEO effective December 31, 2009, in part due to controversy and legal investigations concerning the purchase of Merrill Lynch.

Brian Moynihan

Brian Thomas Moynihan (born October 9, 1959) is an American investment banker, businessman and the chairman and CEO of Bank of America. He joined the board of directors, following his promotion to president and CEO in 2010.

Early life and educat ...

became president and CEO effective January 1, 2010, and afterward credit card charge offs and delinquencies declined in January. Bank of America also repaid the $45 billion it had received from the Troubled Assets Relief Program.

Acquisition of Countrywide Financial

On August 23, 2007, the company announced a $2 billion

repurchase agreement for

Countrywide Financial. This purchase of

preferred stock was arranged to provide a

return on investment of 7.25% ''

per annum'' and provided the option to purchase

common stock at a price of $18 per share.

On January 11, 2008, Bank of America announced that it would buy Countrywide Financial for $4.1 billion. In March 2008, it was reported that the

Federal Bureau of Investigation

The Federal Bureau of Investigation (FBI) is the domestic intelligence and security service of the United States and its principal federal law enforcement agency. Operating under the jurisdiction of the United States Department of Justice, t ...

(FBI) was investigating Countrywide for possible fraud relating to home loans and mortgages. This news did not hinder the acquisition, which was completed in July 2008, giving the bank a substantial market share of the mortgage business, and access to Countrywide's resources for servicing mortgages. The acquisition was seen as preventing a potential bankruptcy for Countrywide. Countrywide, however, denied that it was close to bankruptcy. Countrywide provided mortgage servicing for nine million mortgages valued at $1.4 trillion as of December 31, 2007.

This purchase made Bank of America Corporation the leading mortgage originator and servicer in the U.S., controlling 20–25% of the home loan market. The deal was structured to merge Countrywide with the Red Oak Merger Corporation, which Bank of America created as an independent subsidiary. It has been suggested that the deal was structured this way to prevent a potential bankruptcy stemming from large losses in Countrywide hurting the parent organization by keeping Countrywide

bankruptcy remote

A bankruptcy remote company is a company within a corporate group whose bankruptcy has as little economic impact as possible on other entities within the group. A bankruptcy remote company is often a single-purpose entity, and frequently deployed ...

. Countrywide Financial has changed its name to

Bank of America Home Loans

Bank of America Home Loans is the mortgage unit of Bank of America. In 2008, Bank of America purchased the failing Countrywide Financial for $4.1 billion. In 2006, Countrywide financed 20% of all mortgages in the United States, at a value of abou ...

.

In December 2011, the

Justice Department

A justice ministry, ministry of justice, or department of justice is a ministry or other government agency in charge of the administration of justice. The ministry or department is often headed by a minister of justice (minister for justice in a ...

announced a $335 million

settlement

Settlement may refer to:

*Human settlement, a community where people live

*Settlement (structural), the distortion or disruption of parts of a building

*Closing (real estate), the final step in executing a real estate transaction

*Settlement (fina ...

with Bank of America over discriminatory lending practice at Countrywide Financial.

Attorney General

In most common law jurisdictions, the attorney general or attorney-general (sometimes abbreviated AG or Atty.-Gen) is the main legal advisor to the government. The plural is attorneys general.

In some jurisdictions, attorneys general also have exec ...

Eric Holder said a federal probe found

discrimination

Discrimination is the act of making unjustified distinctions between people based on the groups, classes, or other categories to which they belong or are perceived to belong. People may be discriminated on the basis of race, gender, age, relig ...

against qualified African-American and Latino borrowers from 2004 to 2008. He said that minority borrowers who qualified for

prime loans were steered into higher-interest-rate

subprime loans

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subpr ...

.

Acquisition of Merrill Lynch

On September 14, 2008, Bank of America announced its intention to purchase

Merrill Lynch & Co., Inc. in an all-stock deal worth approximately $50 billion. Merrill Lynch was at the time within days of collapse, and the acquisition effectively saved Merrill from bankruptcy. Around the same time Bank of America was reportedly also in talks to purchase

Lehman Brothers, however a lack of government guarantees caused the bank to abandon talks with Lehman. Lehman Brothers filed for bankruptcy the same day Bank of America announced its plans to acquire Merrill Lynch. This acquisition made Bank of America the largest

financial services

Financial services are the Service (economics), economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, acco ...

company in the world.

Temasek Holdings, the largest shareholder of Merrill Lynch & Co., Inc., briefly became one of the largest shareholders of Bank of America, with a 3% stake. However, taking a loss

Reuters estimated at $3 billion, the

Singapore sovereign wealth fund sold its whole stake in Bank of America in the first quarter of 2009.

Shareholders of both companies approved the acquisition on December 5, 2008, and the deal closed January 1, 2009. Bank of America had planned to retain various members of the then Merrill Lynch's CEO,

John Thain

John Alexander Thain (born May 26, 1955) is an American businessman, investment banker, and former chair and CEO of the CIT Group.

Thain was the last chairman and chief executive officer of Merrill Lynch before its merger with Bank of America. ...

's management team after the merger. However, after Thain was removed from his position, most of his allies left. The departure of

Nelson Chai

Nelson Joosuk Chai (born 1965) is an American investment banker and financial executive. He formerly served as the chief financial officer of American financial services company Merrill Lynch and briefly as Bank of America's president for the Asi ...

, who had been named Asia-Pacific president, left just one of Thain's hires in place: Tom Montag, head of sales and trading.

The bank, in its January 16, 2009, earnings release, revealed massive losses at Merrill Lynch in the fourth quarter, which necessitated an infusion of money that had previously been negotiated with the government as part of the government-persuaded deal for the bank to acquire Merrill. Merrill recorded an operating loss of $21.5 billion in the quarter, mainly in its sales and trading operations, led by Tom Montag. The bank also disclosed it tried to abandon the deal in December after the extent of Merrill's trading losses surfaced, but was compelled to complete the merger by the U.S. government. The bank's stock price sank to $7.18, its lowest level in 17 years, after announcing earnings and the Merrill mishap. The market capitalization of Bank of America, including Merrill Lynch, was then $45 billion, less than the $50 billion it offered for Merrill just four months earlier, and down $108 billion from the merger announcement.

Bank of America CEO Kenneth Lewis testified before Congress

that he had some misgivings about the acquisition of Merrill Lynch and that federal official pressured him to proceed with the deal or face losing his job and endangering the bank's relationship with federal regulators.

Lewis's statement is backed up by internal emails subpoenaed by Republican lawmakers on the House Oversight Committee. In one of the emails, Richmond Federal Reserve President

Jeffrey Lacker

Jeffrey M. Lacker (born September 27, 1955) is an American economist and was president of the Federal Reserve Bank of Richmond until April 4, 2017. He is now a Distinguished Professor in thDepartment of Economicsat the Virginia Commonwealth Unive ...

threatened that if the acquisition did not go through, and later Bank of America were forced to request federal assistance, the management of Bank of America would be "gone". Other emails, read by Congressman

Dennis Kucinich

Dennis John Kucinich (; born October 8, 1946) is an American politician. A U.S. Representative from Ohio from 1997 to 2013, he was also a candidate for the Democratic nomination for president of the United States in 2004 and 2008. He ran for ...

during the course of Lewis' testimony, state that Mr. Lewis had foreseen the outrage from his shareholders that the purchase of Merrill would cause, and asked government regulators to issue a letter stating that the government had ordered him to complete the deal to acquire Merrill. Lewis, for his part, states he didn't recall requesting such a letter.

The acquisition made Bank of America the number one

underwriter of global

high-yield debt, the third largest underwriter of global equity and the ninth largest adviser on global mergers and acquisitions. As the credit crisis eased, losses at Merrill Lynch subsided, and the subsidiary generated $3.7 billion of Bank of America's $4.2 billion in profit by the end of quarter one in 2009, and over 25% in quarter 3 2009.

On September 28, 2012, Bank of America settled the class-action lawsuit over the Merrill Lynch acquisition and will pay $2.43 billion. This was one of the first major securities class action lawsuits stemming from the financial crisis of 2007–2008 to settle. Many major financial institutions had a stake in this lawsuit, including

Chicago Clearing Corporation

Chicago Clearing Corporation (CCC) is a securities class action settlement claim filing service based in Chicago, Illinois. Started in 1993 to buy and sell coupons issued at the end of class action settlements, the company now employs more than 2 ...

,

hedge funds, and bank trusts, due to the belief that Bank of America stock was a sure investment.

Federal Troubled Asset Relief Program

On January 16, 2009, Bank of America received $20 billion and a guarantee of $118 billion in potential losses from the U.S. government through the

Troubled Asset Relief Program (TARP). This was in addition to the $25 billion given to the bank in the fall of 2008 through TARP. The additional payment was part of a deal with the U.S. government to preserve Bank of America's merger with

Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment bank ...

. Since then, members of the U.S. Congress have expressed considerable concern about how this money has been spent, especially since some of the recipients have been accused of misusing the bailout money. Then CEO

Ken Lewis was quoted as claiming "We are still lending, and we are lending far more because of the TARP program." Members of the U.S. House of Representatives, however, were skeptical and quoted many anecdotes about loan applicants (particularly small business owners) being denied loans and credit card holders facing stiffer terms on the debt in their card accounts.

According to an article in ''

The New York Times'' published on March 15, 2009, Bank of America received an additional $5.2 billion in government bailout money via the bailout of

American International Group.

As a result of its federal bailout and management problems, ''

The Wall Street Journal'' reported that the Bank of America was operating under a secret "memorandum of understanding" (MOU) from the U.S. government that requires it to "overhaul its board and address perceived problems with risk and liquidity management". With the federal action, the institution has taken several steps, including arranging for six of its

directors to resign and forming a Regulatory Impact Office. Bank of America faces several deadlines in July and August and if not met, could face harsher penalties by federal regulators. Bank of America did not respond to ''The Wall Street Journal'' story.

On December 2, 2009, Bank of America announced it would repay the entire $45 billion it received in TARP and exit the program, using $26.2 billion of excess liquidity along with $18.6 billion to be gained in "common equivalent securities" (

Tier 1 capital). The bank announced it had completed the repayment on December 9. Bank of America's

Ken Lewis said during the announcement, "We appreciate the critical role that the U.S. government played last fall in helping to stabilize financial markets, and we are pleased to be able to fully repay the investment, with interest.... As America's largest bank, we have a responsibility to make good on the taxpayers' investment, and our record shows that we have been able to fulfill that commitment while continuing to lend."

Bonus settlement

On August 3, 2009, Bank of America agreed to pay a $33 million fine, without admission or denial of charges, to the

U.S. Securities and Exchange Commission (SEC) over the non-disclosure of an agreement to pay up to $5.8 billion of bonuses at Merrill. The bank approved the bonuses before the merger but did not disclose them to its shareholders when the shareholders were considering approving the Merrill acquisition, in December 2008. The issue was originally investigated by

New York Attorney General Andrew Cuomo, who commented after the suit and announced a settlement that "the timing of the bonuses, as well as the disclosures relating to them, constituted a 'surprising fit of corporate irresponsibility and "our investigation of these and other matters pursuant to New York's

Martin Act will continue." Congressman Kucinich commented at the same time that "This may not be the last fine that Bank of America pays for how it handled its merger of Merrill Lynch." A federal judge,

Jed Rakoff

Jed Saul Rakoff (born August 1, 1943) is a Senior United States district judge of the United States District Court for the Southern District of New York.

Education

Rakoff was born in Philadelphia, Pennsylvania on August 1, 1943. He grew up in ...

, in an unusual action, refused to approve the settlement on August 5.

A first hearing before the judge on August 10 was at times heated, and he was "sharply critic

l of the bonuses. David Rosenfeld represented the SEC, and Lewis J. Liman, son of

Arthur L. Liman

Arthur Lawrence LimanHaberman, Clyde ''The New York Times'', July 18, 1997. Accessed April 2, 2009. (November 5, 1932 – July 17, 1997) was a partner at the New York law firm Paul, Weiss, Rifkind, Wharton & Garrison, and was well known for his ...

, represented the bank. The actual amount of bonuses paid was $3.6 billion, of which $850 million was "guaranteed" and the rest was shared among 39,000 workers who received average payments of $91,000; 696 people received more than $1 million in bonuses; at least one person received a more than $33 million bonus.

On September 14, the judge rejected the settlement and told the parties to prepare for trial to begin no later than February 1, 2010. The judge focused much of his criticism on the fact that the fine in the case would be paid by the bank's shareholders, who were the ones that were supposed to have been injured by the lack of disclosure. He wrote, "It is quite something else for the very management that is accused of having lied to its shareholders to determine how much of those victims' money should be used to make the case against the management go away," ... "The proposed settlement," the judge continued, "suggests a rather cynical relationship between the parties: the S.E.C. gets to claim that it is exposing wrongdoing on the part of the Bank of America in a high-profile merger; the bank's management gets to claim that they have been coerced into an onerous settlement by overzealous regulators. And all this is done at the expense, not only of the shareholders but also of the truth."

While ultimately deferring to the SEC, in February 2010, Judge Rakoff approved a revised settlement with a $150 million fine "reluctantly", calling the accord "half-baked justice at best" and "inadequate and misguided". Addressing one of the concerns he raised in September, the fine will be "distributed only to Bank of America shareholders harmed by the non-disclosures, or 'legacy shareholders, an improvement on the prior $33 million while still "paltry", according to the judge. Case: SEC v. Bank of America Corp., 09-cv-06829,

United States District Court for the Southern District of New York.

Investigations also were held on this issue in the

,

[Story, Louise]

"Judge Rejects Settlement Over Merrill Bonuses"

, ''The New York Times'', September 14, 2009. Retrieved September 14, 2009. under chairman

Edolphus Towns (D-NY) and in its investigative

Domestic Policy Subcommittee

Domestic may refer to:

In the home

* Anything relating to the human home or family

** A domestic animal, one that has undergone domestication

** A domestic appliance, or home appliance

** A domestic partnership

** Domestic science, sometimes cal ...

under Kucinich.

Fraud

In 2010, the U.S. government accused the bank of defrauding schools, hospitals, and dozens of state and local government organizations via misconduct and illegal activities involving the investment of proceeds from municipal bond sales. As a result, the bank agreed to pay $137.7 million, including $25 million to the Internal Revenue Service and $4.5 million to the state attorney general, to the affected organizations to settle the allegations.

Former bank official Douglas Campbell pleaded guilty to antitrust, conspiracy, and wire fraud charges. , other bankers and brokers are under indictment or investigation.

On October 24, 2012, the top

federal prosecutor

An assistant United States attorney (AUSA) is an official career civil service position in the U.S. Department of Justice composed of lawyers working under the U.S. Attorney of each U.S. federal judicial district. They represent the federal gove ...

in

Manhattan filed a

lawsuit

-

A lawsuit is a proceeding by a party or parties against another in the civil court of law. The archaic term "suit in law" is found in only a small number of laws still in effect today. The term "lawsuit" is used in reference to a civil actio ...

alleging that Bank of America fraudulently cost American taxpayers more than $1 billion when Countrywide Financial sold toxic mortgages to

Fannie Mae and

Freddie Mac. The scheme was called 'Hustle', or High Speed Swim Lane.

On May 23, 2016, the Second U.S. Circuit Court of Appeals ruled that the finding of fact by the jury that low quality mortgages were supplied by Countrywide to Fannie Mae and Freddie Mac in the "Hustle" case supported only "intentional breach of contract," not a fraud. The action, for civil fraud, relied on provisions of the

Financial Institutions Reform, Recovery and Enforcement Act

The Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA), is a United States federal law enacted in the wake of the savings and loan crisis of the 1980s.

It established the Resolution Trust Corporation to close hundreds o ...

. The decision turned on lack of intent to defraud at the time the contract to supply mortgages was made.

Downsizing (2011 to 2014)

During 2011, Bank of America began conducting personnel reductions of an estimated 36,000 people, contributing to intended savings of $5 billion per year by 2014.

In December 2011, ''Forbes'' ranked Bank of America's financial wealth 91st out of the nation's largest 100 banks and thrift institutions.

Bank of America cut around 16,000 jobs in a quicker fashion by the end of 2012 as revenue continued to decline because of new regulations and a slow economy. This put a plan one year ahead of time to eliminate 30,000 jobs under a cost-cutting program, called Project New BAC.

In the first quarter of 2014,

Berkshire

Berkshire ( ; in the 17th century sometimes spelt phonetically as Barkeshire; abbreviated Berks.) is a historic county in South East England. One of the home counties, Berkshire was recognised by Queen Elizabeth II as the Royal County of Berk ...

bank purchased 20 Bank of America branches in Central and eastern New York for 14.4 million dollars. The branches were from Utica/Rome region and down the Mohawk Valley east to the capital region.

In April and May 2014, Bank of America sold two dozen branches in Michigan to

Huntington Bancshares. The locations were converted to Huntington National Bank branches in September.

As part of its new strategy Bank of America is focused on growing its mobile banking platform. , Bank of America has 31 million active online users and 16 million mobile users. Its retail banking branches have decreased to 4,900 as a result of increased mobile banking use and a decline in customer branch visits. By 2018, the number of mobile users has increased to 25.3 million and the number of locations fell to 4,411 at the end of June.

Sale of stake in China Construction Bank

In 2005, Bank of America acquired a 9% stake in

China Construction Bank, one of the

Big Four banks in China, for $3 billion. It represented the company's largest foray into China's growing banking sector. Bank of America has offices in Hong Kong, Shanghai, and

Guangzhou and was looking to greatly expand its Chinese business as a result of this deal. In 2008, Bank of America was awarded Project Finance Deal of the Year at the 2008 ALB Hong Kong Law Awards. In November 2011, Bank of America announced plans to divest most of its stake in the China Construction Bank.

In September 2013, Bank of America sold its remaining stake in the

China Construction Bank for as much as $1.5 billion, marking the firm's full exit from the country.

$17 billion settlement with Justice Department

In August 2014, Bank of America agreed to a near–$17 billion deal to settle claims against it relating to the sale of toxic mortgage-linked securities including subprime home loans, in what was believed to be the largest settlement in U.S. corporate history. The bank agreed with the

U.S. Justice Department to pay $9.65 billion in fines, and $7 billion in relief to the victims of the faulty loans which included homeowners, borrowers, pension funds and municipalities.

Real estate economist

Jed Kolko

Jed David Kolko is an American economist serving as the Under Secretary of Commerce for Economic Affairs in the Biden administration.

Early life and education

Kolko was raised in Rochester, New York. He earned a Bachelor of Arts degree in soc ...

said the settlement is a "drop in the bucket" compared to the $700 billion in damages done to 11 million homeowners. Since the settlement covered such a substantial portion of the market, he said for most consumers "you're out of luck."

Much of the government's prosecution was based on information provided by three whistleblowers – Shareef Abdou (a senior vice president at the bank), Robert Madsen (a professional appraiser employed by a bank subsidiary), and Edward O'Donnell (a Fannie Mae official). The three men received $170 million in whistleblower awards.

DOD Community Bank

Bank of America has formed a partnership with the

United States Department of Defense creating a newly chartered bank DOD Community Bank ("Community Bank") providing full banking services to military personnel at 68 branches and ATM locations on U.S. military installations in

Guantanamo Bay Naval Base Cuba,

Diego Garcia,

Germany,

Japan

Japan ( ja, 日本, or , and formally , ''Nihonkoku'') is an island country in East Asia. It is situated in the northwest Pacific Ocean, and is bordered on the west by the Sea of Japan, while extending from the Sea of Okhotsk in the north ...

,

Italy,

Kwajalein Atoll

Kwajalein Atoll (; Marshallese: ) is part of the Republic of the Marshall Islands (RMI). The southernmost and largest island in the atoll is named Kwajalein Island, which its majority English-speaking residents (about 1,000 mostly U.S. civilia ...

,

South Korea, the

Netherlands, and the

United Kingdom. Even though Bank of America operates Community Bank, customer services are not interchangeable between the two financial institutions, meaning that a Community Bank customer cannot go to a Bank of America branch and withdraw from their account and vice versa. Deposits made into checking and savings accounts are insured by the

Federal Deposit Insurance Corporation up to $250,000 despite the fact that none of Community's operating branches are located within the jurisdictional borders of the United States.

Decision not to finance makers of military-style guns

In April 2018, Bank of America announced that it would stop providing financing to makers of military-style weapons such as the

AR-15 rifle. In announcing the decision, Bank of America referenced recent mass shootings and said that it wanted to "contribute in any way we can" to reduce them.

Return to expansion (2015–present)

In 2015, Bank of America began expanding organically, opening branches in cities where it previously did not have a retail presence. They started that year in

Denver, followed by

Minneapolis–Saint Paul and

Indianapolis

Indianapolis (), colloquially known as Indy, is the state capital and most populous city of the U.S. state of Indiana and the seat of Marion County. According to the U.S. Census Bureau, the consolidated population of Indianapolis and Marion ...

, in all cases having at least one of its

Big Four Big Four or Big 4 may refer to:

Groups of companies

* Big Four accounting firms: Deloitte, Ernst & Young, KPMG, PwC

* Big Four (airlines) in the U.S. in the 20th century: American, Eastern, TWA, United

* Big Four (banking), several groupings ...

competitors, with

Chase Bank being available in Denver and Indianapolis, while

Wells Fargo is available in Denver and the Twin Cities.

The Twin Cities market is also the home market of

U.S. Bancorp

U.S. Bancorp (stylized as us bancorp) is an American bank holding company based in Minneapolis, Minnesota, and incorporated in Delaware. It is the parent company of U.S. Bank National Association, and is the fifth largest banking institution i ...

, the largest non-Big Four rival.

In January 2018, Bank of America announced an organic expansion of its retail footprint into

Pittsburgh and surrounding areas, to supplement its existing commercial lending and investment businesses in the area. Before the expansion, Pittsburgh had been one of the largest US cities without a retail presence by any of the Big Four, with locally based

PNC Financial Services

The PNC Financial Services Group, Inc. (stylized as PNC) is an American bank holding company and financial services corporation based in Pittsburgh, Pennsylvania. Its banking subsidiary, PNC Bank, operates in 27 U.S. state, states and the D ...

(no. 6 nationally) having a commanding market share in the area;

this coincided with Chase making a similar expansion into Pittsburgh. By the end of the fiscal year 2020, Bank of America had become Pittsburgh's 16th largest bank by deposits, which considering the dominance of PNC and

BNY Mellon

The Bank of New York Mellon Corporation, commonly known as BNY Mellon, is an American investment banking services holding company headquartered in New York City. BNY Mellon was formed from the merger of The Bank of New York and the Mellon Finan ...

in the market is considered relatively impressive. By 2021, Bank of America had moved up to 12th in the market.

In February 2018, Bank of America announced it would expand into Ohio across the state's three biggest cities (

Cleveland,

Columbus

Columbus is a Latinized version of the Italian surname "''Colombo''". It most commonly refers to:

* Christopher Columbus (1451-1506), the Italian explorer

* Columbus, Ohio, capital of the U.S. state of Ohio

Columbus may also refer to:

Places ...

, and

Cincinnati), which are strongholds of Chase. Columbus serves as the bank's hub in Ohio due to its central location as the state's capital, its overall size and growth, and an existing Bank of America call center for its credit card division in suburban

Westerville. Within a year of entering Ohio, Columbus quickly saw the bank become the 5th largest in the market by deposits, behind only banks either based in Ohio (

Fifth Third Bank and locally based

Huntington Bancshares) or have a major presence as a result of an acquisition of an Ohio-based institution (Chase and PNC), and ahead of US Bancorp (also with a large presence due to acquiring an Ohio-based bank), Ohio-based

KeyBank

KeyBank, the primary subsidiary of KeyCorp, is a regional bank headquartered in Cleveland, Ohio, and is the only major bank based in Cleveland. KeyBank is one of the largest banks in the United States.

Key's customer base spans retail, small b ...

, and several local institutions. As of 2021, Bank of America is the 9th largest bank by deposits in all of Ohio.

Operations

Bank of America generates 90% of its revenues in its domestic market. The core of Bank of America's strategy is to be the number one bank in its domestic market. It has achieved this through key acquisitions.

Consumer Banking

Consumer Banking, the largest division in the company, provides financial services to consumers and small businesses including, banking, investments, merchant services, and lending products including business loans, mortgages, and credit cards. It provides

stockbroker

A stockbroker is a regulated broker, broker-dealer, or registered investment adviser (in the United States) who may provide financial advisory and investment management services and execute transactions such as the purchase or sale of stocks an ...

services via

Merrill Edge Merrill may refer to:

Places in the United States

*Merrill Field, Anchorage, Alaska

*Merrill, Iowa

* Merrill, Maine

*Merrill, Michigan

* Merrill, Mississippi, an unincorporated community near Lucedale in George County

*Merrill, Oregon

*Merrill, Wi ...

, a specific

division for investment and related services (such as research and call center counsel) after Merrill Lynch became a subsidiary of Bank of America. The consumer banking division represented 38% of the company's total revenue in 2016.

[ The company earns revenue from interest income, service charges, and fees. In addition, the company is a ]mortgage servicer A mortgage servicer is a company to which some borrowers pay their mortgage loan payments and which performs other services in connection with mortgages and mortgage-backed securities. The mortgage servicer may be the entity that originated the mor ...

. It competes primarily with the retail banking

Retail banking, also known as consumer banking or personal banking, is the provision of services by a bank to the general public, rather than to companies, corporations or other banks, which are often described as wholesale banking. Banking servi ...

arms of America's three other megabanks: Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking ...

, JPMorgan Chase, and Wells Fargo. The Consumer Banking organization includes over 4,600 retail financial centers and approximately 15,900 automated teller machines.

Bank of America is a member of the Global ATM Alliance

The Global ATM Alliance is a joint venture of several major international banks that allows customers of their banks to use their automated teller machine (ATM) card or debit card at another bank within the alliance with no international ATM access ...

, a joint venture of several major international banks that provides for reduced fees for consumers using their ATM card or check card The term check card can refer to:

* An identification card issued by a retailer allowing the holder to tender payment by check. Such cards were commonly issued in the United States by supermarkets and other retailers before the widespread use of d ...

at another bank within the Global ATM Alliance when travelling internationally. This feature is restricted to withdrawals using a debit card and users are still subject to foreign currency conversion fees, credit card withdrawals are still subject to cash advance fees and foreign currency conversion fees.

Global Banking

The Global Banking division provides banking services, including investment banking and lending products to businesses. It includes the businesses of Global Corporate Banking, Global Commercial Banking, Business Banking, and Global Investment Banking. The division represented 22% of the company's revenue in 2016.

The Global Banking division provides banking services, including investment banking and lending products to businesses. It includes the businesses of Global Corporate Banking, Global Commercial Banking, Business Banking, and Global Investment Banking. The division represented 22% of the company's revenue in 2016.[

Before Bank of America's acquisition of ]Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment bank ...

, the Global Corporate and Investment Banking (GCIB) business operated as Banc of America Securities

In the English language, banq and banc are coined words pronounced identically to the word "bank". Both terms have been adopted by financial services companies and others to satisfy legal restrictions on the usage of the word ''bank''. The compo ...

LLC. The bank's investment banking activities operate under the Merrill Lynch subsidiary and provided mergers and acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect ...

advisory, underwriting, capital markets, as well as sales & trading in fixed income and equities markets. Its strongest groups include Leveraged Finance, Syndicated Loans

A syndicated loan is one that is provided by a group of lenders and is structured, arranged, and administered by one or several commercial banks or investment banks known as lead arrangers.

The syndicated loan market is the dominant way for larg ...

, and mortgage-backed securities. It also has one of the largest research teams on Wall Street

Wall Street is an eight-block-long street in the Financial District of Lower Manhattan in New York City. It runs between Broadway in the west to South Street and the East River in the east. The term "Wall Street" has become a metonym for t ...

. Bank of America Merrill Lynch

BofA Securities, Inc., previously Bank of America Merrill Lynch (BAML), is an American multinational investment banking division under the auspices of Bank of America. It is not to be confused with Merrill, the stock brokerage and trading plat ...

is headquartered in New York City.

Global Wealth and Investment Management

The Global Wealth and Investment Management (GWIM) division manages the investment assets of institutions and individuals. It includes the businesses of Merrill Lynch Global Wealth Management and U.S. Trust and represented 21% of the company's total revenue in 2016.[ It is among the 10 largest U.S. wealth managers. It has over $2.5 trillion in client balances.][ GWIM has five primary lines of business: Premier Banking & Investments (including Bank of America Investment Services, Inc.), The Private Bank, Family Wealth Advisors, and Bank of America Specialist.

]

Global Markets

The Global Markets division offers services to institutional clients, including trading in financial securities. The division provides research and other services such as securities service

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

, market maker, and risk management using derivatives

The derivative of a function is the rate of change of the function's output relative to its input value.

Derivative may also refer to:

In mathematics and economics

* Brzozowski derivative in the theory of formal languages

* Formal derivative, an ...

. The division represented 19% of the company's total revenues in 2016.[

]

Labor

On April 9, 2019, the company announced minimum wage will be increased beginning May 1, 2019, to $17.00 an hour until it reaches a goal of $20.00 an hour in 2021.

Offices

The Bank of America principal executive offices are located in the Bank of America Corporate Center, Charlotte, North Carolina. The skyscraper is located at 100 North Tryon Street, and stands at 871 ft (265 m), having been completed in 1992.

In 2012, Bank of America cut ties to the American Legislative Exchange Council (ALEC).

International offices

Bank of America's Global Corporate and Investment Banking has its U.S. headquarters in Charlotte, European headquarters in Dublin, and Asian headquarters in Hong Kong and Singapore.

Corporate Governance

Charitable efforts

In 2007, the bank offered employees a $3,000 rebate for the purchase of hybrid vehicles. The company also provided a $1,000 rebate or a lower interest rate for customers whose homes qualified as energy efficient. In 2007, Bank of America partnered with Brighter Planet to offer an eco-friendly credit card, and later a debit card, which help build renewable energy projects with each purchase. In 2010, the bank completed construction of the 1 Bank of America Center in Charlotte center city. The tower, and accompanying hotel, is a

In 2007, the bank offered employees a $3,000 rebate for the purchase of hybrid vehicles. The company also provided a $1,000 rebate or a lower interest rate for customers whose homes qualified as energy efficient. In 2007, Bank of America partnered with Brighter Planet to offer an eco-friendly credit card, and later a debit card, which help build renewable energy projects with each purchase. In 2010, the bank completed construction of the 1 Bank of America Center in Charlotte center city. The tower, and accompanying hotel, is a LEED-certified

Leadership in Energy and Environmental Design (LEED) is a

green building certification program used worldwide. Developed by the non-profit U.S. Green Building Council (USGBC), it includes a set of rating systems for the design, construction ...

building.

Bank of America has also donated money to help health centers in Massachusetts and made a $1 million donation in 2007 to help homeless shelters in Miami.

In 1998, the bank made a ten-year commitment of $350 billion to provide affordable mortgages, build affordable housing, support small businesses and create jobs in disadvantaged neighbourhoods.

In 2004, the bank pledged $750 million over a ten-year period for community development lending and affordable housing programs.

Chief Executive Officer

List of CEOs

# Hugh McColl (1998–2001)

# Ken Lewis (2001–2009)

# Brian Moynihan

Brian Thomas Moynihan (born October 9, 1959) is an American investment banker, businessman and the chairman and CEO of Bank of America. He joined the board of directors, following his promotion to president and CEO in 2010.

Early life and educat ...

(2010– )

CEO Pay Ratio

Pursuant to Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, publicly traded companies are required to disclose (1) the median total annual compensation of all employees other than the CEO and (2) the ratio of the CEO's annual total compensation to that of the median employee (CEO Pay Ratio The CEO Pay Ratio is a wage ratio. Pursuant to Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, publicly traded companies are required to disclose (1) the median total annual compensation of all employees other than ...

).

Total 2018 compensation for Brian Moynihan

Brian Thomas Moynihan (born October 9, 1959) is an American investment banker, businessman and the chairman and CEO of Bank of America. He joined the board of directors, following his promotion to president and CEO in 2010.

Early life and educat ...

, CEO, amounted to $22,765,354, and total compensation of the median employee was determined to be $92,040. The resulting pay ratio is estimated to be 247:1.

Lawsuits

Mortgage abuses

In August 2011, Bank of America was sued for $10 billion by American International Group over an alleged "massive fraud" on mortgage debt. Another lawsuit filed against Bank of America, pertained to $57.5 billion in mortgage-backed securities Bank of America sold to Fannie Mae and Freddie Mac. That December, Bank of America agreed to pay $335 million to settle a federal government claim that Countrywide Financial had discriminated

Discrimination is the act of making unjustified distinctions between people based on the groups, classes, or other categories to which they belong or are perceived to belong. People may be discriminated on the basis of race, gender, age, relig ...

against Hispanic and African-American homebuyers from 2004 to 2008, prior to being acquired by BofA. In September 2012, BofA settled out of court for $2.4 billion in a class action lawsuit filed by BofA shareholders who felt they were misled about the purchase of Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment bank ...

.

On February 9, 2012, it was announced that the five largest mortgage servicers (Ally/GMAC, Bank of America, Citi, JPMorgan Chase, and Wells Fargo) agreed to a historic settlement with the federal government and 49 states. The settlement, known as the National Mortgage Settlement (NMS), required the servicers to provide about $26 billion in relief to distressed homeowners and indirect payments to the states and the federal government. This settlement amount makes the NMS the second largest civil settlement in U.S. history, only trailing the Tobacco Master Settlement Agreement. The five banks were also required to comply with 305 new mortgage servicing standards. Oklahoma held out and agreed to settle with the banks separately.

On October 24, 2012, American federal prosecutor

An assistant United States attorney (AUSA) is an official career civil service position in the U.S. Department of Justice composed of lawyers working under the U.S. Attorney of each U.S. federal judicial district. They represent the federal gove ...

s filed a $1 billion civil lawsuit against Bank of America for mortgage fraud under the False Claims Act, which provides for possible penalties of triple the damages suffered. The government asserted that Countrywide, which was acquired by Bank of America, rubber-stamped mortgage loans to risky borrowers and forced taxpayers to guarantee billions of bad loans through Fannie Mae and Freddie Mac. The suit was filed by Preet Bharara, the United States attorney in Manhattan, the inspector general of FHFA and the special inspector for the Troubled Asset Relief Program. In March 2014, Bank of America settled the suit by agreeing to pay $6.3 billion to Fannie Mae and Freddie Mac and to buy back around $3.2 billion worth of mortgage bonds.

A $7.5 million settlement was reached in April 2014 with former chief financial officer for Bank of America, Joe L. Price, over allegations that the bank's management withheld material information related to its 2008 merger with Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment bank ...

. In August 2014, the United States Department of Justice and the bank agreed to a $16.65 billion agreement over the sale of risky, mortgage-backed securities before the Great Recession; the loans behind the securities were transferred to the company when it acquired banks such as Merrill Lynch and Countrywide in 2008.

Unfair billing practices

In April 2014, the Consumer Financial Protection Bureau (CFPB) ordered Bank of America to provide an estimated $727 million in relief to consumers harmed by practices related to credit card add-on products. According to the Bureau, roughly 1.4 million customers were affected by deceptive marketing of add-on products, and 1.9 million customers were illegally charged for credit monitoring and reporting services they were not receiving. The deceptive marketing misconduct involved telemarketing scripts containing misstatements and off-script sales pitches made by telemarketers that were misleading and omitted pertinent information. The unfair billing practices involved billing customers for privacy-related products without having the authorization necessary to perform the credit monitoring and credit report retrieval services. As a result, the company billed customers for services they did not receive, unfairly charged consumers for interest and fees, illegally charged approximately 1.9 million accounts, and failed to provide the product benefit. In May 2022, CFPB ordered Bank of America to pay $10 million in penalties for illegal garnishments.

Discrimination

In 2018, former senior executive Omeed Malik filed a $100 million arbitration

Arbitration is a form of alternative dispute resolution (ADR) that resolves disputes outside the judiciary courts. The dispute will be decided by one or more persons (the 'arbitrators', 'arbiters' or 'arbitral tribunal'), which renders the ' ...

case through FINRA

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Associati ...

against Bank of America after the company investigated him for alleged sexual misconduct. His defamation

Defamation is the act of communicating to a third party false statements about a person, place or thing that results in damage to its reputation. It can be spoken (slander) or written (libel). It constitutes a tort or a crime. The legal defini ...

claim was on the basis of retaliation

Revenge is committing a harmful action against a person or group in response to a grievance, be it real or perceived. Francis Bacon described revenge as a kind of "wild justice" that "does... offend the law ndputteth the law out of office." Pr ...

, breach of contract

Breach of contract is a legal cause of action and a type of civil wrong, in which a binding agreement or bargained-for exchange is not honored by one or more of the parties to the contract by non-performance or interference with the other party ...

, and discrimination

Discrimination is the act of making unjustified distinctions between people based on the groups, classes, or other categories to which they belong or are perceived to belong. People may be discriminated on the basis of race, gender, age, relig ...

against his Muslim

Muslims ( ar, المسلمون, , ) are people who adhere to Islam, a monotheistic religion belonging to the Abrahamic tradition. They consider the Quran, the foundational religious text of Islam, to be the verbatim word of the God of Abrah ...

background. Malik received an eight-figure settlement

Settlement may refer to:

*Human settlement, a community where people live

*Settlement (structural), the distortion or disruption of parts of a building

*Closing (real estate), the final step in executing a real estate transaction

*Settlement (fina ...

in July of the same year.

Controversies

Parmalat controversy

Parmalat

Parmalat S.p.A. is a dairy and food corporation which is a subsidiary of French multinational company Lactalis. It was founded by Calisto Tanzi in 1961.

Having become the leading global company in the production of long-life milk using ultra-h ...

SpA is a multinational Italian dairy and food corporation. Following Parmalat's 2003 bankruptcy, the company sued Bank of America for $10 billion, alleging the bank profited from its knowledge of Parmalat's financial difficulties. The parties announced a settlement in July 2009, resulting in Bank of America paying Parmalat $98.5 million in October 2009. In a related case, on April 18, 2011, an Italian court acquitted Bank of America and three other large banks, along with their employees, of charges they assisted Parmalat in concealing its fraud, and of lacking sufficient internal controls to prevent such frauds. Prosecutors did not immediately say whether they would appeal the rulings. In Parma, the banks were still charged with covering up the fraud.

Consumer credit controversies