Tax Evader on:

[Wikipedia]

[Google]

[Amazon]

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals,

In 1968, Nobel laureate economist Gary Becker first theorized the ''economics of crime'', on the basis of which authors M.G. Allingham and A. Sandmo produced, in 1972, an economic model of tax evasion. This model deals with the evasion of income tax, the main source of tax revenue in developed countries. According to the authors, the level of evasion of income tax depends on the detection probability and the level of punishment provided by law. Later studies however, pointed limitations of the model, highlighting that individuals are also more likely to comply with taxes when they believe that tax money is appropriately used and when they can take part on public decisions.

The literature's theoretical models are elegant in their effort to identify the variables likely to affect non-compliance. Alternative specifications, however, yield conflicting results concerning both the signs and magnitudes of variables believed to affect tax evasion. Empirical work is required to resolve the theoretical ambiguities. Income tax evasion appears to be positively influenced by the

In 1968, Nobel laureate economist Gary Becker first theorized the ''economics of crime'', on the basis of which authors M.G. Allingham and A. Sandmo produced, in 1972, an economic model of tax evasion. This model deals with the evasion of income tax, the main source of tax revenue in developed countries. According to the authors, the level of evasion of income tax depends on the detection probability and the level of punishment provided by law. Later studies however, pointed limitations of the model, highlighting that individuals are also more likely to comply with taxes when they believe that tax money is appropriately used and when they can take part on public decisions.

The literature's theoretical models are elegant in their effort to identify the variables likely to affect non-compliance. Alternative specifications, however, yield conflicting results concerning both the signs and magnitudes of variables believed to affect tax evasion. Empirical work is required to resolve the theoretical ambiguities. Income tax evasion appears to be positively influenced by the

During the second half of the 20th century, value-added tax (VAT) emerged as a modern form of consumption tax throughout the world, with the notable exception of the

During the second half of the 20th century, value-added tax (VAT) emerged as a modern form of consumption tax throughout the world, with the notable exception of the

The level of evasion depends on a number of factors, including the amount of money a person or a corporation possesses. Efforts to evade income tax decline when the amounts involved are lower. The level of evasion also depends on the efficiency of the tax administration.

The level of evasion depends on a number of factors, including the amount of money a person or a corporation possesses. Efforts to evade income tax decline when the amounts involved are lower. The level of evasion also depends on the efficiency of the tax administration.

Professor

Professor

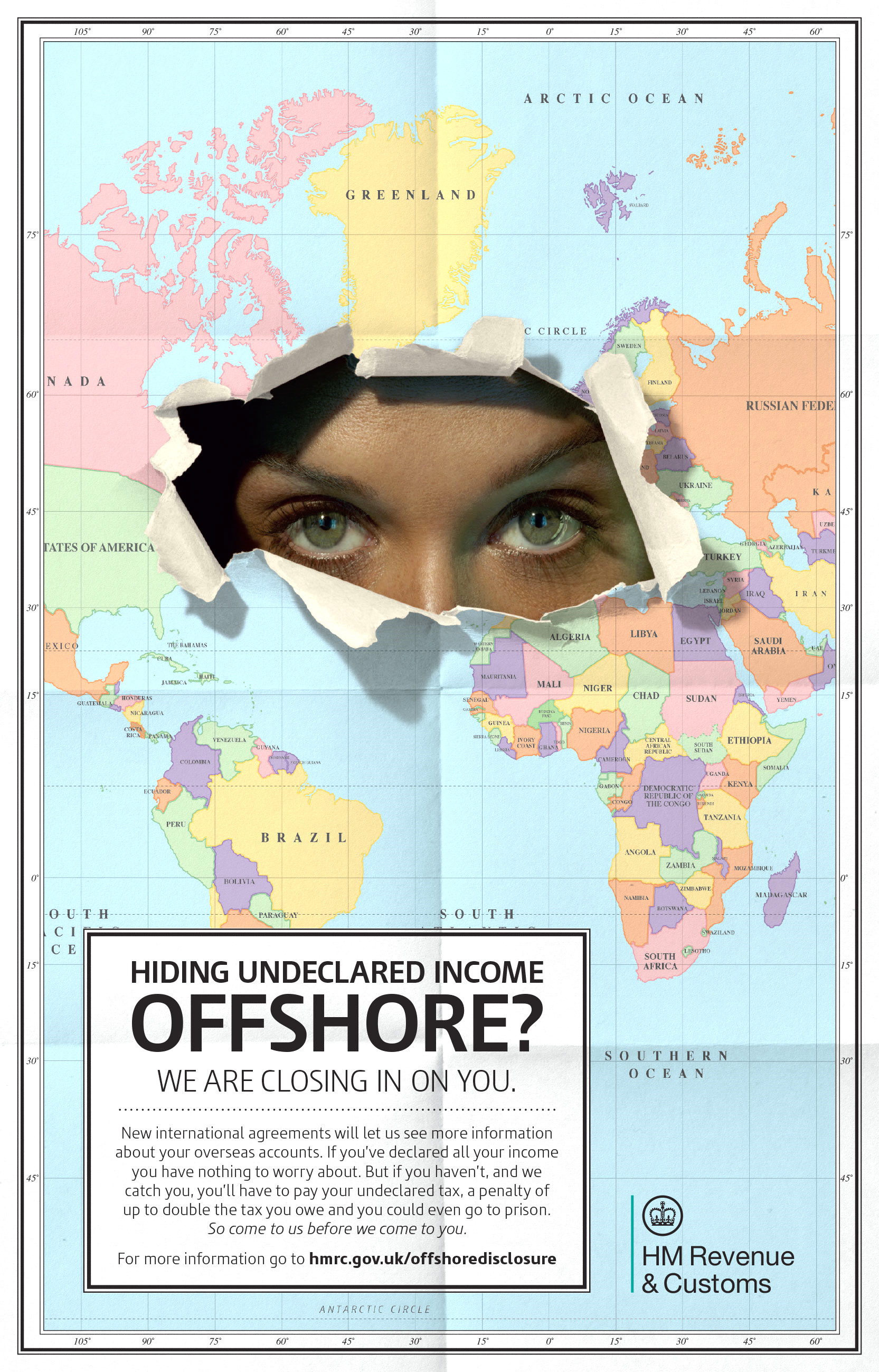

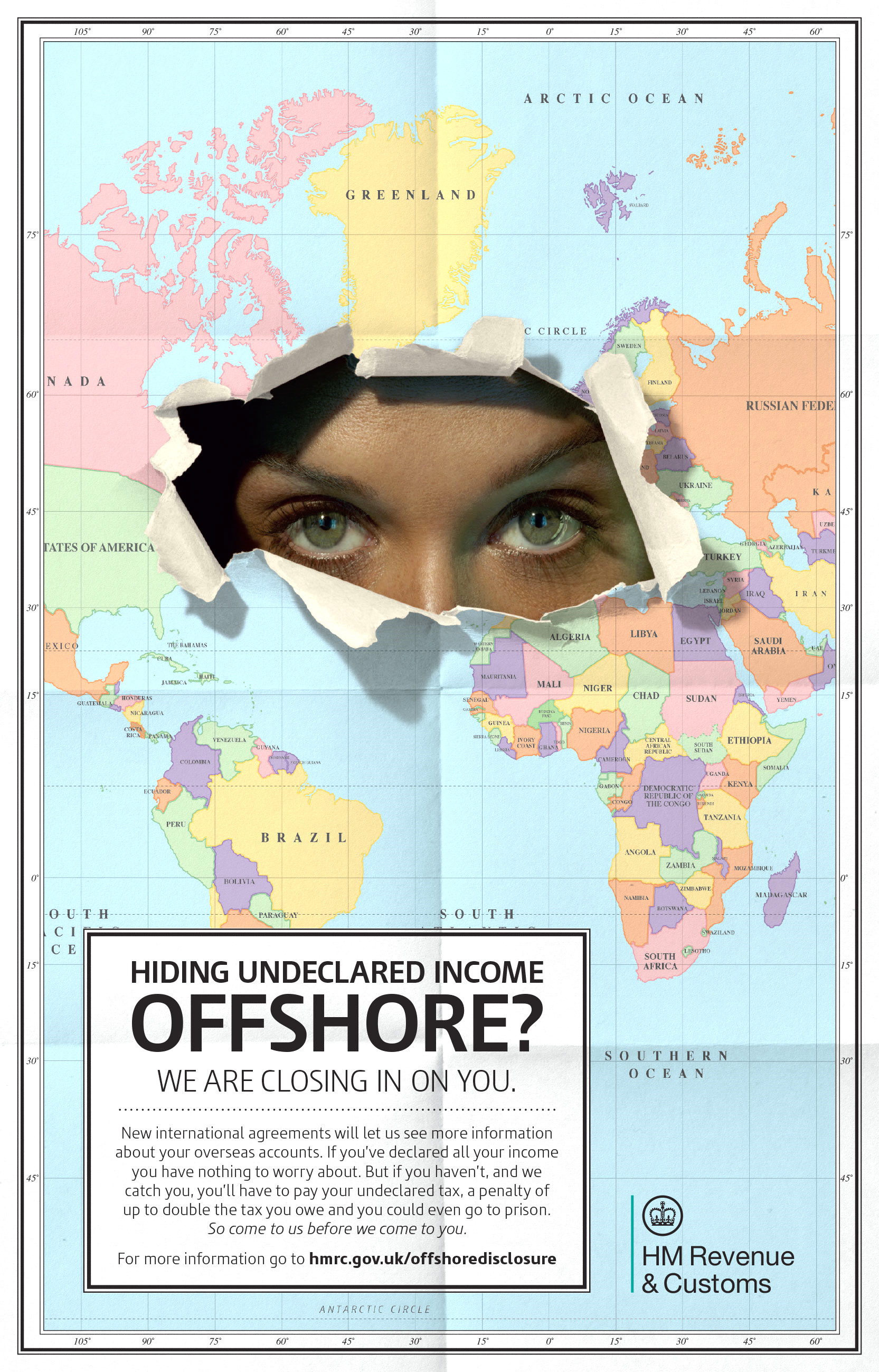

HMRC, the UK tax collection agency, estimated that in the tax year 2016–17, pure tax evasion (i.e. not including things like hidden economy or criminal activity) cost the government £5.3 billion. This compared to a wider tax gap (the difference between the amount of tax that should, in theory, be collected by HMRC, against what is actually collected) of £33 billion in the same year, an amount that represented 5.7% of liabilities. At the same time,

HMRC, the UK tax collection agency, estimated that in the tax year 2016–17, pure tax evasion (i.e. not including things like hidden economy or criminal activity) cost the government £5.3 billion. This compared to a wider tax gap (the difference between the amount of tax that should, in theory, be collected by HMRC, against what is actually collected) of £33 billion in the same year, an amount that represented 5.7% of liabilities. At the same time,

Tax Evasion and Fraud

collected news and commentary at ''

Employment Tax Evasion Schemes

common employment schemes at

US Justice Dept press release

on Jeffrey Chernick, UBS tax evader

US Justice Tax Division

and its enforcement efforts {{Authority control Informal economy

corporations

A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and r ...

, trusts

A trust is a legal relationship in which the holder of a right gives it to another person or entity who must keep and use it solely for another's benefit. In the Anglo-American common law, the party who entrusts the right is known as the "settl ...

, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the taxpayer's tax liability, and it includes dishonest tax reporting, declaring less income, profits or gains than the amounts actually earned, overstating deductions, using bribes against authorities in countries with high corruption rates and hiding money in secret locations.

Tax evasion is an activity commonly associated with the informal economy

An informal economy (informal sector or grey economy) is the part of any economy that is neither taxed nor monitored by any form of government.

Although the informal sector makes up a significant portion of the economies in developing countrie ...

. One measure of the extent of tax evasion (the "tax gap") is the amount of unreported income, which is the difference between the amount of income that should be reported to the tax authorities and the actual amount reported.

In contrast, tax avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdict ...

is the legal use of tax laws to reduce one's tax burden. Both tax evasion and tax avoidance can be viewed as forms of tax noncompliance

Tax noncompliance (informally tax avoision) is a range of activities that are unfavorable to a government's tax system. This may include tax avoidance, which is tax reduction by legal means, and tax evasion which is the criminal non-payment of tax ...

, as they describe a range of activities that intend to subvert a state's tax system, but such classification of tax avoidance is disputable since avoidance is lawful in self-creating systems. Both tax evasion and tax avoidance can be practiced by corporations, trusts, or individuals.

Economics

In 1968, Nobel laureate economist Gary Becker first theorized the ''economics of crime'', on the basis of which authors M.G. Allingham and A. Sandmo produced, in 1972, an economic model of tax evasion. This model deals with the evasion of income tax, the main source of tax revenue in developed countries. According to the authors, the level of evasion of income tax depends on the detection probability and the level of punishment provided by law. Later studies however, pointed limitations of the model, highlighting that individuals are also more likely to comply with taxes when they believe that tax money is appropriately used and when they can take part on public decisions.

The literature's theoretical models are elegant in their effort to identify the variables likely to affect non-compliance. Alternative specifications, however, yield conflicting results concerning both the signs and magnitudes of variables believed to affect tax evasion. Empirical work is required to resolve the theoretical ambiguities. Income tax evasion appears to be positively influenced by the

In 1968, Nobel laureate economist Gary Becker first theorized the ''economics of crime'', on the basis of which authors M.G. Allingham and A. Sandmo produced, in 1972, an economic model of tax evasion. This model deals with the evasion of income tax, the main source of tax revenue in developed countries. According to the authors, the level of evasion of income tax depends on the detection probability and the level of punishment provided by law. Later studies however, pointed limitations of the model, highlighting that individuals are also more likely to comply with taxes when they believe that tax money is appropriately used and when they can take part on public decisions.

The literature's theoretical models are elegant in their effort to identify the variables likely to affect non-compliance. Alternative specifications, however, yield conflicting results concerning both the signs and magnitudes of variables believed to affect tax evasion. Empirical work is required to resolve the theoretical ambiguities. Income tax evasion appears to be positively influenced by the tax rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, and effective. These rates can also be p ...

, the unemployment rate, the level of income and dissatisfaction with government. The U.S. Tax Reform Act of 1986 appears to have reduced tax evasion in the United States.

In a 2017 study Alstadsæter et al. concluded based on random stratified audits and leaked data that occurrence of tax evasion rises sharply as amount of wealth rises and that the very richest are about 10 times more likely than average people to engage in tax evasion.

Tax gap

The tax gap describes how much tax should have been raised in relation to much tax is actually raised. The tax gap is mainly growing due to two factors, the lack of enforcement on the one hand and the lack of compliance on the other hand. The former is mainly rooted in the costly enforcement of the taxation law. The Iatter is based on the foundation that tax compliance is costly for individuals as well as firms (tax filling,bureaucracy

The term bureaucracy () refers to a body of non-elected governing officials as well as to an administrative policy-making group. Historically, a bureaucracy was a government administration managed by departments staffed with non-elected offi ...

), hence not paying taxes would be more economical in their opinion.

Evasion of customs duty

Customs duties

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and poli ...

are an important source of revenue in developing countries. Importers attempt to evade customs duty by (a) under-invoicing and (b) misdeclaration of quantity and product-description. When there is ad valorem import duty, the tax base can be reduced through under-invoicing. Misdeclaration of quantity is more relevant for products with specific duty. Production description is changed to match a H. S. Code commensurate with a lower rate of duty.

Smuggling

Smuggling

Smuggling is the illegal transportation of objects, substances, information or people, such as out of a house or buildings, into a prison, or across an international border, in violation of applicable laws or other regulations.

There are various ...

is import or export of products by illegal means. Smuggling is resorted to for total evasion of customs duties, as well as for the import and export of contraband

Contraband (from Medieval French ''contrebande'' "smuggling") refers to any item that, relating to its nature, is illegal to be possessed or sold. It is used for goods that by their nature are considered too dangerous or offensive in the eyes o ...

. Smugglers do not pay duty since the transport is covert, so no customs declaration is made.

Evasion of value-added tax and sales taxes

During the second half of the 20th century, value-added tax (VAT) emerged as a modern form of consumption tax throughout the world, with the notable exception of the

During the second half of the 20th century, value-added tax (VAT) emerged as a modern form of consumption tax throughout the world, with the notable exception of the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territorie ...

. Producers who collect VAT from consumers may evade tax by under-reporting the amount of sales. The US has no broad-based consumption tax at the federal level, and no state currently collects VAT; the overwhelming majority of states instead collect sales taxes. Canada

Canada is a country in North America. Its ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, covering over , making it the world's second-largest country by tot ...

uses both a VAT at the federal level (the Goods and Services Tax) and sales taxes at the provincial level; some provinces have a single tax combining both forms.

In addition, most jurisdictions

Jurisdiction (from Latin 'law' + 'declaration') is the legal term for the legal authority granted to a legal entity to enact justice. In federations like the United States, areas of jurisdiction apply to local, state, and federal levels.

Jur ...

which levy a VAT or sales tax also legally require their residents to report and pay the tax on items purchased in another jurisdiction. This means that consumers who purchase something in a lower-taxed or untaxed jurisdiction with the intention of avoiding VAT or sales tax in their home jurisdiction are technically breaking the law in most cases.

This is especially prevalent in federal countries

A federation (also known as a federal state) is a political entity characterized by a union of partially self-governing provinces, states, or other regions under a central federal government ( federalism). In a federation, the self-governi ...

like the US and Canada where sub-national jurisdictions charge varying rates of VAT or sales tax.

In liberal democracies, a fundamental problem with inhibiting evasion of local sales taxes is that liberal democracies, by their very nature, have few (if any) border controls between their internal jurisdictions. Therefore, it is not generally cost-effective to enforce tax collection on low-value goods carried in private vehicles from one jurisdiction to another with a different tax rate. However, sub-national governments will normally seek to collect sales tax on high-value items such as cars.

Objectives to evade taxes

One reason for taxpayers to evade taxes is the personal benefits that come with it, thus the individual problems that lead to that decision Additionally, Wallschutzky's exchange relationship hypothesis presents as a sufficient motive for many. The exchange relationship hypothesis states that tax payers believe that the exchange between their taxes and the public good/social services as unbalanced. Furthermore, the little capability of the system to catch the tax evaders poses as another incentive. Most often, it is more economical to evade taxes, being caught and paying a fine as a consequence, than paying the accumulated tax burden over the years. Thus, evasion numbers should be even higher than they are, hence for many people there seem to be moral objective countering this practice.Government response

The level of evasion depends on a number of factors, including the amount of money a person or a corporation possesses. Efforts to evade income tax decline when the amounts involved are lower. The level of evasion also depends on the efficiency of the tax administration.

The level of evasion depends on a number of factors, including the amount of money a person or a corporation possesses. Efforts to evade income tax decline when the amounts involved are lower. The level of evasion also depends on the efficiency of the tax administration. Corruption

Corruption is a form of dishonesty or a criminal offense which is undertaken by a person or an organization which is entrusted in a position of authority, in order to acquire illicit benefits or abuse power for one's personal gain. Corruption m ...

by tax officials makes it difficult to control evasion. Tax administrations use various means to reduce evasion and increase the level of enforcement: for example, privatization of tax enforcementChowdhury, F. L. (1992) ''Evasion of Customs Duty in Bangladesh'', unpublished MBA dissertation, Graduate School of Management, Monash University, Australia. or tax farming.

In 2011 HMRC, the UK tax collection agency stated that it would continue to crack down on tax evasion, with the goal of collecting £18 billion in revenue before 2015. In 2010, HMRC began a voluntary amnesty program that targeted middle-class professionals and raised £500 million.

Corruption by tax officials

Corrupt tax officials co-operate with the taxpayers who intend to evade taxes. When they detect an instance of evasion, they refrain from reporting it in return for bribes.Corruption

Corruption is a form of dishonesty or a criminal offense which is undertaken by a person or an organization which is entrusted in a position of authority, in order to acquire illicit benefits or abuse power for one's personal gain. Corruption m ...

by tax officials is a serious problem for the tax administration in many countries.

Level of evasion and punishment

Tax evasion is a crime in almost all developed countries, and the guilty party is liable tofines Fines may refer to:

*Fines, Andalusia, Spanish municipality

*Fine (penalty)

* Fine, a dated term for a premium on a lease of land, a large sum the tenant pays to commute (lessen) the rent throughout the term

*Fines, ore or other products with a sma ...

and/or imprisonment

Imprisonment is the restraint of a person's liberty, for any cause whatsoever, whether by authority of the government, or by a person acting without such authority. In the latter case it is "false imprisonment". Imprisonment does not necessari ...

. In Switzerland

). Swiss law does not designate a ''capital'' as such, but the federal parliament and government are installed in Bern, while other federal institutions, such as the federal courts, are in other cities (Bellinzona, Lausanne, Luzern, Neuchâtel ...

, many acts that would amount to criminal tax evasion in other countries are treated as civil matters. Dishonestly misreporting income in a tax return is not necessarily considered a crime. Such matters are handled in the Swiss tax courts, not the criminal courts.

In Switzerland, however, some tax misconduct (such as the deliberate falsification of records) is criminal. Moreover, civil tax transgressions may give rise to penalties. It is often considered that the extent of evasion depends on the severity of punishment for evasion.

Privatization of tax enforcement

Professor

Professor Christopher Hood

Christopher Cropper Hood (born 1947) is a visiting Professor of the Blavatnik School of Government at the University of Oxford, and an Emeritus Fellow of All Souls College, Oxford. Hood was Gladstone Professor of Government at All Souls College ...

first suggested privatization

Privatization (also privatisation in British English) can mean several different things, most commonly referring to moving something from the public sector into the private sector. It is also sometimes used as a synonym for deregulation when ...

of tax enforcement to control tax evasion more efficiently than a government department would, and some governments have adopted this approach. In Bangladesh

Bangladesh (}, ), officially the People's Republic of Bangladesh, is a country in South Asia. It is the eighth-most populous country in the world, with a population exceeding 165 million people in an area of . Bangladesh is among the mos ...

, customs administration was partly privatized in 1991.

Abuse by private tax collectors (see tax farming below) has on occasion led to revolutionary overthrow of governments who have outsourced tax administration.

Tax farming

Tax farming

Farming or tax-farming is a technique of financial management in which the management of a variable revenue stream is assigned by legal contract to a third party and the holder of the revenue stream receives fixed periodic rents from the contract ...

is an historical means of collection of revenue. Governments received a lump sum in advance from a private entity, which then collects and retains the revenue and bears the risk of evasion by the taxpayers. It has been suggested that tax farming may reduce tax evasion in less developed countries.

This system may be liable to abuse by the "tax-farmers" seeking to make a profit, if they are not subject to political constraints. Abuses by tax farmers (together with a tax system that exempted the aristocracy) were a primary reason for the French Revolution

The French Revolution ( ) was a period of radical political and societal change in France that began with the Estates General of 1789 and ended with the formation of the French Consulate in November 1799. Many of its ideas are considere ...

that toppled Louis XVI.

PSI agencies

Pre-shipment inspection agencies like Société Générale De Surveillance S. A. and its subsidiary Cotecna are in business to prevent evasion of customs duty through under-invoicing and misdeclaration. However, PSI agencies have cooperated with importers in evading customs duties. Bangladeshi authorities found Cotecna guilty of complicity with importers for evasion of customs duties on a huge scale. In August 2005, Bangladesh had hired four PSI companies – Cotecna Inspection SA, SGS (Bangladesh) Limited, Bureau Veritas BIVAC (Bangladesh) Limited and INtertek Testing Limited – for three years to certify price, quality and quantity of imported goods. In March 2008, the Bangladeshi National Board of Revenue cancelled Cotecna's certificate for serious irregularities, while importers' complaints about the other three PSI companies mounted. Bangladesh planned to have its customs department train its officials in " WTO valuation, trade policy,ASYCUDA The Automated System for Customs Data (ASYCUDA) is a computerized system designed by the United Nations Conference on Trade and Development (UNCTAD) to administer a country's customs. In 2004 there were more than 50 operational projects with expendi ...

system, risk management" to take over the inspections.

Cotecna was also found to have bribed Pakistan's prime minister Benazir Bhutto

Benazir Bhutto ( ur, بینظیر بُھٹو; sd, بينظير ڀُٽو; Urdu ; 21 June 1953 – 27 December 2007) was a Pakistani politician who served as the 11th and 13th prime minister of Pakistan from 1988 to 1990 and again from 1993 t ...

to secure a PSI contract by Pakistani importers. She and her husband were sentenced both in Pakistan and Switzerland.

By continent

Asia

United Arab Emirates

In early October 2021, 11.9 million leaked financial records in addition to 2.9 TB of data was released in the name ofPandora Papers

The Pandora Papers are 11.9 million leaked documents with 2.9 terabytes of data that the International Consortium of Investigative Journalists (ICIJ) published beginning on 3 October 2021. The leak exposed the secret offshore accounts of 3 ...

by the International Consortium of Investigative Journalists (ICIJ), exposing the secret offshore accounts of around 35 world leaders in tax havens

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

to evade taxes. One of the many leaders to be exposed was the ruler of Dubai and prime minister of the United Arab Emirates, Sheikh Mohammed bin Rashid al-Maktoum

Sheikh Mohammed bin Rashid Al Maktoum ( ar, محمد بن راشد آل مكتوم, links=no; ; born 15 July 1949) is the Prime Minister of the United Arab Emirates, vice president, prime minister, and minister of defence of the United Arab Emir ...

. Sheikh Mohammed was identified as the shareholder of three firms that were registered in the tax havens of Bahamas

The Bahamas (), officially the Commonwealth of The Bahamas, is an island country within the Lucayan Archipelago of the West Indies in the Atlantic Ocean, North Atlantic. It takes up 97% of the Lucayan Archipelago's land area and is home to ...

and British Virgin Islands

)

, anthem = "God Save the King"

, song_type = Territorial song

, song = "Oh, Beautiful Virgin Islands"

, image_map = File:British Virgin Islands on the globe (Americas centered).svg

, map_caption =

, mapsize = 290px

, image_map2 = Brit ...

through an Emirati company, partially owned by an investment conglomerate, Dubai Holding and Axiom Limited, major shares of which were owned by the ruler.

As per the leaked records, the Dubai ruler owned a massive number of upmarket and luxurious real estate across Europe via the cited offshore entities registered in tax havens.

Additionally, the Pandora Papers also cites that the former Managing Director of IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster globa ...

and French finance minister, Dominique Strauss-Kahn was permitted to create a consulting firm in the United Arab Emirates in 2018 after the expiry of tax exemptions of his Moroccan company, which he used for receiving millions of dollars worth of tax free consulting fees.

Europe

Germany, France, Italy, Denmark, Belgium

A network of banks, stock traders and top lawyers has obtained billions from the European treasuries through suspected fraud and speculation with dividend tax. The five hardest hit countries have lost together at least $62.9 billion. Germany is the hardest hit country, with around €31 billion withdrawn from the German treasury. Estimated losses for other countries include at least €17 billion for France, €4.5 billion in Italy, €1.7 billion in Denmark and €201 million for Belgium.Greece

Scandinavia

A paper by economists Annette Alstadsæter, Niels Johannesen and Gabriel Zucman, which used data from HSBC Switzerland ("Swiss leaks

Swiss Leaks (or SwissLeaks) is the name of a journalistic investigation, released in February 2015, of a giant tax evasion scheme allegedly operated with the knowledge and encouragement of the British multinational bank HSBC via its Swiss subs ...

") and Mossack Fonseca

Mossack Fonseca & Co. () was a Panamanian law firm and Corporate services, corporate service provider.Panama Papers

The Panama Papers ( es, Papeles de Panamá) are 11.5 million leaked documents (or 2.6 terabytes of data) that were published beginning on April 3, 2016. The papers detail financial and attorney–client information for more than 214,488 ...

"), found that "on average about 3% of personal taxes are evaded in Scandinavia, but this figure rises to about 30% in the top 0.01% of the wealth distribution... Taking tax evasion into account increases the rise in inequality seen in tax data since the 1970s markedly, highlighting the need to move beyond tax data to capture income and wealth at the top, even in countries where tax compliance is generally high. We also find that after reducing tax evasion—by using tax amnesties—tax evaders do not legally avoid taxes more. This result suggests that fighting tax evasion can be an effective way to collect more tax revenue from the ultra-wealthy."

United Kingdom

HMRC, the UK tax collection agency, estimated that in the tax year 2016–17, pure tax evasion (i.e. not including things like hidden economy or criminal activity) cost the government £5.3 billion. This compared to a wider tax gap (the difference between the amount of tax that should, in theory, be collected by HMRC, against what is actually collected) of £33 billion in the same year, an amount that represented 5.7% of liabilities. At the same time,

HMRC, the UK tax collection agency, estimated that in the tax year 2016–17, pure tax evasion (i.e. not including things like hidden economy or criminal activity) cost the government £5.3 billion. This compared to a wider tax gap (the difference between the amount of tax that should, in theory, be collected by HMRC, against what is actually collected) of £33 billion in the same year, an amount that represented 5.7% of liabilities. At the same time, tax avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdict ...

was estimated at £1.7 billion (this does not include international tax arrangements that cannot be challenged under the UK law, including some forms of base erosion and profit shifting (BEPS)).

In 2013, the Coalition government

A coalition government is a form of government in which political parties cooperate to form a government. The usual reason for such an arrangement is that no single party has achieved an absolute majority after an election, an atypical outcome in ...

announced a crackdown on economic crime. It created a new criminal offence for aiding tax evasion and removed the requirement for tax investigation authorities to prove "intent to evade tax" to prosecute offenders.

In 2015, Chancellor George Osborne promised to collect £5bn by "waging war" on tax evaders by announcing new powers for HMRC to target people with offshore bank accounts. The number of people prosecuted for tax evasion doubled in 2014/15 from the year before to 1,258.

United States

In the United States of America, Federal tax evasion is defined as the purposeful, illegal attempt to evade the assessment or the payment of a tax imposed by federal law. Conviction of tax evasion may result in fines and imprisonment. TheInternal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory ta ...

(IRS) has identified small businesses and sole proprietors as the largest contributors to the tax gap between what Americans owe in federal taxes and what the federal government receives. Small businesses and sole proprietorships contribute to the tax gap because there are few ways for the government to know about skimming or non-reporting of income without mounting significant investigations.

the most common means of tax evasion was overstatement of charitable contributions, particularly church donations.

Estimates of lost government revenue

The IRS estimates that the 2001 tax gap was $345 billion and for 2006 it was $450 billion. A study of the 2008 tax gap found a range of $450–$500 billion, and unreported income to be about $2 trillion, concluding that 18 to 19 percent of total reportable income was not being properly reported to the IRS.Tax evasion and inequality

Generally, individuals tend to evade taxes, while companies rather avoid taxes. There is a great heterogenic among people who evade people as it is a substantial issue in society, that is creating an excessive tax gap. Studies suggest that 8% of global financial wealth lies in offshore accounts. Often, offshore wealth that is stored in tax havens stays undetected in random audits. Even though there is high diversity among people who evade taxes, there is a higher probability among the highest wealth group. According to Alstadsæter, Johannesen and Zucman 2019 the extent of taxes evaded is substantially higher with higher income, and exceptionally higher among people of the top wealth group. In line with this, the probability to appear in thePanama Papers

The Panama Papers ( es, Papeles de Panamá) are 11.5 million leaked documents (or 2.6 terabytes of data) that were published beginning on April 3, 2016. The papers detail financial and attorney–client information for more than 214,488 ...

rises significantly among the top 0.01% of the wealth group, as does the probability to own an unreported account at HSBC. However, the upper wealth group is also more inclined to use tax amnesty.

See also

Further reading

*Slemrod, Joel

Joel Brian Slemrod (born July 14, 1951) is an American economist and academic, currently serving as a professor of economics at the University of Michigan and the Paul W. McCracken Collegiate Professor of Business Economics and Public Policy at th ...

. 2019. "Tax Compliance and Enforcement." ''Journal of Economic Literature'', 57 (4): 904–54.

* Emmanuel Saez and Gabriel Zucman. 2019. ''The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay''. W.W. Norton.

References

External links

Tax Evasion and Fraud

collected news and commentary at ''

The Economist

''The Economist'' is a British weekly newspaper printed in demitab format and published digitally. It focuses on current affairs, international business, politics, technology, and culture. Based in London, the newspaper is owned by The Econo ...

''

*Employment Tax Evasion Schemes

common employment schemes at

IRS

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax ...

;United States

US Justice Dept press release

on Jeffrey Chernick, UBS tax evader

US Justice Tax Division

and its enforcement efforts {{Authority control Informal economy