A tax is a compulsory financial charge or some other type of levy imposed on a

taxpayer

A taxpayer is a person or organization (such as a company) subject to pay a tax. Modern taxpayers may have an Taxpayer Identification Number, identification number, a reference number issued by a government to Citizenship, citizens or Company, f ...

(an individual or

legal entity

In law, a legal person is any person or 'thing' (less ambiguously, any legal entity) that can do the things a human person is usually able to do in law – such as enter into contracts, sue and be sued, own property, and so on. The reason for ...

) by a

government

A government is the system or group of people governing an organized community, generally a state.

In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is a ...

al organization in order to fund

government spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual o ...

and various

public expenditure

Public expenditure is spending made by the government of a country on collective needs and wants, such as pension, provisions, security, infrastructure, etc. Until the 19th century, public expenditure was limited as laissez faire philosophies be ...

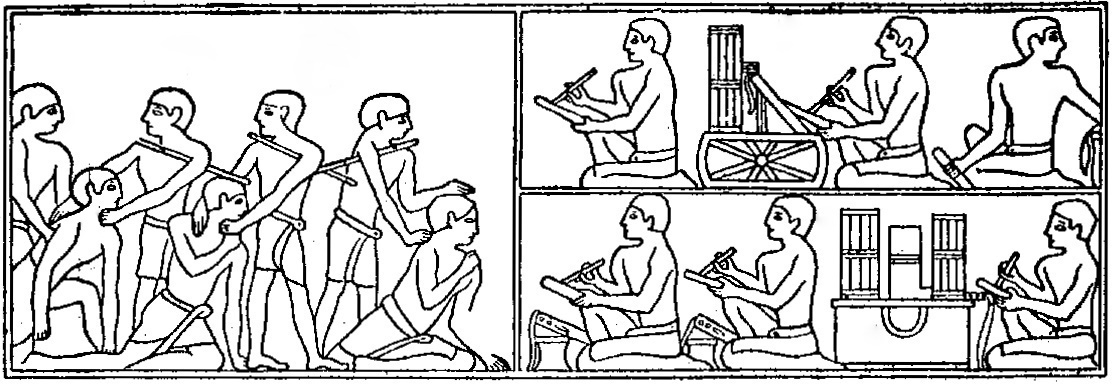

s (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC.

A failure to pay in a timely manner (

non-compliance), along with evasion of or resistance to taxation, is punishable by

law

Law is a set of rules that are created and are enforceable by social or governmental institutions to regulate behavior,Robertson, ''Crimes against humanity'', 90. with its precise definition a matter of longstanding debate. It has been vario ...

. Taxes consist of

direct

Direct may refer to:

Mathematics

* Directed set, in order theory

* Direct limit of (pre), sheaves

* Direct sum of modules, a construction in abstract algebra which combines several vector spaces

Computing

* Direct access (disambiguation), a ...

or

indirect tax

An indirect tax (such as sales tax, per unit tax, value added tax (VAT), or goods and services tax (GST), excise, consumption tax, tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the i ...

es and may be paid in money or as its labor equivalent.

Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a

flat percentage rate of taxation on personal annual income, but most

scale taxes are progressive based on brackets of annual income amounts. Most countries charge a tax on an individual's

income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. For ...

as well as on

corporate income

A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and re ...

. Countries or subunits often also impose

wealth tax

A wealth tax (also called a capital tax or equity tax) is a tax on an entity's holdings of assets. This includes the total value of personal assets, including cash, bank deposits, real estate, assets in insurance and pension plans, ownershi ...

es,

inheritance tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died.

International tax law distinguishes between an es ...

es,

estate taxes,

gift tax

In economics, a gift tax is the tax on money or property that one living person or corporate entity gives to another. A gift tax is a type of transfer tax that is imposed when someone gives something of value to someone else. The transfer must ...

es,

property tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheri ...

es,

sales tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a govern ...

es,

use tax

A use tax is a type of tax levied in the United States by numerous state governments. It is essentially the same as a sales tax but is applied not where a product or service was sold but where a merchant bought a product or service and then conve ...

es,

payroll tax

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the em ...

es,

duties

A duty (from "due" meaning "that which is owing"; fro, deu, did, past participle of ''devoir''; la, debere, debitum, whence "debt") is a commitment or expectation to perform some action in general or if certain circumstances arise. A duty may ...

and/or

tariff

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and poli ...

s.

In economic terms, taxation transfers wealth from households or businesses to the government. This has effects on

economic growth

Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy in a financial year. Statisticians conventionally measure such growth as the percent rate of ...

and

economic welfare

The welfare definition of economics is an attempt by Alfred Marshall, a pioneer of neoclassical economics, to redefine his field of study. This definition expands the field of economic science to a larger study of humanity. Specifically, Marshall's ...

that can be both increased (known as

fiscal multiplier

In economics, the fiscal multiplier (not to be confused with the money multiplier) is the ratio of change in national income arising from a change in government spending. More generally, the exogenous spending multiplier is the ratio of change ...

) or decreased (known as

excess burden of taxation

In economics, the excess burden of taxation, also known as the deadweight cost or deadweight loss of taxation, is one of the economic losses that society suffers as the result of taxes or subsidies. Economic theory posits that distortions change ...

). Consequently, taxation is a highly debated topic by some, although taxation is deemed necessary by general consensus in order for society to function and grow in an orderly and equitable manner, others such as

libertarians

Libertarianism (from french: libertaire, "libertarian"; from la, libertas, "freedom") is a political philosophy that upholds liberty as a core value. Libertarians seek to maximize autonomy and political freedom, and minimize the state's enc ...

and

anarcho-capitalists

Anarcho-capitalism (or, colloquially, ancap) is an anti-statist, libertarian, and anti-political philosophy and economic theory that seeks to abolish centralized states in favor of stateless societies with systems of private property enfor ...

denounce taxation broadly or in its entirety, classifying it as

theft

Theft is the act of taking another person's property or services without that person's permission or consent with the intent to deprive the rightful owner of it. The word ''theft'' is also used as a synonym or informal shorthand term for some ...

or

extortion

Extortion is the practice of obtaining benefit through coercion. In most jurisdictions it is likely to constitute a criminal offence; the bulk of this article deals with such cases. Robbery is the simplest and most common form of extortion, ...

through

coercion

Coercion () is compelling a party to act in an involuntary manner by the use of threats, including threats to use force against a party. It involves a set of forceful actions which violate the free will of an individual in order to induce a desi ...

and the use of

force

In physics, a force is an influence that can change the motion of an object. A force can cause an object with mass to change its velocity (e.g. moving from a state of rest), i.e., to accelerate. Force can also be described intuitively as a p ...

.

Overview

The legal definition and the economic definition of taxes differ in some ways such that economists do not regard many transfers to governments as taxes. For example, some transfers to the public sector are comparable to prices. Examples include tuition at public universities and fees for utilities provided by local governments. Governments also obtain resources by "creating" money and coins (for example, by printing bills and by minting coins), through voluntary gifts (for example, contributions to public universities and museums), by imposing penalties (such as

traffic fines), by borrowing and confiscating

criminal

In ordinary language, a crime is an unlawful act punishable by a state or other authority. The term ''crime'' does not, in modern criminal law, have any simple and universally accepted definition,Farmer, Lindsay: "Crime, definitions of", in Can ...

proceeds. From the view of economists, a tax is a non-penal, yet compulsory transfer of resources from the private to the

public sector

The public sector, also called the state sector, is the part of the economy composed of both public services and public enterprises. Public sectors include the public goods and governmental services such as the military, law enforcement, infra ...

, levied on a basis of predetermined criteria and without reference to specific benefits received.

In modern taxation systems, governments levy taxes in money; but

in-kind The term in kind (or in-kind) generally refers to goods, services, and transactions not involving money or not measured in monetary terms. It is a part of many spheres, mainly economics, finance, but also politics, work career, food, health and othe ...

and ''

corvée

Corvée () is a form of unpaid, forced labour, that is intermittent in nature lasting for limited periods of time: typically for only a certain number of days' work each year.

Statute labour is a corvée imposed by a state for the purposes of ...

'' taxation are characteristic of traditional or pre-

capitalist

Capitalism is an economic system based on the private ownership of the means of production and their operation for profit. Central characteristics of capitalism include capital accumulation, competitive markets, price system, priva ...

states and their functional equivalents. The method of taxation and the government expenditure of taxes raised is often highly debated in

politics

Politics (from , ) is the set of activities that are associated with making decisions in groups, or other forms of power relations among individuals, such as the distribution of resources or status. The branch of social science that studies ...

and

economics

Economics () is the social science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services.

Economics focuses on the behaviour and intera ...

. Tax collection is performed by a government agency such as the

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory ta ...

(IRS) in the

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territorie ...

,

His Majesty's Revenue and Customs

, patch =

, patchcaption =

, logo = HM Revenue & Customs.svg

, logocaption =

, badge =

, badgecaption =

, flag =

, flagcaption =

, image_size =

, co ...

(HMRC) in the

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the continental mainland. It comprises England, Scotland, Wales and North ...

, the

Canada Revenue Agency

The Canada Revenue Agency (CRA; ; ) is the revenue service of the Canadian federal government, and most provincial and territorial governments. The CRA collects taxes, administers tax law and policy, and delivers benefit programs and tax credit ...

or the

Australian Taxation Office

The Australian Taxation Office (ATO) is an Australian statutory agency and the principal revenue collection body for the Australian Government. The ATO has responsibility for administering the Australian federal taxation system, superannuati ...

. When taxes are not fully paid, the state may impose civil penalties (such as

fines Fines may refer to:

* Fines, Andalusia, Spanish municipality

* Fine (penalty)

* Fine, a dated term for a premium on a lease of land, a large sum the tenant pays to commute (lessen) the rent throughout the term

*Fines, ore or other products with a s ...

or

forfeiture) or criminal penalties (such as

incarceration

Imprisonment is the restraint of a person's liberty, for any cause whatsoever, whether by authority of the government, or by a person acting without such authority. In the latter case it is "false imprisonment". Imprisonment does not necessari ...

) on the non-paying entity or individual.

Purposes and effects

The levying of taxes aims to raise revenue to fund

governing

Governance is the process of interactions through the laws, social norm, norms, power (social and political), power or language of an organized society over a social system (family, tribe, formal organization, formal or informal organization, a ...

or to alter prices in order to affect

demand

In economics, demand is the quantity of a good that consumers are willing and able to purchase at various prices during a given time. The relationship between price and quantity demand is also called the demand curve. Demand for a specific item ...

. States and their functional equivalents throughout history have used the money provided by taxation to carry out many functions. Some of these include expenditures on economic

infrastructure

Infrastructure is the set of facilities and systems that serve a country, city, or other area, and encompasses the services and facilities necessary for its economy, households and firms to function. Infrastructure is composed of public and priv ...

(

road

A road is a linear way for the conveyance of traffic that mostly has an improved surface for use by vehicles (motorized and non-motorized) and pedestrians. Unlike streets, the main function of roads is transportation.

There are many types of ...

s,

public transport

Public transport (also known as public transportation, public transit, mass transit, or simply transit) is a system of transport for passengers by group travel systems available for use by the general public unlike private transport, typical ...

ation,

sanitation

Sanitation refers to public health conditions related to clean drinking water and treatment and disposal of human excreta and sewage. Preventing human contact with feces is part of sanitation, as is hand washing with soap. Sanitation systems ...

,

legal systems

The contemporary national legal systems are generally based on one of four basic systems: civil law, common law, statutory law, religious law or combinations of these. However, the legal system of each country is shaped by its unique history and ...

,

public security

Public security or public safety is the prevention of and protection from events that could endanger the safety and security of the public from significant danger, injury, or property damage. It is often conducted by a state government to ensure ...

, public

education

Education is a purposeful activity directed at achieving certain aims, such as transmitting knowledge or fostering skills and character traits. These aims may include the development of understanding, rationality, kindness, and honesty. Va ...

, public

health system

Health, according to the World Health Organization, is "a state of complete physical, mental and social well-being and not merely the absence of disease and infirmity".World Health Organization. (2006)''Constitution of the World Health Organiza ...

s),

military

A military, also known collectively as armed forces, is a heavily armed, highly organized force primarily intended for warfare. It is typically authorized and maintained by a sovereign state, with its members identifiable by their distinct ...

,

scientific

Science is a systematic endeavor that builds and organizes knowledge in the form of testable explanations and predictions about the universe.

Science may be as old as the human species, and some of the earliest archeological evidence for ...

research & development

Research and development (R&D or R+D), known in Europe as research and technological development (RTD), is the set of innovative activities undertaken by corporations or governments in developing new services or products, and improving existi ...

,

culture

Culture () is an umbrella term which encompasses the social behavior, institutions, and norms found in human societies, as well as the knowledge, beliefs, arts, laws, customs, capabilities, and habits of the individuals in these groups.Tyl ...

and

the arts

The arts are a very wide range of human practices of creative expression, storytelling and cultural participation. They encompass multiple diverse and plural modes of thinking, doing and being, in an extremely broad range of media. Both ...

,

public works

Public works are a broad category of infrastructure projects, financed and constructed by the government, for recreational, employment, and health and safety uses in the greater community. They include public buildings ( municipal buildings, sc ...

,

distribution Distribution may refer to:

Mathematics

*Distribution (mathematics), generalized functions used to formulate solutions of partial differential equations

* Probability distribution, the probability of a particular value or value range of a vari ...

,

data collection

Data collection or data gathering is the process of gathering and measuring information on targeted variables in an established system, which then enables one to answer relevant questions and evaluate outcomes. Data collection is a research com ...

and

dissemination

To disseminate (from lat. ''disseminare'' "scattering seeds"), in the field of communication, is to broadcast a message to the public without direct feedback from the audience.

Meaning

Dissemination takes on the theory of the traditional view ...

, public

insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge ...

, and the operation of government itself. A government's ability to raise taxes is called its

fiscal capacity Fiscal capacity is the ability of the state to extract revenues to provide public goods and carry out other functions of the state, given an administrative, fiscal accounting structure. In economics and political science, fiscal capacity may be refe ...

.

When

expenditures

An expense is an item requiring an outflow of money, or any form of Wealth, fortune in general, to another person or group as payment for an item, service, or other category of costs. For a leasehold estate, tenant, renting, rent is an expense. Fo ...

exceed tax

revenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business.

Commercial revenue may also be referred to as sales or as turnover. Some companies receive reven ...

, a government accumulates

government debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit oc ...

. A portion of taxes may be used to service past debts. Governments also use taxes to fund

welfare

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specificall ...

and

public service

A public service is any service intended to address specific needs pertaining to the aggregate members of a community. Public services are available to people within a government jurisdiction as provided directly through public sector agencies ...

s. These services can include

education system

The educational system generally refers to the structure of all institutions and the opportunities for obtaining education within a country. It includes all pre-school institutions, starting from family education, and/or early childhood education ...

s,

pension

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments ...

s for the

elderly

Old age refers to ages nearing or surpassing the life expectancy of human beings, and is thus the end of the human life cycle. Terms and euphemisms for people at this age include old people, the elderly (worldwide usage), OAPs (British usage ...

,

unemployment benefits

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by authorized bodies to unemployment, unemployed people. In the United States, benefits are fun ...

,

transfer payment

In macroeconomics and finance, a transfer payment (also called a government transfer or simply transfer) is a redistribution of income and wealth by means of the government making a payment, without goods or services being received in return. Th ...

s,

subsidies

A subsidy or government incentive is a form of financial aid or support extended to an economic sector (business, or individual) generally with the aim of promoting economic and social policy. Although commonly extended from the government, the ter ...

and

public transportation

Public transport (also known as public transportation, public transit, mass transit, or simply transit) is a system of transport for passengers by group travel systems available for use by the general public unlike private transport, typical ...

.

Energy

In physics, energy (from Ancient Greek: ἐνέργεια, ''enérgeia'', “activity”) is the quantitative property that is transferred to a body or to a physical system, recognizable in the performance of work and in the form of heat a ...

,

water

Water (chemical formula ) is an inorganic, transparent, tasteless, odorless, and nearly colorless chemical substance, which is the main constituent of Earth's hydrosphere and the fluids of all known living organisms (in which it acts as a ...

and

waste management

Waste management or waste disposal includes the processes and actions required to manage waste from its inception to its final disposal.

This includes the collection, transport, treatment and disposal of waste, together with monitoring ...

systems are also common

public utilities

A public utility company (usually just utility) is an organization that maintains the infrastructure for a public service (often also providing a service using that infrastructure). Public utilities are subject to forms of public control and r ...

.

According to the proponents of the

chartalist theory of

money creation

Money creation, or money issuance, is the process by which the money supply of a country, or of an economic or monetary region,Such as the Eurozone or ECCAS is increased. In most modern economies, money creation is controlled by the central bank ...

, taxes are not needed for government revenue, as long as the government in question is able to issue

fiat money

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was sometime ...

. According to this view, the purpose of taxation is to maintain the stability of the currency, express public policy regarding the distribution of wealth, subsidizing certain industries or population groups or isolating the costs of certain benefits, such as highways or social security.

Effects of taxes can be divided into two fundamental categories:

* Taxes cause an

income effect

The theory of consumer choice is the branch of microeconomics that relates preferences to consumption expenditures and to consumer demand curves. It analyzes how consumers maximize the desirability of their consumption as measured by their pref ...

because they reduce

purchasing power

Purchasing power is the amount of goods and services that can be purchased with a unit of currency. For example, if one had taken one unit of currency to a store in the 1950s, it would have been possible to buy a greater number of items than would ...

to taxpayers.

* Taxes cause a

substitution effect

In economics and particularly in consumer choice theory, the substitution effect is one component of the effect of a change in the price of a good upon the amount of that good demanded by a consumer, the other being the income effect.

When a g ...

when taxation causes a substitution between taxed goods and untaxed goods.

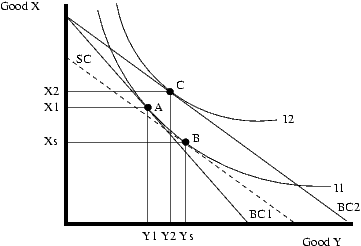

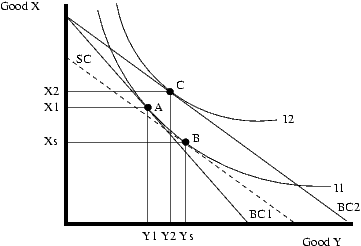

If we consider, for instance, two

normal good

In economics, a normal good is a type of a Good (economics), good which experiences an increase in demand due to an increase in income, unlike inferior goods, for which the opposite is observed. When there is an increase in a person's income, for ...

s, ''x'' and ''y,'' whose prices are respectively ''p

x'' and ''p

y'' and an individual budget constraint given by the equation ''xp

x'' + ''yp

y'' = Y, where Y is the income, the slope of the budget constraint, in a graph where is represented good ''x'' on the vertical axis and good ''y'' on the horizontal axes, is equal to -''p

y''/''p

x'' . The initial equilibrium is in the point (C), in which

budget constraint

In economics, a budget constraint represents all the combinations of goods and services that a consumer may purchase given current prices within his or her given income. Consumer theory uses the concepts of a budget constraint and a preference ...

and

indifference curve

In economics, an indifference curve connects points on a graph representing different quantities of two goods, points between which a consumer is ''indifferent''. That is, any combinations of two products indicated by the curve will provide the c ...

are

tangent

In geometry, the tangent line (or simply tangent) to a plane curve at a given point is the straight line that "just touches" the curve at that point. Leibniz defined it as the line through a pair of infinitely close points on the curve. More ...

, introducing an ''

ad valorem tax

An ''ad valorem'' tax (Latin for "according to value") is a tax whose amount is based on the value of a transaction or of property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ...

'' on the ''y'' good (budget constraint: ''p

xx'' + ''p

y''(1 + ''τ'')''y ='' Y'')'', the budget constraint's slope becomes equal to -''p

y''(1 + τ)/''p

x''. The new equilibrium is now in the tangent point (A) with a lower indifferent curve.

As can be noticed the tax's introduction causes two consequences:

# It changes the consumers' real income (less purchasing power)

# It raises the relative price of ''y'' good.

The income effect shows the variation of ''y'' good quantity given by the change of real income. The substitution effect shows the variation of ''y'' good determined by relative prices' variation. This kind of taxation (that causes the substitution effect) can be considered distortionary.

Another example can be the introduction of an income

lump-sum tax

A lump-sum tax is a special way of taxation, based on a fixed amount, rather than on the real circumstance of the taxed entity. (''xp

x'' + ''yp

y'' = Y - T), with a parallel shift downward of the budget constraint, can be produced a higher revenue with the same loss of consumers' utility compared with the property tax case, from another point of view, the same revenue can be produced with a lower utility sacrifice. The lower utility (with the same revenue) or the lower revenue (with the same utility) given by a distortionary tax are called excess pressure. The same result, reached with an income lump-sum tax, can be obtained with these following types of taxes (all of them cause only a budget constraint's shift without causing a substitution effect), the budget constraint's slope remains the same (-''p

x''/''p

y''):

* A general tax on consumption: (Budget constraint: ''p

x''(1 + τ)''x'' + ''p

y''(1 + τ)''y ='' Y)

* A proportional income tax: (Budget constraint: ''xp

x'' + ''yp

y'' = Y(1 - ''t''))

When the t and τ rates are chosen respecting this equation (where t is the rate of income tax and tau is the consumption tax's rate):

the effects of the two taxes are the same.

A tax effectively changes the relative prices of products. Therefore, most

economists

An economist is a professional and practitioner in the social science discipline of economics.

The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this field there are ...

, especially

neoclassical economists

Neoclassical economics is an approach to economics in which the production, consumption and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good ...

, argue that taxation creates

market distortion In neoclassical economics, a market distortion is any event in which a market reaches a market clearing price for an item that is substantially different from the price that a market would achieve while operating under conditions of perfect competi ...

and results in economic inefficiency unless there are (positive or negative) externalities associated with the activities that are taxed that need to be internalized to reach an efficient market outcome. They have therefore sought to identify the kind of tax system that would minimize this distortion. Recent scholarship suggests that in the

United States of America

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territo ...

, the federal government effectively taxes investments in higher education more heavily than it subsidizes higher education, thereby contributing to a shortage of skilled workers and unusually high differences in pre-tax earnings between highly educated and less-educated workers.

Taxes can even have effects on labor supply: we can consider a model in which the consumer chooses the number of hours spent working and the amount spent on consumption. Let us suppose that only one good exists and no income is saved.

Consumers have a given number of hours (H) that is divided between work (L) and free time (F = H - L). The hourly wage is called ''w'' and it tells us the free time's

opportunity cost

In microeconomic theory, the opportunity cost of a particular activity is the value or benefit given up by engaging in that activity, relative to engaging in an alternative activity. More effective it means if you chose one activity (for example ...

, i.e. the income to which the individual renounces consuming an additional hour of free time. Consumption and hours of work have a positive relationship, more hours of work mean more earnings and, assuming that workers don't save money, more earnings imply an increase in consumption (Y = C = ''w''L). Free time and consumption can be considered as two normal goods (workers have to decide between working one hour more, that would mean consuming more or having one more hour of free time) and the budget constraint is negatively inclined (Y = ''w''(H - F)). The

indifference curve

In economics, an indifference curve connects points on a graph representing different quantities of two goods, points between which a consumer is ''indifferent''. That is, any combinations of two products indicated by the curve will provide the c ...

related to these two goods has a negative slope and free time becomes more and more important with high levels of consumption. This is because a high level of consumption means that people are already spending many hours working, so, in this situation, they need more free time than consume and it implies that they have to be paid with a higher salary to work an additional hour. A proportional income tax, changing budget constraint's slope (now Y = ''w''(1 - ''t'')(H - F)), implies both substitution and income effects. The problem now is that the two effects go in opposite ways: the income effect tells us that, with an income tax, the consumer feels poorer and for this reason he wants to work more, causing an increase in labor offer. On the other hand, the substitution effect tells us that free time, being a normal good, is now more convenient compared to consume and it implies a decrease in labor offer. Therefore, the total effect can be both an increase or a decrease of labor offer, depending on the indifference curve's shape.

The

Laffer curve

In economics, the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the government's tax revenue. The Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0% and ...

depicts the amount of government revenue as a function of the rate of taxation. It shows that for a tax rate above a certain critical rate, government revenue starts decreasing as the tax rate rises, as a consequence of a decline in labor supply. This theory supports that, if the tax rate is above that critical point, a decrease in the tax rate should imply a rise in labor supply that in turn would lead to an increase in government revenue.

Governments use different kinds of taxes and vary the tax rates. They do this in order to distribute the tax burden among individuals or classes of the population involved in taxable activities, such as the

business sector

In economics, the business sector or corporate sector - sometimes popularly called simply "business" - is "the part of the economy made up by companies". It is a subset of the domestic economy, excluding the economic activities of general govern ...

, or to redistribute resources between individuals or classes in the population. Historically, taxes on the poor supported the

nobility

Nobility is a social class found in many societies that have an aristocracy (class), aristocracy. It is normally ranked immediately below Royal family, royalty. Nobility has often been an Estates of the realm, estate of the realm with many e ...

; modern

social-security systems aim to support the poor, the disabled, or the retired by taxes on those who are still working. In addition, taxes are applied to fund foreign aid and military ventures, to influence the

macroeconomic

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole.

For example, using interest rates, taxes, and ...

performance of the economy (a government's strategy for doing this is called its

fiscal policy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables ...

; see also

tax exemption

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, redu ...

), or to modify patterns of consumption or employment within an economy, by making some classes of the transaction more or less attractive.

A state's tax system often reflects its communal values and the values of those in current political power. To create a system of taxation, a state must make choices regarding the distribution of the tax burden—who will pay taxes and how much they will pay—and how the taxes collected will be spent. In democratic nations where the public elects those in charge of establishing or administering the tax system, these choices reflect the type of community that the public wishes to create. In countries where the public does not have a significant amount of influence over the system of taxation, that system may reflect more closely the values of those in power.

All large

business

Business is the practice of making one's living or making money by producing or Trade, buying and selling Product (business), products (such as goods and Service (economics), services). It is also "any activity or enterprise entered into for pr ...

es incur administrative costs in the process of delivering revenue collected from customers to the suppliers of the goods or services being purchased. Taxation is no different, as governments are large organizations; the resource collected from the public through taxation is always greater than the amount which can be used by the government. The difference is called the

compliance cost Compliance costs are all expenses that a company uses up to adhere to government regulations. Compliance costs incorporate salaries of employees in compliance, time and funds spend on announcing, new system necessitated to meet retention, and so on. ...

and includes (for example) the labor cost and other expenses incurred in complying with tax laws and rules. The collection of a tax in order to spend it on a specified purpose, for example collecting a tax on alcohol to pay directly for alcoholism-rehabilitation centers, is called

hypothecation

Hypothec (; german: Hypothek, french: hypothèque, pl, hipoteka, from Lat. ''hypotheca'', from Gk. : hypothēkē), sometimes tacit hypothec, is a term used in civil law systems (e.g. law of entire Continental Europe except Gibraltar) or mixed ...

.

Finance minister

A finance minister is an executive or cabinet position in charge of one or more of government finances, economic policy and financial regulation.

A finance minister's portfolio has a large variety of names around the world, such as "treasury", " ...

s often dislike this practice, since it reduces their freedom of action. Some economic theorists regard hypothecation as intellectually dishonest since, in reality, money is

fungible

In economics, fungibility is the property of a good or a commodity whose individual units are essentially interchangeable, and each of whose parts is indistinguishable from any other part. Fungible tokens can be exchanged or replaced; for exam ...

. Furthermore, it often happens that taxes or excises initially levied to fund some specific government programs are then later diverted to the government general fund. In some cases, such taxes are collected in fundamentally inefficient ways, for example, through highway tolls.

Since governments also resolve commercial disputes, especially in countries with

common law

In law, common law (also known as judicial precedent, judge-made law, or case law) is the body of law created by judges and similar quasi-judicial tribunals by virtue of being stated in written opinions."The common law is not a brooding omnipresen ...

, similar arguments are sometimes used to justify a

sales tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a govern ...

or

value added tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end ...

. Some (

libertarians

Libertarianism (from french: libertaire, "libertarian"; from la, libertas, "freedom") is a political philosophy that upholds liberty as a core value. Libertarians seek to maximize autonomy and political freedom, and minimize the state's enc ...

, for example) portray most or all forms of taxes as

immoral

Immorality is the violation of moral laws, norms or standards. It refers to an agent doing or thinking something they know or believe to be wrong. Immorality is normally applied to people or actions, or in a broader sense, it can be applied to gr ...

due to their involuntary (and therefore eventually

coercive or violent) nature. The most extreme anti-tax view,

anarcho-capitalism

Anarcho-capitalism (or, colloquially, ancap) is an anti-statist, libertarian, and anti-political philosophy and economic theory that seeks to abolish centralized states in favor of stateless societies with systems of private property enforce ...

, holds that all social services should be voluntarily bought by the people using them.

Types

The

Organisation for Economic Co-operation and Development

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organization, intergovernmental organisation with 38 member countries ...

(OECD) publishes an analysis of the tax systems of member countries. As part of such analysis, OECD has developed a definition and system of classification of internal taxes, generally followed below. In addition, many countries impose taxes (

tariff

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and poli ...

s) on the import of goods.

Income

Income tax

Many jurisdictions tax the income of individuals and of

business entities

In law, a legal person is any person or 'thing' (less ambiguously, any legal entity) that can do the things a human person is usually able to do in law – such as enter into contracts, sue and be sued, own property, and so on. The reason for ...

, including

corporation

A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and r ...

s. Generally, the authorities impose a tax on net profits from a

business

Business is the practice of making one's living or making money by producing or Trade, buying and selling Product (business), products (such as goods and Service (economics), services). It is also "any activity or enterprise entered into for pr ...

, on net gains, and on other income. Computation of income subject to tax may be determined under accounting principles used in the jurisdiction, which

tax-law principles in the jurisdiction may modify or replace. The

incidence of taxation varies by system, and some systems may be viewed as

progressive or

regressive. Rates of tax may vary or be constant (flat) by income level. Many systems allow individuals certain personal allowances and other non-business reductions to taxable income, although business deductions tend to be favored over personal deductions.

Tax-collection agencies often collect

personal income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Ta ...

on a

pay-as-you-earn basis, with corrections made after the end of the

tax year

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or ...

. These corrections take one of two forms:

* payments to the government, from taxpayers who have not paid enough during the tax year

*

tax refund

A tax refund or tax rebate is a payment to the taxpayer due to the taxpayer having paid more tax than they owed.

By country

United States

According to the Internal Revenue Service, 77% of tax returns filed in 2004 resulted in a refund check, ...

s from the government to those who have overpaid

Income-tax systems often make deductions available that reduce the total tax liability by reducing total taxable income. They may allow losses from one type of income to count against another - for example, a loss on the stock market may be deducted against taxes paid on wages. Other tax systems may isolate the loss, such that business losses can only be deducted against business income tax by carrying forward the loss to later tax years.

Negative income tax

In economics, a negative income tax (abbreviated NIT) is a

progressive income tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases.Sommerfeld, Ray M., Silvia A. Madeo, Kenneth E. Anderson, Betty R. Jackson (1992), ''Concepts of Taxation'', Dryden Press: Fort Worth, TX The term ''progre ...

system where people earning below a certain amount receive supplemental payment from the government instead of paying taxes to the government.

Capital gains

Most jurisdictions imposing an income tax treat

capital gain

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares.

...

s as part of income subject to tax. Capital gain is generally a gain on sale of capital assets—that is, those assets not held for sale in the ordinary course of business. Capital assets include personal assets in many jurisdictions. Some jurisdictions provide preferential rates of tax or only partial taxation for capital gains. Some jurisdictions impose different rates or levels of capital-gains taxation based on the length of time the asset was held. Because tax rates are often much lower for capital gains than for ordinary income, there is widespread controversy and dispute about the proper definition of capital.

Corporate

Corporate tax refers to income tax, capital tax, net-worth tax, or other taxes imposed on corporations. Rates of tax and the taxable base for corporations may differ from those for individuals or for other taxable persons.

Social-security contributions

Many countries provide publicly funded retirement or healthcare systems. In connection with these systems, the country typically requires employers and/or employees to make compulsory payments. These payments are often computed by reference to wages or earnings from self-employment. Tax rates are generally fixed, but a different rate may be imposed on employers than on employees. Some systems provide an upper limit on earnings subject to the tax. A few systems provide that the tax is payable only on wages above a particular amount. Such upper or lower limits may apply for retirement but not for health-care components of the tax. Some have argued that such taxes on wages are a form of "forced savings" and not really a tax, while others point to redistribution through such systems between generations (from newer cohorts to older cohorts) and across income levels (from higher income levels to lower income-levels) which suggests that such programs are really taxed and spending programs.

Payroll or workforce

Unemployment and similar taxes are often imposed on employers based on the total payroll. These taxes may be imposed in both the country and sub-country levels.

Wealth

A wealth tax is levied on the total value of personal assets, including: bank deposits, real estate, assets in insurance and pension plans, ownership of

unincorporated businesses,

financial securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

, and personal trusts.

[ (recommending a net wealth tax for the US of 0.05% for the first $100,000 in assets to 0.3% for assets over $1,000,000)] Liabilities (primarily mortgages and other loans) are typically deducted, hence it is sometimes called a net wealth tax.

Property

Recurrent property taxes may be imposed on immovable property (real property) and on some classes of movable property. In addition, recurrent taxes may be imposed on the net wealth of individuals or corporations. Many jurisdictions impose

estate tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died.

International tax law distinguishes between an es ...

,

gift tax

In economics, a gift tax is the tax on money or property that one living person or corporate entity gives to another. A gift tax is a type of transfer tax that is imposed when someone gives something of value to someone else. The transfer must ...

or other

inheritance tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died.

International tax law distinguishes between an es ...

es on property at death or at the time of gift transfer. Some jurisdictions impose

taxes on financial or capital transactions.

Property taxes

A property tax (or millage tax) is an

'' ad valorem'' tax levy on the value of a property that the owner of the property is required to pay to a government in which the property is situated. Multiple jurisdictions may tax the same property. There are three general varieties of property: land, improvements to land (immovable man-made things, e.g. buildings), and personal property (movable things).

Real estate

Real estate is property consisting of land and the buildings on it, along with its natural resources such as crops, minerals or water; immovable property of this nature; an interest vested in this (also) an item of real property, (more general ...

or realty is the combination of land and improvements to the land.

Property taxes are usually charged on a recurrent basis (e.g., yearly). A common type of property tax is an annual charge on the ownership of

real estate

Real estate is property consisting of land and the buildings on it, along with its natural resources such as crops, minerals or water; immovable property of this nature; an interest vested in this (also) an item of real property, (more general ...

, where the tax base is the estimated value of the property. For a period of over 150 years from 1695, the government of England levied a

window tax

Window tax was a property tax based on the number of windows in a house. It was a significant social, cultural, and architectural force in England, France, and Ireland during the 18th and 19th centuries. To avoid the tax, some houses from the pe ...

, with the result that one can still see

listed buildings

In the United Kingdom, a listed building or listed structure is one that has been placed on one of the four statutory lists maintained by Historic England in England, Historic Environment Scotland in Scotland, in Wales, and the Northern Irel ...

with windows bricked up in order to save their owner's money. A similar tax on hearths existed in France and elsewhere, with similar results. The two most common types of event-driven property taxes are

stamp duty

Stamp duty is a tax that is levied on single property purchases or documents (including, historically, the majority of legal documents such as cheques, receipts, military commissions, marriage licences and land transactions). A physical revenu ...

, charged upon change of ownership, and

inheritance tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died.

International tax law distinguishes between an es ...

, which many countries impose on the estates of the deceased.

In contrast with a tax on real estate (land and buildings), a

land-value tax (or LVT) is levied only on the unimproved value of the land ("land" in this instance may mean either the economic term, i.e., all-natural resources, or the natural resources associated with specific areas of the Earth's surface: "lots" or "land parcels"). Proponents of the land-value tax argue that it is economically justified, as it will not deter production, distort market mechanisms or otherwise create

deadweight loss

In economics, deadweight loss is the difference in production and consumption of any given product or service including government tax. The presence of deadweight loss is most commonly identified when the quantity produced ''relative'' to the amoun ...

es the way other taxes do.

When real estate is held by a higher government unit or some other entity not subject to taxation by the local government, the taxing authority may receive a

payment in lieu of taxes A payment in lieu of taxes (usually abbreviated as PILOT, or sometimes as PILT) is a payment made to compensate a government for some or all of the property tax revenue lost due to tax exempt ownership or use of real property.

Canada

The federal g ...

to compensate it for some or all of the foregone tax revenues.

In many jurisdictions (including many American states), there is a general tax levied periodically on residents who own

personal property

property is property that is movable. In common law systems, personal property may also be called chattels or personalty. In civil law systems, personal property is often called movable property or movables—any property that can be moved fr ...

(personalty) within the jurisdiction. Vehicle and boat registration fees are subsets of this kind of tax. The tax is often designed with blanket coverage and large exceptions for things like food and clothing. Household goods are often exempt when kept or used within the household.

Any otherwise non-exempt object can lose its exemption if regularly kept outside the household.

Thus, tax collectors often monitor newspaper articles for stories about wealthy people who have lent art to museums for public display, because the artworks have then become subject to personal property tax.

If an artwork had to be sent to another state for some touch-ups, it may have become subject to personal property tax in ''that'' state as well.

Inheritance

Inheritance tax, estate tax, and death tax or duty are the names given to various taxes that arise on the death of an individual. In United States

tax law

Tax law or revenue law is an area of legal study in which public or sanctioned authorities, such as federal, state and municipal governments (as in the case of the US) use a body of rules and procedures (laws) to assess and collect taxes in a ...

, there is a distinction between an estate tax and an inheritance tax: the former taxes the personal representatives of the deceased, while the latter taxes the beneficiaries of the estate. However, this distinction does not apply in other jurisdictions; for example, if using this terminology UK inheritance tax would be an estate tax.

Expatriation

An expatriation tax is a tax on individuals who renounce their

citizenship

Citizenship is a "relationship between an individual and a state to which the individual owes allegiance and in turn is entitled to its protection".

Each state determines the conditions under which it will recognize persons as its citizens, and ...

or residence. The tax is often imposed based on a deemed disposition of all the individual's property. One example is the

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territorie ...

under the ''

American Jobs Creation Act

The American Jobs Creation Act of 2004 () was a federal tax act that repealed the export tax incentive (ETI), which had been declared illegal by the World Trade Organization several times and sparked retaliatory tariffs by the European Union. It ...

'', where any individual who has a net worth of $2 million or an average income-tax liability of $127,000 who renounces his or her citizenship and leaves the country is automatically assumed to have done so for tax avoidance reasons and is subject to a higher tax rate.

Transfer

Historically, in many countries, a contract needs to have a stamp affixed to make it valid. The charge for the stamp is either a fixed amount or a percentage of the value of the transaction. In most countries, the stamp has been abolished but

stamp duty

Stamp duty is a tax that is levied on single property purchases or documents (including, historically, the majority of legal documents such as cheques, receipts, military commissions, marriage licences and land transactions). A physical revenu ...

remains. Stamp duty is levied in the UK on the purchase of shares and securities, the issue of bearer instruments, and certain partnership transactions. Its modern derivatives,

stamp duty reserve tax

Stamp duty is a tax that is levied on single property purchases or documents (including, historically, the majority of legal documents such as cheques, receipts, military commissions, marriage licences and land transactions). A physical reven ...

and

stamp duty land tax

Stamp duty in the United Kingdom is a form of tax charged on legal instruments (written documents), and historically required a physical stamp to be attached to or impressed upon the document in question. The more modern versions of the tax no l ...

, are respectively charged on transactions involving securities and land. Stamp duty has the effect of discouraging speculative purchases of assets by decreasing liquidity. In the

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territorie ...

, transfer tax is often charged by the state or local government and (in the case of real property transfers) can be tied to the recording of the deed or other transfer documents.

Wealth (net worth)

Some countries' governments will require a declaration of the taxpayers'

balance sheet

In financial accounting, a balance sheet (also known as statement of financial position or statement of financial condition) is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business ...

(assets and liabilities), and from that exact a tax on

net worth

Net worth is the value of all the non-financial and financial assets owned by an individual or institution minus the value of all its outstanding liabilities. Since financial assets minus outstanding liabilities equal net financial assets, net ...

(assets minus liabilities), as a percentage of the net worth, or a percentage of the net worth exceeding a certain level. The tax may be levied on "

natural

Nature, in the broadest sense, is the physical world or universe. "Nature" can refer to the phenomena of the physical world, and also to life in general. The study of nature is a large, if not the only, part of science. Although humans are p ...

" or "

legal persons."

Goods and services

Value added

A value-added tax (VAT), also known as Goods and Services Tax (G.S.T), Single Business Tax, or Turnover Tax in some countries, applies the equivalent of a sales tax to every operation that creates value. To give an example, sheet steel is imported by a machine manufacturer. That manufacturer will pay the VAT on the purchase price, remitting that amount to the government. The manufacturer will then transform the steel into a machine, selling the machine for a higher price to a wholesale distributor. The manufacturer will collect the VAT on the higher price but will remit to the government only the excess related to the "value-added" (the price over the cost of the sheet steel). The wholesale distributor will then continue the process, charging the retail distributor the VAT on the entire price to the retailer, but remitting only the amount related to the distribution mark-up to the government. The last VAT amount is paid by the eventual retail customer who cannot recover any of the previously paid VAT. For a VAT and sales tax of identical rates, the total tax paid is the same, but it is paid at differing points in the process.

VAT is usually administrated by requiring the company to complete a VAT return, giving details of VAT it has been charged (referred to as input tax) and VAT it has charged to others (referred to as output tax). The difference between output tax and input tax is payable to the Local Tax Authority.

Many tax authorities have introduced automated VAT which has increased

accountability

Accountability, in terms of ethics and governance, is equated with answerability, blameworthiness, liability, and the expectation of account-giving. As in an aspect of governance, it has been central to discussions related to problems in the publ ...

and

auditability

An audit is an "independent examination of financial information of any entity, whether profit oriented or not, irrespective of its size or legal form when such an examination is conducted with a view to express an opinion thereon.” Auditing ...

, by utilizing computer systems, thereby also enabling anti-cybercrime offices as well.

Sales

Sales taxes are levied when a commodity is sold to its final consumer. Retail organizations contend that such taxes discourage retail sales. The question of whether they are generally progressive or regressive is a subject of much current debate. People with higher incomes spend a lower proportion of them, so a flat-rate sales tax will tend to be regressive. It is therefore common to exempt food, utilities, and other necessities from sales taxes, since poor people spend a higher proportion of their incomes on these commodities, so such exemptions make the tax more progressive. This is the classic "You pay for what you spend" tax, as only those who spend money on non-exempt (i.e. luxury) items pay the tax.

A small number of U.S. states rely entirely on sales taxes for state revenue, as those states do not levy a state income tax. Such states tend to have a moderate to a large amount of tourism or inter-state travel that occurs within their borders, allowing the state to benefit from taxes from people the state would otherwise not tax. In this way, the state is able to reduce the tax burden on its citizens. The U.S. states that do not levy a state income tax are Alaska, Tennessee, Florida, Nevada, South Dakota, Texas, Washington state, and Wyoming. Additionally, New Hampshire and Tennessee levy state income taxes only on

dividends

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-in ...

and interest income. Of the above states, only Alaska and New Hampshire do not levy a state sales tax. Additional information can be obtained at th

Federation of Tax Administratorswebsite.

In the United States, there is a growing movement for the replacement of all federal payroll and income taxes (both corporate and personal) with a national retail sales tax and monthly tax rebate to households of citizens and legal resident aliens. The tax proposal is named

FairTax

FairTax was a single rate tax proposal in 2005, 2008 and 2009 in the United States that includes complete dismantling of the Internal Revenue Service. The proposal would eliminate all federal income taxes (including the alternative minimum ta ...

. In Canada, the federal sales tax is called the Goods and Services Tax (GST) and now stands at 5%. The provinces of British Columbia, Saskatchewan, Manitoba, and Prince Edward Island also have a provincial sales tax

ST The provinces of Nova Scotia, New Brunswick, Newfoundland & Labrador, and Ontario have harmonized their provincial sales taxes with the GST—Harmonized Sales Tax

ST and thus is a full VAT. The province of Quebec collects the Quebec Sales Tax

STwhich is based on the GST with certain differences. Most businesses can claim back the GST, HST, and QST they pay, and so effectively it is the final consumer who pays the tax.

Excises

An excise duty is an

indirect tax

An indirect tax (such as sales tax, per unit tax, value added tax (VAT), or goods and services tax (GST), excise, consumption tax, tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the i ...

imposed upon goods during the process of their manufacture, production or distribution, and is usually proportionate to their quantity or value. Excise duties were first introduced into England in the year 1643, as part of a scheme of revenue and taxation devised by parliamentarian

John Pym

John Pym (20 May 1584 – 8 December 1643) was an English politician, who helped establish the foundations of Parliamentary democracy. One of the Five Members whose attempted arrest in January 1642 sparked the First English Civil War, his use ...

and approved by the

Long Parliament

The Long Parliament was an English Parliament which lasted from 1640 until 1660. It followed the fiasco of the Short Parliament, which had convened for only three weeks during the spring of 1640 after an 11-year parliamentary absence. In Septem ...

. These duties consisted of charges on beer, ale, cider, cherry wine, and tobacco, to which list were afterward added paper, soap, candles, malt, hops, and sweets. The basic principle of excise duties was that they were taxes on the production, manufacture, or distribution of articles which could not be taxed through the

customs house

A custom house or customs house was traditionally a building housing the offices for a jurisdictional government whose officials oversaw the functions associated with importing and exporting goods into and out of a country, such as collecting ...

, and revenue derived from that source is called excise revenue proper. The fundamental conception of the term is that of a tax on articles produced or manufactured in a country. In the taxation of such articles of luxury as spirits, beer, tobacco, and cigars, it has been the practice to place a certain duty on the importation of these articles (a

customs duty

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and polic ...

).

Excises (or exemptions from them) are also used to modify consumption patterns of a certain area (

social engineering). For example, a high excise is used to discourage

alcohol

Alcohol most commonly refers to:

* Alcohol (chemistry), an organic compound in which a hydroxyl group is bound to a carbon atom

* Alcohol (drug), an intoxicant found in alcoholic drinks

Alcohol may also refer to:

Chemicals

* Ethanol, one of sev ...

consumption, relative to other goods. This may be combined with

hypothecation

Hypothec (; german: Hypothek, french: hypothèque, pl, hipoteka, from Lat. ''hypotheca'', from Gk. : hypothēkē), sometimes tacit hypothec, is a term used in civil law systems (e.g. law of entire Continental Europe except Gibraltar) or mixed ...

if the proceeds are then used to pay for the costs of treating illness caused by

alcohol use disorder

Alcoholism is, broadly, any drinking of alcohol that results in significant mental or physical health problems. Because there is disagreement on the definition of the word ''alcoholism'', it is not a recognized diagnostic entity. Predomin ...

. Similar taxes may exist on

tobacco

Tobacco is the common name of several plants in the genus '' Nicotiana'' of the family Solanaceae, and the general term for any product prepared from the cured leaves of these plants. More than 70 species of tobacco are known, but the ...

,

pornography

Pornography (often shortened to porn or porno) is the portrayal of sexual subject matter for the exclusive purpose of sexual arousal. Primarily intended for adults, , etc., and they may be collectively referred to as "

sin tax

A sin tax is an excise tax specifically levied on certain goods deemed harmful to society and individuals, such as alcohol, tobacco, drugs, candies, soft drinks, fast foods, coffee, sugar, gambling, and pornography. In contrast to Pigovian tax ...

es". A

carbon tax

A carbon tax is a tax levied on the carbon emissions required to produce goods and services. Carbon taxes are intended to make visible the "hidden" social costs of carbon emissions, which are otherwise felt only in indirect ways like more sev ...

is a tax on the consumption of carbon-based non-renewable fuels, such as petrol, diesel-fuel, jet fuels, and natural gas. The object is to reduce the release of carbon into the atmosphere. In the United Kingdom,

vehicle excise duty Vehicle Excise Duty (VED; also known as "vehicle tax", "car tax", and more controversially as "road tax", and formerly as a "tax disc") is an annual tax that is levied as an excise duty and which must be paid for most types of powered vehicles which ...

is an annual tax on vehicle ownership.

Tariff

An import or export tariff (also called customs duty or impost) is a charge for the movement of goods through a political border. Tariffs discourage

trade

Trade involves the transfer of goods and services from one person or entity to another, often in exchange for money. Economists refer to a system or network that allows trade as a market.

An early form of trade, barter, saw the direct excha ...

, and they may be used by governments to protect domestic industries. A proportion of tariff revenues is often hypothecated to pay the government to maintain a navy or border police. The classic ways of cheating a tariff are

smuggling

Smuggling is the illegal transportation of objects, substances, information or people, such as out of a house or buildings, into a prison, or across an international border, in violation of applicable laws or other regulations.

There are various ...

or declaring a false value of goods. Tax, tariff and trade rules in modern times are usually set together because of their common impact on

industrial policy

An industrial policy (IP) or industrial strategy of a country is its official strategic effort to encourage the development and growth of all or part of the economy, often focused on all or part of the manufacturing sector. The government takes m ...

,

investment policy

An investment policy is any government regulation or law that encourages or discourages foreign investment in the local economy, e.g. currency exchange limits.

Explanation

As globalization integrates the economies of neighboring and of trad ...

, and

agricultural policy

Agricultural policy describes a set of laws relating to domestic agriculture and imports of foreign agricultural products. Governments usually implement agricultural policies with the goal of achieving a specific outcome in the domestic agricultu ...

. A

trade bloc

A trade bloc is a type of intergovernmental agreement, often part of a regional intergovernmental organization, where barriers to trade (tariffs and others) are reduced or eliminated among the participating states.

Trade blocs can be stand-alon ...

is a group of allied countries agreeing to minimize or eliminate tariffs against trade with each other, and possibly to impose protective tariffs on imports from outside the bloc. A

customs union

A customs union is generally defined as a type of trade bloc which is composed of a free trade area with a common external tariff.GATTArticle 24 s. 8 (a)

Customs unions are established through trade pacts where the participant countries set up ...

has a

common external tariff

A common external tariff (CET) must be introduced when a group of countries forms a customs union. The same customs duties, import quotas, preferences or other non-tariff barriers to trade apply to all goods entering the area, regardless of which ...

, and the participating countries share the revenues from tariffs on goods entering the customs union.

In some societies, tariffs also could be imposed by local authorities on the movement of goods between regions (or via specific internal gateways). A notable example is the ''

likin'', which became an important revenue source for local governments in the late

Qing China

The Qing dynasty ( ), officially the Great Qing,, was a Manchu people, Manchu-led Dynasties in Chinese history, imperial dynasty of China and the last orthodox dynasty in Chinese history. It emerged from the Later Jin (1616–1636), La ...

.

Other

License fees

Occupational taxes or license fees may be imposed on businesses or individuals engaged in certain businesses. Many jurisdictions impose a tax on vehicles.

Poll

A poll tax, also called a ''per capita tax'', or ''capitation tax'', is a tax that levies a set amount per individual. It is an example of the concept of

fixed tax

A fixed tax is a lump sum tax that is not measured as a percentage of the tax base (income, wealth, or consumption). Fixed taxes like a poll tax or sin tax are often considered regressive, but could have progressive effects if applied to lu ...

. One of the earliest taxes mentioned in the

Bible

The Bible (from Koine Greek , , 'the books') is a collection of religious texts or scriptures that are held to be sacred in Christianity, Judaism, Samaritanism, and many other religions. The Bible is an anthologya compilation of texts of a ...