State of Israel Bonds on:

[Wikipedia]

[Google]

[Amazon]

Israel Bonds, the commonly-known name of Development Corporation for Israel (DCI), is the U.S.

Israel Bonds, the commonly-known name of Development Corporation for Israel (DCI), is the U.S.

Israel Bonds, the commonly-known name of Development Corporation for Israel (DCI), is the U.S.

Israel Bonds, the commonly-known name of Development Corporation for Israel (DCI), is the U.S. underwriter

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liabilit ...

of debt securities issued by the State of Israel

Israel (; he, יִשְׂרָאֵל, ; ar, إِسْرَائِيل, ), officially the State of Israel ( he, מְדִינַת יִשְׂרָאֵל, label=none, translit=Medīnat Yīsrāʾēl; ), is a country in Western Asia. It is situated ...

. DCI is headquartered in New York City

New York, often called New York City or NYC, is the List of United States cities by population, most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the L ...

, and is a broker-dealer

In financial services, a broker-dealer is a natural person, company or other organization that engages in the business of trading securities for its own account or on behalf of its customers. Broker-dealers are at the heart of the securities and d ...

and member of the Financial Industry Regulatory Authority

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Associati ...

(FINRA). Dani Naveh

Dan Naveh ( he, דן נוה, born 21 June 1960) is an Israeli businessman and former politician. He served as a member of the Knesset for Likud between 1999 and 2007 and as a government minister from 2001 until 2006. He is the founder and the man ...

is president and CEO.

Bonds are sold in Canada through Canada-Israel Securities, Ltd.; Europe through Development Company for Israel GmbH; and Development Company for Israel, Ltd. in the UK. Sales have increased steadily since the initial Independence Issue was offered in 1951, with total worldwide sales now exceeding $48 billion.

At first, investors in Israel bonds were largely members of the American Jewish community looking to support the fledgling state's economy. However, throughout subsequent years, private and institutional investors alike viewed Israel bonds as a meaningful investments. Over 90 U.S. state and municipal pension and treasury funds have invested more than $3 billion in Israel bonds to date. Other investors in Israel bonds include corporations, insurance companies, associations, unions, banks, financial institution

Financial institutions, sometimes called banking institutions, are business entities that provide services as intermediaries for different types of financial monetary transactions. Broadly speaking, there are three major types of financial insti ...

s, universities, foundations and synagogue

A synagogue, ', 'house of assembly', or ', "house of prayer"; Yiddish: ''shul'', Ladino: or ' (from synagogue); or ', "community". sometimes referred to as shul, and interchangeably used with the word temple, is a Jewish house of worshi ...

s. Israel uses proceeds from the sale of the bonds for general purposes of the state.

Origins

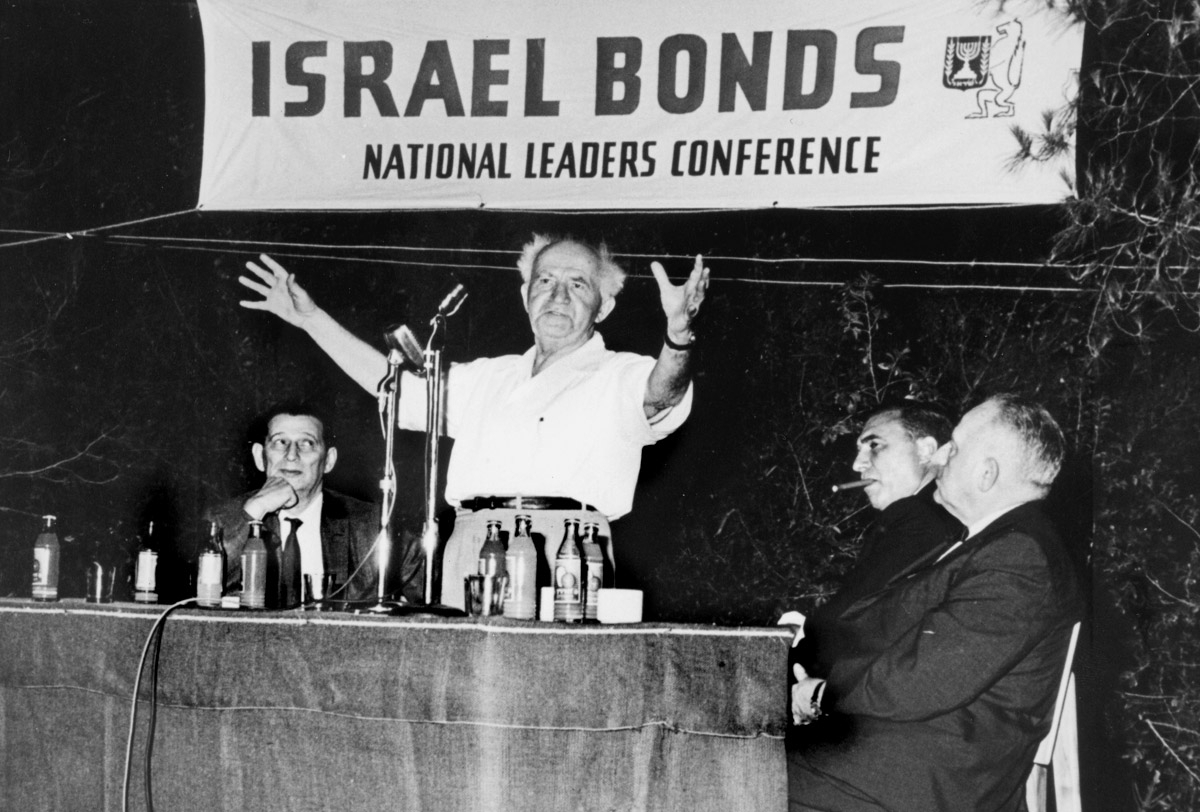

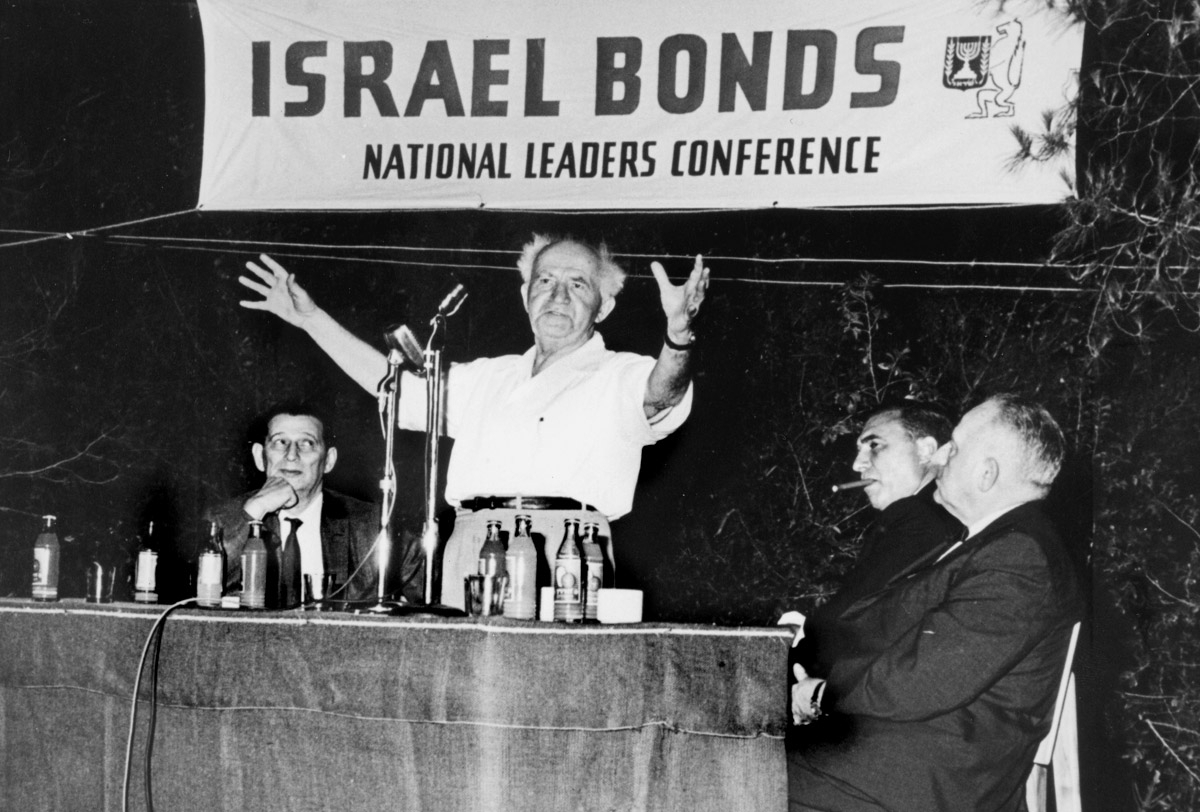

The idea to float bonds issued by Israel's government was conceived by Israel's firstprime minister

A prime minister, premier or chief of cabinet is the head of the cabinet and the leader of the ministers in the executive branch of government, often in a parliamentary or semi-presidential system. Under those systems, a prime minister is not ...

, David Ben-Gurion

David Ben-Gurion ( ; he, דָּוִד בֶּן-גּוּרִיּוֹן ; born David Grün; 16 October 1886 – 1 December 1973) was the primary national founder of the State of Israel and the first prime minister of Israel. Adopting the name ...

, in the aftermath of Israel’s War of Independence, when the nation was critically short of economic resources.

Ben-Gurion turned to Diaspora

A diaspora ( ) is a population that is scattered across regions which are separate from its geographic place of origin. Historically, the word was used first in reference to the dispersion of Greeks in the Hellenic world, and later Jews after ...

Jewry, with the goal of obtaining millions of dollars in funding by engaging them as active partners in building the new Jewish state. In September 1950, he convened a meeting of American Jewish

American Jews or Jewish Americans are American citizens who are Jewish, whether by religion, ethnicity, culture, or nationality. Today the Jewish community in the United States consists primarily of Ashkenazi Jews, who descend from diaspora ...

leaders at Jerusalem's King David Hotel

The King David Hotel ( he, מלון המלך דוד, Malon ha-Melekh David; ar, فندق الملك داود) is a 5-star hotel in Jerusalem and a member of The Leading Hotels of the World. Opened in 1931, the hotel was built with locally qua ...

, where Ben-Gurion shared his vision for a bond issue, which the delegates supported. The Knesset

The Knesset ( he, הַכְּנֶסֶת ; "gathering" or "assembly") is the unicameral legislature of Israel. As the supreme state body, the Knesset is sovereign and thus has complete control of the entirety of the Israeli government (with ...

voted to launch Israel’s first bond issue in February 1951. In May, the prime minister traveled to New York City

New York, often called New York City or NYC, is the List of United States cities by population, most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the L ...

to help launch the inaugural Independence Issue at a Madison Square Garden

Madison Square Garden, colloquially known as The Garden or by its initials MSG, is a multi-purpose indoor arena in New York City. It is located in Midtown Manhattan between Seventh and Eighth avenues from 31st to 33rd Street, above Pennsylva ...

ceremony, raising $35 million. Expectations for first-year sales were $25 million. Instead, final results for 1951 more than doubled projections, exceeding $52 million.

Achievements

By 1957, "bond sales alone amount(ed) to an astonishing 35% of Israel's special development budget", with Foreign MinisterGolda Meir

Golda Meir, ; ar, جولدا مائير, Jūldā Māʾīr., group=nb (born Golda Mabovitch; 3 May 1898 – 8 December 1978) was an Israeli politician, teacher, and ''kibbutznikit'' who served as the fourth prime minister of Israel from 1969 to 1 ...

emphatically stating, "the central role in building our economic strength has been played by Israel bonds."

Over subsequent decades, sales continued to increase, particularly in times of crisis. During 1967's Six-Day War

The Six-Day War (, ; ar, النكسة, , or ) or June War, also known as the 1967 Arab–Israeli War or Third Arab–Israeli War, was fought between Israel and a coalition of Arab world, Arab states (primarily United Arab Republic, Egypt, S ...

, sales exceeded $250 million, and in 1973, the year of the Yom Kippur War

The Yom Kippur War, also known as the Ramadan War, the October War, the 1973 Arab–Israeli War, or the Fourth Arab–Israeli War, was an armed conflict fought from October 6 to 25, 1973 between Israel and a coalition of Arab states led by Egy ...

, sales exceeded $500 million. In 1991, the year of the Gulf War

The Gulf War was a 1990–1991 armed campaign waged by a 35-country military coalition in response to the Iraqi invasion of Kuwait. Spearheaded by the United States, the coalition's efforts against Iraq were carried out in two key phases: ...

and Iraqi missile strikes on Israel, sales exceeded $1 billion.

In 2020,in response to the COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identif ...

, Israel Bonds approached the Finance Ministry to increase its goal for the year. The Finance Ministry approved the initiative, and the year concluded with record U.S. sales exceeding $1.5 billion.

Total worldwide sales of Israel bonds since the first bonds were issued in 1951 exceeded $48 billion in October 2022.

Securities

Initially, Israel Bonds offered a single investment option. As the program became more successful, multiple types of Israel bonds with varying maturities and purchase minumums were made available. The following bonds are/were offered in 2022: * Jubilee Bonds – fixed rate 2, 3, 5,10 and 15-year bonds; $25,000 minimum investment. * Maccabee Bonds – fixed rate 2, 3,5, 10 and 15-year bonds; $5,000 minimum investment. * Sabra Bonds – fixed rate 3-year bonds; $1,000 minimum investment Interest is paid upon maturity. * Mazel Tov Bonds – fixed rate 5-year bonds; $100 minimum investment Interest paid upon maturity. * eMazel Tov Bonds – fixed rate 5-year bonds; $36 minimum investment interest paid at maturity. Available only online. * Shalom Bonds - fixed rate 1 and 2-year bonds, $36 minimum investment; Interest paid at maturity. May only be held by a religious, charitable, literary, scientific or educational organization, contributions to which are, at the time of transfer, deductible for income and similar tax purposes. Available only online. * Jubilee Fixed Rate Financing Bonds – 2-year bonds; minimum subscription of $100,000; must be financed through an Authorized Lender. Although Israel has never defaulted in the payment of principal or interest on any of its internal or external debt, prospective purchasers are warned of sovereign credit risk.References

External links

* {{DEFAULTSORT:State Of Israel Bonds Securities (finance) Government of Israel Finance in Israel Government bonds issued by Israel