Site-value Taxation on:

[Wikipedia]

[Google]

[Amazon]

A land value tax (LVT) is a levy on the value of

LVT considers the effect on land value of location, and of improvements made to neighbouring land, such as proximity to roads and public works. LVT is the purest implementation of the public finance principle known as

LVT considers the effect on land value of location, and of improvements made to neighbouring land, such as proximity to roads and public works. LVT is the purest implementation of the public finance principle known as

The

The

Labour Land Campaign

advocates within the Labour Party and the broader labour movement for "a more equitable distribution of the Land Values that are created by the whole community" through LVT. Its membership includes members of the British Labour Party, Trade Unions and Cooperatives and individuals. The Liberal Democrats' ALTER (Action for Land Taxation and Economic Reform) aims The Green Party "favour moving to a system of Land Value Tax, where the level of taxation depends on the rental value of the land concerned." A course in "Economics with Justice" with a strong foundation in LVT are offered at the School of Economic Science, which was founded by Andrew MacLaren MP and has historical links with the Henry George Foundation of Great Britain, Henry George Foundation.

New South Wales Land Tax Management Act 1956 (Australia)

{{DEFAULTSORT:Land Value Tax Land value taxation, Land taxation Georgism Real estate valuation Tax reform Valuation (finance)

land

Land, also known as dry land, ground, or earth, is the solid terrestrial surface of the planet Earth that is not submerged by the ocean or other bodies of water. It makes up 29% of Earth's surface and includes the continents and various isla ...

without regard to buildings, personal property and other improvements

Improvement is the process of a thing moving from one state to a state considered to be better, usually through some action intended to bring about that better state. The concept of improvement is important to governments and businesses, as well a ...

. It is also known as a location value tax, a point valuation tax, a site valuation tax, split rate tax, or a site-value rating.

Land value taxes are generally favored by economists as they do not cause economic inefficiency

In microeconomics, economic efficiency, depending on the context, is usually one of the following two related concepts:

* Allocative or Pareto efficiency: any changes made to assist one person would harm another.

* Productive efficiency: no addit ...

, and reduce inequality

Inequality may refer to:

Economics

* Attention inequality, unequal distribution of attention across users, groups of people, issues in etc. in attention economy

* Economic inequality, difference in economic well-being between population groups

* ...

. A land value tax is a progressive tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases.Sommerfeld, Ray M., Silvia A. Madeo, Kenneth E. Anderson, Betty R. Jackson (1992), ''Concepts of Taxation'', Dryden Press: Fort Worth, TX The term ''progre ...

, in that the tax burden

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom tax is initially imposed. The t ...

falls on land owners, because land ownership is correlated with wealth and income. The land value tax has been referred to as "the perfect tax" and the economic efficiency of a land value tax has been accepted since the eighteenth century. Economists since Adam Smith and David Ricardo

David Ricardo (18 April 1772 – 11 September 1823) was a British political economist. He was one of the most influential of the classical economists along with Thomas Malthus, Adam Smith and James Mill. Ricardo was also a politician, and a ...

have advocated this tax because it does not hurt economic activity or discourage or subsidize development.

LVT is associated with Henry George

Henry George (September 2, 1839 – October 29, 1897) was an American political economist and journalist. His writing was immensely popular in 19th-century America and sparked several reform movements of the Progressive Era. He inspired the eco ...

, whose ideology became known as Georgism

Georgism, also called in modern times Geoism, and known historically as the single tax movement, is an economic ideology holding that, although people should own the value they produce themselves, the economic rent derived from land—includi ...

. George argued that taxing the land value is most logical source of public revenue because the supply of land is fixed and because public infrastructure improvements would be reflected in (and thus paid for by) increased land values. The often cited passage is titled "The unbound Savannah."

Land value taxation is currently implemented throughout Denmark

)

, song = ( en, "King Christian stood by the lofty mast")

, song_type = National and royal anthem

, image_map = EU-Denmark.svg

, map_caption =

, subdivision_type = Sovereign state

, subdivision_name = Kingdom of Denmark

, establish ...

, Estonia

Estonia, formally the Republic of Estonia, is a country by the Baltic Sea in Northern Europe. It is bordered to the north by the Gulf of Finland across from Finland, to the west by the sea across from Sweden, to the south by Latvia, a ...

, Lithuania, Russia

Russia (, , ), or the Russian Federation, is a transcontinental country spanning Eastern Europe and Northern Asia. It is the largest country in the world, with its internationally recognised territory covering , and encompassing one-eig ...

, Singapore

Singapore (), officially the Republic of Singapore, is a sovereign island country and city-state in maritime Southeast Asia. It lies about one degree of latitude () north of the equator, off the southern tip of the Malay Peninsula, bor ...

, and Taiwan

Taiwan, officially the Republic of China (ROC), is a country in East Asia, at the junction of the East and South China Seas in the northwestern Pacific Ocean, with the People's Republic of China (PRC) to the northwest, Japan to the nort ...

; it has also been applied to lesser extents in parts of Australia, Mexico

Mexico (Spanish: México), officially the United Mexican States, is a country in the southern portion of North America. It is bordered to the north by the United States; to the south and west by the Pacific Ocean; to the southeast by Guatema ...

(Mexicali

Mexicali (; ) is the capital city of the Mexican state of Baja California. The city, seat of the Mexicali Municipality, has a population of 689,775, according to the 2010 census, while the Calexico–Mexicali metropolitan area is home to 1,000,0 ...

), and the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territori ...

(e.g., Pennsylvania

Pennsylvania (; ( Pennsylvania Dutch: )), officially the Commonwealth of Pennsylvania, is a state spanning the Mid-Atlantic, Northeastern, Appalachian, and Great Lakes regions of the United States. It borders Delaware to its southeast, ...

).

Economic properties

Efficiency

Most taxes distort economic decisions and discourage beneficial economic activity. For example,property tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inhe ...

es discourage construction, maintenance, and repair because taxes increase with improvements. LVT is not based on how land is used. Because the supply of land is essentially fixed, land rents depend on what tenants are prepared to pay, rather than on landlord expenses. Thus landlords cannot pass LVT to tenants, who would move or rent smaller spaces before absorbing increased rent.

The land's occupants benefit from improvements surrounding a site. Such improvements shift tenants' demand curve to the right (they will pay more). Landlords benefit from price competition among tenants; the only direct effect of LVT in this case is to reduce the amount of social benefit that is privately captured as land price by titleholders.

LVT is said to be justified for economic reasons because it does not deter production, distort markets, or otherwise create deadweight loss

In economics, deadweight loss is the difference in production and consumption of any given product or service including government tax. The presence of deadweight loss is most commonly identified when the quantity produced ''relative'' to the amoun ...

. Land value tax can even have negative deadweight loss (social benefits), particularly when land use improves. Nobel Prize

The Nobel Prizes ( ; sv, Nobelpriset ; no, Nobelprisen ) are five separate prizes that, according to Alfred Nobel's will of 1895, are awarded to "those who, during the preceding year, have conferred the greatest benefit to humankind." Alfr ...

-winner William Vickrey

William Spencer Vickrey (21 June 1914 – 11 October 1996) was a Canadian-American professor of economics and Nobel Laureate. Vickrey was awarded the 1996 Nobel Memorial Prize in Economic Sciences with James Mirrlees for their research into the e ...

believed that

LVT's efficiency has been observed in practice. Fred Foldvary stated that LVT discourages speculative land holding because the tax reflects changes in land value (up and down), encouraging landowners to develop or sell vacant/underused plots in high demand. Foldvary claimed that LVT increases investment in dilapidated inner city

The term ''inner city'' has been used, especially in the United States, as a euphemism for majority-minority lower-income residential districts that often refer to rundown neighborhoods, in a downtown or city centre area. Sociologists some ...

areas because improvements don't cause tax increases. This in turn reduces the incentive to build on remote sites and so reduces urban sprawl

Urban sprawl (also known as suburban sprawl or urban encroachment) is defined as "the spreading of urban developments (such as houses and shopping centers) on undeveloped land near a city." Urban sprawl has been described as the unrestricted growt ...

. For example, Harrisburg, Pennsylvania's LVT has operated since 1975. This policy was credited by mayor Stephen R. Reed with reducing the number of vacant downtown structures from around 4,200 in 1982 to fewer than 500.

LVT is arguably an ecotax

An environmental tax, ecotax (short for ecological taxation), or green tax is a tax levied on activities which are considered to be harmful to the environment and is intended to promote environmentally friendly activities via economic incentives. ...

because it discourages the waste of prime locations, which are a finite resource. Many urban planners claim that LVT is an effective method to promote transit-oriented development

In urban planning, transit-oriented development (TOD) is a type of urban development that maximizes the amount of residential, business and leisure space within walking distance of public transport. It promotes a symbiotic relationship between ...

.

Real estate values

The value of land reflects the value it can provide over time. This value can be measured by the ground rent that a piece of land receives on the market. Thepresent value

In economics and finance, present value (PV), also known as present discounted value, is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money has inte ...

of ground-rent is the basis for land prices. A land value tax (LVT) will reduce the ground rent received by the landlord, and thus will decrease the price of land, holding all else constant. The rent charged for land may also decrease as a result of efficiency gains if speculators stop hoarding unused land.

Real estate bubble

A real-estate bubble or property bubble (or housing bubble for residential markets) is a type of economic bubble that occurs periodically in local or global real-estate markets, and typically follow a land boom. A land boom is the rapid increase ...

s direct savings towards rent seeking

Rent-seeking is the act of growing one's existing wealth without creating new wealth by manipulating the social or political environment.

Rent-seeking activities have negative effects on the rest of society. They result in reduced economic effi ...

activities rather than other investments and can contribute to recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

s. Advocates claim that LVT reduces the speculative element in land pricing, thereby leaving more money for productive capital investment.

At sufficiently high levels, LVT would cause real estate prices to fall by taxing away land rents that would otherwise become 'capitalized' into the price of real estate. It also encourages landowners to sell or develop locations that they are not using. This might cause some landowners, especially pure landowners, to resist high land value tax rates. Landowners often possess significant political influence, which may help explain the limited spread of land value taxes so far.

Tax incidence

A land value tax hasprogressive tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases.Sommerfeld, Ray M., Silvia A. Madeo, Kenneth E. Anderson, Betty R. Jackson (1992), ''Concepts of Taxation'', Dryden Press: Fort Worth, TX The term ''progre ...

effects, in that it is paid by the owners of valuable land who tend to be the rich, and since the amount of land is fixed, the tax burden

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom tax is initially imposed. The t ...

cannot be passed on as higher rents or lower wages to tenants, consumers or workers.

Practical issues

Several practical issues complicate LVT implementation. Most notably, it must be: * Calculated fairly and accurately * High enough to raise sufficient revenue without causing land abandonment, but if land is abandoned, it could be claimed by the State (as occurs in Israel), * Billed to the correct person or business entityAssessment/appraisal

Levying an LVT requires an assessment and a title register. In a 1796United States Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that involve a point o ...

opinion, Justice William Paterson said that leaving the valuation process up to assessors would cause bureaucratic complexities, as well as non-uniform procedures. Murray Rothbard

Murray Newton Rothbard (; March 2, 1926 – January 7, 1995) was an American economist of the Austrian School, economic historian, political theorist, and activist. Rothbard was a central figure in the 20th-century American libertarian ...

later raised similar concerns, claiming that no government can fairly assess value, which can only be determined by a free market

In economics, a free market is an economic system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. Such markets, as modeled, operate without the intervention of government or any ot ...

.

Compared to modern property tax assessments, land valuations involve fewer variables and have smoother gradient

In vector calculus, the gradient of a scalar-valued differentiable function of several variables is the vector field (or vector-valued function) \nabla f whose value at a point p is the "direction and rate of fastest increase". If the gr ...

s than valuations that include improvements. This is due to variation of building design and quality. Modern statistical techniques have improved the process; in the 1960s and 1970s, multivariate analysis

Multivariate statistics is a subdivision of statistics encompassing the simultaneous observation and analysis of more than one outcome variable.

Multivariate statistics concerns understanding the different aims and background of each of the dif ...

was introduced as an assessment tool. Usually, such a valuation process commences with a measurement of the most and least valuable land within the taxation area. A few sites of intermediate value are then identified and used as "landmark" values. Other values are interpolated between the landmark values. The data is then collated in a database, "smoothed" and mapped using a geographic information system (GIS). Thus, even if the initial valuation is difficult, once the system is in use, successive valuations become easier.

Revenue

In the context of LVT as asingle tax

A single tax is a system of taxation based mainly or exclusively on one tax, typically chosen for its special properties, often being a tax on land value. The idea of a single tax on land values was proposed independently by John Locke and Bar ...

(replacing all other taxes), some have argued that LVT alone cannot raise enough tax revenue

Tax revenue is the income that is collected by governments through taxation. Taxation is the primary source of government revenue. Revenue may be extracted from sources such as individuals, public enterprises, trade, royalties on natural resour ...

. However, the presence of other taxes can reduce land values and hence the revenue that can be raised from them. The Physiocrats

Physiocracy (; from the Greek for "government of nature") is an economic theory developed by a group of 18th-century Age of Enlightenment French economists who believed that the wealth of nations derived solely from the value of "land agricultur ...

argued that all other taxes ultimately come at the expense of land rental values. Most modern LVT systems function alongside other taxes and thus only reduce their impact without removing them. Land taxes that are higher than the rental surplus (the full land rent for that time period) would result in land abandonment.

Title

In some countries, LVT is impractical because of uncertainty regardingland titles

Land registration is any of various systems by which matters concerning ownership, possession, or other rights in land are formally recorded (usually with a government agency or department) to provide evidence of title, facilitate transactions, ...

and tenure

Tenure is a category of academic appointment existing in some countries. A tenured post is an indefinite academic appointment that can be terminated only for cause or under extraordinary circumstances, such as financial exigency or program disco ...

. For instance a parcel of grazing land may be communally owned by village inhabitants and administered by village elders. The land in question would need to be held in a trust or similar body for taxation purposes. If the government cannot accurately define ownership boundaries and ascertain the proper owners, it cannot know from whom to collect the tax. Clear titles are absent in many developing countries. In African countries with imperfect land registration, boundaries may be poorly surveyed and the owner can be unknown.

Incentives

Speculation

The owner of a vacant lot in a thriving city must still pay a tax and would rationally perceive the property as a financial liability, encouraging them to put the land to use in order to cover the tax. LVT removes financial incentives to hold unused land solely for price appreciation, making more land available for productive uses. Land value tax creates an incentive to convert these sites to more intensive private uses or into public purposes.Incidence

The selling price of a good that is fixed in supply, such as land, does not change if it is taxed. By contrast, the price of manufactured goods can rise in response to increased taxes, because the higher cost reduces the number of units that suppliers are willing to sell at the original price. The price increase is how the maker passes along some part of the tax to consumers. However, if the revenue from LVT is used to reduce other taxes or to provide valuable public investment, it can cause land prices to rise as a result of higher productivity, by more than the amount that LVT removed. Landtax incidence

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom tax is initially imposed. The t ...

rests completely upon landlords, although business sectors that provide services to landlords are indirectly impacted. In some economies, 80 percent of bank lending finances real estate, with a large portion of that for land. Reduced demand for land speculation might reduce the amount of circulating bank credit.

While land owners are unlikely to be able to charge higher rents to compensate for LVT, removing other taxes may increase rents, as this may affect the demand for land.

Land use

Assuming constant demand, an increase in constructed space decreases the cost of improvements to land such as houses. Shifting property taxes from improvements to land encourages development. Infill of underutilized urban space is one common practice to reduceurban sprawl

Urban sprawl (also known as suburban sprawl or urban encroachment) is defined as "the spreading of urban developments (such as houses and shopping centers) on undeveloped land near a city." Urban sprawl has been described as the unrestricted growt ...

.

Collection

LVT is less vulnerable totax evasion

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the tax ...

, since land cannot be concealed or moved overseas and titles are easily identified, as they are registered with the public. Land value assessments are usually considered public information, which is available upon request. Transparency reduces tax evasion.

Ethics

Land acquires ascarcity

In economics, scarcity "refers to the basic fact of life that there exists only a finite amount of human and nonhuman resources which the best technical knowledge is capable of using to produce only limited maximum amounts of each economic good. ...

value owing to the competing needs for space. The value of land generally owes nothing to the landowner and everything to the surroundings.

Religion

It has been claimed that land is God's gift to mankind. For example, theCatholic Church

The Catholic Church, also known as the Roman Catholic Church, is the largest Christian church, with 1.3 billion baptized Catholics worldwide . It is among the world's oldest and largest international institutions, and has played a ...

asserts in its 1967 " universal destination of goods" principle:

In addition, the Church maintains that civil authorities have the right and duty to regulate the legitimate exercise of the right to ownership for the sake of the common good, including the right to tax.

Equity

LVT considers the effect on land value of location, and of improvements made to neighbouring land, such as proximity to roads and public works. LVT is the purest implementation of the public finance principle known as

LVT considers the effect on land value of location, and of improvements made to neighbouring land, such as proximity to roads and public works. LVT is the purest implementation of the public finance principle known as value capture Value capture is a type of public financing that recovers some or all of the value that public infrastructure generates for private landowners.

In many countries, the public sector is responsible for the infrastructure required to support urban dev ...

.

A public works

Public works are a broad category of infrastructure projects, financed and constructed by the government, for recreational, employment, and health and safety uses in the greater community. They include public buildings ( municipal buildings, sc ...

project can increase land values and thus increase LVT revenues. Arguably, public improvements should be paid for by the landowners who benefit from them. Thus, LVT captures the land value of socially created wealth, allowing a reduction in tax on privately created (non-land) wealth.

LVT generally is a progressive tax, with those of greater means paying more, in that land ownership correlates to income and landlords cannot shift the tax burden

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom tax is initially imposed. The t ...

onto tenants. LVT generally reduces economic inequality

There are wide varieties of economic inequality, most notably income inequality measured using the distribution of income (the amount of money people are paid) and wealth inequality measured using the distribution of wealth (the amount of ...

, removes incentives to misuse real estate, and reduces the vulnerability of economies to property booms and crashes.

History

Pre-modern

Land value taxation began after the introduction ofagriculture

Agriculture or farming is the practice of cultivating plants and livestock. Agriculture was the key development in the rise of sedentary human civilization, whereby farming of domesticated species created food surpluses that enabled people t ...

. It was originally based on crop yield. This early version of the tax required simply sharing the yield at the time of the harvest, on a yearly basis.

Rishis of ancient India claimed that land should be held in common and that unfarmed land should produce the same tax as productive land. "The earth ...is common to all beings enjoying the fruit of their own labour; it belongs...to all alike"; therefore, "there should be left some for everyone". Apastamba

''Āpastamba Dharmasūtra'' (Sanskrit: आपस्तम्ब धर्मसूत्र) is a Sanskrit text and one of the oldest Dharma-related texts of Hinduism that have survived into the modern age from the 1st-millennium BCE. It is one o ...

said "If any person holding land does not exert himself and hence bears no produce, he shall, if rich, be made to pay what ought to have been produced".

Mencius was a Chinese philosopher (around 300 BCE) who advocated for the elimination of taxes and tariffs, to be replaced by the public collection of urban land rent: "In the market-places, charge land-rent, but don't tax the goods."

During the Middle Ages, in the West, the first regular and permanent land tax system was based on a unit of land known as the hide. The hide was originally the amount of land sufficient to support a household. It later became subject to a land tax known as "geld".

Physiocrats

The

The physiocrat

Physiocracy (; from the Greek for "government of nature") is an economic theory developed by a group of 18th-century Age of Enlightenment French economists who believed that the wealth of nations derived solely from the value of "land agricultur ...

s were a group of economist

An economist is a professional and practitioner in the social science discipline of economics.

The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this field there are ...

s who believed that the wealth of nations was derived solely from the value of land agriculture

Agriculture or farming is the practice of cultivating plants and livestock. Agriculture was the key development in the rise of sedentary human civilization, whereby farming of domesticated species created food surpluses that enabled people t ...

or land development. Before the Industrial Revolution

The Industrial Revolution was the transition to new manufacturing processes in Great Britain, continental Europe, and the United States, that occurred during the period from around 1760 to about 1820–1840. This transition included going f ...

, this was approximately correct. Physiocracy is one of the "early modern" schools of economics. Physiocrats called for the abolition of all existing taxes, completely free trade

Free trade is a trade policy that does not restrict imports or exports. It can also be understood as the free market idea applied to international trade. In government, free trade is predominantly advocated by political parties that hold econ ...

and a single tax

A single tax is a system of taxation based mainly or exclusively on one tax, typically chosen for its special properties, often being a tax on land value. The idea of a single tax on land values was proposed independently by John Locke and Bar ...

on land. They did not distinguish between the intrinsic value of land and ground rent. Their theories originated in France

France (), officially the French Republic ( ), is a country primarily located in Western Europe. It also comprises of overseas regions and territories in the Americas and the Atlantic, Pacific and Indian Oceans. Its metropolitan area ...

and were most popular during the second half of the 18th century. The movement was particularly dominated by Anne Robert Jacques Turgot

Anne Robert Jacques Turgot, Baron de l'Aulne ( ; ; 10 May 172718 March 1781), commonly known as Turgot, was a French economist and statesman. Originally considered a physiocrat, he is today best remembered as an early advocate for economic libe ...

(1727–1781) and François Quesnay (1694–1774). It influenced contemporary statesmen, such as Charles Alexandre de Calonne. The physiocrats were highly influential in the early history of land value taxation in the United States.

Radical Movement

A participant in theRadical Movement

The Radical Movement (french: Mouvement radical, MR), officially the Radical, Social and Liberal Movement (french: link=no, Mouvement radical, social et libéral), was a Social liberalism, social-liberal list of political parties in France, politi ...

, Thomas Paine

Thomas Paine (born Thomas Pain; – In the contemporary record as noted by Conway, Paine's birth date is given as January 29, 1736–37. Common practice was to use a dash or a slash to separate the old-style year from the new-style year. In th ...

contended in his '' Agrarian Justice'' pamphlet that all citizens should be paid 15 pounds at age 21 "as a compensation in part for the loss of his or her natural inheritance by the introduction of the system of landed property." "Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds." This proposal was the origin of the citizen's dividend advocated by Geolibertarianism

Geolibertarianism is a political and economic ideology that integrates libertarianism with Georgism. It favors a taxation system based (as in Georgism) on income derived from land and natural resources instead of on labor, coupled with a mini ...

. Thomas Spence

Thomas Spence ( 17508 September 1814) was an English RadicalProperty in Land Every One's Rightin 1775. It was re-issued as ''The Real Rights of Man'' in later editions. It was also reissued by, amongst others, Henry Hyndman under the title o ...

advocated a similar proposal except that the land rent would be distributed equally each year regardless of age.

Classical economists

Adam Smith, in his 1776 book ''The Wealth of Nations

''An Inquiry into the Nature and Causes of the Wealth of Nations'', generally referred to by its shortened title ''The Wealth of Nations'', is the '' magnum opus'' of the Scottish economist and moral philosopher Adam Smith. First published in ...

'', first rigorously analyzed the effects of a land value tax, pointing out how it would not hurt economic activity, and how it would not raise contract rents.

Henry George

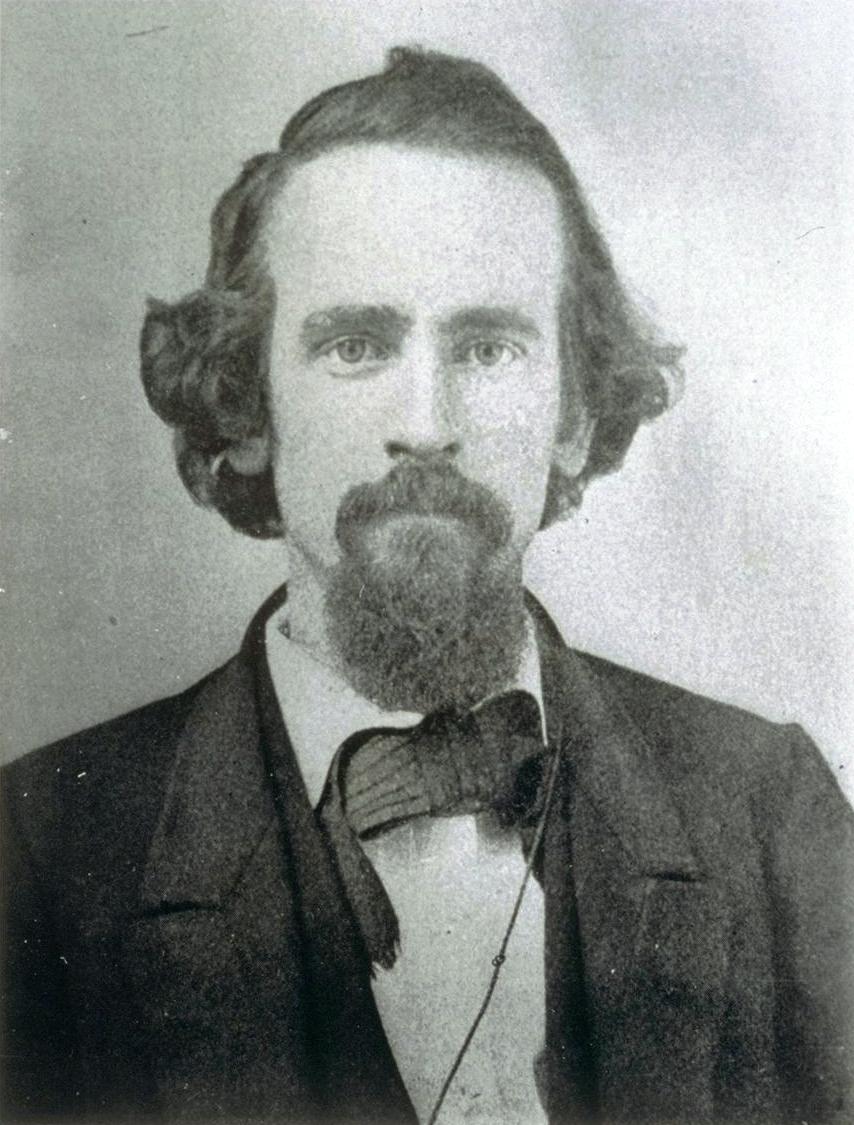

Henry George

Henry George (September 2, 1839 – October 29, 1897) was an American political economist and journalist. His writing was immensely popular in 19th-century America and sparked several reform movements of the Progressive Era. He inspired the eco ...

(2 September 1839 – 29 October 1897) was perhaps the most famous advocate of recovering land rents for public purposes. An American journalist

A journalist is an individual that collects/gathers information in form of text, audio, or pictures, processes them into a news-worthy form, and disseminates it to the public. The act or process mainly done by the journalist is called journalis ...

, politician and political economist

Political economy is the study of how economic systems (e.g. markets and national economies) and political systems (e.g. law, institutions, government) are linked. Widely studied phenomena within the discipline are systems such as labour m ...

, he advocated a "single tax

A single tax is a system of taxation based mainly or exclusively on one tax, typically chosen for its special properties, often being a tax on land value. The idea of a single tax on land values was proposed independently by John Locke and Bar ...

" on land

Land, also known as dry land, ground, or earth, is the solid terrestrial surface of the planet Earth that is not submerged by the ocean or other bodies of water. It makes up 29% of Earth's surface and includes the continents and various isla ...

that would eliminate the need for all other taxes. George first articulated the proposal in ''Our Land and Land Policy'' (1871). Later, in his best-selling work ''Progress and Poverty

''Progress and Poverty: An Inquiry into the Cause of Industrial Depressions and of Increase of Want with Increase of Wealth: The Remedy'' is an 1879 book by social theorist and economist Henry George. It is a treatise on the questions of why pover ...

'' (1879), George argued that because the value of land depends on natural qualities combined with the economic activity of communities, including public investments, the economic rent

In economics, economic rent is any payment (in the context of a market transaction) to the owner of a factor of production in excess of the cost needed to bring that factor into production. In classical economics, economic rent is any payment m ...

of land was the best source of tax revenue. This book significantly influenced land taxation in the United States and other countries, including Denmark, which continues ''grundskyld'' ('ground duty') as a key component of its tax system. The philosophy that natural resource rents should be captured by society is now often known as Georgism

Georgism, also called in modern times Geoism, and known historically as the single tax movement, is an economic ideology holding that, although people should own the value they produce themselves, the economic rent derived from land—includi ...

. Its relevance to public finance is underpinned by the Henry George theorem.

Meiji Restoration

After the 1868Meiji Restoration

The , referred to at the time as the , and also known as the Meiji Renovation, Revolution, Regeneration, Reform, or Renewal, was a political event that restored practical imperial rule to Japan in 1868 under Emperor Meiji. Although there were ...

in Japan, land tax reform was undertaken. An LVT was implemented beginning in 1873. By 1880 initial problems with valuation and rural opposition had been overcome and rapid industrialisation began.

Liberal and Labour Parties in the United Kingdom

In theUnited Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the European mainland, continental mainland. It comprises England, Scotlan ...

, LVT was an important part of the platform of the Liberal Party

The Liberal Party is any of many political parties around the world. The meaning of ''liberal'' varies around the world, ranging from liberal conservatism on the right to social liberalism on the left.

__TOC__ Active liberal parties

This is a li ...

during the early part of the twentieth century. David Lloyd George

David Lloyd George, 1st Earl Lloyd-George of Dwyfor, (17 January 1863 – 26 March 1945) was Prime Minister of the United Kingdom from 1916 to 1922. He was a Liberal Party politician from Wales, known for leading the United Kingdom during ...

and H. H. Asquith

Herbert Henry Asquith, 1st Earl of Oxford and Asquith, (12 September 1852 – 15 February 1928), generally known as H. H. Asquith, was a British statesman and Liberal Party politician who served as Prime Minister of the United Kingdom f ...

proposed "to free the land that from this very hour is shackled with the chains of feudalism." It was also advocated by Winston Churchill

Sir Winston Leonard Spencer Churchill (30 November 187424 January 1965) was a British statesman, soldier, and writer who served as Prime Minister of the United Kingdom twice, from 1940 to 1945 during the Second World War, and again from ...

early in his career. The modern Liberal Party (not to be confused with the Liberal Democrats, who are the heir to the earlier Liberal Party and who offer some support for the idea) remains committed to a local form of LVT, as do the Green Party of England and Wales

The Green Party of England and Wales (GPEW; cy, Plaid Werdd Cymru a Lloegr, kw, Party Gwer Pow an Sowson ha Kembra, often simply the Green Party or Greens) is a green, left-wing political party in England and Wales. Since October 2021, Carla ...

and the Scottish Greens

The Scottish Greens (also known as the Scottish Green Party; gd, Pàrtaidh Uaine na h-Alba ; sco, Scots Green Pairtie) are a green political party in Scotland. The party has seven MSPs in the Scottish Parliament as of May 2021. As of the 2 ...

.

The 1931 Labour budget included an LVT, but before it came into force it was repealed by the Conservative-dominated national government that followed.

An attempt at introducing LVT in the administrative County of London

The County of London was a county of England from 1889 to 1965, corresponding to the area known today as Inner London. It was created as part of the general introduction of elected county government in England, by way of the Local Government A ...

was made by the local authority under the leadership of Herbert Morrison

Herbert Stanley Morrison, Baron Morrison of Lambeth, (3 January 1888 – 6 March 1965) was a British politician who held a variety of senior positions in the UK Cabinet as member of the Labour Party. During the inter-war period, he was Minis ...

in the 1938–1939 Parliament, called the London Rating (Site Values) Bill. Although it failed, it detailed legislation for the implementation of a system of LVT using annual value assessment.

After 1945, the Labour Party adopted the policy, against substantial opposition, of collecting "development value": the increase in land price arising from planning consent. This was one of the provisions of the Town and Country Planning Act 1947

The Town and Country Planning Act 1947 (10 & 11 Geo. VI c. 51) was an Act of Parliament in the United Kingdom passed by the Labour government led by Clement Attlee. It came into effect on 1 July 1948, and along with the Town and Country Plannin ...

, but it was repealed when the Labour government lost power in 1951.

Senior Labour figures in recent times have advocated an LVT, notably Andy Burnham in his 2010 leadership campaign, former Leader of the Opposition Jeremy Corbyn

Jeremy Bernard Corbyn (; born 26 May 1949) is a British politician who served as Leader of the Opposition and Leader of the Labour Party from 2015 to 2020. On the political left of the Labour Party, Corbyn describes himself as a socialist ...

, and Shadow Chancellor John McDonnell

John Martin McDonnell (born 8 September 1951) is a British politician who served as Shadow Chancellor of the Exchequer from 2015 to 2020. A member of the Labour Party, he has been Member of Parliament (MP) for Hayes and Harlington since 1997. ...

.

Republic of China

The Republic of China was one of the first jurisdictions to implement an LVT, specified in its constitution. Sun Yat-Sen would learn about LVT from the Kiautschou Bay concession, which had successful implementation of LVT, bringing increased wealth and financial stability to the colony. The Republic of China would go on to implement LVT in farms at first, later implementing it in the urban areas due to its success.Modern economists

Alfred Marshall argued in favour of a "fresh air rate", a tax to be charged to urban landowners and ''levied on that value of urban land that is caused by the concentration of population''. That ''general rate'' should have ''to be spent on breaking out small green spots in the midst of dense industrial districts, and on the preservation of large green areas between different towns and between different suburbs which are tending to coalesce''. This idea influenced Marshall's pupil Arthur Pigou's ideas on taxing negative externalities. Pigou wrote an essay supporting LVT, interpreted as support for Lloyd George'sPeople's Budget

The 1909/1910 People's Budget was a proposal of the Liberal government that introduced unprecedented taxes on the lands and incomes of Britain's wealthy to fund new social welfare programmes. It passed the House of Commons in 1909 but was blo ...

.

Paul Samuelson

Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he " ...

supported LVT. "Our ideal society finds it essential to put a rent on land as a way of maximizing the total consumption available to the society. ...Pure land rent is in the nature of a 'surplus' which can be taxed heavily without distorting production incentives or efficiency. A land value tax can be called 'the useful tax on measured land surplus'."

Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

stated: "There's a sense in which all taxes are antagonistic to free enterprise – and yet we need taxes. ...So the question is, which are the least bad taxes? In my opinion the least bad tax is the property tax on the unimproved value of land, the Henry George argument of many, many years ago."

Michael Hudson is a proponent for taxing rent, especially land rent. ".... politically, taxing economic rent has become the bête noire of neoliberal globalism. It is what property owners and rentiers fear most of all, as land, subsoil resources and natural monopolies far exceed industrial capital in magnitude. What appears in the statistics at first glance as 'profit' turns out upon examination to be Ricardian or 'economic' rent."

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was ...

agreed that LVT is efficient, however he disputed whether it should be considered a single tax, as he believed it would not be enough alone, excluding taxes on natural resource rents and other Georgist taxes, to fund a welfare state. "Believe it or not, urban economics models actually do suggest that Georgist taxation would be the right approach at least to finance city growth. But I would just say: I don't think you can raise nearly enough money to run a modern welfare state by taxing land nly"

Joseph Stiglitz, articulating the Henry George theorem wrote that, "Not only was Henry George correct that a tax on land is nondistortionary, but in an equilitarian society ... tax on land raises just enough revenue to finance the (optimally chosen) level of government expenditure."

Rick Falkvinge

Rick Falkvinge (born Dick Greger Augustsson on 21 January 1972) is a Swedish information technology entrepreneur and founder of the Swedish Pirate Party. He is currently a political evangelist with the party, spreading the ideas across the worl ...

proposed a "simplified taxless state" where the state owns all the land it can defend from other states, and leases this land to people at market rates.

Implementation

Australia

Land taxes in Australia are levied by the states. The exemption thresholds vary, as do tax rates and other rules. InNew South Wales

)

, nickname =

, image_map = New South Wales in Australia.svg

, map_caption = Location of New South Wales in AustraliaCoordinates:

, subdivision_type = Country

, subdivision_name = Australia

, established_title = Before federation

, es ...

, the state land tax exempts farmland and principal residences and there is a tax threshold. Determination of land value for tax purposes is the responsibility of the Valuer-General. In Victoria

Victoria most commonly refers to:

* Victoria (Australia), a state of the Commonwealth of Australia

* Victoria, British Columbia, provincial capital of British Columbia, Canada

* Victoria (mythology), Roman goddess of Victory

* Victoria, Seychelle ...

, the land tax threshold is on the total value of all Victorian property owned by a person on 31 December of each year, and taxed at a progressive rate. The principal residence, primary production land and land used by a charity are exempt from land tax. In Tasmania

)

, nickname =

, image_map = Tasmania in Australia.svg

, map_caption = Location of Tasmania in AustraliaCoordinates:

, subdivision_type = Country

, subdi ...

the threshold is and the audit date is 1 July. Between and the tax rate is 0.55% and over it is 1.5%. In Queensland

)

, nickname = Sunshine State

, image_map = Queensland in Australia.svg

, map_caption = Location of Queensland in Australia

, subdivision_type = Country

, subdivision_name = Australia

, established_title = Before federation

, establishe ...

, the threshold for individuals is and for other entities, and the audit date is 30 June. In South Australia the threshold is and taxed at a progressive rate, the audit date is 30 June.

By revenue, property taxes represent 4.5% of total taxation in Australia. A government report in 1986 for Brisbane, Queensland

Brisbane ( ) is the capital and most populous city of the Australian state of Queensland, and the third-most populous city in Australia and Oceania, with a population of approximately 2.6 million. Brisbane lies at the centre of the South ...

advocated an LVT.

The Henry Tax Review of 2010 commissioned by the federal government recommended that state governments replace stamp duty with LVT. The review proposed multiple marginal rates and that most agricultural land would be in the lowest band with a rate of zero. The Australian Capital Territory

The Australian Capital Territory (commonly abbreviated as ACT), known as the Federal Capital Territory (FCT) until 1938, is a landlocked federal territory of Australia containing the national capital Canberra and some surrounding townships. I ...

moved to adopt this system and planned to reduce stamp duty by 5% and raise land tax by 5% for each of twenty years.

Canada

LVT were common in Western Canada at the turn of the twentieth century. In Vancouver LVT became the sole form of municipal taxation in 1910 under the leadership of mayor, Louis D. Taylor. Gary B. Nixon (2000) stated that the rate never exceeded 2% of land value, too low to prevent the speculation that led directly to the 1913 real estate crash. All Canadian provinces later taxed improvements.Estonia

Estonia

Estonia, formally the Republic of Estonia, is a country by the Baltic Sea in Northern Europe. It is bordered to the north by the Gulf of Finland across from Finland, to the west by the sea across from Sweden, to the south by Latvia, a ...

levies an LVT to fund municipalities. It is a state level tax, but 100% of the revenue funds Local Councils. The rate is set by the Local Council within the limits of 0.1–2.5%. It is one of the most important sources of funding for municipalities. LVT is levied on the value of the land only. Few exemptions are available and even public institutions are subject to it. Church sites are exempt, but other land held by religious institutions is not. The tax has contributed to a high rate (~90%) of owner-occupied residences within Estonia, compared to a rate of 67.4% in the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territori ...

.

Hong Kong

Government rent in Hong Kong, formerly the crown rent, is levied in addition to Rates. Properties located in theNew Territories

The New Territories is one of the three main regions of Hong Kong, alongside Hong Kong Island and the Kowloon Peninsula. It makes up 86.2% of Hong Kong's territory, and contains around half of the population of Hong Kong. Historically, it ...

(including New Kowloon

New Kowloon is an area in Hong Kong, bounded in the south by Boundary Street, and in the north by the ranges of the Eagle's Nest, Beacon Hill, Lion Rock, Tate's Cairn and Kowloon Peak. It covers the present-day Kwun Tong District and Wong T ...

), or located in the rest of the territory and whose land grant was recorded after 27 May 1985, pay 3% of the rateable rental value.

Hungary

Municipal governments in Hungary levy an LVT based on the area or the land's adjusted market value. The maximum rate is 3% of the adjusted market value.Kenya

Kenya's LVT history dates to at least 1972, shortly after it achieved independence. Local governments must tax land value, but are required to seek approval from the central government for rates that exceed 4 percent. Buildings were not taxed in Kenya as of 2000. The central government is legally required to pay municipalities for the value of land it occupies. Kelly claimed that possibly as a result of this land reform, Kenya became the only stable country in its region. As of late 2014, the city of Nairobi still taxed only land values, although a tax on improvements had been proposed.Mexico

The capital city of Baja California,Mexicali

Mexicali (; ) is the capital city of the Mexican state of Baja California. The city, seat of the Mexicali Municipality, has a population of 689,775, according to the 2010 census, while the Calexico–Mexicali metropolitan area is home to 1,000,0 ...

, has had an LVT since the 1990s when it became the first locality in Mexico to implement such a tax.

Namibia

A land value taxation on rural land was introduced in Namibia, with the primary intention of improving land use.Russia

In 1990, several economists wrote to thenPresident

President most commonly refers to:

*President (corporate title)

* President (education), a leader of a college or university

* President (government title)

President may also refer to:

Automobiles

* Nissan President, a 1966–2010 Japanese ...

Mikhail Gorbachev suggesting that Russia

Russia (, , ), or the Russian Federation, is a transcontinental country spanning Eastern Europe and Northern Asia. It is the largest country in the world, with its internationally recognised territory covering , and encompassing one-eig ...

adopt LVT; its failure to do so was argued as causal in the rise of oligarchs

Oligarch may refer to:

Authority

* Oligarch, a member of an oligarchy, a power structure where control resides in a small number of people

* Oligarch (Kingdom of Hungary), late 13th–14th centuries

* Business oligarch, wealthy and influential bu ...

.

Currently, Russia has an LVT of 0.3% on residential, agricultural and utilities lands as well as a 1.5% tax for other types of land.

Singapore

Singapore owns the majority of its land which it leases for 99-year terms. In addition, Singapore taxes development uplift at around 70%. These two sources of revenue fund most of Singapore's new infrastructure.South Korea

South Korea has an aggregate land tax that is levied annually based on an individual's landholding value across the whole country. Speculative and residential land has a progressive tax rate of 0.2–5%, commercial and building sites 0.3–2%, farm and forest lands 0.1% and luxury properties 5%.Spain

Taiwan

As of 2010, land value taxes and land value increment taxes accounted for 8.4% of total government revenue in Taiwan.Thailand

The Thai government introduced the Land and Building Tax Act B.E. 2562 in March 2019, which came into effect on 1 January 2020. It sets a maximum tax rate of 1.2% on commercial and vacant land, 0.3% for residential land and 0.15% for agricultural land.United States

In the late 19th century George's followers founded a single tax colony atFairhope, Alabama

Fairhope is a city in Baldwin County, Alabama, United States, located on the eastern shoreline of Mobile Bay. The 2020 Census lists the population of the city as 22,477. Fairhope is a principal city of the Daphne-Fairhope-Foley metropolita ...

. Although the colony, now a nonprofit corporation, still holds land in the area and collects a relatively small ground rent, the land is subject to state and local property taxes.

Common property taxes include land value, which usually has a separate assessment. Thus, land value taxation already exists in many jurisdictions. Some jurisdictions have attempted to rely more heavily on it. In Pennsylvania

Pennsylvania (; ( Pennsylvania Dutch: )), officially the Commonwealth of Pennsylvania, is a state spanning the Mid-Atlantic, Northeastern, Appalachian, and Great Lakes regions of the United States. It borders Delaware to its southeast, ...

certain cities raised the tax on land value while reducing the tax on improvement/building/structure values. For example, the city of Altoona adopted a property tax that solely taxes land value in 2002 but repealed the tax in 2016. Many Pennsylvania cities use a split-rate tax, which taxes the value of land at a higher rate than the value of buildings.

Countries with active discussion

China

China's Real Rights Law contains provisions founded on LVT analysis.Ireland

In 2010 the government ofIreland

Ireland ( ; ga, Éire ; Ulster Scots dialect, Ulster-Scots: ) is an island in the Atlantic Ocean, North Atlantic Ocean, in Northwestern Europe, north-western Europe. It is separated from Great Britain to its east by the North Channel (Grea ...

announced that it would introduce an LVT, beginning in 2013. Following a 2011 change in government, a property tax was introduced instead.

New Zealand

After decades of a modest LVT, New Zealand abolished it in 1990. Discussions continue as to whether or not to bring it back. Earlier Georgist politicians included Patrick O'Regan and Tom Paul (who was Vice-President of the New Zealand Land Values League).United Kingdom

In September 1908, Chancellor of the ExchequerDavid Lloyd George

David Lloyd George, 1st Earl Lloyd-George of Dwyfor, (17 January 1863 – 26 March 1945) was Prime Minister of the United Kingdom from 1916 to 1922. He was a Liberal Party politician from Wales, known for leading the United Kingdom during ...

instructed McKenna, the First Lord of the Admiralty

The First Lord of the Admiralty, or formally the Office of the First Lord of the Admiralty, was the political head of the English and later British Royal Navy. He was the government's senior adviser on all naval affairs, responsible for the di ...

, to build more Dreadnought

The dreadnought (alternatively spelled dreadnaught) was the predominant type of battleship in the early 20th century. The first of the kind, the Royal Navy's , had such an impact when launched in 1906 that similar battleships built after her ...

s. The ships were to be financed by an LVT. Lloyd George believed that relating national defence to land tax would both provoke the opposition of the House of Lords and rally the people round a simple emotive issue. The Lords, composed of wealthy land owners, rejected the Budget in November 1909, leading to a constitutional crisis.

LVT was on the UK statute books briefly in 1931, introduced by Philip Snowden's 1931 budget, strongly supported by prominent LVT campaigner Andrew MacLaren, Andrew MacLaren MP. MacLaren lost his seat at the next election (1931) and the act was repealed, MacLaren tried again with a private member's bill in 1937; it was rejected 141 to 118.Labour Land Campaign

advocates within the Labour Party and the broader labour movement for "a more equitable distribution of the Land Values that are created by the whole community" through LVT. Its membership includes members of the British Labour Party, Trade Unions and Cooperatives and individuals. The Liberal Democrats' ALTER (Action for Land Taxation and Economic Reform) aims The Green Party "favour moving to a system of Land Value Tax, where the level of taxation depends on the rental value of the land concerned." A course in "Economics with Justice" with a strong foundation in LVT are offered at the School of Economic Science, which was founded by Andrew MacLaren MP and has historical links with the Henry George Foundation of Great Britain, Henry George Foundation.

=Scotland

= In February 1998, the Scottish Office of the British Government launched a public consultation process on land reform. A survey of the public response found that: "excluding the responses of the lairds and their agents, reckoned as likely prejudiced against the measure, 20% of all responses favoured the land tax" (12% in grand total, without the exclusions). The government responded by announcing "a comprehensive economic evaluation of the possible impact of moving to a land value taxation basis". However, no measure was adopted. In 2000 the Parliament's Local Government Committee's inquiry into local government finance explicitly included LVT, but the final report omitted any mention. In 2003 the Scottish Parliament passed a resolution: "That the Parliament notes recent studies by the Scottish Executive and is interested in building on them by considering and investigating the contribution that land value taxation could make to the cultural, economic, environmental and democratic renaissance of Scotland." In 2004 a letter of support was sent from members of the Scottish Parliament to the organisers and delegates of the IU's 24th international conference—including members of theScottish Greens

The Scottish Greens (also known as the Scottish Green Party; gd, Pàrtaidh Uaine na h-Alba ; sco, Scots Green Pairtie) are a green political party in Scotland. The party has seven MSPs in the Scottish Parliament as of May 2021. As of the 2 ...

, the Scottish Socialist Party and the Scottish National Party.

The policy was considered in the 2006 Scottish Local Government Finance Review whose 2007 Report concluded that "although land value taxation meets a number of our criteria, we question whether the public would accept the upheaval involved in radical reform of this nature, unless they could clearly understand the nature of the change and the benefits involved.... We considered at length the many positive features of a land value tax which are consistent with our recommended local property tax [LPT], particularly its progressive nature." However, "[h]aving considered both rateable value and land value as the basis for taxation, we concur with Layfield (UK Committee of Inquiry, 1976) who recommended that any local property tax should be based on capital values."

In 2009, Glasgow City Council resolved to introduce LVT by saying "the idea could become the blueprint for Scotland's future local taxation". The Council agreed to a "long term move to a local property tax / land value tax hybrid tax". Its Local Taxation Working Group stated that simple [non-hybrid] land value taxation should itself "not be discounted as an option for local taxation reform: it potentially holds many benefits and addresses many existing concerns".

Zimbabwe

In Zimbabwe, government coalition partners the Movement for Democratic Change - Tsvangirai, Movement for Democratic Change adopted LVT.Belgium

Bernard Clerfayt called for the overhaul of the property tax in the Brussels region, with a higher tax for land values than for buildings.Tax rates

EU countries

See also

* Citizen's dividend * Classical economics * Danegeld * Earth Rights Institute * Ecotax * Equity (economics)#Taxation, Equity in taxation * Geographic information system *Geolibertarianism

Geolibertarianism is a political and economic ideology that integrates libertarianism with Georgism. It favors a taxation system based (as in Georgism) on income derived from land and natural resources instead of on labor, coupled with a mini ...

* Georgism

Georgism, also called in modern times Geoism, and known historically as the single tax movement, is an economic ideology holding that, although people should own the value they produce themselves, the economic rent derived from land—includi ...

* The IU, International Union for Land Value Taxation (The IU)

* Land (economics)

* Land monopoly, Land monopolization and Land reform, reform

* Land speculation

* Land tenure and Land registration, registration

* Law of rent

* Lockean proviso

* Natural resource economics

* Optimal tax

* Physiocracy

* Pigovian tax

* Progressive tax

* Property rights (economics)

* Property Tax

* Rent-seeking

* Scottish League for the Taxation of Land Values

* Single tax

* Tax reform

* Tax shift

* Value capture

* Wealth tax

References

Notes

Sources

*Further reading

* *External sources

New South Wales Land Tax Management Act 1956 (Australia)

{{DEFAULTSORT:Land Value Tax Land value taxation, Land taxation Georgism Real estate valuation Tax reform Valuation (finance)