Secular Stagnation Theory on:

[Wikipedia]

[Google]

[Amazon]

In economics, secular stagnation is a condition when there is negligible or no economic growth in a market-based economy. In this context, the term ''secular'' means long-term (from Latin "

The term secular stagnation refers to a market economy with a chronic (secular or long-term) lack of demand. Historically, a booming economy with low unemployment and high GDP growth (i.e., an economy at or above capacity) would generate inflation in wages and products. However, an economy facing secular stagnation behaves as if it is operating below capacity, even when the economy appears to be booming; inflation does not appear. In a healthy economy, if household savings exceed business investments, interest rates fall; lower interest rates stimulate spending and investment, which bring savings and investments into balance. However, an economy facing secular stagnation may require an interest rate below zero to bring savings and investment into balance. The surplus of savings over investment may be generating price appreciation in financial assets or real estate. For example, the U.S. had low unemployment but low inflation in the years leading up to the

The term secular stagnation refers to a market economy with a chronic (secular or long-term) lack of demand. Historically, a booming economy with low unemployment and high GDP growth (i.e., an economy at or above capacity) would generate inflation in wages and products. However, an economy facing secular stagnation behaves as if it is operating below capacity, even when the economy appears to be booming; inflation does not appear. In a healthy economy, if household savings exceed business investments, interest rates fall; lower interest rates stimulate spending and investment, which bring savings and investments into balance. However, an economy facing secular stagnation may require an interest rate below zero to bring savings and investment into balance. The surplus of savings over investment may be generating price appreciation in financial assets or real estate. For example, the U.S. had low unemployment but low inflation in the years leading up to the

/ref> The idea of secular stagnation dates back to the

Secular stagnation was dusted off by

Secular stagnation was dusted off by

saeculum

A is a length of time roughly equal to the potential lifetime of a person or, equivalently, the complete renewal of a human population. Originally it meant the time from the moment that something happened (for example the founding of a city) unt ...

"—century or lifetime), and is used in contrast to ''cyclical'' or ''short-term''. It suggests a change of fundamental dynamics which would play out only in its own time. The concept was originally put forth by Alvin Hansen

Alvin Harvey Hansen (August 23, 1887 – June 6, 1975) was an American economist who taught at the University of Minnesota and was later a chair professor of economics at Harvard University. Often referred to as "the American John Maynard Keynes ...

in 1938. According to ''The Economist

''The Economist'' is a British weekly newspaper printed in demitab format and published digitally. It focuses on current affairs, international business, politics, technology, and culture. Based in London, the newspaper is owned by The Econo ...

'', it was used to "describe what he feared was the fate of the American economy following the Great Depression of the early 1930s: a check to economic progress as investment opportunities were stunted by the closing of the frontier and the collapse of immigration". Warnings of impending secular stagnation have been issued after all deep recessions since the Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

, but the hypothesis has remained controversial.

Definition

The term secular stagnation refers to a market economy with a chronic (secular or long-term) lack of demand. Historically, a booming economy with low unemployment and high GDP growth (i.e., an economy at or above capacity) would generate inflation in wages and products. However, an economy facing secular stagnation behaves as if it is operating below capacity, even when the economy appears to be booming; inflation does not appear. In a healthy economy, if household savings exceed business investments, interest rates fall; lower interest rates stimulate spending and investment, which bring savings and investments into balance. However, an economy facing secular stagnation may require an interest rate below zero to bring savings and investment into balance. The surplus of savings over investment may be generating price appreciation in financial assets or real estate. For example, the U.S. had low unemployment but low inflation in the years leading up to the

The term secular stagnation refers to a market economy with a chronic (secular or long-term) lack of demand. Historically, a booming economy with low unemployment and high GDP growth (i.e., an economy at or above capacity) would generate inflation in wages and products. However, an economy facing secular stagnation behaves as if it is operating below capacity, even when the economy appears to be booming; inflation does not appear. In a healthy economy, if household savings exceed business investments, interest rates fall; lower interest rates stimulate spending and investment, which bring savings and investments into balance. However, an economy facing secular stagnation may require an interest rate below zero to bring savings and investment into balance. The surplus of savings over investment may be generating price appreciation in financial assets or real estate. For example, the U.S. had low unemployment but low inflation in the years leading up to the Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

, although a massive housing bubble developed.The Economist-America's recovery breeds complacency about macroeconomic risks-September 2018/ref> The idea of secular stagnation dates back to the

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

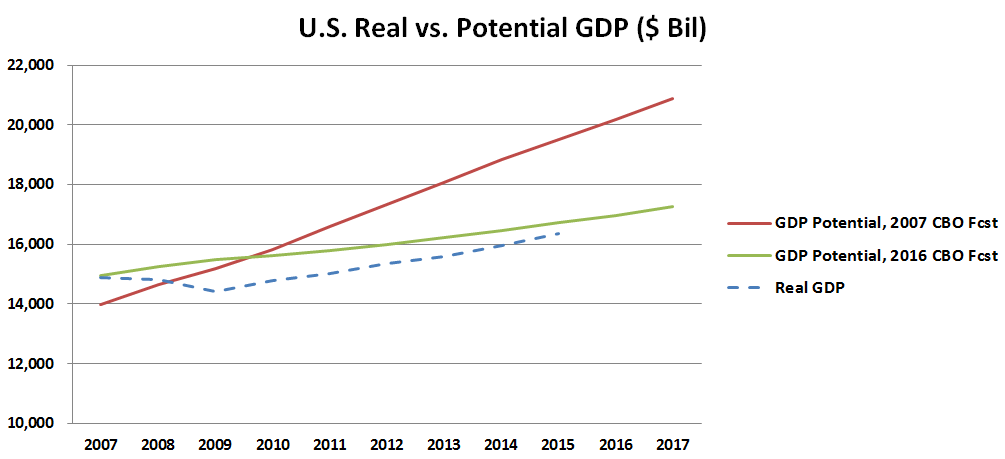

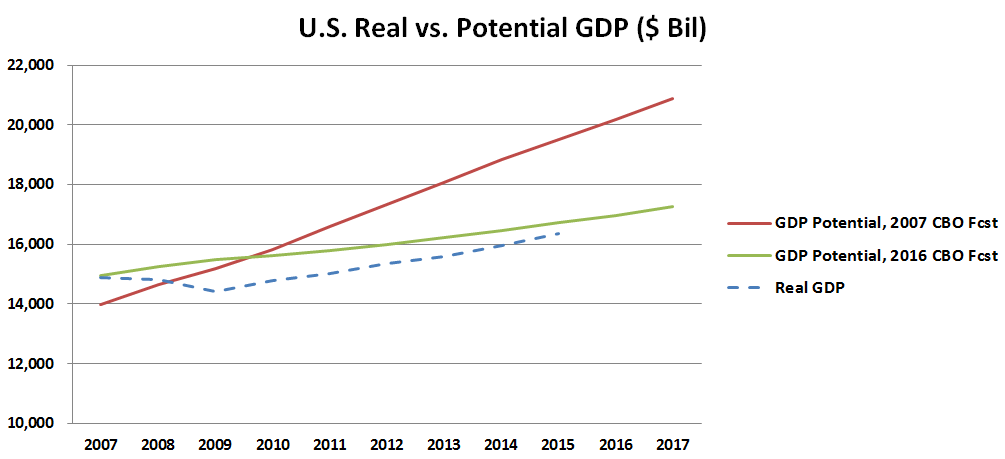

, when some economists feared that the United States had permanently entered a period of low growth. ''The Economist'' explained in 2018 that many factors may contribute to secular stagnation, by either driving up savings or reducing investment. Households paying down debt (i.e., deleveraging) increase savings and are spending less; businesses react to the lack of demand by investing less. This was a major factor in the slow U.S. GDP growth during 2009-2012 following the Great Recession. Another possible cause is income inequality, which shifts more money to the wealthy, who tend to save it rather than spend it, thus increasing savings and perhaps driving up financial asset prices. Aging populations (which spend less per capita) and a slowdown in productivity may also reduce investment. Central banks face a difficult dilemma; do they raise interest rates to ward off inflation (e.g., implement monetary policy austerity) assuming the economy is in a cyclical boom, or assume the economy (even if temporarily booming) is in secular stagnation and therefore take a more stimulative approach?

Stagnation and the financial explosion: the 1980s

An analysis of stagnation and what is now calledfinancialization

Financialization (or financialisation in British English) is a term sometimes used to describe the development of financial capitalism during the period from 1980 to present, in which debt-to-equity ratios increased and financial services acco ...

was provided in the 1980s by Harry Magdoff

Harry Samuel Magdoff (August 21, 1913 – January 1, 2006) was a prominent American socialist commentator. He held several administrative positions in government during the presidency of Franklin D. Roosevelt and later became co-editor of the M ...

and Paul Sweezy

Paul Marlor Sweezy (April 10, 1910 – February 27, 2004) was a Marxist economist, political activist, publisher, and founding editor of the long-running magazine ''Monthly Review''. He is best remembered for his contributions to economic theory ...

, coeditors of the independent socialist journal ''Monthly Review

The ''Monthly Review'', established in 1949, is an independent socialist magazine published monthly in New York City. The publication is the longest continuously published socialist magazine in the United States.

History Establishment

Following ...

''. Magdoff was a former economic advisor to Vice President Henry A. Wallace

Henry Agard Wallace (October 7, 1888 – November 18, 1965) was an American politician, journalist, farmer, and businessman who served as the 33rd vice president of the United States, the 11th U.S. Secretary of Agriculture, and the 10th U.S. S ...

in Roosevelt’s New Deal

The New Deal was a series of programs, public work projects, financial reforms, and regulations enacted by President Franklin D. Roosevelt in the United States between 1933 and 1939. Major federal programs agencies included the Civilian Cons ...

administration, while Sweezy was a former Harvard economics professor. In their 1987 book, ''Stagnation and the Financial Explosion'', they argued, based on Keynes, Hansen, Michał Kalecki

Michał Kalecki (; 22 June 1899 – 18 April 1970) was a Polish Marxian economist. Over the course of his life, Kalecki worked at the London School of Economics, University of Cambridge, University of Oxford and Warsaw School of Economics an ...

, and Marx, and marshaling extensive empirical data, that, contrary to the usual way of thinking, stagnation or slow growth was the norm for mature, monopolistic (or oligopolistic) economies, while rapid growth was the exception.

Private accumulation had a strong tendency to weak growth and high levels of excess capacity and unemployment/underemployment, which could, however, be countered in part by such exogenous factors as state spending (military and civilian), epoch-making technological innovations (for example, the automobile in its expansionary period), and the growth of finance. In the 1980s and 1990s Magdoff and Sweezy argued that a financial explosion of long duration was lifting the economy, but this would eventually compound the contradictions of the system, producing ever bigger speculative bubbles, and leading eventually to a resumption of overt stagnation.

2008–2009

Economists have asked whether the low economic growth rate in the developed world leading up to and following thesubprime mortgage crisis

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the Financial crisis of 2007–2008, 2007–2008 global financial crisis. It was triggered by a large decline ...

of 2007-2008 was due to secular stagnation. Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was th ...

wrote in September 2013: " ere is a case for believing that the problem of maintaining adequate aggregate demand is going to be very persistent – that we may face something like the 'secular stagnation' many economists feared after World War II." Krugman wrote that fiscal policy stimulus and higher inflation (to achieve a negative real rate of interest necessary to achieve full employment) may be potential solutions.

Larry Summers

Lawrence Henry Summers (born November 30, 1954) is an American economist who served as the 71st United States secretary of the treasury from 1999 to 2001 and as director of the National Economic Council from 2009 to 2010. He also served as pres ...

presented his view during November 2013 that secular (long-term) stagnation may be a reason that U.S. growth is insufficient to reach full employment: "Suppose then that the short term real interest rate that was consistent with full employment .e., the "natural rate"had fallen to negative two or negative three percent. Even with artificial stimulus to demand you wouldn't see any excess demand. Even with a resumption in normal credit conditions you would have a lot of difficulty getting back to full employment."

Robert J. Gordon

Robert James Gordon is an American economist. He is the Stanley G. Harris Professor of the Social Sciences at Northwestern University. Gordon is one of the world’s leading experts on inflation, unemployment, and long-term economic growth. His ...

wrote in August 2012: "Even if innovation were to continue into the future at the rate of the two decades before 2007, the U.S. faces six headwinds that are in the process of dragging long-term growth to half or less of the 1.9 percent annual rate experienced between 1860 and 2007. These include demography, education, inequality, globalization, energy/environment, and the overhang of consumer and government debt. A provocative 'exercise in subtraction' suggests that future growth in consumption per capita for the bottom 99 percent of the income distribution could fall below 0.5 percent per year for an extended period of decades".

Post-2009

Secular stagnation was dusted off by

Secular stagnation was dusted off by Hans-Werner Sinn

Hans-Werner Sinn (born 7 March 1948) is a German economist who served as President of the Ifo Institute for Economic Research from 1999 to 2016. He currently serves on the German economy ministry’s advisory council. He is Professor Emeritus ...

in a 2009 article dismissing the threat of inflation, and became popular again when Larry Summers

Lawrence Henry Summers (born November 30, 1954) is an American economist who served as the 71st United States secretary of the treasury from 1999 to 2001 and as director of the National Economic Council from 2009 to 2010. He also served as pres ...

invoked the term and concept during a 2013 speech at the IMF.

However, ''The Economist

''The Economist'' is a British weekly newspaper printed in demitab format and published digitally. It focuses on current affairs, international business, politics, technology, and culture. Based in London, the newspaper is owned by The Econo ...

'' criticizes secular stagnation as "a baggy concept, arguably too capacious for its own good". Warnings of impending secular stagnation have been issued after all deep recessions, but turned out to be wrong because they underestimated the potential of existing technologies.

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was th ...

, writing in 2014, clarified that it refers to "the claim that underlying changes in the economy, such as slowing growth in the working-age population, have made episodes like the past five years in Europe and the United States, and the last 20 years in Japan, likely to happen often. That is, we will often find ourselves facing persistent shortfalls of demand, which can’t be overcome even with near-zero interest rates." At its root is "the problem of building consumer demand at a time when people are less motivated to spend".

One theory is that the boost in growth by the internet and technological advancement in computers of the new economy

The New Economy refers to the ongoing development of the American economic system. It evolved from the notions of the classical economy via the transition from a manufacturing-based economy to a service-based economy, and has been driven by ...

does not measure up to the boost caused by the great inventions

An invention is a unique or novel device, method, composition, idea or process. An invention may be an improvement upon a machine, product, or process for increasing efficiency or lowering cost. It may also be an entirely new concept. If an i ...

of the past. An example of such a great invention is the assembly line

An assembly line is a manufacturing process (often called a ''progressive assembly'') in which parts (usually interchangeable parts) are added as the semi-finished assembly moves from workstation to workstation where the parts are added in seq ...

production method of Fordism

Fordism is a manufacturing technology that serves as the basis of modern economic and social systems in industrialized, standardized mass production and mass consumption. The concept is named after Henry Ford. It is used in social, economic, and ...

. The general form of the argument has been the subject of papers by Robert J. Gordon. It has also been written about by Owen. C. Paepke and Tyler Cowen

Tyler Cowen (; born January 21, 1962) is an American economist, columnist and blogger. He is a professor at George Mason University, where he holds the Holbert L. Harris chair in the economics department. He hosts the economics blog ''Marginal R ...

.

Secular stagnation has also been linked to the rise of the digital economy. Carl Benedikt Frey

Carl Benedikt Frey is a Swedish-German economist and economic historian. He is Oxford Martin Citi Fellow at University of Oxford, Oxford University where he directs the programme on the Future of Work at the Oxford Martin School.

Career

After s ...

, for example, has suggested that digital technologies are much less capital-absorbing, creating only little new investment demand relative to other revolutionary technologies.

Another is that the damage done by the Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

was so long-lasting and permanent, so many workers will never get jobs again, that we really can't recover.

A third is that there is a "persistent and disturbing reluctance of businesses to invest and consumers to spend", perhaps in part because so much of the recent gains have gone to the people at the top, and they tend to save more of their money than people—ordinary working people who can't afford to do that.

A fourth is that advanced economies are just simply paying the price for years of inadequate investment in infrastructure and education, the basic ingredients of growth.

A fifth is related to decreased mortality and increased longevity, thus changes in the demographic structure in advanced economies, affecting both demand, through increased savings, and supply, through reduced innovation activities.

And a sixth is that economic growth is largely related to the concept of energy returned on energy invested

In energy economics and ecological energetics, energy return on investment (EROI), also sometimes called energy returned on energy invested (ERoEI), is the ratio of the amount of usable energy (the ''exergy'') delivered from a particular energy re ...

(EROEI), or energy surplus, which with the discovery of fossil fuels

A fossil fuel is a hydrocarbon-containing material formed naturally in the Earth's crust from the remains of dead plants and animals that is extracted and burned as a fuel. The main fossil fuels are coal, oil, and natural gas. Fossil fuels ...

shot up to very high and historically unprecedented levels. This allowed, and in effect fueled, dramatic increases in human consumption since the Industrial Revolution

The Industrial Revolution was the transition to new manufacturing processes in Great Britain, continental Europe, and the United States, that occurred during the period from around 1760 to about 1820–1840. This transition included going f ...

and many related technological advances. Under this argument, diminishing and increasingly difficult to access fossil fuel reserves directly lead to significantly reduced EROEI, and therefore put a brake on, and potentially reverse, long-term economic growth, leading to secular stagnation. Linked to the EROEI argument are those stemming from the Limits to Growth

''The Limits to Growth'' (''LTG'') is a 1972 report that discussed the possibility of exponential economic and population growth with finite supply of resources, studied by computer simulation. The study used the World3 computer model to simula ...

school of thinking, whereby environmental and resource constraints in general are likely to impose an eventual limit on the continued expansion of human consumption and incomes. While 'limits to growth' thinking went out of fashion in the decades following the initial publication in 1972, a recent study shows human development continues to align well with the 'overshoot and collapse' projection outlined in the standard run of the original analysis, and this is before factoring in the potential effects of climate change

In common usage, climate change describes global warming—the ongoing increase in global average temperature—and its effects on Earth's climate system. Climate change in a broader sense also includes previous long-term changes to E ...

.

A 2018 CUSP working paper by Tim Jackson, The Post-Growth

Post-growth is stance on economic growth concerning the limits-to-growth dilemma — recognition that, on a planet of finite material resources, extractive economies and populations cannot grow infinitely. The term "post-growth" acknowledges th ...

Challenge, argues that low growth rates might in fact be ‘the new normal’.

See also

*Era of Stagnation

The "Era of Stagnation" (russian: Пери́од засто́я, Períod zastóya, or ) is a term coined by Mikhail Gorbachev in order to describe the negative way in which he viewed the economic, political, and social policies of the Soviet Uni ...

* Biflation

*Business cycle

Business cycles are intervals of Economic expansion, expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are ...

*Recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

*Stagflation

In economics, stagflation or recession-inflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for economic policy, since action ...

*Prosperity Without Growth

''Prosperity Without Growth'' is a book by author and economist Tim Jackson. It was originally released as a report by the Sustainable Development Commission. The study rapidly became the most downloaded report in the Commission's nine-year h ...

*Limits to Growth

''The Limits to Growth'' (''LTG'') is a 1972 report that discussed the possibility of exponential economic and population growth with finite supply of resources, studied by computer simulation. The study used the World3 computer model to simula ...

*Productivity

Productivity is the efficiency of production of goods or services expressed by some measure. Measurements of productivity are often expressed as a ratio of an aggregate output to a single input or an aggregate input used in a production proces ...

*Zero lower bound The Zero Lower Bound (''ZLB'') or Zero Nominal Lower Bound (''ZNLB'') is a macroeconomic problem that occurs when the short-term nominal interest rate is at or near zero, causing a liquidity trap and limiting the central bank's capacity to stimulate ...

References

{{Reflist Macroeconomic problems Economic growth Market trends