Section 125 of the Constitution Act, 1867 on:

[Wikipedia]

[Google]

[Amazon]

Section 125 of the ''Constitution Act, 1867'' (french: article 125 de la Loi constitutionnelle de 1867) is a provision of the

Section 125 of the ''Constitution Act, 1867'' (french: article 125 de la Loi constitutionnelle de 1867) is a provision of the

''Reference re Goods and Services Tax'', [1992

/nowiki> 2 SCR 445.]

In addition, provincial authorities must still pay customs duties, because such charges are not strictly based on the taxation power. As noted in the ''Johnnie Walker'' case:

Because of that, as noted in ''Re Exported Natural Gas Tax'':

Section 125 of the ''Constitution Act, 1867'' (french: article 125 de la Loi constitutionnelle de 1867) is a provision of the

Section 125 of the ''Constitution Act, 1867'' (french: article 125 de la Loi constitutionnelle de 1867) is a provision of the Constitution of Canada

The Constitution of Canada (french: Constitution du Canada) is the supreme law in Canada. It outlines Canada's system of government and the civil and human rights of those who are citizens of Canada and non-citizens in Canada. Its contents a ...

relating to taxation immunities of the federal and provincial governments. The section provides that the property of the provincial and federal governments are not subject to taxation.

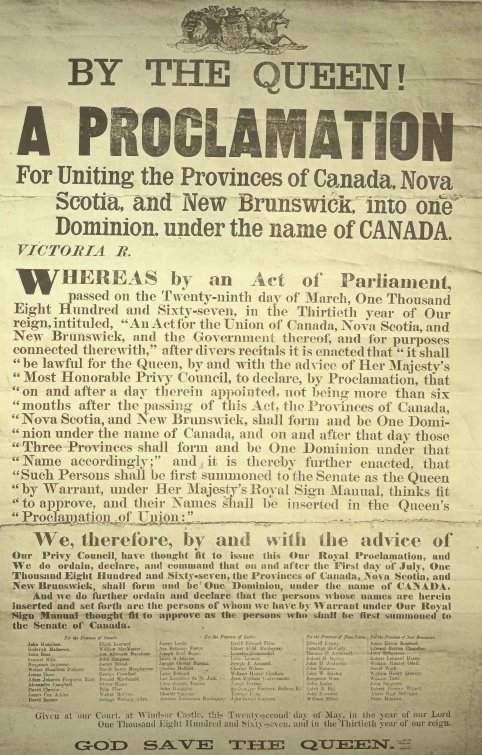

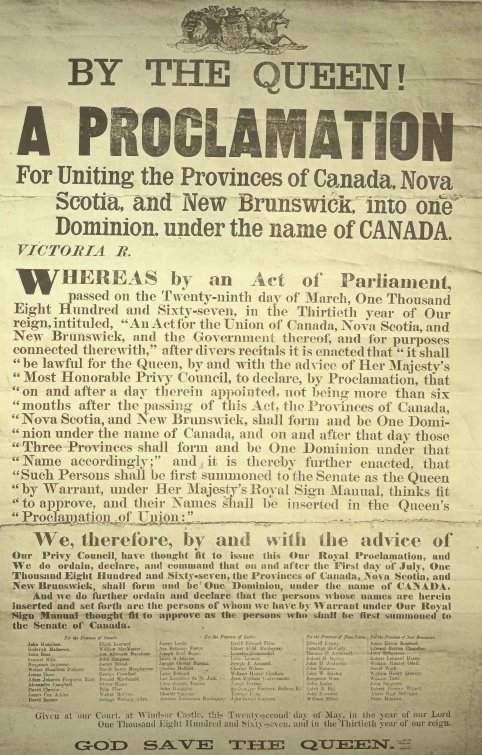

The ''Constitution Act, 1867

The ''Constitution Act, 1867'' (french: Loi constitutionnelle de 1867),''The Constitution Act, 1867'', 30 & 31 Victoria (U.K.), c. 3, http://canlii.ca/t/ldsw retrieved on 2019-03-14. originally enacted as the ''British North America Act, 186 ...

'' is the constitutional statute which established Canada

Canada is a country in North America. Its ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, covering over , making it the world's second-largest country by tota ...

. Originally named the ''British North America Act, 1867

The ''Constitution Act, 1867'' (french: Loi constitutionnelle de 1867),''The Constitution Act, 1867'', 30 & 31 Victoria (U.K.), c. 3, http://canlii.ca/t/ldsw retrieved on 2019-03-14. originally enacted as the ''British North America Act, 186 ...

'', the Act continues to be the foundational statute for the Constitution of Canada, although it has been amended many times since 1867. It is now recognised as part of the supreme law of Canada.

''Constitution Act, 1867''

The ''Constitution Act, 1867

The ''Constitution Act, 1867'' (french: Loi constitutionnelle de 1867),''The Constitution Act, 1867'', 30 & 31 Victoria (U.K.), c. 3, http://canlii.ca/t/ldsw retrieved on 2019-03-14. originally enacted as the ''British North America Act, 186 ...

'' is part of the Constitution of Canada

The Constitution of Canada (french: Constitution du Canada) is the supreme law in Canada. It outlines Canada's system of government and the civil and human rights of those who are citizens of Canada and non-citizens in Canada. Its contents a ...

and thus part of the supreme law of Canada

Canada is a country in North America. Its ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, covering over , making it the world's second-largest country by tota ...

. It was the product of extensive negotiations by the governments of the British North America

British North America comprised the colonial territories of the British Empire in North America from 1783 onwards. English overseas possessions, English colonisation of North America began in the 16th century in Newfoundland (island), Newfound ...

n provinces in the 1860s. The Act sets out the constitutional framework of Canada, including the structure of the federal government

A federation (also known as a federal state) is a political entity characterized by a union of partially self-governing provinces, states, or other regions under a central federal government (federalism). In a federation, the self-govern ...

and the powers of the federal government and the provinces. Originally enacted in 1867 by the British Parliament

The Parliament of the United Kingdom is the Parliamentary sovereignty in the United Kingdom, supreme Legislature, legislative body of the United Kingdom, the Crown Dependencies and the British Overseas Territories. It meets at the Palace of We ...

under the name the ''British North America Act, 1867'', in 1982 the Act was brought under full Canadian control through the Patriation

Patriation is the political process that led to full Canadian sovereignty, culminating with the Constitution Act, 1982. The process was necessary because under the Statute of Westminster 1931, with Canada's agreement at the time, the British parl ...

of the Constitution, and was renamed the ''Constitution Act, 1867

The ''Constitution Act, 1867'' (french: Loi constitutionnelle de 1867),''The Constitution Act, 1867'', 30 & 31 Victoria (U.K.), c. 3, http://canlii.ca/t/ldsw retrieved on 2019-03-14. originally enacted as the ''British North America Act, 186 ...

''. Since Patriation

Patriation is the political process that led to full Canadian sovereignty, culminating with the Constitution Act, 1982. The process was necessary because under the Statute of Westminster 1931, with Canada's agreement at the time, the British parl ...

, the Act can only be amended in Canada, under the amending formula set out in the ''Constitution Act, 1982

The ''Constitution Act, 1982'' (french: link=no, Loi constitutionnelle de 1982) is a part of the Constitution of Canada.Formally enacted as Schedule B of the '' Canada Act 1982'', enacted by the Parliament of the United Kingdom. Section 60 of ...

''.

Text of section 125

Section 125 reads: Section 125 is found in Part VIII of the ''Constitution Act, 1867'', dealing with revenues, debts, assets, and raxation. It has not been amended since the Act was enacted in 1867.Nature of the taxation power in Canada

Section 125 affects the taxation powers of both levels of government, and has received a broad interpretation in the Canadian courts. Since the 1930Supreme Court of Canada

The Supreme Court of Canada (SCC; french: Cour suprême du Canada, CSC) is the highest court in the judicial system of Canada. It comprises nine justices, whose decisions are the ultimate application of Canadian law, and grants permission to ...

ruling in ''Lawson v. Interior Tree Fruit and Vegetables Committee of Direction'', taxation is held to consist of the following characteristics:

* it is enforceable by law;

* imposed under the authority of the legislature;

* levied by a public body; and

* intended for a public purpose.

In addition, the 1999 SCC ruling in ''Westbank First Nation v. British Columbia Hydro and Power Authority'' has also declared that a government levy would be in pith and substance

Pith and substance is a legal doctrine in Canadian constitutional interpretation used to determine under which head of power a given piece of legislation falls. The doctrine is primarily used when a law is challenged on the basis that one level of ...

a tax if it was "unconnected to any form of a regulatory scheme."''Westbank First Nation v. British Columbia Hydro and Power Authority'', 999">''Westbank First Nation v. British Columbia Hydro and Power Authority'', [1999

/nowiki> 3 SCR 134 paras. 43, 44. The test for a regulatory fee set out in ''Westbank'' requires: * a complete, complex and detailed code of regulation; * a regulatory purpose which seeks to affect some behaviour; * the presence of actual or properly estimated costs of the regulation; and * a relationship between the person being regulated and the regulation, where the person being regulated either benefits from, or causes the need for, the regulation. This is important to note, as taxation is barred under s. 121, but regulatory fees are not, and Canadian jurisprudence under s. 125 has turned on that distinction.

s levying taxes on federal property, as well as to First Nations in Canada">First nations levying taxes on provincial property, although measures have been taken to mitigate the impact.

However, provinces must collect and remit sales taxes on any commercial sales they make, since the obligation when it acts as supplier does not amount to a taxation of the province's property./nowiki> 3 SCR 134 paras. 43, 44. The test for a regulatory fee set out in ''Westbank'' requires: * a complete, complex and detailed code of regulation; * a regulatory purpose which seeks to affect some behaviour; * the presence of actual or properly estimated costs of the regulation; and * a relationship between the person being regulated and the regulation, where the person being regulated either benefits from, or causes the need for, the regulation. This is important to note, as taxation is barred under s. 121, but regulatory fees are not, and Canadian jurisprudence under s. 125 has turned on that distinction.

Interpretation in the Canadian courts

The nature of s. 125 has been described as thus: Therefore, its prohibition covers taxation on the holding, as well as the acquisition and disposal, of property. In addition: * the provision also extends to property held byCrown corporation

A state-owned enterprise (SOE) is a government entity which is established or nationalised by the ''national government'' or ''provincial government'' by an executive order or an act of legislation in order to earn profit for the governmen ...

s, and

* the prohibition on levying such taxation also extends to local government

Local government is a generic term for the lowest tiers of public administration within a particular sovereign state. This particular usage of the word government refers specifically to a level of administration that is both geographically-lo .../nowiki> 2 SCR 445.]

Notes

References

* {{Constitution of Canada, confederation Constitution of Canada Canadian Confederation Federalism in Canada